Fillable Printable Form CRA - Combined Registration Application for State of Delaware

Fillable Printable Form CRA - Combined Registration Application for State of Delaware

Form CRA - Combined Registration Application for State of Delaware

FROM:

DIVISION OF REVENUE

STATE OF DELAWARE

P.O. BOX 8750

WILMINGTON, DE 19899-8750

State of Delaware

Form CRA

COMBINED REGISTRATION APPLICATION

FOR

STATE OF DELAWARE

BUSINESS LICENSE AND/OR

WITHHOLDING AGENT

LOCATION OF OFFICES

TOLL-FREE TELEPHONE NUMBER (DELAWARE ONLY) 1 - 800 - 292 - 7826

DOVER WILMINGTON GEORGETOWN

Division of Revenue Division of Revenue

Division of Revenue

Thomas Collins Building

Route 13, Dove r , Delaware 1990 1

State Office Building

820 N. French Street

Wilmington, Delaware 1980 1

20653 Dupont Blvd., Suite 2

George town, Delaw are 19947

Telephone : (30 2) 744-1085

Taxpayer s Assistance Section

Telephone : (30 2) 577-8205

Telephone : (30 2) 856-5358

FORM CRA Rev. 06/21/11

COMBINED REGIST

R

A

TION APPLIC

A

TION FORM

1. This Combined Registration Application form must be completed by all persons or companies conducting an

y

business activity in Delaware or having one or more employees who work in the State of Delaware or who ar

e

residents of Delaware for whom you are deducting Delaware income tax. Part A is to be completed by al

l

taxpayers. Part B must be completed by any person or company paying Delaware withholding tax. Part C must

be

completed by taxpayers applying for a Delaware Business License(s). The attachment for C ontractors Only is to

be

attached to the application along with the other appropriate forms listed. The Initial Employer's Report of Delawar

e

Tax Withheld and the Initial Gross Receipts Tax Return are only to be used for your FIRST time filing of thes

e

returns. Separate checks must accompany each type of tax return(s) you file. A separate Initial Gross Receipts Ta

x

Return must be filed for each type of license acquired.

2. You should receive your personalized Withholding and Gross Receipts forms by the time your next return is due. I

f

you have not received your forms, contact the Busin ess Mast er File Section at (302) 577-8778. If you hav

e

questions concerning the completion of the forms, contact the Withholding Tax Section at (302) 577-8779; or th

e

Gross Receipts Section at (302) 577-8780.

3. All questions in Part A MUST be answered; if not applicable, write “NA” in the answer block.

4. This application may not be accepted

if all necessary information is not provided.

5. This application must be signed at the end of Part C by the owner or officer and dated.

6. Mail completed application with the required license fee, if applicable, to DIVISION OF R E VENUE, P.O. BOX

8750, WILMINGTON, DELAWARE 19899-8750.

SPECIFIC INSTRU CTIONS - PLEASE READ CAREFULLY - PLEASE PRINT CLEARLY OR T YPE.

Line 1. Enter your Federal Employer Identification Number or Social Security number, whichever is used for federa

l

purposes. If you are an employer or your business ownership is not that of a Sole Proprietorship, you must hav

e

a Federal Employer Identification number. You can apply for a number using Federal Form SS-4. (Call you

r

nearest IRS office.) If you have applied for a Federal Employer Identification number, please enter "APPLIE

D

FOR" on Line 1 and the Division of Revenue will assign a temporary number until your Federal Identificatio

n

number has been rece ived. Notify the Business M aster File Unit at (302) 577-8778, when your Federa

l

Employer Identification Number is obtained. All of your tax returns should be filed under ON

E

identification number. If you are a sole proprietor and you have a federal identification number, you mus

t

enter both numbers on Line 1 of Part A and Part C.

Line 2. Enter the name of the busin ess (individual, partnership, corporate name, governmental agency, etc.).

Line 3. Enter the trade name of your business if different from the primary business name on Line 2.

Line 4. Enter the address of your primary business location. (A Post Office Box is NOT an acceptable location

address.)

Line 5. Enter the address to which correspondence should be mailed if different from your primary business location. If

you have a PO Box, enter that information here.

Line 6. If your business operates on a seasonal basis, enter the month your seasonal activity begins and ends.

Line 7. Please check the appropriate box which indicates the period of your taxable year. If you are a fiscal year

taxpayer, please enter the last month and day of the taxable year.

Line 8. If incorporated, enter the State in which incorporated.

Line 9. If incorporated, enter the date on which incorporated.

Line 10. Enter the date your business operations began or will begin in Delaware.

Line 11. Check the appropriate box which describes your legal form of business. If you are a sole proprietor and yo

u

have a federal identification number, please ensure that you have entered both numbers on Line 1. If yo

u

are registering to remit withholding taxes for a person performing domestic services in your home, indicat

e

your type of ownership as #18 Employer-Domestic Employees. If you are only registering to be a withholdin

g

agent as a convenience to y our employ ees and are not conducting business in Delaware, Check Typ

e

ownership #35, Withholding Agent Only.

Line 12. On line 11 if you have checked 06 - Sub Chapter S Corporation, please indicate if you have Shareholders that

are NOT Del aware residents.

Line 13. Enter the parent co mpany 's name.

Line 14. Enter the parent company's identification number.

Line 15. Enter the previous name of your business if it has been changed.

Line 16. Enter the previous identification number of your business if it has been changed.

Line 17. Enter the name, title, phone number, fax number and e-mail address of the individual who should be contacted

regarding t ax matters.

Line 18. Enter the name, title and social security number of the proprietor, partners or principal officers of yo u

r

business. If more than three, please attach a separate list. If you have a Registered Ag ent, provide tha

t

information also.

Line 19. Fully describe the specific nature of your business.

N

OTE: Without a COMPLETE application, we cannot process the forms necessary for your filing requirements.

2

STATE OF DELAWARE

DEPARTMENT OF FINA NCE

DIVISION OF REVENUE

820 N. French Street

Wilmington, Delaware 19801

(302) 577

-

8778

COMBINED REGISTRATION APPLICATION

FOR

STATE OF DELAWARE

BUSINESS LICENSE AND/OR

WITHHOLDING AGENT

DO NOT WRITE OR STAPLE IN THIS ARE

A

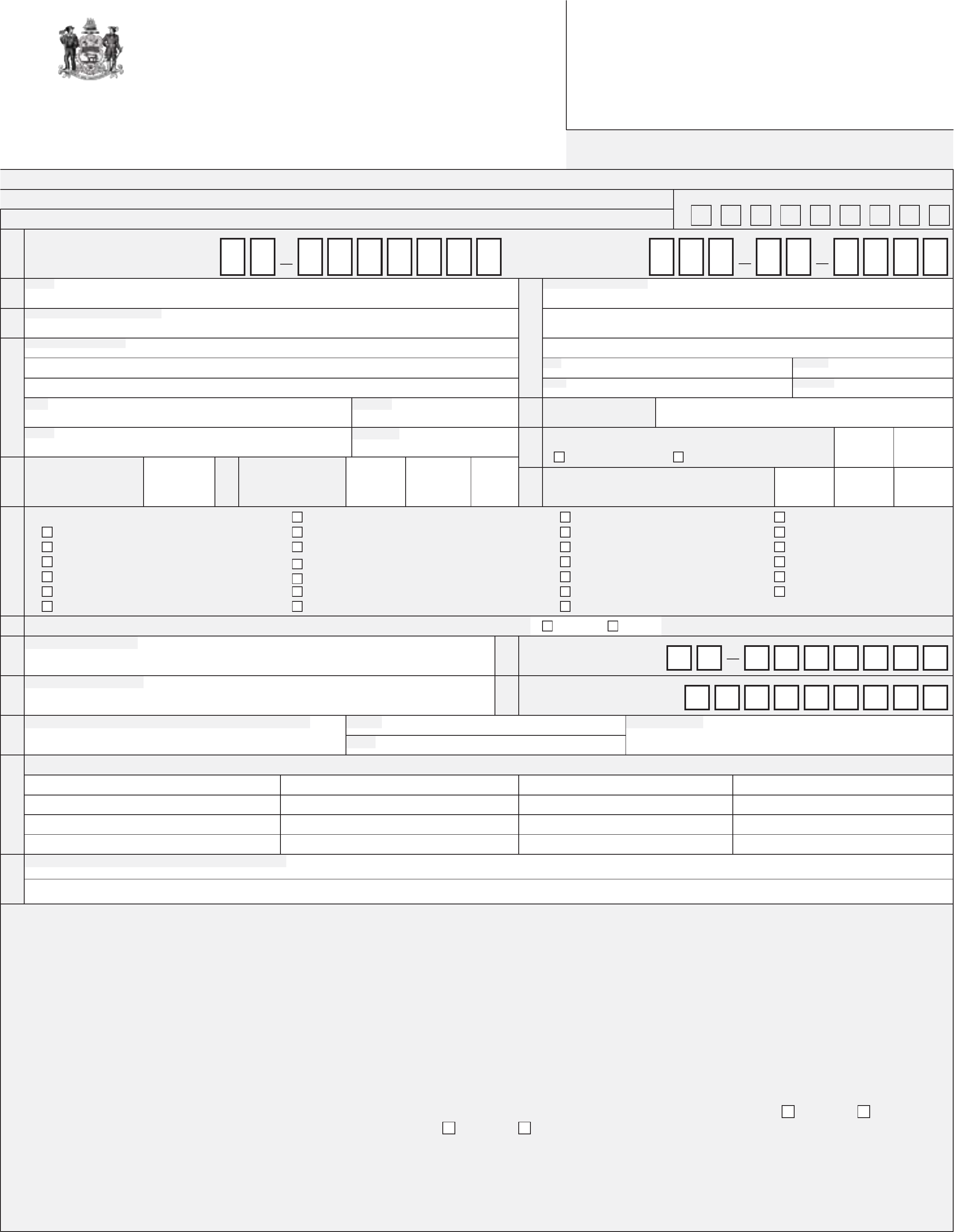

THIS FORM MUST BE COMP LETED BY ALL PERSONS OR COMPANIES CONDUCTING BUSINESS ACTIVITIES IN DELAWARE

FAILURE TO COMPLETE ALL QUESTIONS MAY RESULT IN DENIAL OF A BUSINESS LICENSE

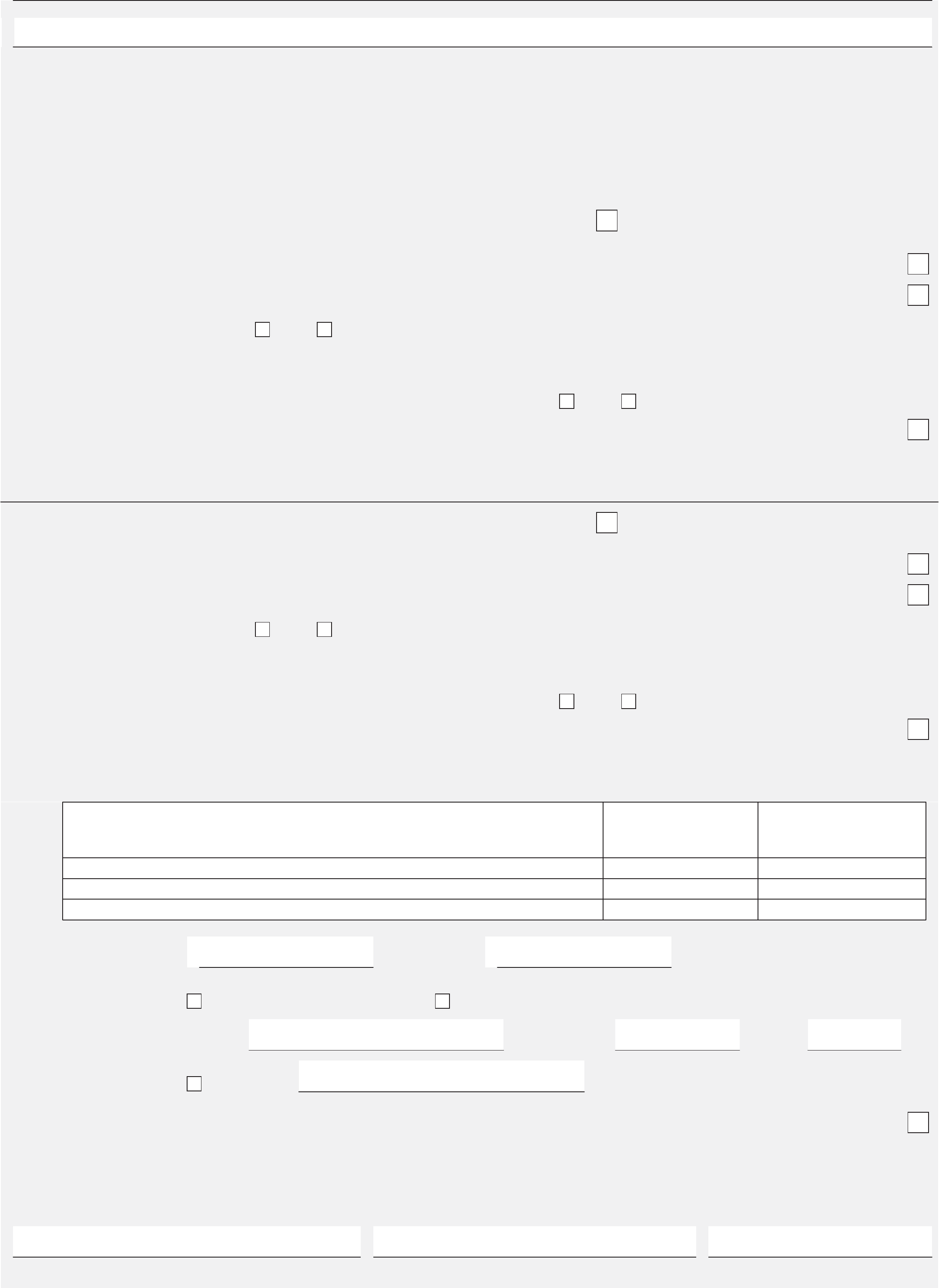

PART A - TO BE COMPLE TED BY ALL TAXPAYERS

1

3-

TEMPORARY

FO

R

OFFICE USE ONLY

Enter Em

p

lo

y

er Identification Numbe

r

1-

or Social Security Number

2-

2

Name Mailin

g

Address if Di fferen

t

3

Trad e Na m e

(

If different from above

)

5

4

Primar

y

Locat i on A d dr ess

Cit

y

Countr

y

State Zi

p

Code

Cit

y

Countr

y

6

If business is Seasonal,

State Active Months

From: ____ ________ _ To: ___ ________

Month Month

State Zi

p

Code

7

A

ccountin

g

Period

(

Check a

pp

ro

p

riate Box

)

Enter Month and Day

of Fiscal Year Endin

g

MO DAY

8

If Incor

p

orated Ente

r

9

MO DAY YEAR

10

Calendar Yea

r

Fiscal Year - 12 Mon th Basis Ending

MO DAY YEAR

State Incorporated

Date Incorporated

When did or when will you

be

g

in o

p

eratin

g

in Delaware

11

T

yp

e of Ownershi

p (

Check A

pp

ro

p

riate box

)

08 Fiduciar

y (

Estate or Trust

)

21 Insurance Com

p

an

y

30 LLC - Partnershi

p

01 Sole Pro

p

rietorshi

p

09 Coo

p

erative

23 Limited L iabilit

y

Com

p

an

y

31 LLC - Cor

p

oration

02 Partnershi

p

10 Other: Ex

p

lain

____________________________

24 Limited Liabilit

y

Partnersh i

p

32 LLC - Non-Elect

03 Non-Profit Cor

p

oration

11 Holdin

g

/Investment Com

p

an

y

25 Delaware State Government 33 LLC - Non-Elect Individual

04 Cor

p

oration

12 Professional Association 26 Delaware Count

y

Government

34 QSSS

06 Sub-Cha

p

ter S Cor

p

oration 18 Em

p

lo

y

er - Domestic Em

p

lo

y

ee

(

s

)

27 Delaware Mu nici

p

al Government

35 Withholdin

g

A

g

ent Onl

y

07 Federal Government 20 Bank 28 Other State's Government A

g

enc

y

12 Sub Chapter S Corporations only - Do you have Shareholders that DO NOT reside in Delaware? YES NO

Parent Com

p

an

y

Name

13

15

17

Previous Business Name

Name of individual who ma

y

be contacted re

g

ardin

g

tax matters. Phone

FA

X

14

16

Parent Employe

r

Identification Number

Previous Identification Number

EIN SSN (Circle One)

E-mail Address

18

Identify Owners, Partners, Corporate Officers, Registered Agent or Trustees:

Name: Las

t

First Title Social Securit

y

#

19

Full

y

Describe Business Activit

y (

MUST BE COMPLETED

)

PART B - TO B E COM PL ET ED BY ALL E M PLOYER S

Every employer making the payment of wages taxable to a resident or non-resident employee working in Delaware is required to withhold state income

taxes. Employers may also withhold Delaware state income tax from residents of Delaware who do not work in Delaware.

The filing frequency for a withholding agent is determined by the amount of withholding paid during a "lookback" period. The lookback period is

a

twelve month period between July 1 and June 30 immediately preceding the calendar year for which the lookback period is determined. The Division o

f

Revenue will determine the amount of tax reported during the lookback period and advise all withholding agents of their withholding filing method. Al

l

withholding agents having no prior record of withholding will file on a monthly basis until the next “lookback period”.

Amount of Withholding During “Lookback” Period Filing Method

$3,600 or Less Quarterly

$3,600.01 and Less Than $20,000 Monthly

$20,000.01 and Greater Eighth Monthly

1. Will you have employees that work in Delaware, or wit hhol d DE stat e inco me ta x from DE residents that do not work in DE? YES NO

2. Do you need a copy of the Delaware State Withholding Tax Tables? YES NO

Sole proprietors and partners are responsible for filing and paying their own Delaware state taxes. This is done by remitting personal estimated taxes on a

quarterly basis. To obtain Personal Estimated Tax Packages; call the Individual Master File Unit at (302) 577-8588.

PLEASE NOTE: All employers are also required to register with the Delaware Department of Labor, Unemployment Insurance and report new

hires to the Division of Child Support Enfor c ement.

MAKE CHECK PAYABLE AND MAIL TO: DELAWARE DIVISION OF REVENUE, P.O. BOX 8750, Wilmington, DE 19899-8750

Rev. 9/2000

3

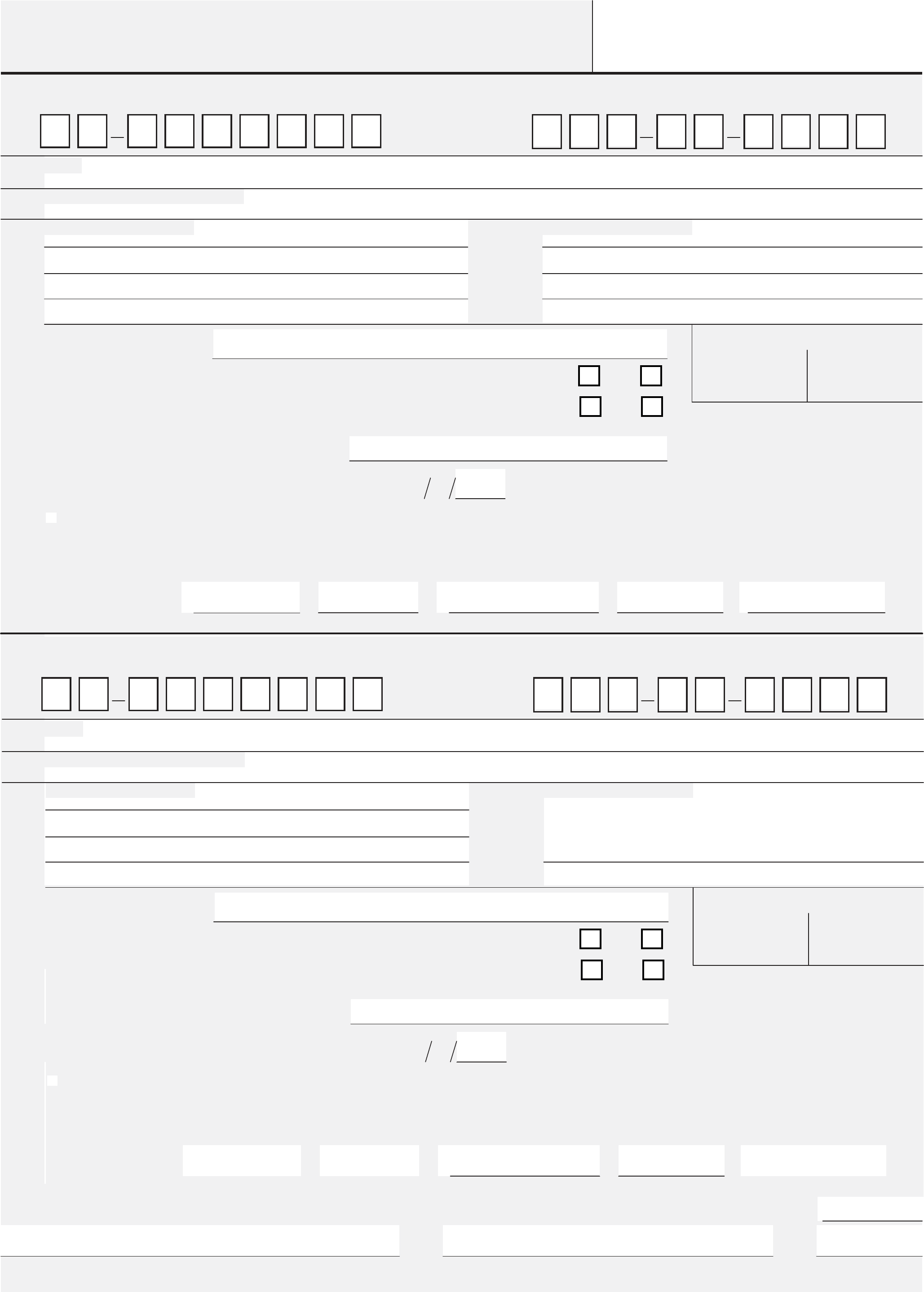

PART C - TO BE COMPLETED BY TAXPAYERS APPLYING FOR A LICENSE

LICENSE APPLICATIONS WILL NOT BE PROCESSED WITHOUT LICENSE FEE

LICENSE #1 - NAME AND ADDRESS

1. Enter Federal Employer Identification Number OR

REV CODE 0101-01

Social Security Number

1- 2-

2. Name

3. Trade Name if Different from Above

4. Business Location Address 5. Mailing Address if Different

City State Zip Code City State Zip Code

6. Describe your business activity

FOR OFFICE USE ONLY

Bus Code Suffix

7. When did or when will you begin operating in Delaware?

8. For what calendar year are you applying? Calendar year ending

12 31

[ ] Check if 65 years or older and Proration Basis for Initial Licenses Jan - 100% Apr - 75% Jul - 50% Oct - 25%

whose total sales are less than $10,000

M

ultiply Annual Fee by Respective Month Feb - 92% May - 67% Aug - 42% Nov - 17%

(25% of Annual Fee) Percentage and Circle Month Started Mar - 83% Jun - 58% Sep - 33% Dec - 8%

PLEASE READ PART C INSTRUCTIONS BEFORE COMPLETING COMPUTATION OF THE FEE.

COMPUTATION OF FEE

$

X = $ x = $

Annual Fee

# of units if Applicable

Total License

(annual fee X # of units)

Prorated Percentage Total Fee

9.

AMOUNT DUE MUST BE REMITTED WITH THIS APPLICATION. (Total Fee from License # 1 and License # 2.)

$

6a. Do you sell tires at retail in Delaware from this location? (For exemptions, see [10]

on Page 7.)

6b

YES NO

YES NO

LICENSE #2 - NAME AND ADDRESS

REV CODE 0101-01

1. Enter Federal Employer Identification Number OR Social Security Number

1- 2-

2. Name

3. Trade Name if Different from Above

4. Business Location Address 5. Mailing Address if Different

City State Zip Code City State Zip Code

6. Describe your business activity

FOR OFFICE USE ONLY

Bus Code Suffix

7. When did or when will you begin operating in Delaware?

8. For what calendar year are you applying? Calendar year ending

12 31

[ ] Check if 65 years or older and Proration Basis for Initial Licenses Jan - 100% Apr - 75% Jul - 50% Oct - 25%

whose total sales are less than $10,000

M

ultiply Annual Fee by Respective Month Feb - 92% May - 67% Aug - 42% Nov - 17%

(25% of Annual Fee) Percentage and Circle Month Started Mar - 83% Jun - 58% Sep - 33% Dec - 8%

PLEASE READ PART C INSTRUCTIONS BEFORE COMPLETING COMPUTATION OF THE FEE.

COMPUTATION OF FEE

$

X = $ x = $

Annual Fee

# of units if Applicable

Total License

(annual fee X # of units)

Prorated Percentage Total Fee

6a. Do you sell tires at retail in Delaware from this location? (For exemptions, see [10]

on Page 7.)

6b. Do you sell prepaid wireless telecommunication services at retail from this location?

(For exemptions, see [9] on Page 7.)

YES NO

YES NO

SIGNATURE TITLE DATE

I declare under penalties as provided by law that the information on this application is true, correct and complete.

4

. Do you sell prepaid wireless telecommunication services at retail from this location?

(For exemptions, see [9] on Page 7.)

PART B - REGISTERING TO W ITHHOLD DELAWA RE INCOME TAX ES

Delaware requires that every employer register with the Delaware Division of Revenue. Registration is

accomplished by completing this form. Delaware Withholding Agents

must use the same identification number as their

Federal Employer Identification Number. Every employer required to deduct and withhold tax must file a withholding

tax return as prescribed by the statute and pay over to the Division of Revenue or its designated depository the tax

required to be deducted and withheld. An initial return is included in this application to use in filing your first return. If

you do not receive your preprinted forms in time to file your second return, call the Business Master File Unit at (302)

577-8778. If you do not have Delaware Withholding Tax Tables or need information, call the Withholding Tax Unit at

(302) 577-8779 or visit our website (see page 8). The Division of Revenue does not accept common paymasters.

Please Note: All employers are also required to register with the Department of Labor Unemployment Insurance.

For information call (302) 761-8484.

Mandatory Electronic Funds Transfer Any employer required under the provisions of §6302 of the Internal

Revenue Code to deposit federal employment taxes by electronic funds transfer will be required to deposit Delaware

withholding taxes by electronic funds transfer. The effective date for this new req uirement is one y ear after the employer

is required to deposit the federal funds electronically. House Bill 605 imposes a penalty on employers who are required

by Delaware law but fail to deposit their withholding tax electronically. The penalty is the lesser of 5.0% of the amount

that should have been electronically transferred or $500. Employers who want to participate either as mandated under

the Internal Revenue Code requirements or voluntarily for Delaware should contact the Division of Revenue at (302)

577-8231 for additional information and the proper form.

PART C - APPLYING F OR DELAWARE BUSINESS OR OCCUPATIONAL LICENSE(S)

Enter your Federal Identification Number or Social Security Number as entered on Part A. If you are a sole

proprietor and you have a federal identification number, you must enter both numbers on Line 1.

Delaware law requires every person, firm or corporation conducting a business within this State to obtain a license

and to pay an additional monthly or quarterly fee based on the aggregate gross receipts derived from the operation of

such business. Failure to obtain a business license will result in a $200 penalty if such failure is not self disclosed. A

separate license is required for each separate business activity. You may apply for two (2) different licenses on this

application. Enter the type of license applied for and the business name and address for each separate location and/or

activity. Complete the schedule for the COMPUTATION OF FEE for each license. If you start doing business in

Delaware after February 1st, you may prorate the fees for your initial year according to the schedule, i.e., if you started

doing business in Delaware in the month of April and you are a Retailer, you are required to pay .75 x $75.00 which is

$56.25. License Fees for all new applications are proratable except Cigarette, Motor Vehicle Dealers, Circus Exhibitors

and Outdoor Musical Festival Promoters.

Decals for Cigarette, Merchandise Vending Machines and Amusement Machines are proratable upon first

application or as additional machines are purchased and placed in service.

Unless otherwise listed, the annual license fee is $75 for the first location. Occupational, Professional, General

Service, Lessors of Tangible Personal Property and Retailer's licenses require a $25 license fee for each additional

location. Farm Machinery Retailers, Food Processors, Commercial Feed Dealers, Manu facturers and Wholesalers

licenses require a $75 license for each additional location. Contractors, Motor Vehicle Dealers and Steam, Gas and

Electric licenses are not required to obtain a license for additional locations. Public utilities (gas, electric, telephone and

telegraph) are required to complete this application but are not required to obtain a business license. A complete list of

Revenue licenses is contained in this booklet titled "Detailed List of Revenue Licenses and Tax Rates". Any person 65

years of age or older whose gross receipts are less than $10,000 per year shall pay one quarter (¼) of the annual

occupational license fee specified. There is a $15.00 fee for the replacement of any lost or stolen license.

The lice nse fe e mus t acc ompany this application. Applications without the license fee will not be processed.

Most businesses are liable for a monthly or q uarterly gross receipts tax at rates ranging from 0.077% to

0.576% (.00077 - .00576) in excess of allowable exclusions. Unless expressly provided in the statutes, the term "gross

receipts" is the total receipts of a business for goods sold or services

rendered and no deduction is made for the cost of

goods or property sold, labor costs, interest expense, delivery costs, State or Federal taxes or any other expenses. For

additional information visit our website: www.revenue.delaware.gov. Select business tax questions, then scroll down to

"Tax Tips". After you have filed your application, the Division of Revenue will mail the appropriate forms required to

report and pay the Gross Receipts T ax. An initial quarterly return is included in this application to use in filing your first

return. Please refer to the table on the next page to determine the tax rate and exclusion amount for your business

activity. If you do not receive your pre-printed forms in time to file your second return, call the Business Master File

Unit at (302) 577-8778.

5

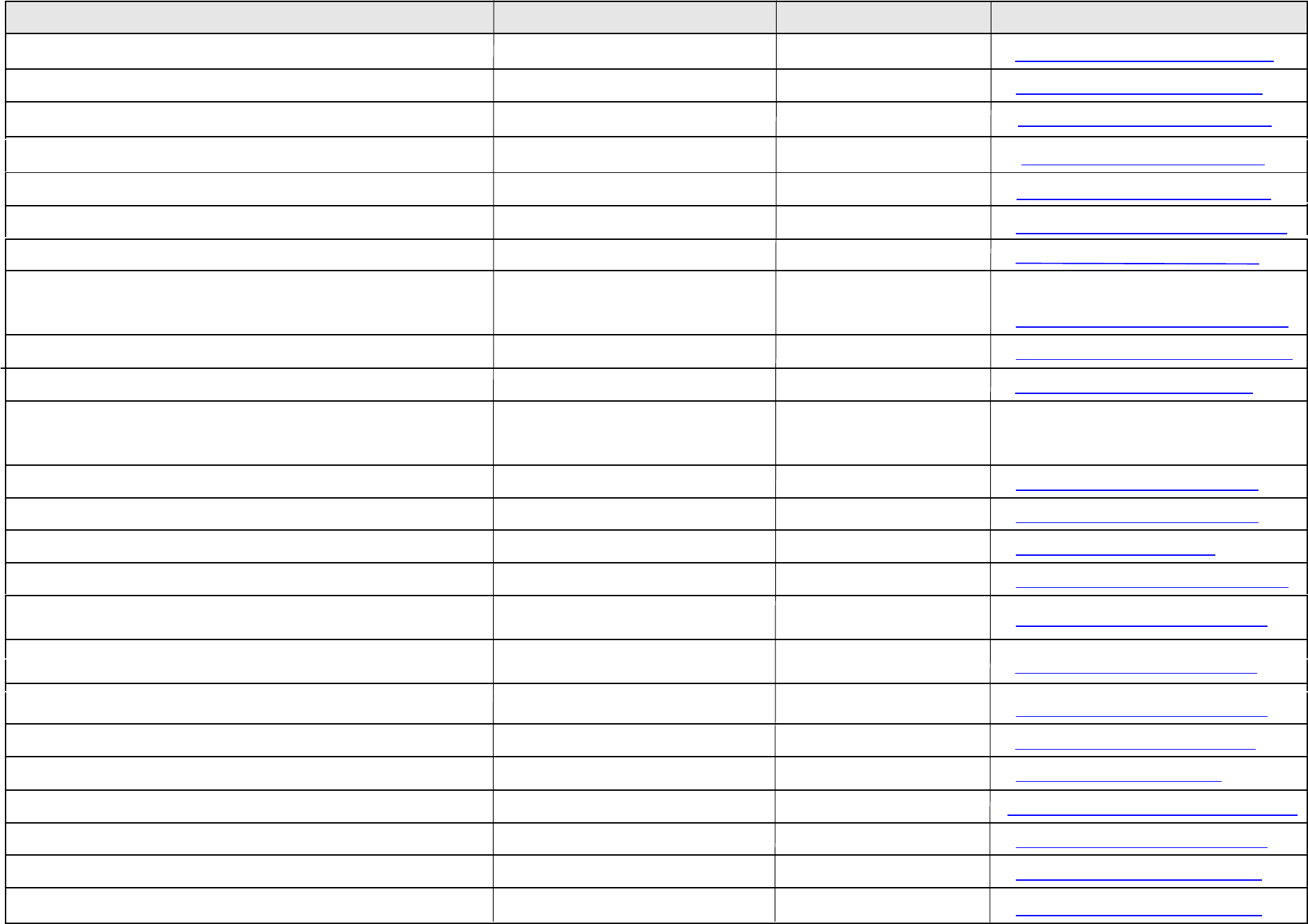

DETAILED LIST OF DIVISION OF REVENUE LICENSES AND TAX RATES

Cate

g

or

y

Business

Group Code

Annual

Fee

A

dditional

Locations

Tax Rate

Effective

1/1/12

Tax Rate

Effective

1/1/14

Returns

Due

Exclusion

A

dvertising Agency

101

$ 75 $ 25 0.004023 Monthly $ 100,000

Amusement Machine Owner

105

Business License Fee 75 25 0.004023 Monthly 100,000

Each Machine (Decal)

131

75

– – – –

Auctioneer Non-Resident Each County

519

225 225 0.004023 Monthly 100,000

Auctioneer Resident

520

75 25 0.004023 Monthly 100,000

Broker

120

75 25 0.004023 Monthly 100,000

*Cigarette

* Wholesaler and/or Affixing Agent

213

200 200

– – –

Wholesale Bus. License also needed

214

75 75 0.004023 Monthly 100,000

* Retail Permit (3 years)

201

15

– – – –

Vend. Mach. Decals Ea. Machine

212

3

– – – –

*Circus Exhibitor 750

– – – –

Non-profit Organizations

126

300

– – – –

Commercial Feed Dealers

360

75 75 0.001006 Monthly 100,000

Commercial Lessors

198

75 25 0.004023 Monthly 100,000

Contractors

331

75

–

0.006537 Monthly 100,000

Developers

332

75

–

0.006537 Monthly 100,000

Non-Residents

(Bonding Requirements)

335

75

–

0.006537 Monthly 100,000

Construction Transportation

333

75

–

0.006537 Monthly 100,000

Crude Oil Lightering Operator

713 100,000

– –

Annually

–

Drayperson or Mover

026

75 25 0.004023 Monthly 100,000

Electric Use Tax

708

– –

.0425/.0200

Tech Info Memo 97-8 and 97-9

Farm Machinery Retailer

394

75 75 0.001006 Monthly 100,000

Finance or Small Loan Agency

144

450 450

– – –

Food Processors

374

75 75 0.002012 Monthly 100,000

Gas Use Tax

704

– –

.0425/.0200

Tech Info Memo 97-8 and 97-9

General Services

099

75 25 0.004023 Monthly 100,000

[1] [8] Grocery Supermarkets

404

90 40 0.0033 Monthly 100,000

[2] Hotel -- Per Suite / Per Room

152

30/25

–

0.08 Monthly

–

Lessee/Use of Tangible Personal Property

612

Motor Vehicles

613

– –

0.020114 Quarterly

–

With Retail License

611

– –

0.020114 Quarterly

–

Lessor of Tangible Personal Property

Motor Vehicles

602

75 25 0.003017 Quarterly 300,000

603

75 25 0.003017 Quarterly 300,000

Manufacturers

356

75 75 0.001886 Monthly 1,250,000

Manufacturers, Automobile

357

75 25 0.001886 Monthly 1,250,000

Manufacturers Representative

045

75 25 0.004023 Monthly 100,000

[2] Motel - Per Room

161

25

–

0.08 Monthly

–

[7] *Motor Vehicle Dealer

450

100

–

2.00 ea veh.

Quarterly

–

Occupational / Professional

099

75 25 0.004023 Monthly 100,000

*Outdoor Music Festival Promoter

108

750

– – – –

Parking Lot or Garage Operator

174

75 35 0.004023 Monthly 100,000

Petroleum Dealers

[3] [8] Retailer

387

90 40 0.007543 Monthly 100,000

[4] Wholesaler

368

75 75 0.004023 Monthly 100,000

Personal Services

007

75 25 0.004023 Monthl

y 100,000

Photographer - Resident

178

75 25 0.004023 Monthly 100,000

*Transient - Plus $25 per day

194

– –

0.004023 Monthly 100,000

6

0.003983

0.003983

–

0.003983

0.003983

0.003983

–

0.003983

–

–

–

–

0.000996

0.003983

0.006472

0.006472

0.006472

0.006472

–

0.003983

.0425/.0200

0.000996

–

0.001991

.0425/.0200

0.003983

0.003267

0.08

0.019914

0.019914

0.002987

0.002987

0.001260

0.000945

0.003983

0.08

2.00 ea veh.

0.003983

–

0.003983

0.007468

0.003983

0.003983

0.003983

0.003983

Manufacturers, Clean Energy

Technology Device

358

75 25 Monthly 1,250,000 0.000945

–

DETAILED LIST OF DIVISION OF REVENUE LICENSES AND TAX RATES

Tax Rate

Tax Rate

Business

Annual

Additional

Category

Effective

Effective

Returns

Exclusion

Group Code

Fee

Locations

Due

1/1/12

1/1/14

Private Detective

(State Police Approval Required)

183

75 25 0.004023 0.00

3983

Monthly 100,000

Professional Services

007

75 25 0.004023 0.00

3983

Monthly 100,000

–

Public Utilities

701

– –

0.0425/0.0200 0.0425/0.0200

Monthly

Cable Television and Satellite

707

– –

0.02125 0.02125 Monthly

y

–

[5]Electric Utility

708

– –

0.0425/.0200 0.0425/.0200 M

onthly

–

Gas Utility

704

– –

0.0425/.0200 0.0425/.0200 Monthly –

[6] Telephone & Telegraph Wire Tax

702

Contact the Division of Revenue at 302-577-8778.

Annually

–

Real Estate Broker

581

75 25

0.004023

0.00

3983

Monthly

100,000

Restaurant Retailer

393

75 25

0.006537

0.006472 Monthly

100,000

[8] Retailer -General

396

90 40

0.00

7543 0.007468 Monthly

100,000

[8] Transient

(Registration & Bonding Required)

400

90 40

0.00

7543 0.007468 Monthly

100,000

*[8] Transient 10 days or less

403

40 – 0.007543 0.007468 After 10th day 3,000

[9] Retail E911 Prepaid Wireless

(Eff. 01/01/15)

409

– –

–

$0.60/transaction

Quarterly

–

[10] Retail - Tire Sales (Eff. 01/01/07)

406

– –

$2.00/tire sold $2.00/tire sold Monthly

–

Sales Representative

186

75

– – – – –

Security Guard Co.

(State Police Approval Required)

183

75 25

0.004023

0.00

3983

Monthly

100,000

Security Systems

(State Police Approval Required)

100

115 25

0.004023

0.00

3983

Monthly

100,000

Showperson

189

375

– – – – –

Steam, Gas & Electric

703

50 1st year 0.001 0.001 Annually

Taxicab or Bus Operator --1st Veh / Each

173

45 30

– – – –

[2] Tourist Home--Per Room

(Min. 5 Rooms)

192

15

–

0.08 0.08 Monthly

–

Trailer Park --Each Space

193

10

– – – – –

[8]

Transient Nursery Retailer

405

90 90 0.007543

0.007468

Monthly

100,000

Transportation Agent

056

75 25

– – – –

Travel Agency

097

225 25

– – – –

Machine Decals

Amusement Machine

131

75

– – – – –

Vending Machine --Each Machine

399

5

– – – – –

Cigarette --Each Machine

212

3

– – – – –

(Business License Also Needed)

Wholesalers

377 75 75

0.004023

0.003983 Monthly

100,000

* Those categories marked with an asterisk (*) are not proratable and the full amount must be paid.

[1]Grocery Supermarkets –

The

2012

tax rate for the first $2 million is .0033 and .006181 on the remaining taxable gross receipts.

[2]Hotels, Motels and Tourist Homes –

The eight percent (8%) tax is collected from the guest and remitted to the Division of Revenue.

[3]Petroleum Retailers –

The

2012

composite rate includes the General Fund tax of .007543 and a Hazardous Substance tax of .009.

[4]Petroleum Wholesalers –

The

2012

composite rate includes the General Fund tax of .004023, a Hazardous Substance tax of .009 and surtax of .002514.

[5]Electric Utility –

The tax rate is .0235 (Effective 8/01/09) for electric consumed by manufacturers, food processors and agribusinesses.

[6]Interstate calls are exempt.

[7]Motor Vehicle Dealer –

House Bill 163, effective August, 1999, requires Motor Vehicle Dealers who self-finance any sale of a motor

vehicle to a retail buyer without charging interest to file an original surety bond in the principal sum of $25,000 with the Division of Revenue.

[8]Retail Crime Fee –

This license fee includes an additional $15.00. This is an annual fee assessed in accordance with HB 458 of the

144th General Assembly.

[9] E911 Prepaid Wireless Surcharge -

Retail transactions subject to the $0.60 E911 Prepaid Wireless Surcharge must occur in Delaware,

[10] Retail Tire License and Scrap Tire Fee –

Exemptions include tires sold for farm tractors and off-highway vehicles (dirt bikes,

off-road ATVs), tires sold as part of a vehicle sale, and wholesale tire sales.

7

–

Telecommunications

709

– –

0.0500 0.0500

Monthly

The

2014

tax rate is .003267 on all taxable gross receipts.

The

2014

composite rate includes the General Fund tax of .007468 and a Hazardous Substance tax of .009.

The

2014

composite rate includes the General Fund tax of .003983, a Hazardous Substance tax of .009 and surtax of .002489.

be shipped to a consumer with a Delaware address, or include a consumer with a mobile-phone telephone number associated with a Delaware

location. Retail transactions exempt from the Surcharge include any business that sells 10 minutes or less or $5.00 or less in prepaid wireless

services.The Surcharge does not apply to any prepaid wireless service provided to a person through the Lifeline program.

SPECIFIC CONTACTS AT DIVISION OF REVENUE:

TOPIC CONTACT PHONE #

E

-MAIL ADDRESS

Withholding Tax

Corporate Income Tax Amended Returns S hirley B. Deans (302) 577-8258 shirley.deans@

state.de.us

Petroleum Superfund Tax

Rick Jezyk (302) 577-8265

Public Accommodations Tax

Steve Seidel (302) 577-8455

8

Gina Milligan (302) 577-8214

REPORTING OF NEW HIRES

Delaware Law requires that every employer who is required to withhold Delaware income tax from its employees is also required to report the

hiring of new employees to the Division of Child Support Enforcement. The report must be made within 20 days of hiring the new employee(s) and

must contain the name, address and social security of the employee and the name, address and federal employer identification number of the

employer. The report may be made using federal form W-4 or an equivalent form of your choice. The report may be in paper and mailed to Division

of Child Support Enforcement, New Hire Reporting, P.O. Box 913, New Castle, DE 19720, faxed to (302) 577-4873 or E-mail to:

[email protected]. Reports may be made by electronic or magnetic media and a multistate employer may elect to report to one state. For more

information concerning multistate or magnetic filing, call the Division of Child Support Enforcement at (302) 577-7171. Contact the Customer

Service Unit at (302) 369-2160 for specific questions.

UNEMPLOYMENT INSURANCE

In addition to registering as an employer with the Division of Revenue, all employers must file Form UC-1 with theState of Delaware, Department of

Labor. Employers are required to pay unemployment insurance taxes with respect toany calendar year if they (a) pay wages of $1,500 or more during any

calendar quarter in that year or (b) employ at leastone person for 20 days during such calendar year, each day being in a different week. If you have any

questionsconcerning your filing requirements with the Department of Labor you may write to Department of Labor, Division ofUnemployment Insurance,

P.O. Box 9950, Wilmington, DE 19809 or by calling (302) 761-8484.

PLACES TO FIND ADDITIONAL INFORMATION

DIVISION OF REVENUE

The Office of Business Taxes of the Division of Revenue has a Home Page especially designed for business customersto answer questions and

assist business taxpayers in obtaining a business license and meeting their filing requirements.The site also permits a business to file many

business taxes using the Internet. T

he address is www.r

evenue.delaware.gov. At the Division of Revenue's Home Page, select "Business Tax"

from the side bar menu.

Com

p

an

y

Na

m

e Federal Em

p

lo

y

er Identification Numbe

r

SPECIAL REQUIREME N TS FOR CONTRACTO RS

ALL RESIDENT AND NON-RESIDENT CONTRACTORS must complete the following check list and attach all require

d

documentation and this form to their Combined Registration Application. Please see the instructions on the back of this form. Yo

u

should also get a copy Technical Information Memorandum TIM 93-5 for contractors. If you did not receive the required forms or i

f

you ha ve questions , c ont ac

t

the Division of Revenu e at (302) 5 77-8205.

RESIDENT CONTR A CTO RS Check Of

f

1. DEPARTMENT OF LABOR FORM UC-1 (Must be completed and attached even if you do not have employees).

2.

INDUSTRIAL ACCIDENT BOARD FORM

(

Must be com

p

leted and attached even if

y

ou do not have em

p

lo

y

ees

)

.

3. Will

y

ou subcontract?

YES

If

y

es, com

p

lete and attach Division of Revenue For

m

5060, Statemen

t

o

f

Contractors Awarded by General Contractors and Subcontractors. The civil penalty for failure or refusal to comply with

thi

s

section is a

f

ine o

f

u

p

to $10,000

f

or each occurrence.

N

O

4. Are

y

ou a

pp

l

y

in

g

for a business license for biddin

g p

ur

p

oses onl

y

? YES

N

O

5. Co mplete Part C of the Combined Registr a tion Application and attach your check for the license fee.

The license fee is not re

q

uired if the a

pp

lication is bein

g

submitted for biddin

g p

ur

p

oses onl

y

.

NON-RESIDENT CONTRACTORS

1. DEPARTMENT OF LABOR FORM UC-1 (Must be completed and attached even if you do not have employees).

2.

INDUSTRIAL ACCIDENT BOARD FORM

(

Must be com

p

leted and attached even if

y

ou do not have em

p

lo

y

ees

)

.

3. Will

y

ou subcontract?

YES

If

y

es, com

p

lete and attach Division of Revenue For

m

5060, Statemen

t

o

f

Contractors Awarded by General Contractors and Subcontractors. The civil penalty for failure or refusal to comply with

this section is a

f

ine o

f

u

p

to $10,000

f

or each occurrence.

N

O

4. Are

y

ou a

pp

l

y

in

g

for a business license for biddin

g p

ur

p

oses onl

y

? YES

N

O

5. Non-resident contractors must supply a bond equal to 6% of the cont ract (s) tota ling $2 0, 00 0 or more with this

application. If you don't have a bonding requirement at this time, check the box on this line and skip item number 6.

A bond is re

q

uired at the time when the total of all contracts exceeds $20

,

000.

6.

N

ame & Address of person(s) with whom you have this contract(s) Contract Perio

d

Contrac

t

Am ount $

Total Contracts $ x .06 = $

(

Amount of Bond

)

T

yp

e of Bond: Ca sh

(

Attach Form 1125-C

)

Suret

y (

Attach Form 1125

)

N

ame of Bondin

g

Com

p

an

y

Bond Numbe

r

Value $

Letter of Credi

t

Bank Na

m

e

(

Re

q

uires Dire ct or of R e venue's a

pp

roval.

)

7. Co mplete Part C of the Combined Registr a tion Application and attach your check for the license fee.

The license fee is not required if the application is bein g s ub mitted for bidding p ur p oses o nl y .

I declare under penalties as provided by law that this application has been examined by me and to the best of my knowledge

and belief is a tru e

,

correct and com

p

lete statement.

Si

g

nature Title Date

9

INSTRUCTIONS FOR SPECIAL REQUIREMENTS FOR CONTRACTORS

Please star

t

b

y completing the S tate o f Dela ware Co mbined Reg istration App lication fo

r

State of Delaware Business

License and/o r

W

ithholdin

g

A

g

ent

(

Form CRA

)

in it s entire

t

y

.

Refe

r

to the Technical Information Memorandum 93-5 fo

r

specific requirements of Residen

t

and Non-Residen

t

Contractors and Real Estate Deve lo

p

ers.

1. The statute requires tha

t

all cont

r

actors registe

r

with the Departmen

t

of Labo

r

. Form UC-1 mus

t

b

e completed o

r

you must supply a Certificate of Notice issued by the Division of Unemployment Insurance to document suc

h

re

g

istration.

2. The statute also requires tha

t

you show evidence of insurance to

p

ay

W

orkmen's Compensation. You mus

t

suppl

y

either a copy of Page 1 of your insurance policy

OR

the name, address, and policy number of your carrier

OR

a

copy of Form 22 issued by the Industrial Accident Board which certifies your ability to make direct payments o

f

workmen's com

p

ensa tion. Ev en if

y

ou do not have em

p

lo

y

ees, the Division of Industrial Affairs form is re

q

uired.

3.

Every archite ct,

p

rofessional engine e

r

, contracto

r

, o

r

construction manage

r

must file with the Division of Rev enu

e

a statement of the total value of any contract or subcontract entered into with a non-resident of the State o

f

Delaware within ten (10) days of enterin g into such contra cts. This statement, Form 5060, must include the name

s

and addresses of the contracting parties. The civil penalty for failure or refusal to comply with this section is

a

fine of u

p

to $10,000 for each such occurrence.

4. Non-Resident Contractors are required

t

o obta in a

b

ondequaltosix

p

ercen

t

(6%) of the contrac

t

amoun

t

fo

r

al

l

single contracts/subcontracts exceeding $20,000 or when the aggregate of two or more contracts/subcontracts in

a

calendar year total $20,000 or more. Form 1125, Non-Resident Contractor Bond, may be used to fulfill thi

s

bonding requirement. The Division of Revenue will accept an alternative bond form supplied by your

b

ondin

g

company or cash bonds on any contract amount. The contractor's bond must be filed

before

constructio

n

commences on any contract for which a bond is required.

Bonds will

b

e released a

t

the completion of the contrac

t

and afte

r

a verification tha

t

all State tax liabilities hav

e

been met. The following information must be supplied at the time of making the request for the release of th

e

b

ond or a re

q

uest for a refund of a cash bond.

1. A copy of the contract award.

2. Date construction commenced.

3. Date construction ended.

4. A schedule by month of payments received.

5. A list of persons (resident and non-resident), with social security numbers, employed at the construction

site.

6. A Schedu le by mon th of the wag es paid to the persons referenc ed in item #5.

5.

If this a

pp

lication is fo r biddin

g p

ur

p

oses onl

y

,

p

lease check the box on line fou

r

.

6.

Be sure to include you

r

license fee. You

r

fee is

p

roratable fo

r

you

r

initial yea

r

,

b

ased on what month of the yea

r

your business will begin. Only one license fee is required regardless of the number of locations a contractor ma

y

have. If you are engaged in any activity other than contracting as described in the Technical Memorandum, yo

u

may be required to obtain a separate business license for that activity. The license fee is not required if th

e

a

pp

lication is bein

g

submitted for biddin

g p

ur

p

oses onl

y

.

7.

Real Estate Developmen

t

involves the acquisition of land (raw o

r

improved), the

b

uilding of structures thereo

n

and the sale of the land with structures to a customer. Persons engaged in the business of a Real Estate Develope

r

are subje ct to the licensing requirements as a contracto r and must complete this form. Contractors are permitted t

o

reduce their gross receipts by amounts paid to subcontractors and Real Estate Developers are permitted to furthe

r

reduce such receip ts by ex penses incurred in the development of realty (see Technical Inform ation Memorandum

93-5 for details

)

BE SURE TO SIGN THE STATEMENT AT THE BOTTOM ON THE COMBINED REGISTRATION

APPLICATION AND THE CONTRACTORS FORM.

10

Month Day Year Month Day Year

DO NOT WRITE OR STAPLE IN THIS AREA

089 OR 090

MAILING ADDRESS IF DIFFERENT

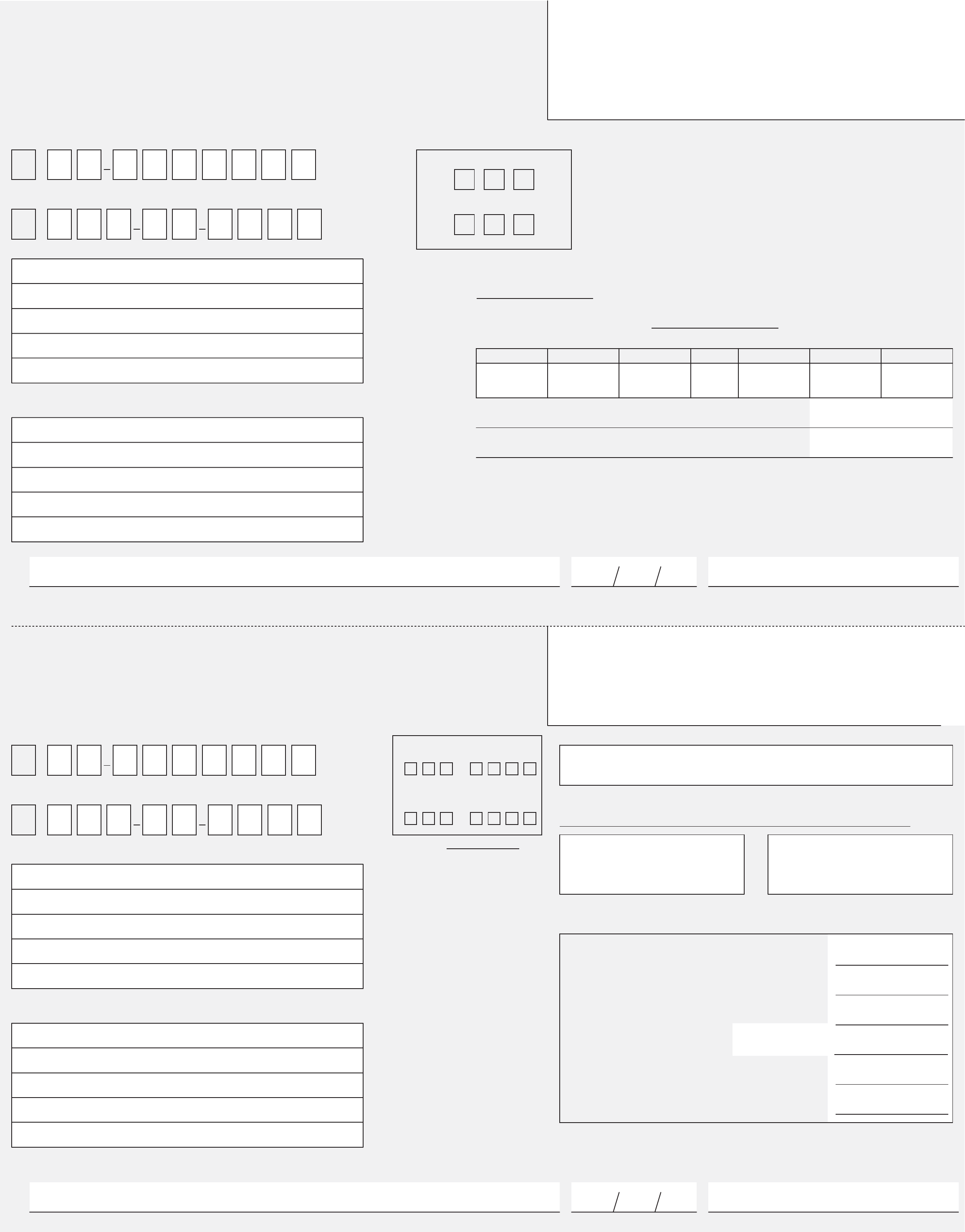

1. AMOUNT WITHHELD AND DUE FOR PERIOD $

2. AMOUNT REMITTED

$

DO NOT WRITE OR STAPLE IN THIS AREA

028

Last day of first mo nth

followin

g

the end of

q

uarte

r

GROSS RECEIPTS

1. TOTAL GROSS RECEIPTS $

2. LESS EXCLUSION $

STATE OF DELAWARE

Mail This Copy With Remittance

Payable To

Delaware Division of Revenue

P.O. Box 8995

Wilmington, DE 19899-8995

Employer Identification Number

1

INITIAL

MONTHLY

EMPLOYER'S REPOR T OF

DELAWARE TA X WITHHELD

FOR OFFICE USE ONLY

Social Securit

y

Numbe

r

2

BUSINESS NAME AN D ADDRESS

Suffix

PAYMENT DUE DATE

15 da

y

s after end of month

PAYMENT FOR PERIOD

FROM TO

X

AUTHO RI ZE D SIGNATURE (I DECLA RE UNDE R PENALTIES OF PERJU RY THA T THIS IS A TRUE, CORRECT A ND COMPLETE RETU RN.) DATE TELEPHONE NUMBER

STATE OF DELAWARE

Mail This Copy With Remittance

Payable To

INITIAL

Delaware Division of Revenue

P.O. Box 2340

Wilmington, DE 19899-2340

Employer Identification Number

1

GROSS RECEIP TS

TAX RETURN

FOR OFFICE USE ONLY

QUARTERLY

S B

BUSINESS DESCRIPTION

Social Securit

y

Numbe

r

2

S B

PAYMENT FOR QUARTER ENDING PAYMENT DUE DATE

BUSINESS NAME AN D ADDRESS

FILING PERIOD

MAILING ADDRESS IF DIFFERENT

3. TAXABLE AMOUNT $

TAX RATE

4. GROSS RECEIPTS TAX, LINE 3

X

_______________

=$

5. APPROVED TAX CREDITS $

6. BALANCE DUE. SUBTRACT LINE 5 FROM LINE 4 $

X

AUTHO RI ZE D SIGNATURE (I DECLA RE UNDE R PENALTIES OF PERJU RY THA T THIS IS A TRUE, CORRECT A ND COMPLETE RETU RN.) DATE TELEPHONE NUMBER

11