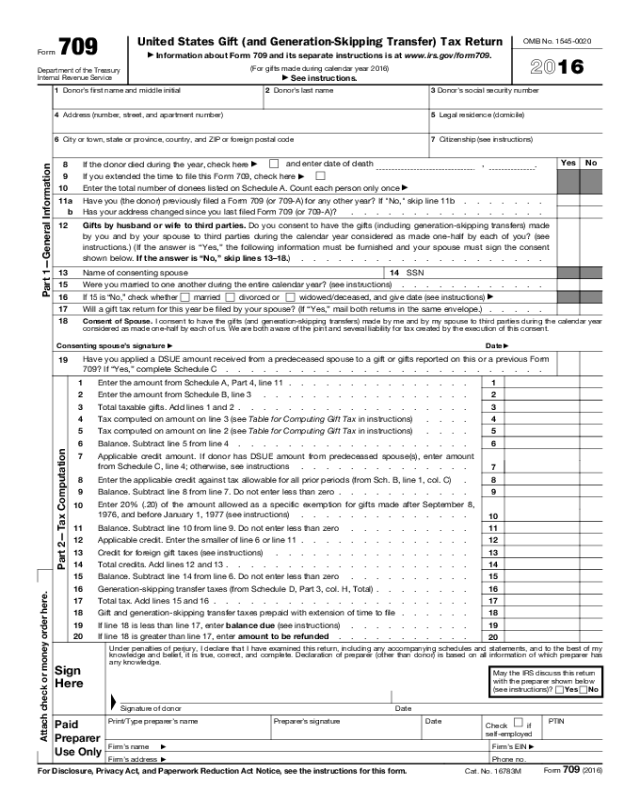

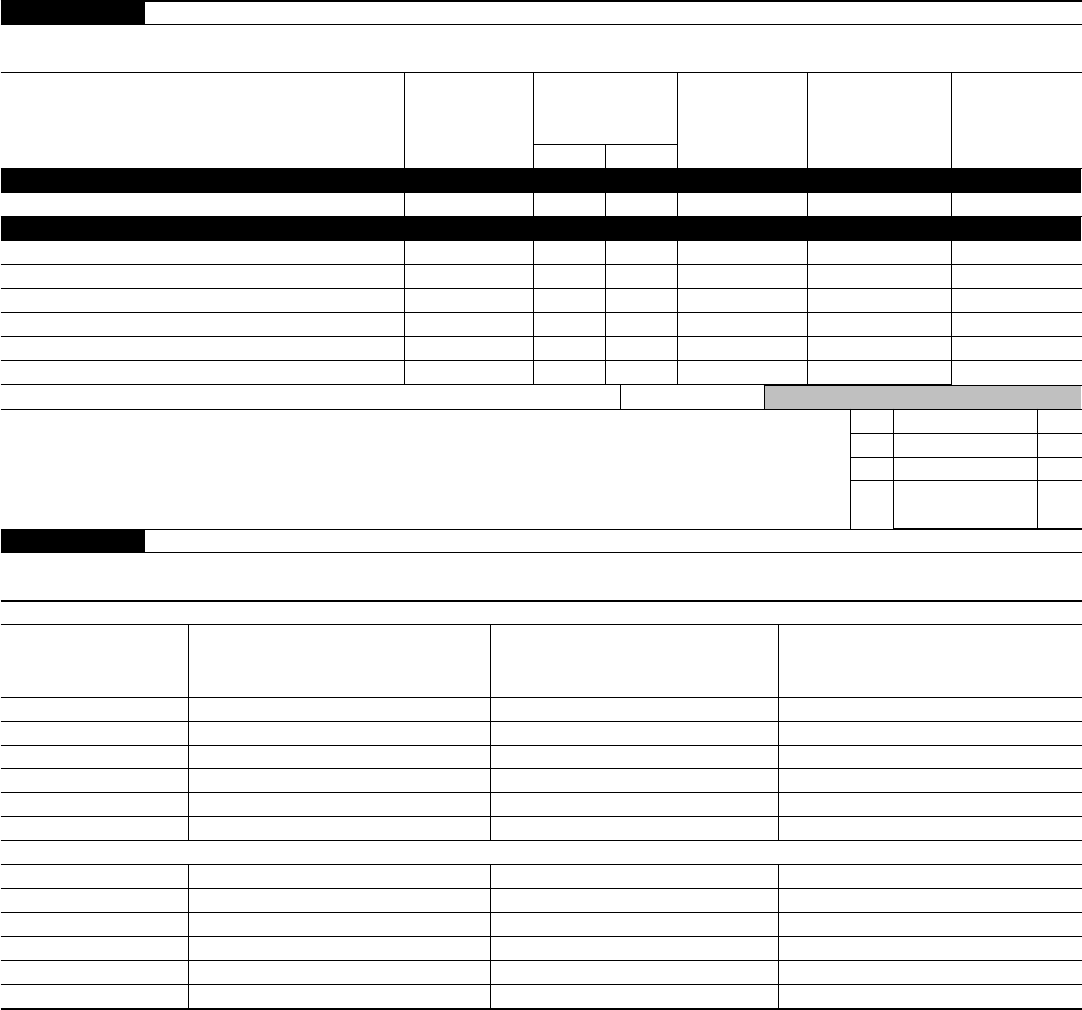

Form 709

Department of the Treasury

Internal Revenue Service

United States Gift (and Generation-Skipping Transfer) Tax Return

▶

Information about Form 709 and its separate instructions is at www.irs.gov/form709.

(For gifts made during calendar year 2016)

▶

See instructions.

OMB No. 1545-0020

2016

Part 1—General Information

1 Donor’s first name and middle initial 2 Donor’s last name 3 Donor’s social security number

4 Address (number, street, and apartment number) 5 Legal residence (domicile)

6 City or town, state or province, country, and ZIP or foreign postal code

7 Citizenship (see instructions)

8 If the donor died during the year, check here

▶

and enter date of death ,

.

Yes No

9

If you extended the time to file this Form 709, check here

▶

10 Enter the total number of donees listed on Schedule A. Count each person only once

▶

11 a Have you (the donor) previously filed a Form 709 (or 709-A) for any other year? If "No," skip line 11b . . . . . . .

b Has your address changed since you last filed Form 709 (or 709-A)? . . . . . . . . . . . . . . . .

12 Gifts by husband or wife to third parties. Do you consent to have the gifts (including generation-skipping transfers) made

by you and by your spouse to third parties during the calendar year considered as made one-half by each of you? (see

instructions.) (If the answer is “Yes,” the following information must be furnished and your spouse must sign the consent

shown below. If the answer is “No,” skip lines 13–18.) . . . . . . . . . . . . . . . . . . . .

13 Name of consenting spouse 14 SSN

15 Were you married to one another during the entire calendar year? (see instructions) . . . . . . . . . . . .

16

If 15 is “No,” check whether

married

divorced or widowed/deceased, and give date (see instructions)

▶

17 Will a gift tax return for this year be filed by your spouse? (If “Yes,” mail both returns in the same envelope.) . . . . .

18

Consent of Spouse. I consent to have the gifts (and generation-skipping transfers) made by me and by my spouse to third parties during the calendar year

considered as made one-half by each of us. We are both aware of the joint and several liability for tax created by the execution of this consent.

Consenting spouse’s signature

▶

Date

▶

19

Have you applied a DSUE amount received from a predeceased spouse to a gift or gifts reported on this or a previous Form

709? If “Yes,” complete Schedule C . . . . . . . . . . . . . . . . . . . . . . . . . .

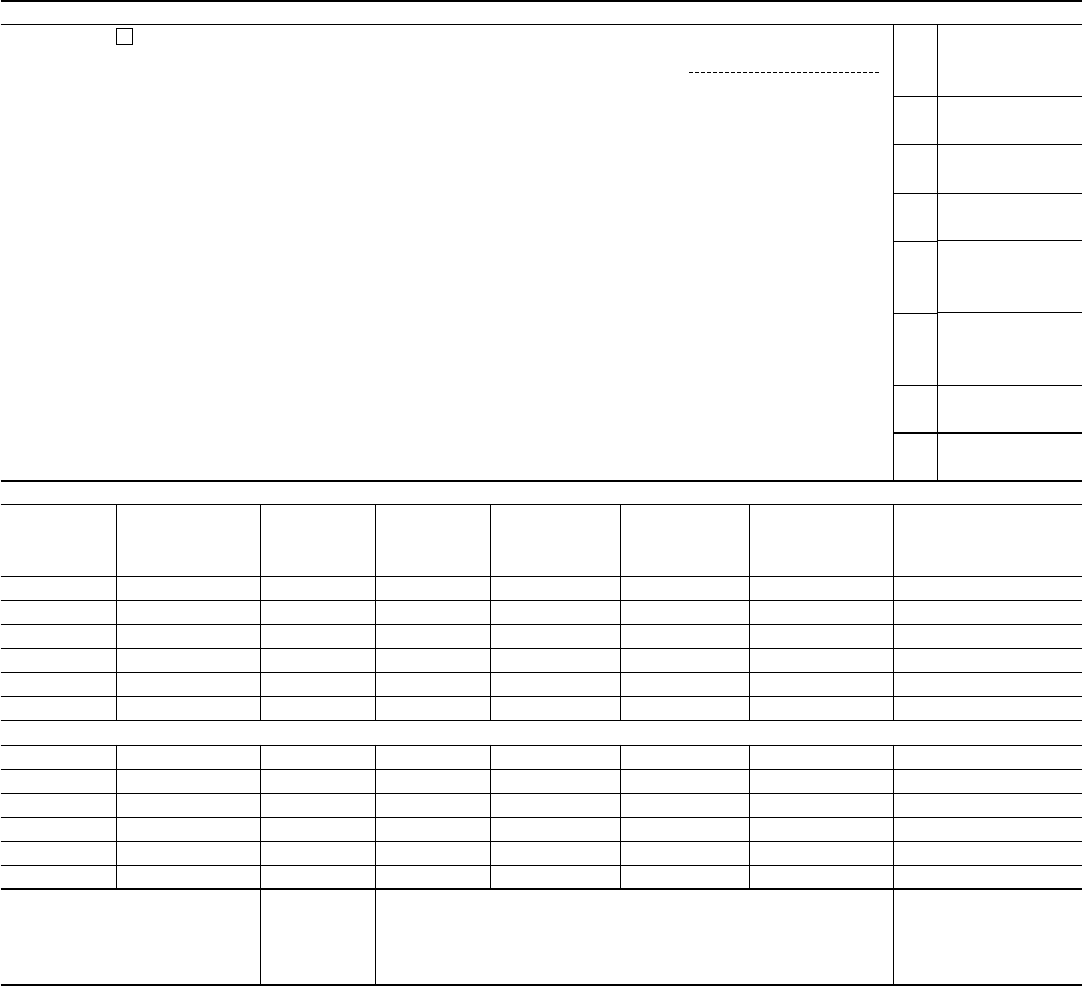

Part 2—Tax Computation

1 Enter the amount from Schedule A, Part 4, line 11 . . . . . . . . . . . . . . . 1

2 Enter the amount from Schedule B, line 3 . . . . . . . . . . . . . . . . . 2

3 Total taxable gifts. Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . 3

4 Tax computed on amount on line 3 (see Table for Computing Gift Tax in instructions) . . . . 4

5 Tax computed on amount on line 2 (see Table for Computing Gift Tax in instructions) . . . . 5

6 Balance. Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . 6

7

Applicable credit amount. If donor has DSUE amount from predeceased spouse(s), enter amount

from Schedule C, line 4; otherwise, see instructions . . . . . . . . . . . . . .

7

8 Enter the applicable credit against tax allowable for all prior periods (from Sch. B, line 1, col. C) .

8

9 Balance. Subtract line 8 from line 7. Do not enter less than zero . . . . . . . . . . . 9

10

Enter 20% (.20) of the amount allowed as a specific exemption for gifts made after September 8,

1976, and before January 1, 1977 (see instructions) . . . . . . . . . . . . . .

10

11 Balance. Subtract line 10 from line 9. Do not enter less than zero . . . . . . . . . . 11

12 Applicable credit. Enter the smaller of line 6 or line 11 . . . . . . . . . . . . . . 12

13 Credit for foreign gift taxes (see instructions) . . . . . . . . . . . . . . . . 13

14 Total credits. Add lines 12 and 13 . . . . . . . . . . . . . . . . . . . . 14

15 Balance. Subtract line 14 from line 6. Do not enter less than zero . . . . . . . . . . 15

16 Generation-skipping transfer taxes (from Schedule D, Part 3, col. H, Total) . . . . . . . . 16

17 Total tax. Add lines 15 and 16 . . . . . . . . . . . . . . . . . . . . .

17

18 Gift and generation-skipping transfer taxes prepaid with extension of time to file . . . . . .

18

19 If line 18 is less than line 17, enter balance due (see instructions) . . . . . . . . . .

19

20 If line 18 is greater than line 17, enter amount to be refunded . . . . . . . . . . .

20

Attach check or money order here.

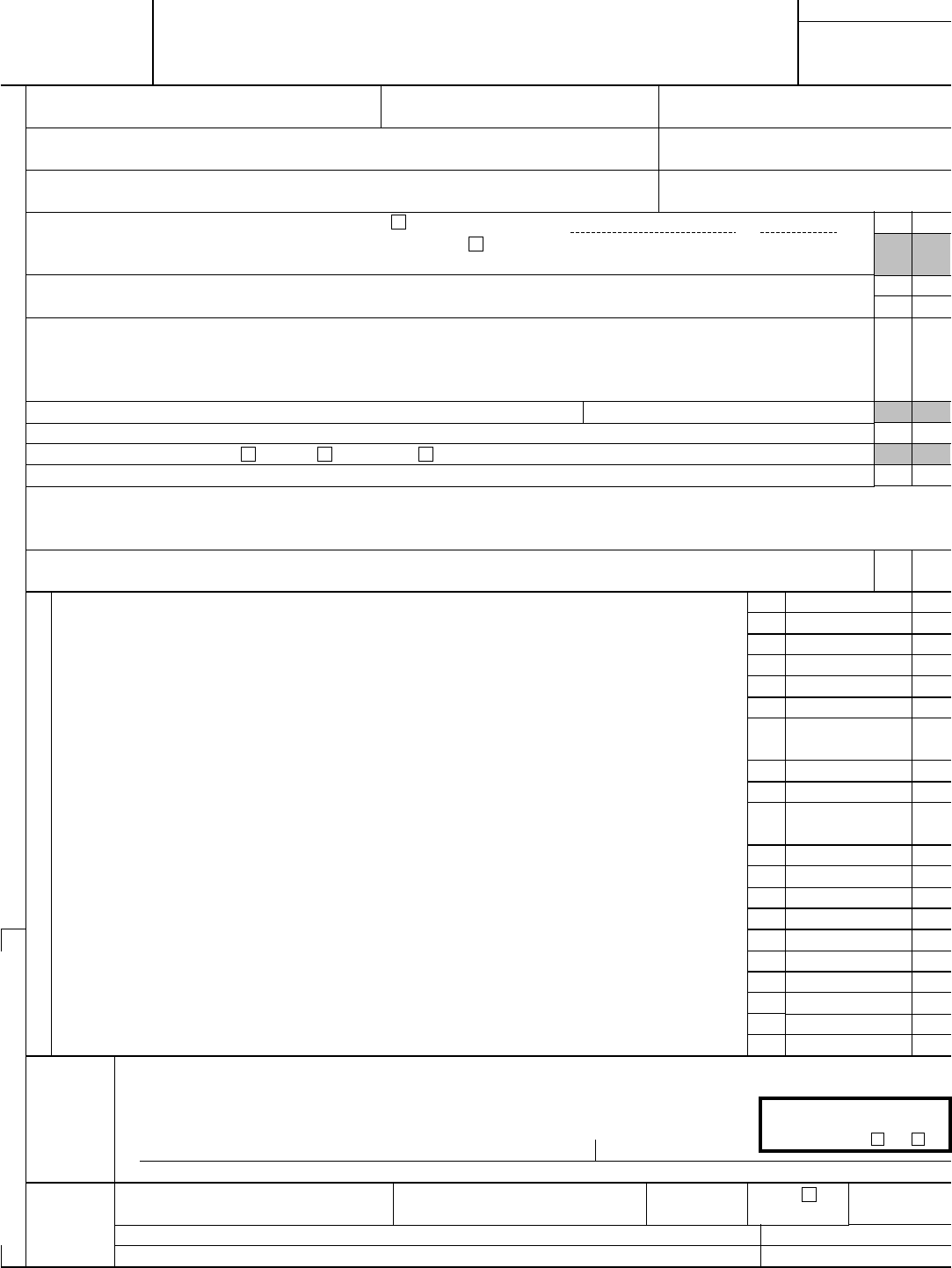

Sign

Here

Under penalties of perjury, I declare that I have examined this return, including any accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than donor) is based on all information of which preparer has

any knowledge.

May the IRS discuss this return

with the preparer shown below

(see instructions)?

Yes No

▲

Signature of donor

Date

Paid

Preparer

Use Only

Print/Type preparer’s name Preparer’s signature Date

Check if

self-employed

PTIN

Firm’s name

▶

Firm’s address

▶

Firm’s EIN

▶

Phone no.

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see the instructions for this form.

Cat. No. 16783M

Form 709 (2016)