Fillable Printable Land Rental and Lease Form - New York

Fillable Printable Land Rental and Lease Form - New York

Land Rental and Lease Form - New York

Ground Lease

_________________________________,

Landlord

and

_________________________________,

Tenant

Location of Premises

Street: ________________

Town/Village/City: ________________

County: ________________

State: New York

Tax Map Identification No. ________________

- 1 -

FORM OF GROUND LEASE (2009):

This form was originally prepared by the Committee on Real Property Law of the Association of the Bar of the

City of New York. This form may have been altered by the user and any such alterations may not be apparent.

To view or download the original unaltered text of this form and a commentary about this form, visit the Real

Estate Forms site at the Reports/Publications/Forms link at www.nycbar.org. This form will not be suitable for

all transactions. No warranty or representation is made as to the legal sufficiency of the form

Ground Lease

AGREEMENT OF LEASE, dated as of __________, ____, 20__, between

__________________, a _______________ [corporation/limited partnership/limited liability

company], having offices at ________, _____________, New York _____, as landlord

(“Landlord”) and _______________, a _________ [corporation/limited partnership/limited liability

company], having offices at ________, _____________, New York ______, as tenant (“Tenant”).

WITNESSETH:

Landlord and Tenant, for themselves, their legal representatives, successors and permitted

assigns, hereby agree as follows:

Article I. Basic Terms and Definitions; Rules of Construction

Section 1.01

The following basic terms, as used in this Lease and in all amendments to the Lease

(unless otherwise specified or unless the context otherwise requires), shall have the meanings set

forth below:

(a)

Land: All that certain plot, piece or parcel of land located in the City/Village/Town of

______, County of _______, State of New York, which land is described in Exhibit 1

annexed hereto.

(b)

Improvements: All buildings and other improvements now located, or hereafter erected, on

the Land, together with all fixtures now or in the future installed or erected in or upon the

Land or such improvements and owned or leased by Landlord or Tenant (including boiler(s),

equipment, elevators, escalators, machinery, pipes, conduit, wiring, septic systems, wells,

heating, ventilation and air conditioning systems).

(c)

Premises: The Land, the Improvements, and all rights, privileges, easements, and

appurtenances to the Land and Improvements, including all right, title and interest of

Landlord, if any, in and to any development rights, strips or gores of land adjoining the Land

and in and to any land lying in the bed of any road, highway, street or avenue adjoining the

Land to the center line thereof. References in this Lease to the “Premises” shall be construed

as if followed by the phrase “or any part thereof” unless the context otherwise requires.

(d)

Base Rent: The rent set forth in Exhibit 2 annexed hereto.

- 2 -

(e)

Commencement Date: _____________________________.

(f)

Expiration Date: The last day of the month in which occurs the ___ anniversary of the

Commencement Date, as same may be extended pursuant to Article XXVIII.

(g)

Guarantor: ______________________________________.

(h)

Interest Rate: Three (3) percentage points above the rate of interest publicly announced

from time to time by Citibank, N.A., or its successor, as its “base rate” (or such other term as

may be used by Citibank, N.A. or its successor, from time to time, for the rate presently

referred to as its “base rate”), but in no event greater than the maximum rate permitted by

applicable Law. If Citibank, N.A. or its successor no longer publicly announces such rate,

then another bank prime rate (or its equivalent) selected by Landlord shall be used by

Landlord in lieu of such base rate.

(i)

Landlord’s Notice Address: ____________________________________________.

(j)

Market Value: The most probable price which a property (whether fee estate, leasehold

estate, or the Premises, as the case may be) should bring in a competitive and open market

under all conditions requisite for a fair sale, the buyer and seller (or assignee and assignor in

the case of the sale of a leasehold estate) each acting prudently and knowledgeably, and

assuming the price is not affected by undue stimulus, under the following conditions:

i. Buyer and seller (or assignor and assignee, as the case may be) are typically

motivated; and

ii. Both parties are well informed or well advised, and acting in what they consider

their best interests; and

iii.

A reasonable time is allowed for exposure in the open market; and

iv. Payment is made in terms of cash in United States dollars or in terms of financial

arrangements comparable thereto; and

v. The price represents the normal consideration for the property sold unaffected by

special or creative financing or sales concessions granted by anyone associated with

the sale.

(k)

Outside Delivery Date: _________________________________________________.

(l)

Party Responsible for Transfer Taxes: ___________________________________.

(m)

Permitted Use: All uses of the Premises that are permitted by applicable Law.

- 3 -

(n)

Personal Property: All furniture and other personal property owned or leased by Landlord

or Tenant or any Affiliate of Landlord or Tenant, located upon the Premises and used in the

operation of the Premises, excluding trucks and cars.

(o)

Rent Address. __________, ______________, New York ______ Attn:

_________________; or at such other address(es) as Landlord may, from time to time,

designate by notice to Tenant given in the manner prescribed in this Lease.

(p)

Rent Commencement Date: The date that is _____ months after the Commencement Date.

(q)

Tenant’s Notice Address: ________________________.

(r)

Landlord’s Broker: _______________________.

(s)

Tenant’s Broker: _________________________.

Section 1.02

The following terms, as used in this Lease and in all amendments to the Lease

(unless otherwise specified or unless the context otherwise requires), shall have the meanings and/or

be construed, as the case may be, as set forth below:

(a)

Additional Rent: All amounts payable by Tenant under this Lease, other than the Base

Rent, and whether or not designated as Additional Rent, are deemed “Additional Rent.”

(b)

Affiliate: Any Person that directly or indirectly controls, is controlled by, or is under

common control with the designated Person or any officer, director, managing or general

partner, or member of such designated Person.

(c)

Business Days: Monday through Friday, excluding holidays observed by the State of New

York, the federal government of the United States, and/or the labor unions servicing the

Building.

(d)

CPI Fraction. A fraction (which shall never be less than one), the numerator of which is the

Price Index (hereinafter defined) most recently published prior to the applicable date and the

denominator of which is the Price Index most recently published prior to the Commencement

Date. The term Price Index means the Consumer Price Index published by the Bureau of

Labor Statistics of the United States Department of Labor (or any successor thereto), for All

Urban Consumers, U.S. City Average, All Items (1982-1984). If such Consumer Price Index

is terminated, a successor or substitute index, appropriately adjusted, shall be reasonably

selected by Landlord. If such Consumer Price Index is converted to a different standard

reference base or is otherwise revised, the Price Index shall be determined with the use of

such conversion factor, formula or conversion table as may be published by the Bureau of

Labor Statistics or, if such Bureau shall not publish same, then with the use of such

conversion factor, formula or table as may be reasonably selected by Landlord.

- 4 -

(e)

Liabilities: All losses, claims, suits, demands, costs, liabilities, and expenses, including

reasonable attorneys’ fees, penalties, interest, fines, judgment amounts, fees, and damages, of

whatever kind or nature.

(f)

Fee Lender: The holder of any Fee Mortgage.

(g)

Fee Mortgage: Any mortgage, deed of trust, assignment of leases and rents, financing

statement or other agreement or instrument, and all modifications, extensions, supplements,

consolidations and replacements thereof, other than a Subjected Fee Mortgage, that secures

repayment of any indebtedness by the grant of a lien, security interest or other encumbrance

on the fee estate of Landlord in the Premises and/or Landlord’s interest in this Lease, the

Improvements, and/or the Personal Property, whether executed before or after this Lease.

(h)

Governmental Authority. Any federal, state, county, municipal or other governmental or

regulatory authority, agency, board, department, bureau, body, commission, or

instrumentality, or quasi-governmental authority, and any court, arbitrator, or other

administrative, judicial or quasi-judicial tribunal, or any other public or quasi-public

authority, having jurisdiction over the Premises or the matter at issue.

(i)

Including: “Including” means “including but not limited to.” “Includes” means “includes

without limitation.”

(j)

Institutional Lender: A savings and loan association, savings bank, commercial bank or

trust company, insurance company, educational institution, welfare, pension or retirement

fund or system, any other entity subject to supervision and regulation by the insurance or

banking departments of the State of New York or by a department or agency of the United

States exercising similar functions (or any successor department or departments hereafter

exercising the same functions as said departments), any governmental agency or entity

insured by a governmental agency, a finance company, a private mortgage company, a

conduit or pooled mortgage investment fund, a real estate investment trust, an investment

bank, or any other lender generally considered an “institutional” real estate lender and which

makes loans secured by real estate as an ordinary part of its business, provided that in order

for any of such entities to be included as an “Institutional Lender,” it shall be subject to

service of process within New York State and shall either (i) have a net worth of at least

$___________ and assets that have a value of at least $______, or (ii) be a real estate

mortgage investment conduit (“REMIC”) or similar vehicle so long as the mortgage held by

the REMIC or similar vehicle is serviced by an entity that meets the requirements of clause

(i) above or by a rated servicer, or (iii) any entity controlled by any of the entities described

in clause (i) or (ii) above. An entity meeting the foregoing requirements shall be deemed an

Institutional Lender whether acting individually or in a fiduciary capacity. Notwithstanding

the foregoing, no Affiliate of Tenant shall be deemed an Institutional Lender.

(k)

Insurance Requirements: Any code, order, directive, recommendation, or requirement of

any fire insurance rating body applicable to the Premises.

- 5 -

(l)

Landlord Parties: Landlord, Landlord’s managing agent, and all of their Affiliates, officers,

directors, shareholders, members, managers, partners, and employees.

(m)

Law: Any present or future law, statute, ordinance, regulation, code, judgment, injunction,

arbitral award, order, rule, directive, proclamation, decree, common law or other requirement,

ordinary or extraordinary, foreseen or unforeseen, of the Federal or any state or local

government, or any political subdivision, arbitrator, department, commission, board, bureau,

agency or instrumentality thereof, or of any court or other administrative, judicial or quasi-

judicial tribunal or agency of competent jurisdiction, or of any other public or quasi-public

authority or group, having jurisdiction over the Premises; and any reciprocal easement,

covenant, restriction, or other agreement, restriction or easement of record affecting the

Premises as of the date of this Lease or subsequent thereto.

(n)

Lenders: All Leasehold Lenders and all Fee Lenders.

(o)

Legal Requirements: All requirements of Law.

(p)

Person: Any individual, corporation, partnership, firm or other legal entity.

(q)

Qualified Appraiser: An appraiser having an MAI designation from the Appraisal Institute

or any successor entity (or such other equivalent designation or certification as may be used

by the Appraisal Institute or any successor entity in lieu of an MAI designation) and who has

at least 10 years experience in valuing commercial property within _______ County, New

York

(r)

Rent: The Base Rent and Additional Rent.

(s)

Requirements: All applicable Legal Requirements and Insurance Requirements.

(t)

Subjected Fee Mortgage: A fee mortgage or other lien on Landlord’s fee estate given by

Landlord, as an accommodation to Tenant, to further secure Tenant’s Leasehold Mortgage

financing, together with any and all modifications, extensions, supplements, consolidations

and replacements thereof.

(u)

Substantial Completion: Alterations (including the Initial Construction) shall be deemed

“Substantially Complete” or “Substantially Completed,” and “Substantial Completion”

shall be deemed to have occurred, when (i) Tenant’s architect delivers to Landlord a

certification that the Alterations have been completed with the exception of minor punch list

items and insubstantial details of construction, mechanical adjustment or decoration, in

accordance with the plans and specifications approved by the Governmental Authorities and,

if applicable, Landlord, and (ii) Tenant shall have obtained and furnished to Landlord all

approvals, permits, sign-offs, and other documents required by Law to be issued in

connection with such Alterations, including any letter of completion, permanent or

temporary certificate of occupancy, and/or amendment of certificate of occupancy,

and (iii)

Tenant delivers to Landlord a final release and waiver of mechanics lien covering all of the

Alterations, in form and substance reasonably satisfactory to Landlord, executed by each of

- 6 -

(A) the Major Contractors and (B) as applicable, the general contractor, construction

manager, and/or design-builder.

(v)

Sublease: Any lease, sublease, license or other agreement for the use or occupancy of space

in the Improvements (other than this Lease). “Subtenant” means any tenant, licensee or

other occupant of space in the Improvements (other than Tenant).

(w)

Unavoidable Delays: Delays due to strikes, lockouts, acts of God, inability to obtain labor

or materials, government restrictions, enemy action, terrorist attack, civil commotion, fire or

other casualty, shortages of materials, or other causes of a like nature beyond the reasonable

control of Landlord or Tenant, as the case may be.

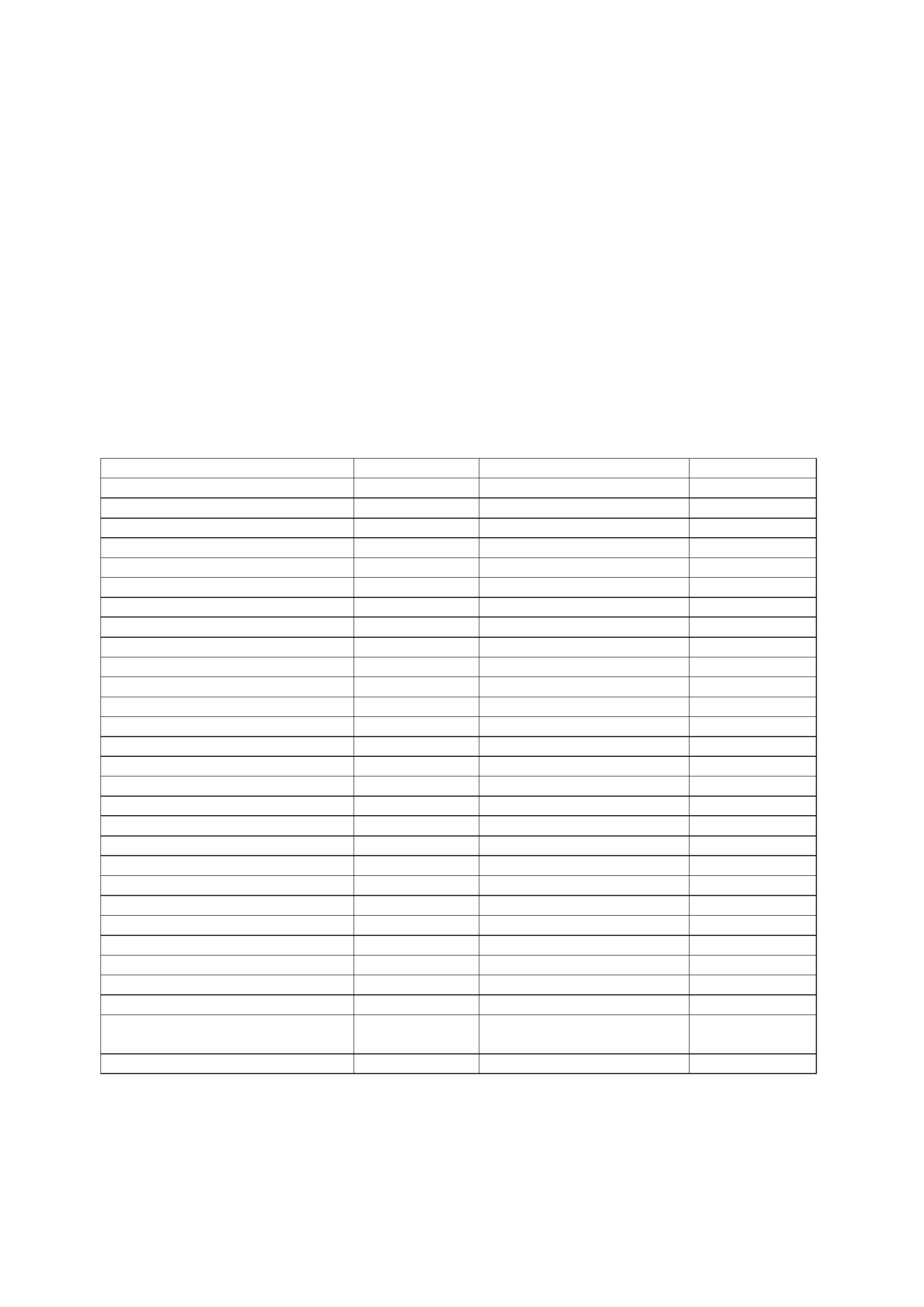

Section 1.03 The following terms, wherever used in this Lease (unless the context requires

otherwise), shall have the meanings in the Sections of this Lease set forth below after such terms:

Abandonment Notice Section 15.04 Hazardous Substance Section 7.02

Alterations Section 6.02 Impositions Section 4.01

Alterations Letter of Credit Section 6.07 Initial Construction Section 5.01

Alterations LC Amount Section 6.07 Insolvency Event Section 17.03

Award Section 12.01 LC Amount Section 5.01

Bank Section 5.01 Leasehold Lender Section 14.02

BID Section 4.01 Leasehold Mortgage Section 14.02

[Omitted] Lender Cure Notice Section 15.03

Broker Section 19.01 Lender Notice Section 15.01

Building Department Section 5.01 Letter of Credit Section 5.01

Casualty Termination Work Section 11.04 Liability Policy Section 9.02

Comparison Area Section 9.01 Major Contractors Section 5.01

Condemnation Restoration Section 12.05 Manager Section 9.10

Construction Completion Date Section 5.06 Material Section 7.02

Construction Completion Guaranty Section 5.01 New Lease Section 15.07

Construction Contracts Section 5.03 Parent Entity Section 16.01

Construction Security Section 5.01 Partial Taking Section 12.05

Customary Section 9.01 Property Damage Policy Section 9.02

Depository Section 11.02 Release Section 7.02

Design Contracts Section 5.03 Remedial Action Section 7.02

Environmental Laws Section 7.02 Restoration Section 11.01

Estimated Construction Cost Section 5.06 SNDA Section 16.05

Event of Default Section 17.01 Substantial Taking Section 12.03

Extension Conditions Section 28.01 Taking Section 12.01

Extension Notice Section 28.01 Temporary Taking Section 12.04

Extension Option Section 28.01 Term Section 2.01

Extension Term Section 28.01 Timetable Section 5.06

Final Governmental Approval Section 7.02 Value of the Fee Estate Section 12.01

Financing Commitment Section 5.06 Value of the Leasehold

Estate

Section 12.01

Full Replacement Cost Section 9.02

- 7 -

Article II. Lease of Property; “As Is” Condition; Commencement Date

Agreement; Term of Lease; Permitted Use

Section 2.01

Subject to the terms and conditions of this Lease, Landlord leases to Tenant, and

Tenant leases from Landlord, the Premises for a term that shall commence on the Commencement

Date and end on the Expiration Date (as such term may be extended from time to time pursuant to

Article XXVIII) (the “Term”), subject to earlier termination pursuant to any of the terms, covenants,

or conditions of this Lease or pursuant to Law.

Section 2.02

Tenant has examined the Premises and accepts possession of the Premises in its “AS

IS” condition on the Commencement Date. Except as otherwise expressly provided in this Lease, (a)

Tenant has full responsibility for the condition, alteration, maintenance, management, repair and

replacement of the Premises, and (b) except as otherwise expressly provided in this Lease, Landlord

has no obligation whatsoever to perform any work or make any repairs with respect to the Premises,

to furnish any services with respect to the Premises, or to incur any expenses with respect to the

Premises, and (c) Landlord has no responsibility with respect to the condition of the Premises

(including any latent defects). Tenant expressly acknowledges and agrees that Landlord has not

made and is not making, and Tenant, in executing and delivering this Lease, is not relying upon, any

warranties, representations, promises or statements, except to the extent that the same are expressly

set forth in this Lease. Without limiting the generality of the preceding provisions, Tenant, by taking

possession of the Premises or any portion thereof, shall conclusively be deemed to have agreed that

the Premises were in satisfactory condition as of the Commencement Date.

Section 2.03

Promptly following the Commencement Date, Landlord and Tenant shall enter into

an agreement, in the form annexed hereto as Exhibit 3, confirming the Commencement Date, the

Rent Commencement Date, and the initial Expiration Date. The failure of either or both parties to

execute such agreement shall not affect the occurrence of the Commencement Date, the Rent

Commencement Date, or the initial Expiration Date.

Section 2.04

If Landlord fails to give Tenant vacant possession of the Premises on the

Commencement Date, Landlord shall have no liability to Tenant and this Lease shall remain in full

force and effect according to its terms, but the Term shall not commence until the date on which

Landlord delivers vacant possession of the Premises to Tenant (which date thereafter shall be deemed

the “Commencement Date”). This Section constitutes an express provision to the contrary pursuant

to Section 223-a of the New York Real Property Law (or any similar Law), which Landlord and

Tenant agree is inapplicable to this Lease; and Tenant hereby waives any right to damages or to

rescind this Lease which Tenant might otherwise have under that Law. Notwithstanding the

foregoing, if Landlord fails to deliver vacant possession of the Premises on or before the Outside

Delivery Date, Tenant may, upon thirty (30) days’ prior notice to Landlord, at Tenant’s option, elect

to terminate this Lease by giving Landlord notice of termination. Upon the date thirty (30) days after

such termination notice is received by Landlord, this Lease and the term thereof shall end and expire

as fully and completely as if such date were the date set forth in this Lease as the stated Expiration

Date of the term of the Lease and the parties shall have no further liability to one another under this

- 8 -

Lease, except that any prepaid Rent or Security Deposit shall be refunded to Tenant and except with

respect to those provisions of this Lease that expressly survive such termination. However, if

Landlord delivers vacant possession of the Premises to Tenant within such 30-day period, such

termination notice shall be void and of no further force or effect and this Lease shall continue in full

force and effect as if such termination notice had not been given.

Section 2.05

Subject to all of the other terms, covenants and conditions of this Lease, Tenant

shall use the Premises only for the Permitted Use. Notwithstanding the foregoing, Tenant shall not at

any time use or occupy the Premises, or suffer or permit anyone else to use or occupy the Premises,

(a) in any manner that violates the provisions of this Lease, and Requirement or the certificate of

occupancy, if any, for the Premises, or (b) so as to cause waste, (c) so as to violate any insurance

policy then issued in respect of the Premises, (d) so as to create a nuisance, or (e) for the sale of

obscene or pornographic materials or the conduct of obscene, pornographic or similar disreputable

activities. Further, the Premises may not be leased to or occupied in whole or in part by the United

States of America, any state or local government within the United States of America, any foreign

government, the United Nations, or any agency, department, bureau, or political subdivision of any

of them or any Person having sovereign immunity.

Article III. Rent

Section 3.01

During the Term, Tenant shall pay Landlord the Base Rent, in equal monthly

installments, in advance, on the first day of each month during the Term, without notice, bill or

demand.

Section 3.02

Notwithstanding the foregoing, provided no Event of Default has occurred and is

continuing, Tenant shall not be required to pay Base Rent from the Commencement Date until the

Rent Commencement Date.

Section 3.03

If the Rent Commencement Date is not the first day of a month, the Base Rent for the

month in which the Rent Commencement Date occurs shall be apportioned according to the number

of days in that month.

Section 3.04

Tenant shall pay all Additional Rent that is payable to Landlord within fifteen (15)

days after Tenant is billed for such amount, unless a different time period is specified in this Lease.

Landlord shall have the same rights and remedies with respect to non-payment of Additional Rent as

Landlord has with respect to Base Rent.

Section 3.05

Rent payable to Landlord shall be paid to Landlord at Landlord’s Address in lawful

money of the United States of America by good check or, at Landlord’s request, by wire transfer. All

Rent shall be paid without notice, demand, deduction, abatement or setoff, except as otherwise

expressly provided in this Lease. A bill for Rent payable to Landlord sent by first class mail to the

address to which Notices are to be given under this Lease shall be deemed a proper demand for the

payment of the amounts set forth therein, but nothing contained herein shall be deemed to require

Landlord to send a Rent bill or otherwise make any demand for the payment of Rent except where

such notice or demand is expressly required by the terms of this Lease.

- 9 -

Section 3.06

This is an absolutely net lease. Accordingly, Landlord shall receive a net return

from the Premises equal to the Base Rent, without deduction for any expense or charge for the

Premises (except as otherwise expressly provided in this Lease). Tenant shall pay as Additional Rent

all expenses, of every kind and nature, relating to or arising from the Premises, including Impositions

and expenses arising from the leasing, management, operation, maintenance, repair, use, or

occupancy of the Premises and all construction relating to the Premises, except as otherwise

expressly provided in this Lease. Notwithstanding the foregoing, so long as no Event of Default has

occurred, Landlord agrees to pay all of the following expenses: (a) any expenses expressly agreed to

be paid by Landlord in this Lease, (b) debt service and other payments with respect to any Fee

Mortgage, (c) expenses incurred by Landlord to monitor and administer this Lease, unless otherwise

expressly provided in this Lease, (d) expenses incurred by Landlord in the ownership, leasing,

management, operation, maintenance, repair, use or occupancy of the Premises with respect to

periods prior to the Commencement Date (subject to adjustment of Impositions as provided in Article

IV), and (e) other expenses that are personal to the Landlord, including Landlord’s income taxes.

Section 3.07

Landlord’s delay in rendering, or failure to render, any statement or bill for

Additional Rent for any period shall not waive Landlord’s right to render a statement or collect such

Additional Rent for that or any subsequent period. If Landlord delivers to Tenant an incorrect

statement with respect to any Rent, Landlord shall have the right to give Tenant a corrected statement

for the period covered by the incorrect statement and to collect the correct amount of the Rent.

Section 3.08

If at any time during the Term the Rent is not fully collectible by reason of any Law,

Tenant shall enter into such agreements and take such other action as Landlord reasonably requests

and which is not prohibited by any Law, to permit Landlord to collect the maximum permissible Rent

(but not in excess of the Rent). If such Law terminates prior to the Expiration Date (a) the Rent shall

be paid in accordance with this Lease, and (b) Tenant shall pay to Landlord, if not prohibited by any

Law, the Rent which would have been paid but for such Law, less the actual amount of Rent paid by

Tenant to Landlord during the period of such Law.

Section 3.09

If any installment of Base Rent or any Additional Rent is not paid within five (5)

days of the date due under this Lease, Tenant shall pay Landlord, as Additional Rent, a late charge

equal to five percent (5%) of the overdue amount for, among other things, defraying the expenses

incident to handling such delinquent payments. Such charge shall be in addition to, and not in lieu

of, any other remedy Landlord may have.

Section 3.10

If any installment of Base Rent or any Additional Rent is not paid within ten (10)

days of the date due under this Lease, Tenant shall pay Landlord, as Additional Rent, in addition to

the above-described late charge, interest on the overdue amount at the Interest Rate. Such overdue

Rent shall bear interest from the date first due (without regard to any grace period) until the date such

Rent is paid. Such interest shall be in addition to, and not in lieu of, any other remedy Landlord may

have.

Article IV.

Payment of Impositions and Utilities

- 10 -

Section 4.01

“Impositions” shall mean, collectively, (a) all real estate taxes, all special

assessments and all other property assessments, including all assessments for public improvements or

betterments, whether or not commenced or completed within the term of this Lease and [for New

York City] all Business Improvement District (“BID”) charges and assessments, (b) all ad valorem,

sales and use taxes, (c) all rent and occupancy taxes and all similar taxes, (d) all personal property

and other taxes on the Personal Property, (e) all water, sewer, and other utility charges imposed by

any Governmental Authority, (f) all fines, fees, charges, penalties, and interest imposed by any

Governmental Authority or utility, and (g) all other governmental charges and taxes, in each case of

any kind or nature whatsoever, general or special, foreseen or unforeseen, ordinary or extraordinary,

which are at any time during or with respect to the Term assessed, levied, charged, confirmed or

imposed with respect to the Premises, the Personal Property or the use, leasing, ownership or

operation thereof, or become payable out of or become a lien upon the Premises, the sidewalks or

streets adjoining the Premises, or the Personal Property or the rents or income therefrom.

Notwithstanding the foregoing, Impositions shall not include (i) any tax imposed on Landlord’s

income or receipts (whether net or gross), (ii) any mortgage recording tax imposed with respect to

any Fee Mortgage (other than a Subjected Fee Mortgage, as to which Tenant shall pay any mortgage

tax), (iii) subject to Article XXVI [Transfer Taxes], any tax imposed with respect to the sale,

exchange or other disposition by Landlord of the Premises (unless imposed in connection with a

Subjected Fee Mortgage), including any lease by Landlord of all or part of the Premises, or (iv)

franchise taxes, excess profits taxes, capital gains taxes, and taxes on doing business that are imposed

on Landlord. If at any time during the Term the present method of real estate taxation or assessment

is changed so that there is substituted for the type of Impositions presently being assessed or imposed

on real estate, or in lieu of any increase in such Impositions, a tax described in clauses (i) or (iv) that

is imposed solely on owners of real estate, such substitute taxes shall be deemed to be included

within the term “Impositions.”

Section 4.02

Throughout the Term, Tenant will pay, or cause to be paid, all Impositions as and

when the same shall become due and payable, provided that if any Imposition may by Law be paid in

installments, Tenant may pay such Imposition in installments as permitted by Law.

Section 4.03

If any of the Impositions are paid, levied or assessed on a fiscal year basis, and if the

Commencement Date occurs on a day other than the first day of such fiscal year or the Expiration

Date occurs on a day other than the last day of such fiscal year, such Impositions shall be apportioned

between Landlord and Tenant on a per diem basis as of the Commencement Date and/or Expiration

Date, as the case may be. To the extent any assessments payable in installments affect the Premises

at the Commencement Date or Expiration Date, (a) installments payable prior to the Commencement

Date and after the Expiration Date shall be payable by Landlord, (b) installments payable after the

Commencement Date and before the Expiration Date shall be payable by Tenant, and (c) any

installment payable with respect to a fiscal period in which the Commencement Date or Expiration

Date occurs shall be apportioned between Landlord and Tenant on a per diem basis.

Section 4.04

Notwithstanding the foregoing, but subject to Section 4.03, Tenant shall not be

responsible for (a) any Impositions that accrued prior to the Commencement Date, or (b) any fines,

fees, charges, penalties, or interest imposed by any Governmental Authority with respect to periods

prior to the Commencement Date or with respect to any notice of violation of Law issued and

outstanding as of the Commencement Date.