Fillable Printable Fuel Allowance Form - Michigan

Fillable Printable Fuel Allowance Form - Michigan

Fuel Allowance Form - Michigan

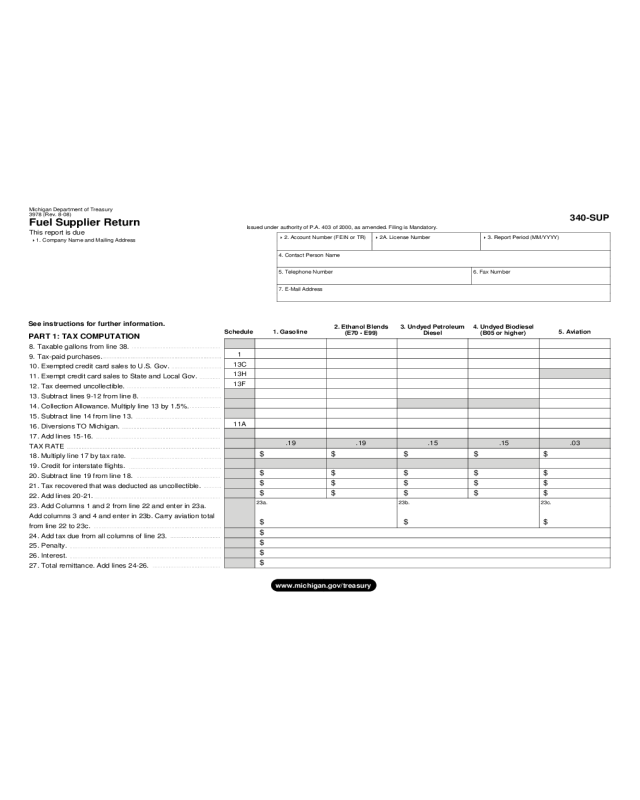

Michigan Department of Treasury

3978 (Rev. 8-08)

Fuel Supplier Return

340-SUP

Issued under authority of P.A. 403 of 2000, as amended. Filing is Mandatory.

This report is due

PART 1: TAX COMPUTATION

8. Taxable gallons from line 38.

9. Tax-paid purchases.

10. Exempted credit card sales to U.S. Gov.

11. Exempt credit card sales to State and Local Gov.

12. Tax deemed uncollectible.

13. Subtract lines 9-12 from line 8.

14. Collection Allowance. Multiply line 13 by 1.5%.

15. Subtract line 14 from line 13.

16. Diversions TO Michigan.

17. Add lines 15-16.

TAX RATE

18. Multiply line 17 by tax rate.

19. Credit for interstate flights.

20. Subtract line 19 from line 18.

21. Tax recovered that was deducted as uncollectible.

22. Add lines 20-21.

23. Add Columns 1 and 2 from line 22 and enter in 23a.

Add columns 3 and 4 and enter in 23b. Carry aviation total

from line 22 to 23c.

24. Add tax due from all columns of line 23.

25. Penalty.

26. Interest.

27. Total remittance. Add lines 24-26.

Schedule 1. Gasoline

2. Ethanol Blends

(E70 - E99)

3. Undyed Petroleum

Diesel

4. Undyed Biodiesel

(B05 or higher)

See instructions for further information.

23a. 23b. 23c.

.19 .19 .15 .15 .03

$$ $$$

$

$

$

$

1

13C

13H

13F

11A

5. Aviation

$$ $$$

$$ $$$

$$ $$$

$$$

www.michigan.gov/treasury

1. Company Name and Mailing Address

2. Account Number (FEIN or TR) 3. Report Period (MM/YYYY)2A. License Number

4. Contact Person Name

5. Telephone Number

7. E-Mail A ddress

6. Fax Number

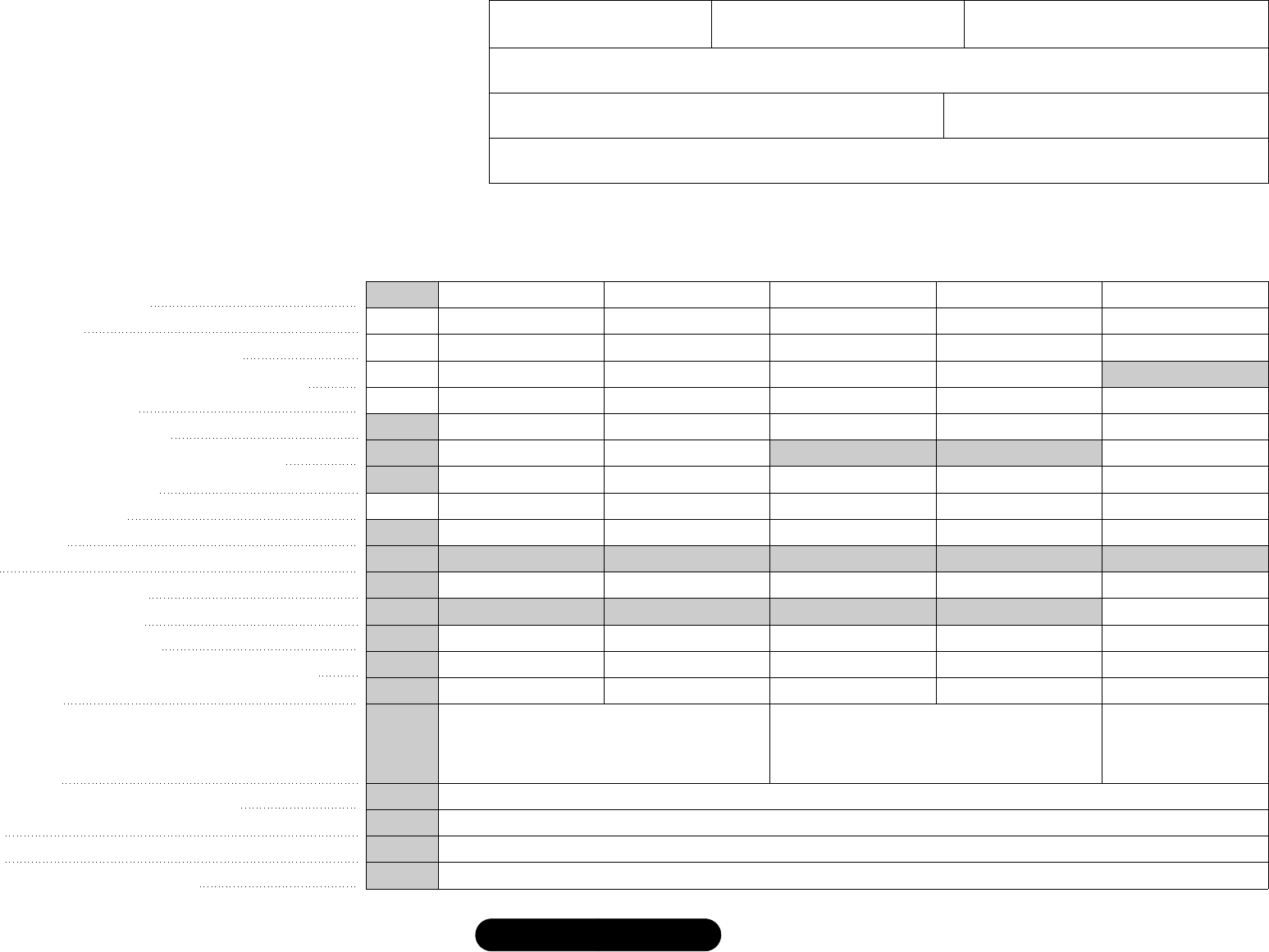

28. Imports from outside the U.S.

29. Imports from another state.

30. Fuel received on exchange.

31. Fuel delivered on exchange.

32. FTZ disbursements.

33. Dyed diesel diverted TO Michigan.

PART 3: TAXABLE DISBURSEMENTS

34. Michigan taxable gallons.

35. Aviation fuel sold to authorized resellers.

36. Taxable dyed diesel disbursements.

37. Michigan taxable gallons sold for export.

38. Add lines 34-37.

PART 4: OTHER TERMINAL DISBURSEMENTS

39. Dyed diesel removed.

40. Sales to suppliers for exports.

41. Exports with destination tax collected.

42. Deliveries to U.S. Government.

43. Deliveries to state and local governments.

44. Leaded Racing Fuel disbursed

45. Deliveries to tax-free storage.

46. Deliveries to exempt institutions.

47. Deliveries to fuel feedstock users.

48. Nontaxable use (form 680).

49. Diversions FROM Michigan.

See instructions for further information.

PART 2: REPORTA BLE INFORMATION

2C

3

2X

6X

10B

11A

5/5Z

5C

5F

7B

6F

6P

7A

8

9

6Z

10F

10G

10M

11B

Schedule Gasoline

Ethanol Blends

(E70 - E99)

Undyed Petroleum

Diesel

Undyed Biodiesel

(B05 or higher)

Aviation

Dyed Diesel

(petroleum/biodiesel)

www.michigan.gov/treasury

Form 3978, Page 2

Form 3978, Page 3

Preparer's Signat ure Printed Name

Telephone Number Preparer FEINPreparer's Address

I certify under penalty of perjury that I have examined this return and to the best of my knowledge and belief, it is true and complete. Suppliers of Gasoline/Ethanol

Blends/Aviation Fuel: I certify to the best of my knowledge and belief that any and all suppliers, w holesalers or retailers of gasoline or aviation fuel to w hom gasoline or aviation

fuel, as defined by statute, was sold by this supplier during the period covered by this report, have been paid or credited as follows:

(A) To Suppliers/Wholesalers - 1.5% of the tax charged as allowed by statute to licensed suppliers of gasoline or aviation fuel.

(B) To Retailers - 1/3 of the 1.5% allowed by statute to licensed suppliers of gasoline or aviation fuel.

(C) No credits or payments have been extended during this report period as no sales of gasoline or aviation fuel have been

made to any supplier/wholesaler or retailer.

I authorize Treasury to discuss my return and attachments with my preparer. Do not discuss with my preparer.

Authorized Signature Printed Name Telephone Number

CERTIFICATIONS

Title Date

Suppliers and Permissive Suppliers are mandated to file electronically. This form is for information purposes only.

Mail Remittance to:

Michigan Department of Treasury

P.O. Box 77401

Detroit, MI 48278

Make checks payable to "State of Michigan - Motor Fuel." Print your account number on your check. Call (517) 636-4600 if you have any questions.

www.michigan.gov/treasury

Mail refund requests or zero return to:

Michigan Department of Treasury

Motor Fuel Unit

P.O. Box 30474

Lansing, MI 48909-7974

Instructions for Form 3978, Fuel Supplier Return

Form 3978, page 4.

All Michigan licensed Suppliers and Permissive

Suppliers must file this return by the 20

th

day of the

month following the end of the report period.

Schedules: Applicable schedules must be completed

in their entirety on a load-by-load basis. Check the

appropriate box on Form 3783, Schedule of Receipts,

or Form 3784, Schedule of Disbursements. A separate

schedule must be submitted for each fuel type. The

correct product codes must be used on all schedules.

Blank schedules may be duplicated as needed.

Before completing page one of the Fuel Supplier

Return, finish all schedules and page two of the return.

Report gross gallons on the return. The top of each

column identifies the fuel to be reported in the column.

Product Codes: See attached list of product codes.

PART 1 – TAX COMPUTATION

Note: Tax is due upon removal, importation, or other

taxable event and if payment is not included you will

be billed for the month in which the transaction(s)

takes place. The tax is calculated on gross gallons and

interest will be computed from the original due date on

out-of-period transactions (late loads).

For each column:

Line 8: Enter the total gross taxable gallons for gaso-

line, ethanol blends, undyed petroleum diesel, undyed

biodiesel and aviation fuel from Line 38, page 2 of the

return.

Line 9: Enter gross gallons purchased with Michigan

tax paid to supply source. (Schedule 1)

Line 10: Enter total gallons for tax-exempt credit card

sales made to the United States Government. (Sched-

ule 13C)

Line 11: Enter total gallons for tax-exempt credit card

sales made to State and Local Government. (Schedule

13H)

Line 12: Tax deemed uncollectible. Enter gallons for

which the tax has been deemed uncollectible. (Sched-

ule 13F) This deduction is for tax that has not been

collected from an eligible purchaser for a period of 90

days after the tax was due. The supplier is required to

provide written notice to the Department within 10

days after the earliest date that the tax was due by the

eligible purchaser.

Line 13: Subtract Line 9, 10, 11 and 12 from Line 8.

Line 14: Collection Allowance: Multiply Line 13 by

1.5% (.015) for gasoline, ethanol blends and aviation

only.

Line 15: Subtract Line 14 from Line 13.

Line 16: Enter gross gallons for gasoline, ethanol

blends, undyed petroleum diesel, undyed biodiesel

and aviation fuel diverted TO Michigan (Schedule

11A). Dyed diesel is to be reported on Line 33, not

Line 16.

Line 17: Add Lines 15 and 16 and enter total taxable

gallons.

Line 18: Multiply Line 17 by the tax rate for each fuel

type.

Line 19: Airlines Only: Enter credit for interstate

flights 1.5 cents per gallon. (Attach Form 680, Claim

for Refund of Motor Fuel Tax, if return not filed

electronically.)

Line 20: Subtract Line 19 from Line 18 and enter the

total.

Line 21: Enter total Motor Fuel tax dollars that were

previously deducted as uncollectible but were later

recovered. The recovered amount must be remitted by

the Supplier on the return filed for the month that the

taxes were paid to the Supplier with a statement of the

period for which the taxes were paid.

Line 22: Add Lines 20 and 21 and enter the total.

Line 23: Add Columns 1 and 2 from Line 22 and enter

in 23a. Add Columns 3 and 4 from Line 22 and enter

in 23b. Carry aviation total (Column 5) from line 22 to

Line 23c.

Line 24: Tax due: Add all Columns of Line 23.

Line 25: Enter penalty amount due if applicable.

Line 26: Enter interest amount due if applicable.

Line 27: Add Lines 24, 25 and 26 and enter total

remittance due for all tax types.

PART 2: REPORTABLE INFORMATION

This section is required. All gallons of gasoline,

ethanol blends, undyed diesel, undyed biodiesel,

dyed diesel/biodiesel and aviation fuel removed,

acquired, imported or received on exchange must be

reported.

Note: Gallons reported on Schedule 2C, 3 and 2X

must also be included in Part 3 or Part 4 of the

return.

Line 28: Enter gallons of gasoline, ethanol blends,

undyed petroleum diesel, undyed biodiesel, dyed

diesel/biodiesel and aviation fuel imported from

outside the United States where the Michigan excise

tax was not paid to a supplier. (Schedule 2C)

Line 29: Enter total gallons of gasoline, ethanol

blends, undyed petroleum diesel, undyed biodiesel,

dyed diesel/biodiesel and aviation fuel imported from

another state. (Schedule 3)

Form 3978, page 5.

Line 30: Enter total taxable gallons of gasoline,

ethanol blends, undyed petroleum diesel, undyed

biodiesel, dyed diesel/biodiesel and aviation fuel

received on exchange agreements above the terminal

rack. (Schedule 2X)

Line 31: Enter total gallons of gasoline, ethanol

blends, undyed diesel, undyed biodiesel, dyed diesel/

biodiesel and aviation fuel delivered above the

terminal rack. (Schedule 6X)

Line 32: Enter FTZ (Foreign Trade Zone) disburse-

ments. (Schedule 10B)

Line 33: Enter gallons of dyed diesel diverted TO

Michigan. (Schedule 11A)

PART 3: TAXABLE DISBURSEMENTS

Line 34: Enter total taxable gallons of gasoline,

ethanol blends, undyed petroleum diesel, undyed

biodiesel, racing fuel and aviation fuel. Do not

include gallons reported on Lines 35 – 49. (Schedule

5/5Z)

Line 35: Enter total gallons of aviation fuel sold to

Aviation Registrants for resale. (Schedule 5C)

Line 36: Enter total gallons of dyed diesel fuel (petro-

leum/biodiesel) sold/used for taxable purpose. Enter

the amount in both the Dyed Diesel/Biodiesel column,

and the Undyed Petroleum Diesel or Undyed Biodiesel

column. (Schedule 5F)

Line 37: Enter total taxable gallons of gasoline,

ethanol blends, undyed petroleum diesel, undyed

biodiesel and aviation fuel sold for export with the

Michigan excise tax collected. (Schedule 7B)

Line 38: Michigan Taxable gallons. Add Lines 34

through 37 and enter total Michigan taxable gallons

for gasoline, ethanol blends, undyed petroleum diesel,

undyed biodiesel and aviation fuel. Enter the

amounts on Line 38 and Line 8, page 1.

PART 4: OTHER TERMINAL

DISBURSEMENTS

Line 39: Enter total gallons of dyed diesel fuel

removed. Do not include gallons reported on Lines 40

- 49. (Schedule 6F)

Line 40: Enter total gallons of gasoline, ethanol

blends, undyed petroleum diesel, undyed biodiesel,

dyed diesel/biodiesel and aviation fuel removed by

Suppliers for immediate export, tax not pre-collected.

(Schedule 6P)

Line 41: Enter total gallons of gasoline, ethanol

blends, undyed petroleum diesel, undyed biodiesel,

dyed diesel/biodiesel and aviation fuel removed for

export, including supplier’s own exports, where the

destination state tax was collected or accrued.

(Schedule 7A)

Line 42: Enter total gallons of gasoline, ethanol

blends, undyed petroleum diesel, undyed biodiesel,

dyed diesel and aviation fuel sold tax-free to the US

Government located in Michigan. (Schedule 8)

Line 43: Enter total gallons of gasoline, ethanol

blends, undyed petroleum diesel, undyed biodiesel

and dyed diesel fuel sold tax-free to the State of

Michigan, and/or its political subdivision, local gov-

ernments and public schools (Schedule 9).

Line 44: Enter total gallons of leaded racing fuel

disbursed. (Schedule 6Z)

Line 45: Enter total gallons delivered into tax-free

terminal storage. Must be a qualified terminal in

Michigan. (Schedule 10F)

Line 46: Enter total gallons of gasoline, ethanol

blends, undyed petroleum diesel, undyed biodiesel,

dyed diesel and aviation fuel sold tax-free to non-

profit, private, parochial, or denominational school,

college or university to transport students in buses to

authorized school functions. (Schedule 10G)

Line 47: Enter total gallons of gasoline or ethanol

blends sold tax-free to Fuel Feedstock users. (Schedule

10M)

Line 48: Enter total gallons of gasoline, ethanol

blends, undyed petroleum diesel or undyed biodiesel

fuel used for your own nontaxable purposes. (Attach

Form 680, Claim for Refund of Motor Fuel Tax, if

return not filed electronically).

Line 49: Enter gross gallons of gasoline, ethanol

blends, undyed petroleum diesel, undyed biodiesel,

dyed diesel/biodiesel or aviation fuel diverted FROM

Michigan. (Schedule 11B)

The Certification of Gasoline, Ethanol Blends or

Aviation Fuel Allowances has been incorporated into

the return. The appropriate boxes must be checked

and by signing the return you are certifying that the

remittance allowance was passed on when making tax-

collected sales.

Computer generated schedules must be approved by

this Department prior to use.

Mail Remittance to:

Michigan Department of Treasury

P.O. Box 77401

Detroit, MI 48278

Mail refund request or zero return to:

Michigan Department of Treasury

Motor Fuel Unit

P.O. Box 30474

Lansing, MI 48909-7974