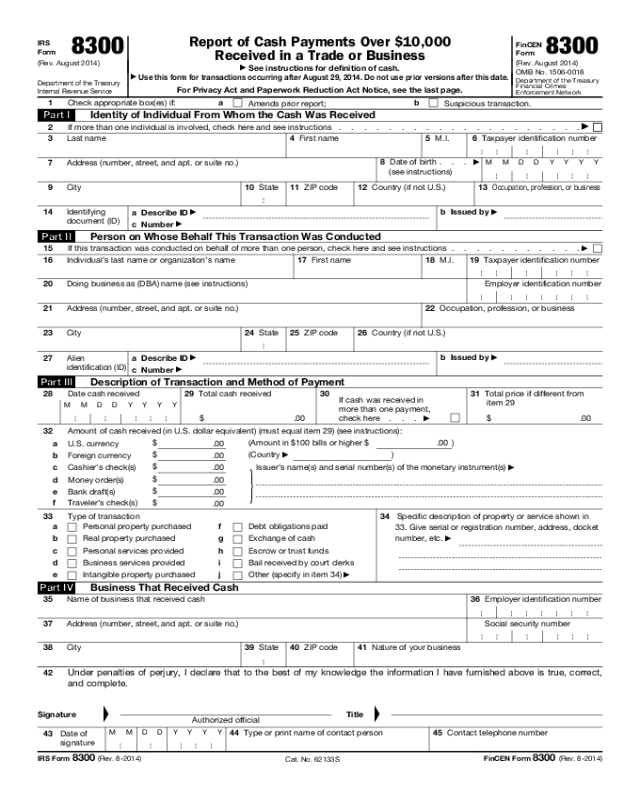

IRS Form 8300 (Rev. 8-2014)

Page 4

FinCEN Form 8300 (Rev. 8-2014)

Penalties. You may be subject to

penalties if you fail to file a correct and

complete Form 8300 on time and you

cannot show that the failure was due to

reasonable cause. You may also be

subject to penalties if you fail to furnish

timely a correct and complete statement

to each person named in a required

report. A minimum penalty of $25,000

may be imposed if the failure is due to

an intentional or willful disregard of the

cash reporting requirements.

Penalties may also be imposed for

causing, or attempting to cause, a trade

or business to fail to file a required

report; for causing, or attempting to

cause, a trade or business to file a

required report containing a material

omission or misstatement of fact; or for

structuring, or attempting to structure,

transactions to avoid the reporting

requirements. These violations may also

be subject to criminal prosecution which,

upon conviction, may result in

imprisonment of up to 5 years or fines of

up to $250,000 for individuals and

$500,000 for corporations or both.

Definitions

Cash. The term “cash” means the

following.

• U.S. and foreign coin and currency

received in any transaction; or

• A cashier’s check, money order, bank

draft, or traveler’s check having a face

amount of $10,000 or less that is

received in a designated reporting

transaction (defined below), or that is

received in any transaction in which the

recipient knows that the instrument is

being used in an attempt to avoid the

reporting of the transaction under either

section 6050I or 31 U.S.C. 5331.

Note. Cash does not include a check

drawn on the payer’s own account, such

as a personal check, regardless of the

amount.

Designated reporting transaction. A

retail sale (or the receipt of funds by a

broker or other intermediary in

connection with a retail sale) of a

consumer durable, a collectible, or a

travel or entertainment activity.

Retail sale. Any sale (whether or not

the sale is for resale or for any other

purpose) made in the course of a trade

or business if that trade or business

principally consists of making sales to

ultimate consumers.

Consumer durable. An item of

tangible personal property of a type

that, under ordinary usage, can

reasonably be expected to remain useful

for at least 1 year, and that has a sales

price of more than $10,000.

Collectible. Any work of art, rug,

antique, metal, gem, stamp, coin, etc.

Travel or entertainment activity. An

item of travel or entertainment that

pertains to a single trip or event if the

combined sales price of the item and all

other items relating to the same trip or

event that are sold in the same

transaction (or related transactions)

exceeds $10,000.

Exceptions. A cashier’s check, money

order, bank draft, or traveler’s check is

not considered received in a designated

reporting transaction if it constitutes the

proceeds of a bank loan or if it is

received as a payment on certain

promissory notes, installment sales

contracts, or down payment plans. See

Publication 1544 for more information.

Person. An individual, corporation,

partnership, trust, estate, association, or

company.

Recipient. The person receiving the

cash. Each branch or other unit of a

person’s trade or business is considered

a separate recipient unless the branch

receiving the cash (or a central office

linking the branches), knows or has

reason to know the identity of payers

making cash payments to other

branches.

Transaction. Includes the purchase of

property or services, the payment of

debt, the exchange of cash for a

negotiable instrument, and the receipt of

cash to be held in escrow or trust. A

single transaction may not be broken

into multiple transactions to avoid

reporting.

Suspicious transaction. A suspicious

transaction is a transaction in which it

appears that a person is attempting to

cause Form 8300 not to be filed, or to

file a false or incomplete form.

Specific Instructions

You must complete all parts. However,

you may skip Part II if the individual

named in Part I is conducting the

transaction on his or her behalf only. For

voluntary reporting of suspicious

transactions, see Item 1, next.

Item 1. If you are amending a report,

check box 1a. Complete the form in its

entirety (Parts I-IV) and include the

amended information. Do not attach a

copy of the original report.

To voluntarily report a suspicious

transaction (see Suspicious transaction

above), check box 1b. You may also

telephone your local IRS Criminal

Investigation Division or call the FinCEN

Financial Institution Hotline at

1-866-556-3974.

Part I

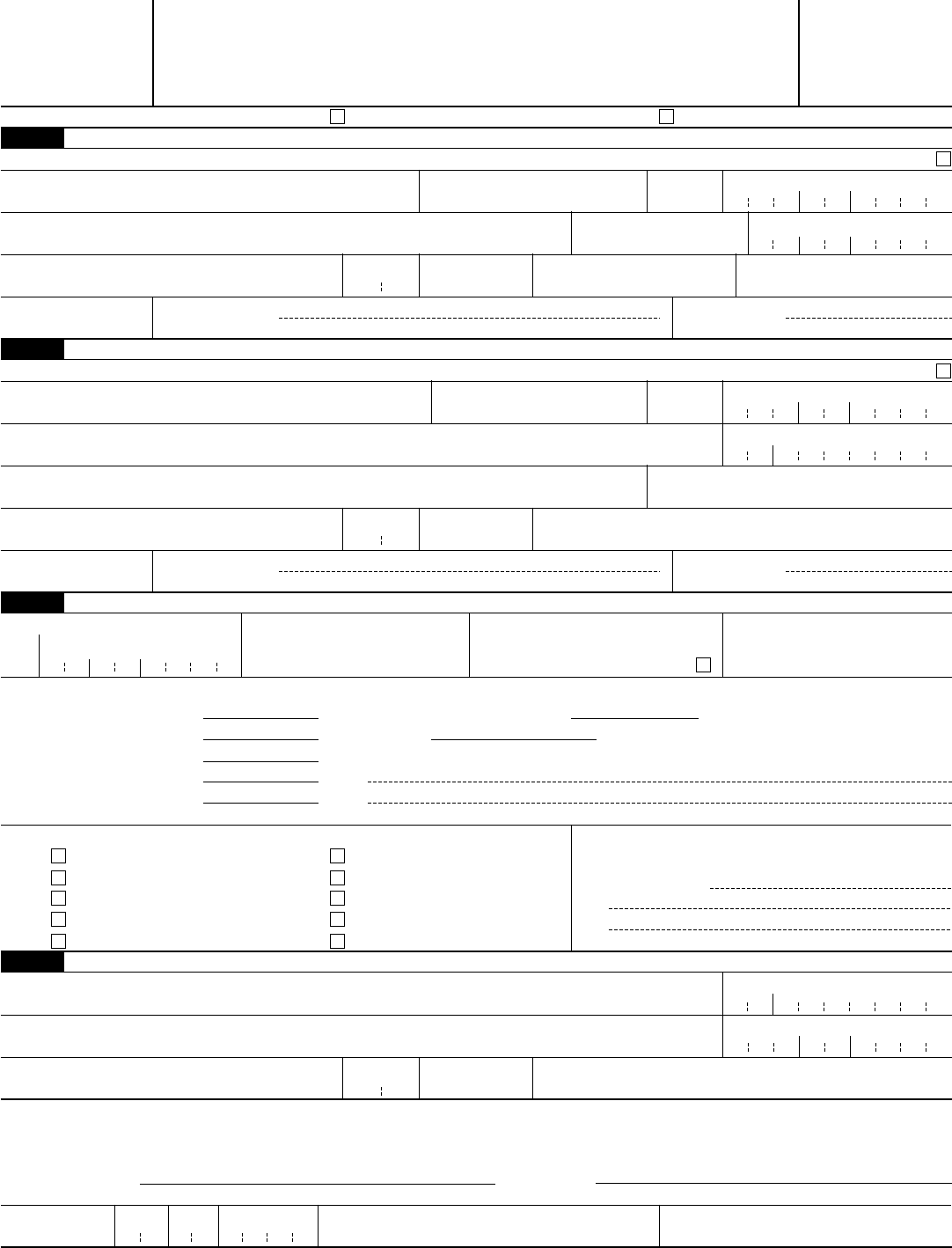

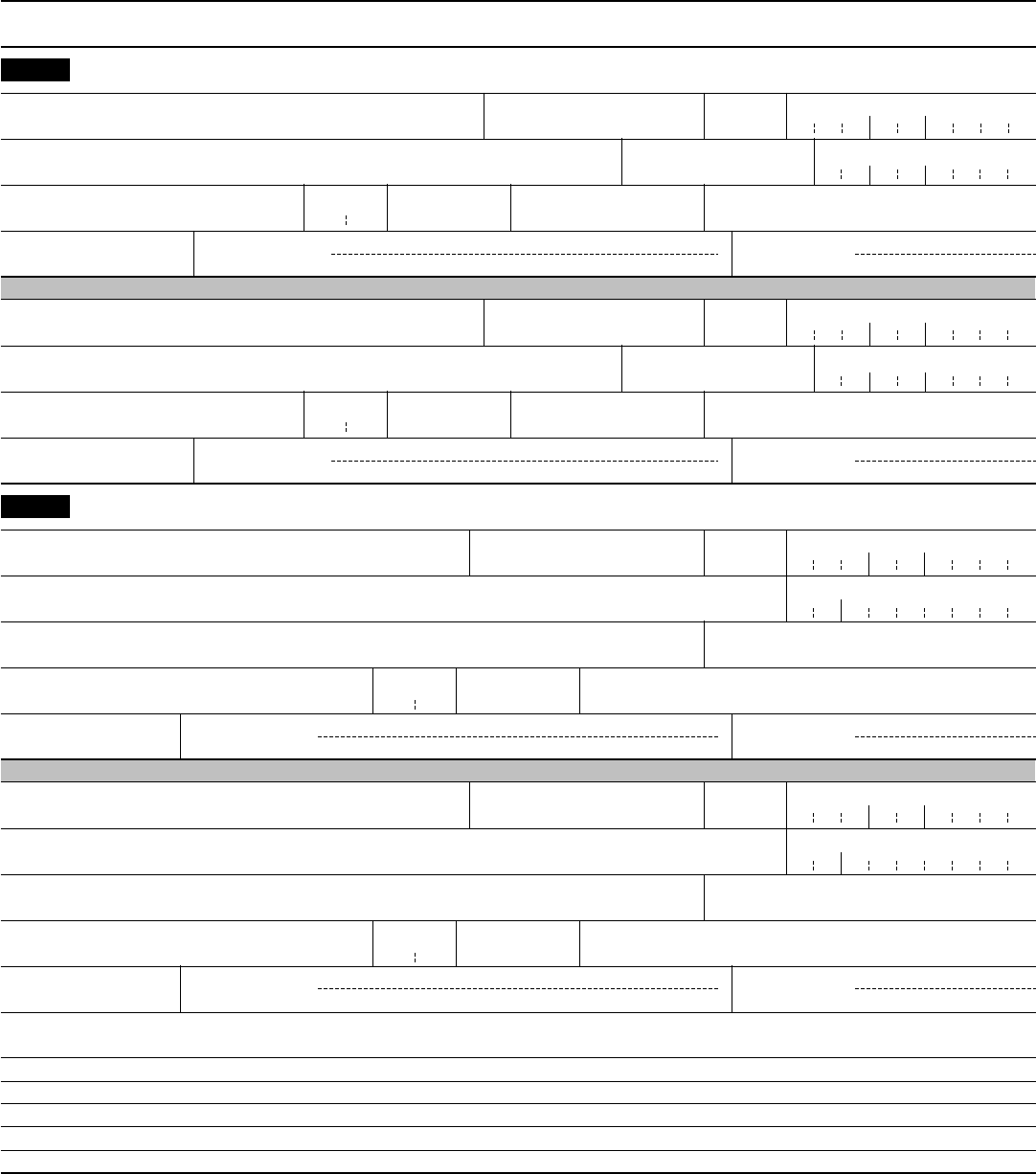

Item 2. If two or more individuals

conducted the transaction you are

reporting, check the box and complete

Part I on page 1 for any one of the

individuals. Provide the same

information for the other individual(s) by

completing Part I on page 2 of the form.

If more than three individuals are

involved, provide the same information in

the comments section on page 2 of the

form.

Item 6. Enter the taxpayer identification

number (TIN) of the individual named.

See Taxpayer identification number (TIN),

earlier, for more information.

Item 8. Enter eight numerals for the date

of birth of the individual named. For

example, if the individual’s birth date is

July 6, 1960, enter “07” “06” “1960.”

Item 13. Fully describe the nature of the

occupation, profession, or business (for

example, “plumber,” “attorney,” or

“automobile dealer”). Do not use general

or nondescriptive terms such as

“businessman” or “self-employed.”

Item 14. You must verify the name and

address of the named individual(s).

Verification must be made by

examination of a document normally

accepted as a means of identification

when cashing checks (for example, a

driver’s license, passport, alien

registration card, or other official

document). In item 14a, enter the type of

document examined. In item 14b,

identify the issuer of the document. In

item 14c, enter the document’s number.

For example, if the individual has a Utah

driver’s license, enter “driver’s license”

in item 14a, “Utah” in item 14b, and the

number appearing on the license in item

14c.

Note. You must complete all three items

(a, b, and c) in this line to make sure that

Form 8300 will be processed correctly.

Part II

Item 15. If the transaction is being

conducted on behalf of more than one

person (including husband and wife or

parent and child), check the box and

complete Part II for any one of the

persons. Provide the same information

for the other person(s) by completing

Part II on page 2. If more than three

persons are involved, provide the same

information in the comments section on

page 2 of the form.

Items 16 through 19. If the person on

whose behalf the transaction is being

conducted is an individual, complete

items 16, 17, and 18. Enter his or her

TIN in item 19. If the individual is a sole

proprietor and has an employer

identification number (EIN), you must

enter both the SSN and EIN in item 19.

If the person is an organization, put its

name as shown on required tax filings in

item 16 and its EIN in item 19.

Item 20. If a sole proprietor or

organization named in items 16 through

18 is doing business under a name other

than that entered in item 16 (for

example, a “trade” or “doing business

as (DBA)” name), enter it here.