Form 8302

Form 8302

(Rev. December 2009)

Department of the Treasury

Internal Revenue Service

Electronic Deposit of Tax Refund of $1 Million or More

©

Attach to your income tax return (other than Forms 1040, 1120, or

1120S), Form 1045, or Form 1139.

OMB No. 1545-1763

Name(s) shown on income tax return

Identifying number

Name and location (City, State) of bank Taxpayer’s phone number

1 Method of deposit (one box must be checked)

Direct Deposit Fedwire

2 Routing number (must be nine digits). The first two digits must be between 01 and 12 or 21 through 32.

3

Account number (include hyphens but omit spaces and special symbols): 4

Type of account (one

box must be checked):

Checking Savings

General Instructions

Section references are to the Internal

Revenue Code unless otherwise noted.

Purpose of Form

File Form 8302 to request that the IRS

electronically deposit a tax refund of $1

million or more directly into an account

at any U.S. bank or other financial

institution (such as a mutual fund, credit

union, or brokerage firm) that accepts

electronic deposits.

The benefits of an electronic deposit

include a faster refund, the added

security of a paperless payment, and the

savings of tax dollars associated with

the reduced processing costs.

Who May File

Form 8302 may be filed with any tax

return other than Form 1040, 1120, or

1120S to request an electronic deposit

of a refund of $1 million or more. You

are not eligible to request an electronic

deposit if:

• The receiving financial institution is a

foreign bank or a foreign branch of a

U.S. bank or

• You have applied for an employer

identification number but are filing your

tax return before receiving one.

If Form 8302 is filed with Form 1045,

Application for Tentative Refund, or

Form 1139, Corporation Application for

Tentative Refund, both of which allow for

more than one year’s reporting,

electronic deposits may be made only

for a year for which the refund is at least

$1 million.

Note. Filers of Form 1040 must request

a direct deposit of refund by completing

the account information on that form.

Filers of Forms 1120 or 1120S must

request a direct deposit of a refund

using Form 8050, Direct Deposit of

Corporate Tax Refund. This includes a

request for a refund of $1 million or

more.

Conditions Resulting in a

Refund by Check

If the IRS is unable to process this

request for an electronic deposit, a

refund by check will be generated.

Reasons for not processing a request

include:

• The name on the tax return does not

match the name on the account.

• You fail to indicate the method of

deposit to be used (i.e., direct deposit or

Fedwire).

• The financial institution rejects the

electronic deposit because of an

incorrect routing or account number.

• You fail to indicate the type of account

the deposit is to be made to (i.e.,

checking or savings).

• There is an outstanding liability the

offset of which reduces the refund to

less than $1 million.

How To File

Attach Form 8302 to the applicable

return or application for refund. To

ensure that your tax return is correctly

processed, see Assembling the Return

in the instructions for the form with

which the Form 8302 is filed. For Forms

1045 or 1139, attach a separate Form

8302 for each carryback year.

Specific Instructions

Identifying number. Enter the employer

identification number or social security

number shown on the tax return to

which Form 8302 is attached.

Line 1. Direct deposit is an electronic

payment alternative that uses the

Automated Clearing House (ACH)

system. Fedwire is a transaction-by-

transaction processing system designed

for items that must be received by

payees the same day as originated by

the IRS.

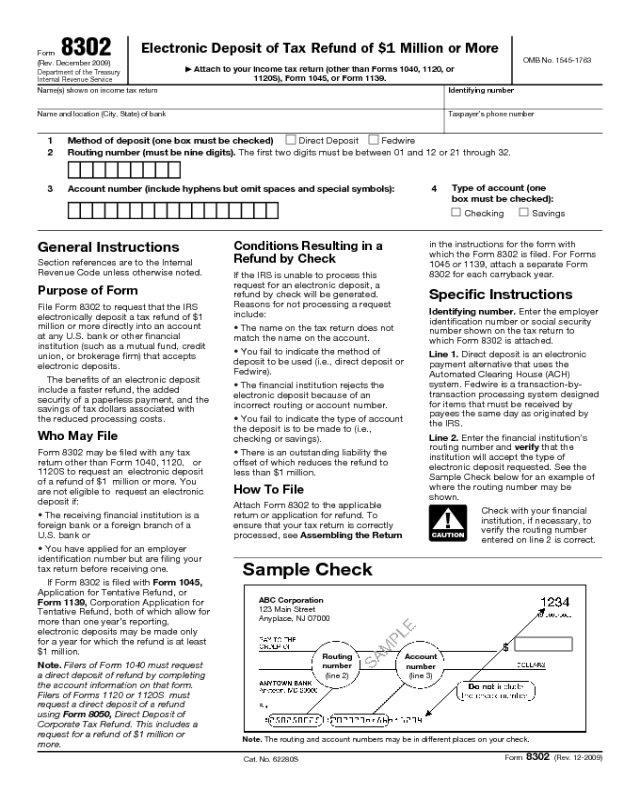

Line 2. Enter the financial institution’s

routing number and verify that the

institution will accept the type of

electronic deposit requested. See the

Sample Check below for an example of

where the routing number may be

shown.

Check with your financial

institution, if necessary, to

verify the routing number

entered on line 2 is correct.

¶

!

CAUTION

Sample Check

ABC Corporation

123 Main Street

Anyplace, NJ 07000

Routing

number

(line 2)

Account

number

(line 3)

Note. The routing and account numbers may be in different places on your check.

Cat. No. 62280S

Form 8302 (Rev. 12-2009)

Form 8302 (12-2009)

Page 2

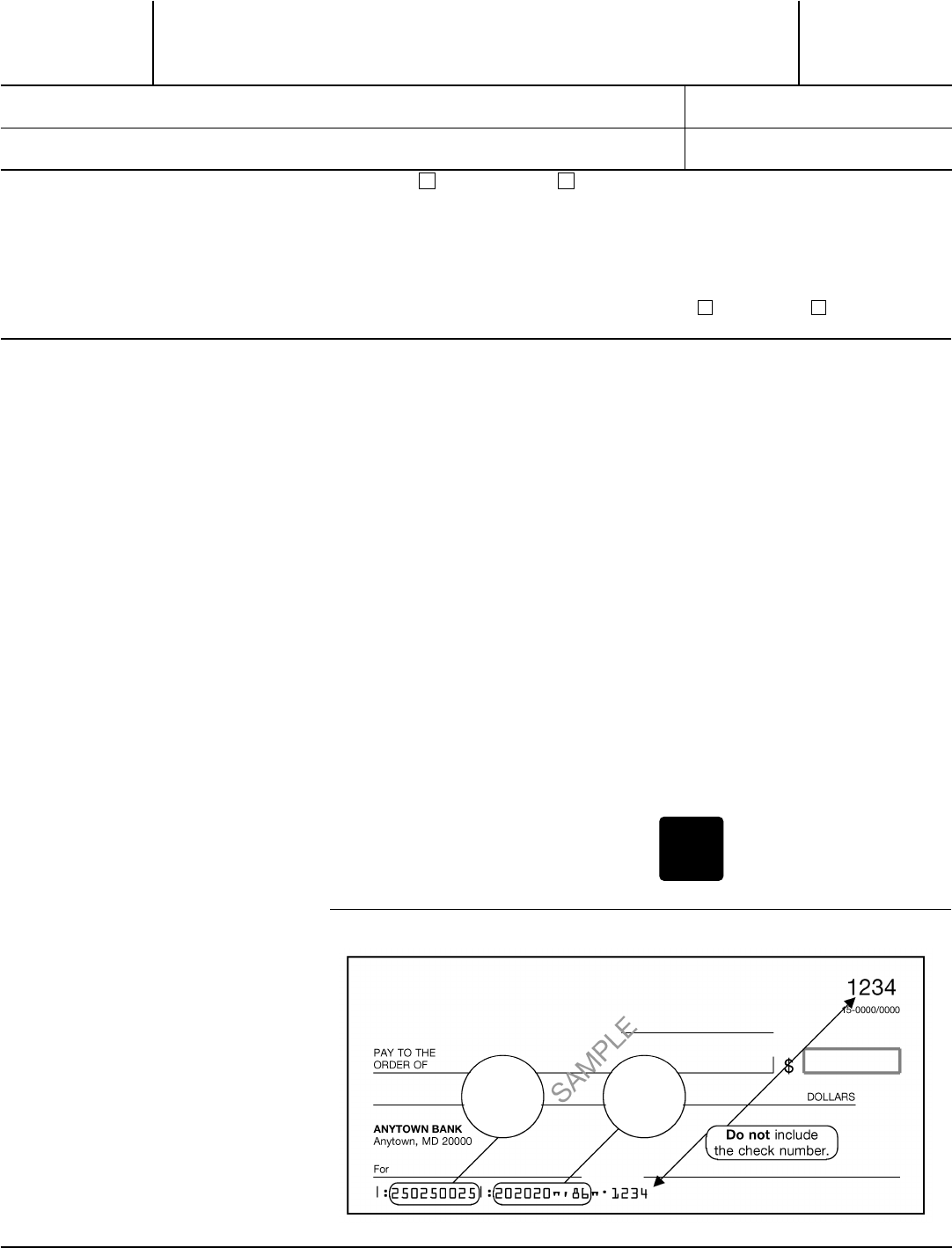

For accounts payable through a

financial institution other than the one at

which the account is located, check with

your financial institution for the correct

routing number. Do not use a deposit

slip to verify the routing number.

Line 3. Enter the taxpayer’s account

number. Enter the number from left to

right and leave any unused boxes blank.

See the Sample Check below for an

example of where the account number

may be shown.

Privacy Act and

Paperwork Reduction

Act Notice

We ask for the information on this form

to carry out the Internal Revenue laws of

the United States. You are required to

give us the information. We need it to

ensure that you are complying with

these laws and to allow us to figure and

collect the right amount of tax.

In addition, the Privacy Act requires

that when we ask you for information we

must first tell you our legal right to ask

for the information, why we are asking

for it, and how it will be used. We must

also tell you what could happen if we do

not receive it and whether your response

is voluntary, required to obtain a benefit,

or mandatory under the law.

Our authority to ask for information is

sections 6001, 6011, and 6012(a) and

their regulations, which require you to

file a return or statement with us for any

tax for which you are liable. Your

response is mandatory under these

sections. Section 6109 requires that you

provide identifying number on what you

file. This is so we know who you are,

and can process your return and other

papers. You must fill in all parts of the

tax form that apply to you.

You are not required to provide the

information requested on a form that is

subject to the Paperwork Reduction Act

unless the form displays a valid OMB

control number. Books or records

relating to a form or its instructions must

be retained as long as their contents

may become material in the

administration of any Internal Revenue

law.

Generally, tax returns and return

information are confidential, as required

by section 6103. However, section 6103

allows or requires the Internal Revenue

Service to disclose or give the

information shown on your tax return to

other as described in the Code. For

example, we may disclose your tax

information to the Department of Justice

to enforce the tax laws, both civil and

criminal, and to cities, states, the District

of Columbia, U.S. commonwealths or

possessions, and certain foreign

governments to carry out their tax laws.

We may also disclose this information to

Federal, state, or local agencies that

investigate or respond to acts or threats

of terrorism or participate in intelligence

or counterintelligence activities

concerning terrorism.

Please keep this notice with your

records. It may help you if we ask you

for other information. If you have any

questions about the rules for filing and

giving information, please call or visit any

Internal Revenue Service office.

The time needed to complete and file

this form will vary depending on

individual circumstances. The estimated

average times are: Recordkeeping, 1

hr., 40 minutes; Learning about the law

or the form, 30 minutes; Preparing,

copying, assembling, and sending the

form to the IRS, 33 minutes.

If you have comments concerning the

accuracy of these time estimates or

suggestions for making this form

simpler, we would be happy to hear from

you. You can write to the IRS at the

address listed in the instructions of the

tax return with which this form is filed.