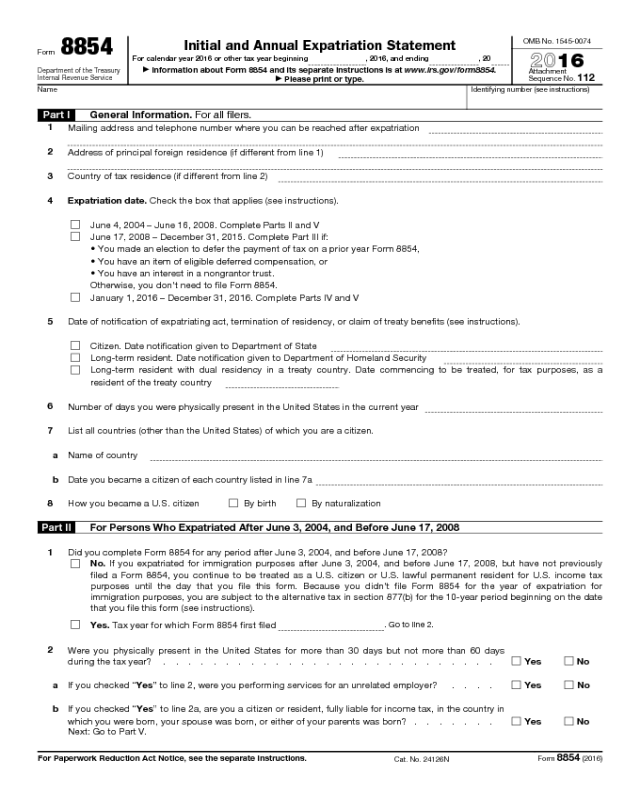

Form 8854

Form 8854

Department of the Treasury

Internal Revenue Service

Initial and Annual Expatriation Statement

For calendar year 2016 or other tax year beginning , 2016, and ending , 20

▶

Information about Form 8854 and its separate instructions is at www.irs.gov/form8854.

▶

Please print or type.

OMB No. 1545-0074

2016

Attachment

Sequence No.

112

Name Identifying number (see instructions)

Part I General Information. For all filers.

1

Mailing address and telephone number where you can be reached after expatriation

2

Address of principal foreign residence (if different from line 1)

3

Country of tax residence (if different from line 2)

4 Expatriation date. Check the box that applies (see instructions).

June 4, 2004 – June 16, 2008. Complete Parts II and V

June 17, 2008 – December 31, 2015. Complete Part III if:

• You made an election to defer the payment of tax on a prior year Form 8854,

• You have an item of eligible deferred compensation, or

• You have an interest in a nongrantor trust.

Otherwise, you don't need to file Form 8854.

January 1, 2016 – December 31, 2016. Complete Parts IV and V

5 Date of notification of expatriating act, termination of residency, or claim of treaty benefits (see instructions).

Citizen. Date notification given to Department of State

Long-term resident. Date notification given to Department of Homeland Security

Long-term resident with dual residency in a treaty country. Date commencing to be treated, for tax purposes, as a

resident of the treaty country

6

Number of days you were physically present in the United States in the current year

7 List all countries (other than the United States) of which you are a citizen.

a

Name of country

b

Date you became a citizen of each country listed in line 7a

8 How you became a U.S. citizen

By birth By naturalization

Part II For Persons Who Expatriated After June 3, 2004, and Before June 17, 2008

1 Did you complete Form 8854 for any period after June 3, 2004, and before June 17, 2008?

No. If you expatriated for immigration purposes after June 3, 2004, and before June 17, 2008, but have not previously

filed a Form 8854, you continue to be treated as a U.S. citizen or U.S. lawful permanent resident for U.S. income tax

purposes until the day that you file this form. Because you didn't file Form 8854 for the year of expatriation for

immigration purposes, you are subject to the alternative tax in section 877(b) for the 10-year period beginning on the date

that you file this form (see instructions).

Yes. Tax year for which Form 8854 first filed

. Go to line 2.

2

Were you physically present in the United States for more than 30 days but not more than 60 days

during the tax year? . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

a If you checked “Yes” to line 2, were you performing services for an unrelated employer? . . . .

Yes No

b If you checked “Yes” to line 2a, are you a citizen or resident, fully liable for income tax, in the country in

which you were born, your spouse was born, or either of your parents was born? . . . . . . . Yes No

Next: Go to Part V.

For Paperwork Reduction Act Notice, see the separate instructions.

Cat. No. 24126N

Form 8854 (2016)

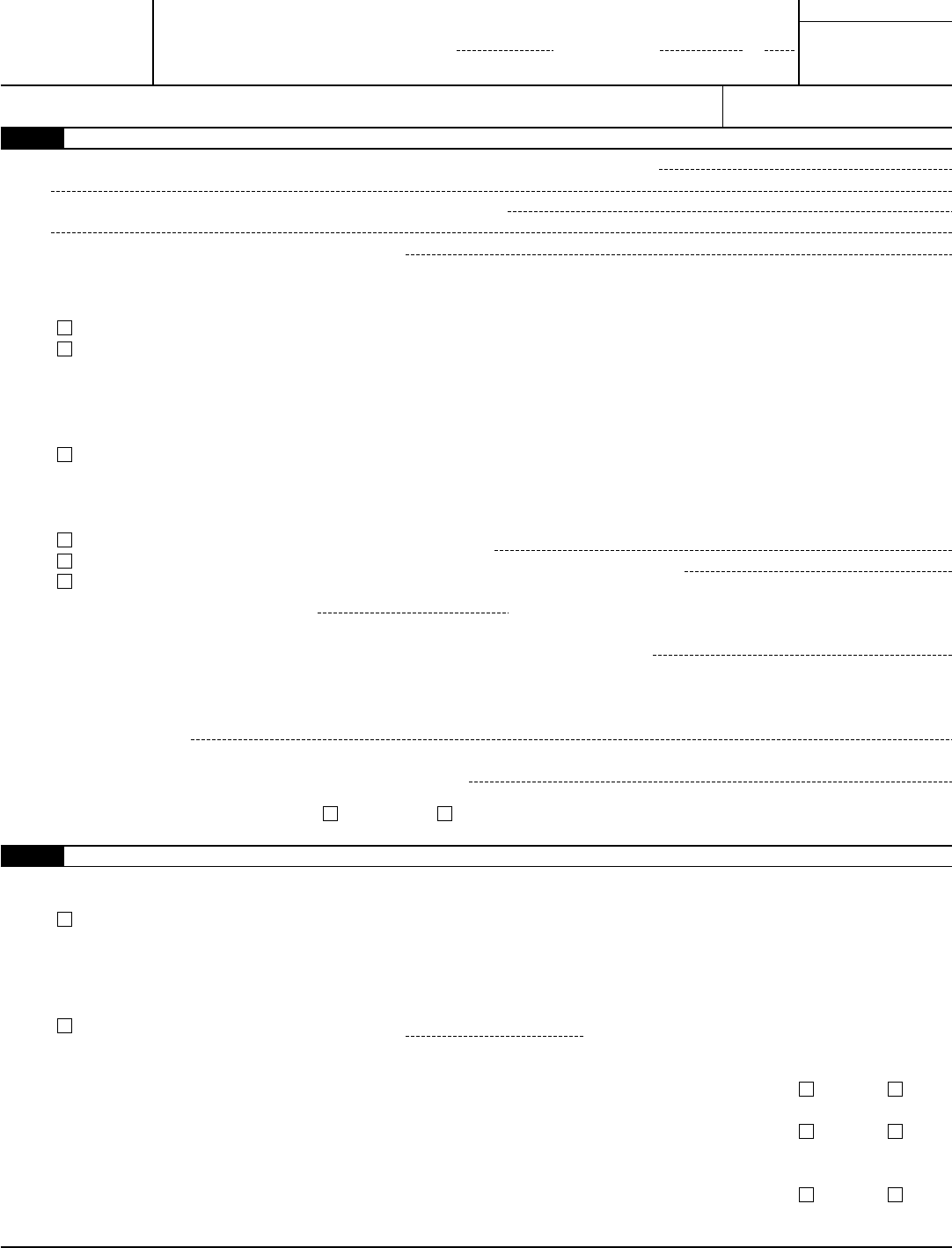

Form 8854 (2016)

Page 2

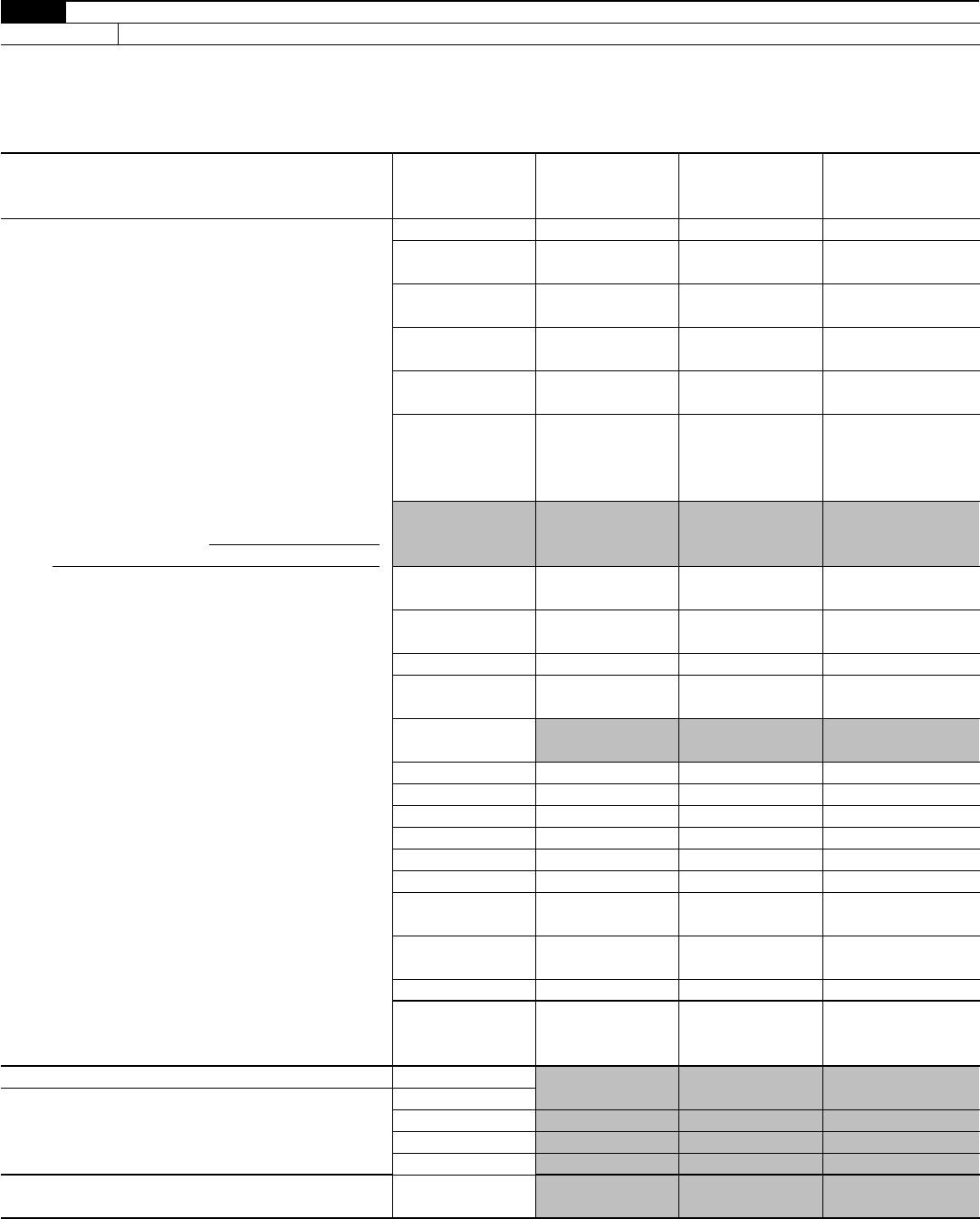

Part III For Persons Who Expatriated After June 16, 2008, and Before January 1, 2016

• If you made an election to defer the payment of tax, complete line 1.

• If you have an item of eligible deferred compensation, complete line 2.

• If you have an interest in a nongrantor trust, complete line 3.

1 Complete columns (a), (b), and (c) for all property on which you deferred tax on a prior year Form 8854. Complete column (d)

for any property you disposed of in 2016 and see the instructions for Part III.

(a)

Description of property

(b)

Amount of mark-to-market gain or

(loss) reported on prior year

Form 8854

(c)

Amount of tax deferred on prior year

Form 8854

(d)

Date of disposition (if any)

2 Did you receive any distributions of eligible deferred compensation items for 2016? Yes No

If “Yes,” Amount of distribution: Amount withheld at source, if any:

3 Did you receive any distributions from a nongrantor trust for 2016?

Yes No

If “Yes,” Amount of distribution: Amount withheld at source, if any:

Part IV For Persons Who Expatriated During 2016

Section A Expatriation Information

1 Enter your U.S. income tax liability (after foreign tax credits) for the 5 tax years ending before the date of expatriation.

1st Year

Before Expatriation

$

2nd Year

Before Expatriation

$

3rd Year

Before Expatriation

$

4th Year

Before Expatriation

$

5th Year

Before Expatriation

$

2 Enter your net worth on the date of your expatriation for tax purposes . . . . . . . . . .

$

3 Did you become at birth a U.S. citizen and a citizen of another country, and do you continue to be a citizen

of, and taxed as a resident of, that other country? . . . . . . . . . . . . . . . . . . .

Yes No

4 If you answered “Yes” to question 3, have you been a resident of the United States for not more than 10 of

the last 15 tax years? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

5 Were you under age 18

1

/2 on the date you expatriated and have you been a U.S. resident for not more than

10 years? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

6 Do you certify under penalties of perjury that you have complied with all of your tax obligations for the 5

preceding tax years (see instructions)? . . . . . . . . . . . . . . . . . . . . . . .

Yes No

Form 8854 (2016)

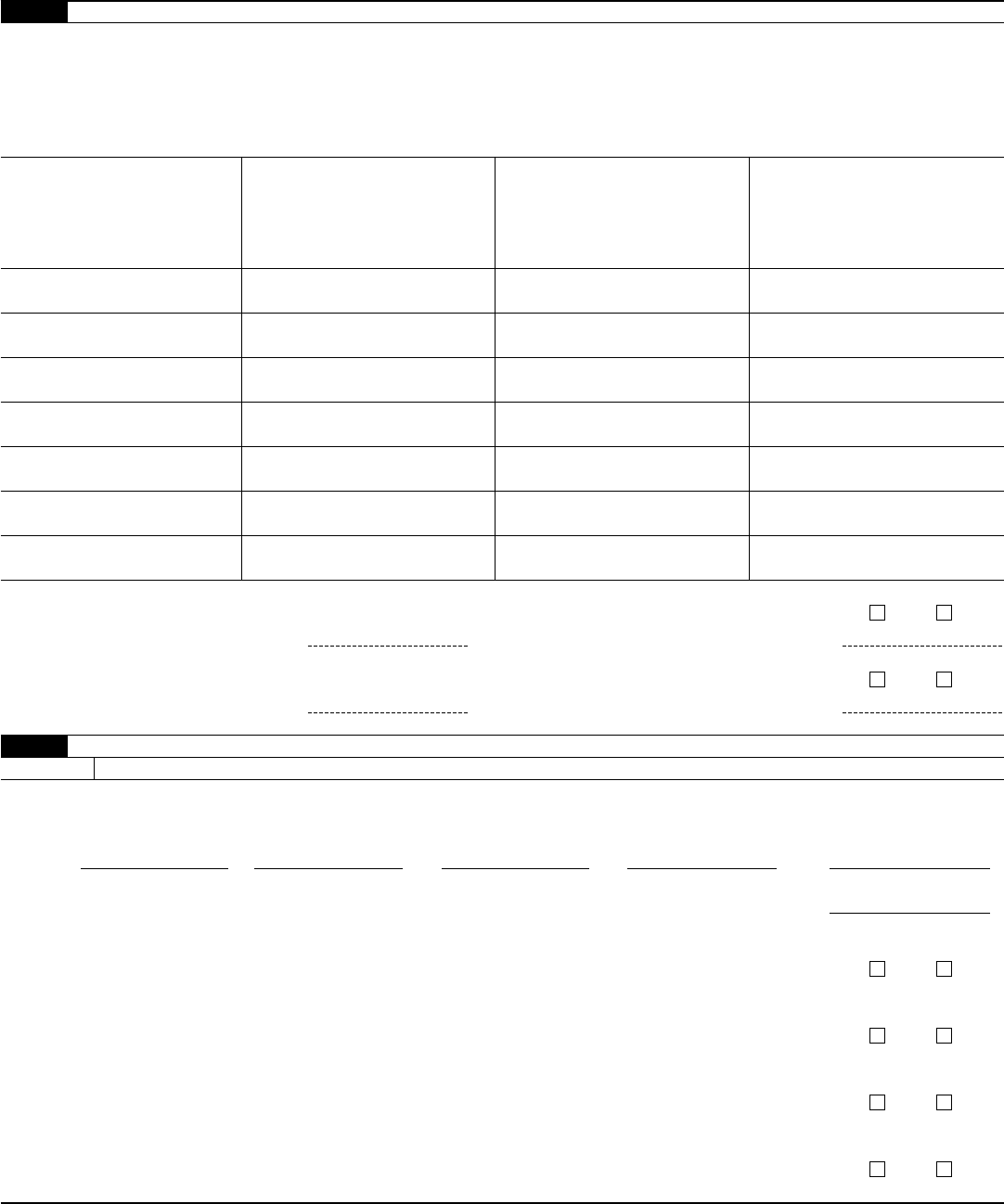

Form 8854 (2016)

Page 3

Section B Property Owned on Date of Expatriation

Don't complete Section B if:

• Your average net income tax liability for the 5 tax years immediately before expatriation (see line 1 in Section A) wasn't more

than $161,000, your net worth (see line 2 in Section A) was under $2 million, and you checked “Yes” on line 6 in Section A;

• In Section A, you checked “Yes” on lines 3, 4, and 6; or

• In Section A, you checked “Yes” on lines 5 and 6.

7

a

Do you have any eligible deferred compensation items? Checking the “Yes” box is an irrevocable waiver

of any right to claim any reduction in withholding for such eligible deferred compensation item under any

treaty with the United States . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

b Do you have any ineligible deferred compensation items? If “Yes,” you must include in income the

present value of your account on the day before your expatriation date . . . . . . . . . . . .

Yes No

c Do you have any specified tax deferred accounts? If “Yes,” you must include in income the entire

account balance on the day before your expatriation date . . . . . . . . . . . . . . . . .

Yes No

d

Do you have an interest in a nongrantor trust? Checking the “Yes” box is a waiver of any right to claim

any reduction in withholding on any distribution from such trust under any treaty with the United States

unless you make the election below . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

Check this box to elect under section 877A(f)(4)(B) to be treated as having received the value of your entire interest in the

trust (as determined for purposes of section 877A) as of the day before your expatriation date. Attach a copy of your

valuation letter ruling issued by the IRS (see instructions).

8 Recognition of gain or loss on the deemed sale of mark-to-market property. Caution. Don't include in column (a) any property

described on line 7a, 7b, 7c, or 7d.

Complete column (g) only if you are deferring tax on gain from any property listed in column (a).

(a)

Description of property

(b)

Fair market value

on day before date

of expatriation

(c)

Cost or other

basis*

(d)

Gain or (loss).

Subtract (c)

from (b)

(e)

Gain after

allocation of the

exclusion amount

(see instructions)

(f)

Form or Schedule

on which gain

or loss is reported

(g)

Amount of tax

deferred (attach

computations)

9 Total. Add the amounts in column (d) and column (e) . . .

10 Total tax deferred. Add the amounts in column (g). Enter here

and on line 15 . . . . . . . . . . . . . .

*You must identify as “(h)(2)” any property for which you are making the special basis election under section 877A(h)(2). This election is irrevocable.

See the instructions for Part IV, Section B, line 8, column (c).

Form 8854 (2016)

Form 8854 (2016)

Page 4

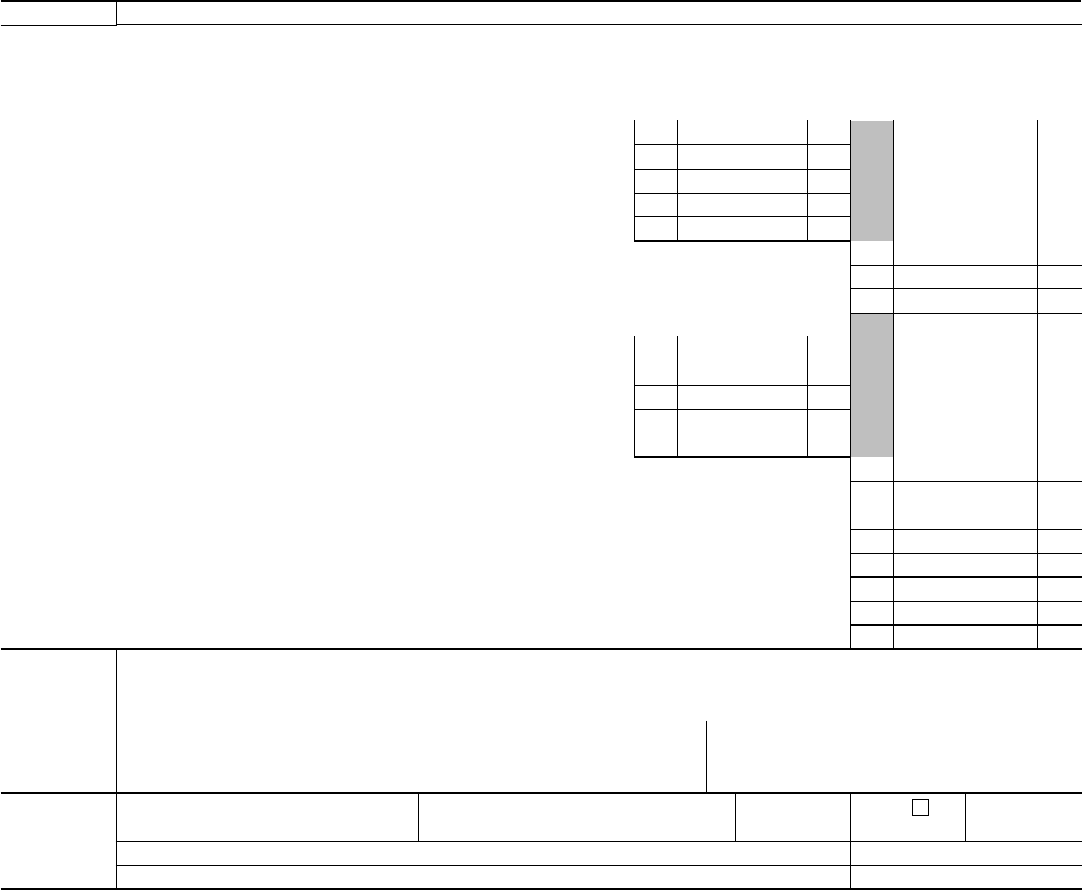

Section C Deferral of Tax

Election to defer tax. You can defer tax only if you have provided adequate security. Adequate security is described

in the instructions.

11 Are you electing to defer tax under section 877A(b)?

Checking the “Yes” box is an irrevocable waiver of any right under any treaty of the United States

that would prevent assessment or collection of any tax imposed because of section 877A.

Yes No

If you checked the “Yes” box, continue to line 12. Otherwise, don't complete lines 12 through 15.

12 Enter the total tax you would have reported on Form 1040, line 63, for the part of the year

including the day before the expatriation date absent the deferral election . . . . . . . .

12

13 Enter the total tax for the same part of the tax year determined without regard to the amounts

attributable to section 877A(a). Attach computation . . . . . . . . . . . . . . . .

13

14 Subtract line 13 from line 12. This is the amount of tax eligible for deferral . . . . . . . 14

15 Enter the total tax deferred from line 10, column (g) . . . . . . . . . . . . . . . . 15

• If you are filing Form 1040, enter this amount in brackets to the left of the entry space for line

63. Identify as “EXP.”

• If you are filing Form 1040NR, enter this amount in brackets to the left of the entry space for line

61. Identify as “EXP.”

Form 8854 (2016)

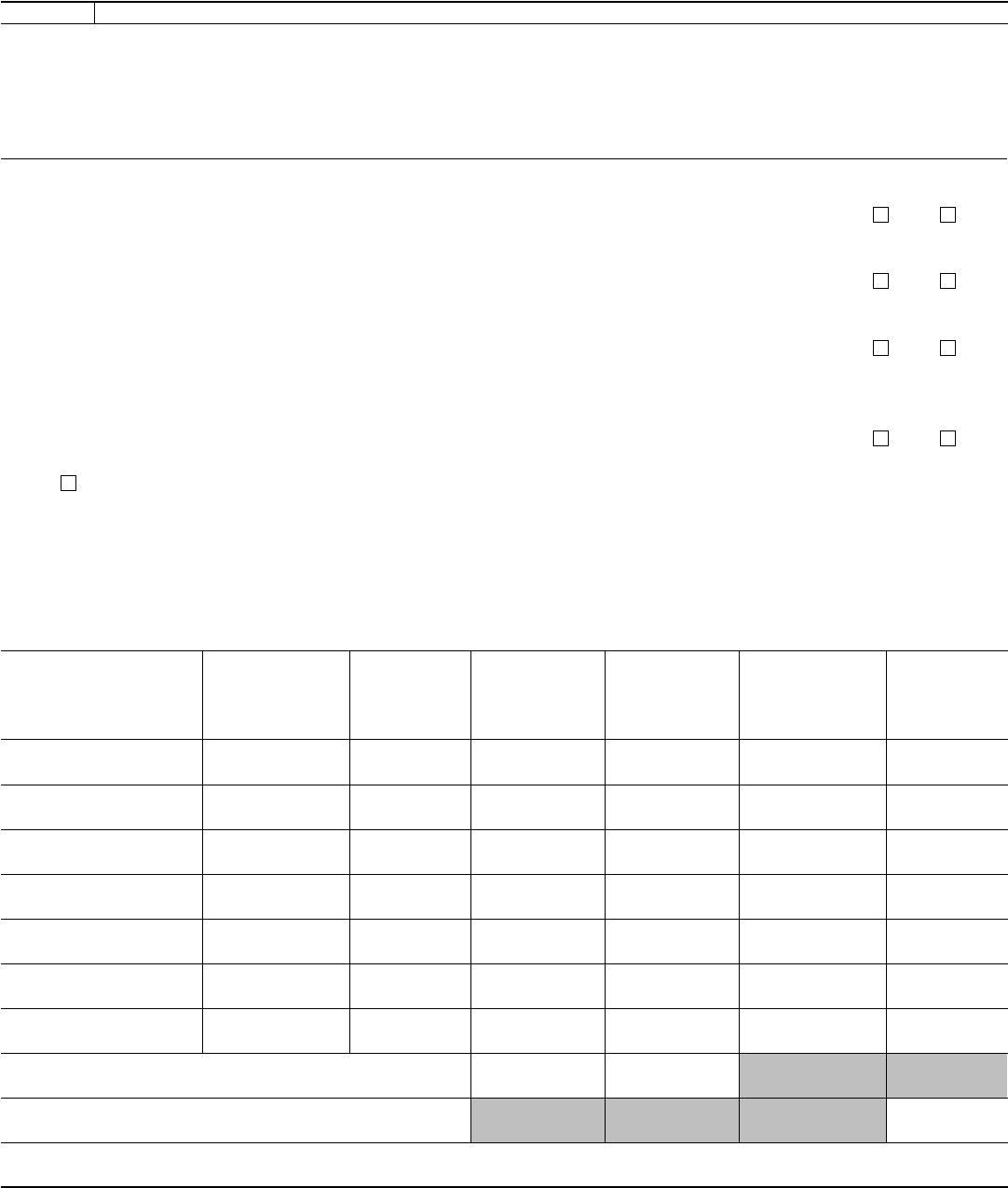

Form 8854 (2016)

Page 5

Part V

Balance Sheet and Income Statement

Schedule A Balance Sheet

List in U.S. dollars the fair market value (column (a)) and the U.S. adjusted basis (column (b)) of your assets and liabilities as of the

following date.

• Part II filers - the end of the tax year for which you are filing the form

• Part IV filers - your expatriation date. Note: Part IV filers don't complete column (d).

For more details, see the separate instructions.

Assets

Liabilities

(a) Fair market

value (FMV)

(b) U.S. adjusted

basis

(c) Gain or (loss).

Subtract column (b)

from column (a)

(d) FMV on beginning

date of U.S. residency

(optional, for long-term

residents only)

1 Cash, including bank deposits . . . . .

2

Marketable stock and securities issued by

U.S. companies . . . . . . . . . .

3

Marketable stock and securities issued by

foreign companies . . . . . . . . .

4

Nonmarketable stock and securities issued

by U.S. companies . . . . . . . . .

5

Nonmarketable stock and securities issued

by foreign companies . . . . . . . .

a

Separately state stock issued by foreign

companies that would be controlled foreign

corporations if you were still a U.S. citizen or

permanent resident (see instructions) . . .

b

Provide the name, address, and EIN, if any,

of any such company

6

Pensions from services performed in the

United States . . . . . . . . . .

7

Pensions from services performed outside

the United States . . . . . . . . .

8 Partnership interests (see instructions) . .

9

Assets held by trusts you own under

sections 671 through 679 (see instructions)

10

Beneficial interests in nongrantor trusts (see

instructions) . . . . . . . . . . .

11 Intangibles used in the United States . . .

12 Intangibles used outside the United States .

13 Loans to U.S. persons . . . . . . .

14 Loans to foreign persons . . . . . . .

15 Real property located in the United States .

16

Real property located outside the United States .

17

Business property located in the United

States . . . . . . . . . . . . .

18

Business property located outside the

United States . . . . . . . . . .

19

Other assets (see instructions) . . . . . .

20

Total assets. Add lines 1 through 5 and lines

6 through 19. Don't include amounts on line

5a in this total . . . . . . . . . .

Amount

21 Installment obligations . . . . . . .

22 Mortgages, etc. . . . . . . . . . .

23 Other liabilities (see instructions) . . . .

24 Total liabilities. Add lines 21 through 23 . .

25

Net worth. Subtract line 24 from line 20,

column (a) . . . . . . . . . . . .

Form 8854 (2016)

Form 8854 (2016)

Page 6

Schedule B

Income Statement

Provide income information for the following period.

• Part II filers - the tax year for which you are filing the form

• Part IV filers - the part of the tax year that ends with the day before your expatriation date; but enter -0- for lines 5 through 7.

1 U.S. source gross income not effectively connected with the conduct of a U.S. trade or business.

a Interest . . . . . . . . . . . . . . . . . . . .

1a

b Dividends . . . . . . . . . . . . . . . . . . . . 1b

c Royalties . . . . . . . . . . . . . . . . . . . .

1c

d Pension distributions . . . . . . . . . . . . . . . . 1d

e Other . . . . . . . . . . . . . . . . . . . . . 1e

f Total. Add lines a through e . . . . . . . . . . . . . . . . . . . . . . . 1f

2 Gross income that is effectively connected with the conduct of a U.S. trade or business . . . 2

3 Income from the performance of services in the United States . . . . . . . . . . . 3

4 Gains from the sale or exchange of:

a Property (other than stock or debt obligations) located in the United

States . . . . . . . . . . . . . . . . . . . . .

4a

b Stock issued by a U.S. domestic corporation . . . . . . . . 4b

c Debt obligations of U.S. persons or of the United States, a state or

political subdivision thereof, or the District of Columbia . . . . .

4c

d Total. Add lines a through c . . . . . . . . . . . . . . . . . . . . . . . 4d

5 Income or gain derived from certain foreign corporations to the extent of your share of earnings

and profits earned or accumulated before the date of expatriation (see instructions) . . . .

5

6

Gains on certain exchanges of property that ordinarily wouldn't be recognized (see instructions)

6

7 Income received or accrued by certain foreign corporations (see instructions) . . . . . . 7

8 Add lines 1f, 2, 3, 4d, 5, 6, and 7 . . . . . . . . . . . . . . . . . . . . . 8

9 Gross income from all other sources . . . . . . . . . . . . . . . . . . . . 9

10 Total. Add lines 8 and 9 . . . . . . . . . . . . . . . . . . . . . . . . 10

Sign Here

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the

best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than filer) is based on all information

of which preparer has any knowledge.

Your signature Date

Paid

Preparer

Use Only

Print/Type preparer’s name

Preparer’s signature Date

Check if

self-employed

PTIN

Firm’s name

▶

Firm’s address

▶

Firm's EIN

▶

Phone no.

Form 8854 (2016)