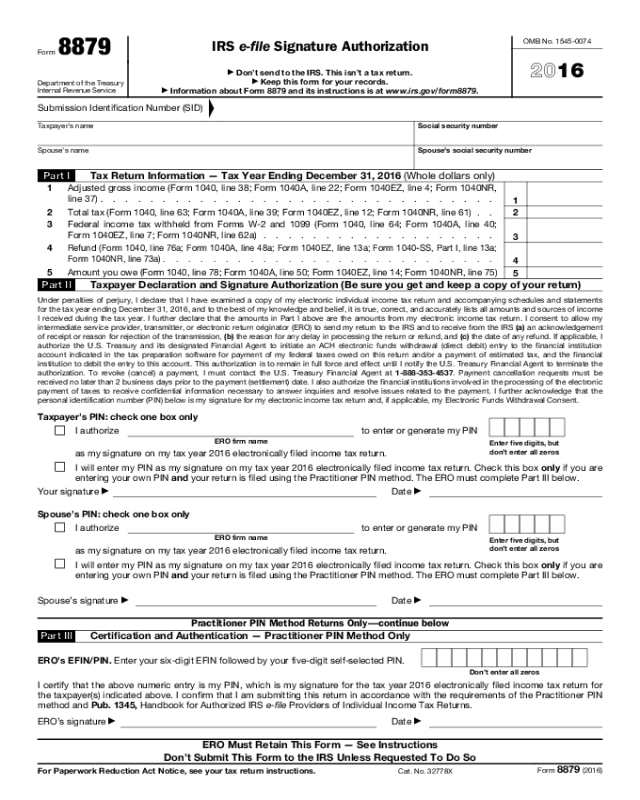

Form 8879 (2016)

Page 2

General Instructions

Section references are to the Internal Revenue

Code unless otherwise noted.

Future developments. For the latest

information about developments related to

Form 8879 and its instructions, such as

legislation enacted after they were published,

go to www.irs.gov/form8879.

What’s New

Beginning in 2017, you can use Form 8879 to

e-file your 2016 Form 1040NR, U.S.

Nonresident Alien Income Tax Return.

Purpose of Form

Form 8879 is the declaration document and

signature authorization for an e-filed return

filed by an electronic return originator (ERO).

Complete Form 8879 when the Practitioner

PIN method is used or when the taxpayer

authorizes the ERO to enter or generate the

taxpayer’s personal identification number

(PIN) on his or her e-filed individual income

tax return.

▲

!

CAUTION

Don’t send this form to the IRS.

The ERO must retain Form 8879.

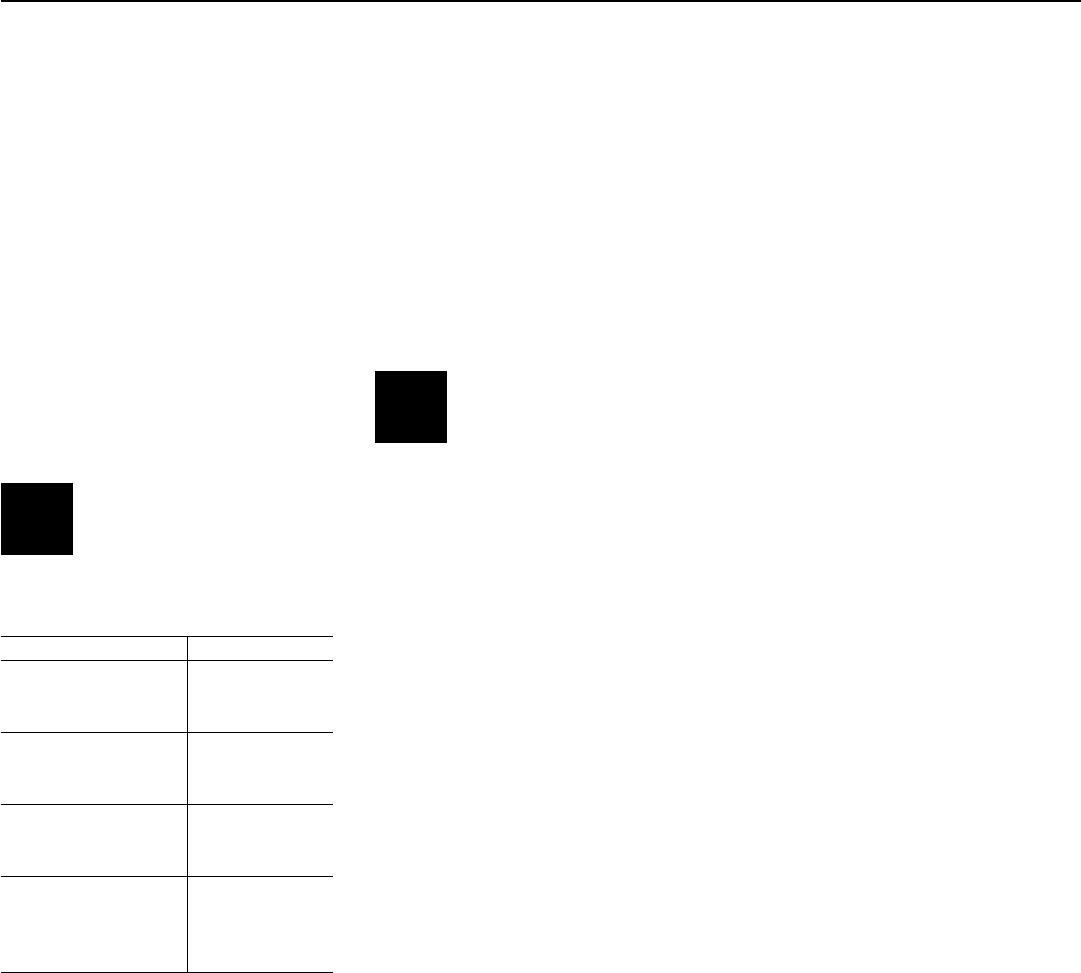

When and How To Complete

Use this chart to determine when and how to

complete Form 8879.

IF the ERO is . . .

THEN . . .

Not using the Practitioner

PIN method and the

taxpayer enters his or her

own PIN

Don’t complete

Form 8879.

Using the Practitioner PIN

method and is authorized

to enter or generate the

taxpayer’s PIN

Complete Form 8879,

Parts I, II, and III.

Using the Practitioner PIN

method and the taxpayer

enters his or her own PIN

Complete Form 8879,

Parts I, II, and III.

Not using the Practitioner

PIN method and is

authorized to enter or

generate the taxpayer’s

PIN

Complete Form

8879, Parts I and II.

ERO Responsibilities

The ERO will do the following.

1. Enter the name(s) and social security

number(s) of the taxpayer(s) at the top of the

form.

2. Complete Part I using the amounts (zeros

may be entered when appropriate) from the

taxpayer’s 2016 tax return. Form 1040-SS

filers leave lines 1 through 3 and line 5 blank.

3. Enter or generate, if authorized by the

taxpayer, the taxpayer’s PIN and enter it in

the boxes provided in Part II.

4. Enter on the authorization line in Part II

the ERO firm name (not the name of the

individual preparing the return) if the ERO is

authorized to enter the taxpayer’s PIN.

5. After completing items (1) through (4)

above, give the taxpayer Form 8879 for

completion and review. The acceptable

delivery methods include hand delivery, U.S.

mail, private delivery service, email, Internet

website, and fax.

6. Enter the 20-digit Submission

Identification Number (SID) assigned to the

tax return, or associate Form 9325,

Acknowledgement and General Information

for Taxpayers Who File Returns Electronically,

with Form 8879 after filing. If Form 9325 is

used to provide the SID, it is NOT required to

be physically attached to Form 8879.

However, it must be kept in accordance with

published retention requirements for Form

8879. See Pub. 4164, Modernized e-File

(MeF) Guide for Software Developers and

Transmitters, for more details.

▲

!

CAUTION

You must receive the completed

and signed Form 8879 from the

taxpayer before the electronic

return is transmitted (or released

for transmission).

For additional information, see Pub. 1345.

Taxpayer Responsibilities

Taxpayers have the following responsibilities.

1. Verify the accuracy of the prepared

income tax return, including direct deposit

information.

2. Check the appropriate box in Part II to

authorize the ERO to enter or generate your

PIN or to do it yourself.

3. Indicate or verify your PIN when

authorizing the ERO to enter or generate it

(the PIN must be five digits other than all

zeros).

4. Sign and date Form 8879. Taxpayers

must sign Form 8879 by handwritten

signature, or electronic signature if supported

by computer software.

5. Return the completed Form 8879 to the

ERO. The acceptable delivery methods

include hand delivery, U.S. mail, private

delivery service, email, Internet website, and

fax.

Your return won’t be transmitted to the IRS

until the ERO receives your signed Form

8879.

Refund information. You can check on the

status of your 2016 refund if it has been at

least 72 hours since IRS acknowledged

receipt of your e-filed return. But if you filed

Form 8379 with your return, allow 11 weeks.

To check the status of your 2016 refund, do

one of the following.

• Go to IRS.gov and click on Where’s My

Refund.

• Call 1-800-829-4477 for automated refund

information and follow the recorded

instructions.

• Call 1-800-829-1954.

Important Notes for EROs

• Don’t send Form 8879 to the IRS unless

requested to do so. Retain the completed

Form 8879 for 3 years from the return due

date or IRS received date, whichever is later.

Form 8879 may be retained electronically in

accordance with the recordkeeping guidelines

in Rev. Proc. 97-22, which is on page 9 of

Internal Revenue Bulletin 1997-13 at

www.irs.gov/pub/irs-irbs/irb97-13.pdf.

• You should confirm the identity of the

taxpayer(s).

• Complete Part III only if you are filing the

return using the Practitioner PIN method. You

aren’t required to enter the taxpayer’s date of

birth, prior year adjusted gross income, or PIN

in the Authentication Record of the

electronically filed return.

• If you aren’t using the Practitioner PIN

method, enter the taxpayer(s) date of birth

and either the adjusted gross income or the

PIN, or both, from the taxpayer’s prior year

originally filed return in the Authentication

Record of the taxpayer’s electronically filed

return. Don’t use an amount from an

amended return or a math error correction

made by the IRS.

• Enter the taxpayer’s PIN(s) on the input

screen only if the taxpayer has authorized you

to do so. If married filing jointly, it is

acceptable for one spouse to authorize you to

enter his or her PIN, and for the other spouse

to enter his or her own PIN. It isn’t acceptable

for a taxpayer to select or enter the PIN of an

absent spouse.

• Taxpayers must use a PIN to sign their

e-filed individual income tax return

transmitted by an ERO.

• Provide the taxpayer with a copy of the

signed Form 8879 for his or her records upon

request.

• Provide the taxpayer with a corrected copy

of Form 8879 if changes are made to the

return (for example, based on taxpayer

review).

• EROs can sign the form using a rubber

stamp, mechanical device (such as a

signature pen), or computer software

program. See Notice 2007-79, 2007-42 I.R.B.

809, available at

www.irs.gov/irb/2007-42_IRB/ar10.html for

more information.

• For more information, go to

www.irs.gov/efile.