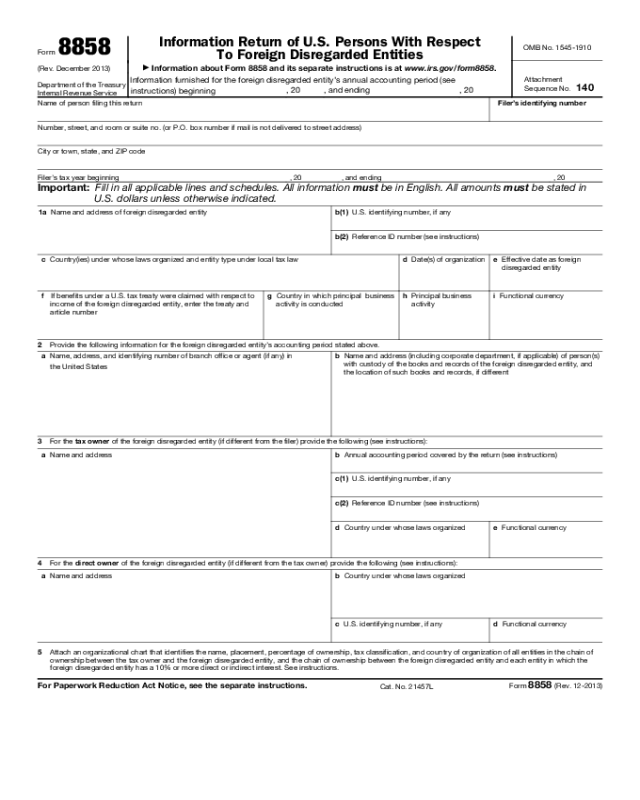

Form 8858 (Rev. 12-2013)

Page 2

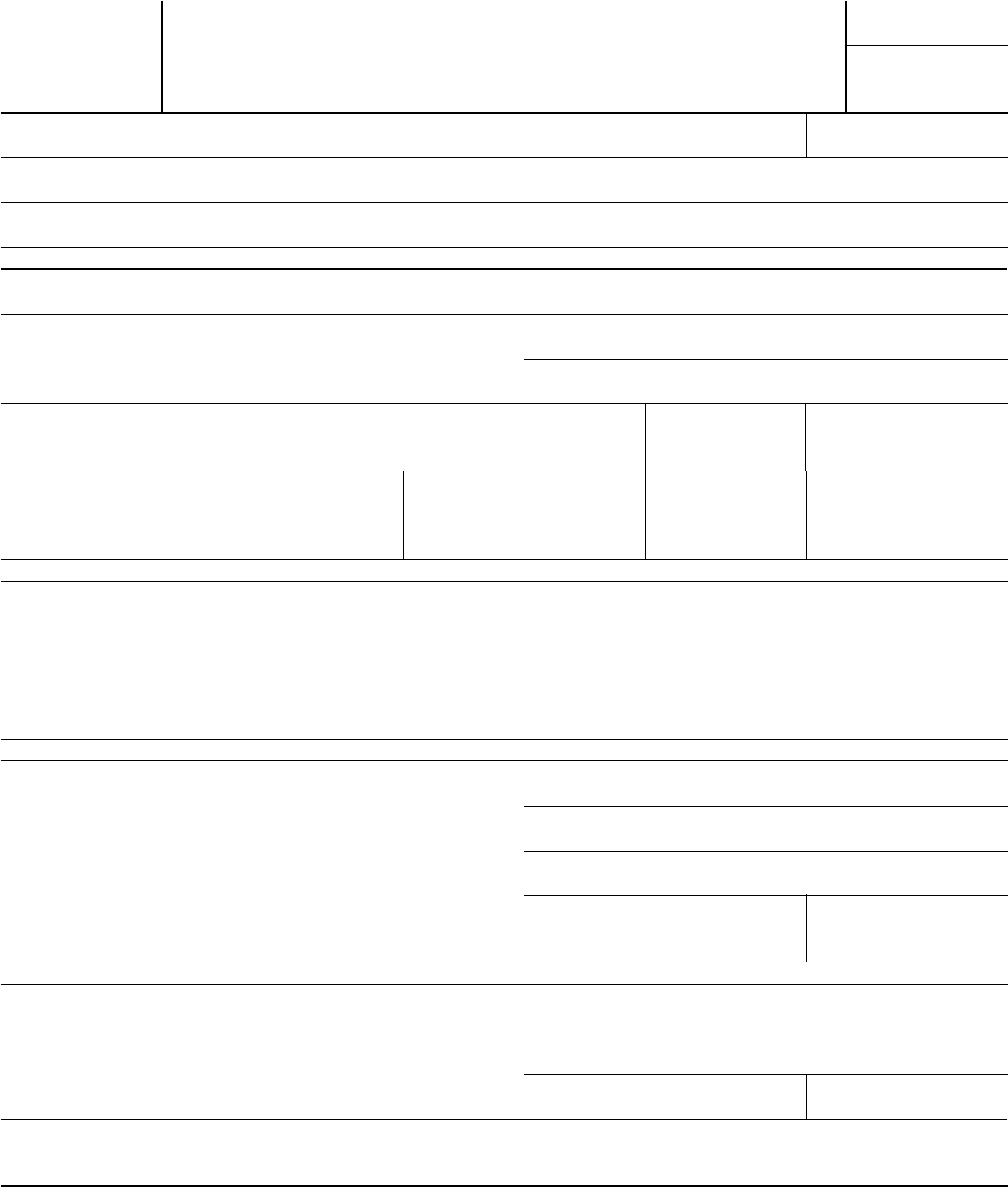

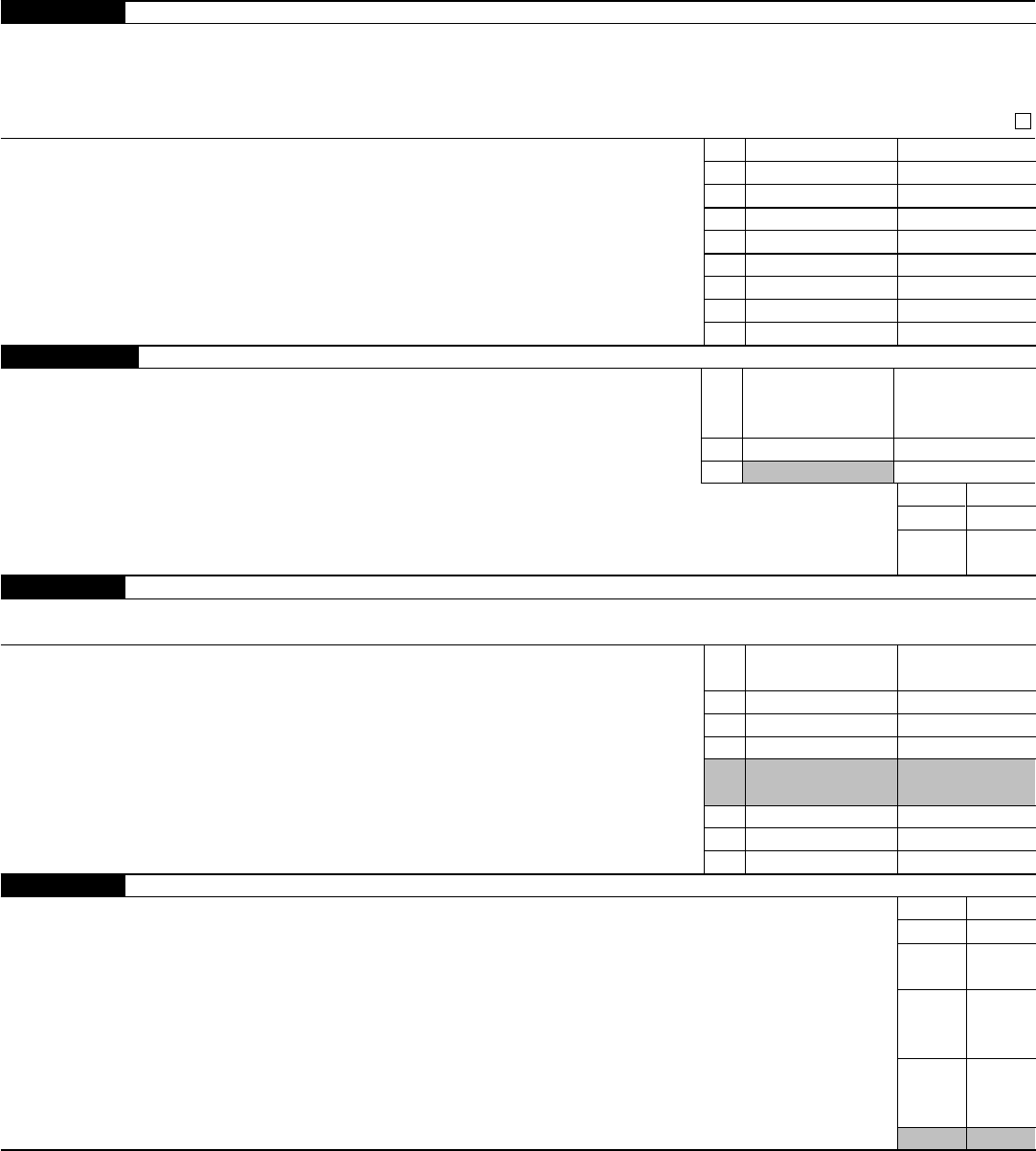

Schedule C Income Statement (see instructions)

Important: Report all information in functional currency in accordance with U.S. GAAP. Also, report each amount in U.S.

dollars translated from functional currency (using GAAP translation rules or the average exchange rate determined under

section 989(b)). If the functional currency is the U.S. dollar, complete only the U.S. Dollars column. See instructions for

special rules for foreign disregarded entities that use DASTM.

If you are using the average exchange rate (determined under section 989(b)), check the following box . . . . . .

Functional Currency U.S. Dollars

1 Gross receipts or sales (net of returns and allowances) . . . . . . . . . 1

2 Cost of goods sold . . . . . . . . . . . . . . . . . . . . . 2

3 Gross profit (subtract line 2 from line 1) . . . . . . . . . . . . . . 3

4 Other income. . . . . . . . . . . . . . . . . . . . . . . 4

5 Total income (add lines 3 and 4) . . . . . . . . . . . . . . . . 5

6 Total deductions . . . . . . . . . . . . . . . . . . . . . 6

7 Other adjustments . . . . . . . . . . . . . . . . . . . . . 7

8 Net income (loss) per books . . . . . . . . . . . . . . . . . . 8

Schedule C-1 Section 987 Gain or Loss Information

Note. See the instructions if there are multiple recipients of remittances

from the foreign disregarded entity.

(a)

Amount stated in

functional currency of

foreign disregarded entity

(b)

Amount stated in

functional currency of

recipient

1 Remittances from the foreign disregarded entity . . . . . . . . . . . 1

2 Section 987 gain (loss) of recipient . . . . . . . . . . . . . . . 2

Yes No

3 Were all remittances from the foreign disregarded entity treated as made to the direct owner? . . . . .

4

Did the tax owner change its method of accounting for section 987 gain or loss with respect to remittances

from the foreign disregarded entity during the tax year? . . . . . . . . . . . . . . . . . .

Schedule F Balance Sheet

Important: Report all amounts in U.S. dollars computed in functional currency and translated into U.S. dollars in

accordance with U.S. GAAP. See instructions for an exception for foreign disregarded entities that use DASTM.

Assets

(a)

Beginning of annual

accounting period

(b)

End of annual

accounting period

1 Cash and other current assets . . . . . . . . . . . . . . . . . 1

2 Other assets . . . . . . . . . . . . . . . . . . . . . . . 2

3 Total assets . . . . . . . . . . . . . . . . . . . . . . . 3

Liabilities and Owner’s Equity

4 Liabilities . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Owner’s equity . . . . . . . . . . . . . . . . . . . . . . 5

6 Total liabilities and owner’s equity . . . . . . . . . . . . . . . . 6

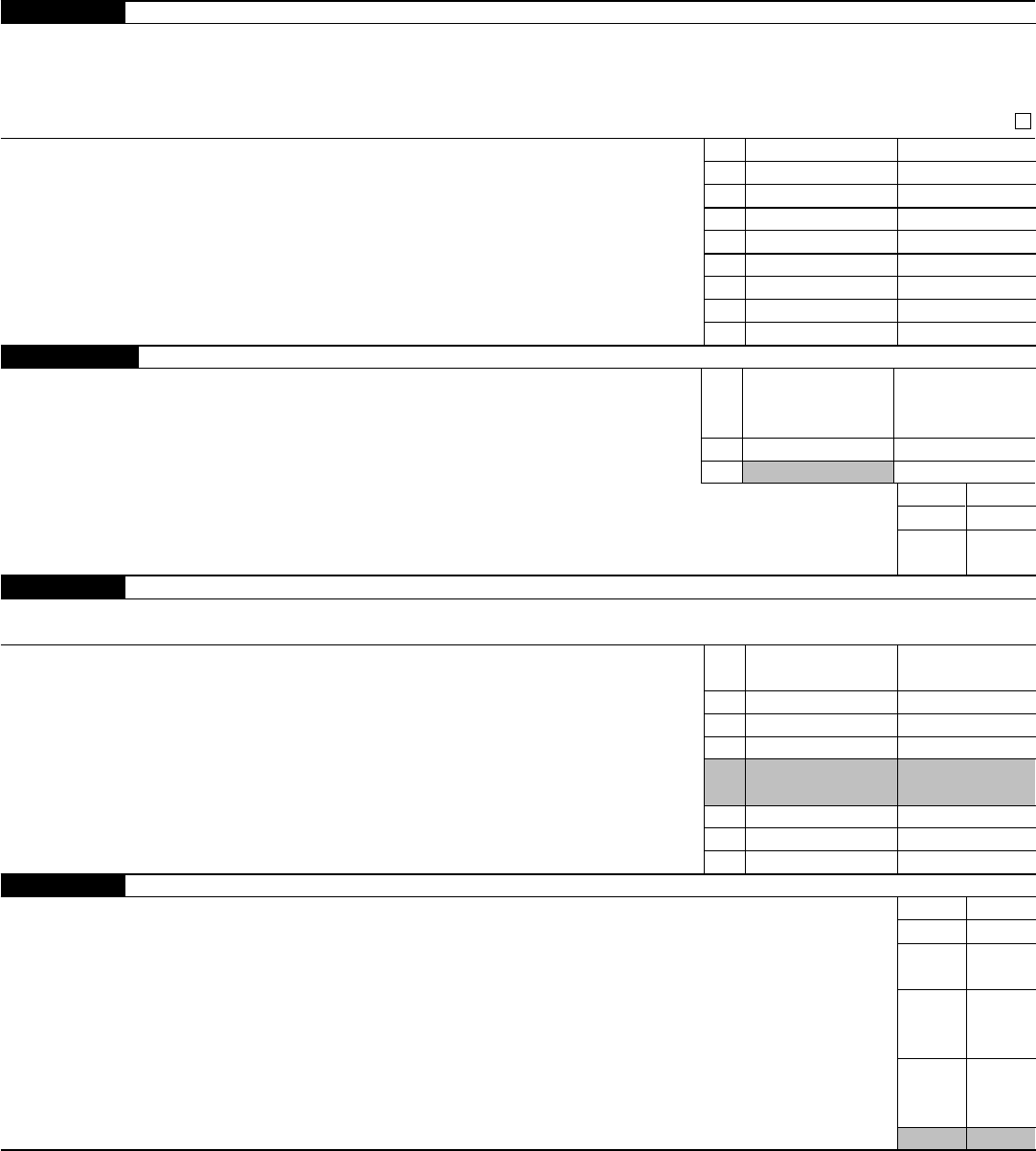

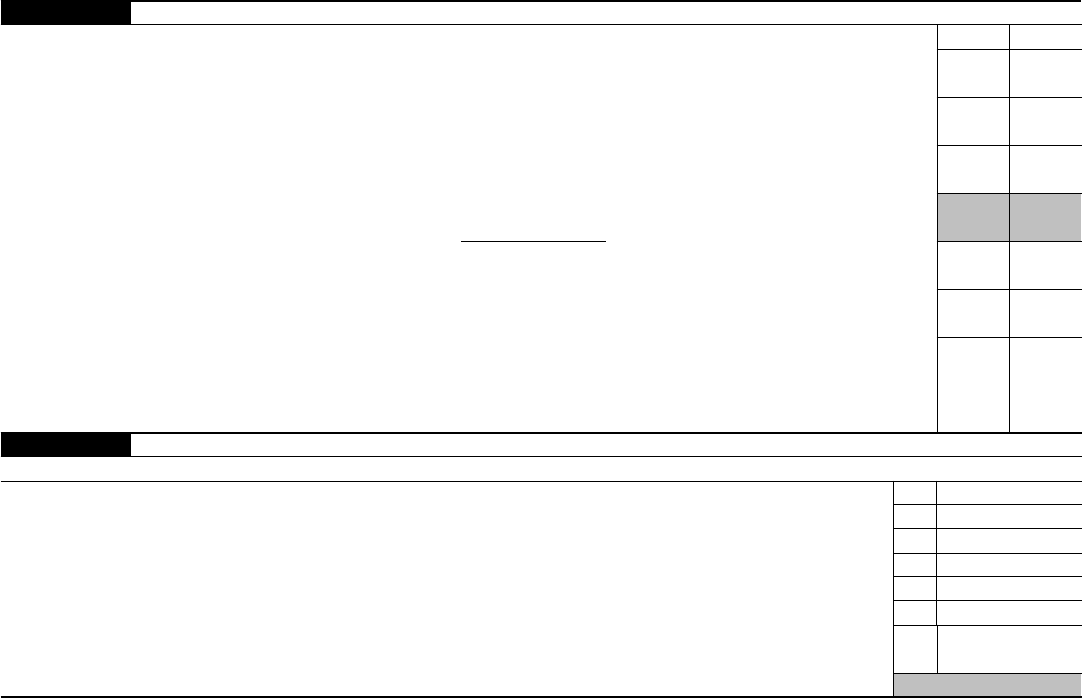

Schedule G Other Information

Yes No

1 During the tax year, did the foreign disregarded entity own an interest in any trust?. . . . . . . . .

2 During the tax year, did the foreign disregarded entity own at least a 10% interest, directly or indirectly, in

any foreign partnership? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Answer the following question only if the foreign disregarded entity made its election to be treated as

disregarded from its owner during the tax year: Did the tax owner claim a loss with respect to stock or

debt of the foreign disregarded entity as a result of the election? . . . . . . . . . . . . . . .

4 If the interest in the foreign disregarded entity is a separate unit under Reg. 1.1503(d)-1(b)(4) or part of a

combined separate unit under Reg. 1.1503(d)-1(b)(4)(ii) does the separate unit or combined separate unit

have a dual consolidated loss as defined in Reg. 1.1503(d)-1(b)(5)(ii)? . . . . . . . . . . . . .

If “Yes,” enter the amount of the dual consolidated loss

▶

$

Answer question 5a.

Form 8858 (Rev. 12-2013)