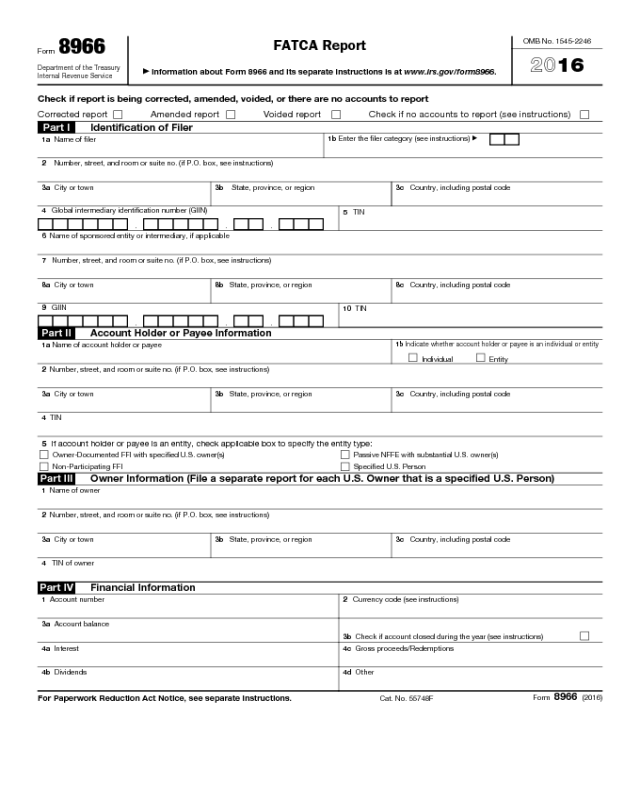

Form 8966

Form

8966

Department of the Treasury

Internal Revenue Service

FATCA Report

▶

Information about Form 8966 and its separate instructions is at www.irs.gov/form8966.

OMB No. 1545-2246

2016

Check if report is being corrected, amended, voided, or there are no accounts to report

Corrected report Amended report Voided report Check if no accounts to report (see instructions)

Part I

Identification of Filer

1a Name of filer

1b Enter the filer category (see instructions)

▶

2 Number, street, and room or suite no. (if P.O. box, see instructions)

3a City or town 3b State, province, or region 3c Country, including postal code

4 Global intermediary identification number (GIIN)

. . .

5 TIN

6 Name of sponsored entity or intermediary, if applicable

7 Number, street, and room or suite no. (if P.O. box, see instructions)

8a City or town

8b State, province, or region 8c Country, including postal code

9 GIIN

. . .

10 TIN

Part II

Account Holder or Payee Information

1a Name of account holder or payee

1b Indicate whether account holder or payee is an individual or entity

Individual Entity

2 Number, street, and room or suite no. (if P.O. box, see instructions)

3a City or town 3b State, province, or region 3c Country, including postal code

4 TIN

5 If account holder or payee is an entity, check applicable box to specify the entity type:

Owner-Documented FFI with specified U.S. owner(s) Passive NFFE with substantial U.S. owner(s)

Non-Participating FFI Specified U.S. Person

Part III Owner Information (File a separate report for each U.S. Owner that is a specified U.S. Person)

1 Name of owner

2 Number, street, and room or suite no. (if P.O. box, see instructions)

3a City or town 3b State, province, or region 3c Country, including postal code

4 TIN of owner

Part IV Financial Information

1 Account number 2 Currency code (see instructions)

3a Account balance

3b Check if account closed during the year (see instructions)

4a Interest

4b Dividends

4c Gross proceeds/Redemptions

4d Other

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 55748F

Form

8966 (2016)

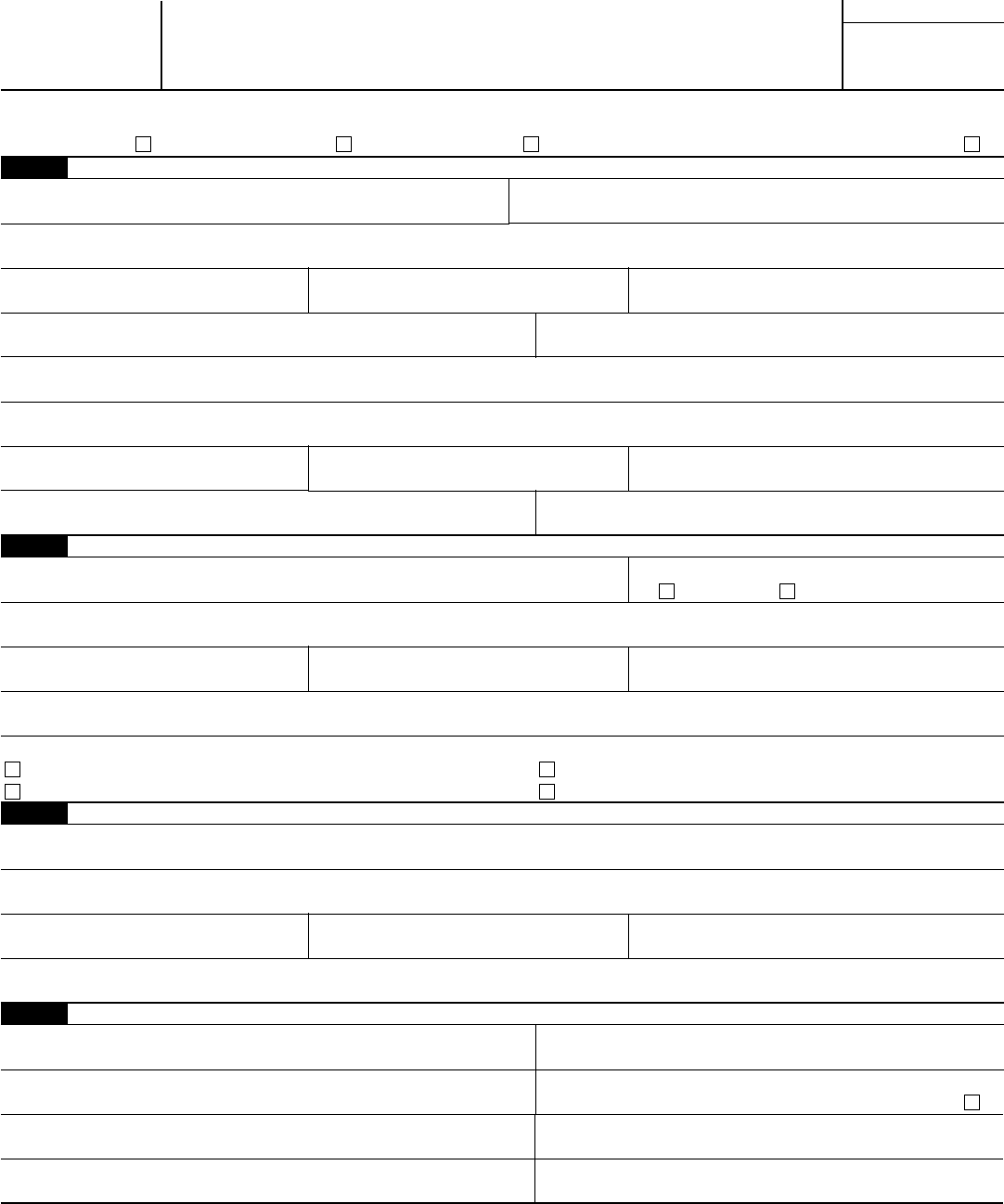

Form 8966 (2016)

Page 2

Part V Pooled Reporting Type

1 Check applicable pooled reporting type (check only one):

Recalcitrant account holders with U.S. Indicia

Dormant accounts

Recalcitrant account holders that are U.S. persons

Recalcitrant account holders without U.S. Indicia

Non-participating FFI

Recalcitrant account holders that are passive NFFEs

2 Number of accounts 3 Aggregate payment amount

4 Aggregate account balance 5 Currency code

Form

8966 (2016)