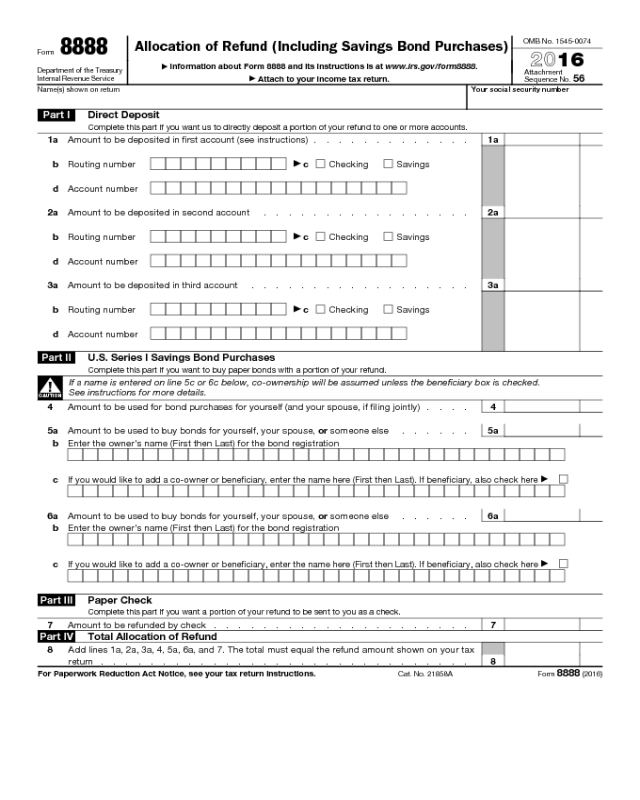

Form 8888

Form

8888

Department of the Treasury

Internal Revenue Service

Allocation of Refund (Including Savings Bond Purchases)

▶

Information about Form 8888 and its instructions is at www.irs.gov/form8888.

▶

Attach to your income tax return.

OMB No. 1545-0074

2016

Attachment

Sequence No.

56

Name(s) shown on return

Your social security number

Part I Direct Deposit

Complete this part if you want us to directly deposit a portion of your refund to one or more accounts.

1a Amount to be deposited in first account (see instructions) . . . . . . . . . . . . . 1a

b Routing number

▶

c Checking Savings

d Account number

2 a Amount to be deposited in second account . . . . . . . . . . . . . . . . . 2a

b Routing number

▶

c Checking Savings

d Account number

3 a Amount to be deposited in third account . . . . . . . . . . . . . . . . . . 3a

b Routing number

▶

c Checking Savings

d Account number

Part II U.S. Series I Savings Bond Purchases

Complete this part if you want to buy paper bonds with a portion of your refund.

▲

!

CAUTION

If a name is entered on line 5c or 6c below, co-ownership will be assumed unless the beneficiary box is checked.

See instructions for more details.

4 Amount to be used for bond purchases for yourself (and your spouse, if filing jointly) . . . .

4

5a Amount to be used to buy bonds for yourself, your spouse, or someone else . . . . . . 5a

b Enter the owner's name (First then Last) for the bond registration

c

If you would like to add a co-owner or beneficiary, enter the name here (First then Last). If beneficiary, also check here

▶

6a Amount to be used to buy bonds for yourself, your spouse, or someone else . . . . . . 6a

b Enter the owner's name (First then Last) for the bond registration

c

If you would l

i

ke to add a co-owner or beneficiary, enter the name here (First then Last). If beneficiary, also check here

▶

Part III Paper Check

Complete this part if you want a portion of your refund to be sent to you as a check.

7 Amount to be refunded by check . . . . . . . . . . . . . . . . . . . . . 7

Part IV Total Allocation of Refund

8

Add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. The total must equal the refund amount shown on your tax

return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 21858A

Form 8888 (2016)

Form 8888 (2016)

Page 2

Future Developments

Information about any future developments

affecting Form 8888 (such as legislation

enacted after we release it) will be posted

on www.irs.gov/form8888.

General Instructions

Purpose of Form

Use Form 8888 if:

• You want us to directly deposit your

refund (or part of it) to either two or three

accounts at a bank or other financial

institution (such as a mutual fund,

brokerage firm, or credit union) in the

United States, or

• You want to use at least part of your

refund to buy up to $5,000 in paper or

electronic series I savings bonds.

An account can be a checking, savings,

or other account such as:

• An individual retirement arrangement

(IRA), including a myRA®,

• A health savings account (HSA),

• An Archer MSA,

• A Coverdell education savings account

(ESA), or

• A TreasuryDirect® online account.

You can't have your refund deposited into

more than one account or buy paper series I

savings bonds if you file Form 8379, Injured

Spouse Allocation.

Deposit of refund to only one account. If

you want your refund deposited to only one

account, don't complete this form. Instead,

request direct deposit on your tax return.

Account must be in your name. Don't

request a deposit of your refund to an

account that isn't in your name, such as

your tax return preparer’s account.

Although you may owe your tax return

preparer a fee for preparing your return,

don't have any part of your refund

deposited into the preparer's account to

pay the fee.

The number of refunds that can be

directly deposited to a single account or

prepaid debit card is limited to three a year.

After this limit is reached, paper checks will

be sent instead. Learn more at

www.irs.gov/Individuals/Direct-Deposit-

Limits.

Amended return. Don't attach Form 8888

to Form 1040X. A refund on an amended

return can't be directly deposited to an

account or used to buy savings bonds.

Why Use Direct Deposit?

• You get your refund faster by direct

deposit than you do by check.

• Payment is more secure. There is no

check that can get lost or stolen.

• It saves tax dollars because it costs the

government less.

• It is more convenient. You don't have to

make a trip to the bank to deposit your

check.

IRA

You can have your refund (or part of it)

directly deposited to a traditional IRA, Roth

IRA (including a myRA

®

), or SEP-IRA, but

not a SIMPLE IRA. You must establish the

IRA at a bank or other eligible financial

institution before you request direct

deposit. Make sure your direct deposit will

be accepted. You must also notify the

trustee or custodian of your account of the

year to which the deposit is to be applied

(unless the trustee or custodian won't

accept a deposit for 2016). If you don't, the

trustee or custodian can assume the

deposit is for the year during which you are

filing your return. For example, if you file

your 2016 return during 2017 and don't

notify the trustee or custodian in advance,

the trustee or custodian can assume the

deposit to your IRA in 2017 is for 2017. If

you designate your deposit to be for 2016,

you must verify that the deposit was

actually made to the account by the due

date of the return (without regard to

extensions). If the deposit isn't made by

that date, the deposit isn't an IRA

contribution for 2016. In that case, you

must file an amended 2016 return and

reduce any IRA deduction and any

retirement savings contributions credit you

claimed.

▲

!

CAUTION

You and your spouse, if filing

jointly, each may be able to

contribute up to $5,500 ($6,500

if age 50 or older at the end of

2016) to a traditional IRA or Roth IRA

(including a myRA

®

) for 2016. You may owe

a penalty if your total contributions exceed

these limits, and these limits may be

reduced depending on your compensation

and income. For more information on IRA

contributions, see Pub. 590-A. If the limits

on IRA contributions change for 2017, Pub.

590-A will have the new 2017 limits.

myRA

®

You can have your refund (or part of it)

directly deposited to a myRA® account,

which is a starter retirement account

offered by the Department of the Treasury.

For more information on myRA

®

and to

open a myRA

®

account online, go to

www.myra.gov.

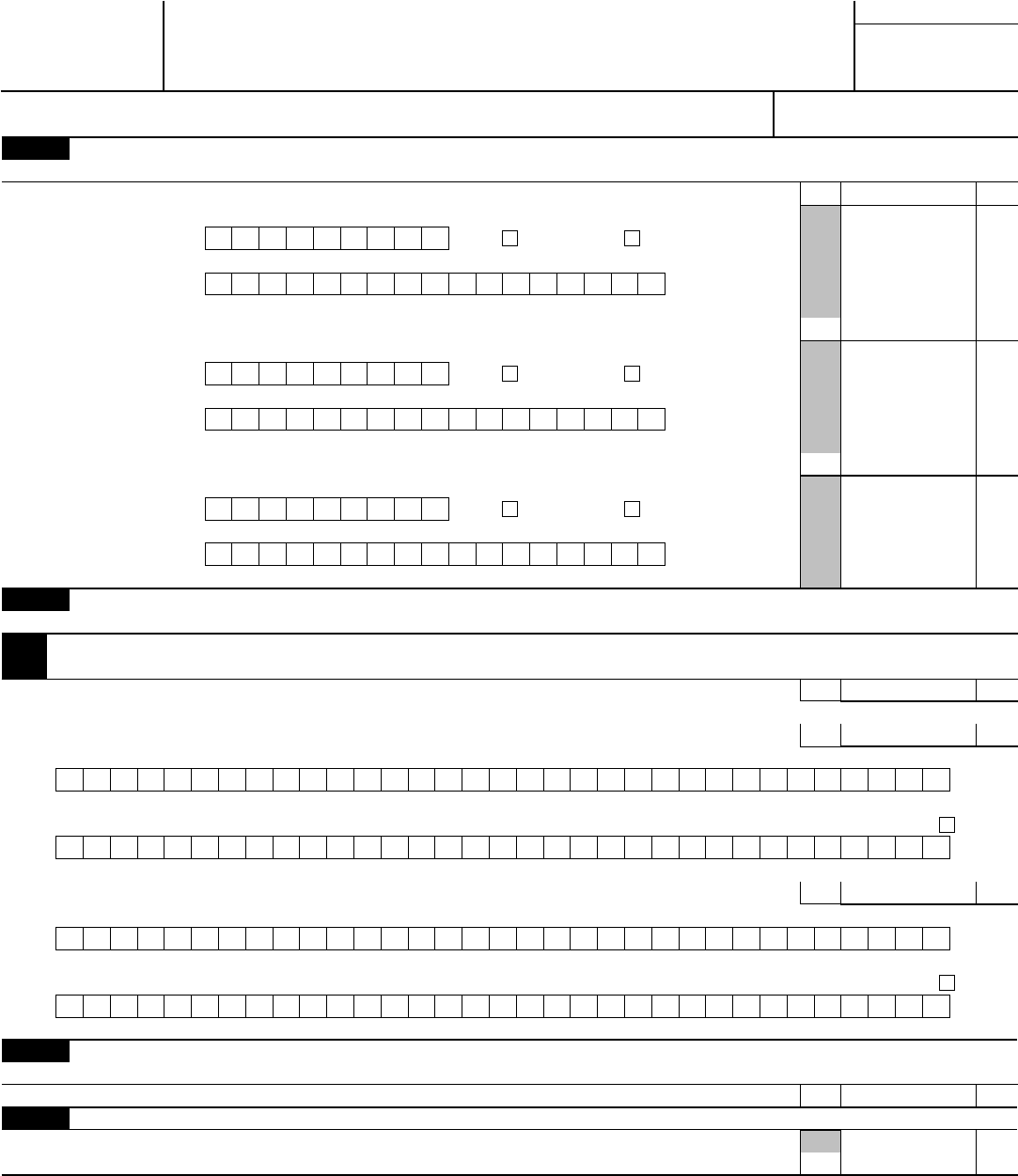

Sample Check

TONY MAPLE

JENNIFER MAPLE

123 Pear Lane

Anyplace, GA 00000

SAMPLE

1234

▲

15-0000/0000

PAY TO THE

ORDER OF

$

Routing

number

Account

number

DOLLARS

ANYPLACE BANK

Anyplace, GA 00000

For

Don't include

the check number.

| |

:250250025 :202020"'86".

1234

◀

Note: The routing and account numbers may be in different places on your check.

TreasuryDirect® Account

You can request a deposit of your refund

(or part of it) to a TreasuryDirect® online

account to buy U.S. Treasury marketable

securities and savings bonds. For more

information, go to http://go.usa.gov/3KvcP.

U.S. Series I Savings Bonds

You can request that your refund (or part of

it) be used to buy up to $5,000 in series I

savings bonds. You can buy them

electronically by direct deposit into your

TreasuryDirect® account. See instructions

under Part I for details. Or, if you don't

have a TreasuryDirect® account, you can

buy paper savings bonds. See the

instructions under Part II for details.

Specific Instructions

Part I

TIP

If you are filing Form 8888 only

to buy paper series I savings

bonds, skip Part I and go to

Part II.

▲

!

CAUTION

If you file a joint return and

complete Form 8888, your

spouse may get at least part of

the refund.

Lines 1a, 2a, and 3a

Enter the portion of your refund you want

directly deposited to each account. Each

deposit must be at least $1.

Your entire deposit may be deposited in

one account. If there are any delays in the

processing of your return by the IRS, your

entire refund will be deposited in the first

account listed on Form 8888. Make sure

the first account you list on Form 8888 is

an account you would want the entire

refund deposited in if this happens.

An account can be a checking, savings,

or other account such as an IRA, HSA,

Archer MSA, ESA, myRA

®

, or

TreasuryDirect® online account.

Lines 1b, 2b, and 3b

The routing number must be nine digits.

The first two digits must be 01 through 12

or 21 through 32. On the sample check

below, the routing number is 250250025.

Tony and Jennifer Maple would use that

routing number unless their financial

institution instructed them to use a different

routing number for direct deposits.

Form 8888 (2016)

Page 3

Ask your financial institution for the

correct routing number to enter if:

• The routing number on a deposit slip is

different from the routing number on your

checks,

• Your deposit is to a savings account that

doesn't allow you to write checks,

• Your checks state they are payable

through a financial institution different from

the one at which you have your account, or

• Your deposit is to a myRA

®

account.

Lines 1c, 2c, and 3c

Check the appropriate box for the type of

account. Don't check more than one box

for each line. If your deposit is to an

account such as an IRA, HSA, brokerage

account, or other similar account, ask your

financial institution whether you should

check the “Checking” or “Savings” box.

You must check the correct box to ensure

your deposit is accepted. If your deposit is

to a TreasuryDirect

®

online account or

myRA

®

account, check the “Savings” box.

Lines 1d, 2d, and 3d

The account number can be up to 17

characters (both numbers and letters).

Include hyphens but omit spaces and

special symbols. Enter the number from left

to right and leave any unused boxes blank.

On the sample check in these instructions,

the account number is 20202086. Don't

include the check number.

Reasons Your Direct Deposit

Request Will Be Rejected

If any of the following apply, your direct

deposit request will be rejected and a

check will be sent instead.

• You are asking to have a joint refund

deposited to an individual account, and

your financial institution(s) won't allow this.

The IRS isn't responsible if a financial

institution rejects a direct deposit.

• The name on your account doesn't match

the name on the refund, and your financial

institution(s) won't allow a refund to be

deposited unless the name on the refund

matches the name on the account.

• Three direct deposits of tax refunds have

already been made to the same account or

prepaid debit card.

• You haven't given a valid account

number.

• You file your 2016 return after

December 31, 2017.

If your financial institution rejects one or

two but not all of your direct deposit

requests, you may get part of your refund

as a paper check and part as a direct

deposit.

Example. You complete lines 1 and 2

correctly but forget to enter an account

number on line 3d. You will get a paper

check for any amount shown on line 3a.

The parts of your refund shown on lines

1a and 2a will be directly deposited to the

accounts you indicated.

▲

!

CAUTION

The IRS isn't responsible for a

lost refund if you enter the

wrong account information.

Check with your financial

institution to get the correct routing and

account numbers and to make sure your

direct deposit will be accepted.

Changes in Refund Due to Math

Errors or Refund Offsets

The rules below explain how your direct

deposits may be adjusted.

Math Errors

The following rules apply if your refund is

increased or decreased due to a math

error.

Refund increased. If you made an error on

your return and the amount of your refund

is increased, the additional amount will be

deposited to the last account listed. If you

asked that your refund be split among

three accounts, any increase will be

deposited to the account on line 3. If you

asked that your refund be split among two

accounts, any increase will be deposited to

the account on line 2.

Example. Your return shows a refund of

$300 and you ask that the refund be split

among three accounts with $100 in each

account. Due to an error on the return, your

refund is increased to $350. The additional

$50 will be added to the deposit to the

account on line 3.

Refund decreased. If you made an error

on your return and the amount of your

refund is decreased, the decrease will be

taken first from any deposit to an account

on line 3, next from the deposit to the

account on line 2, and finally from the

deposit to the account on line 1.

Example. Your return shows a refund of

$300, and you ask that the refund be split

among three accounts with $100 in each

account. Due to an error on your return,

your refund is decreased by $150. You

won't receive the $100 you asked us to

deposit to the account on line 3, and the

deposit to the account on line 2 will be

reduced by $50.

Note: If you appeal the math error and your

appeal is upheld, the resulting refund will

be deposited to the account on line 1.

Refund Offset

The following rules apply if your refund is

offset (used) to pay past-due federal tax or

certain other debts.

Past-due federal tax. If you owe past-due

federal tax and your refund is offset by the

IRS to pay the tax, the past-due amount

will be deducted first from any deposit to

an account on line 3, next from the deposit

to the account on line 2, and finally from

the deposit to the account on line 1.

Other offsets. If you owe other past-due

amounts (such as state income tax, child

support, spousal support, or certain federal

nontax debts, such as student loans)

subject to offset by the Treasury

Department’s Bureau of the Fiscal Service,

the past-due amounts will be deducted first

from the deposit to the account with the

lowest routing number. Any remaining

amount due will be deducted from the

deposit to the account with the next lowest

routing number and then from the deposit

to the account with the highest routing

number.

▲

!

CAUTION

If the deposit to one or more of

your accounts is changed due

to a math error or refund offset,

and that account is subject to

contribution limits, such as an IRA, HSA,

Archer MSA, or Coverdell ESA, or the

deposit was deducted as a contribution to

a tax-favored account on your tax return,

you may need to correct your contribution

or file an amended return.

Example. You deduct $1,000 on your

2016 tax return for an IRA contribution. The

contribution is to be made from a direct

deposit of your 2016 refund. Due to an

offset by the Bureau of the Fiscal Service,

the direct deposit isn't made to your IRA.

You need to correct your contribution by

contributing $1,000 to the IRA from another

source by the due date of your return

(determined without regard to any

extension) or file an amended return

without the IRA deduction.

Part II

You may request up to three different

savings bond registrations. However, each

registration must be a multiple of $50, and

the total of lines 4, 5a, and 6a can't be

more than $5,000 (or your refund amount,

whichever is smaller).

TIP

You can skip line 4 if you want

to buy bonds for someone other

than yourself (and your spouse,

if filing jointly).

Line 4

Enter the portion of your refund you want

to use to buy bonds for yourself (and your

spouse, if filing jointly). These bonds will be

registered in the name(s) shown on your

return.

Lines 5a and 6a

Enter the portion of your refund you want

to use to buy bonds for yourself, your

spouse, or someone else. This amount

must be a multiple of $50.

Lines 5b and 6b

Enter the owner’s name for this bond

registration. This can be you, your spouse,

or someone else. However, enter only one

name. Enter the first name followed by the

Form 8888 (2016)

Page 4

last name and place one space in between

them. Use the person's given name and

don't use nicknames. Use only letters and

print clearly. Don't use symbols.

Lines 5c and 6c

If you want to add a co-owner or

beneficiary to this registration, enter their

name. This can be you, your spouse, or

someone else. However, enter only one

name. Enter the first name followed by the

last name and place one space in between

them. Use the person’s given name and

don't use nicknames. Use only letters and

print clearly. Don't use special symbols.

If this is a beneficiary designation, also

check the box on line 5c or 6c. Otherwise,

co-ownership will be assumed.

The bonds will be issued in the names

you have requested and mailed to you.

If you have determined that the IRS

processed your refund and placed the

order for your bonds, you can contact the

Treasury Retail Securities site at

1-844-284-2676 to ask about the status of

your bonds.

When your bonds won't be issued. Your

bonds won't be issued if any of the

following apply.

• The bond request isn't a multiple of $50.

• Your refund is decreased because of a

math error.

• You enter more than one name on line

5b, 5c, 6b, or 6c.

• Your refund is offset for any reason.

Instead, your refund will be sent to you in

the form of a check.

Math errors that increase your refund. If

you made an error on your return and the

amount of your refund is increased, the

additional amount will be sent to you in the

form of a check. However, if you requested

direct deposit in Part I, the rules under

Changes in Refund Due to Math Errors or

Refund Offsets will apply.

Part III

Line 7

If any portion of your refund remains after

completing Parts I and II, you can request

this portion be sent to you in the form of a

check. Enter the amount on line 7 that you

would like to be sent by check.

Part IV

Line 8

The total on line 8 must equal the total

amount of the refund shown on your tax

return. It must also equal the total of the

amounts on lines 1a, 2a, 3a, 4, 5a, 6a, and

7. If the total on line 8 is different, a check

will be sent instead.

▲

!

CAUTION

Don't file a Form 8888 on which

you have crossed out or whited

out any numbers or letters. If

you do, the IRS will reject your

allocation of refund and savings bond

purchases, and send you a check instead.