Fillable Printable Income Declaration - Australia

Fillable Printable Income Declaration - Australia

Income Declaration - Australia

1 of 4

CS1668.1506

When to use this form

The Australian Government Department of Human Services uses

your adjusted taxable income to calculate your child support

assessment. Adjusted taxable income is the total of your taxable

income, plus other income components such as gross reportable

fringe benefits total, target foreign income, total net investment

losses, some tax free pensions or benefits and reportable

superannuation contributions. This forms allows you to provide an

income declaration if your taxable income has not yet been assessed

by the Australian Taxation Office (ATO). It is important to keep your

income details up-to-date to ensure your child support assessment

is accurate.

IMPORTANT: When you lodge your tax return, we may replace your

income declaration with your taxable income and amend your child

support. The best way to ensure your child support is correct is to

lodge your tax return on time every year. If you lodge your tax return

late we may not be able to backdate any changes to your child

support assessment.

This form is available for printing online, go to our website

humanservices.gov.au/forms or call us on 131 272 Monday to

Friday between 8.30 am and 4.45 pm, local time. Note: call charges

apply – calls from mobile phones may be charged at a higher rate.

To complete this form

• Print using BLOCK LETTERS

• Use blue or black pen

• Tick where applicable

• Sign the form

Where do I send this form?

Send the completed form to:

Department of Human Services

GPO Box 9815

MELBOURNE VIC 3001

or

Fax: 1300 309 949

For more information

For more information, go to our website

humanservices.gov.au/childsupport or call us on 131 272.

Help in other languages

Korean

⚫♞ᨦ#

᭥#㘂⩪᩶#ᑮ❪⠞#㗮✾㘂⎊#Ḯ⟪#㉟ᴲ⚗#⇆Ữ⍎

(TIS), 131 450

ᴲ⟦ᤆ͑

⚚ᠧ㘂⎗⎆⛎1

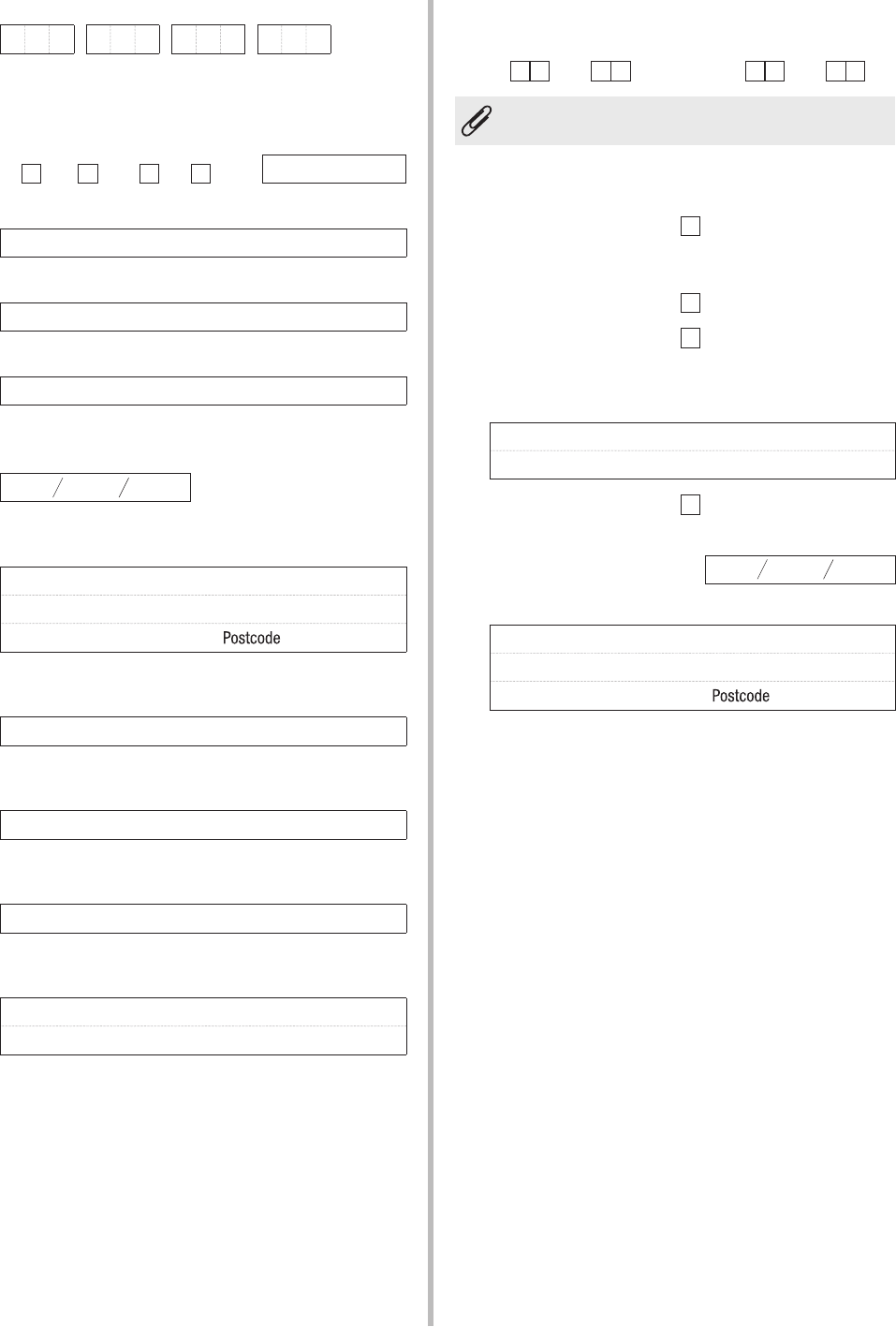

Income Declaration

CS1668.1506

2 of 4

1 Your Child Support Reference Number

— — —

(as shown on your Child Support Letters)

2 What are your personal details?

Mr Mrs Miss Ms Other

Family name

First given name

Other given names

3 Date of birth

4 Postal address

5 Home phone

( )

6 Work phone

( )

7 Mobile phone

8 Email

@

9 Which tax years are you supplying income details for?

Financial year (July – June) ie: 2009 – 2010

20 – 20 20 – 20

Please attach a separate sheet if you need to provide

details for more than two financial years.

10 Have you lodged tax returns for the above years?

No Are you required to

lodge tax returns for the

above years?

No Go to question 11

Yes Please state the years

that you need to lodge and

the date you will lodge

these returns.

Yes What date did you

lodge the returns?

What name and address were on your returns?

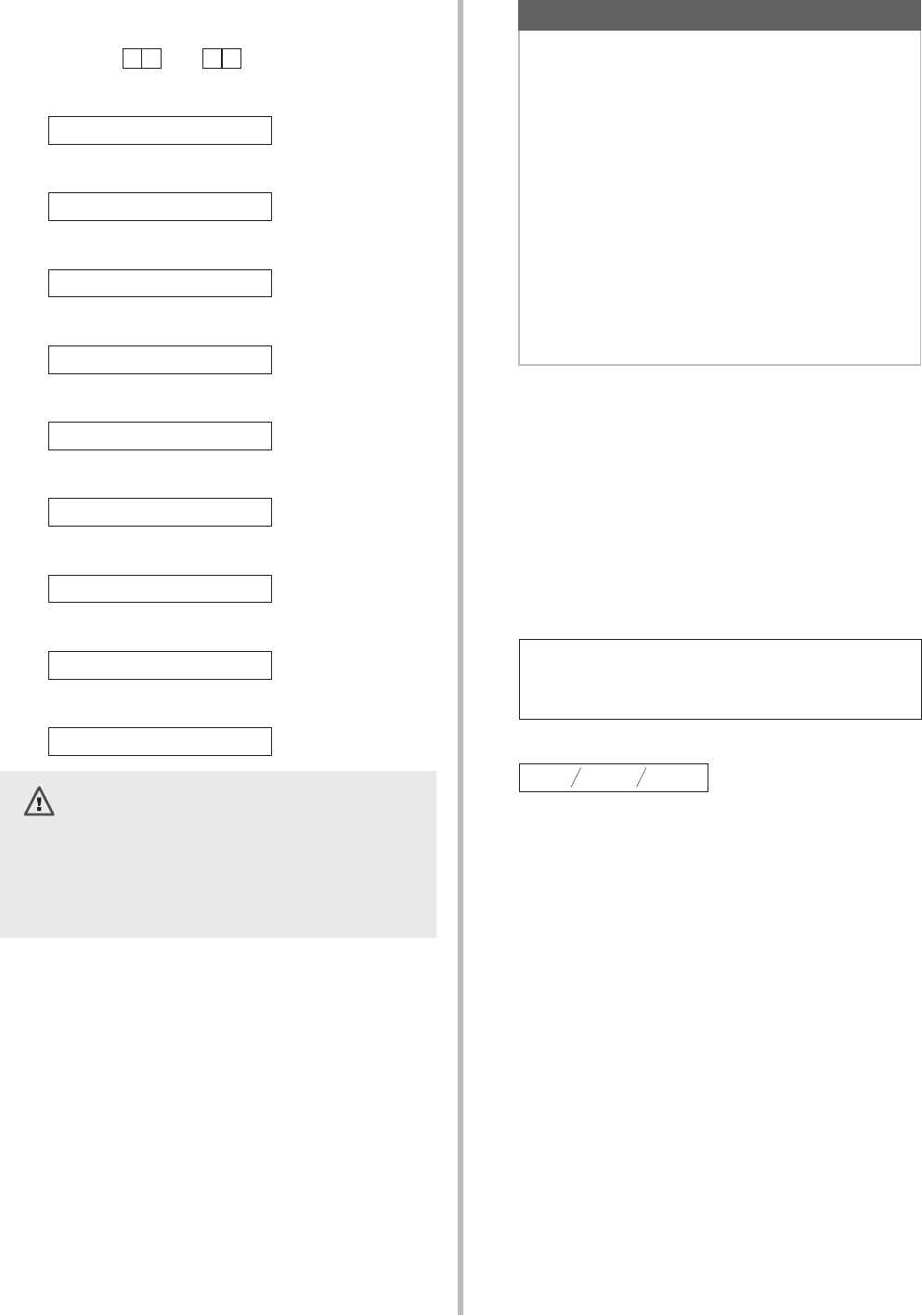

CS1668.1506

3 of 4

11 What are your income details for the years identified in

question 9?

Tax Year 20 – 20

a Gross income (see Notes)

$

b Allowable deductions (see Notes)

$

c Net taxable income (a minus b)

$

d Total net investment losses (see Notes)

$

e Reportable fringe benefits (see Notes)

$

f Target foreign income (see Notes)

$

g Total tax free pensions and benefits

$

h Reportable superannuation contributions

$

i Total adjusted taxable income (c + d + e + f + g + h)

$

IMPORTANT: If you now earn at least 15 per cent less

than the adjusted taxable income provided on this form,

you may be able to supply an estimate of your income.

If your estimate is accepted, we will amend your child

support to reflect your new income. Any changes to your

assessment will be effective from the date your estimate

is received. Your assessment will not be backdated.

12

IMPORTANT INFORMATION

Privacy and your personal information

Your personal information is protected by law, including the

Privacy Act 1988, and is collected by the Australian

Government Department of Human Services for the

assessment and administration of payments and services.

This information is required to process your application or

claim.

Your information may be used by the department or given to

other parties for the purposes of research, investigation or

where you have agreed or it is required or authorised by law.

You can get more information about the way in which the

Department of Human Services will manage your personal

information, including our privacy policy, at

www.humanservices.gov.au/privacy or by requesting a copy

from the department.

13 Statement

I declare that:

• the information provided in this form is complete and

correct.

I understand that:

• giving false or misleading information is a serious offence.

Your signature

-

Date

CS1668.1506

4 of 4

What if I have a complaint?

Step One:

Contact us and speak to your Customer Service Officer who

will try to solve the problem.

Step Two:

If you are not satisfied with the outcome, ask to speak to

their manager.

Step Three:

If you are still not satisfied, call our Complaints Service on

132 919 and speak to a Complaints Officer.

If you feel that we have been unable to successfully

resolve your complaint, you can escalate your concerns by

contacting the Commonwealth Ombudsman.

How can I report suspected fraud?

If you have information about someone who is misusing

government services, please phone the Australian

Government Services Tip-off Line on 131 524.

The tip-off line allows you to confidentially report fraud

against the Department of Human Services.

NOTES:

Gross income must include gross income from wages

before tax, pension/benefits, business income, rental

income, investment income, net capital gains and eligible

terminations payments. Include any other assessable

income that would be included in your tax return.

Allowable tax deductions must be recognised by the ATO

e.g. work related expenses, business expenses, net rental

property losses, net financial investment losses.

A total net investment loss is the amount by which the

expenses for your investments, e.g. from rental property,

shares, managed investments and forestry managed

investment schemes, exceed the gross income from those

investments, if this loss was deducted from your income for

tax purposes.

Reportable fringe benefits are benefits that are provided to

an employee or an associate, instead of full salary/wage

payment (e.g. salary sacrificing in exchange for a car).

Target foreign income is any foreign income exempt from

tax, less any losses or outgoings incurred in deriving that

income.