Fillable Printable INDEPENDENT CONTRACTOR AGREEMENT FOR CONSTRUCTION

Fillable Printable INDEPENDENT CONTRACTOR AGREEMENT FOR CONSTRUCTION

INDEPENDENT CONTRACTOR AGREEMENT FOR CONSTRUCTION

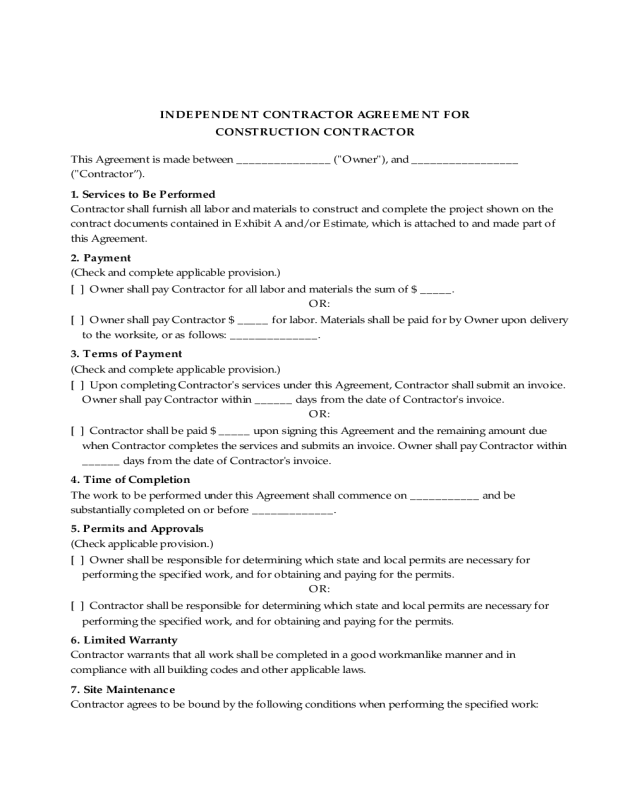

INDEPENDENT CONTRACTOR AGREEMENT FOR

CONSTRUCTION CONTRACTOR

This Agreement is made between _______________ ("Owner"), and _________________

("Contractor”).

1. Services to Be Performed

Contractor shall furnish all labor and materials to construct and complete the project shown on the

contract documents contained in Exhibit A and/or Estimate, which is attached to and made part of

this Agreement.

2. Payment

(Check and complete applicable provision.)

[ ] Owner shall pay Contractor for all labor and materials the sum of $ _____.

OR:

[ ] Owner shall pay Contractor $ _____ for labor. Materials shall be paid for by Owner upon delivery

to the worksite, or as follows: ______________.

3. Terms of Payment

(Check and complete applicable provision.)

[ ] Upon completing Contractor's services under this Agreement, Contractor shall submit an invoice.

Owner shall pay Contractor within ______ days from the date of Contractor's invoice.

OR:

[ ] Contractor shall be paid $ _____ upon signing this Agreement and the remaining amount due

when Contractor completes the services and submits an invoice. Owner shall pay Contractor within

______ days from the date of Contractor's invoice.

4. Time of Completion

The work to be performed under this Agreement shall commence on ___________ and be

substantially completed on or before _____________.

5. Permits and Approvals

(Check applicable provision.)

[ ] Owner shall be responsible for determining which state and local permits are necessary for

performing the specified work, and for obtaining and paying for the permits.

OR:

[ ] Contractor shall be responsible for determining which state and local permits are necessary for

performing the specified work, and for obtaining and paying for the permits.

6. Limited Warranty

Contractor warrants that all work shall be completed in a good workmanlike manner and in

compliance with all building codes and other applicable laws.

7. Site Maintenance

Contractor agrees to be bound by the following conditions when performing the specified work:

• Contractor shall remove all debris and leave the premises in a broom clean condition.

• Contractor shall perform the specified work during the following hours: ______

• Contractor agrees that disruptively loud activities shall be performed only at the following times:

____________________.

• At the end of each day's work, Contractor's equipment shall be stored in the following location:

_______________________.

8. Subcontractors

Contractor may at its discretion engage subcontractors to perform services under this Agreement, but

Contractor shall remain responsible for proper completion of this Agreement.

9. Independent Contractor Status

Contractor is an independent contractor, not Owner's employee. Contractor's employees or

subcontractors are not Owner's employees. Contractor and Owner agree to the following rights

consistent with an independent contractor relationship.

• Contractor has the right to perform services for others during the term of this Agreement.

• Contractor has the sole right to control and direct the means, manner and method by which the

services required by this Agreement will be performed.

• The Contractor or Contractor's employees or subcontractors shall perform the services required

by this Agreement; Owner shall not hire, supervise or pay any assistants to help Contractor.

• Owner shall not require Contractor or Contractor's employees or subcontractors to devote full

time to performing the services required by this Agreement.

• Neither Contractor nor Contractor's employees or subcontractors are eligible to participate in any

employee pension, health, vacation pay, sick pay or other fringe benefit plan of Owner.

10. Local, State and Federal Taxes

Contractor shall pay all income taxes, and FICA (Social Security and Medicare taxes) incurred while

performing services under this Agreement. Owner will not:

• withhold FICA from Contractor's payments or make FICA payments on Contractor's behalf

• make state or federal unemployment compensation contributions on Contractor's behalf, or

• withhold state or federal income tax from Contractor's payments.

The charges included here do not include taxes. If Contractor is required to pay any federal, state or

local sales, use, property or value added taxes based on the services provided under this Agreement,

the taxes shall be separately billed to Owner. Contractor shall not pay any interest or penalties incurred

due to late payment or nonpayment of any taxes by Owner.

11. Insurance

Contractor agrees to obtain adequate business liability insurance for injuries to its employees and

others incurring loss or injury as a result of the acts of Contractor or its employees or subcontractors.

12. Terminating the Agreement

(Check and complete applicable provision.)

[ ] With reasonable cause, either Owner or Contractor may terminate this Agreement effective

immediately by giving written notice of cause for termination. Reasonable cause includes:

• a material violation of this Agreement, or

• nonpayment of Contractor's compensation after 20 days written demand for payment.

Contractor shall be entitled to full payment for services performed prior to the effective date of

termination.

OR:

[ ] Either Owner or Contractor may terminate this Agreement at any time by giving _____ days

written notice of termination. Contractor shall be entitled to full payment for services performed

prior to the date of termination.

13. Exclusive Agreement

This is the entire Agreement between Contractor and Owner.

(Optional: Check if applicable.)

[ ] 14. Modifying the Agreement

Owner and Contractor recognize that:

• Contractor's original cost and time estimates may be too low due to unforeseen events, or to

factors unknown to Contractor when this Agreement was made

• Owner may desire a mid-project change in Contractor's services that would add time and cost to

the project and possibly inconvenience Contractor, or

• Other provisions of this Agreement may be difficult to carry out due to unforeseen

circumstances.

If any intended changes or any other events beyond the parties' control require adjustments to this

Agreement, the parties shall make a good faith effort to agree on all necessary particulars. Such

agreements shall be put in writing, signed by the parties and added to this Agreement.

15. Resolving Disputes

If a dispute arises under this Agreement, any party may take the matter to court.

If any court action is necessary to enforce this Agreement, the prevailing party shall be entitled to

reasonable attorney fees, costs and expenses in addition to any other relief to which he or she may be

entitled.

16. Notices

All notices and other communications in connection with this Agreement shall be in writing and shall

be considered given as follows:

• When delivered personally to the recipient's address as stated on this Agreement

• Three days after being deposited in the United States mail, with postage prepaid to the recipient's

address as stated on this Agreement, or

• When sent by fax or telex to the last fax or telex number of the recipient known to the person

giving notice. Notice is effective upon receipt provided that a duplicate copy of the notice is

promptly given by first class mail, or the recipient delivers a written confirmation of receipt.

17. No Partnership

This Agreement does not create a partnership relationship. Neither party has authority to enter into

contracts on the other's behalf.

19. Applicable Law

This Agreement will be governed by the laws of the State of _____________.

Signatures

Owner:

_________________________ [Name of Owner]

By: ____________________________

Signature

_________________________ [Typed or Printed Name]

Title: _________________________

Date: _________________________

Contractor:

_________________________ [Name of Contractor]

By: ____________________________

Signature

_________________________ [Typed or Printed Name]

Title: _________________________

Taxpayer ID Number: _________________

Date: _________________________