Fillable Printable Installment Sale Agreement

Fillable Printable Installment Sale Agreement

Installment Sale Agreement

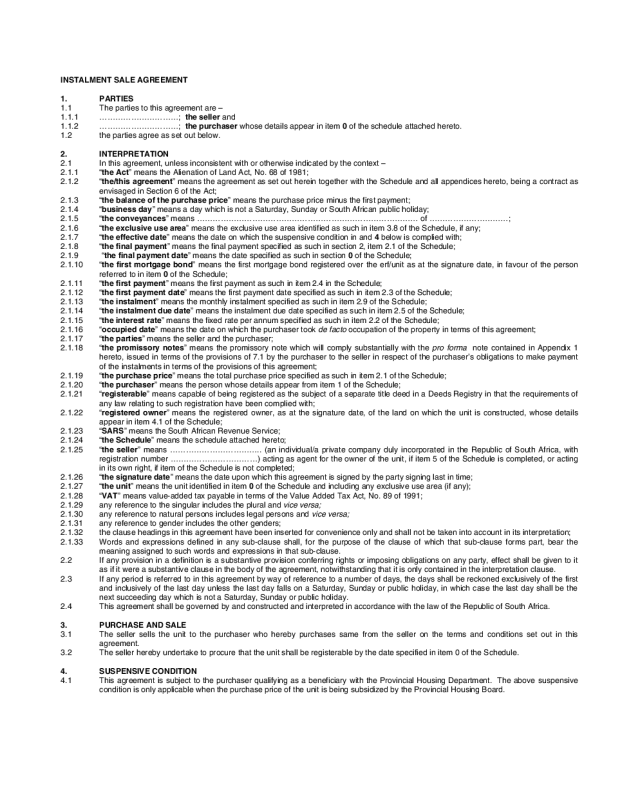

INSTALMENT SALE AGREEMENT

1.PARTIES

1.1The parties to this agreement are –

1.1.1…………………………; the seller and

1.1.2…………………………; the purchaser whose details appear in item 0 of the schedule attached hereto.

1.2the parties agree as set out below.

2.INTERPRETATION

2.1In this agreement, unless inconsistent with or otherwise indicated by the context –

2.1.1“the Act” means the Alienation of Land Act, No. 68 of 1981;

2.1.2“the/this agreement” means the agreement as set out herein together with the Schedule and all appendices hereto, being a contract as

envisaged in Section 6 of the Act;

2.1.3“the balance of the purchase price” means the purchase price minus the first payment;

2.1.4“business day” means a day which is not a Saturday, Sunday or South African public holiday;

2.1.5“the conveyances” means ………………………………………………………………………… of …………………………;

2.1.6“the exclusive use area” means the exclusive use area identified as such in item 3.8 of the Schedule, if any;

2.1.7“the effective date” means the date on which the suspensive condition in and 4 below is complied with;

2.1.8“the final payment” means the final payment specified as such in section 2, item 2.1 of the Schedule;

2.1.9 “the final payment date” means the date specified as such in section 0 of the Schedule;

2.1.10“the first mortgage bond” means the first mortgage bond registered over theerf/unit as at the signature date, in favour of the person

referred to in item 0 of the Schedule;

2.1.11“the first payment” means the first payment as such in item 2.4 in the Schedule;

2.1.12“the first payment date” means the first payment date specified as such in item 2.3 of the Schedule;

2.1.13“the instalment” means the monthly instalment specified as such in item 2.9 of the Schedule;

2.1.14“the instalment due date” means the instalment due date specified as such in item 2.5 of the Schedule;

2.1.15“the interest rate” means the fixed rate per annum specified as such in item 2.2 of the Schedule;

2.1.16“occupied date” means the date on which the purchaser took de facto occupation of the property in terms of this agreement;

2.1.17“the parties” means the seller and the purchaser;

2.1.18“the promissory notes” means the promissory note which will comply substantially with thepro forma note contained in Appendix 1

hereto, issued in terms of the provisions of 7.1 by the purchaser to the seller in respect of the purchaser’s obligations to make payment

of the instalments in terms of the provisions of this agreement;

2.1.19“the purchase price” means the total purchase price specified as such in item 2.1 of the Schedule;

2.1.20“the purchaser” means the person whose details appear from item 1 of the Schedule;

2.1.21“registerable” means capable of being registered as the subject of a separate title deed in a Deeds Registry in that the requirements of

any law relating to such registration have been complied with;

2.1.22“registered owner” means the registered owner, as at the signature date, of the land on which the unit is constructed, whose details

appear in item 4.1 of the Schedule;

2.1.23“SARS” means the South African Revenue Service;

2.1.24“the Schedule” means the schedule attached hereto;

2.1.25“the seller” means …………………………….. (an individual/a private company duly incorporated in the Republic of South Africa, with

registration number ……………………………) acting as agent for the owner of the unit, if item 5 of the Schedule is completed, or acting

in its own right, if item of the Schedule is not completed;

2.1.26“the signature date” means the date upon which this agreement is signed by the party signing last in time;

2.1.27“the unit” means the unit identified in item 0 of the Schedule and including any exclusive use area (if any);

2.1.28“VAT” means value-added tax payable in terms of the Value Added Tax Act, No. 89 of 1991;

2.1.29any reference to the singular includes the plural and vice versa;

2.1.30any reference to natural persons includes legal persons and vice versa;

2.1.31any reference to gender includes the other genders;

2.1.32the clause headings in this agreement have been inserted for convenience only and shall not be taken into account in its interpretation;

2.1.33Words and expressions defined in any sub-clause shall, for the purpose of the clause of which that sub-clause forms part, bear the

meaning assigned to such words and expressions in that sub-clause.

2.2If any provision in a definition is a substantive provision conferring rights or imposing obligations on any party, effect shall be given to it

as if it were a substantive clause in the body of the agreement, notwithstanding that it is only contained in the interpretation clause.

2.3If any period is referred to in this agreement by way of reference to a number of days, the days shall be reckoned exclusively of the first

and inclusively of the last day unless the last day falls on a Saturday, Sunday or public holiday, in which case the last day shall be the

next succeeding day which is not a Saturday, Sunday or public holiday.

2.4This agreement shall be governed by and constructed and interpreted in accordance with the law of the Republic of South Africa.

3.PURCHASE AND SALE

3.1The seller sells the unit to the purchaser who hereby purchasessame from the seller on the terms and conditions set out in this

agreement.

3.2The seller hereby undertake to procure that the unit shall be registerable by the date specified in item 0 of the Schedule.

4.SUSPENSIVE CONDITION

4.1This agreement is subject to the purchaser qualifying as a beneficiary with the Provincial Housing Department. The above suspensive

condition is only applicable when the purchase price of the unit is being subsidized by the Provincial Housing Board.

5.PAYMENT

5.1The purchaser shall pay the purchase price to the seller at the address specified in item 0 of the Schedule and at the times envisaged in

5.3 below.

5.2The purchase price is exclusive of VAT and shall bear interest as calculated in terms of 6 below.

5.3The purchaser shall pay to the seller –

5.3.1the instalments, the first instalment to be paid by the first payment date, and subsequent instalments to be paid by the instalment due

date in each succeeding month thereafter; the

5.3.2final payment by the final payment date; and

5.3.3the VAT calculated on the capital reduction component of each instalment, calculated at the rate of VAT as it applied from time to time

and averaged out in respect of all instalments as agreed with SARS.

5.4If the purchaser qualifies for a housing subsidy issued in terms of the Housing Act (Act 107 of 1997), then such subsidy payment shall be

applied by the seller for the benefit of the purchaser’s account -

5.4.1as the last payment in respect of the purchaser’s indebtedness to it; and

5.4.2only when the outstanding balance due by the purchaser equals the subsidy amount.

5.5The purchaser is obliged in terms of Section 15(2) of the Act to accept at any time during the currency of this agreement a loan secured

by a first mortgage bond over the erf/unit arranged by the seller if that loan is sufficient to cover the payment of all amounts owed by the

purchaser to the seller in terms of the agreement as well as the costs of registration of the mortgage bond. The purchaser shall give all

such assistance as the Act requires in order to register the mortgage bond after receiving a written notice from the seller requiring him to

accept a loan as contemplated in this clause 5.6

5.6All payments made by the purchaser shall be allocated in the first place to defray the costs, other than the purchase price, for which the

purchaser is liable in terms of this agreement, thereafter to defray interest, thereafter to defray VAT on the purchase price and finally, to

defray the purchase price.

5.7The purchaser shall at all times be entitled to –

5.7.1make any payment before the due date of such payment;

5.7.2make larger payments than the payments for which this agreement provides;

5.7.3tender payment of all amounts owing in terms of this agreement to the seller and to claim transfer of the unit against such payment; or

5.7.4claim transfer to the unit in terms of Section 27 of the Act once he/she has paid at least half the purchase price. If the purchaser

exercises his or her rights in terms of this section, the seller shall nevertheless be entitled to exercise any voting rights which attach to

the unit at any meeting of the body corporate of the sectional title scheme of which the unit is a part, until the full purchase price has

been paid by the purchaser.

6.INTEREST

6.1The balance of the purchase price shall accrue interest at the interest rate. Such interest shall be calculated –

6.1.1from the occupation date on the balance of the purchase price and for the period from that date until the last day of the month in which

that date falls;

6.1.2thereafter monthly in advance on the first day of each successive month on the balance of the purchase price outstanding on the last

day of the previous month.

6.2The interest calculated in terms of 6.1 shall be capitalised immediately when it is calculated.

7.PROMISSORY NOTES

7.1The purchaser shall on the effective date issue the promissory notes to the seller in respect of his or her obligations in terms of this

agreement to pay the instalments to the seller.

7.2Should the purchaser fail to issue the promissory notes in 7.1, such failure shall constitute a material breach of this agreement and the

seller shall be entitled to the remedies set out in 18 below.

7.3The seller shall be entitled to sell the promissory notes to any third party.

7.4The purchaser shall be entitled to make any payment in respect of the promissory notes before the due date of such payment or to make

larger payments than the payments for which the promissory notes provide, provided that in such event the amounts of the respective

payments to be made from time to time in terms of the promissory notes shall remain unaltered, but the number of payments shall

reduce commencing with the last payment to be made in respect of the promissory note.

8.POSSESSION, OCCUPATION, RISK, PROFIT AND LOSS

8.1It is recorded that at the occupation date the purchaser shall be in occupation of the unit.

8.2The risk of profit and loss in respect of the unit will pass to the purchaser on the occupation date.

8.3The purchaser shall, with effect from the occupation date, pay to the seller a levy equal to the participation quota of the unit multiplied by

all and any costs of any nature whatsoever actually incurred by the seller in respect of the sectional title scheme of which the unit forms

a part, in providing services to that sectional title scheme and in administering that sectional title scheme. In particular, but without

limitation, those costs included all and any rates and taxes payable by the seller in respect of the sectional title scheme, and the costs of

providing services common to all the occupants of all the units in the sectional title scheme such as lifts, cleaning and air conditioning.

8.4The levy to be paid by the purchaser shall, in respect of each and every month, be based on the seller’s estimates of the costs in

question. The seller shall, as soon as may be reasonably possible after the end of each and every one of its financial years, cause the

actual costs incurred by it to be determined and shall adjust the future levies payable by the purchaser in order to ensure that the levy

paid by the purchaser constitutes the participation quota of the unit of the costs actually incurred by the seller (as envisaged in 8.3

above).

8.5In case where erf/unit is not part of a sectional title scheme the purchaser shall, from occupation date, be liable to pay to the seller an

amount including (but not necessarily limited to) the rates and taxes and other imposts levied on the property (including charges for

water and electricity consumed, the insurance cover on the property and the costs of maintenance of the property).

8.6The purchaser shall be liable for his or her water and electricity consumption from the occupation date onwards.

8.7The purchaser shall, from the occupation date until the full purchase prince is paid, not permit more than the number of people specified

as such in item 3.9 in the schedule at any one time to reside in the unit.

3

9.WARRANTIES, REPRESENTATIONS AND GUARANTEES

9.1The unit is sold voetstoots.

9.2The purchaser shall be obliged to accept transfer subject to the conditions, reservations and servitudes affecting the unit.

9.3If upon a re-survey or re-measurement, the extent of the unit is found not to correspond to that set out in this agreement, then neither

party shall be entitled to claim for any shortfall or surplus.

9.4The purchaser acknowledges that save for the warranties contained in 9.5 below, no warranties, undertakings or representations

whatsoever have been made or given to him by the seller, whether expressly or impliedly.

9.5The seller warrants that –

9.5.1save for the first mortgage bond, the unit is not encumbered;

9.5.2no notice has been received by the seller of the intention of any authority to expropriate the unit of which the unit forms part of any

portion thereof;

9.5.3no legal action has been instituted against the seller and the seller has no knowledge of any contemplated legal action in terms whereof

the unit may be attached and transfer may be interdicted;

9.5.4it is entitled to dispose of the unit.

10.RECORDING OF THE AGREEMENT

10.1The seller shall effect a recording of the agreement in terms of Section 20 of the Act and, if it should fail to do so, the purchaser may

effect a recording in terms of that section.

10.2Notwithstanding 4 above, this clause shall come into effect on the signature date.

10.3Save for the first mortgage bond, the seller undertakes not to encumber the unit by mortgage bone on or before the date on which the

agreement is recorded.

11.COSTS TO BE BORNE BY THE PURCHASER

The purchaser shall be liable for the payment of all costs in connection with –

11.1the credit check of the purchaser in the amount specified as such in item 0 of the Schedule;

11.2the subsidy application in the amount as specified in item 0 of the Schedule;

11.3the drafting of this agreement in the amount specified as such in item 0 of the Schedule;

11.4the recording of this agreement in terms of Section 20 of the Act in the amount specified in item 0 of the Schedule;

11.5transfer of the unit to the purchaser in the amount specified as such in item 0 of the Schedule;

11.6the stamp duties payable in respect of the promissory note in the amount specified as such in item 0 of the Schedule.

12.MAINTENANCE AND REPAIR

With effect from the occupation date the purchaser shall at all times keep the unit in a tidy condition and in a proper state of repair.

13.USE AND ENJOYMENT

13.1The purchaser shall at all times –

13.1.1comply with the sectional title rules and building conduct rules of the sectional title scheme in which the unit is situated; and

13.2use the unit only for the occupation of the unit by the purchaser and his/her immediately family, provided that the purchaser may use the

unit for any other purpose if it had first obtained the prior written consent of the seller therefore, which consent shall, subject to any

applicable zoning laws, not be unreasonably withheld.

13.3The purchaser shall, from the occupation date until the full purchase price is paid, not permit more than the maximum number of people

as specified in item 3.9 of the Schedule, to reside in the property at any one time.

14.IMPROVEMENTS

14.1The purchaser shall not, under any circumstances, before the purchaser has paid the purchase price in full –

14.1.1make any improvements to the unit; or

14.1.2effect any changes to existing improvements on or to the unit.

14.2The purchaser shall not be entitled to any compensation for improvements made by him to the unit with or without the seller’s consent

except insofar as his or her rights in this respect are protected by Sections 15(1)(b) and 28(1)(a)(ii) of the Act.

15.INSPECTION

The seller’s representative shall at all reasonable times be entitled to enter upon the unit to inspect it or for any purpose connected with

the effective execution of this agreement.

16.TRANSFER

16.1Transfer of the unit shall be effected by the conveyancers against fulfilment by the purchaser of all his or her obligations in terms of this

agreement, and after cancellation of the first mortgage bond.

16.2The purchaser shall, within 5 (five) business days of being called upon to do so by the seller or theconveyancers furnish all such

information, attend at the conveyancers, and sign all such documents as may be necessary or required to enable theconveyancers to

transfer the unit to him.

17.LEASE OR RESALE

17.1The purchaser shall not during the currency of this agreement sell, let or otherwise part with possession or occupation of the unit or a

part of it without the prior written consent of the seller, which consent may be not unreasonably withheld. It is recorded, for avoidance of

doubt, that the seller shall not consent to the sale of the unit or a part of it by the purchaser, if the purchase price has not been paid in

full.

17.2The seller’s consent granted in terms of 17.1 above, shall in no way release the purchaser from any of his or her obligations in terms of

this agreement.

4

17.3Before the purchaser parts with possession or occupation of the unit as contemplated in 17.1 above, he/she shall furnish the seller with a

written undertaking by the person to whom possession or occupation is given that such person shall duly observe all the provisions of

this agreement insofar as they relate to occupants of the unit.

18.BREACH OF AGREEMENT BY THE PURCHASER

18.1The seller and purchaser agree that all the purchaser’s obligations in terms of this agreement are material.

18.2If the purchaser –

18.2.1breaches any of his or her obligations in terms of this agreement; and

18.2.2fails to comply with a notice served on him as set out in 18.3 below,

18.2.3the seller shall be entitled to act in terms of 18.4 below.

18.3The notice referred to in 18.2 above shall be handed to the purchaser or sent by registered post to the purchaser’s domicilium address

contained in the schedule (or any amended address of which the purchaser may notify the seller in accordance with Section 23 of the

Act) and shall contain –

18.3.1a description of the obligation which the purchaser has breached;

18.3.2a demand that the purchaser rectify the breach within a stated period which shall not be less than 30 (thirty) days provided that if, in that

same calendar year, 2 (two) such notices have already been served on the purchaser at an interval of more than 30 (thirty) days, the

stated period need not be longer than 7 (seven) days; and

18.3.3an indication of the steps which the seller intends taking if the breach is not rectified.

18.4In the circumstances set out in clause 18.2 above, the seller shall, without further notice and without prejudice to any other right or

remedy which it may have in terms of this agreement or at law, be entitled, but not obliged –

18.4.1to cancel this agreement;

18.4.2to repossess the unit;

18.4.3to recover from the purchaser all amounts then outstanding in terms of this agreement, together with interest up to the date of payment;

and

18.4.4to retain, as a penalty, all amounts, including the deposit, paid to it by the purchaser in terms of this agreement.

19.PURCHASER’S RIGHT OF TERMINATION

Notwithstanding any contrary provisions contained in this agreement, the purchaser shall be entitled to cancel this agreement within 5

(five) days after the signature date by written notice delivered to the seller, in terms of the provisions of Section 29A of the Act.

20.DOMICILE

The address of the seller and the address of the purchaser contained in the Schedule shall, in accordance with the provisions of Section

23 of the Act, serve as their respective domicillia citandi et executandi.

21.INFORMATION REQUIRED TO BE GIVEN TO THE PURCHASER IN TERMS OF THE ACT

The purchaser’s attention is drawn to –

21.1the extent of the unit indicated in the Schedule;

21.2the fact that no transfer duty is payable in respect of the unit (since the sale of the unit attracts VAT);

21.3his or her right or rights –

21.3.1under Section 11 of the Act to perform the obligations of the seller;

21.3.2under Section 17 of the Act as set out in 5.7.1, 5.7.2 and 5.7.3 above;

21.3.3under Section 20 of the Act as set out in 9 above;

21.3.4under Section 13(2) of the Act, to be temporarily absolved in certain circumstances from the liability to pay interest if the seller should

fail to furnish him with a copy of this agreement as required in terms of Section 13(1) of the Act;

21.3.5under Section 16(3) of the Act, to be temporarily absolved in certain circumstances from the liability to pay interest if the seller should

fail to furnish him with a statement of account as required in terms of Section 16(1) and (2) of the Act;

21.3.6under Section 23 of the Act, to inform the seller of a change of the address serving as his or her domicilium citandi et executandi and to

regard the seller’s address as its (the seller’s) domicilium citandi et executandi;

21.3.7under Section 27 of the Act, to claim transfer of the unit as set out in 5.7.4 above;

2.1.4his or her obligation –

2.1.4.1in terms of Section 9 of the Act (to notify every mortgagee of the conclusion of this agreement, of the purchaser’s address and of such

other particulars as the mortgagee may reasonably require to be furnished to it);

2.1.4.2in terms of Section 15(2) of the Act, to accept a loan secured by a mortgage bond over the unit if the seller arranges that loan and the

loan is granted;

2.1.4.3in terms of Section 21(1) of the Act (to give information to the owner);

2.1.5the limitation in terms of Section 19 of the Act of the right of the seller to take action against the purchaser unless the seller has given

notice as set out in 18.2 and 18.3 above.

22.WHOLE AGREEMENT

This agreement constitutes the whole agreement between the parties as to the subject matter hereof and no agreements,

representations or warranties between the parties regarding the subject matter hereof other than those set out herein are binding on the

parties.

23.VARIATION

No addition to or variation, consensual cancellation or novation of this agreement and no waiver of any right arising from this agreement

or its breach termination shall be of any force or effect unless reduced to writing and signed by all the parties or their duly authorised

representatives.

24.RELAXATION

No latitude, extension of time or other indulgence which may be given or allowed by any/either party to any/other party/ies in respect of

the performance of any obligation hereunder and no delay or forbearance in the enforcement of any right of any/either party arising from

this agreement and no single or partial exercise of any right of any/either party under this agreement, shall in any circumstances be

construed to be an implied consent or election by such party or operate as a waiver or a novation of or otherwise affect any of the party’s

right in terms of or arising from this agreement or estop or preclude any such party from enforcing at any time and without notice, strict

and punctual compliance with each and every provision or term hereof.

SIGNED at ______________________________ on ________________________________________

AS WITNESS:

_______________________________________For:

______________________________________________________________________________

(Names of witness in block letters)Duly Authorised

SIGNED at ______________________________ on ________________________________________

AS WITNESS:

______________________________________________________________________________

______________________________________________________________________________

(Names of witness in block letters)

6

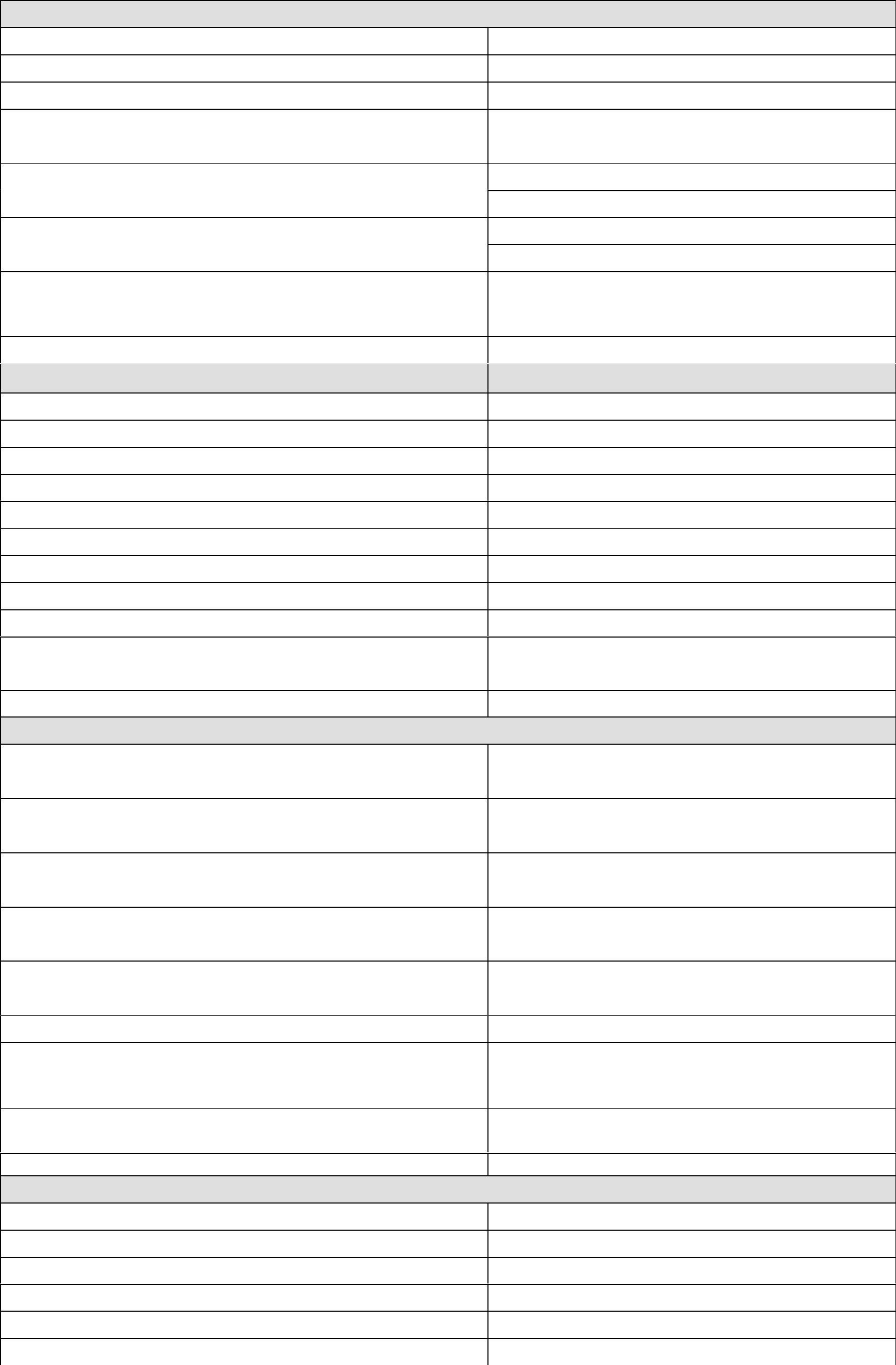

SCHEDULE

PURCHASER

Full Names:

Identify Number:

Marital Status:

Residential Address:

Work Address:

Telephone Number:

Full Names of Spouse (if applicable):

Identify Number of Spouse (if applicable):

PURCHASE PRICE AND PAYMENT

The Purchase Price

Interest Rate

First Payment Date

First Payment Amount

Payment Due Date

Final Instalment Date

Occupation Date

Number of Monthly instalments

2.10 Amount of Final Payment

2.11Monthly cost of rates and taxes, utilities

and house structure insurance

2.12 Monthly cost of Credit Insurance

UNIT

Erf/Section Number

Extent of Erf/Section Number:

Sectional Title Scheme Name (if applicable):

Sectional Title Scheme Number (if applicable):

Local Authority:

Province

An undivided share in the common unit in the scheme apportioned

to the said section in accordance with the participation quota (if

applicable):

Exclusive use area (created in terms of the Rules of the Body

Corporate) (if applicable):

Maximum occupants/Maximum adults/Ratio adults to children

OWNER

Name:

Business Address:

Postal Address:

Telephone Number

Facsimile Number

Contact Person

SELLER

Name:

Business Address:

Postal Address:

Telephone Number

Facsimile Number

Contact Person

OPENING OF SECTION TITLE REGISTER

The latest date by which the unit shall be registerable in the name

of the Purchaser:

COST

Cost of credit check of Purchaser:

Cost of subsidy application and administration

Cost of drafting of agreement:

Cost or recording of agreement:

Cost of transfer of unit:

Stamp duties in respect of promissory note:

FIRST MORTGAGE BOND

Name of Mortgagor/Mortgagee:

Address of Mortgagor/Mortgagee:

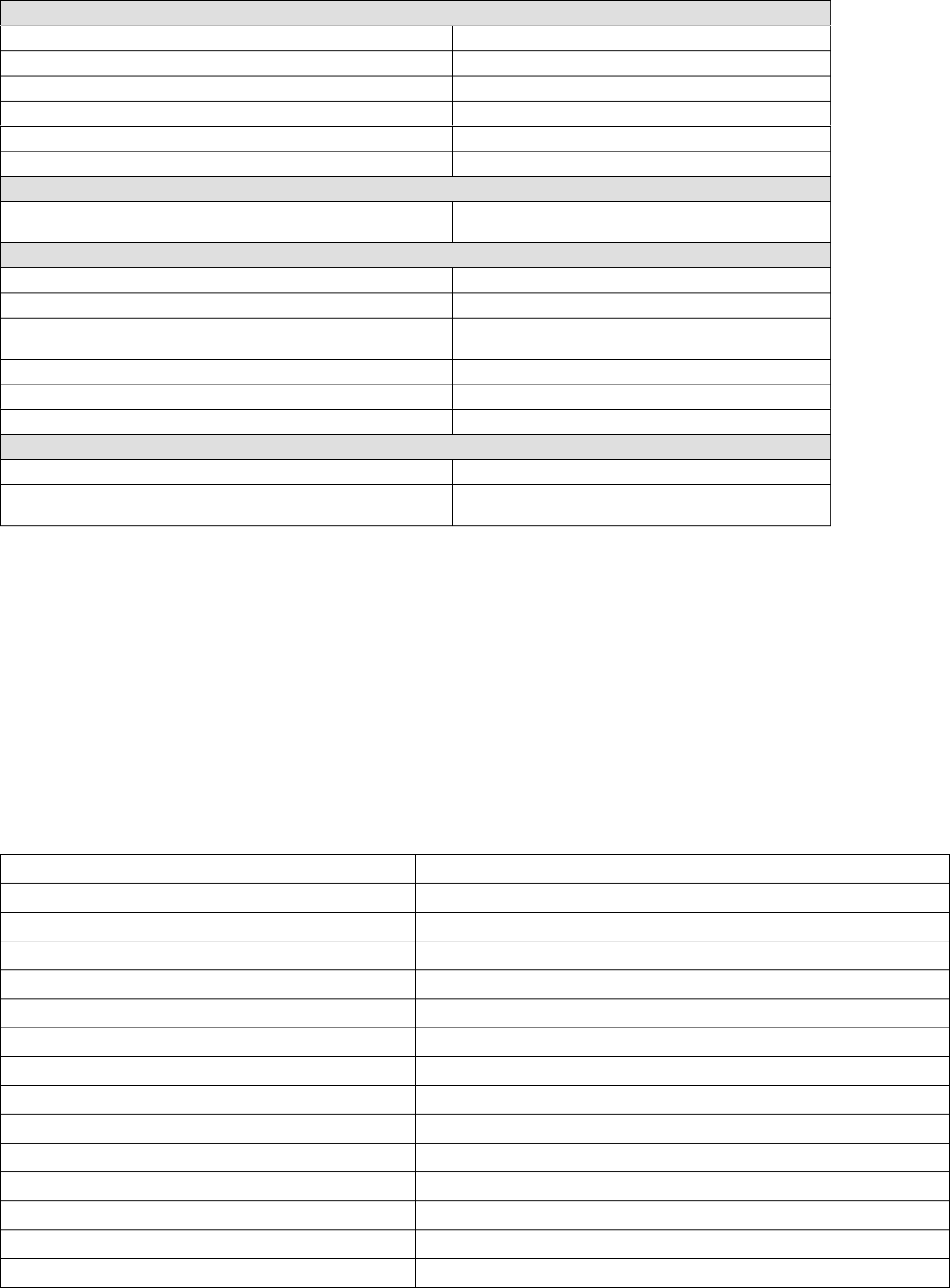

APPENDIX 1

PROMISSORY NOTE

I, the undersigned,…………………………………………… Identity Number……………………… hereby undertake to pay to

…………………………………….., Registration Number …………… or its order, the amount of R ………………………

(………………………………………………) plus interest at the rate of ……………% (………………………………………………….) per annum,

calculated and compounded monthly in advance from ……………………………………………. 20…….

The amount referred to above together with interest shall be paid to………………………………………… Registration Number

…………………………… in the instalments and on the dates listed below.

In the event of a default in payment of any instalment on the due date thereof, the full amount referred to above, together with interest shall

immediately become due and payable to ……………………………… Registration Number ……………………………

InstalmentDate

SIGNED at ____________________________________________ on this ______ day of _______________________________ 20……..