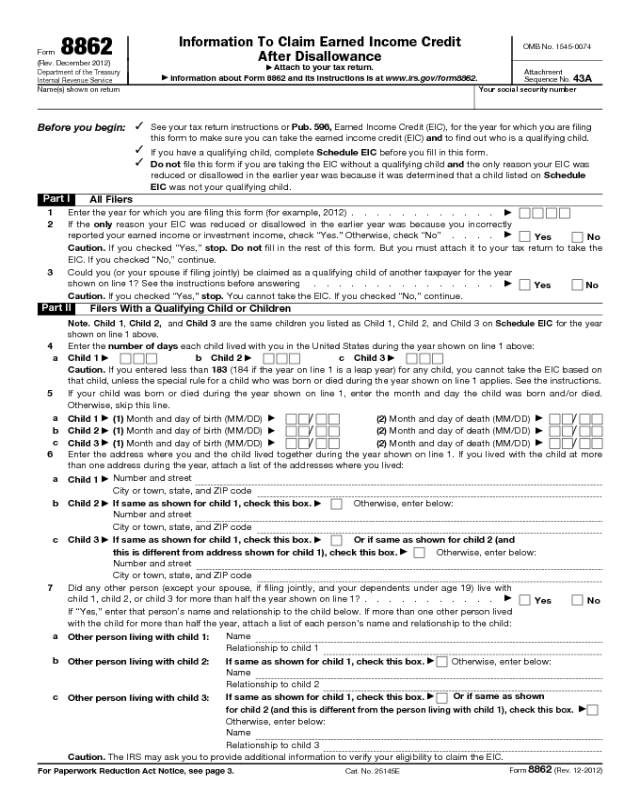

Form 8862

Form 8862

(Rev. December 2012)

Department of the Treasury

Internal Revenue Service

Information To Claim Earned Income Credit

After Disallowance

▶

Attach to your tax return.

▶

Information about Form 8862 and its instructions is at www.irs.gov/form8862.

OMB No. 1545-0074

Attachment

Sequence No.

43A

Name(s) shown on return Your social security number

Before you begin:

✓

See your tax return instructions or Pub. 596, Earned Income Credit (EIC), for the year for which you are filing

this form to make sure you can take the earned income credit (EIC) and to find out who is a qualifying child.

✓

If you have a qualifying child, complete Schedule EIC before you fill in this form.

✓

Do not file this form if you are taking the EIC without a qualifying child and the only reason your EIC was

reduced or disallowed in the earlier year was because it was determined that a child listed on Schedule

EIC was not your qualifying child.

Part I

All Filers

1 Enter the year for which you are filing this form (for example, 2012) . . . . . . . . . . . .

▶

2 If the only reason your EIC was reduced or disallowed in the earlier year was because you incorrectly

reported your earned income or investment income, check “Yes.” Otherwise, check “No” . . . .

▶

Yes No

Caution. If you checked “Yes,” stop. Do not fill in the rest of this form. But you must attach it to your tax return to take the

EIC. If you checked “No,” continue.

3 Could you (or your spouse if filing jointly) be claimed as a qualifying child of another taxpayer for the year

shown on line 1? See the instructions before answering . . . . . . . . . . . . . . .

▶

Yes No

Caution. If you checked “Yes,” stop. You cannot take the EIC. If you checked “No,” continue.

Part II

Filers With a Qualifying Child or Children

Note. Child 1, Child 2, and Child 3 are the same children you listed as Child 1, Child 2, and Child 3 on Schedule EIC for the year

shown on line 1 above.

4 Enter the number of days each child lived with you in the United States during the year shown on line 1 above:

a

Child 1

▶

b Child 2

▶

c Child 3

▶

Caution. If you entered less than 183 (184 if the year on line 1 is a leap year) for any child, you cannot take the EIC based on

that child, unless the special rule for a child who was born or died during the year shown on line 1 applies. See the instructions.

5 If your child was born or died during the year shown on line 1, enter the month and day the child was born and/or died.

Otherwise, skip this line.

a

Child 1

▶

(1) Month and day of birth (MM/DD)

▶

/

(2) Month and day of death (MM/DD)

▶

/

b

Child 2

▶

(1) Month and day of birth (MM/DD)

▶

/

(2) Month and day of death (MM/DD)

▶

/

c

Child 3

▶

(1) Month and day of birth (MM/DD)

▶

/

(2) Month and day of death (MM/DD)

▶

/

6 Enter the address where you and the child lived together during the year shown on line 1. If you lived with the child at more

than one address during the year, attach a list of the addresses where you lived:

a

Child 1

▶

Number and street

City or town, state, and ZIP code

b

Child 2

▶

If same as shown for child 1, check this box.

▶

Otherwise, enter below:

Number and street

City or town, state, and ZIP code

c

If same as shown for child 1, check this box.

▶

Or if same as shown for child 2 (and

this is different from address shown for child 1), check this box.

▶

Otherwise, enter below:

Number and street

City or town, state, and ZIP code

7

Did any other person (except your spouse, if filing jointly, and your dependents under age 19) live with

child 1, child 2, or child 3 for more than half the year shown on line 1? . . . . . . . . . . .

▶

Yes No

If “Yes,” enter that person’s name and relationship to the child below. If more than one other person lived

with the child for more than half the year, attach a list of each person’s name and relationship to the child:

a

Other person living with child 1:

Name

Relationship to child 1

b

Other person living with child 2:

If same as shown for child 1, check this box.

▶

Otherwise, enter below:

Name

Relationship to child 2

c

Other person living with child 3:

If same as shown for child 1, check this box.

▶

Or if same as shown

for child 2 (and this is different from the person living with child 1), check this box.

▶

Otherwise, enter below:

Name

Relationship to child 3

Caution. The IRS may ask you to provide additional information to verify your eligibility to claim the EIC.

For Paperwork Reduction Act Notice, see page 3.

Cat. No. 25145E

Form 8862 (Rev. 12-2012)

Child 3

▶

Form 8862 (Rev. 12-2012)

Page 2

Part III

Filers Without a Qualifying Child

8 Enter the number of days during the year shown on line 1 that you lived in the United States . . .

▶

Caution. If you entered less than 183 (184 if the year on line 1 is a leap year), stop. You cannot take the EIC. See the

instructions.

9 If married filing a joint return, enter the number of days during the year shown on line 1 that your spouse

lived in the United States . . . . . . . . . . . . . . . . . . . . . . . . . .

▶

Caution. If you entered less than 183 (184 if the year on line 1 is a leap year), stop. You cannot take the EIC. See the

instructions.

Form 8862 (Rev. 12-2012)

Form 8862 (Rev. 12-2012)

Page 3

General Instructions

Future Developments

For the latest information about developments related to Form

8862 and its instructions, such as legislation enacted after they

were published, go to www.irs.gov/form8862.

Purpose of Form

You must complete Form 8862 and attach it to your tax return if

both of the following apply.

1. Your EIC was reduced or disallowed for any reason other

than a math or clerical error for a year after 1996.

2. You now want to take the EIC and you meet all the

requirements.

Exception 1. Do not file Form 8862 if either of the following

applies.

• After your EIC was reduced or disallowed in an earlier year (a)

you filed Form 8862 (or other documents) and your EIC was

then allowed, and (b) your EIC has not been reduced or

disallowed again for any reason other than a math or clerical

error.

• You are taking the EIC without a qualifying child and the only

reason your EIC was reduced or disallowed in the earlier year

was because it was determined that a child listed on Schedule

EIC was not your qualifying child.

In either of these cases, you can take the EIC without filing

Form 8862 if you meet all the EIC eligibility requirements.

Exception 2. Do not file Form 8862 and do not take the EIC for

the:

• 2 years after the most recent tax year for which there was a

final determination that your EIC claim was due to reckless or

intentional disregard of the EIC rules, or

• 10 years after the most recent tax year for which there was a

final determination that your EIC claim was due to fraud.

You also must attach Schedule EIC to your return if

you have a qualifying child or children. In addition to

filing Form 8862 and, if required, Schedule EIC, you

may be asked to provide other information before any

refund claimed on your return is issued. The process of

establishing your eligibility to take the EIC will delay your refund.

▲

!

CAUTION

Additional Information

For more details on the EIC, including the definition of a

qualifying child and who is eligible to take the EIC, see your tax

return instructions or Pub. 596, Earned Income Credit (EIC), for

the year for which you are filing Form 8862.

Specific Instructions

Need More Space for an Item?

If you do, attach a statement that is the same size as Form

8862. Number each entry on the statement to correspond with

the line number on Form 8862. Put your name and social

security number on the statement and attach it at the end of

your return.

Line 3

If your filing status is married filing jointly for the year shown on

line 1, check “No” on line 3.

Also check “No” if you could be claimed as a qualifying child

of another person for the year shown on line 1 but the other

person is not required to file, and is not filing, a tax return for

that year or is filing it only as a claim for refund. A claim for

refund is a return filed only to get a refund of withheld income

tax or estimated tax paid. A return is not a claim for refund if the

EIC or any other refundable credit is claimed on it.

Lines 4 and 5

Temporary absences, such as for school, vacation, medical

care, or detention in a juvenile facility, count as time lived at

home.

Child born or died. If your child was born or died during the

year entered on line 1 and your home was the child’s home for

more than half the time he or she was alive during that year,

replace the number entered on line 4 for that child with

“365” ("366" if the year on line 1 is a leap year) and complete

line 5.

Lines 8 and 9

Enter the number of days you lived in the United States during

the year shown on line 1.

Example. You are single and are filing Form 8862 for 2012.

Your home was in the United States for all of 2012. On line 8,

you would enter “366.”

Members of the military. If you were on extended active duty

outside the United States, your home is considered to be in the

United States during that duty period. Include your active duty

time on line 8 and your spouse’s, if applicable, on line 9. See

Pub. 596 for the definition of extended active duty.

Paperwork Reduction Act Notice. We ask for the information

on this form to carry out the Internal Revenue laws of the United

States. You are required to give us the information. We need it

to ensure that you are complying with these laws and to allow

us to figure and collect the right amount of tax.

You are not required to provide the information requested on

a form that is subject to the Paperwork Reduction Act unless

the form displays a valid OMB control number. Books or

records relating to a form or its instructions must be retained as

long as their contents may become material in the

administration of any Internal Revenue law. Generally, tax

returns and return information are confidential, as required by

Internal Revenue Code section 6103.

The average time and expenses required to complete and file

this form will vary depending on individual circumstances. For

the estimated averages, see the instructions for your income tax

return.

If you have suggestions for making this form simpler, we

would be happy to hear from you. See the instructions for your

income tax return.