Fillable Printable Instructions for Preparing Break Even Analysis

Fillable Printable Instructions for Preparing Break Even Analysis

Instructions for Preparing Break Even Analysis

222 MULBERRY STREET

P.O. BOX 431

SCRANTON, PA 18501-0431

570.342.7711

570.347.6262

24-Hour Loan Information Line: 570.342.7711 extension 222

An affiliate of the Greater Scranton Chamber of Commerce

• Classify your costs into two groups for a specific time period: Direct and Indirect

*It is recommended that you use a one-month time period. Do not use a period of time greater

than one quarter.

Direct costs are caused by sales and increase or decrease as sales volume increases or decreases.

The following costs are examples of variable costs: cost of goods sold, direct labor, commissions, dis

counts, etc.

Indirect costs are those that will remain the same over a reasonable range of sales. The following costs

are examples of fixed costs: rent, loan payments, utilities, insurance, administrative salaries, advertising,

depreciation, supplies, etc.

• Determine the number of products and/or services sold over the determined period of time.

Use the same period of time that you used when determining direct and indirect costs.

• Determine the average sale price per unit for the products and/or services sold over the determined

period of time.

Use the same period of time that you used when determining direct and indirect costs.

• Calculate your costs per unit

Direct Cost Per Unit = Total Direct Costs / # Products and/or Services Sold

Indirect Cost Per Unit = Total Indirect Costs / # Products and/or Services Sold

Total Cost Per Unit = Direct Cost Per Unit + Indirect Cost Per Unit

*This number tells you the amount you will need to charge per item to break even.

•

Calculate your break even point

# of units to cover direct costs = Total Direct Costs / Average sale price per unit

# of units to cover indirect costs = Total Indirect Costs / Average sale price per unit

Total # of units sold to break even = # of units to cover direct costs + # of units to cover indirect costs

*This number tells you the number of products/services you will need to sell to break even.

MetroAction provides these sample documents solely to illustrate the information

needed to complete the loan application process. MetroAction is not responsible for

their use or any claims arising from their use. Your legal counsel, your accountant and

other professionals should be consulted in all relevant matters.

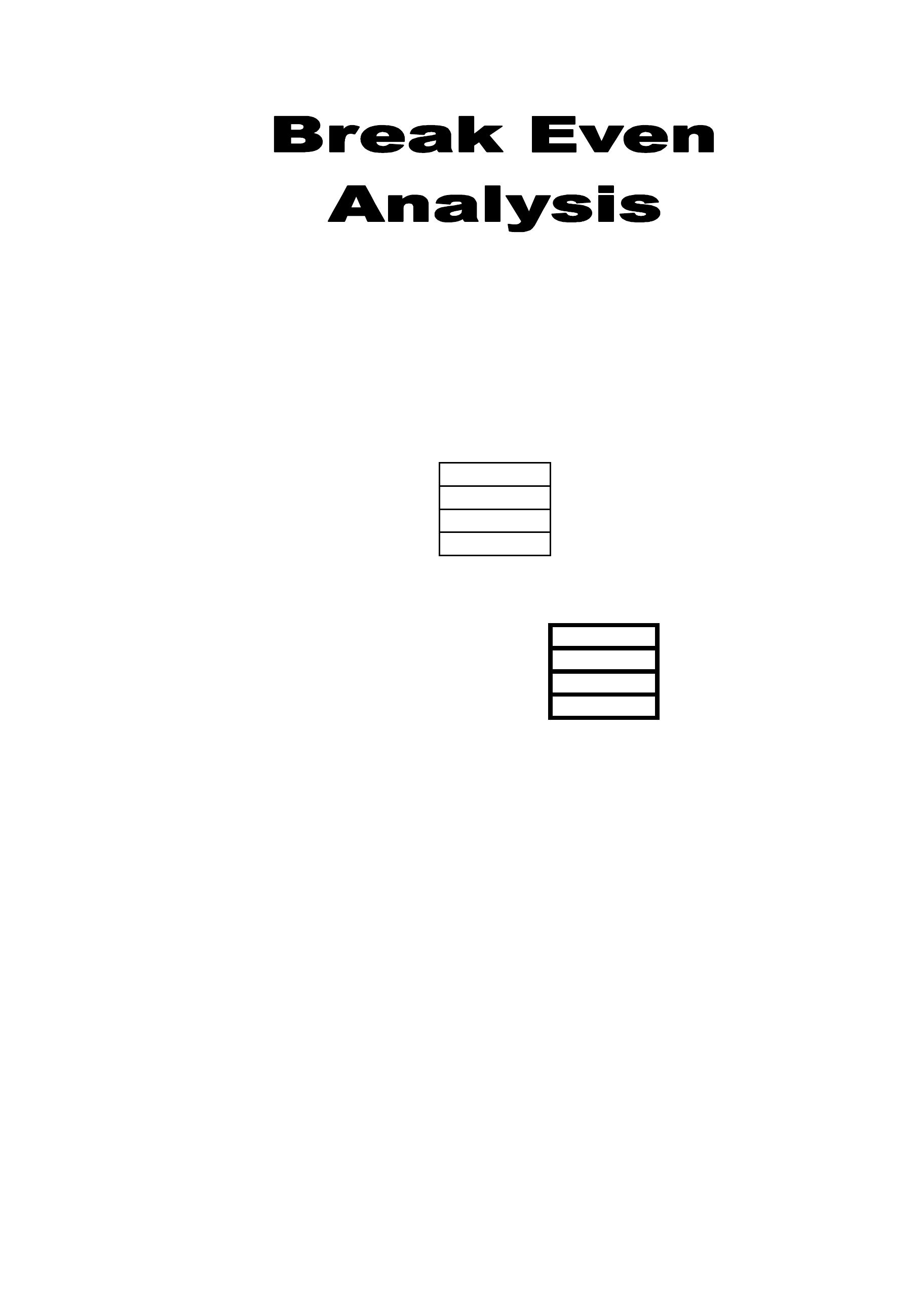

For Period: _________________________________________

A. Total direct costs for the month: $

B. Total indirect costs for the month: $

C. Total # of products/services sold for the month:

D. Average sale price per unit: $

Calculation Formula

F. Direct cost per unit A/C $

G. Indirect cost per unit B/C $

H. Break Even Sale Price F+G $

I. Break Even Units (A/D)+(B/D)

MetroAction provides these sample documents solely to illustrate the information needed to complete the loan

application process. MetroAction is not responsible for their use or any claims arising from their use. Your

legal counsel, your accountant and other professionals should be consulted in all relevant matters.