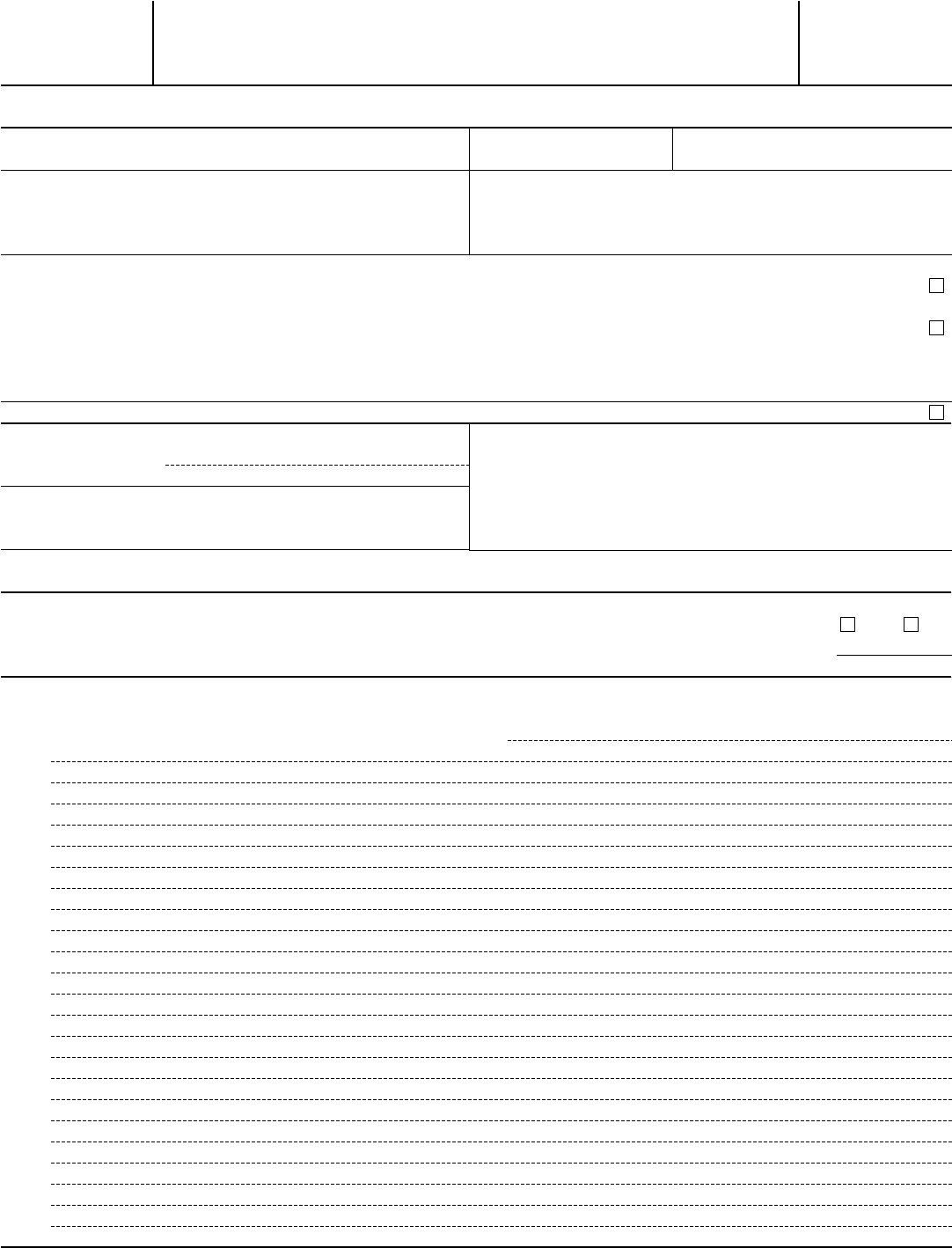

Form 8833

Form 8833

(Rev. December 2013)

Department of the Treasury

Internal Revenue Service

Treaty-Based Return Position Disclosure

Under Section 6114 or 7701(b)

▶

Attach to your tax return.

▶

Information about Form 8833 and its instructions is at www.irs.gov/form8833.

OMB No. 1545-1354

Attach a separate Form 8833 for each treaty-based return position taken. Failure to disclose a treaty-based return position may

result in a penalty of $1,000 ($10,000 in the case of a C corporation) (see section 6712).

Name

U.S. taxpayer identifying number Reference ID number, if any (see instructions)

Address in country of residence

Address in the United States

Check one or both of the following boxes as applicable:

• The taxpayer is disclosing a treaty-based return position as required by section 6114 . . . . . . . . . . . . .

▶

• The taxpayer is a dual-resident taxpayer and is disclosing a treaty-based return position as required by

Regulations section 301.7701(b)-7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

▶

Note. If the taxpayer is a dual-resident taxpayer and a long-term resident, by electing to be treated as a resident of a foreign country

for purposes of claiming benefits under an applicable income tax treaty, the taxpayer will be deemed to have expatriated pursuant to

section 877A. For more information, see the instructions.

Check this box if the taxpayer is a U.S. citizen or resident or is incorporated in the United States . . . . . . . . . .

▶

1 Enter the specific treaty position relied on:

a

Treaty country

b Article(s)

2

List the Internal Revenue Code provision(s) overruled or

modified by the treaty-based return position

3 Name, identifying number (if available to the taxpayer), and

address in the United States of the payor of the income (if

fixed or determinable annual or periodical). See instructions.

4

List the provision(s) of the limitation on benefits article (if any) in the treaty that the taxpayer relies on to prevent application

of that article

▶

5

Is the taxpayer disclosing a treaty-based return position for which reporting is specifically required pursuant

to Regulations section 301.6114-1(b)? . . . . . . . . . . . . . . . . . . . . . . .

Yes No

If “Yes,” enter the specific subsection(s) of Regulations section 301.6114-1(b) requiring reporting . . . .

▶

Also include the information requested in line 6.

6

Explain the treaty-based return position taken. Include a brief summary of the facts on which it is based. Also, list the nature

and amount (or a reasonable estimate) of gross receipts, each separate gross payment, each separate gross income item, or

other item (as applicable) for which the treaty benefit is claimed

For Paperwork Reduction Act Notice, see the instructions.

Cat. No. 14895L

Form 8833 (Rev. 12-2013)

[This page left blank intentionally]

Form 8833 (Rev. 12-2013)

Page 3

Section references are to the Internal

Revenue Code unless otherwise noted.

Future Developments

For the latest information about

developments related to Form 8833 and

its instructions, such as legislation

enacted after they were published, go to

www.irs.gov/form8833.

General Instructions

Purpose of Form

Form 8833 must be used by taxpayers

to make the treaty-based return position

disclosure required by section 6114. The

form must also be used by dual-resident

taxpayers (defined later) to make the

treaty-based return position disclosure

required by Regulations section

301.7701(b)-7. A separate form is

required for each treaty-based return

position taken by the taxpayer.

Who Must File

Generally, a taxpayer who takes a

treaty-based return position must

disclose that position. See Exceptions

from reporting below.

A taxpayer takes a treaty-based return

position by maintaining that a treaty of

the United States overrules or modifies

a provision of the Internal Revenue

Code and thereby causes (or potentially

causes) a reduction of tax on the

taxpayer’s tax return. For these

purposes, a treaty includes, but is not

limited to, an income tax treaty; estate

and gift tax treaty; or friendship,

commerce, and navigation treaty. See

Regulations sections 301.6114-1(a) and

(b) for more details and for examples of

treaty-based return positions taken by

taxpayers for which they must make

disclosure.

Exceptions from reporting. See

Regulations section 301.6114-1(c) for

examples of treaty-based return

positions taken by taxpayers for which

they are not required to make

disclosure.

In general, disclosure of a treaty-

based return position is not required for

amounts that are:

1. Reported on Form 1042-S, and

2. Received by a:

a. Related party from a reporting

corporation within the meaning of

section 6038A (relating to information

returns on Form 5472 filed by U.S.

corporations that are 25-percent owned

by a foreign person),

b. Beneficial owner that is a direct

account holder of a U.S. financial

institution or qualified intermediary, or a

direct partner, beneficiary or owner of a

withholding foreign partnership or trust,

from that U.S. financial institution,

qualified intermediary, or withholding

foreign partnership or trust, or

c. Taxpayer that is not an individual or

a State, if the amounts are not received

through an account with an intermediary

or with respect to an interest in a

partnership or a simple or grantor trust,

and if the amounts do not total more

than $500,000 for the tax year.

However, Regulations sections

301.6114-1(c)(6)(ii), (7)(iv), and (8)(ii)

provide that the exceptions described

above do not apply to any amounts for

which a treaty-based return disclosure is

specifically required under these

instructions.

The following are amounts for which a

treaty-based return disclosure on Form

8833 is specifically required.

• Amounts described in paragraph 2a or

2c earlier that are received by a

corporation that is a resident under the

domestic law of both the United States

and a foreign treaty jurisdiction.

• Amounts described in paragraph 2a or

2c earlier that are received by a

corporation that is a resident of both the

jurisdiction whose treaty is invoked and

another foreign jurisdiction that has an

income tax treaty with that treaty

jurisdiction. See Revenue Ruling

2004-76, 2004-31 I.R.B. 111, available at

www.irs.gov/pub/irs-irbs/irb04-31.pdf.

• Amounts described in paragraph 2a or

2c earlier that are received by a foreign

collective investment vehicle that is a

contractual arrangement and not a

person under foreign law. See Example

7 of Regulations section 1.894-1(d)(5).

• Amounts described in paragraph 2a or

2c earlier that are received by a foreign

“interest holder” in a “domestic reverse

hybrid entity,” as those terms are used

in Regulations section 1.894-1(d)(2).

Dual-resident taxpayer. An alien

individual is a dual-resident taxpayer if

that individual is considered to be a

resident of both the United States and

another country under each country’s

tax laws. If the income tax treaty

between the United States and the other

country contains a provision for

resolution of conflicting claims of

residence by the United States and its

treaty partner, and the individual

determines that under those provisions

he or she is a resident of the foreign

country for treaty purposes, the

individual may claim treaty benefits as a

resident of that foreign country, provided

that he or she complies with the

instructions below.

If you are an individual who is a

dual-resident taxpayer and you choose to

claim treaty benefits as a resident of the

foreign country, you are treated as a

nonresident alien in figuring your U.S.

income tax liability for the part of the tax

year you are considered a dual-resident

taxpayer. If you are eligible to be treated as

a resident of the foreign country pursuant

to the applicable income tax treaty and you

choose to claim benefits as a resident of

such foreign country, attach Form 8833 to

Form 1040NR, U.S. Nonresident Alien

Income Tax Return, or Form 1040NR-EZ,

U.S. Income Tax Return for Certain

Nonresident Aliens With No Dependents.

In order to be treated as a resident of the

foreign country, you must timely file

(including extensions) Form 1040NR or

Form 1040NR-EZ with the Form 8833

attached. If you choose to be treated as a

resident of a foreign country under an

income tax treaty, you are still treated as a

U.S. resident for purposes other than

figuring your U.S. income tax liability (see

Regulations section 301.7701(b)-7(a)(3)).

When and Where To File

Attach Form 8833 to your tax return (i.e.,

Form 1040NR, Form 1040NR-EZ, Form

1120-F, etc.). If you would not otherwise

be required to file a tax return, you must

file one at the IRS Service Center where

you would normally file a return to make

the treaty-based return position

disclosure under section 6114 (see

Regulations section 301.6114-1(a)(1)(ii))

or under Regulations section

301.7701(b)-7.

Specific Instructions

U.S. Taxpayer Identifying Number

The identifying number of an individual is

his or her social security number or

individual taxpayer identification number.

The identifying number of all others is

their employer identification number.

For more information about identifying

numbers, see the instructions for the tax

return with which this form is filed.

Reference ID Number

If the taxpayer is a foreign corporation,

enter any reference ID number assigned

to the foreign corporation by a U.S.

person with respect to which information

reporting is required (for example, on

Form 5471 or Form 5472).

Address in Country of Residence

Enter the information in the following

order: city, province or state, and

country. Follow the country’s practice for

entering the postal code. Please do not

abbreviate the country name.

Form 8833 (Rev. 12-2013)

Page 4

Termination of U.S. Residency

If you are a dual-resident taxpayer and a

long-term resident (LTR) and you are

filing this form to be treated as a resident

of a foreign country for purposes of

claiming benefits under an applicable

U.S. income tax treaty, you will be

deemed to have terminated your U.S.

residency status for federal income tax

purposes. Because you are terminating

your U.S. residency status, you may be

subject to tax under section 877A and

you must file Form 8854, Initial and

Annual Expatriation Statement. You are

an LTR if you were a lawful permanent

resident of the United States in at least 8

of the last 15 tax years ending with the

year your status as an LTR ends. For

additional information, see the

Instructions for Form 8854, and

Publication 519, U.S. Tax Guide for

Aliens.

Line 3

Income that is fixed or determinable

annual or periodical includes interest

(other than original issue discount),

dividends, rents, premiums, annuities,

salaries, wages, and other

compensation. For more information

(including other items of income that are

fixed or determinable annual or

periodical), nonresident aliens and dual-

resident taxpayers filing as nonresident

aliens should see section 871(a) and

Regulations section 1.871-7(b) and (c).

Foreign corporations should see section

881(a) and Regulations section

1.881-2(b) and (c).

Line 5

If the taxpayer answers “Yes” to the

question on line 5, the taxpayer must

enter the subsection of Regulations

section 301.6114-1(b) with respect to

which the taxpayer is disclosing a treaty-

based return position. The taxpayer must

also provide the information requested

on line 6.

Line 6

All taxpayers taking a treaty-based

return position must provide the

requested information on line 6,

regardless of whether reporting is

explicitly required under Regulations

section 301.6114-1(b).

Paperwork Reduction Act Notice. We

ask for the information on this form to

carry out the Internal Revenue laws of

the United States. You are required to

give us the information. We need it to

ensure that you are complying with these

laws and to allow us to figure and collect

the right amount of tax.

You are not required to provide the

information requested on a form that is

subject to the Paperwork Reduction Act

unless the form displays a valid OMB

control number. Books or records

relating to a form or its instructions must

be retained as long as their contents

may become material in the

administration of any Internal Revenue

law. Generally, tax returns and return

information are confidential, as required

by section 6103.

The time needed to complete and file

this form will vary depending on

individual circumstances. The estimated

burden for individual taxpayers filing this

form is approved under OMB control

number 1545-0074 and is included in

the estimates shown in the instructions

for their individual income tax return. The

estimated burden for all other taxpayers

who file this form is shown below.

Recordkeeping . . . . 3 hr., 7 min.

Learning about the

law or the form . . . . 1 hr., 35 min.

Preparing and sending

the form to the IRS . . 1 hr., 43 min.

If you have comments concerning the

accuracy of these time estimates or

suggestions for making this form

simpler, we would be happy to hear

from you. See the instructions for the tax

return with which this form is filed.