Fillable Printable Free Commercial Invoice Template

Fillable Printable Free Commercial Invoice Template

Free Commercial Invoice Template

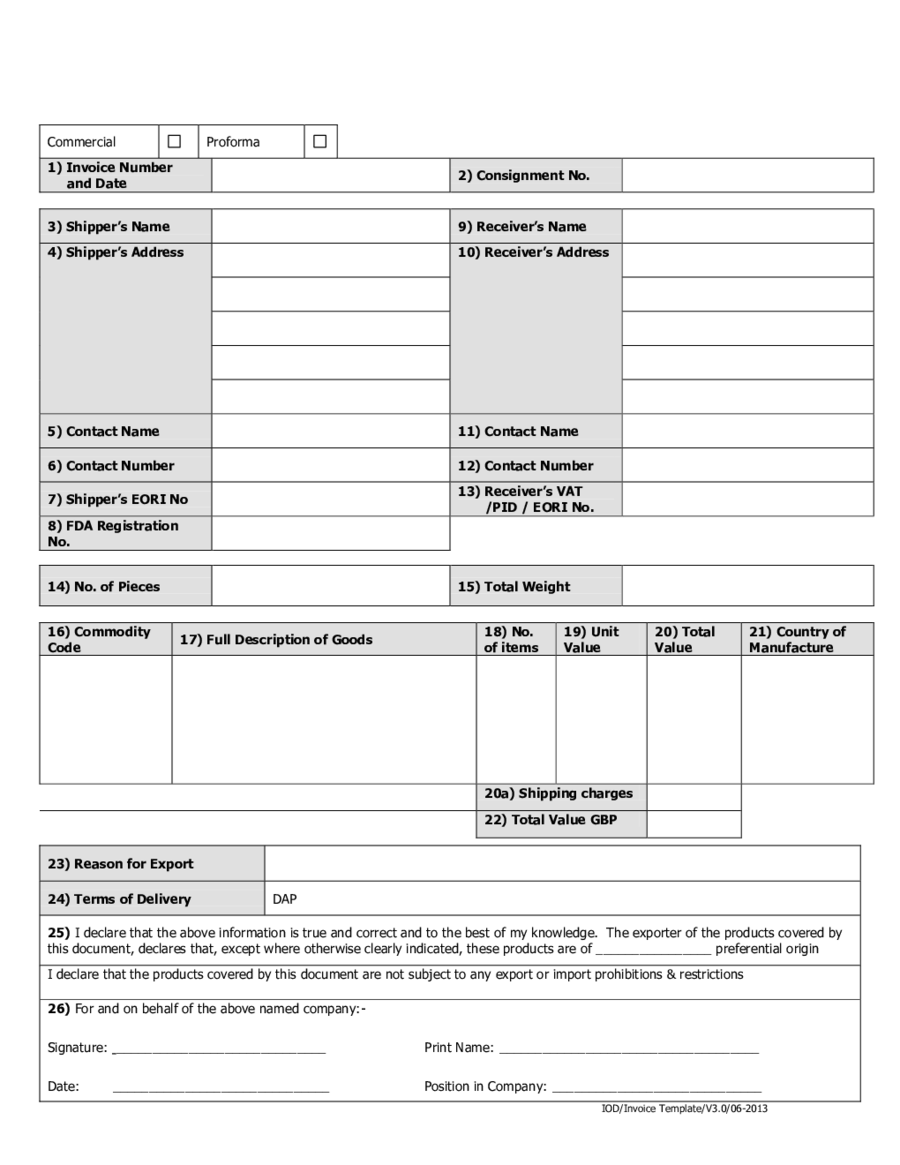

Commercial

Proforma

1) Invoice Number

and Date

2) Consignment No.

3) Shipper’s Name

9) Receiver’s Name

4) Shipper’s Address

10) Receiver’s Address

5) Contact Name

11) Contact Name

6) Contact Number

12) Contact Number

7) Shipper’s EORI No

13) Receiver’s VAT

/PID / EORI No.

8) FDA Registration

No.

14) No. of Pieces

15) Total Weight

16) Commodity

Code

17) Full Description of Goods

18) No.

of items

19) Unit

Value

20) Total

Value

21) Country of

Manufacture

20a) Shipping charges

22) Total Value GBP

23) Reason for Export

24) Terms of Delivery

DAP

25) I declare that the above information is true and correct and to the best of my knowledge. The exporter of the products covered by

this document, declares that, except where otherwise clearly indicated, these products are of ________________ preferential origin

I declare that the products covered by this document are not subject to any export or import prohibitions & restrictions

26) For and on behalf of the above named company:-

Signature: _____________________________ Print Name: ____________________________________

Date: ______________________________ Position in Company: _____________________________

IOD/Invoice Template/V3.0/06-2013

When to supply an invoice

If you send shipments through the DPD Express or DPD Classic network to a non-EU destination you will need to supply

Customs paperwork in the form of a Proforma or Commercial Invoice in order to clear your shipment through Customs at

its destination.

Invoices are not required for EU countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia, Finland,

France, Germany, Greece, Hungary, Italy, Latvia, Lithuania, Luxembourg, Malta, Ne

therlands, Poland, Portugal, Romania,

Slovakia, Slovenia, Spain or Sweden.

You need 5 copies of an invoice for each consignment, each with an original signature.

Preparing an invoice

Firstly, the invoice must state whether it is a “proforma invoice” or “commercial invoice”:

A proforma invoice is to be used for consignments that are being supplied to the consignee free of charge

A commercial invoice is to be used for consignments which are being sold to the consignee

1. The invoice number and date

2. The DPD/Interlink consignment number

3. Your company name

4. Your company address and country

5. Your contact name

6. Your telephone number

7. Your EORI (Economic Operator Registration & Identification

) Number. This replaced the TURN in July 2009.

All businesses involved in International export or import require an EORI

Any enquiries regarding EORI’s should be directed to HM Revenue & Customs:

eori.customs&[email protected]si.gov.uk or visit their website:

http://customs.hmrc.gov.uk/channelsPortalWebApp/channelsPortalWebApp.portal?_nfpb=true&_pageLabel=p

ageImport_ShowContent&id=HMCE_PROD1_028598&propertyType=document

8. Certain commodities exported to the USA require the sender to register with the FDA in

USA. These

commodities include cosmetics, pharmaceutical products, non-perishable food items. Refer to www.fda.gov

for further information. A copy of the Prior Notice must be attached to the invoice before export.

9. The name of the company you are sending your consignment to (the consignee)

10. The address and country of the country of the company you are sending to

11. The contact name at the company you are sending to

12. The telephone number of the company you are sending to

13. The company registration (VAT) number, Personal ID (PID) number or EORI of the customer you are sending

to. This required to clear your shipment through Customs and is mandatory for consignments to Norway and

Canary Islands.

14. Number of parcels in the consignment

15. Total gross weight of the consignment in kilograms

16. Enter the Customs Commodity Code (Tariff Number) for the item you are sending, insert it in here alongside

the description of the goods. The Customs Commodity Code dictate

s the amount of duty that will be applied

by Customs to the goods when they arrive. This is required for export and import customs clearance and

ensures the goods are classified accurately and that shipper’s customer is not be over-charged in duties.

Commodity Codes can be looked up at: http://www.businesslink.gov.uk/bdotg/action/tariff

17. Full and accurate description of the goods is essential for Customs and airline security purposes. Poorly

described shipments could be detained for

further examination by Customs and so delay the delivery of the

consignment.

18. Number of items for each description in box 17

19. Unit value of each item in box 17

20. The total of box 18 multiplied by box 19

20a. The total shipping/freight charge

21. Country of manufacture of your goods – list separate countries, if applicable

22. Total of box 20 and 20a

23. State the reason for export e.g. sales, samples for review.

24. Terms of delivery – DPDgroup UK only accept consignments which are prepaid and the duty/tax is

payable

by

the consignee. This is represented by the universal Incoterm “DAP” - Delivered at Place. For shipments on the

DPD Classic service to Norway & Switzerland please used DAP CLEARED

25. Declaration of origin. Certain countries may offer duty relief if an EUR declaration is made or an EUR1

document is supplied with the goods. Consult your local Customs officer for further details.

DPDgroup UK will not accept consignments which are subject to any export or import prohibitions an

d

restrictions, unless agreed in writing prior to export.

26. Original signature, printed name, position of the person completing the invoice

IOD/Invoice Template/V3.0/05-2013