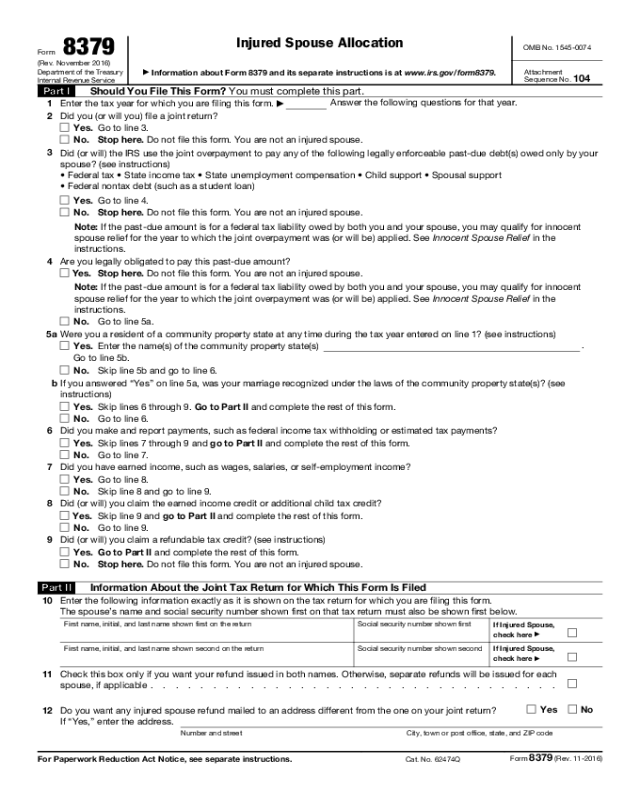

Form 8379

(Rev. November 2016)

Department of the Treasury

Internal Revenue Service

Injured Spouse Allocation

▶

Information about Form 8379 and its separate instructions is at www.irs.gov/form8379.

OMB No. 1545-0074

Attachment

Sequence No.

104

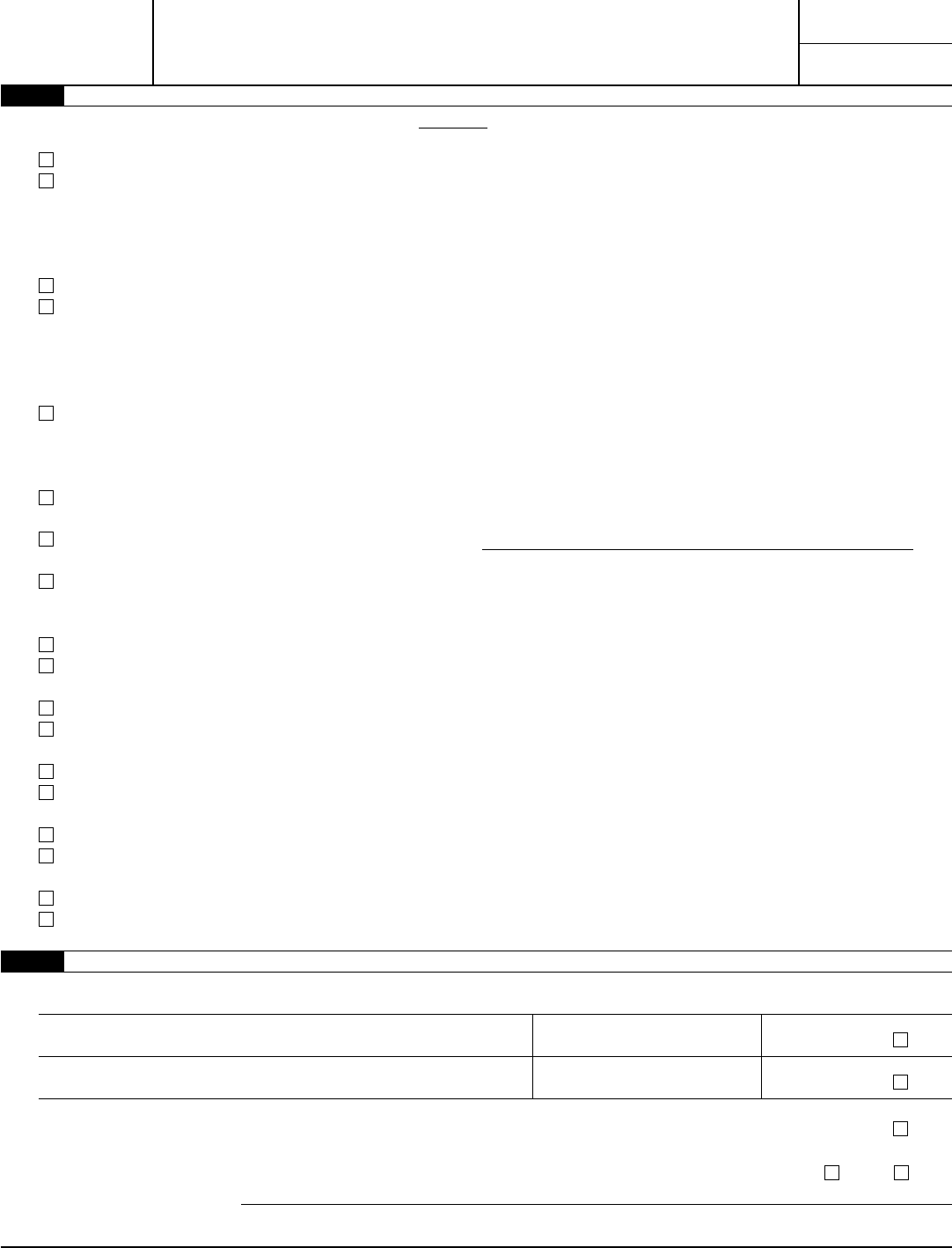

Part I Should You File This Form? You must complete this part.

1 Enter the tax year for which you are filing this form.

▶

Answer the following questions for that year.

2 Did you (or will you) file a joint return?

Yes. Go to line 3.

No. Stop here. Do not file this form. You are not an injured spouse.

3

Did (or will) the IRS use the joint overpayment to pay any of the following legally enforceable past-due debt(s) owed only by your

spouse? (see instructions)

• Federal tax • State income tax • State unemployment compensation • Child support • Spousal support

• Federal nontax debt (such as a student loan)

Yes. Go to line 4.

No. Stop here. Do not file this form. You are not an injured spouse.

Note: If the past-due amount is for a federal tax liability owed by both you and your spouse, you may qualify for innocent

spouse relief for the year to which the joint overpayment was (or will be) applied. See Innocent Spouse Relief in the

instructions.

4 Are you legally obligated to pay this past-due amount?

Yes. Stop here. Do not file this form. You are not an injured spouse.

Note: If the past-due amount is for a federal tax liability owed by both you and your spouse, you may qualify for innocent

spouse relief for the year to which the joint overpayment was (or will be) applied. See Innocent Spouse Relief in the

instructions.

No. Go to line 5a.

5a Were you a resident of a community property state at any time during the tax year entered on line 1? (see instructions)

Yes. Enter the name(s) of the community property state(s)

.

Go to line 5b.

No. Skip line 5b and go to line 6.

b If you answered “Yes” on line 5a, was your marriage recognized under the laws of the community property state(s)? (see

instructions)

Yes. Skip lines 6 through 9. Go to Part II and complete the rest of this form.

No. Go to line 6.

6 Did you make and report payments, such as federal income tax withholding or estimated tax payments?

Yes. Skip lines 7 through 9 and go to Part II and complete the rest of this form.

No. Go to line 7.

7 Did you have earned income, such as wages, salaries, or self-employment income?

Yes. Go to line 8.

No. Skip line 8 and go to line 9.

8 Did (or will) you claim the earned income credit or additional child tax credit?

Yes. Skip line 9 and go to Part II and complete the rest of this form.

No. Go to line 9.

9 Did (or will) you claim a refundable tax credit? (see instructions)

Yes. Go to Part II and complete the rest of this form.

No. Stop here. Do not file this form. You are not an injured spouse.

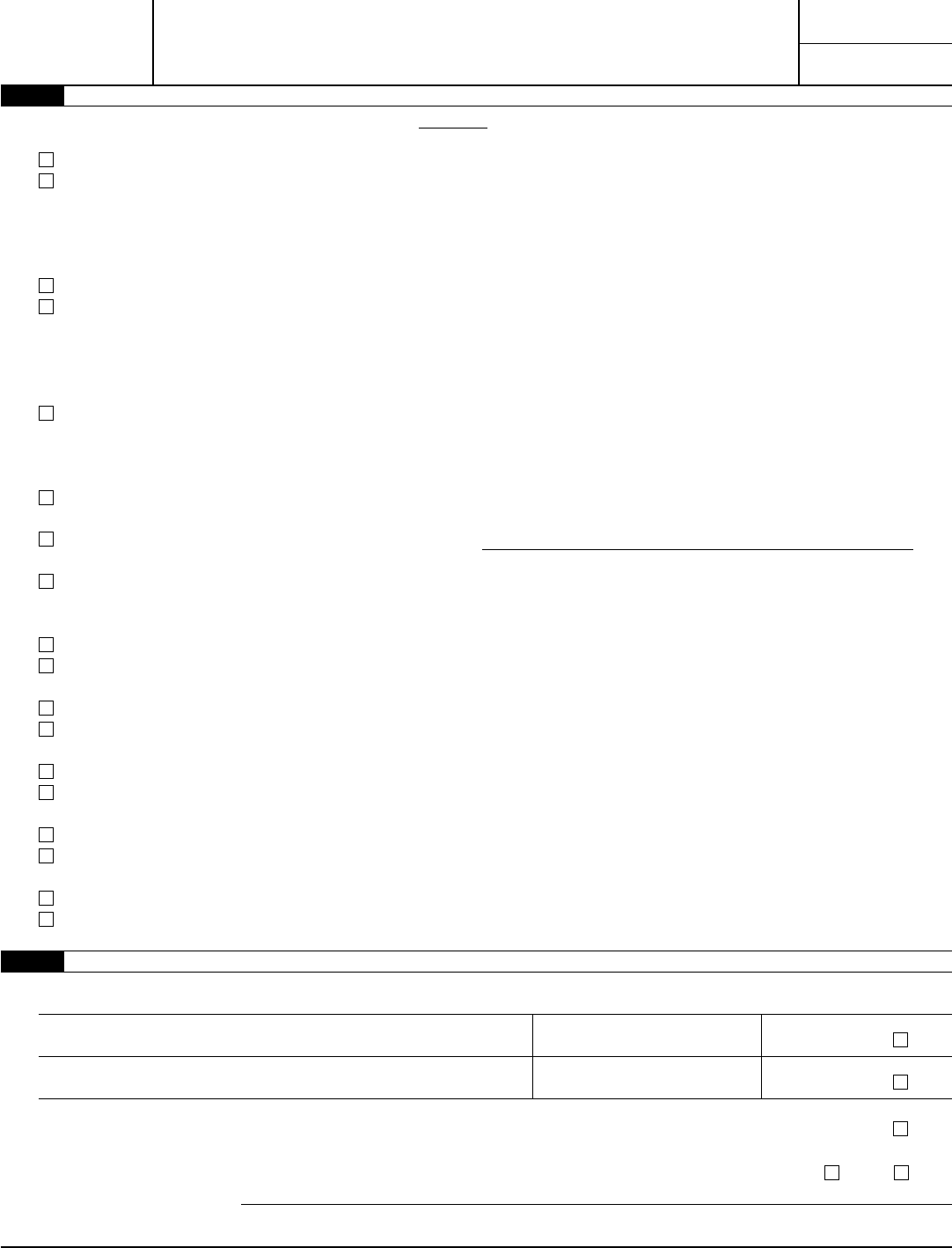

Part II Information About the Joint Tax Return for Which This Form Is Filed

10

Enter the following information exactly as it is shown on the tax return for which you are filing this form.

The spouse’s name and social security number shown first on that tax return must also be shown first below.

First name, initial, and last name shown first on the return Social security number shown first

If Injured Spouse,

check here

▶

First name, initial, and last name shown second on the return Social security number shown second

If Injured Spouse,

check here

▶

11 Check this box only if you want your refund issued in both names. Otherwise, separate refunds will be issued for each

spouse, if applicable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Do you want any injured spouse refund mailed to an address different from the one on your joint return?

If “Yes,” enter the address.

Yes No

Number and street City, town or post office, state, and ZIP code

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 62474Q

Form 8379 (Rev. 11-2016)