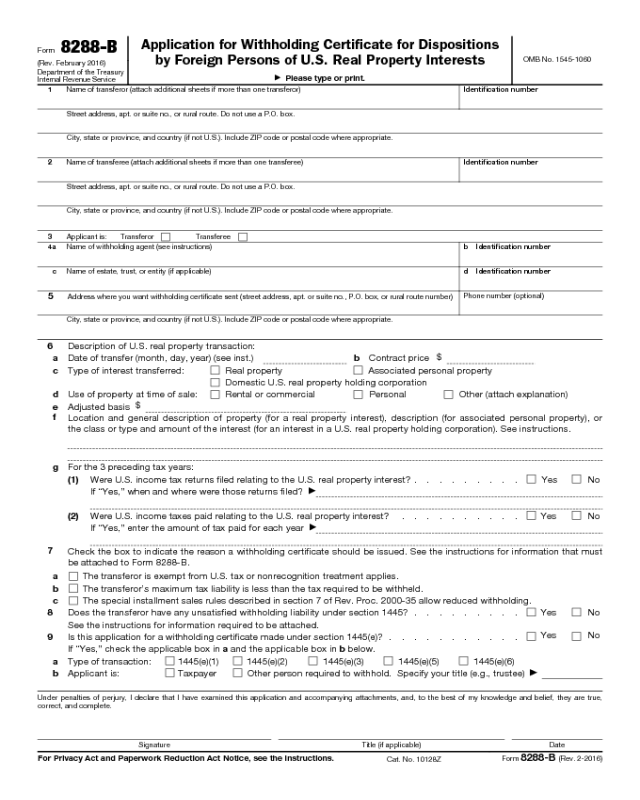

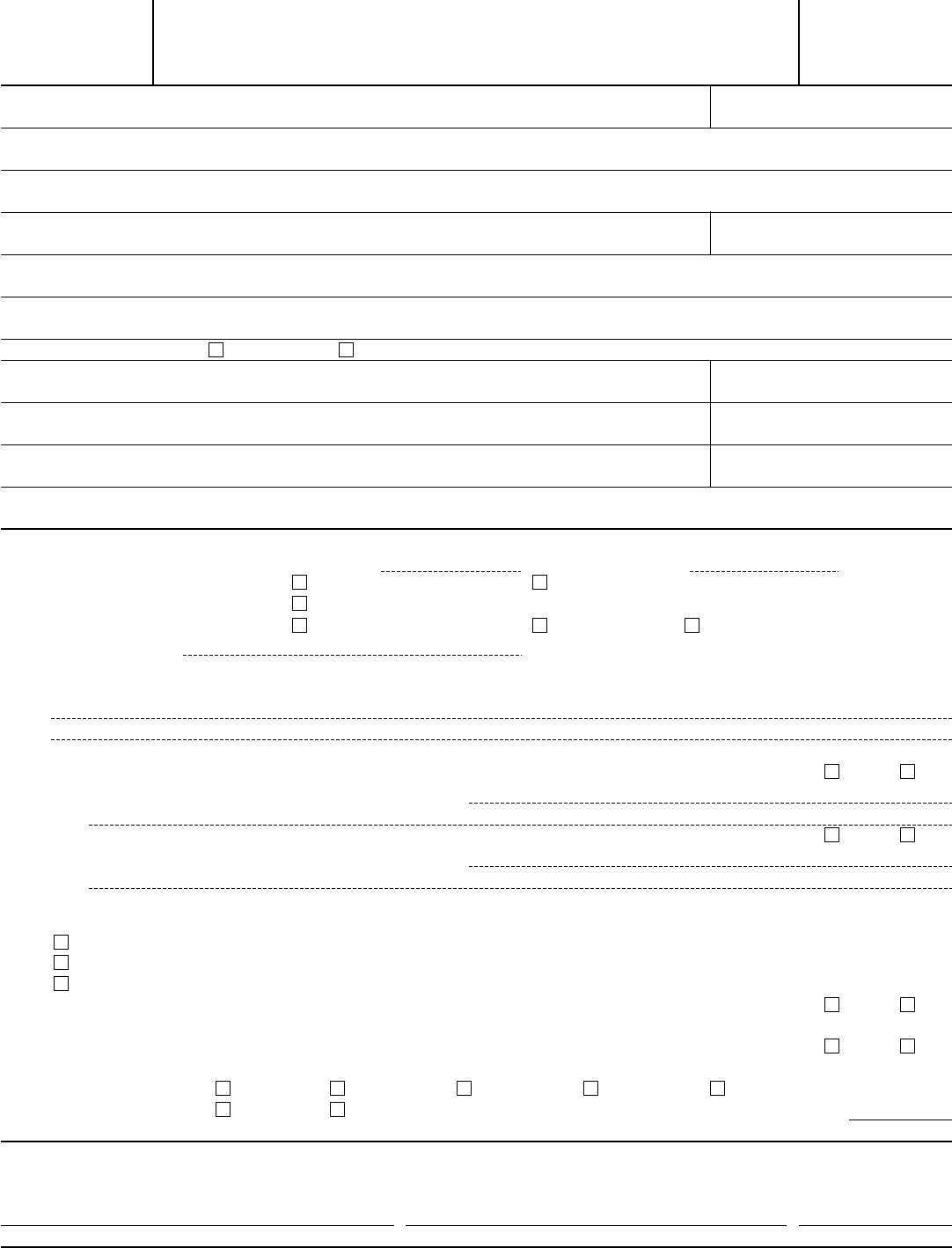

Form 8288-B

Form 8288-B

(Rev. February 2016)

Application for Withholding Certificate for Dispositions

by Foreign Persons of U.S. Real Property Interests

▶

Please type or print.

OMB No. 1545-1060

1 Name of transferor (attach additional sheets if more than one transferor) Identification number

Street address, apt. or suite no., or rural route. Do not use a P.O. box.

City, state or province, and country (if not U.S.). Include ZIP code or postal code where appropriate.

2 Name of transferee (attach additional sheets if more than one transferee) Identification number

Street address, apt. or suite no., or rural route. Do not use a P.O. box.

City, state or province, and country (if not U.S.). Include ZIP code or postal code where appropriate.

3 Applicant is:

Transferor Transferee

4a Name of withholding agent (see instructions) b Identification number

c Name of estate, trust, or entity (if applicable) d Identification number

5 Address where you want withholding certificate sent (street address, apt. or suite no., P.O. box, or rural route number)

Phone number (optional)

City, state or province, and country (if not U.S.). Include ZIP code or postal code where appropriate.

6 Description of U.S. real property transaction:

a Date of transfer (month, day, year) (see inst.)

b Contract price

$

c Type of interest transferred:

Real property Associated personal property

Domestic U.S. real property holding corporation

d Use of property at time of sale:

Rental or commercial Personal Other (attach explanation)

e Adjusted basis

$

f

Location and general description of property (for a real property interest), description (for associated personal property), or

the class or type and amount of the interest (for an interest in a U.S. real property holding corporation). See instructions.

g For the 3 preceding tax years:

(1) Were U.S. income tax returns filed relating to the U.S. real property interest? . . . . . . . . .

Yes No

If “Yes,” when and where were those returns filed?

▶

(2) Were U.S. income taxes paid relating to the U.S. real property interest? . . . . . . . . . . Yes No

If “Yes,” enter the amount of tax paid for each year

▶

7

Check the box to indicate the reason a withholding certificate should be issued. See the instructions for information that must

be attached to Form 8288-B.

a

The transferor is exempt from U.S. tax or nonrecognition treatment applies.

b

The transferor’s maximum tax liability is less than the tax required to be withheld.

c

The special installment sales rules described in section 7 of Rev. Proc. 2000-35 allow reduced withholding.

8 Does the transferor have any unsatisfied withholding liability under section 1445? . . . . . . . . .

Yes No

See the instructions for information required to be attached.

9 Is this application for a withholding certificate made under section 1445(e)? . . . . . . . . . . .

Yes No

If “Yes,” check the applicable box in a and the applicable box in b below.

a Type of transaction:

1445(e)(1) 1445(e)(2) 1445(e)(3) 1445(e)(5) 1445(e)(6)

b Applicant is:

Taxpayer Other person required to withhold. Specify your title (e.g., trustee)

▶

Under penalties of perjury, I declare that I have examined this application and accompanying attachments, and, to the best of my knowledge and belief, they are true,

correct, and complete.

Signature Title (if applicable)

Date

For Privacy Act and Paperwork Reduction Act Notice, see the instructions.

Cat. No. 10128Z

Form 8288-B (Rev. 2-2016)

Department of the Treasury

Internal Revenue Service

Form 8288-B (Rev. 2-2016)

Page 2

Section references are to the Internal

Revenue Code unless otherwise noted.

Future Developments

For the latest information about

developments related to Form 8288 and its

instructions, such as legislation enacted

after they were published, go to

www.irs.gov/form8288.

General Instructions

Purpose of form. Use Form 8288-B to

apply for a withholding certificate to reduce

or eliminate withholding on dispositions of

U.S. real property interests by foreign

persons, but only if the application is based

on:

1. A claim that the transferor is entitled to

nonrecognition treatment or is exempt from

tax,

2. A claim solely on a calculation that

shows the transferor’s maximum tax liability

is less than the tax otherwise required to be

withheld, or

3. A claim that the special installment

sales rules described in section 7 of Rev.

Proc. 2000-35 allowed reduced

withholding.

Do not use this form for applications:

• Based on an agreement for the payment

of tax with conforming security,

• For blanket withholding certificates under

Rev. Proc. 2000-35, or

• Other than the three types described

above.

See Regulations sections 1.1445-3 and

1.1445-6 and Rev. Proc. 2000-35 for

information and procedures for applying for

a withholding certificate.

Who can apply for a withholding

certificate. Either the transferee or the

transferor (or other authorized person) can

file this application.

Withholding certificate. The IRS can issue

a withholding certificate to reduce or

eliminate withholding under section 1445. A

certificate issued before the transfer notifies

the transferee that reduced withholding or

no withholding is required. A certificate

issued after the transfer may authorize an

early or a normal refund. If, on the date of

transfer, an application for a withholding

certificate is or has been submitted to the

IRS, the applicable withholding is not

required to be paid over to the IRS until the

20th day after the day that the IRS mails the

withholding certificate or notice of denial. A

transferor that applies for a withholding

certificate must notify the transferee in

writing that the certificate has been applied

for on the day of or prior to the transfer.

The IRS will normally act on an

application within 90 days of receipt of all

information necessary to make a proper

determination. The IRS will determine

whether withholding should be reduced or

eliminated or whether a withholding

certificate should not be issued.

Identification number. The U.S.

taxpayer identification number (TIN) of all

parties to the transaction must be on the

application for a withholding certificate. For

U.S. individuals, the TIN is a social security

number (SSN). For all other entities, it is an

employer identification number (EIN). If you

do not have an EIN, you can apply for one

online at www.irs.gov/smallbiz or by

telephone at 1-800-829-4933. Also, you can

file Form SS-4, Application for Employer

Identification Number, by fax or mail.

If you are a nonresident alien individual

who is required to have a TIN, but is not

eligible to obtain an SSN, you must apply

for an IRS individual taxpayer identification

number (ITIN). If you do not have a TIN and

are eligible for an ITIN, you can apply for an

ITIN by attaching the completed Form

8288-B to a completed Form W-7 and

forwarding the package to the IRS at the

address given in the Form W-7 instructions.

Get Form W-7, Application for IRS

Individual Taxpayer Identification Number,

for more information.

Any withholding certificate issued by the

IRS applies only for the limited purpose of

determining the withholding obligation

under section 1445 and does not apply to

any substantive issue that may arise in

connection with the transfer. The

acceptance by the IRS of any evidence

submitted in connection with this

application is not binding on the IRS for any

purpose other than issuing the withholding

certificate. The information submitted in

support of the application may be subject

to verification by the IRS prior to issuance

of a withholding certificate.

If you receive a withholding certificate

from the IRS and withholding is still

required, a copy of the withholding

certificate must be attached to Form 8288,

U.S. Withholding Tax Return for

Dispositions by Foreign Persons of U.S.

Real Property Interests.

Installment sales. A transferee is required

to withhold on the full sales price regardless

of the amount of the payment. However, if

the transferor is not a dealer and will report

gain using the installment method under

section 453, a withholding certificate

allowing reduced withholding may be

obtained. Any withholding certificate based

on the installment sale method will provide

for payment of interest on the deferred tax

liability under section 453A(c) when

applicable.

For installment sales subject to

withholding under section 1445(a) or (e), the

IRS will consider applications for a

withholding certificate based on the

transferee’s (or entity’s or fiduciary’s)

agreement to all of the following:

1. Withhold and pay over 15% or lower

amount determined by the IRS (or the

amount the IRS determines to be

appropriate under section 1445(e)) of the

down payment. The amount of the down

payment includes any liabilities of the

transferor (entity in the case of section

1445(e)) assumed by the transferee, or

liabilities to which the U.S. real property

interest was subject immediately before and

after the transfer.

2. Withhold 15% or lower amount

determined by the IRS (or the amount the

IRS determines to be appropriate under

section 1445(e)) of each subsequent

payment and the interest on the deferred

tax liability.

3. Use Forms 8288 and 8288-A (relating to

withholding on dispositions by foreign

persons of U.S. real property interests) to pay

over all amounts withheld. The identification

number of the transferor (or interest holder

subject to withholding under section 1445(e))

must be included on Forms 8288 and 8288-A.

4. Notify the IRS before the disposition or

encumbrance of the U.S. real property

interest (of the installment obligation under

section 1445(e)), and when it occurs, pay

over the remaining amount to be withheld.

5. Continue to withhold under a reduced

withholding certificate until an amended

certificate is issued, even if the transferor

pledges the installment obligation in

exchange for all or part of the proceeds due

on the obligation and includes in gross

income under section 453A(d) the net

proceeds of the secured indebtedness.

Where to send applications for a

withholding certificate. Form 8288-B and

other applications for a withholding

certificate must be sent to Internal Revenue

Service, P.O. Box 409101, Ogden, UT

84409.

Specific Instructions

Complete all information for each line. An

application that is not substantially

complete when submitted will be rejected.

For example, an application without a

specific or estimated date of transfer will

not be considered to be substantially

complete.

Line 1. Enter the name, street address, and

identification number of the transferor. If

there are multiple transferors, attach

additional sheets giving the required

information about each one. For a

transaction under section 1445(e), enter the

required information for each foreign person

for whom you are requesting reduced

withholding.

Line 2. Enter the name, street address, and

identification number of the transferee. If

there are multiple transferees, attach

additional sheets giving the required

information about each one.

Line 4a. The withholding agent will normally

be the buyer or other transferee as

described in section 1445(d)(4). For

distributions under section 1445(e), the

withholding agent also includes a trustee,

executor, or other authorized person.

Line 4b. If you are not applying for this

withholding certificate in your personal

capacity, enter your SSN or ITIN (see

Identification number on this page for more

information).

Form 8288-B (Rev. 2-2016)

Page 3

Line 4c. If you are acting on behalf of an

estate or trust, or are signing as an

authorized person for an entity other than

an individual (for example, a corporation,

qualified investment entity, or partnership),

enter the name of the estate, trust, or entity.

Line 4d. Enter the EIN of the estate, trust,

or entity.

Line 5. Enter the address you want the IRS

to use for purposes of returning the

withholding certificate.

Line 6a. Enter the year as a four-digit

number (for example, “2013”).

Line 6c. “Associated personal property”

means property (for example, furniture) sold

with a building. See Regulations section

1.897-1.

Line 6d. Check “Other” if the property was

used for both personal and rental use and

attach an explanation.

Line 6f. Enter the address and description

of the property (for example, “10-story,

100-unit luxury apartment building”). For a

real estate holding corporation interest

transferred, enter the class or type and

amount of the interest (for example,

“10,000 shares Class A Preferred Stock

XYZ Corporation”). You may attach

additional sheets. Be sure to include your

name and TIN on each sheet you attach.

Line 6g. A U.S. income tax return includes

Forms 1040NR, and 1120-F.

Line 7a. If you checked 7a, attach:

1. A brief description of the transfer,

2. A summary of the law,

3. Facts supporting the claim of

exemption or nonrecognition,

4. Evidence that the transferor has no

unsatisfied withholding liability, and

5. The most recent assessed value for

state or local property tax purposes of the

interest to be transferred, or other estimate

of its fair market value. You need not submit

supporting evidence of the value of the

property.

A nonresident alien or foreign

corporation must also attach a statement

of the adjusted basis of the property

immediately before the distribution or

transfer.

Line 7b. If you checked 7b, attach a

calculation of the maximum tax that can be

imposed on the disposition. You must also

include a statement signed by the transferor

under penalties of perjury that the

calculation and all supporting evidence is

true and correct to the best knowledge of

the transferor.

The calculation of the maximum tax that

can be imposed must include:

1. Evidence of the amount to be realized

by the transferor, such as a copy of the

signed contract of transfer;

2. Evidence of the adjusted basis of the

property, such as closing statements, invoices

for improvements, and depreciation

schedules, or if no depreciation schedules are

submitted, a statement of the nature of the

use of the property and why depreciation was

not allowed;

3. Amounts to be recaptured for

depreciation, investment credit, or other

items subject to recapture;

4. The maximum capital gain and/or ordinary

income tax rates applicable to the transfer;

5. The tentative tax owed; and

6. Evidence showing the amount of any

increase or reduction of tax to which the

transferor is subject, including any

reduction to which the transferor is entitled

under a U.S. income tax treaty.

If you have a net operating loss, see Rev.

Proc. 2000-35, section 4.06, for special

rules about the maximum tax calculation.

If the purchase price includes personal

property not subject to tax under section

897, for the calculation of maximum tax, the

transferor must also include a statement

listing each such item of personal property

transferred and the fair market value

attributable to each item. The fair market

value claimed should be supported by an

independent appraisal or other similar

documentation.

Line 7c. If you checked 7c, see Installment

sales, earlier.

Line 8. You must provide a calculation of

the transferor’s unsatisfied withholding

liability or evidence that it does not exist.

This liability is the amount of any tax the

transferor was required to, but did not,

withhold and pay over under section 1445

when the U.S. real property interest now

being transferred was acquired, or upon a

prior acquisition. The transferor’s

unsatisfied withholding liability is included

in the calculation of maximum tax liability

so that it can be satisfied by the

withholding on the current transfer.

Evidence that there is no unsatisfied

withholding liability includes any of the

following:

1. Evidence that the transferor acquired

the subject or prior real property interest

before 1985;

2. A copy of Form 8288 filed and proof of

payment;

3. A copy of a withholding certificate

issued by the IRS plus a copy of Form

8288 and proof of payment of any amount

required by that certificate;

4. A copy of the nonforeign certificate

furnished by the person from whom the

U.S. real property interest was acquired

(the certificate must be executed at the

time of acquisition);

5. Evidence that the transferor purchased

the subject or prior real property interest for

$300,000 or less and a statement, signed

by the transferor under penalties of perjury,

that the transferor purchased the property

for use as a residence within the meaning of

Regulations section 1.1445-2(d)(1);

6. Evidence that the person from whom the

transferor acquired the subject or prior U.S. real

property interest fully paid any tax imposed on

that transaction under section 897;

7. A copy of a notice of nonrecognition

treatment provided to the transferor under

Regulations section 1.1445-2(d)(2) by the

person from whom the transferor acquired

the subject or prior U.S. real property

interest; or

8. A statement, signed by the transferor

under penalties of perjury, explaining why

the transferor was not required to withhold

under section 1445(a) with regard to the

transferor’s acquisition of the subject or

prior real property interest.

Line 9a. If the transaction is subject to

withholding under section 1445(e), check

the box to indicate which provision of

section 1445(e) applies.

Line 9b. Indicate whether the applicant is

the taxpayer or the person required to

withhold, and in what capacity that person

is required to withhold.

Signature. The application must be signed by

an individual, a responsible corporate officer, a

general partner of a partnership, or a trustee,

executor, or other fiduciary of a trust or estate.

The application may also be signed by an

authorized agent with a power of attorney.

Form 2848, Power of Attorney and Declaration

of Representative, can be used for this

purpose.

Privacy Act and Paperwork Reduction Act

Notice. We ask for the information on this

form to carry out the Internal Revenue laws

of the United States. Section 1445 generally

imposes a withholding obligation on the

buyer or other transferee (withholding agent)

when a U.S. real property interest is

acquired from a foreign person. Section

1445 also imposes a withholding obligation

on certain foreign and domestic

corporations, qualified investment entities,

and the fiduciary of certain trusts and

estates. This form is used to apply for a

withholding certificate to reduce or eliminate

withholding on dispositions of U.S. real

property interests by foreign persons if

certain conditions apply.

You are required to provide this

information. Section 6109 requires you to

provide your identification number. We

need this information to ensure that you are

complying with the Internal Revenue laws

and to allow us to figure and collect the

right amount of tax. Failure to provide this

information in a timely manner, or providing

false information, may subject you to

penalties. Routine uses of this information

include giving it to the Department of

Justice for civil and criminal litigation, and

to cities, states, the District of Columbia,

and to U.S. commonwealths and

possessions for use in the administration of

their tax laws. We may also disclose this

information to other countries under a tax

treaty, to federal and state agencies to

enforce federal nontax criminal laws, or to

federal law enforcement and intelligence

agencies to combat terrorism.

Form 8288-B (Rev. 2-2016)

Page 4

You are not required to provide the

information requested on a form that is

subject to the Paperwork Reduction Act

unless the form displays a valid OMB

control number. Books or records relating

to a form or its instructions must be

retained as long as their contents may

become material in the administration of

any Internal Revenue law. Generally, tax

returns and return information are

confidential, as required by section 6103.

The time needed to complete and file this

form will vary depending on individual

circumstances. The estimated average time is:

Recordkeeping . . . . . 2 hr., 4 min.

Learning about the

law or the form . . . . . 2 hr., 7 min.

Preparing the form . . . 1 hr., 7 min.

Copying, assembling,

and sending the form

to the IRS . . . . . . . 20 min.

If you have comments concerning the

accuracy of these time estimates or

suggestions for making this form simpler,

we would be happy to hear from you. You

can send your comments to the Internal

Revenue Service, Tax Forms and

Publications, SE:W:CAR:MP:TFP, 1111

Constitution Ave. NW, IR-6526,

Washington, DC 20224. Do not send this

form to this office. Instead, see Where to

send applications for a withholding

certificate, earlier.