Fillable Printable Installment Agreement Request - Georgia

Fillable Printable Installment Agreement Request - Georgia

Installment Agreement Request - Georgia

Installment Agreement Request

PLEASE READ:

Instructions for Form GA- 9465, Installment Agreement Request

General Instructions

Purpose of Form

Use Form GA-9465 to request a monthly installment plan if

you cannot pay the full amount you owe shown on your tax

return (or on a notice we sent you). Generally, you can have

up to 36 months to pay. Before requesting an installment

agreement, you should consider other less costly alternatives,

such as getting a bank loan or using available credit on a

credit card.

Do not file this form if you are in bankruptcy or have a pending

offer-in-compromise. If your tax liability has been assigned to

a private collection agency, contact that particular agency for

payment plan options.

How the Installment Agreement Works

We will usually let you know within 30 days after we receive

your request whether it is approved or denied. If we approve

your request, you will receive a notice detailing the terms

of the agreement. Please note that an additional $50

administration fee will be added to the fi rst payment due.

You may qualify to pay a reduced fee of $25 if your income is

less than $22,050.

You will also be charged interest and may be charged a late

payment penalty on any tax not paid by its due date, even if

your request to pay in installments is granted. Interest and

any applicable penalties will be charged until the balance is

paid in full. To limit interest and penalty charges, file your

return on time and pay as much of the tax as possible with

your return (or notice). All payments received will be applied

to your account in the best interests of the State of Georgia.

Also, any refund due you in a future tax period may be applied

against the amount you owe. If there remains a balance after

the refund is applied, you are still required to make your

regular monthly payments until the liability is paid in full. If the

offset of your refund pays the assessment in full, we will

cancel the automatic debit from your account. Any

overpayment of your account will be refunded to you.

Payment Method

The Department of Revenue accepts payment by electronic

funds withdrawal from your checking or savings account at a

bank or other financial institution.

Modification of an Installment Agreement

After an installment agreement is approved, you may submit a

request to modify the original agreement. If the modification

is approved, the Department will charge you a $50

administration fee.

You may qualify to pay a reduced

administrative fee of $25 if your income is less than $22,050.

You must comply with the existing agreement while the

Department considers your request to modify the agreement.

Termination of an Installment Agreement

If you do not make your payments on time or do not pay any

balance due on a return you file later, you will be in default on

your agreement and we may take enforcement actions, such

as the filing of a state tax execution or a levy or garnishment

action, to collect the entire amount you owe.

•

DO NOT submit this form if you are currently in bankruptcy, have unfiled state tax returns that are past due, have a pending

•

DO try and submit this form electronically by visiting the Department’s Georgia Tax Center at https://gtc.dor.ga.gov.

•

DO enter the Letter ID in Line 1 if you received a notice from the Department showing an amount due.

Please note that you will not be able to submit an installment payment agreement request via the Georgia Tax Center if you

have an active protest or appeal, are subject to a Department enforcement action, are in bankruptcy, have an accepted offer

in compromise, or already have an active payment plan with the Department.

offer in compromise with the Department, or your state tax liability has been assigned to a private collection agency.

If your liability has been assigned to a private collection agency, contact that agency.

If a tax execution has already been recorded prior to the

approval of the agreement, the Department will not initiate

enforcement action against you to collect the outstanding tax

debt. Upon default of the installment agreement, the Depart-

ment may initiate all appropriate enforced collection activity.

The issuance of a tax execution will result in the imposi-

tion of an additional 20% collection fee that will be added

to the tax liability.

By approving your request, we agree to let you pay the tax you

owe in monthly installments instead of immediately paying the

amount in full. In return, you agree to make your monthly

payments on time. You also agree to meet all your future tax

liabilities. For example, this means that you must have

enough withholding or estimated tax payments so that your

income tax liability for future years is paid in full when you

timely file your return. Your request for an installment agree-

ment will be denied if all required tax returns have not been

filed.

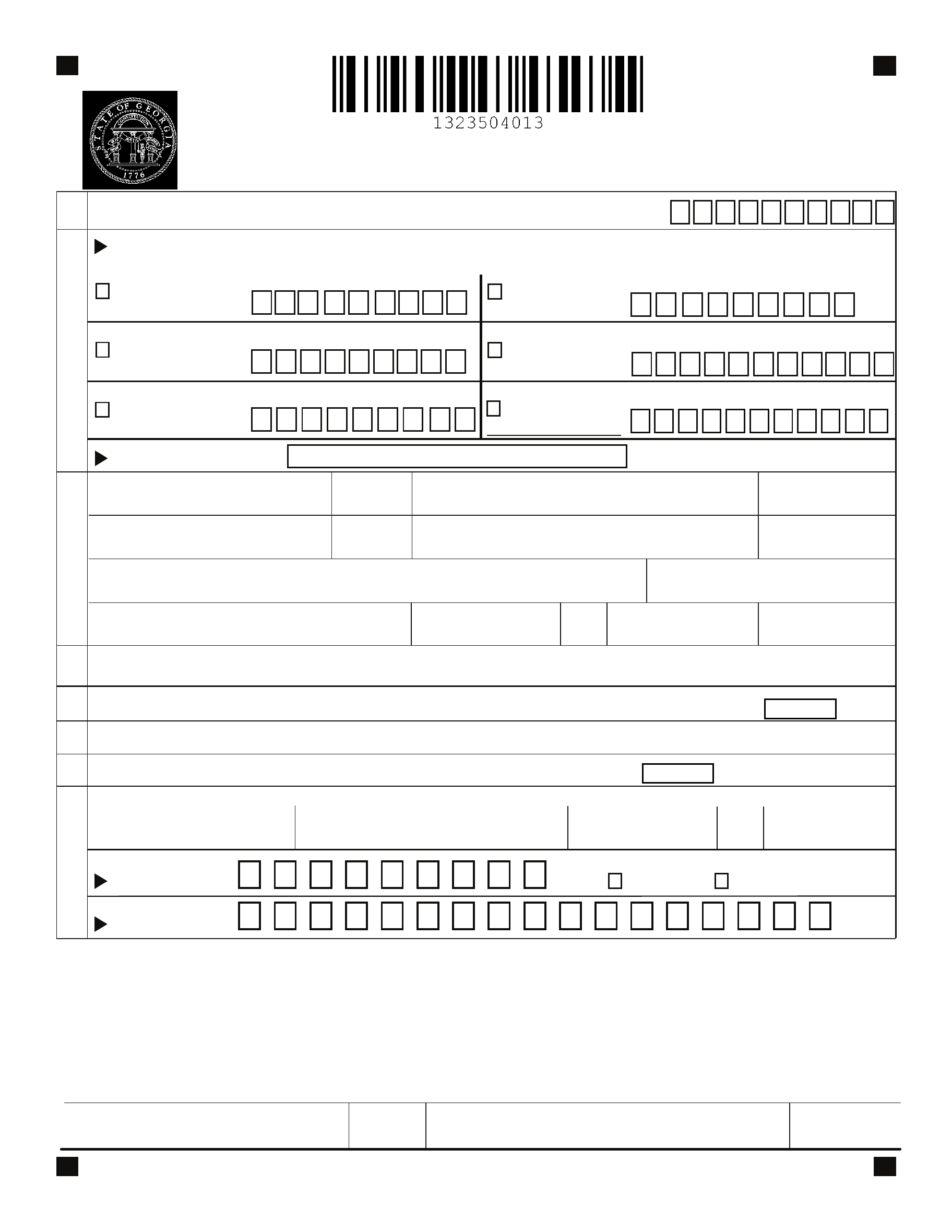

Check tax type and enter the related tax identification number and tax periods at issue:

1.

L

2.

4.

Enter the total amount you owe as shown on your tax return or notice: _______________________

5.

Enter the total number of months subject to the installment payment agreement, not to exceed 36 months:

6.

Enter the amount you will pay each month:

Enter the day (1

st

to 28

th

) your monthly payment will be debited from your bank account:

8.

All payments must be made by electronic funds withdrawal from your checking account. Complete the following information:

Name of Financial Institution Address

b.

Routing Number:

a.

Checking Savings

7.

Account Number:

Georgia Department of Revenue

Installment Agreement Request

Form

GA-9465

(Rev. 2/2013)

Page 1

Taxpayer’s First Name

Middle Initial Last Name

Social Security Number

If a joint liability, Spouse’s First Name

Middle Initial Last Name Social Security Number

Business Name

(use if business is requesting installment payment agreement)

Federal Employer Identification No.

Taxpayer’s Mailing Address City State ZIP

Phone Number

3.

Your Signature Date

Spouse’s Signature(if a joint return, both must sign)

Date

9.

City State ZIP

Enter tax periods at issue:

_ _ _ _ _ _ _ _ _ _

Withholding Tax

Other

TAX ID:

Individual Income Tax

SSN:

FEIN:

Corporate

Income Tax

Sales and Use Tax

STN:

IFTA Fuel Tax

IFTA: GA

WTN:

-

-

-

-

_ _ _ _ _ _ _ _ _ _

If you received a notice showing an amount due, please enter the Letter ID number listed on the notice (if available):

I hereby waive all rights of any additional notice or appeal concerning the assessment and collection of any part or all of the tax liability to

be paid by means of this installment payment agreement request. I specifically waive the 30 day period to contest any notice of proposed

assessment issued under O.C.G.A. § 48-2-46 and the right to appeal any final assessment notice issued under O.C.G.A § 48-2-47.

I authorize the Georgia Department of Revenue and its designated financial agent to initiate a monthly ACH electronic funds withdrawal entry to the

financial institution account indicated above for payments of the state taxes owed and the financial institution to debit the entry to this account. I also

authorize the financial institutions involved in the processing of electronic payments of taxes to receive confidential information necessary to answer

inquires and resolve issues related to those payments. By mutual agreement, it is understood that any tax refund, state or federal, will be applied

through offset to the liability included in this payment agreement request until such is fully paid and satisfied. Your signature acknowledges that

you have waived all rights of any additional notice, refund, or appeal concerning the assessment and collection of any part or all of the

tax liability to be paid by means of this installment payment agreement request.

MAIL TO:

Georgia Department of Revenue

Processing Center

PO Box 740396

Atlanta, GA 30374-0396

Provide all requested information. If you are making this

request for a joint tax return, show the names and social

security numbers (SSNs) in the same order as on your tax

return. If you are making this request for a business, show

the name of the person responsible for paying any sales or

withholding taxes and the related social security numbers on

line 3.

Line 1

If you received a notice from the Department showing an

amount due, enter the Letter ID listed on the notice. Doing so

will help the Department process your request.

Line 2

Line 4

Enter the total amount you owe as shown on your tax return

or notice.

Line 5

Enter the total number of months subject to the installment

payment agreement not to exceed 36 months.

Line 6

Enter the amount you can pay each month. Interest and

penalties will continue to accrue until you pay in full.

Line 7

Enter the day your monthly payment will be debi ted from your

bank account (1st to the 28th).

Line 8

Line 8a

The routing number must be nine digits. The first two digits of

the routing number must be 01 through 12 or 21 through 32.

Use a check to verify the routing number. On the sample

check on this page, the routing number is 250250025. But if

your check is payable through a financial institution do not use

the routing number on that check. Instead, contact your

financial institution for the correct routing number. Do not

use the routing number indicated on your deposit slip.

Line 8b

The account number can be up to 17 characters (both

numbers and letters). Include hyphens but omit spaces and

special symbols. Enter the number from left to right and leave

any unused boxes blank. On the sample check below, the

account number is 20202086. Do not include the check

number.

Line 9

You (or in the case of a business, the person responsible for

remitting payments) must sign the statement. This signature

authorizes the Georgia Department of Revenue to use the

information on this form to make monthly withdrawals from the

account listed in Line 8. This authorization remains in force

until the Department receives written notification from you.

Your signature also acknowledges that you have waived all

rights of any additional notice, refund, or appeal concerning

the assessment and collection of any part or all of the tax

liability to be paid by means of this installment agreement

request.

Specific Instructions

To avoid processing delays,

Form

GA-9465

(Rev. 2/2013)

Page 2

•

V

O

I

D

In order to pay by electronic funds withdrawal from your check-

ing account at a bank or other financial institution (such as

mutual fund, brokerage firm, or credit union), you must fill in all

information requested in line 8. Check with your financial

institution to make sure that an electronic funds withdrawal is

allowed and to get the correct routing and account numbers.

Attach a blank check to your installment payment request and

mark “VOID” across the front.

(line 8a)

(line 8b)

Check the box to identify the tax type for the installment

payment agreement request and the corresponding tax identifi-

cation number.