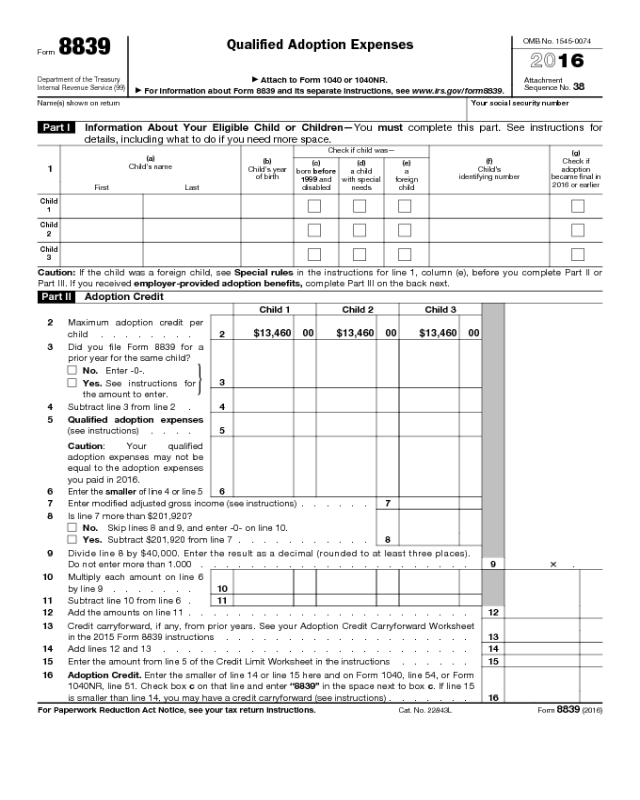

Form 8839

Form 8839

Department of the Treasury

Internal Revenue Service (99)

Qualified Adoption Expenses

▶

Attach to Form 1040 or 1040NR.

▶

For information about Form 8839 and its separate instructions, see www.irs.gov/form8839.

OMB No. 1545-0074

2016

Attachment

Sequence No.

38

Name(s) shown on return Your social security number

Part I Information About Your Eligible Child or Children—You must complete this part. See instructions for

details, including what to do if you need more space.

1

(a)

Child’s name

(b)

Child’s year

of birth

Check if child was—

(c)

born before

1999 and

disabled

(d)

a child

with special

needs

(e)

a

foreign

child

(f)

Child’s

identifying number

(g)

Check if

adoption

became final in

2016 or earlier

First Last

Child

1

Child

2

Child

3

Caution: If the child was a foreign child, see Special rules in the instructions for line 1, column (e), before you complete Part II or

Part III. If you received employer-provided adoption benefits, complete Part III on the back next.

Part II Adoption Credit

Child 1

Child 2

Child 3

2

Maximum adoption credit per

child . . . . . . . .

2

3

Did you file Form 8839 for a

prior year for the same child?

No. Enter -0-.

Yes. See instructions for

the amount to enter.

}

3

4 Subtract line 3 from line 2 . 4

5

Qualified adoption expenses

(see instructions) . . . .

Caution: Your qualified

adoption expenses may not be

equal to the adoption expenses

you paid in 2016.

5

6

Enter the smaller of line 4 or line 5

6

7

Enter modified adjusted gross income (see instructions) . . . . . .

7

8 Is line 7 more than $201,920?

No. Skip lines 8 and 9, and enter -0- on line 10.

Yes. Subtract $201,920 from line 7 . . . . . . . . . . .

8

9

Divide line 8 by $40,000. Enter the result as a decimal (rounded to at least three places).

Do not enter more than 1.000 . . . . . . . . . . . . . . . . . . . . . .

9

×

.

10

Multiply each amount on line 6

by line 9 . . . . . . .

10

11 Subtract line 10 from line 6 . 11

12 Add the amounts on line 11 . . . . . . . . . . . . . . . . . . . . . . . 12

13 Credit carryforward, if any, from prior years. See your Adoption Credit Carryforward Worksheet

in the 2015 Form 8839 instructions . . . . . . . . . . . . . . . . . . . .

13

14 Add lines 12 and 13 . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Enter the amount from line 5 of the Credit Limit Worksheet in the instructions . . . . . . 15

16 Adoption Credit. Enter the smaller of line 14 or line 15 here and on Form 1040, line 54, or Form

1040NR, line 51. Check box c on that line and enter “8839” in the space next to box c. If line 15

is smaller than line 14, you may have a credit carryforward (see instructions) . . . . . . .

16

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 22843L

Form 8839 (2016)

$13,460

00

$13,460

00

$13,460

00

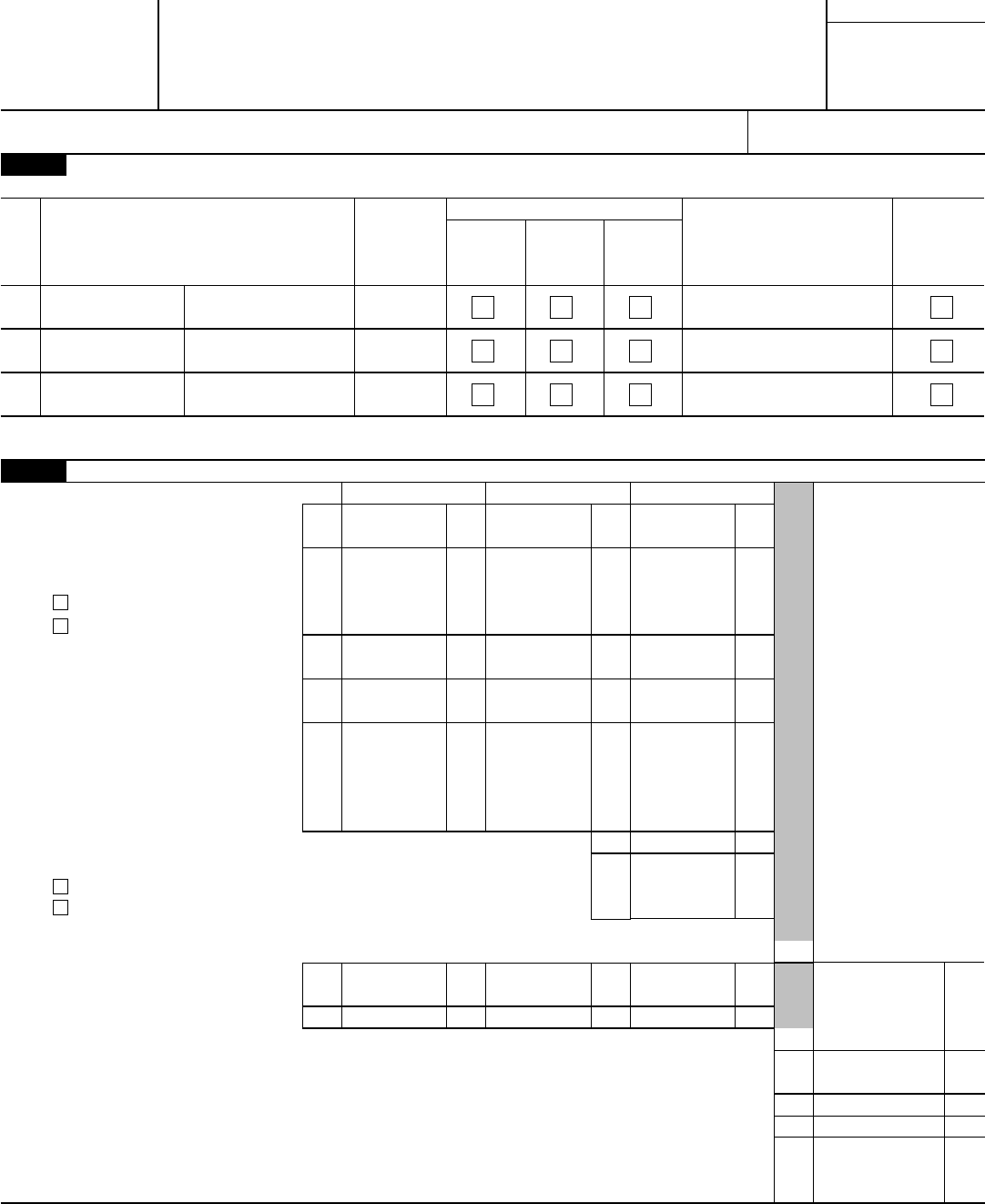

Form 8839 (2016)

Page 2

Part III

Employer-Provided Adoption Benefits

Child 1

Child 2

Child 3

17 Maximum exclusion per child 17

18

Did you receive employer-

provided adoption benefits for a

prior year for the same child?

No. Enter -0-.

Yes. See instructions for

the amount to enter.

}

18

19 Subtract line 18 from line 17

19

20 Employer-provided adoption

benefits you received in 2016.

This amount should be shown

in box 12 of your 2016 Form(s)

W-2 with code T . . . .

20

21 Add the amounts on line 20 . . . . . . . . . . . . . . . . . . . . . . .

21

22 Enter the smaller of line 19 or

line 20. But if the child was a

child with special needs and the

adoption became final in 2016,

enter the amount from line 19

22

23 Enter modified adjusted gross income (from

the worksheet in the instructions) . . . .

23

24 Is line 23 more than $201,920?

No. Skip lines 24 and 25, and enter -0-

on line 26.

Yes.

Subtract $201,920 from line

23

24

25

Divide line 24 by $40,000. Enter the result as a decimal (rounded to

at least three places). Do not enter more than 1.000 . . . . .

25

×

.

26 Multiply each amount on line 22

by line 25 . . . . . . .

26

27 Excluded benefits. Subtract

line 26 from line 22 . . . .

27

28 Add the amounts on line 27 . . . . . . . . . . . . . . . . . . . . . . .

28

29 Taxable benefits. Is line 28 more than line 21?

No.

Subtract line 28 from line 21. Also, include this amount, if more than zero, on

line 7 of Form 1040 or line 8 of Form 1040NR. On the dotted line next to line

7 of Form 1040 or line 8 of Form 1040NR, enter “AB.”

Yes.

Subtract line 21 from line 28. Enter the result as a negative number. Reduce

the total you would enter on line 7 of Form 1040 or line 8 of Form 1040NR by

the amount on Form 8839, line 29. Enter the result on line 7 of Form 1040 or

line 8 of Form 1040NR. Enter “SNE” on the dotted line next to the entry line.

}

. . 29

TIP

You may be able to claim the adoption credit in Part II on the front of this form if any of the following apply.

• You paid adoption expenses in 2015, those expenses were not fully reimbursed by your employer or otherwise, and

the adoption was not final by the end of 2015.

• The total adoption expenses you paid in 2016 were not fully reimbursed by your employer or otherwise, and the

adoption became final in 2016 or earlier.

• You adopted a child with special needs and the adoption became final in 2016.

Form 8839 (2016)

$13,460

00

$13,460

00

$13,460

00