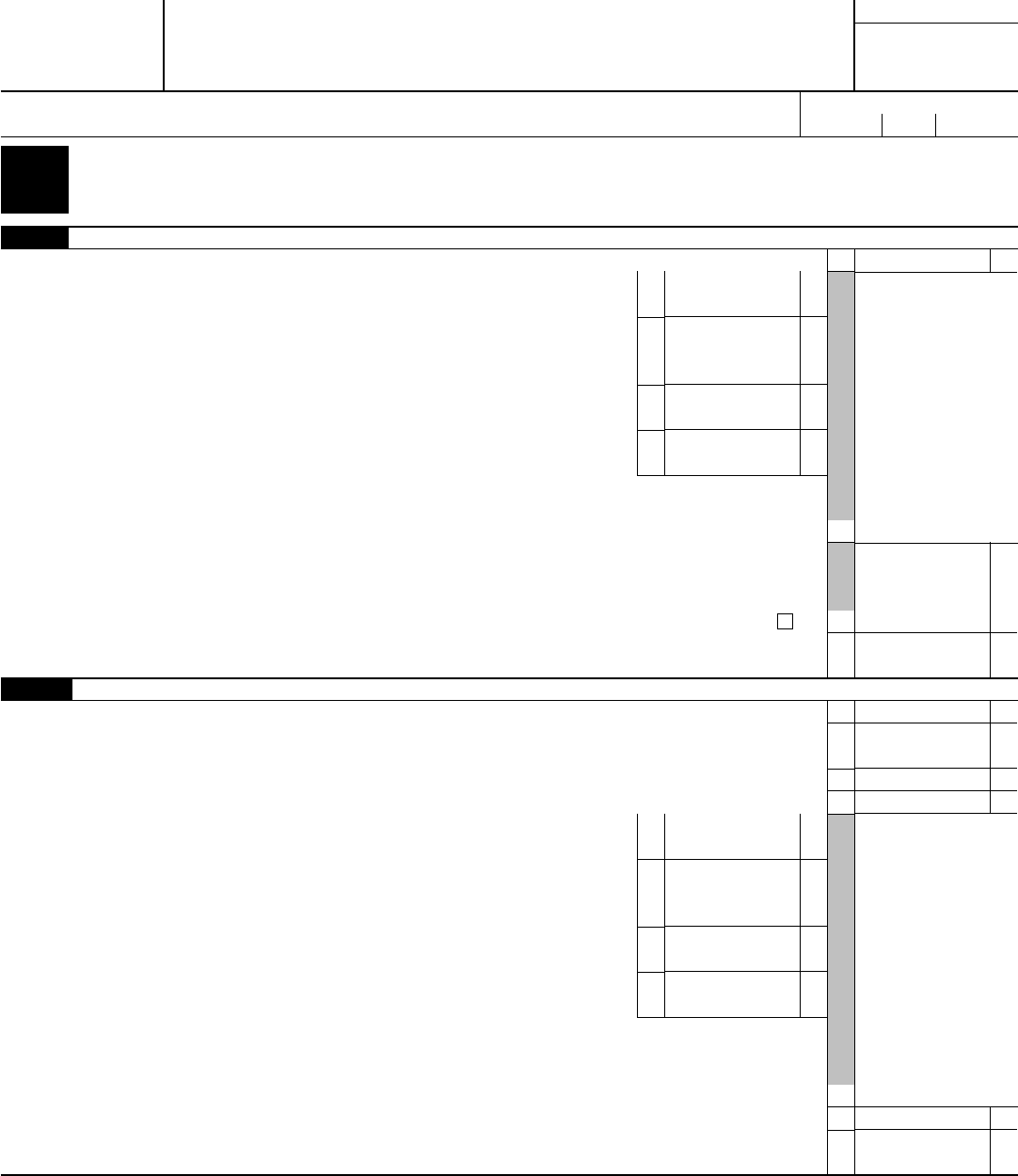

Form 8863

Department of the Treasury

Internal Revenue Service (99)

Education Credits

(American Opportunity and Lifetime Learning Credits)

▶

Attach to Form 1040 or Form 1040A.

▶

Information about Form 8863 and its separate instructions is at www.irs.gov/form8863.

OMB No. 1545-0074

2016

Attachment

Sequence No.

50

Name(s) shown on return

Your social security number

▲

!

CAUTION

Complete a separate Part III on page 2 for each student for whom you're claiming either credit before

you complete Parts I and II.

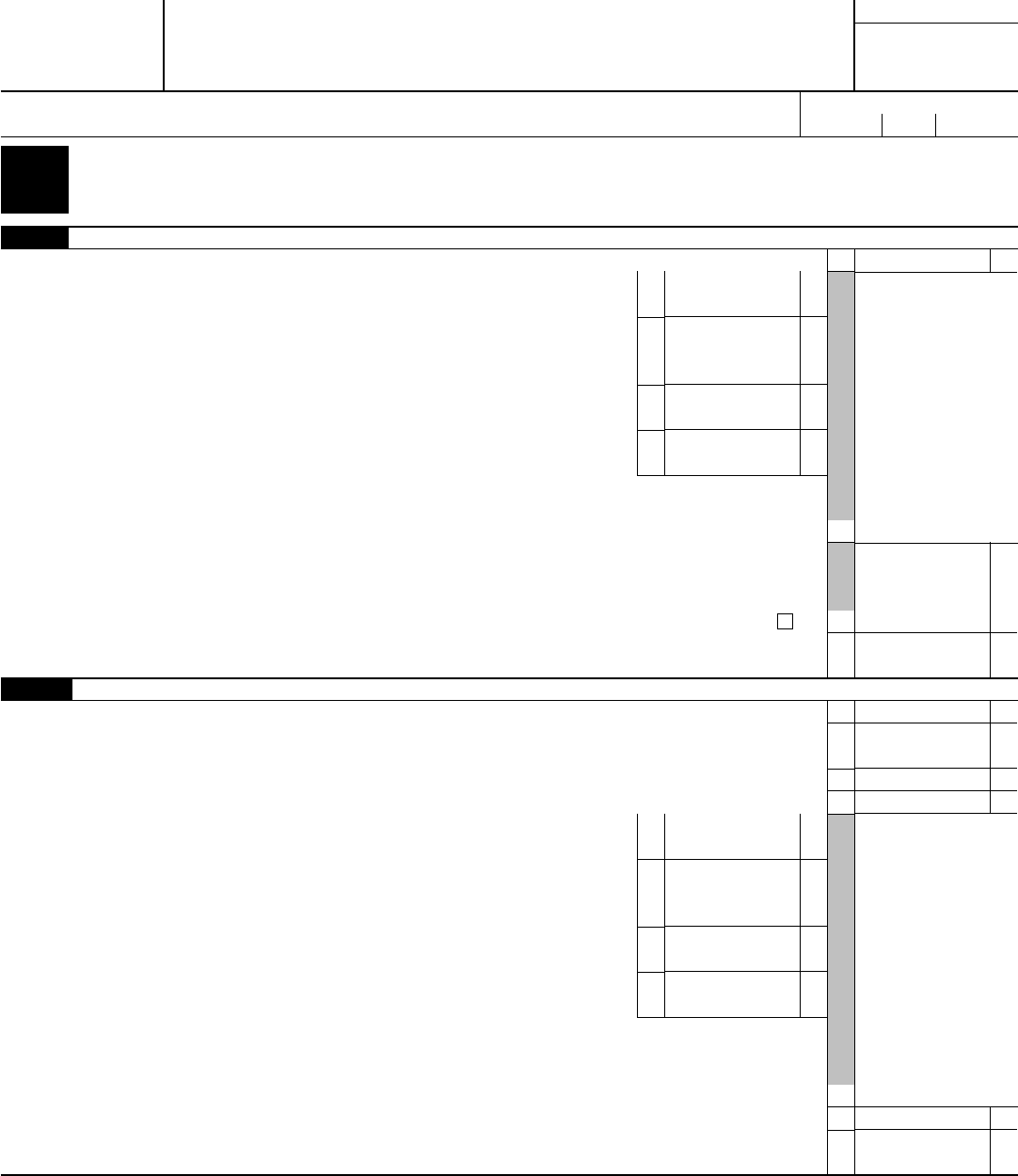

Part I Refundable American Opportunity Credit

1 After completing Part III for each student, enter the total of all amounts from all Parts III, line 30 . 1

2 Enter: $180,000 if married filing jointly; $90,000 if single, head of

household, or qualifying widow(er) . . . . . . . . . . . . .

2

3 Enter the amount from Form 1040, line 38, or Form 1040A, line 22. If

you're filing Form 2555, 2555-EZ, or 4563, or you're excluding income

from Puerto Rico, see Pub. 970 for the amount to enter . . . . . .

3

4 Subtract line 3 from line 2. If zero or less, stop; you can't take any

education credit . . . . . . . . . . . . . . . . . . .

4

5 Enter: $20,000 if married filing jointly; $10,000 if single, head of household,

or qualifying widow(er) . . . . . . . . . . . . . . . . .

5

6 If line 4 is:

• Equal to or more than line 5, enter 1.000 on line 6 . . . . . . . . . . . .

• Less than line 5, divide line 4 by line 5. Enter the result as a decimal (rounded to

at least three places) . . . . . . . . . . . . . . . . . . . . .

}

. . . .

6 .

7 Multiply line 1 by line 6. Caution: If you were under age 24 at the end of the year and meet

the conditions described in the instructions, you can't take the refundable American opportunity

credit; skip line 8, enter the amount from line 7 on line 9, and check this box . . . .

▶

7

8 Refundable American opportunity credit. Multiply line 7 by 40% (0.40). Enter the amount here and

on Form 1040, line 68, or Form 1040A, line 44. Then go to line 9 below. . . . . . . . . .

8

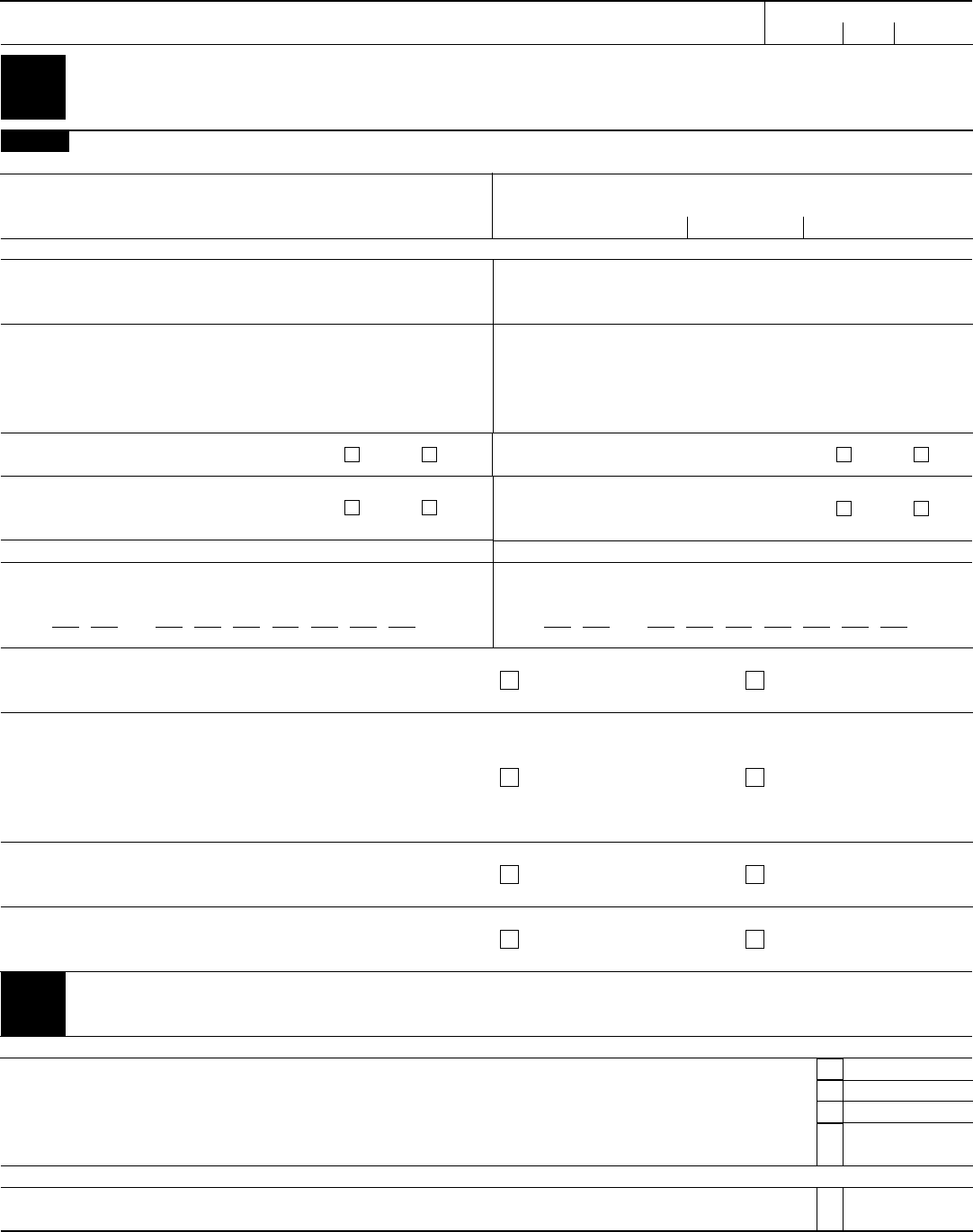

Part II Nonrefundable Education Credits

9 Subtract line 8 from line 7. Enter here and on line 2 of the Credit Limit Worksheet (see instructions) 9

10 After completing Part III for each student, enter the total of all amounts from all Parts III, line 31. If

zero, skip lines 11 through 17, enter -0- on line 18, and go to line 19 . . . . . . . . . .

10

11 Enter the smaller of line 10 or $10,000 . . . . . . . . . . . . . . . . . . . . 11

12 Multiply line 11 by 20% (0.20) . . . . . . . . . . . . . . . . . . . . . . . 12

13 Enter: $131,000 if married filing jointly; $65,000 if single, head of

household, or qualifying widow(er) . . . . . . . . . . . . .

13

14 Enter the amount from Form 1040, line 38, or Form 1040A, line 22. If you're

filing Form 2555, 2555-EZ, or 4563, or you're excluding income from

Puerto Rico, see Pub. 970 for the amount to enter . . . . . . . .

14

15 Subtract line 14 from line 13. If zero or less, skip lines 16 and 17, enter -0-

on line 18, and go to line 19 . . . . . . . . . . . . . . .

15

16 Enter: $20,000 if married filing jointly; $10,000 if single, head of household,

or qualifying widow(er) . . . . . . . . . . . . . . . . .

16

17 If line 15 is:

• Equal to or more than line 16, enter 1.000 on line 17 and go to line 18

• Less than line 16, divide line 15 by line 16. Enter the result as a decimal (rounded to at least three

places) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 .

18

Multiply line 12 by line 17. Enter here and on line 1 of the Credit Limit Worksheet (see instructions)

▶

18

19 Nonrefundable education credits. Enter the amount from line 7 of the Credit Limit Worksheet (see

instructions) here and on Form 1040, line 50, or Form 1040A, line 33 . . . . . . . . . .

19

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 25379M

Form 8863 (2016)