Fillable Printable Installment Agreement Request Form

Fillable Printable Installment Agreement Request Form

Installment Agreement Request Form

Installment Agreement Request

We will always ask you to immediately pay your tax liability (including interest and penalties) in full. We encourage you to

borrow from private sources to immediately pay your tax liability in full. If you are financially unable to pay the tax liability

in full, you may be eligible to make payments in installments over time. We recommend you make the largest monthly

payment possible because your tax liability continues to accrue interest and applicable penalties until paid in full.

Eligibility

You may be eligible for an installment agreement if the following conditions apply:

• The tax liability you owe does not exceed $25,000.

• The installment period for payment does not exceed 60 months.

• You have filed all required valid personal income tax returns.

• You are not in an existing installment agreement.

Taxpayer Installment Agreement Conditions

You agree to:

• Make timely monthly payments until your tax liability is paid in full.

• Maintain adequate funds in your bank account.

• File all required valid personal income tax returns timely.

• Pay all future income tax liabilities timely.

• Pay a $34 installment agreement fee, which we will add to your tax liability. The fee amount is subject to change without

further notice.

• If the tax liability you owe exceeds $10,000 or the installment agreement period for payment exceeds 36 months, or

both, then you must certify that you have a financial hardship. In cases of financial hardship, installment agreements are

subject to periodic review.

• Confirm that the withholding rates for Employment Development Department Form DE 4 and Internal Revenue Service

W-4 on file with your employer will withhold enough state income tax to pay your state income tax liability for your next

state income tax return. If the withholding rates are insufficient, make changes to the forms accordingly.

• Make any required estimated payments if you receive income from sources other than wages.

We approve or reject your request based on your ability to pay and your compliance history. We may file a lien and/or

request a financial statement as a condition for approval. If you fail to prove or if you misrepresent your financial condition,

we may reject your installment agreement request.

Electronic Funds Transfer (EFT)

To authorize electronic funds withdrawal from your bank account, you must complete and sign the EFT Authorization

on PAGE 3 of FTB 3567. Your authorization allows us to automatically withdraw the agreed-upon funds from your bank

account monthly on a date you specify. You must select an automatic withdrawal date that is no later than the 28th day of

the month. If you select a date after the 28th, we will withdraw the amount on the 28th of each month. Failure to select a

date will delay processing your installment agreement request.

Insufficient Funds

To avoid any dishonored payment penalties and possible termination of your installment agreement, maintain adequate

funds in your bank account to cover each monthly payment until you pay your tax liability in full.

State Tax Liens

We may file a state tax lien to protect the state’s interest until you pay off your tax liability (Government Code

Sections 7170-7173). This can affect your credit report.

Franchise Tax Board Privacy Notice

For privacy information, go to ftb.ca.gov and search for privacy notice. To request this notice by mail, call 800.338.0505

and enter form code 948 when instructed. If outside the United States, call 916.845.6500.

FTB 3567 (REV 07-2014) C2 PAGE 1

Franchise Tax Board

State of California

How to Request an Installment Agreement

Online

Go to ftb.ca.gov and search for installment agreement,

select online and follow the instructions on the Installment

Agreement – Apply Online page.

Only newly assessed liabilities may qualify for an

online installment agreement.

By Mail

Complete and sign PAGE 3 of the enclosed FTB 3567,

Installment Agreement Request. Mail to: STATE OF

CALIFORNIA, FRANCHISE TAX BOARD, PO BOX 2952,

SACRAMENTO CA 95812-2952.

Incomplete information will delay processing your request.

Do not submit this form if you have an existing installment

agreement or a current wage garnishment (Order to

Withhold, Continuous Order to Withhold, or Earnings

Withholding Order for Taxes). If any of these situations

apply to you, call us at 800.689.4776.

By Phone

800.689.4776, 8 a.m. to 5 p.m. weekdays, except state

holidays. For persons with hearing or speech impairments,

call 800.822.6268 (TTY/TDD).

To Check the Status of Your Submitted Request

If you applied online – Go to ftb.ca.gov, search for

installment agreement and select if you applied online.

You will need to enter your social security number and the

confirmation number you received when you submitted

your request.

If you applied by mail or phone – You should receive

written notification from us within 30 days from the date

we received your request. If you do not hear from us after

30 days, call us at 800.689.4776.

While you are waiting for approval of your installment

agreement request, we recommend that you make the

monthly payment you proposed. To pay online (Web Pay)

or to pay by credit card, go to ftb.ca.gov and search for

payment options. To pay by check or money order, make

payment payable to FRANCHISE TAX BOARD and write

your account number on your payment. Mail your payment

to: STATE OF CALIFORNIA, FRANCHISE TAX BOARD,

PO BOX 942867, SACRAMENTO CA 94267-0011.

If We Accept Your Installment Agreement Request, we

will send you a notice confirming the payment amount

and the due date for each monthly payment. We will also

let you know when the first payment under the installment

agreement is due. To avoid termination of the installment

agreement, you must continue to comply with the

installment agreement terms and conditions on PAGE 1

of this form. If you break any of the installment agreement

terms or conditions, we will send you a notice of our

intent to terminate the installment agreement thirty (30)

days prior to the termination and state the reason for

such action.

If We Reject Your Installment Agreement Request, you

may request, in writing, an independent administrative

review. You must send your written request within 30 days

of the date of the rejection of your installment agreement

request, otherwise collection actions may resume. Mail

your written request and any supporting documents to:

Executive and Advocate Services, MS A381, PO Box 157,

Rancho Cordova CA 95741-0157.

Future State and Federal Refunds and Interagency

Intercept Collections

We will keep any state tax refund you are due and apply it

towards your tax liability. This action does not replace your

monthly payment. We may also submit your account to the

Federal Treasury Offset Program. An offset is when the

federal tax refund you would have received is used to pay

all or a portion of a state income tax debt you owe. This

may result in an additional offset fee. If the full amount

owed is not collected in one year, we may offset future

federal payments to satisfy your tax debt. We may also

intercept any funds due to you from another state agency.

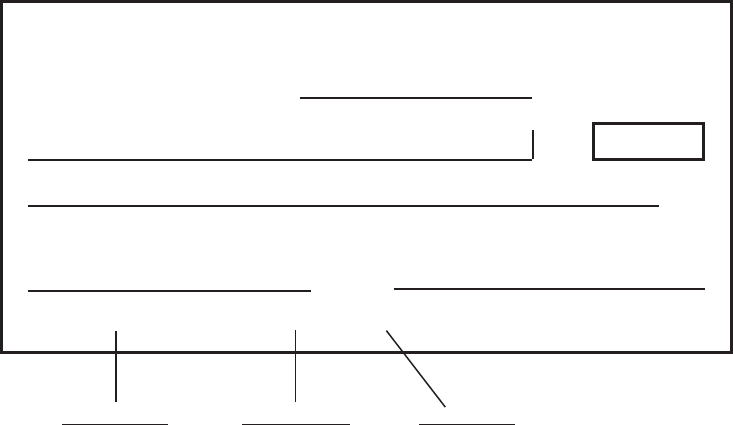

Where Do I Find My Bank Information?

The illustration below shows where your bank routing and

account numbers may be located on your check. You need

these numbers to complete the authorization for EFT. Do

not use a deposit slip to find the bank numbers and do not

send a canceled check with your request. Contact your

bank for assistance in identifying the routing numbers and

your account number.

You must use a regular checking or savings account.

Your Name

1234

1234 Main Street

Anytown, CA 99999

15-0000/0000

20

PAY TO THE

ORDER OF

$

DOLLARS

ANYTOWN BANK

Anytown, CA 99999

FOR

I : 250250025 I : 202020 • 1234

Routing number Account number Check number

Mandatory e-Pay

Beginning on or after January 1, 2009, California

Revenue and Taxation Code (R&TC) Section 19011.5

requires taxpayers to remit all tax payments electronically,

regardless of the taxable year for which the payment

applies, once any estimated tax or extension payment

exceeds $20,000, or their tax liability exceeds $80,000 for

any taxable year beginning on or after January 1, 2009.

Failure to comply with this requirement will result in a

penalty of 1 percent of the amount paid, unless your

failure to pay electronically was for reasonable cause

and not willful neglect (R&TC Section 19011.5). For more

information, refer to the enclosed FTB 1140, Personal

Income Tax Collection Information, or go to ftb.ca.gov

and search for mandatory epay. If you are not required to

make electronic payments, you can pay online with Web

Pay. Go to ftb.ca.gov and search for payment options.

If you pay by check or money order, write your account

number on your payment to ensure we accurately credit

your account.

FTB 3567 (REV 07-2014) C2 PAGE 2

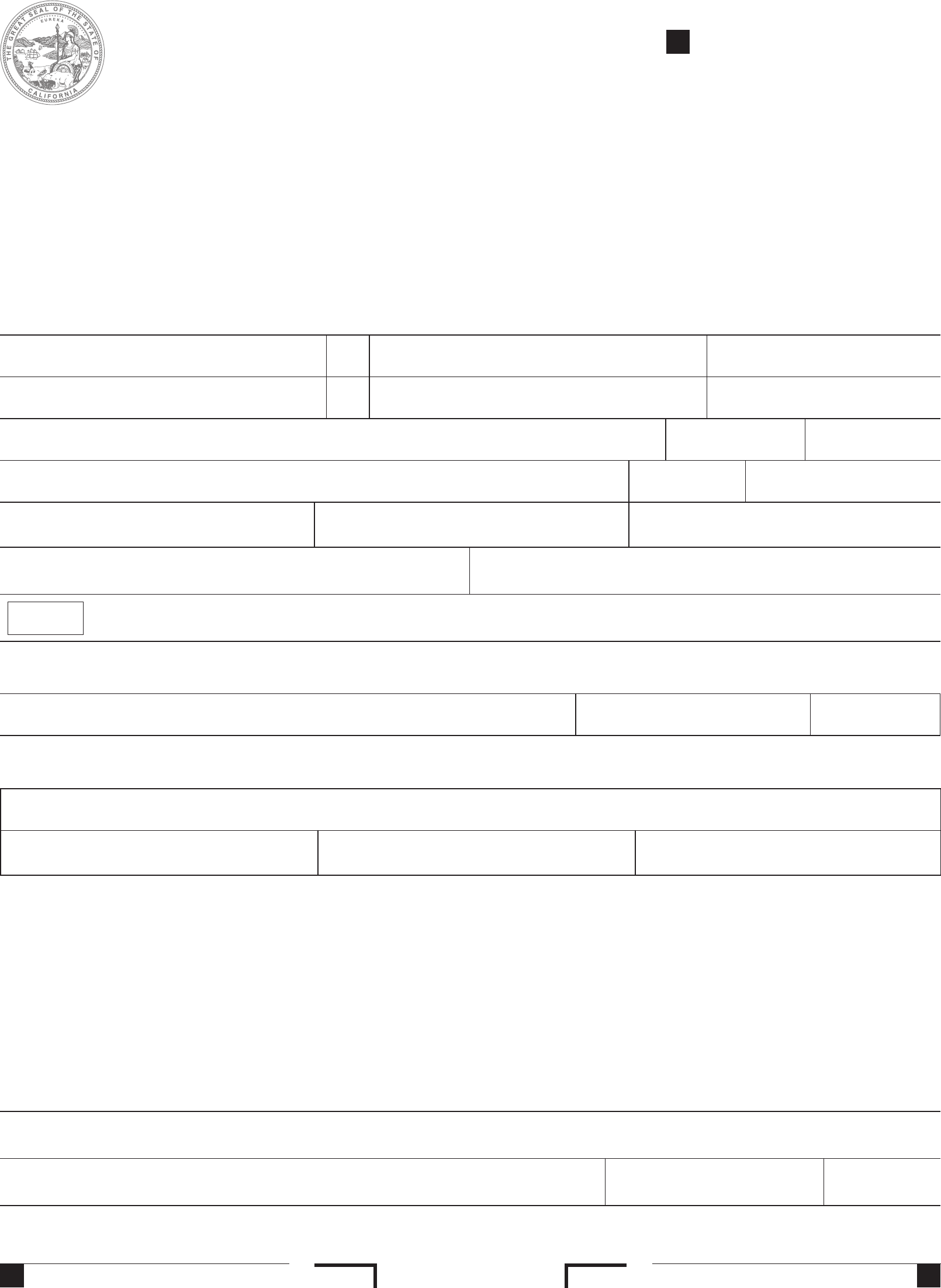

Installment Agreement Request

Complete and sign this page. Mail it to: FRANCHISE TAX BOARD, PO BOX 2952, SACRAMENTO CA 95812-2952. If

we approve your request, we agree to accept monthly installment payments instead of immediate payment in full. In

return, you agree to the taxpayer installment agreement conditions on PAGE 1 of this form. Failure to provide complete

information will delay processing your request. Do not attach this form to your income tax return. Do not submit this form

if you have an existing installment agreement or a current wage garnishment (Order to Withhold, Continuous Order to

Withhold, or Earnings Withholding Order for Taxes).

If your request is for a joint tax liability, print the names and social security numbers (SSNs) or FTB identification

numbers (ID) in the same order as on your California state income tax return.

First Name: M.I.: Last Name: SSN or FTB ID (required):

If Joint, Spouse’s/RDP’s First Name

1

: M.I.: Last Name: Spouse’s/RDP’s SSN or FTB ID:

Current Home Address – Number and Street, PO Box, or Rural Route: Apt. No.: PMB No.:

City, Town, or Post Office: State: ZIP Code:

Home Phone Number: Work Phone Number: Spouse’s/RDP’s Work Phone Number:

( ) _____________________________ ( ) ____________________ Ext. ________ ( ) ____________________ Ext. ________

Box 1. Enter Payment Amount You Will Pay Each Month: Box 2. Enter a Date (no later than the 28th) You Will Make Each Payment:

$

Print Name: Phone Number: Date:

The tax liability I owe exceeds $10,000 or the installment period for payment exceeds 36 months, or both.

By initialing this box, I certify that I have a financial hardship.

E Signature Required for Installment Agreement Request: By my signature, I certify that I have read and agree to the taxpayer installment agreement

conditions on PAGE 1.

X

Electronic Funds Transfer (EFT) Authorization

I authorize an electronic funds withdrawal for the following:

Bank Name and Address:

Bank Routing Number: Bank Account Number: Check One:

Checking Savings

I certify that I have the authority to request an electronic funds withdrawal from the account identified above, and I

authorize the Franchise Tax Board (FTB) to initiate and process electronic funds withdrawal entries to the above account.

This authorization remains in effect until one of the following occurs: 1) All unpaid tax liabilities due or becoming due

during the course of this agreement are paid. 2) FTB terminates the installment agreement. 3) FTB receives written notice

of cancellation of this EFT authorization within five business days prior to the payment due date.

I request that the payment amount in Box 1 above be withdrawn by EFT from my bank account each month on the date

specified in Box 2 above. If this date falls on a Saturday, Sunday, or state holiday, I authorize the transfer for the next

business day.

If FTB cannot deduct the monthly payment from my bank account because of insufficient funds or because my account

is closed, FTB may terminate my installment agreement. I understand that FTB may charge me a dishonored payment

penalty and a collection fee. I will also be responsible for any overdraft fees charges on my account.

E Signature Required for EFT Authorization:

X

Print Name: Phone Number: Date:

1

RDP refers to a registered domestic partner or partnership.

FTB 3567 (REV 07-2014) C2 PAGE 3

356700081373

Franchise Tax Board

State of California