Form 720 (Rev. 4-2017)

Page 7

11

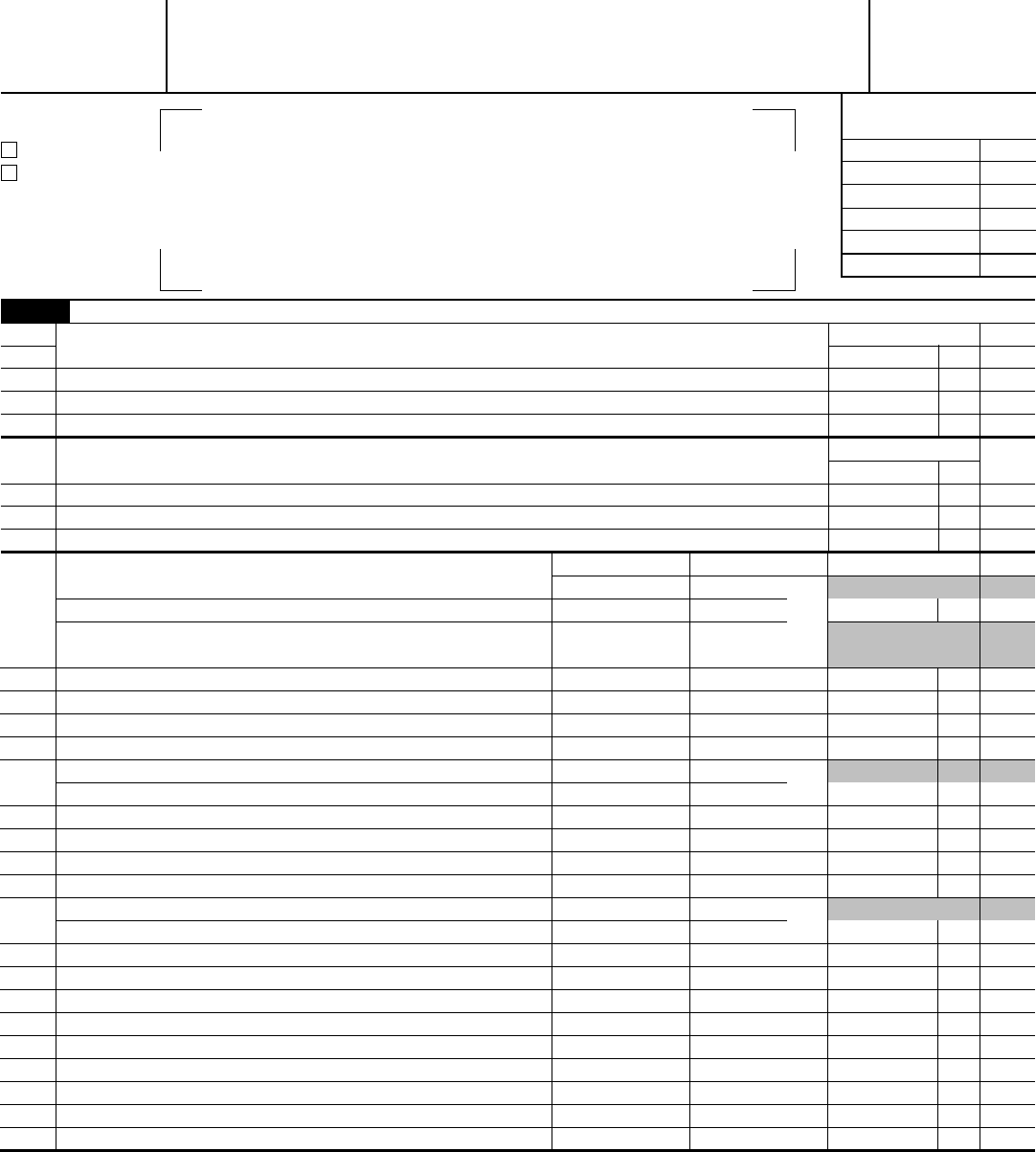

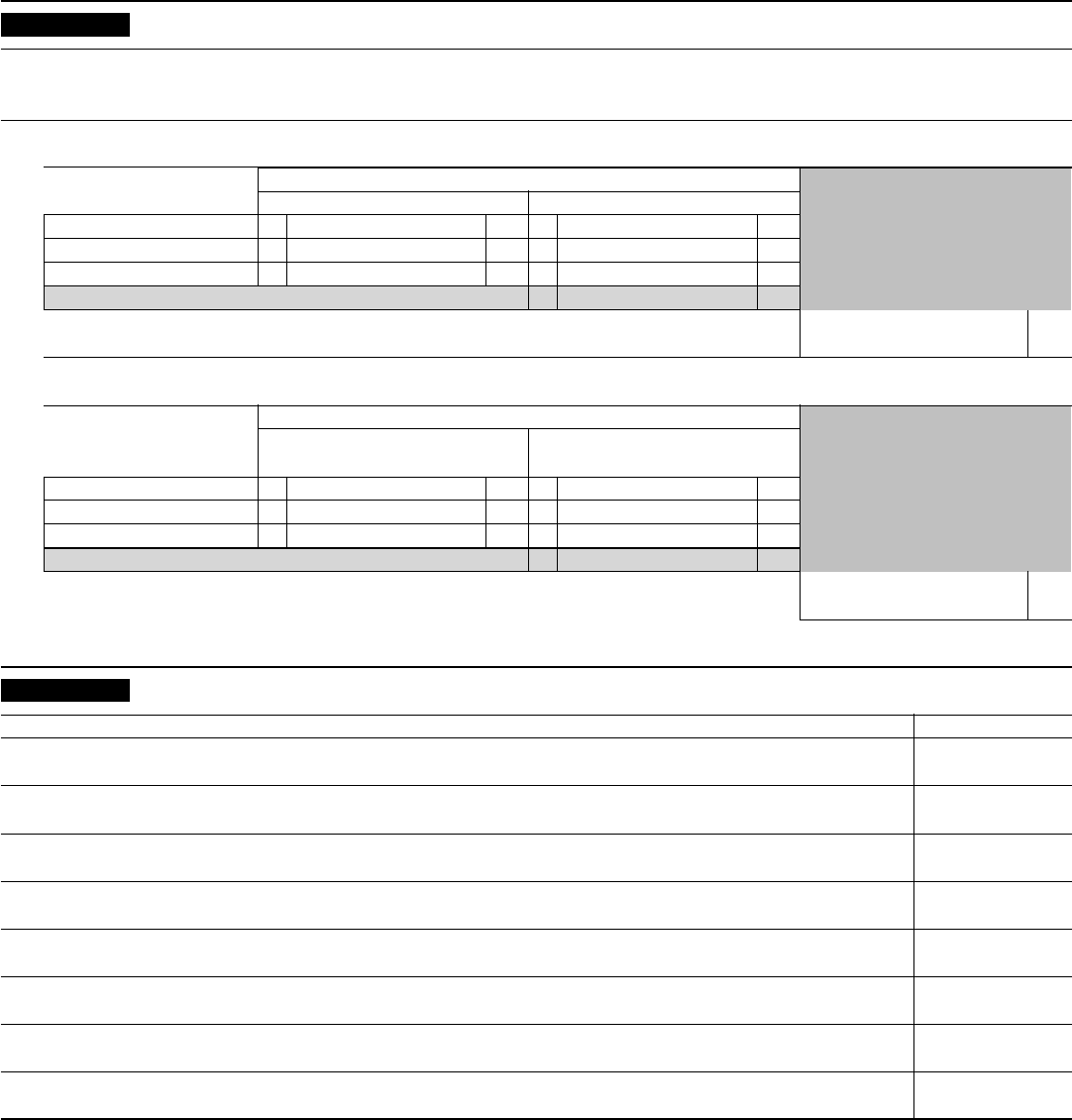

Sales by Registered Ultimate Vendors of Aviation Gasoline

Registration number

▶

Claimant sold the aviation gasoline at a tax-excluded price and has not collected the amount of tax from the buyer, repaid the amount of

tax to the buyer, or has obtained written consent of the buyer to take the claim; and obtained an unexpired certificate from the buyer

and has no reason to believe any information in the certificate is false. See the instructions for additional information to be submitted.

Rate Gallons Amount of claim CRN

a Use by a nonprofit educational organization

$

324

b Use by a state or local government

12

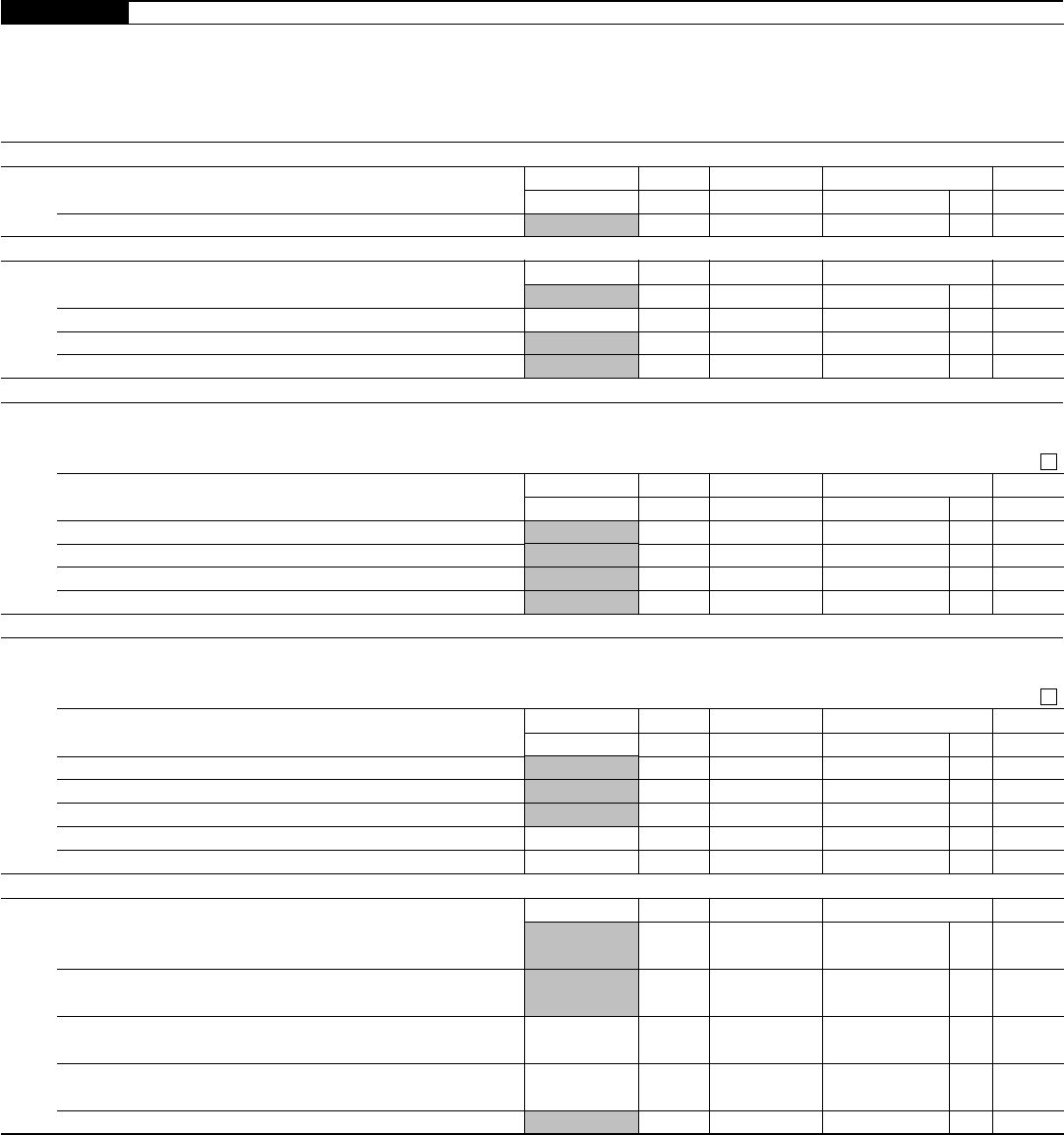

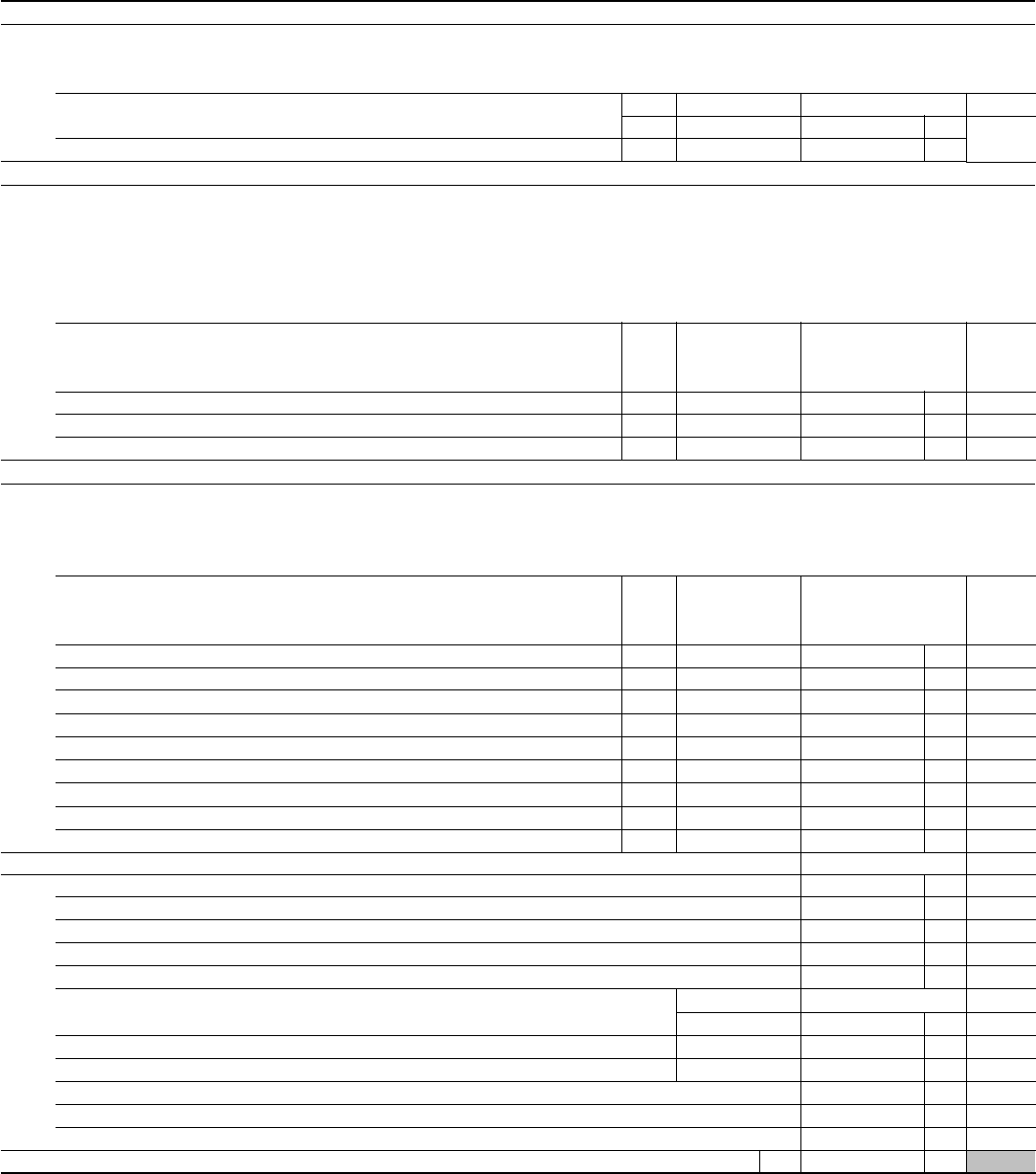

Biodiesel or Renewable Diesel Mixture Credit

Period of claim

▶

Registration number

▶

Biodiesel mixtures. Claimant produced a mixture by mixing biodiesel with diesel fuel. The biodiesel used to produce the mixture met ASTM

D6751 and met EPA's registration requirements for fuels and fuel additives. The mixture was sold by the claimant to any person for use as a

fuel or was used as a fuel by the claimant. Claimant has attached the Certificate for Biodiesel and, if applicable, the Statement of Biodiesel

Reseller. Renewable diesel mixtures. Claimant produced a mixture by mixing renewable diesel with liquid fuel (other than renewable diesel).

The renewable diesel used to produce the renewable diesel mixture was derived from biomass, met EPA's registration requirements for fuels

and fuel additives, and met ASTM D975, D396, or other equivalent standard approved by the IRS. The mixture was sold by the claimant to any

person for use as a fuel or was used as a fuel by the claimant. Claimant has attached the Certificate for Biodiesel and, if applicable, Statement

of Biodiesel Reseller, both of which have been edited as discussed in the instructions for line 13. See the instructions for line 13 for information

about renewable diesel used in aviation.

Caution: As of the publishing of this form, these credits expired for fuel sold or

used after December 31, 2016. Don’t use line 12 unless they’ve been extended.

See IRS.gov/Form720.

Rate

Gal. of biodiesel or

renewable diesel

Amount of claim

CRN

a Biodiesel (other than agri-biodiesel) mixtures

$

388

b

Agri-biodiesel mixtures 390

c Renewable diesel mixtures 307

13

Alternative Fuel Credit and Alternative Fuel Mixture Credit

Registration number

▶

For the alternative fuel mixture credit, claimant produced a mixture by mixing taxable fuel with alternative fuel. Claimant certifies that it (a)

produced the alternative fuel, or (b) has in its possession the name, address, and EIN of the person(s) that sold the alternative fuel to the

claimant; the date of purchase; and an invoice or other documentation identifying the amount of the alternative fuel. The claimant also certifies

that it made no other claim for the amount of the alternative fuel, or has repaid the amount to the government. The alternative fuel mixture was

sold by the claimant to any person for use as a fuel or was used as a fuel by the claimant.

Caution: As of the publishing of this form, these credits expired for fuel

sold or used after December 31, 2016. Don’t use line 13 unless they’ve

been extended. See IRS.gov/Form720.

Rate

Gallons, or

gasoline or diesel

gallon equivalents

(see instructions)

Amount of claim

CRN

a Liquefied petroleum gas (LPG)

$

426

b

“P Series” fuels 427

c

Compressed natural gas (CNG) 428

d

Liquefied hydrogen 429

e

Fischer-Tropsch process liquid fuel from coal (including peat) 430

f

Liquid fuel derived from biomass 431

g

Liquefied natural gas (LNG) 432

h

Liquefied gas derived from biomass 436

i Compressed gas derived from biomass 437

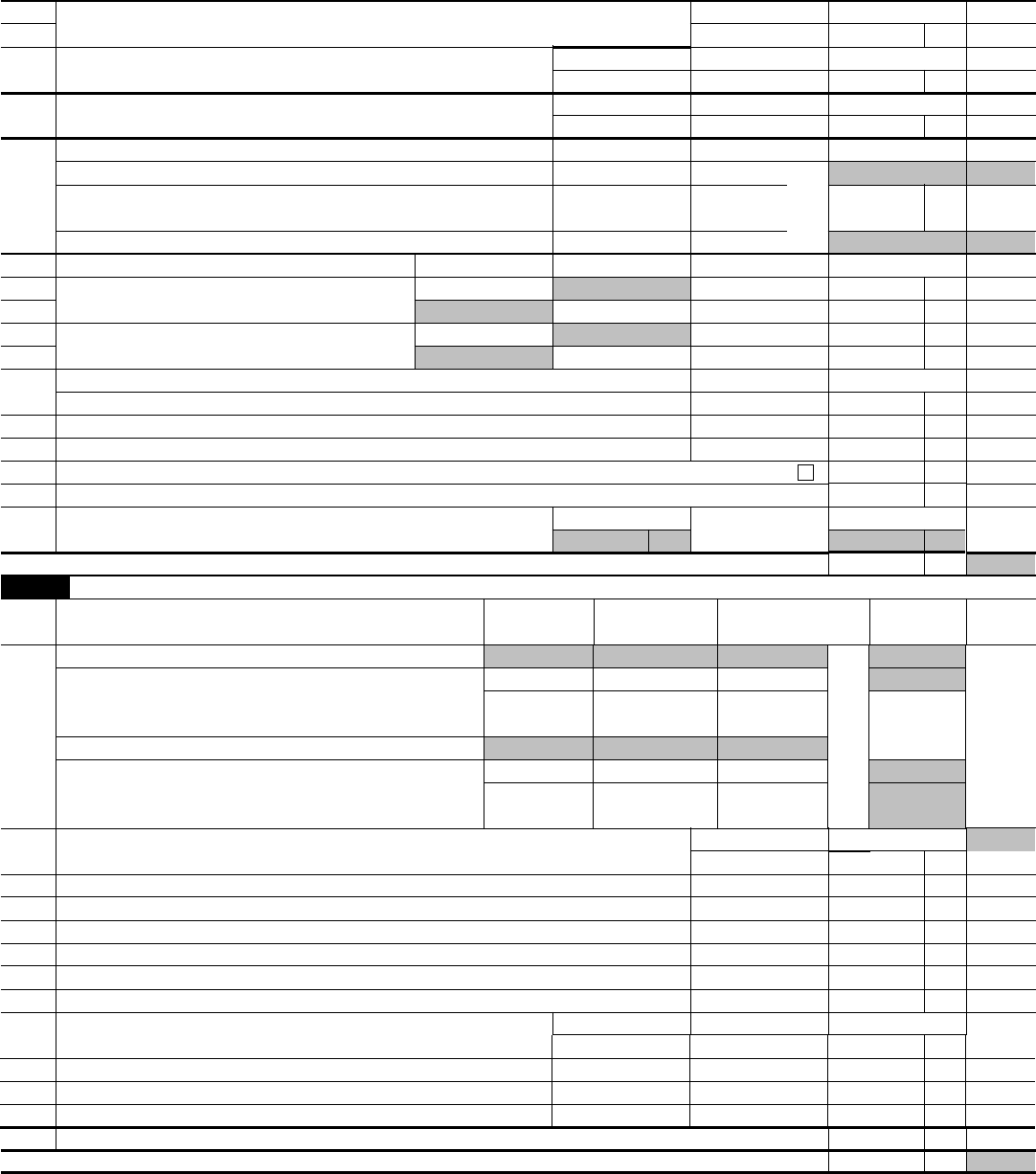

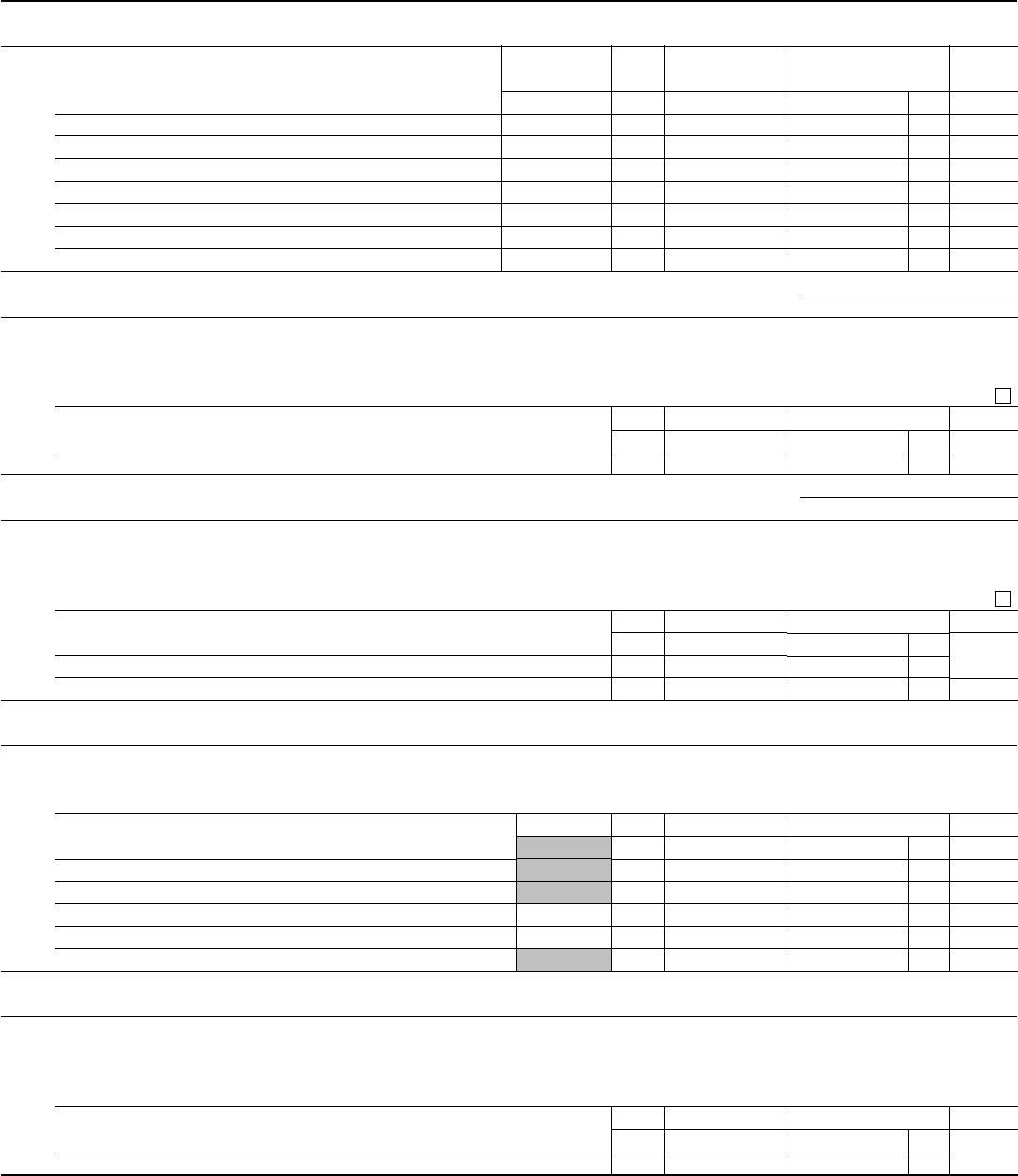

14

Other claims. See the instructions. For lines 14b and 14c, see the Caution above line 1 on page 5.

Amount of claim CRN

a Section 4051(d) tire credit (tax on vehicle reported on IRS No. 33)

$

366

b

Exported dyed diesel fuel and exported gasoline blendstocks taxed at $.001 415

c

Exported dyed kerosene 416

d

Diesel-water fuel emulsion

e Registered credit card issuers

Number of tires Amount of claim CRN

f Taxable tires other than bias ply or super single tires

$

396

g

Taxable tires, bias ply or super single tires (other than super single tires designed for steering)

304

h

Taxable tires, super single tires designed for steering 305

i

j

k

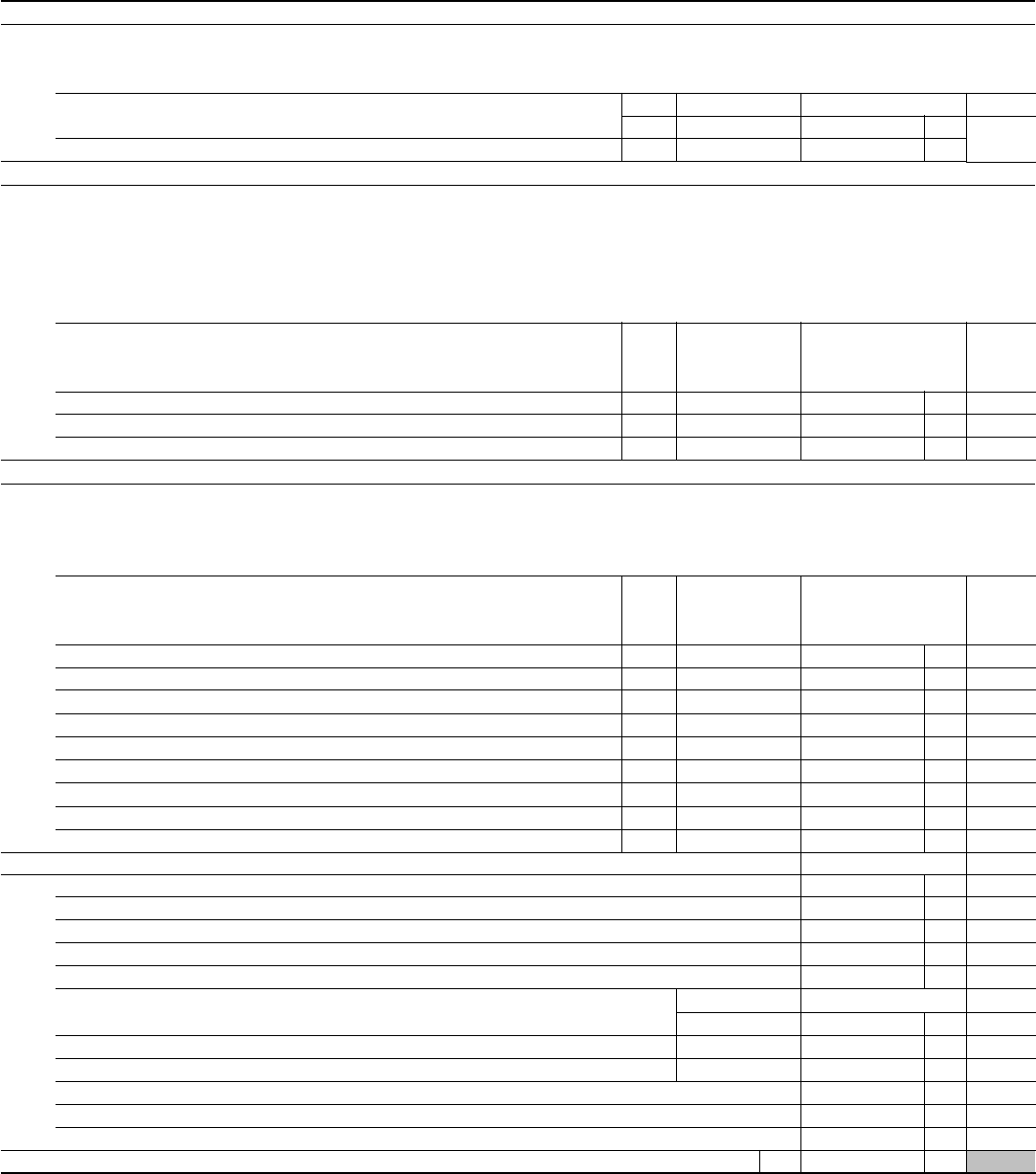

15

Total claims. Add amounts on lines 1 through 14. Enter the result here and on Form 720, Part III, line 4.

15

Form 720 (Rev. 4-2017)