Form SS-4 (Rev. 1-2010)

Page 2

Do I Need an EIN?

File Form SS-4 if the applicant entity does not already have an EIN but is required to show an EIN on any return, statement,

or other document.

1

See also the separate instructions for each line on Form SS-4.

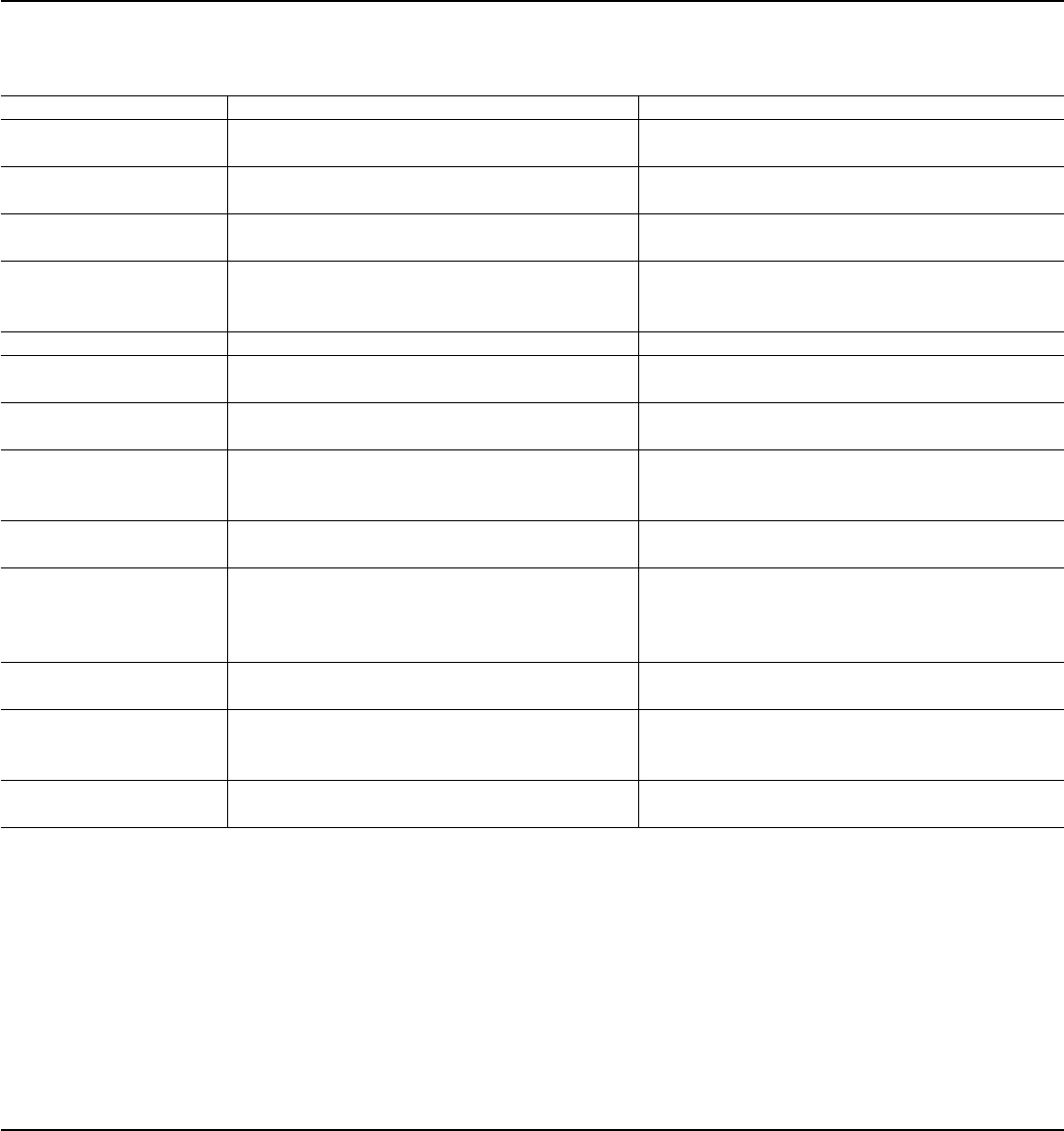

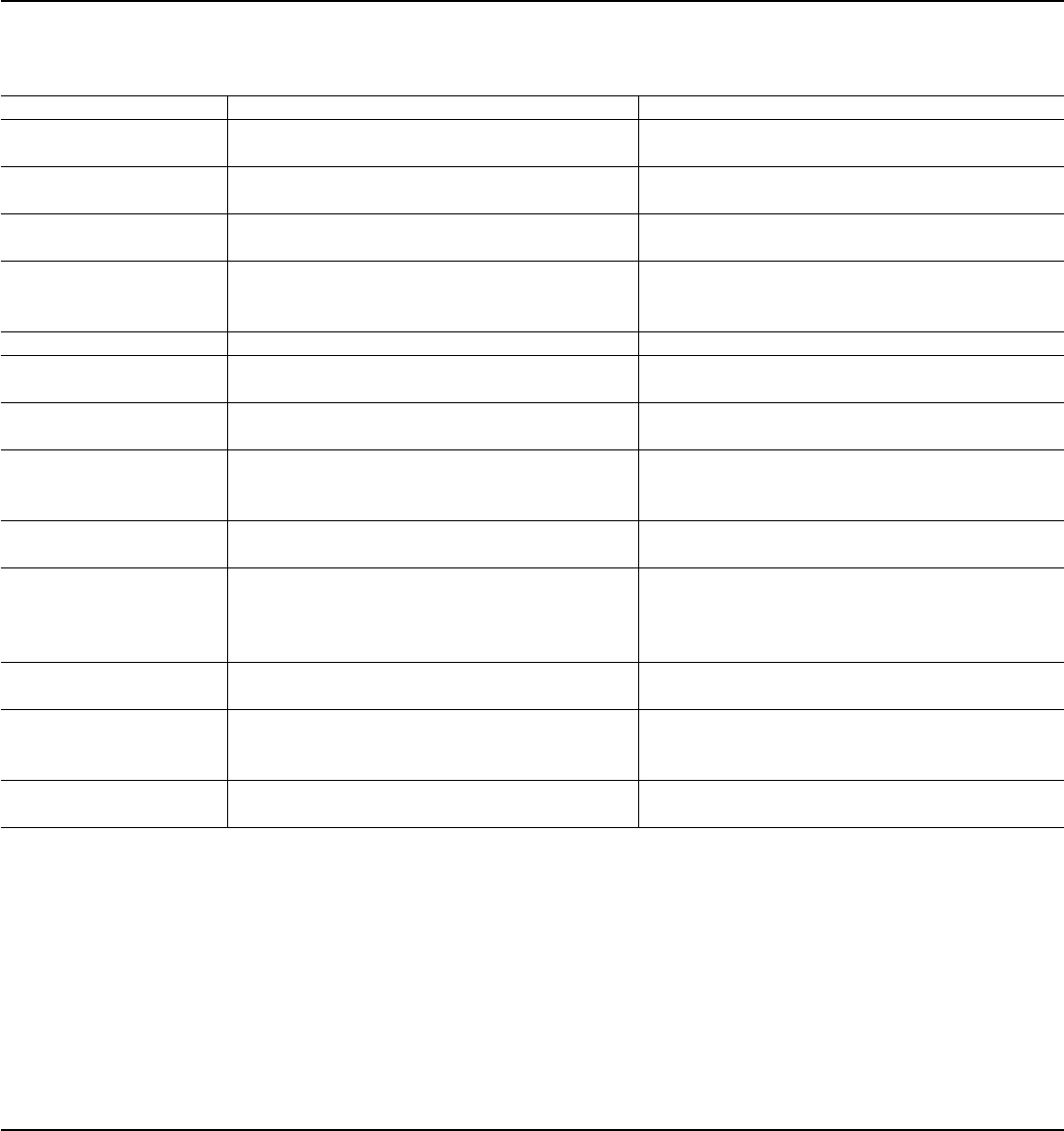

IF the applicant... AND... THEN...

Started a new business Does not currently have (nor expect to have)

employees

Complete lines 1, 2, 4a–8a, 8b–c (if applicable), 9a,

9b (if applicable), and 10–14 and 16–18.

Hired (or will hire) employees,

including household employees

Does not already have an EIN Complete lines 1, 2, 4a–6, 7a–b (if applicable), 8a,

8b–c (if applicable), 9a, 9b (if applicable), 10–18.

Opened a bank account Needs an EIN for banking purposes only Complete lines 1–5b, 7a–b (if applicable), 8a, 8b–c

(if applicable), 9a, 9b (if applicable), 10, and 18.

Changed type of organization Either the legal character of the organization or its

ownership changed (for example, you incorporate a

sole proprietorship or form a partnership)

2

Complete lines 1–18 (as applicable).

Purchased a going business

3

Does not already have an EIN Complete lines 1–18 (as applicable).

Created a trust The trust is other than a grantor trust or an IRA

trust

4

Complete lines 1–18 (as applicable).

Created a pension plan as a

plan administrator

5

Needs an EIN for reporting purposes Complete lines 1, 3, 4a–5b, 9a, 10, and 18.

Is a foreign person needing an

EIN to comply with IRS

withholding regulations

Needs an EIN to complete a Form W-8 (other than

Form W-8ECI), avoid withholding on portfolio assets,

or claim tax treaty benefits

6

Complete lines 1–5b, 7a–b (SSN or ITIN optional),

8a, 8b–c (if applicable), 9a, 9b (if applicable), 10,

and 18.

Is administering an estate Needs an EIN to report estate income on Form 1041 Complete lines 1–6, 9a, 10–12, 13–17 (if applicable),

and 18.

Is a withholding agent for

taxes on non-wage income

paid to an alien (i.e.,

individual, corporation, or

partnership, etc.)

Is an agent, broker, fiduciary, manager, tenant, or

spouse who is required to file Form 1042, Annual

Withholding Tax Return for U.S. Source Income of

Foreign Persons

Complete lines 1, 2, 3 (if applicable), 4a–5b, 7a–b (if

applicable), 8a, 8b–c (if applicable), 9a, 9b (if

applicable), 10, and 18.

Is a state or local agency Serves as a tax reporting agent for public assistance

recipients under Rev. Proc. 80-4, 1980-1 C.B. 581

7

Complete lines 1, 2, 4a–5b, 9a, 10, and 18.

Is a single-member LLC Needs an EIN to file Form 8832, Classification

Election, for filing employment tax returns and

excise tax returns, or for state reporting purposes

8

Complete lines 1–18 (as applicable).

Is an S corporation Needs an EIN to file Form 2553, Election by a Small

Business Corporation

9

Complete lines 1–18 (as applicable).

1

For example, a sole proprietorship or self-employed farmer who establishes a qualified retirement plan, or is required to file excise, employment, alcohol, tobacco, or

firearms returns, must have an EIN. A partnership, corporation, REMIC (real estate mortgage investment conduit), nonprofit organization (church, club, etc.), or farmers’

cooperative must use an EIN for any tax-related purpose even if the entity does not have employees.

2

However, do not apply for a new EIN if the existing entity only (a) changed its business name, (b) elected on Form 8832 to change the way it is taxed (or is covered by the

default rules), or (c) terminated its partnership status because at least 50% of the total interests in partnership capital and profits were sold or exchanged within a 12-

month period. The EIN of the terminated partnership should continue to be used. See Regulations section 301.6109-1(d)(2)(iii).

3

Do not use the EIN of the prior business unless you became the “owner” of a corporation by acquiring its stock.

4

However, grantor trusts that do not file using Optional Method 1 and IRA trusts that are required to file Form 990-T, Exempt Organization Business Income Tax Return,

must have an EIN. For more information on grantor trusts, see the Instructions for Form 1041.

5

A plan administrator is the person or group of persons specified as the administrator by the instrument under which the plan is operated.

6

Entities applying to be a Qualified Intermediary (QI) need a QI-EIN even if they already have an EIN. See Rev. Proc. 2000-12.

7

See also Household employer on page 4 of the instructions. Note. State or local agencies may need an EIN for other reasons, for example, hired employees.

8

See Disregarded entities on page 4 of the instructions for details on completing Form SS-4 for an LLC.

9

An existing corporation that is electing or revoking S corporation status should use its previously-assigned EIN.