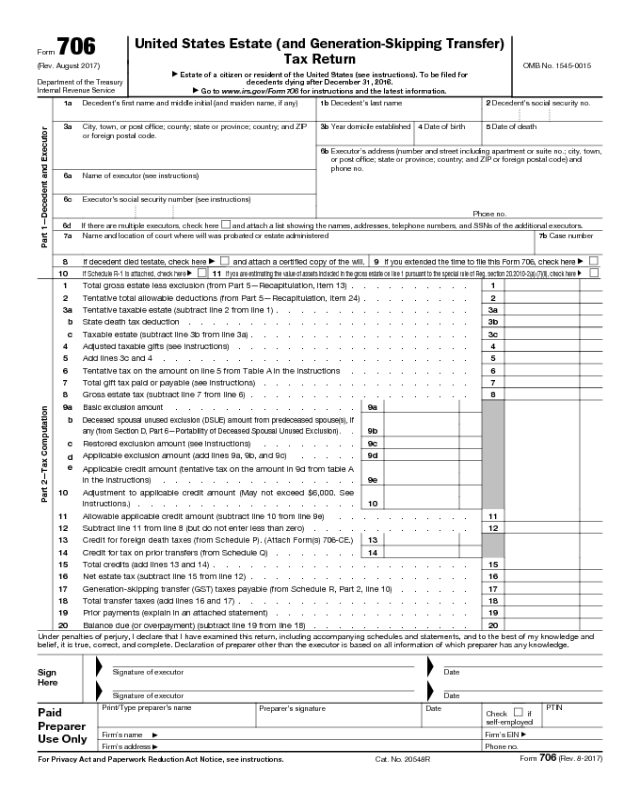

Form 706 (Rev. 8-2017)

Estate of:

Decedent’s social security number

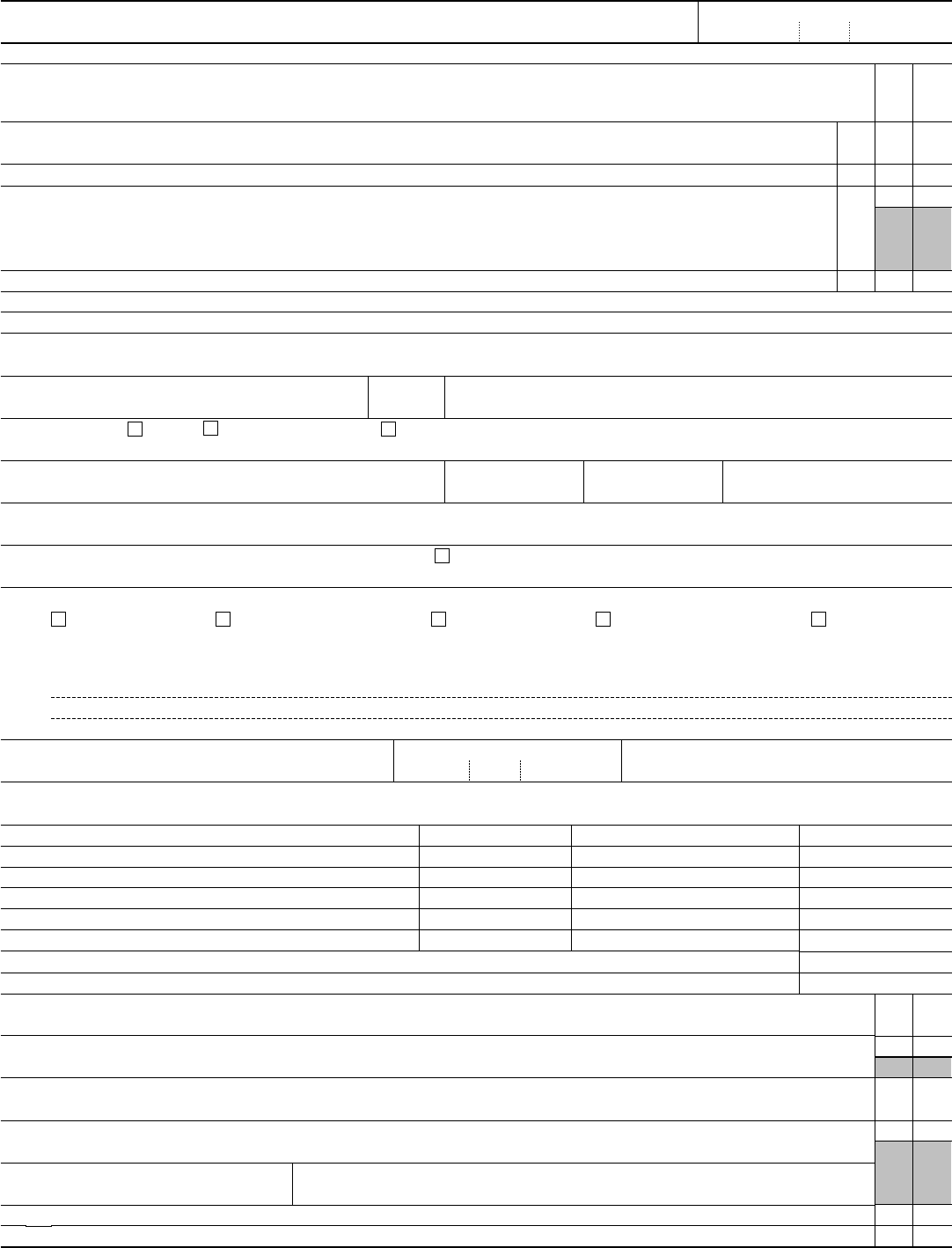

Part 4—General Information (continued)

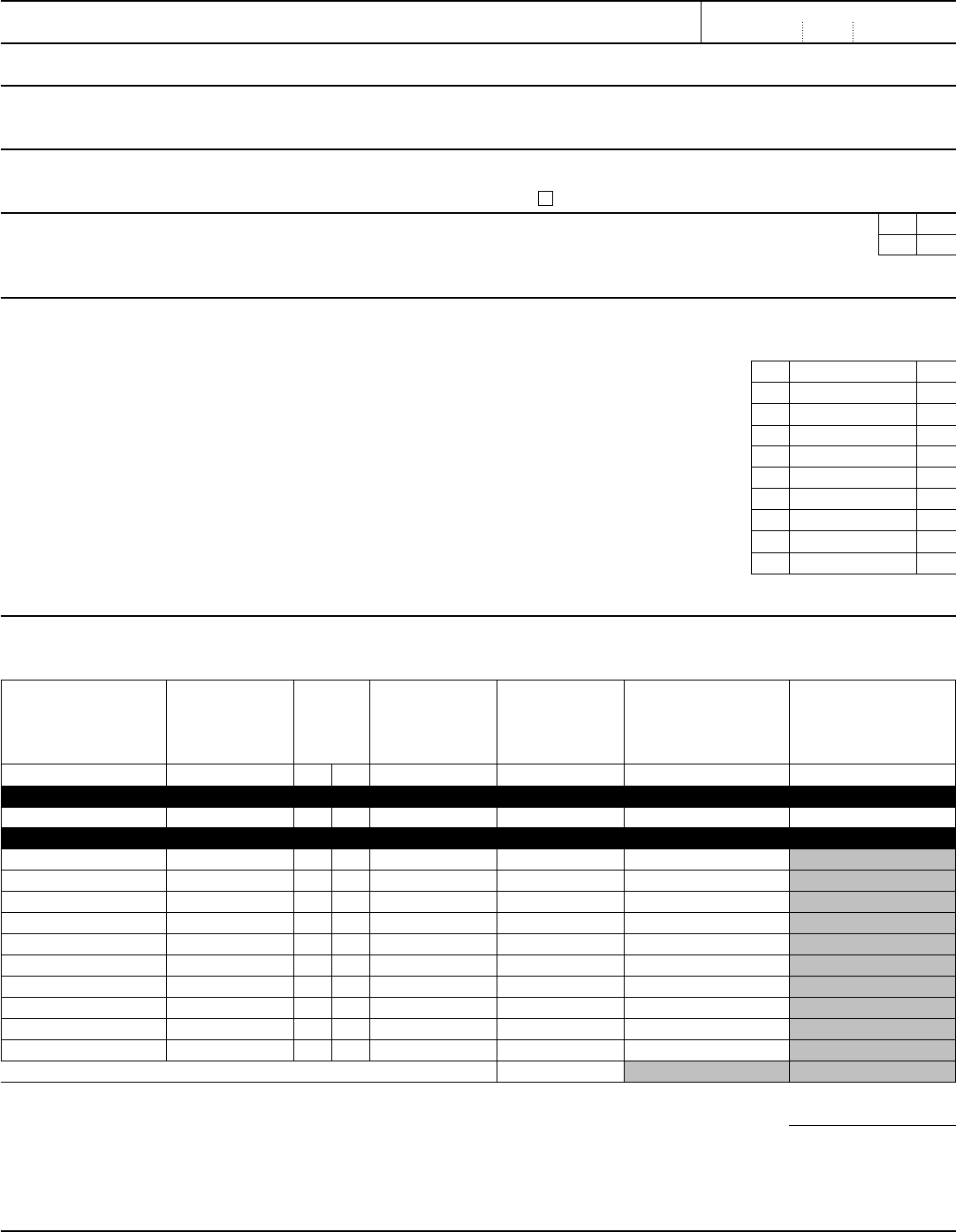

If you answer “Yes” to any of the following questions, you must attach additional information as described.

Yes No

10

Did the decedent at the time of death own any property as a joint tenant with right of survivorship in which (a) one or more of the

other joint tenants was someone other than the decedent’s spouse, and (b) less than the full value of the property is included on

the return as part of the gross estate? If “Yes,” you must complete and attach Schedule E . . . . . . . . . . .

11 a Did the decedent, at the time of death, own any interest in a partnership (for example, a family limited partnership), an

unincorporated business, or a limited liability company; or own any stock in an inactive or closely held corporation? . . . .

b If “Yes,” was the value of any interest owned (from above) discounted on this estate tax return? If “Yes,” see the instructions on

reporting the total accumulated or effective discounts taken on Schedule F or G . . . . . . . . . . . . . .

12 Did the decedent make any transfer described in sections 2035, 2036, 2037, or 2038? (see instructions) If “Yes,” you must

complete and attach Schedule G . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13a Were there in existence at the time of the decedent’s death any trusts created by the decedent during his or her lifetime? . .

b Were there in existence at the time of the decedent’s death any trusts not created by the decedent under which the decedent

possessed any power, beneficial interest, or trusteeship? . . . . . . . . . . . . . . . . . . . . .

c

Was the decedent receiving income from a trust created after October 22, 1986, by a parent or grandparent? . . . . . .

If “Yes,” was there a GST taxable termination (under section 2612) on the death of the decedent? . . . . . . . . .

d If there was a GST taxable termination (under section 2612), attach a statement to explain. Provide a copy of the trust or will

creating the trust, and give the name, address, and phone number of the current trustee(s).

e

Did the decedent at any time during his or her lifetime transfer or sell an interest in a partnership, limited liability company, or

closely held corporation to a trust described in lines 13a or 13b? . . . . . . . . . . . . . . . . . . .

If “Yes,” provide the EIN for this transferred/sold item.

▶

14

Did the decedent ever possess, exercise, or release any general power of appointment? If “Yes,” you must complete and attach Schedule H . . . .

15 Did the decedent have an interest in or a signature or other authority over a financial account in a foreign country, such as a bank

account, securities account, or other financial account? . . . . . . . . . . . . . . . . . . . . .

16 Was the decedent, immediately before death, receiving an annuity described in the “General” paragraph of the instructions for

Schedule I or a private annuity? If “Yes,” you must complete and attach Schedule I . . . . . . . . . . . . .

17 Was the decedent ever the beneficiary of a trust for which a deduction was claimed by the estate of a predeceased spouse

under section 2056(b)(7) and which is not reported on this return? If “Yes,” attach an explanation . . . . . . . . .

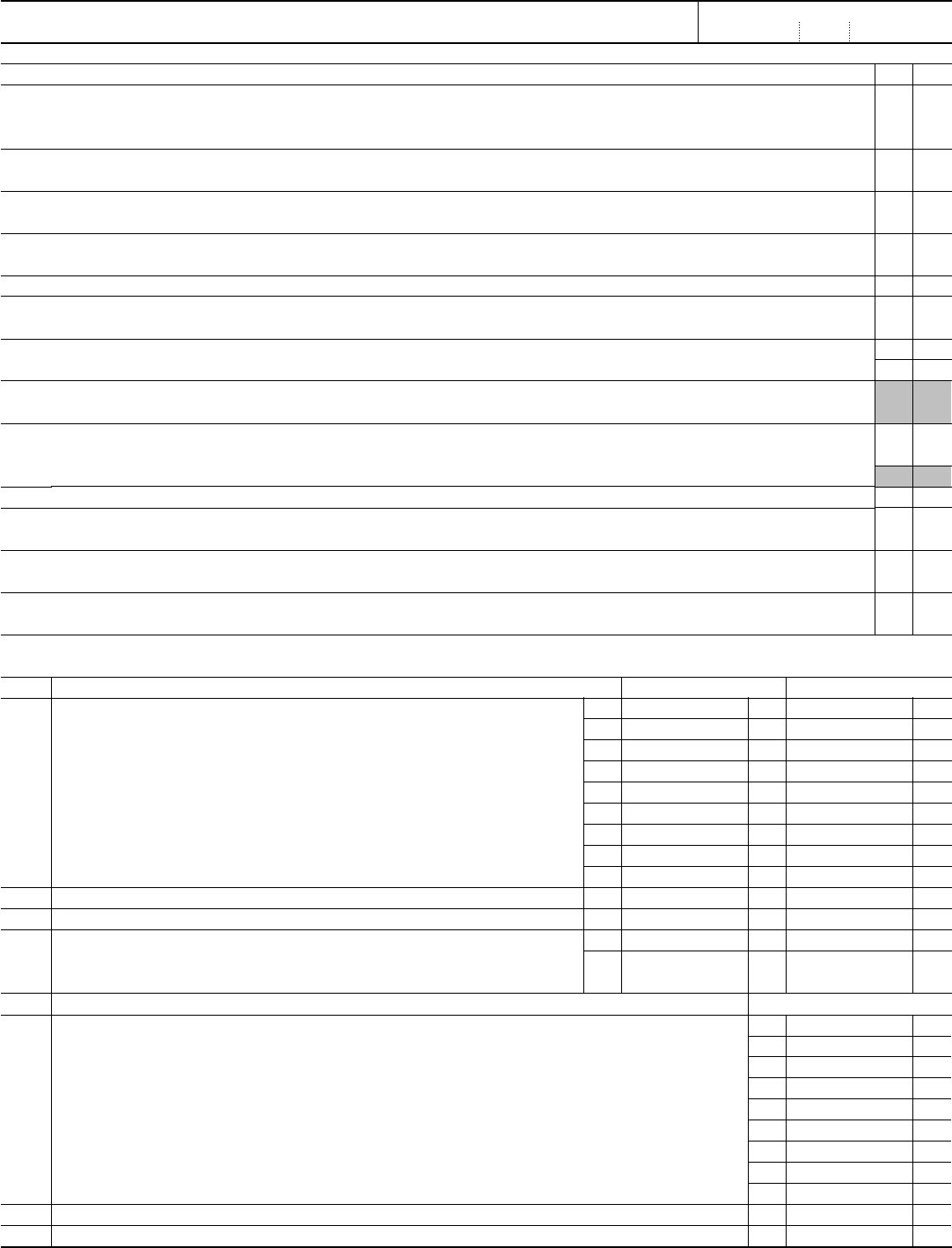

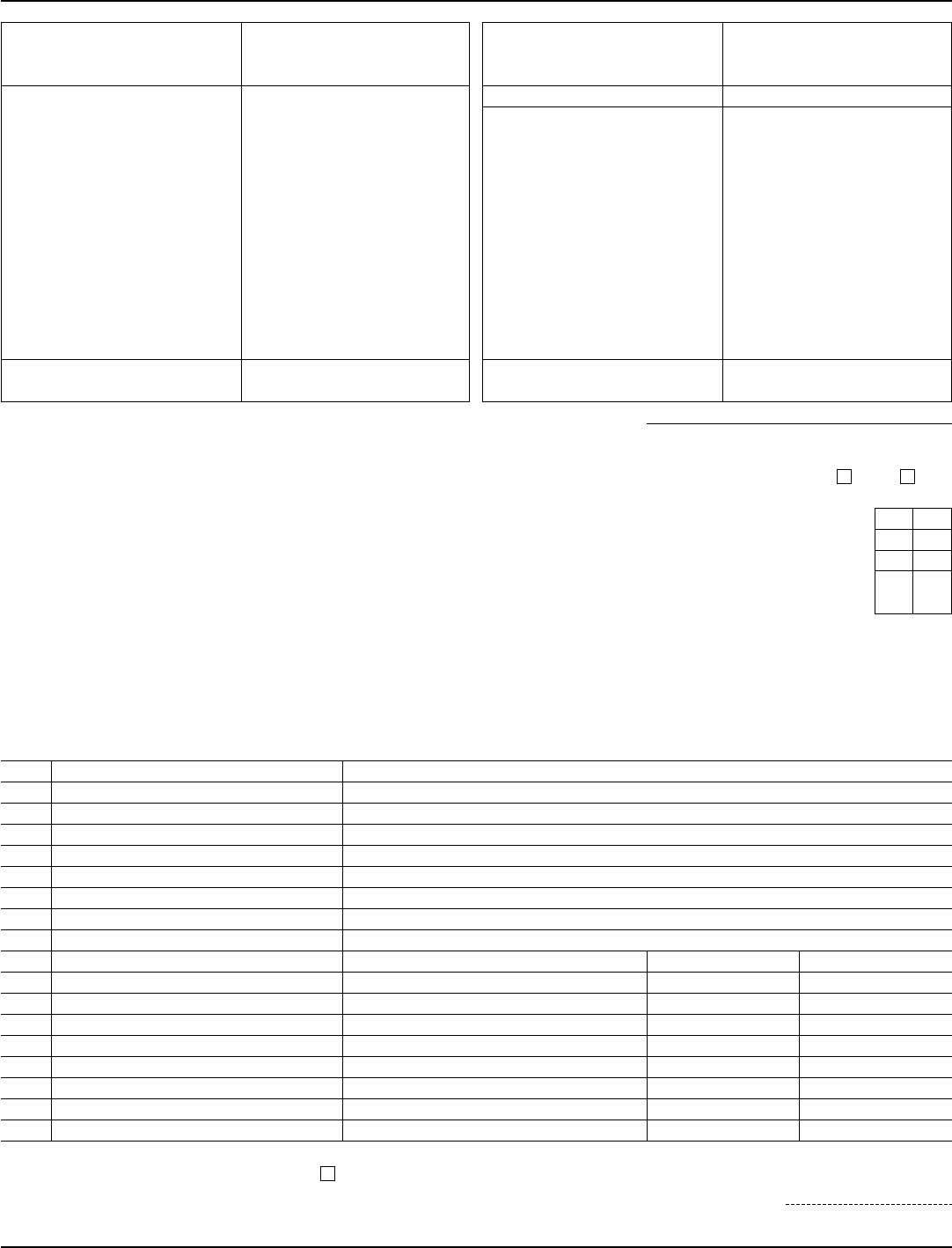

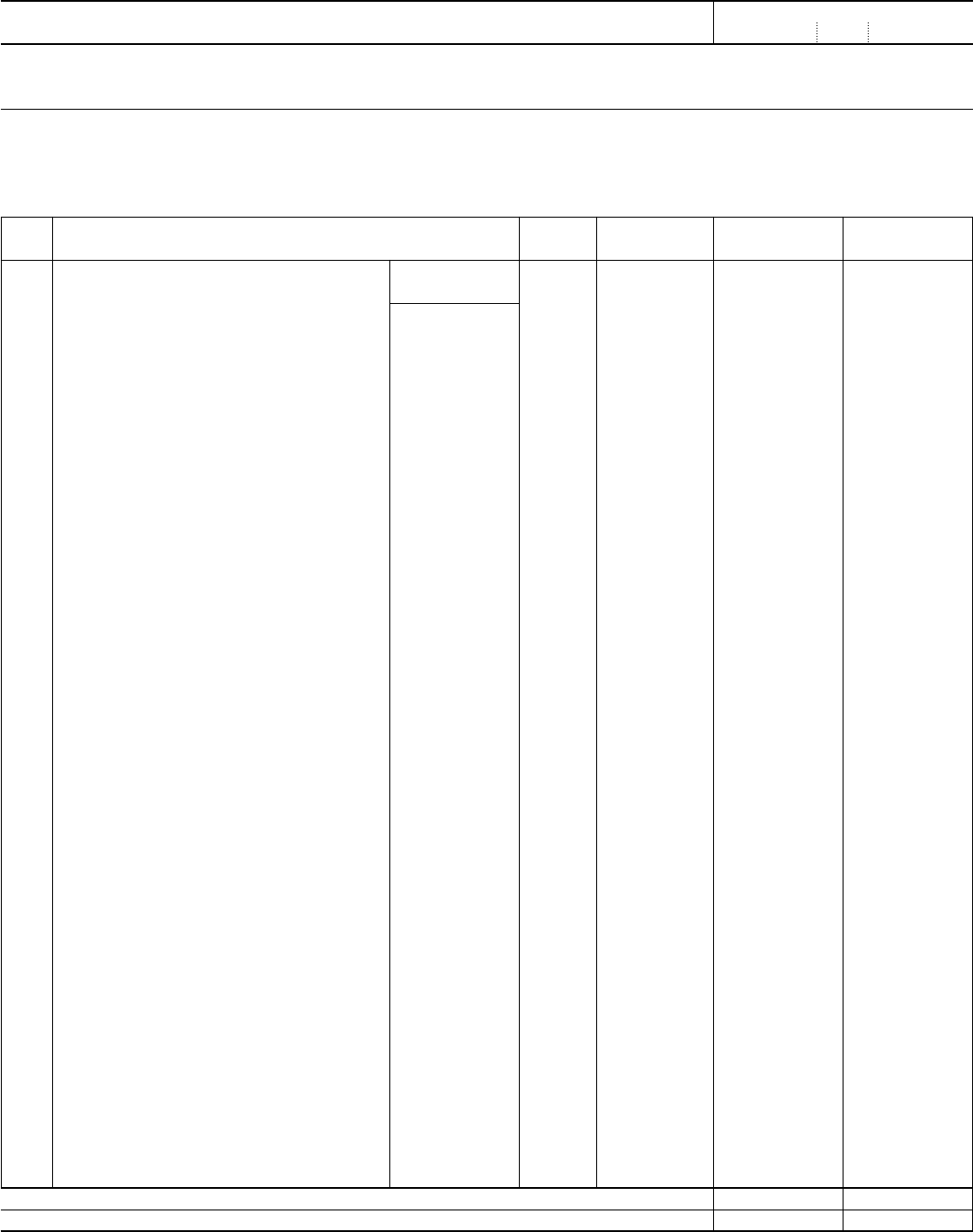

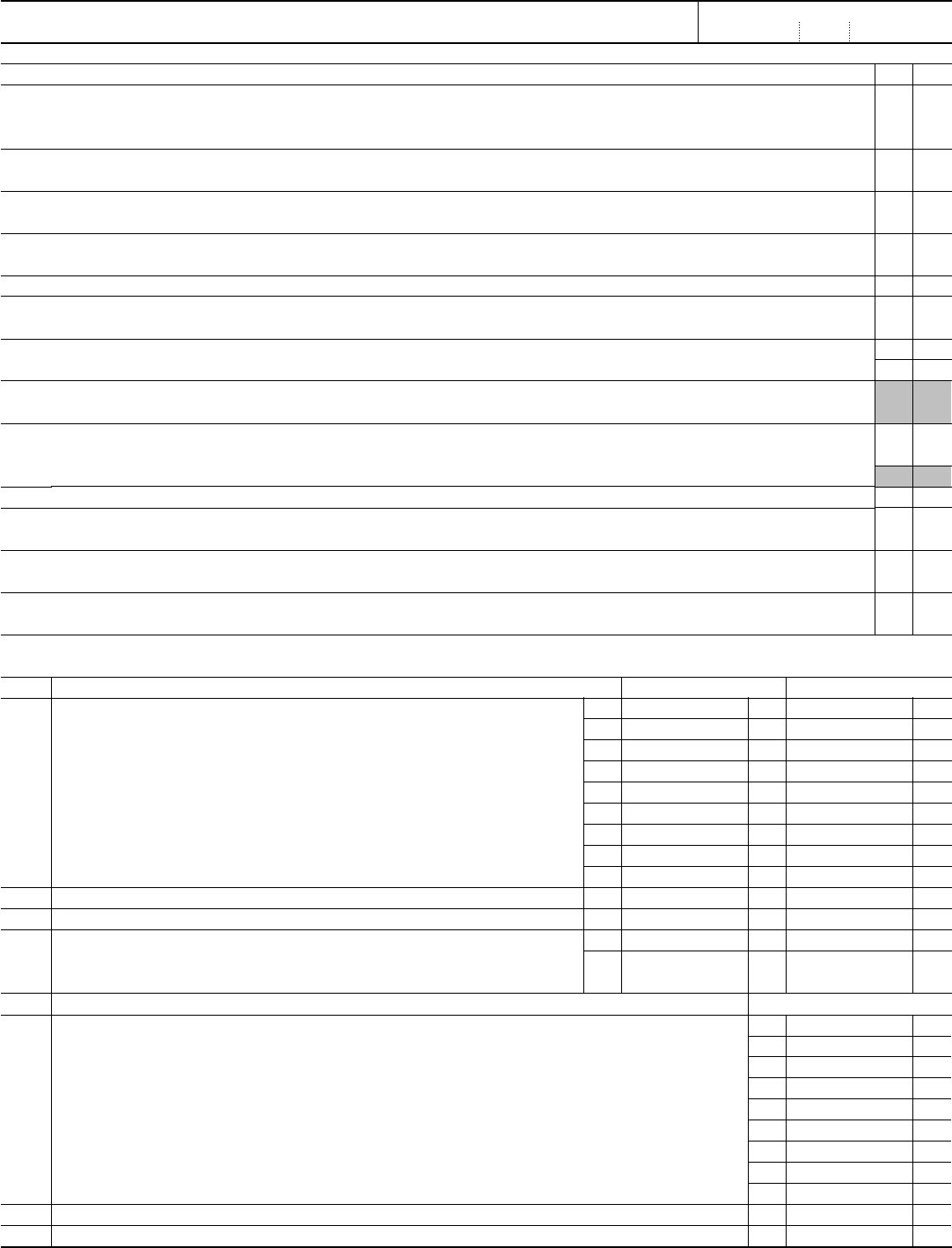

Part 5—Recapitulation. Note:

If estimating the value of one or more assets pursuant to the special rule of Reg. section 20.2010-2(a)(7)(ii), enter on both lines

10 and 23 the amount noted in the instructions for the corresponding range of values. (See instructions for details.)

Item no. Gross estate Alternate value Value at date of death

1

Schedule A—Real Estate . . . . . . . . . . . . . . . .

1

2 Schedule B—Stocks and Bonds . . . . . . . . . . . . . .

2

3 Schedule C—Mortgages, Notes, and Cash . . . . . . . . . . .

3

4 Schedule D—Insurance on the Decedent’s Life (attach Form(s) 712) . . . .

4

5 Schedule E—Jointly Owned Property (attach Form(s) 712 for life insurance) .

5

6 Schedule F—Other Miscellaneous Property (attach Form(s) 712 for life insurance)

6

7 Schedule G—Transfers During Decedent’s Life (att. Form(s) 712 for life insurance)

7

8 Schedule H—Powers of Appointment . . . . . . . . . . . .

8

9 Schedule I—Annuities . . . . . . . . . . . . . . . . .

9

10

Estimated value of assets subject to the special rule of Reg. section 20.2010-2(a)(7)(ii)

10

11 Total gross estate (add items 1 through 10) . . . . . . . . . . .

11

12 Schedule U—Qualified Conservation Easement Exclusion . . . . . .

12

13

Total gross estate less exclusion (subtract item 12 from item 11). Enter here and

on line 1 of Part 2—Tax Computation . . . . . . . . . . . . .

13

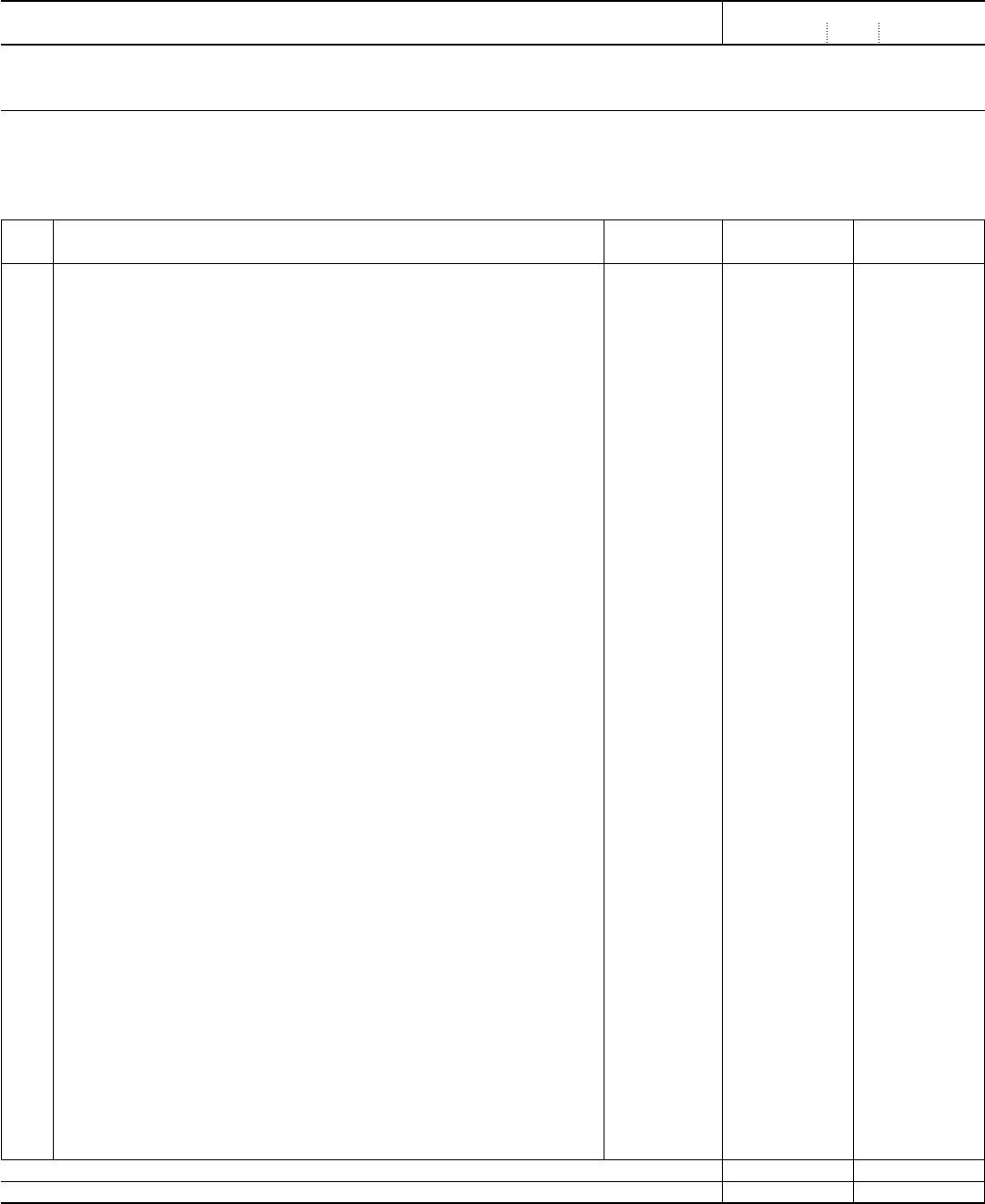

Item no. Deductions Amount

14

Schedule J—Funeral Expenses and Expenses Incurred in Administering Property Subject to Claims . . . . .

14

15 Schedule K—Debts of the Decedent . . . . . . . . . . . . . . . . . . . . .

15

16 Schedule K—Mortgages and Liens . . . . . . . . . . . . . . . . . . . . .

16

17 Total of items 14 through 16 . . . . . . . . . . . . . . . . . . . . . . .

17

18

Allowable amount of deductions from item 17 (see the instructions for item 18 of the Recapitulation) . . . . .

18

19 Schedule L—Net Losses During Administration . . . . . . . . . . . . . . . . . .

19

20 Schedule L—Expenses Incurred in Administering Property Not Subject to Claims . . . . . . . .

20

21 Schedule M—Bequests, etc., to Surviving Spouse . . . . . . . . . . . . . . . . .

21

22 Schedule O—Charitable, Public, and Similar Gifts and Bequests . . . . . . . . . . . . .

22

23 Estimated value of deductible assets subject to the special rule of Reg. section 20.2010-2(a)(7)(ii) . . .

23

24

Tentative total allowable deductions (add items 18 through 23). Enter here and on line 2 of the Tax Computation

24

Page 3