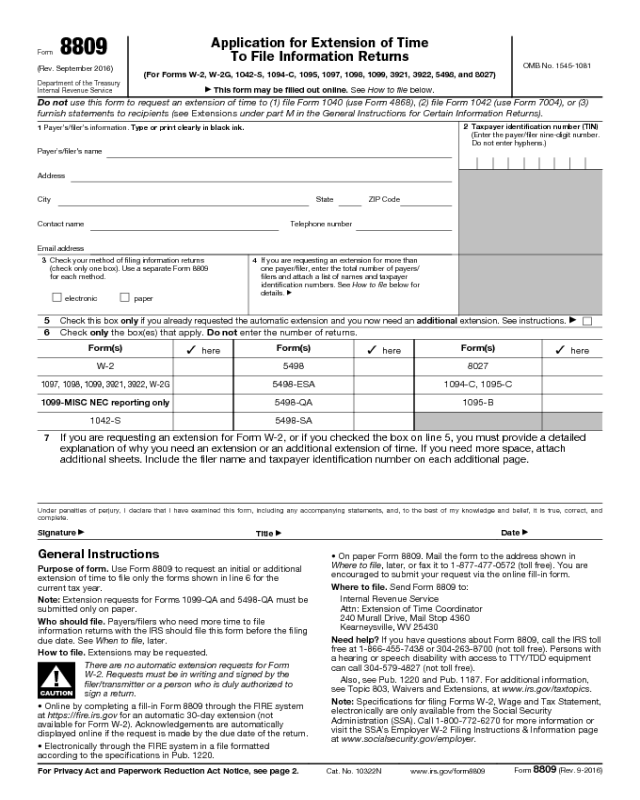

Form 8809

Form 8809

(Rev. September 2016)

Department of the Treasury

Internal Revenue Service

Application for Extension of Time

To File Information Returns

(For Forms W-2, W-2G, 1042-S, 1094-C, 1095, 1097, 1098, 1099, 3921, 3922, 5498, and 8027)

▶

This form may be filled out online. See How to file below.

OMB No. 1545-1081

Do not use this form to request an extension of time to (1) file Form 1040 (use Form 4868), (2) file Form 1042 (use Form 7004), or (3)

furnish statements to recipients (see Extensions under part M in the General Instructions for Certain Information Returns).

1 Payer’s/filer’s information. Type or print clearly in black ink.

Payer’s/filer’s name

Address

City State ZIP Code

Contact name Telephone number

Email address

2 Taxpayer identification number (TIN)

(Enter the payer/filer nine-digit number.

Do not enter hyphens.)

3 Check your method of filing information returns

(check only one box). Use a separate Form 8809

for each method.

electronic paper

4 If you are requesting an extension for more than

one payer/filer, enter the total number of payers/

filers and attach a list of names and taxpayer

identification numbers. See How to file below for

details.

▶

5

Check this box only if you already requested the automatic extension and you now need an additional extension. See instructions.

▶

6 Check only the box(es) that apply. Do not enter the number of returns.

Form(s)

✓ here

Form(s)

✓ here

Form(s)

✓ here

W-2 5498 8027

1097, 1098, 1099, 3921, 3922, W-2G

5498-ESA 1094-C, 1095-C

1099-MISC NEC reporting only

5498-QA

1095-B

1042-S 5498-SA

✴❅❘▼

7

If you are requesting an extension for Form W-2, or if you checked the box on line 5, you must provide a detailed

explanation of why you need an extension or an additional extension of time. If you need more space, attach

additional sheets. Include the filer name and taxpayer identification number on each additional page.

Under penalties of perjury, I declare that I have examined this form, including any accompanying statements, and, to the best of my knowledge and belief, it is true, correct, and

complete.

Signature

▶

Title

▶

Date

▶

General Instructions

Purpose of form. Use Form 8809 to request an initial or additional

extension of time to file only the forms shown in line 6 for the

current tax year.

Note: Extension requests for Forms 1099-QA and 5498-QA must be

submitted only on paper.

Who should file. Payers/filers who need more time to file

information returns with the IRS should file this form before the filing

due date. See When to file, later.

How to file. Extensions may be requested.

▲

!

CAUTION

There are no automatic extension requests for Form

W-2. Requests must be in writing and signed by the

filer/transmitter or a person who is duly authorized to

sign a return.

• Online by completing a fill-in Form 8809 through the FIRE system

at https://fire.irs.gov for an automatic 30-day extension (not

available for Form W-2). Acknowledgements are automatically

displayed online if the request is made by the due date of the return.

• Electronically through the FIRE system in a file formatted

according to the specifications in Pub. 1220.

• On paper Form 8809. Mail the form to the address shown in

Where to file, later, or fax it to 1-877-477-0572 (toll free). You are

encouraged to submit your request via the online fill-in form.

Where to file. Send Form 8809 to:

Internal Revenue Service

Attn: Extension of Time Coordinator

240 Murall Drive, Mail Stop 4360

Kearneysville, WV 25430

Need help? If you have questions about Form 8809, call the IRS toll

free at 1-866-455-7438 or 304-263-8700 (not toll free). Persons with

a hearing or speech disability with access to TTY/TDD equipment

can call 304-579-4827 (not toll free).

Also, see Pub. 1220 and Pub. 1187. For additional information,

see Topic 803, Waivers and Extensions, at www.irs.gov/taxtopics.

Note: Specifications for filing Forms W-2, Wage and Tax Statement,

electronically are only available from the Social Security

Administration (SSA). Call 1-800-772-6270 for more information or

visit the SSA’s Employer W-2 Filing Instructions & Information page

at www.socialsecurity.gov/employer.

For Privacy Act and Paperwork Reduction Act Notice, see page 2.

Cat. No. 10322N www.irs.gov/form8809

Form 8809 (Rev. 9-2016)

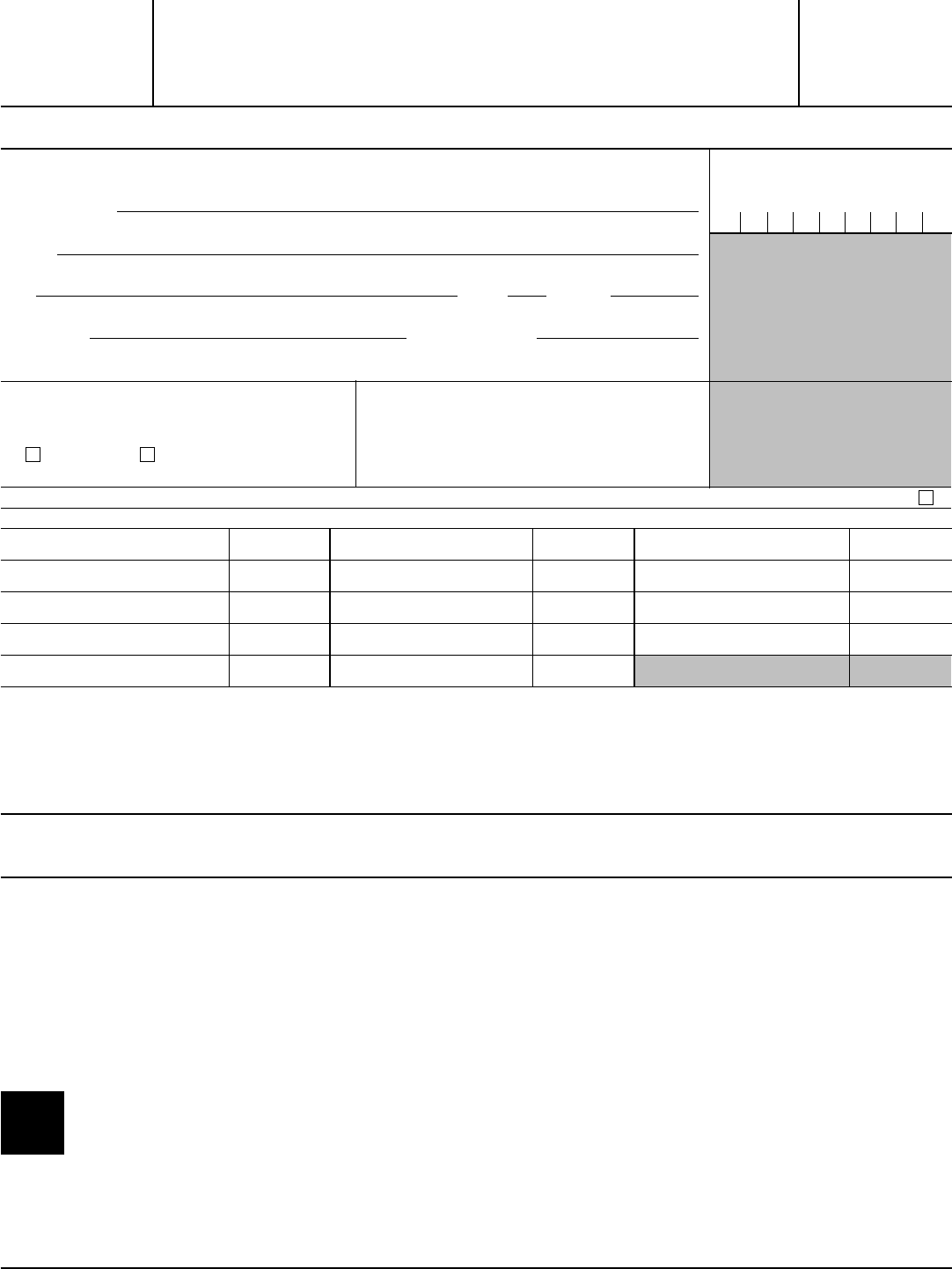

Form 8809 (Rev. 9-2016)

Page 2

When to file. File Form 8809 as soon as you know an extension of

time to file is necessary, but not before January 1 of the filing year.

Form 8809 must be filed by the due date of the returns. See the

chart below that shows the due dates for filing this form on paper or

electronically. Payers/filers of Form W-2 whose business has

terminated should see Terminating a business in the Special

Reporting Situations for Form W-2 section of the General

Instructions for Forms W-2 and W-3 to request an extension.

If you are requesting an extension of time to file several types of

forms, you may use one Form 8809, but you must file Form 8809 by

the earliest due date. For example, if you are requesting an

extension of time to file both Forms 1098 and 5498, you must file

Form 8809 by February 28 (March 31 if you file electronically). You

may complete more than one Form 8809 to avoid this problem. An

extension cannot be granted if a request is filed after the filing due

date of the information returns.

▲

!

CAUTION

If you plan to file Form 1099-MISC reporting

nonemployee compensation (NEC) payments in

box 7, you must request an extension no later than

January 31.

The due dates for filing Form 8809 are shown below.

IF you file Form(s) . . .

ON PAPER, then the due

date is . . .

ELECTRONICALLY,

then the due date

is . . .

W-2 January 31 January 31

W-2G

February 28 March 31

1042-S

March 15 March 15

1094-C

February 28 March 31

1095 February 28 March 31

1097 February 28 March 31

1098 February 28 March 31

1099 February 28 March 31

1099-MISC (NEC only)

January 31 January 31

3921 February 28 March 31

3922 February 28 March 31

5498 May 31 May 31

8027

Last day of February

March 31

If any due date falls on a Saturday, Sunday, or legal holiday, file

by the next business day.

Note: File your information returns as soon as they are ready and

do not send a copy of Form 8809 or any letters with the returns you

file (see exception below).

Exception. When filing Form 8027 on paper only, attach a copy of

your timely filed Form 8809.

Extension period. The automatic extension (if available) is 30 days

from the original due date. If you receive an automatic extension,

you may request one additional extension of not more than 30 days

by submitting a second Form 8809 before the end of the first

extension period (see Line 5, later). Only one extension of time to

file Form W-2 is available. Requests for additional extensions of

time to file information returns, and requests for extensions of time

to file Form W-2, are not automatically granted. Generally, such

requests are granted only where it is shown that extenuating

circumstances prevented filing by the due date of the return

(determined with regard to the automatic extension, if applicable).

Note: The automatic extension of time to file and any approved

requests for additional time will only extend the due date for filing

the information returns with the IRS. It does not extend the due date

for furnishing statements to recipients.

Penalty. Payers/filers may be subject to a late filing penalty if

required information returns are filed late and you have not applied

for and received an approved extension of time to file. The amount

of the penalty is based on when you file the correct information

return. For more information on penalties, see part O in the General

Instructions for Certain Information Returns, and Penalties in the

Instructions for Form 1042-S, the Instructions for Form 8027, and

the General Instructions for Forms W-2 and W-3.

Specific Instructions

Line 1. Enter the payer’s/filer’s name and complete mailing

address, including room or suite number of the filer requesting the

extension of time. Use the name and address where you want

correspondence sent. For example, if you are a preparer and want

to receive correspondence, enter your client’s complete name, care

of (c/o) your firm, and your complete mailing address.

▲

!

CAUTION

The legal name and TIN on your extension request must

be exactly the same as the name you provided when

you applied for your EIN using Form SS-4, the Online

Internet EIN Application, or the EIN Toll-Free Telephone

Service. If a name change has been submitted to the IRS, supply the

current legal name and TIN. Do not use abbreviations.

Enter the name of someone who is familiar with this request

whom the IRS can contact if additional information is required.

Please provide your telephone number and email address.

Line 2. Enter the payer’s/filer’s nine-digit employer identification

number (EIN) or qualified intermediary employer identification

number (QI-EIN). If you are not required to have an EIN or QI-EIN,

enter your social security number. Do not enter hyphens.

Line 5. Check this box only if you have already received the

automatic 30-day extension, and you need an additional extension

for the same year for the same forms. Do not check this box unless

you requested an original extension.

If you check this box, be sure to complete line 7.

Signature. No signature is required for the automatic 30-day

extension (not available for Form W-2). For an additional extension

or to request an extension for Form W-2, Form 8809 must be signed

by the filer/transmitter or a person who is duly authorized to sign a

return.

Privacy Act and Paperwork Reduction Act Notice. We ask for the

information on this form to carry out the Internal Revenue laws of

the United States. We use this information to determine if you

qualify for an extension of time to file information returns. You are

not required to request an extension of time to file; however, if you

request an extension, sections 6081 and 6109 and their regulations

require you to provide this information, including your identification

number. Failure to provide this information may delay or prevent

processing your request; providing false or fraudulent information

may subject you to penalties. Routine uses of this information

include giving it to the Department of Justice for civil and criminal

litigation, and to cities, states, the District of Columbia, and U.S.

commonwealths and possessions for use in administering their tax

laws. We may also disclose this information to other countries under

a tax treaty, to federal and state agencies to enforce federal nontax

criminal laws, or to federal law enforcement and intelligence

agencies to combat terrorism.

You are not required to provide the information requested on a

form that is subject to the Paperwork Reduction Act unless the form

displays a valid OMB control number. Books or records relating to a

form or its instructions must be retained as long as their contents

may become material in the administration of any Internal Revenue

law. Generally, tax returns and return information are confidential,

as required by Code section 6103.

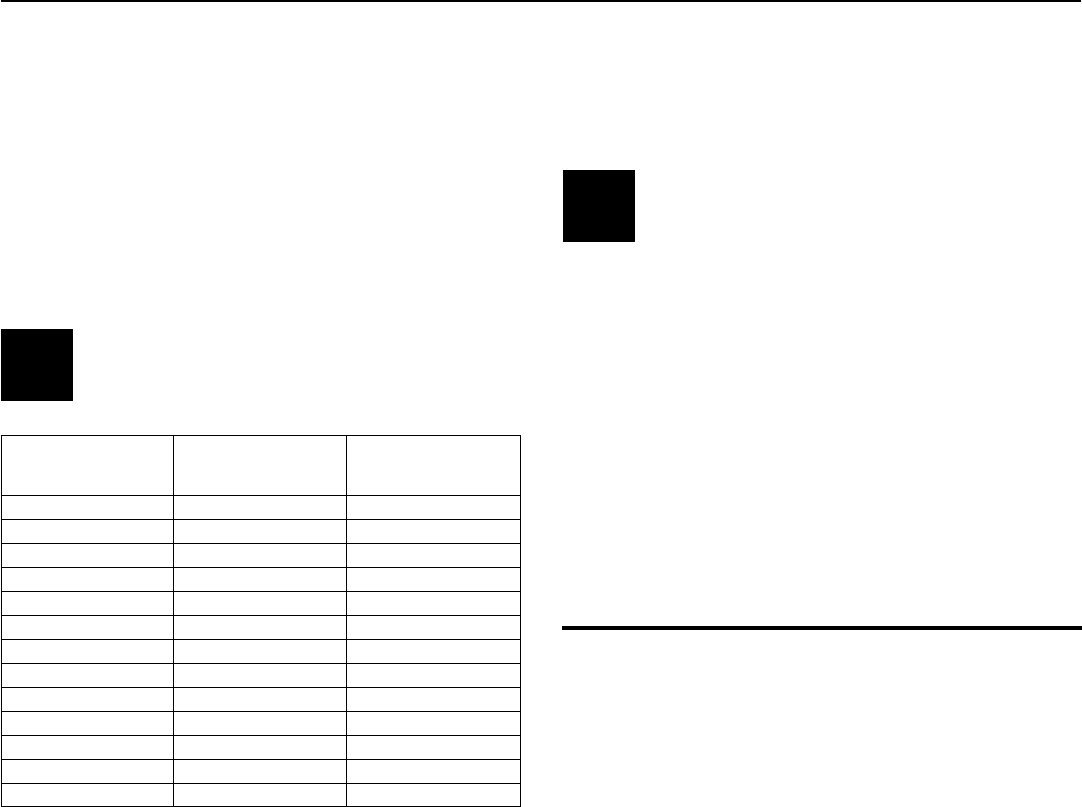

The time needed to complete and file this form will vary

depending on individual circumstances. The estimated average time

is:

Recordkeeping . . . . . . . . . . . . 4 hr., 4 min.

Learning about the law or the form . . . . . . . 18 min.

Preparing and sending

the form to the IRS . . . . . . . . . . . . . 22 min.

If you have comments concerning the accuracy of these time

estimates or suggestions for making this form simpler, we would be

happy to hear from you. You can send us comments from

www.irs.gov/formspubs. Click on More Information and then click

on Give us feedback. Or you can send your comments to the

Internal Revenue Service, Tax Forms and Publications Division,

1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Do

not send the form to this address. Instead, see Where to file, earlier.