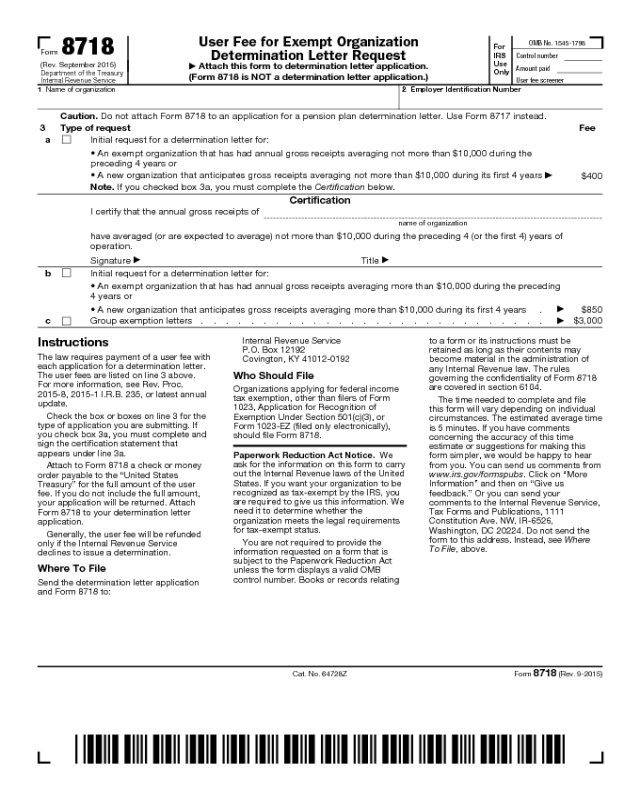

Form 8718

Form 8718

(Rev. September 2015)

Department of the Treasury

Internal Revenue Service

User Fee for Exempt Organization

Determination Letter Request

▶

Attach this form to determination letter application.

(Form 8718 is NOT a determination letter application.)

For

IRS

Use

Only

OMB No. 1545-1798

Control number

Amount paid

User fee screener

1 Name of organization 2 Employer Identification Number

Caution. Do not attach Form 8718 to an application for a pension plan determination letter. Use Form 8717 instead.

3 Type of request Fee

a

Initial request for a determination letter for:

• An exempt organization that has had annual gross receipts averaging not more than $10,000 during the

preceding 4 years or

• A new organization that anticipates gross receipts averaging not more than $10,000 during its first 4 years

▶

$400

Note. If you checked box 3a, you must complete the Certification below.

Certification

I certify that the annual gross receipts of

name of organization

have averaged (or are expected to average) not more than $10,000 during the preceding 4 (or the first 4) years of

operation.

Signature

▶

Title

▶

b Initial request for a determination letter for:

• An exempt organization that has had annual gross receipts averaging more than $10,000 during the preceding

4 years or

• A new organization that anticipates gross receipts averaging more than $10,000 during its first 4 years .

▶

$850

c

Group exemption letters . . . . . . . . . . . . . . . . . . . . . . . . . . . .

▶

$3,000

Instructions

The law requires payment of a user fee with

each application for a determination letter.

The user fees are listed on line 3 above.

For more information, see Rev. Proc.

2015-8, 2015-1 I.R.B. 235, or latest annual

update.

Check the box or boxes on line 3 for the

type of application you are submitting. If

you check box 3a, you must complete and

sign the certification statement that

appears under line 3a.

Attach to Form 8718 a check or money

order payable to the “United States

Treasury” for the full amount of the user

fee. If you do not include the full amount,

your application will be returned. Attach

Form 8718 to your determination letter

application.

Generally, the user fee will be refunded

only if the Internal Revenue Service

declines to issue a determination.

Where To File

Send the determination letter application

and Form 8718 to:

Internal Revenue Service

P.O. Box 12192

Covington, KY 41012-0192

Who Should File

Organizations applying for federal income

tax exemption, other than filers of Form

1023, Application for Recognition of

Exemption Under Section 501(c)(3), or

Form 1023-EZ (filed only electronically),

should file Form 8718.

Paperwork Reduction Act Notice. We

ask for the information on this form to carry

out the Internal Revenue laws of the United

States. If you want your organization to be

recognized as tax-exempt by the IRS, you

are required to give us this information. We

need it to determine whether the

organization meets the legal requirements

for tax-exempt status.

You are not required to provide the

information requested on a form that is

subject to the Paperwork Reduction Act

unless the form displays a valid OMB

control number. Books or records relating

to a form or its instructions must be

retained as long as their contents may

become material in the administration of

any Internal Revenue law. The rules

governing the confidentiality of Form 8718

are covered in section 6104.

The time needed to complete and file

this form will vary depending on individual

circumstances. The estimated average time

is 5 minutes. If you have comments

concerning the accuracy of this time

estimate or suggestions for making this

form simpler, we would be happy to hear

from you. You can send us comments from

www.irs.gov/formspubs. Click on “More

Information” and then on “Give us

feedback.” Or you can send your

comments to the Internal Revenue Service,

Tax Forms and Publications, 1111

Constitution Ave. NW, IR-6526,

Washington, DC 20224. Do not send the

form to this address. Instead, see Where

To File, above.

Cat. No. 64728Z

Form

8718 (Rev. 9-2015)