Fillable Printable Form 8610 - Annual Low-Income Housing Credit Agencies Report (2014)

Fillable Printable Form 8610 - Annual Low-Income Housing Credit Agencies Report (2014)

Form 8610 - Annual Low-Income Housing Credit Agencies Report (2014)

Form 8610

Department of the Treasury

Internal Revenue Service

Annual Low-Income Housing Credit Agencies Report

▶

Under section 42(l)(3) of the Internal Revenue Code.

▶

Information about Form 8610 and its instructions is at www.irs.gov/form8610.

OMB No. 1545-0990

2014

Name of housing credit agency Employer identification number of agency

Address of housing credit agency

Check box if amended

report . . . . . .

▶

FOR IRS USE ONLY

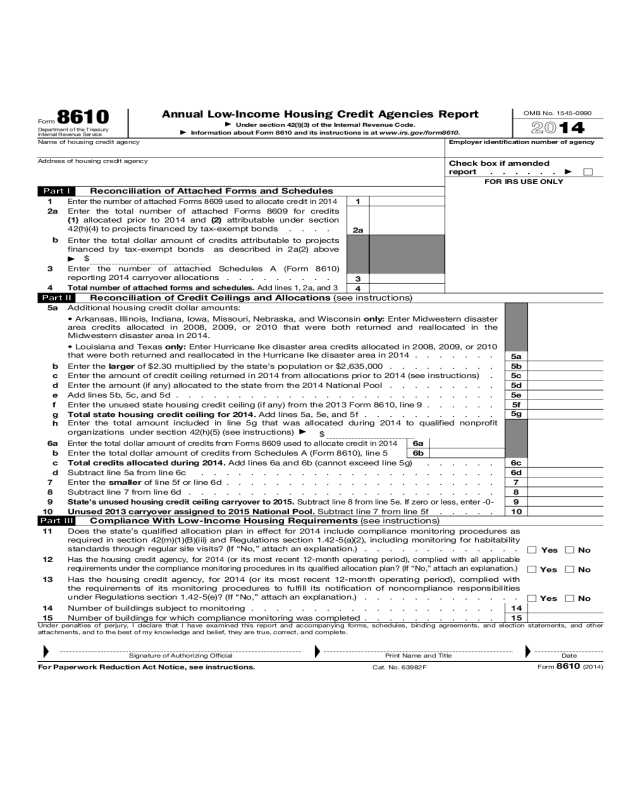

Part I Reconciliation of Attached Forms and Schedules

1

Enter the number of attached Forms 8609 used to allocate credit in 2014

1

2

a

Enter the total number of attached Forms 8609 for credits

(1) allocated prior to 2014 and (2) attributable under section

42(h)(4) to projects financed by tax-exempt bonds . . . .

2a

b

Enter the total dollar amount of credits attributable to projects

financed by tax-exempt bonds as described in 2a(2) above

▶

$

3 Enter the number of attached Schedules A (Form 8610)

reporting 2014 carryover allocations . . . . . . . . .

3

4

Total number of attached forms and schedules. Add lines 1, 2a, and 3

4

Part II Reconciliation of Credit Ceilings and Allocations (see instructions)

5a Additional housing credit dollar amounts:

• Arkansas, Illinois, Indiana, Iowa, Missouri, Nebraska, and Wisconsin only: Enter Midwestern disaster

area credits allocated in 2008, 2009, or 2010 that were both returned and reallocated in the

Midwestern disaster area in 2014.

• Louisiana and Texas only: Enter Hurricane Ike disaster area credits allocated in 2008, 2009, or 2010

that were both returned and reallocated in the Hurricane Ike disaster area in 2014 . . . . . . .

5a

b Enter the larger of $2.30 multiplied by the state’s population or $2,635,000 . . . . . . . . . 5b

c Enter the amount of credit ceiling returned in 2014 from allocations prior to 2014 (see instructions) . 5c

d Enter the amount (if any) allocated to the state from the 2014 National Pool . . . . . . . . . 5d

e Add lines 5b, 5c, and 5d . . . . . . . . . . . . . . . . . . . . . . . . . . 5e

f Enter the unused state housing credit ceiling (if any) from the 2013 Form 8610, line 9 . . . . . . 5f

g Total state housing credit ceiling for 2014. Add lines 5a, 5e, and 5f . . . . . . . . . . .

5g

h

Enter the total amount included in line 5g that was allocated during 2014 to qualified nonprofit

organizations under section 42(h)(5) (see instructions)

▶

$

6a

Enter the total dollar amount of credits from Forms 8609 used to allocate credit in 2014

6a

b Enter the total dollar amount of credits from Schedules A (Form 8610), line 5 6b

c Total credits allocated during 2014. Add lines 6a and 6b (cannot exceed line 5g) . . . . . . 6c

d Subtract line 5a from line 6c . . . . . . . . . . . . . . . . . . . . . . . . 6d

7 Enter the smaller of line 5f or line 6d . . . . . . . . . . . . . . . . . . . . . . 7

8 Subtract line 7 from line 6d . . . . . . . . . . . . . . . . . . . . . . . . . 8

9

State’s unused housing credit ceiling carryover to 2015. Subtract line 8 from line 5e. If zero or less, enter -0-

9

10 Unused 2013 carryover assigned to 2015 National Pool. Subtract line 7 from line 5f . . . . . 10

Part III Compliance With Low-Income Housing Requirements (see instructions)

11

Does the state’s qualified allocation plan in effect for 2014 include compliance monitoring procedures as

required in section 42(m)(1)(B)(iii) and Regulations section 1.42-5(a)(2), including monitoring for habitability

standards through regular site visits? (If “No,” attach an explanation.) . . . . . . . . . . . . .

Yes No

12

Has the housing credit agency, for 2014 (or its most recent 12-month operating period), complied with all applicable

requirements under the compliance monitoring procedures in its qualified allocation plan? (If “No,” attach an explanation.)

Yes No

13

Has the housing credit agency, for 2014 (or its most recent 12-month operating period), complied with

the requirements of its monitoring procedures to fulfill its notification of noncompliance responsibilities

under Regulations section 1.42-5(e)? (If “No,” attach an explanation.) . . . . . . . . . . . . .

Yes No

14 Number of buildings subject to monitoring . . . . . . . . . . . . . . . . . . . .

14

15

Number of buildings for which compliance monitoring was completed . . . . . . . . . . .

15

Under penalties of perjury, I declare that I have examined this report and accompanying forms, schedules, binding agreements, and election statements, and other

attachments, and to the best of my knowledge and belief, they are true, correct, and complete.

▲

Signature of Authorizing Official

▲

Print Name and Title

▲

Date

For Paperwork Reduction Act Notice, see instructions.

Cat. No. 63982F

Form 8610 (2014)

Form 8610 (2014)

Page 2

General Instructions

Section references are to the Internal Revenue Code unless

otherwise noted.

Future Developments

For the latest information about developments related to

Form 8610 and its instructions, such as legislation enacted

after they were published, go to www.irs.gov/form8610.

What’s New

The population component of the state housing credit ceiling

for 2014 is the greater of $2.30 times the state’s population

or $2,635,000.

In addition, certain states are able to increase their

housing credit ceiling. The guidelines for these increases are

explained in Credit ceiling increases, under Purpose of Form,

below.

Under Who Must File, we added a description of

documentation required when an agency provides tolling

relief for certain buildings located in a major disaster area.

Purpose of Form

Housing credit agencies use Form 8610 to transmit Forms

8609, Low-Income Housing Credit Allocation and

Certification, and Schedules A (Form 8610) to the IRS. Form

8610 is also used to report the dollar amount of housing

credits allocated during the calendar year. The housing

credit agency must not allocate more credits than it is

authorized to allocate during the calendar year.

Generally, the state housing credit ceiling for 2014 for any

state is the sum of:

1. The larger of $2,635,000 or $2.30 multiplied by the

state’s population,

2. The amount of state housing credit ceiling returned in

2014 from allocations made prior to 2014,

3. The amount, if any, allocated to the state from the

National Pool, plus

4. The unused state housing credit ceiling, if any, for 2013.

See Regulations section 1.42-14 for more information.

Credit ceiling increases. In the following situations, the

housing credit ceiling for certain states will increase.

For 2014, the housing credit ceiling for Arkansas, Illinois,

Indiana, Iowa, Missouri, Nebraska, and Wisconsin is

increased by the Midwestern disaster area credits allocated

in 2008, 2009, or 2010 that were both returned and

reallocated in the Midwestern disaster area in 2014. See Line

5a, later.

For 2014, the housing credit ceiling for Louisiana and

Texas is increased by the Hurricane Ike disaster area credits

allocated in 2008, 2009, or 2010 that were both returned and

reallocated in the Hurricane Ike disaster area in 2014. See

Line 5a, later.

Who Must File

Any housing credit agency authorized to make an allocation

of the credit (even if no credit is actually allocated) on a Form

8609 or carryover allocation reported on a Schedule A (Form

8610) to an owner of a qualified low-income building during

the calendar year must complete and file Form 8610. In

states with multiple housing credit agencies (including states

with constitutional home rule cities), the agencies must

coordinate and file one Form 8610.

If a housing credit agency has granted any project relief for

carryover allocations discussed in section 5 of Rev. Proc.

2007-54, 2007-31 I.R.B. 293, the agency must attach to

Form 8610 a copy of the Schedule A (Form 8610) for the

projects for which it has approved relief. These attached

copies of Schedule A (Form 8610) must have the box

checked that indicates the housing credit agency granted

carryover allocation relief under Rev. Proc. 2007-54. The

housing credit agency should only include Schedules A

(Form 8610) for projects receiving approval of the carryover

allocation relief since the agency last filed Form 8610. The

information from these particular Schedules A (Form 8610)

are not included on any line in Part I or Part II of Form 8610.

If a housing credit agency has granted any project relief to

toll the beginning of the first year of the credit period as

discussed in section 9 of Rev. Proc. 2007-54, the agency

must attach to the Form 8610 filed for the calendar year in

which the President declared the area a major disaster area

a statement containing the following information: (1) the

name, address, and TIN of the building owner; (2) the

address of the building; (3) the building identification number

(BIN); and (4) the agency approved first year of the credit

period. The statement should be labeled “Relief Under

Section 9 of Rev. Proc. 2007-54.” The statement should be

signed by an agency authorized official and a copy of the

statement should be provided to the building owner.

When To File

File the 2014 Form 8610 with accompanying Forms 8609

(with only Part I completed) and Schedules A (Form 8610) by

March 2, 2015.

Where To File

File Form 8610 and attached forms and schedules with:

Department of the Treasury

Internal Revenue Service Center

Philadelphia, PA 19255-0549

Penalty

The $100 penalty under section 6652(j) applies to any failure

to file Form 8610 when due.

Specific Instructions

Note. The primary housing credit agency may rely on

information provided by any constitutional home rule city or

local housing credit agency under Temporary

Regulations

section 1.42-1T(c)(3) or (4).

To ensure that Form 8610 is correctly processed, attach

all forms and schedules to Form 8610 in the following order.

1. Forms 8609.

2. Schedules A (Form 8610), not including those for

projects approved for carryover allocation relief under Rev.

Proc. 2007-54.

3. Schedules A (Form 8610) for projects approved for

carryover allocation relief under Rev. Proc. 2007-54.

Amended Report

If this is an amended Form 8610, check the “amended report”

box. Use the same version of the form that was originally filed

(for example, a 2014 Form 8610 to amend the 2014 report, a

2013 Form 8610 to amend the 2013 report, etc.).

Complete only those lines that are being amended by

entering the correct information. Attach any additional

documentation necessary to explain why an amended Form

8610 is being filed.

Form 8610 (2014)

Page 3

Part I

Line 1

Enter the total number of Forms 8609 attached to this Form

8610 that were used to allocate credit during 2014. Do not

include Forms 8609 issued to taxpayers that reflect credit

allocations made prior to 2014 on section 42(h)(1)(E) or

42(h)(1)(F) carryover allocation documents.

Line 2a

Enter the total number of Forms 8609 attached to this Form

8610 for:

• Credit allocations made prior to 2014 on section 42(h)(1)(E)

or 42(h)(1)(F) carryover allocation documents and

• Credits attributable to projects financed by tax-exempt

bonds subject to volume cap under section 42(h)(4).

Part II

Line 5a

For 2014, an additional housing credit amount is available

ONLY to the states listed on this line. Follow the instructions

to determine the additional housing credit amount available

for the listed states.

Arkansas, Illinois, Indiana, Iowa, Missouri, Nebraska,

and Wisconsin. The additional amount is the total of the

state's Midwestern disaster area credits allocated in 2008,

2009, or 2010 that were returned and reallocated in the

Midwestern disaster area in 2014.

Louisiana and Texas. The additional amount is the total

of the state's Hurricane Ike disaster area credits allocated in

2008, 2009, or 2010 that were returned and reallocated in

the Hurricane Ike disaster area in 2014.

Line 5b

A state’s population is determined according to section

146(j). See Notice 2014-12, 2014-9 I.R.B. 606, for applicable

population figures.

Line 5c

Do not include on this line allocations made and returned in

the same year. For states identified in line 5a, do NOT

include line 5a disaster credits returned in 2014 (whether or

not reallocated).

Line 5d

Enter the “Amount Allocated,” if any, for your state in Rev.

Proc. 2014-52, 2014-38 I.R.B. 560.

Line 5f

If the 2013 Form 8610 was amended, enter the amount (if

any) from the amended Form 8610, line 9.

Line 5g

This is the state housing credit ceiling available for

allocations during 2014.

Line 5h

Not more than 90% of the line 5g amount is allowed to be

allocated to projects other than qualified low-income

housing projects described in section 42(h)(5)(B).

Enter the sum of the following amounts.

• Any amount reported on line 1b of an attached Form 8609

with box 6g checked.

• Any amount reported on line 5 of an attached Schedule A

(Form 8610) with question 3b answered “Yes.”

Lines 6a and 6b

Enter on the applicable line the dollar amount actually

allocated during 2014. Do not include the following.

• Credits allowed to tax-exempt bond financed projects

under section 42(h)(4). These credits do not count against

the total state housing ceiling authorized on line 5g.

• Amounts allocated and returned during the year, unless

such amounts are reallocated by the close of the year.

On line 6a, enter the total amounts reported on all Forms

8609, Part I, line 1b, that are included on line 1 of this Form

8610. On line 6b, enter the total amounts reported as

carryover allocations that are included on line 3 of this Form

8610.

Part III

Line 14

Include all low-income buildings within the 15-year

compliance period as of the end of the reporting year that

were subject to compliance monitoring under Regulation

1.42-5. Line 14 also includes buildings financed with

tax-exempt bonds and by the Rural Housing Service.

Line 15

Of the low-income buildings reported on Line 14, enter the

number of buildings that have been physically inspected and

subjected to the 20% sampling for unit inspections and

tenant file reviews at least once in the last three years.

Consider the physical inspections and tenant file reviews

completed if the owner has been provided notice of the

results.

Caution. If Line 14 does not equal Line 15, attach an

explanation to the Form 8610 to explain the difference.

Paperwork Reduction Act Notice

We ask for the information on this form to carry out the

Internal Revenue laws of the United States. You are required

to give us the information. We need it to ensure that you are

complying with these laws and to allow us to figure and

collect the right amount of tax.

You are not required to provide the information requested

on a form that is subject to the Paperwork Reduction Act

unless the form displays a valid OMB control number. Books

or records relating to a form or its instructions must be

retained as long as their contents may become material in

the administration of any Internal Revenue law. Generally,

tax returns and return information are confidential, as

required by section 6103.

The time needed to complete and file the following forms

will vary depending on individual circumstances. The

estimated average times are:

Form 8610

Sch. A

(Form 8610)

Recordkeeping . . . .

9 hr., 34 min. 3 hr., 35 min.

Learning about the law or

the form . . . . . .

1 hr., 59 min. 24 min.

Preparing and sending the

form to the IRS . . . .

2 hr., 13 min. 28 min.

If you have comments concerning the accuracy of these

time estimates or suggestions for making these forms

simpler, we would be happy to hear from you. You can send

your comments from www.irs.gov/formspubs. Click on

“More Information” and then on “Give us feedback.” Or you

can write to the Internal Revenue Service, Tax Forms and

Publications, 1111 Constitution Ave. NW, IR-6526,

Washington, DC 20224. Do not send these forms to this

address. Instead, see Where To File, earlier.