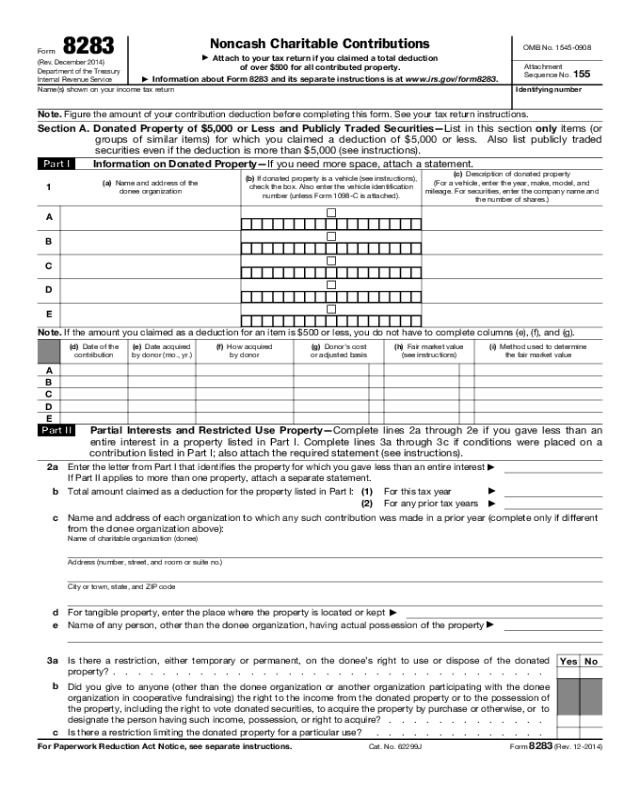

Form 8283 (Rev. 12-2014)

Page 2

Name(s) shown on your income tax return Identifying number

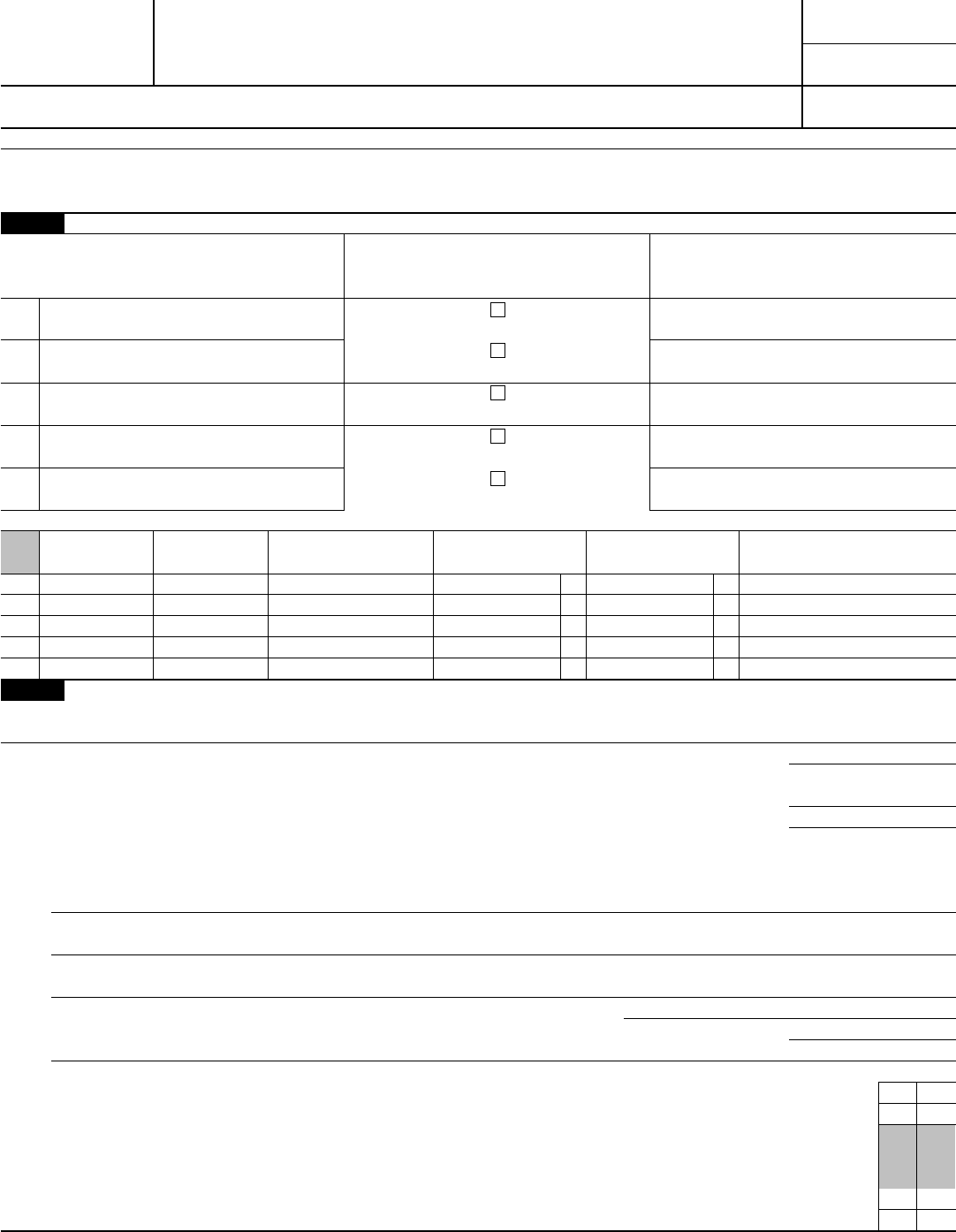

Section B.

Donated Property Over $5,000 (Except Publicly Traded Securities)—Complete this section for one item (or one group of

similar items) for which you claimed a deduction of more than $5,000 per item or group (except contributions of publicly

traded securities reported in Section A). Provide a separate form for each property donated unless it is part of a group of

similar items. An appraisal is generally required for property listed in Section B. See instructions.

Part I Information on Donated Property—To be completed by the taxpayer and/or the appraiser.

4

Check the box that describes the type of property donated:

a

Art* (contribution of $20,000 or more)

b

Qualified Conservation Contribution

c

Equipment

d

Art* (contribution of less than $20,000)

e

Other Real Estate

f

Securities

g

Collectibles**

h

Intellectual Property

i

Vehicles

j

Other

*Art includes paintings, sculptures, watercolors, prints, drawings, ceramics, antiques, decorative arts, textiles, carpets, silver, rare manuscripts, historical memorabilia, and

other similar objects.

**Collectibles include coins, stamps, books, gems, jewelry, sports memorabilia, dolls, etc., but not art as defined above.

Note. In certain cases, you must attach a qualified appraisal of the property. See instructions.

5

(a) Description of donated property (if you need

more space, attach a separate statement)

(b) If tangible property was donated, give a brief summary of the overall

physical condition of the property at the time of the gift

(c) Appraised fair

market value

A

B

C

D

(d) Date acquired

by donor (mo., yr.)

(e) How acquired by donor

(f) Donor’s cost or

adjusted basis

(g) For bargain sales, enter

amount received

See instructions

(h) Amount claimed as a

deduction

(i) Date of contribution

A

B

C

D

Part II Taxpayer (Donor) Statement—List each item included in Part I above that the appraisal identifies as having

a value of $500 or less. See instructions.

I declare that the following item(s) included in Part I above has to the best of my knowledge and belief an appraised value of not more than $500

(per item). Enter identifying letter from Part I and describe the specific item. See instructions.

▶

Signature of taxpayer (donor)

▶

Date

▶

Part III Declaration of Appraiser

I declare that I am not the donor, the donee, a party to the transaction in which the donor acquired the property, employed by, or related to any of the foregoing persons, or

married to any person who is related to any of the foregoing persons. And, if regularly used by the donor, donee, or party to the transaction, I performed the majority of my

appraisals during my tax year for other persons.

Also, I declare that I perform appraisals on a regular basis; and that because of my qualifications as described in the appraisal, I am qualified to make appraisals of the type of property being

valued. I certify that the appraisal fees were not based on a percentage of the appraised property value. Furthermore, I understand that a false or fraudulent overstatement of the property

value as described in the qualified appraisal or this Form 8283 may subject me to the penalty under section 6701(a) (aiding and abetting the understatement of tax liability). In addition, I

understand that I may be subject to a penalty under section 6695A if I know, or reasonably should know, that my appraisal is to be used in connection with a return or claim for refund and a

substantial or gross valuation misstatement results from my appraisal. I affirm that I have not been barred from presenting evidence or testimony by the Office of Professional Responsibility.

Sign

Here

Signature

▶

Title

▶

Date

▶

Business address (including room or suite no.) Identifying number

City or town, state, and ZIP code

Part IV Donee Acknowledgment—To be completed by the charitable organization.

This charitable organization acknowledges that it is a qualified organization under section 170(c) and that it received the donated property as described

in Section B, Part I, above on the following date

▶

Furthermore, this organization affirms that in the event it sells, exchanges, or otherwise disposes of the property described in Section B, Part I (or any

portion thereof) within 3 years after the date of receipt, it will file Form 8282, Donee Information Return, with the IRS and give the donor a copy of that

form. This acknowledgment does not represent agreement with the claimed fair market value.

Does the organization intend to use the property for an unrelated use? . . . . . . . . . . . . . . .

▶

Yes No

Name of charitable organization (donee) Employer identification number

Address (number, street, and room or suite no.) City or town, state, and ZIP code

Authorized signature

Title

Date

Form 8283 (Rev. 12-2014)