Fillable Printable Incoming Account Transfer Form Instructions

Fillable Printable Incoming Account Transfer Form Instructions

Incoming Account Transfer Form Instructions

INCOMING ACCOUNT TRANSFER FORM INSTRUCTIONS

TBRT

F11043 (11/13)

To ensure efficient transfer processing, please provide all information requested on the TIAA-CREF Brokerage Services Incoming Account

Transfer Form as outlined within the instructions below.

NOTE: Please attach a full copy of the most current statement (dated within six months) of the account that you are transferring into

TIAA-CREF Brokerage. Additional documentation may be required if the transfer results in a change in ownership or if there is a question

as to ownership.

Example 1 – a notarized Letter of Authorization is required and must be signed by all account owners when transferring an individual

account into a joint account or when a joint account is transferred into an individual account.

Example 2 – a “Certification of Legal Name” is required when different registrations exist for the same owner, i.e., John H. Doe is also John

Henry Doe is also John Doe. In addition, if you have had a legal name change we require the supporting legal documentation.

STEP 1: TIAA-CREF BROKERAGE ACCOUNT INFORMATION

Name(s) on Account:

This is the title or registration of your TIAA-CREF Brokerage account. Example: John H. Doe, John and Mary

Doe, John H. Doe Living Trust.

Brokerage Account Number:

Please leave the account number blank if this is accompanying a new account application. If you are transferring

into an already established account, enter your existing brokerage account number. A separate transfer form is required for each account

receiving transferred assets.

Social Security Number (SSN): List the SSN of the primary account owner or the Tax ID number of the Trust account, if applicable. Enter

the joint owner’s SSN if applicable.

Type of Account: Check only one option. Complete a separate form for each account registration.

STEP 2: DELIVERING ACCOUNT INFORMATION

Name(s) on Account: This is the title or registration of the account you are transferring from. Enter this just as it appears on your statement.

Example: John H Doe, John and Mary Doe, John H Doe Living Trust. This registration should match the TIAA-CREF

Brokerage account registration.

Social Security Number (SSN): List the SSN of the primary account owner or Tax ID number of the Trust account if applicable.

Delivering Account Number: This is your account number at the delivering firm as it appears on your statement.

Type of Account: Check only one option. Complete a separate form for each account registration.

Delivering Institution name, contact information and address: This is the name of the company that currently holds your account. Please

provide a contact name and phone number so that we may address any concerns on your transfer request. Please provide a physical

overnight mailing address to expedite your transfer request.

STEP 3: TRANSFER INSTRUCTION

Indicate the type of transfer you are requesting by checking the appropriate box. Only one box should be checked.

Transfer my entire account In Kind: This is a full transfer request. This option only applies if the delivering account is a brokerage

account. TIAA-CREF Brokerage Services (TCBS) cannot accept written instructions to sell assets held in brokerage accounts. You must

contact the delivering firm to sell any assets you would like to liquidate prior to submitting your transfer request form. TCBS will transfer all

assets held in the delivering account “In Kind.”

Transfer only the assets listed below In Kind: This is a partial transfer request. This option only applies if the delivering account is a

brokerage account. TCBS cannot accept written instructions to sell assets held in brokerage accounts. You must contact the delivering

firm to sell any assets you would like to liquidate prior to submitting your transfer request form. TCBS will transfer “In Kind” only the assets

listed in this section.

INCOMING ACCOUNT TRANSFER FORM INSTRUCTIONS

TBRT

F11043 (11/13)

STEP 3: TRANSFER INSTRUCTION

(Continued)

Direct Mutual Fund Company Transfers: This is a transfer of your mutual fund holdings held directly at the Mutual Fund company. Complete

a separate form for each mutual fund company transfer. List each fund name and account number that you would like to transfer. You must

provide the number of shares or enter “ALL” if you would like to transfer the entire position. You must indicate either “In Kind” or “Liquidate” for

each fund being transferred. If liquidation is selected you will receive the current market price once your transfer request has been received,

reviewed, and determined to be in good order by the delivering firm. If no indication is selected, the transfers will be processed “In Kind.”

Dividend Reinvestment Plan/Direct Registration Transfers: This is a transfer of equity holdings held directly with the transfer agent. Do not

complete a transfer form for the physical certificates you possess. The Transfer Agent will only deliver whole shares; any fractional shares

will be redeemed.

Bank or Credit Union Transfers: This is a transfer of any retirement plan carried by a bank or credit union containing Certificates of Deposit.

You must indicate whether you would like to liquidate your CD immediately and transfer cash, or if you want to liquidate your CD at maturity

and then transfer the cash. If you choose to liquidate your CD prior to maturity, penalties may be imposed by your bank. If you elect to

transfer at maturity, please submit your transfer request 30 days prior to maturity. Requests to transfer checking or non-retirement savings

accounts will not be accepted.

Direct Rollover request from a Qualified Retirement Plan (QRP) or 403(b) Plan: Please consult with your Plan Administrator for

procedures on moving your plan assets. Many plans require additional paperwork and/or authorization from the plan administrator before

assets can be transferred. Additionally, some plans may not allow “In Kind” transfers.

NOTE: QRP or 403(b) Plans cannot be rolled into a SIMPLE IRA.

STEP 4: RETIREMENT PLAN RESTRICTIONS AND CERTIFICATION

Check each box that applies. This section applies to Retirement Account transfers only.

If you are transferring a retirement account and are over the age of 70½, read this section carefully.

For retirement accounts in which Retirement Account acts as the custodian or servicing agent, all termination fees due to the prior

custodian must be satisfied prior to any transfer of assets. Any deposits made to your Retirement Account custodian account to reimburse

fees once the transfer is processed shall be applied as a current year contribution.

For transfers to retirement accounts: you agree to transfer only those assets which can be held in the account, as described in the relevant

TIAA-CREF Custodial Account Agreement and Disclosure Statement. There may be restrictions for either a transfer or rollover of IRAs and

Qualified Retirement Plans (QRPs) which are also described in your TIAA-CREF Custodial Account Agreement and Disclosure Statement.

Some restrictions that may apply, for example:

1. If you currently participate in a SIMPLE IRA Plan and want to transfer your SIMPLE IRA assets to TIAA-CREF Brokerage SIMPLE IRA,

contact your employer or plan administrator to open a TIAA-CREF Simple IRA plan. Direct transfers from a SIMPLE IRA to SIMPLE IRA is

permitted with an approval from your current employer.

2. Rollovers from your existing SIMPLE IRA Plan into Traditional, Roth, and SEP IRA is only permitted after 2 years from your first

contribution date into a SIMPLE IRA Plan. In order to facilitate these rollovers, you will need to provide a copy of your statement showing

the first contribution into your SIMPLE IRA in addition to current statement dated within 6 months.

Transfers and Rollovers from Retirement plans may have tax consequences. For further information, please speak with your tax advisor.

STEP 5: PARTICIPANT SIGNATURE AND CERTIFICATION

The form must be read, signed, and dated by all TIAA-CREF Brokerage account holders. Signatures must match account titles. Example.

John H. Doe should also be signed as John H. Doe.

SEND COMPLETED FORM(S) TO: STANDARD MAIL: OVERNIGHT:

TIAA-CREF Brokerage Services TIAA-CREF Brokerage Services

P.O. Box 1280 8500 Andrew Carnegie Blvd.

Charlotte, NC 28201 Charlotte, NC 28262

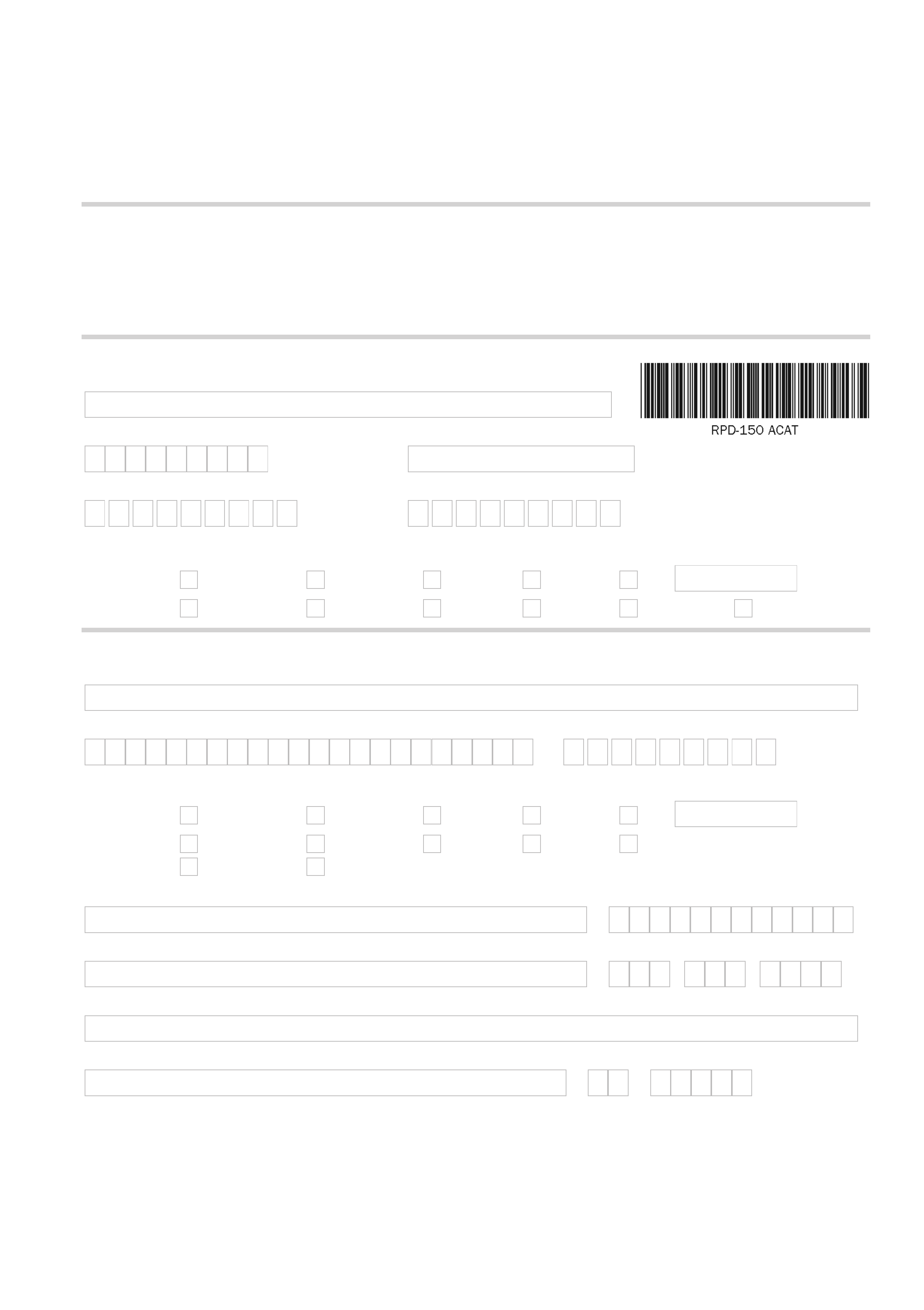

INCOMING ACCOUNT TRANSFER FORM

Page 1 of 3

TBRT

F11043 (11/13)

Use this form only to transfer assets into your TIAA-CREF Brokerage accounts.

If you are transferring assets from more than one account, please complete a separate form for each account.

A copy of the most current statement (dated within six months) of the account you are transferring is required.

Transfers must occur between “like” registered accounts. (e.g., from a joint account into a joint account).

Questions? Please call us at 800 927-3059 Monday to Friday from 8 a.m. to 7 p.m. (ET).

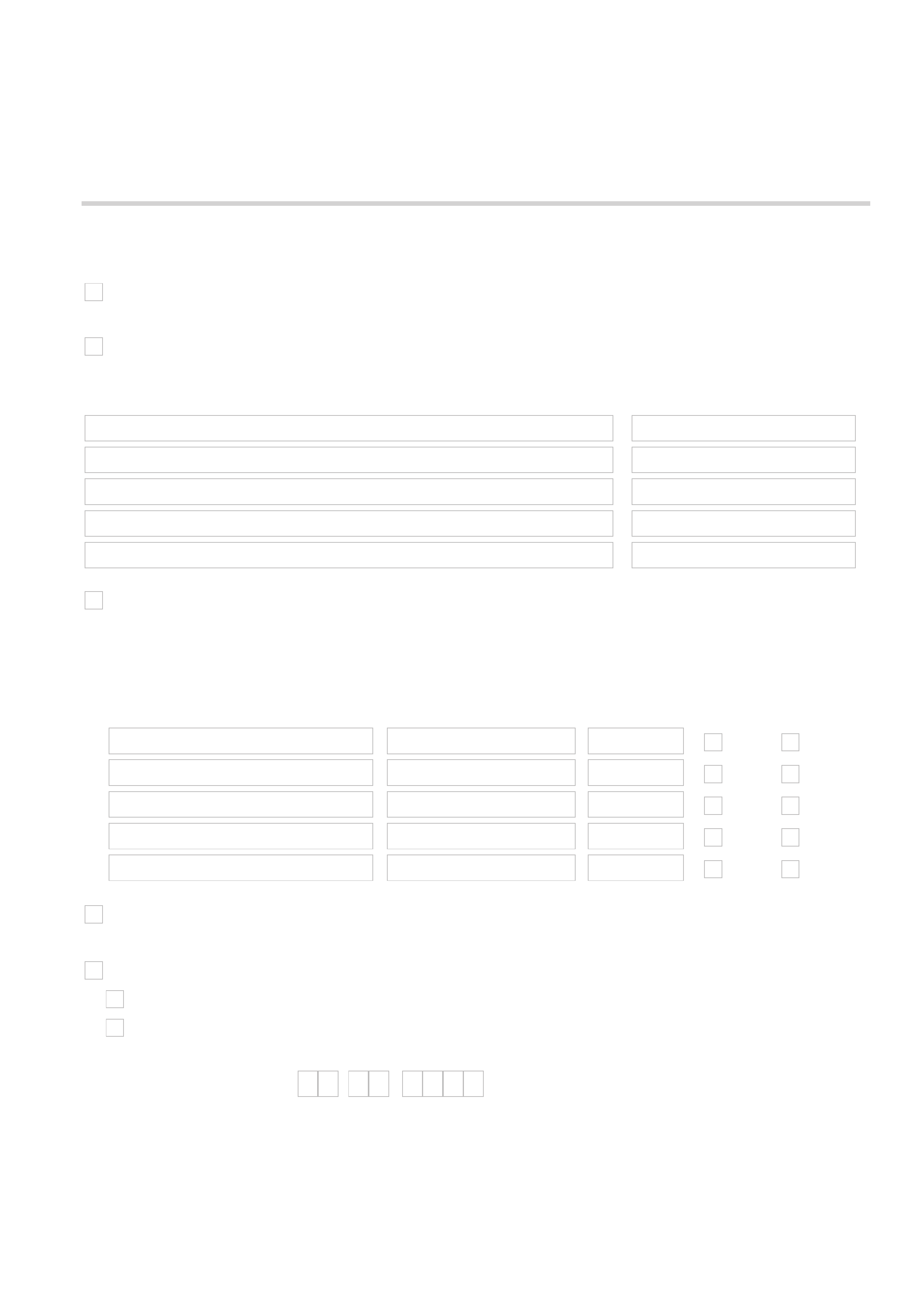

STEP 1: TIAA-CREF BROKERAGE ACCOUNT INFORMATION

Name(s) on Account

Brokerage Account Number

(leave blank if new account)

Pershing Clearing Number

0443 Pershing

Social Security Number/Tax ID Number Joint Applicant Owner’s Social Security Number

(only if applicable)

TYPE OF ACCOUNT

(Check only one. Complete a separate transfer form for each registration type)

Nonretirement: Individual Joint Custodial Trust Other

Retirement: Traditional IRA Rollover IRA Roth IRA SEP IRA Inherited IRA SIMPLE IRA

STEP 2: DELIVERING ACCOUNT INFORMATION

Name(s) on Account

(as it appears on your statement)

Delivering Account Number Social Security Number/Tax ID Number

TYPE OF ACCOUNT

(Check only one. Complete a separate transfer form for each registration type)

Nonretirement: Individual Joint Custodial Trust Other

Retirement: Traditional IRA Rollover IRA Roth IRA SEP IRA Inherited IRA

Qualified Plan SIMPLE IRA

Name of Delivering Institution

(Brokerage Firm, Mutual Fund Company, Bank, etc.)

Delivery Firm’s Clearing Number

(if known)

Contact Person’s Name

Contact Person’s Phone Number

–

–

Delivering Firm’s Overnight Address

(No P.O. Box)

City State Zip Code

INCOMING ACCOUNT TRANSFER FORM

Page 2 of 3

TBRT

F11043 (11/13)

STEP 3: TRANSFER INSTRUCTIONS

(Choose Only One)

NOTE: Money market funds must be liquidated and will be transferred as cash.

Transfer my entire account in kind. (All liquidation requests must be made through your delivering firm by you prior to submitting a full

transfer request.)

Transfer only the assets listed below in kind. (All liquidation requests must be made through your delivering firm by you prior to

submitting a partial transfer request. If you need additional space, you may copy this page to indicate your instructions.)

Security description/Symbol/CUSIP Number of Shares or “All”

Direct Mutual Fund Company Transfers. (All dividends/capital gains will be reinvested, unless otherwise specified. If you have

requested a liquidation, your market price is not guaranteed. You will receive the current market price after your transfer request is

received, reviewed, and determined to be in good order by the delivering firm. If no indication is made for number of shares or delivery

method, all transfers will occur in full and in-kind. If you need additional space, you may copy this page to indicate your instructions.

Please complete a separate transfer form for each fund family.)

Number of

Fund Name/Symbol/CUSIP Fund Account Number Shares or “All” Method

In Kind

Liquidate

In Kind

Liquidate

In Kind

Liquidate

In Kind

Liquidate

In Kind

Liquidate

Dividend Reinvestment Plan/Direct Registration Transfer. (Do not complete a transfer form for physical certificates that you currently

hold.) NOTE: Transfer agent will electronically send position or issue a certificate for whole shares and redeem fractional shares.

Bank or Credit Union Transfers for retirement accounts only. (Check only one. We cannot request transfers of retail accounts.)

Liquidate my CD/savings account immediately and transfer cash. I acknowledge there may be a penalty for my early withdrawal from my CD.

Liquidate my CD/savings at maturity and transfer cash. Maturity must be within 30 days of the date the transfer was submitted.

(mm/dd/yyyy)

Specify the CD maturity date:

/ /

INCOMING ACCOUNT TRANSFER FORM

Page 3 of 3

TBRT

F11043 (11/13)

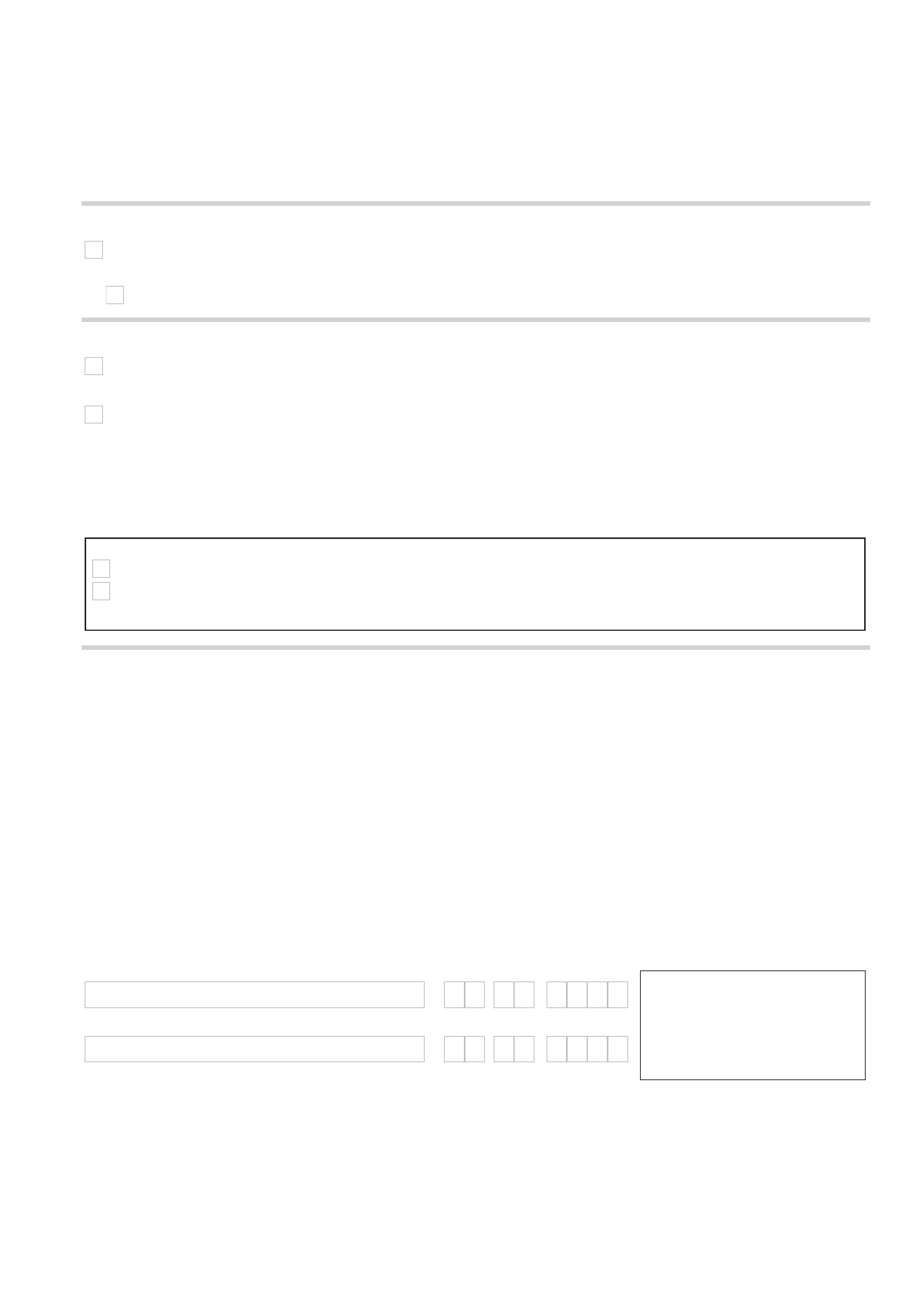

STEP 3: TRANSFER INSTRUCTIONS

(Continued)

Direct Rollover Request From A Qualified Retirement Plan or 403(b) Plan. Please consult with your plan administrator prior to submitting a

transfer request. Your plan may require additional paperwork to be completed before the funds can be rolled over.

I have contacted my plan administrator and submitted to my plan all the required paperwork, if required.

STEP 4: RETIREMENT PLAN RESTRICTIONS AND CERTIFICATIONS

Age 70½ restrictions: If you are over the age of 70½ you attest that the amount to be transferred will not include the required minimum

distribution (RMD) for the current year pursuant to Section 401(a)(9) of the Internal Revenue Code.

Rollover Certification of Employee: I understand the rules and conditions and I have met the requirements for making a rollover. Due to

the important tax consequences of rolling over funds or property, I have been advised to see a tax professional. All information provided by

me is true and correct and may be relied on By Pershing LLC or TIAA-CREF Trust Company, FSB. I assume full responsibility for this rollover

transaction and will hold none of Pershing LLC, TIAA-CREF Brokerage Services, and TIAA-CREF Trust Company, FSB liable for any adverse

consequences that may result. I hereby irrevocably designate this contribution in funds or other property as a rollover contribution.

For Internal Use Only:

STEP 5. PARTICIPANT SIGNATURE AND CERTIFICATION

To the Delivering Firm Named Above: If this account is a qualified retirement account, I have amended the applicable plan so that it names

the successor custodian or trustee, as the case may be, below. Unless otherwise indicated in the instructions above, please transfer all

assets in my account to Pershing without penalties, such assets may be transferred within the time frames required by Financial Industry

Regulatory Authority (FINRA) Rule 11870 or similar rule of FINRA or other designated examining authority.

Unless otherwise indicated in the instructions above, I authorize you to liquidate any nontransferable proprietary money market fund

assets that are part of my account and transfer the resulting credit balance to the successor custodian.

I authorize you to deduct any outstanding fees due to you from the credit balance in my account. If my account does not contain a credit

balance, or if the credit balance in the account is insufficient to satisfy any outstanding fees due to you, I authorize you to liquidate the

assets in my account to the extent necessary to satisfy that obligation. If certificates or other instruments in my account are in your

physical possession, I instruct you to transfer them in good deliverable form, including affixing any necessary tax waivers, to enable the

successor custodian to transfer them in its name for the purpose of the sale, when, and as directed to me.

I understand that upon receiving a copy of this transfer information, you will cancel all open orders for my account on your books. I affirm

that I have destroyed or returned to you credit/debit cards and/or unused checks issued to me in connection with my brokerage account. I

understand that you will contact me with respect to the disposition of any assets in my brokerage account that are nontransferable.

Primary Account Owner/Trustee/Custodian Today’s Date

(mm/dd/yyyy)

/ /

2 0

Signature Guaranteed By:

Additional Account Owner/Trustee Today’s Date

(mm/dd/yyyy)

/ /

2 0

Signature Guarantee obtained by TIAA-CREF

To the Prior Custodian/Trustee:

Pershing LLC accepts appointment as successor custodian.

Please be advised that ___________________________________________________ does hereby accept appointment as successor custodian/trustee.

Successor Custodian/Trustee’s Signature: ____________________________________________________________ Date: _____________________