Fillable Printable Last Will and Testament Form Download

Fillable Printable Last Will and Testament Form Download

Last Will and Testament Form Download

Page 1 of my Last Will and Testament ___________________

(Signature)

THE

LAST WILL AND TESTAMENT

OF

Mary G. Smith

DECLARATION

I, Mary G. Smith, a resident of the state of Florida and county of Brevard County; and being of

sound mind and memory, do hereby make, publish and declare this to be my last will and testament,

thereby revoking and making null and void any and all other last will and testaments and/or codicils to last

will and testaments heretofore made by me. All references herein to “this Will” refer only to this last will

and testament.

FAMILY

At the time of executing this Will, I am married to Richard L. Smith. The names of my children are

listed below. Unless otherwise specifically indicated in this Will, any provision for my children includes the

below-named children, as well as any child of mine hereafter born or adopted.

Stephen A. Smith

Megan A. Smith

Christen L. Smith

DEBT

I direct that as soon as is practical after my death, the executor named pursuant to this Will review all

of my just debts and obligations, including last illness and funeral expenses, except for those secured long-

term debts that may be assumed by the beneficiary of such property, unless such assumption is prohibited by

law or on agreement by the beneficiary. The executor is further directed to pay any attorneys’ fees and any

other estate administrative expenses. The executor shall pay these just debts only after a creditor provides

timely and sufficient evidence to support its claim and in accordance with applicable state law.

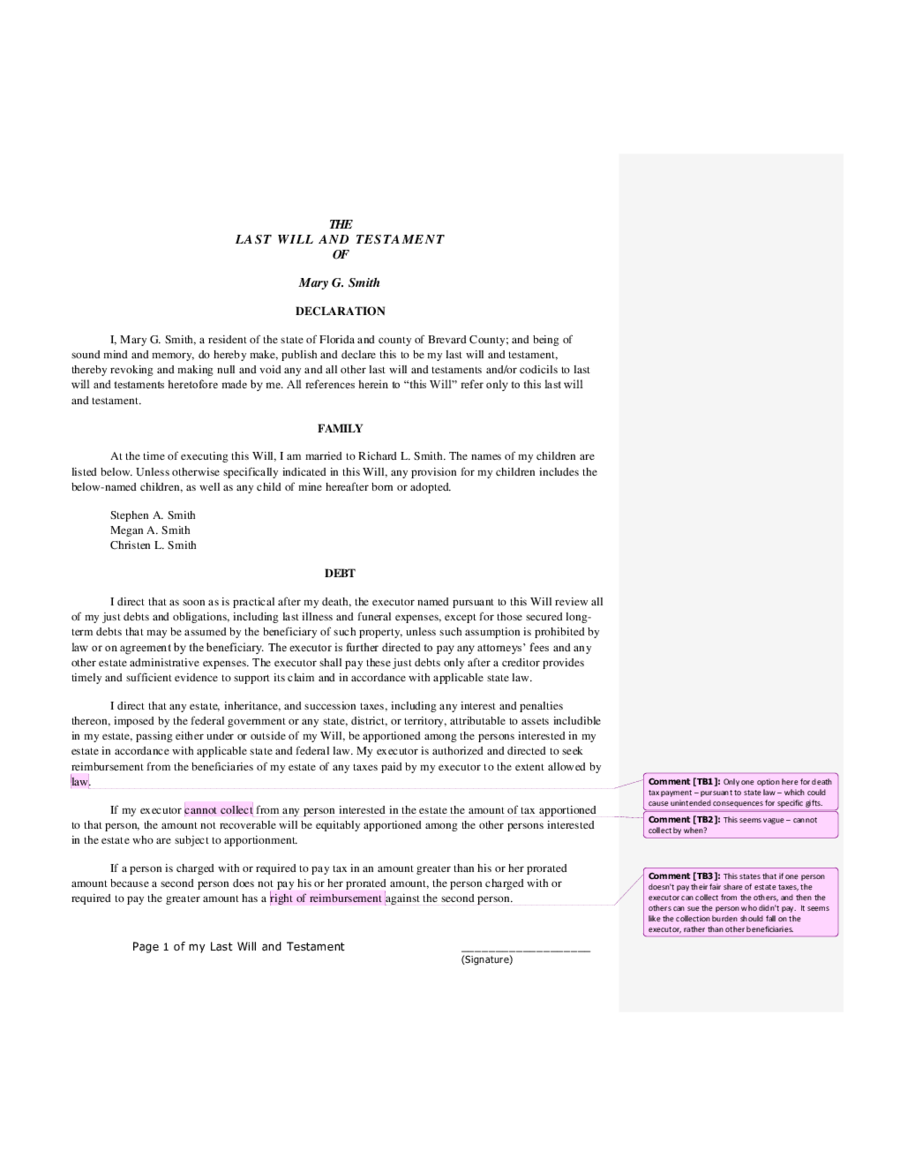

I direct that any estate, inheritance, and succession taxes, including any interest and penalties

thereon, imposed by the federal government or any state, district, or territory, attributable to assets includible

in my estate, passing either under or outside of my Will, be apportioned among the persons interested in my

estate in accordance with applicable state and federal law. My executor is authorized and directed to seek

reimbursement from the beneficiaries of my estate of any taxes paid by my executor to the extent allowed by

law.

If my executor cannot collect from any person interested in the estate the amount of tax apportioned

to that person, the amount not recoverable will be equitably apportioned among the other persons interested

in the estate who are subject to apportionment.

If a person is charged with or required to pay tax in an amount greater than his or her prorated

amount because a second person does not pay his or her prorated amount, the person charged with or

required to pay the greater amount has a right of reimbursement against the second person.

Comment [TB1]: Only one option here for death

tax payment – pursuant to state law – which could

cause unintended consequences for specific gifts.

Comment [TB2]: This seems vague – cannot

collect by when?

Comment [TB3]: This states that if one person

doesn't pay their fair share of estate taxes, the

executor can collect from the others, and then the

others can sue the person who didn't pay. It seems

like the collection burden should fall on the

executor, rather than other beneficiaries.

Page 2 of my Last Will and Testament ___________________

(Signature)

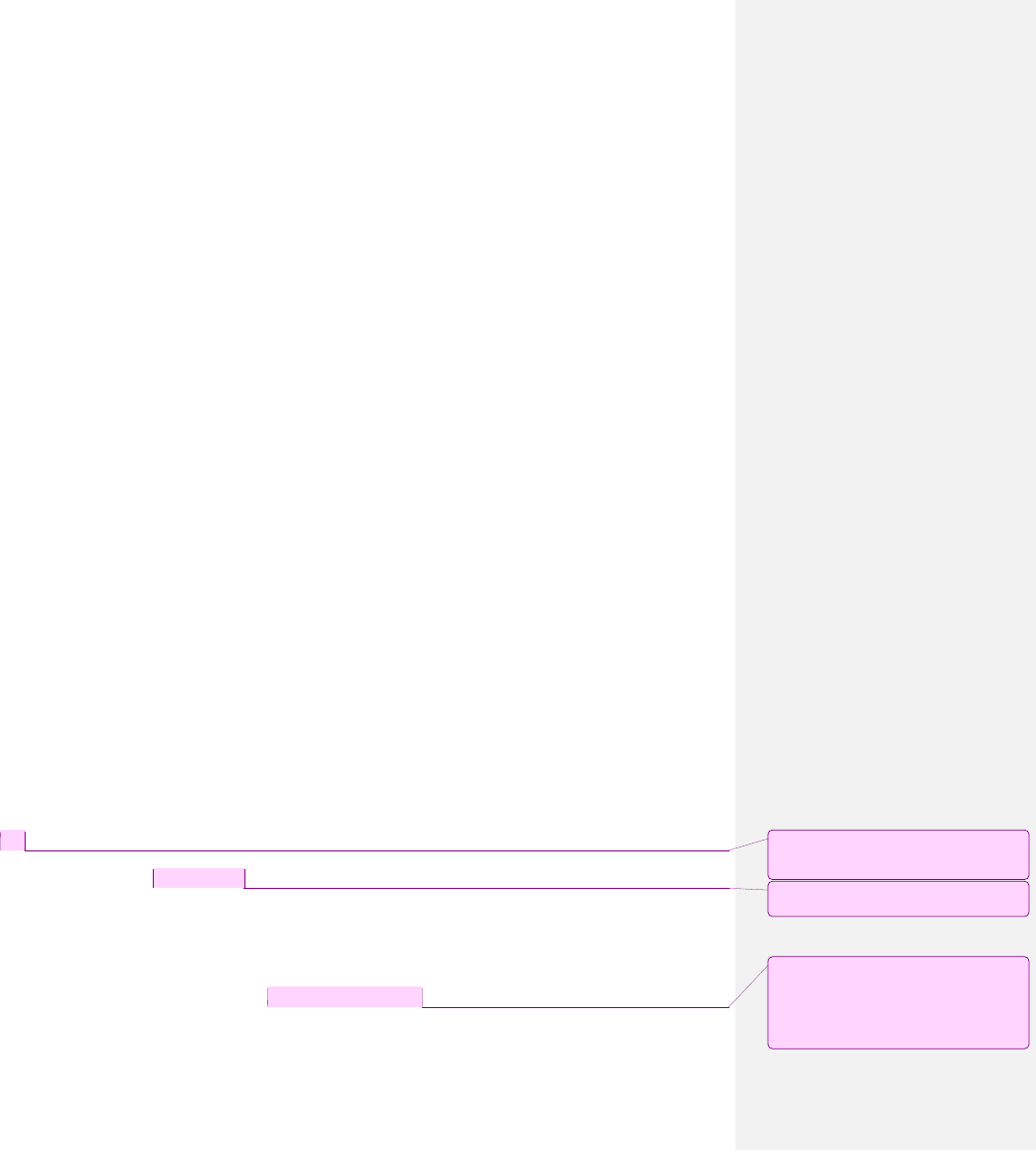

I further direct that if any beneficiary named in this Will is indebted to me at the time of my death,

and evidence of such indebtedness is provided or made available to my executor, that share of my estate that

I give to any and each such beneficiary be reduced in value by an amount equal to the proven indebtedness of

such beneficiary unless: (i) I have specifically provided in this Will for the forbearance of such debt, or (ii)

such beneficiary is the sole principal beneficiary.

PRINCIPAL DISTRIBUTION CLAUSE

If my spouse, Richard L. Smith, survives me, I give, devise, and bequeath to my spouse all of the

rest, residue, and remainder of my property and estate, real, personal, and mixed, tangible and intangible, of

whatever nature and wherever situated, including all property I may acquire or become entitled to after the

execution of this Will, including all lapsed legacies and devises (but excluding any property over which I

may have a power of appointment, it being my intention not to exercise any such power), outright and free of

trust, after payment of all my just debts, expenses, taxes, and specific bequests, if any.

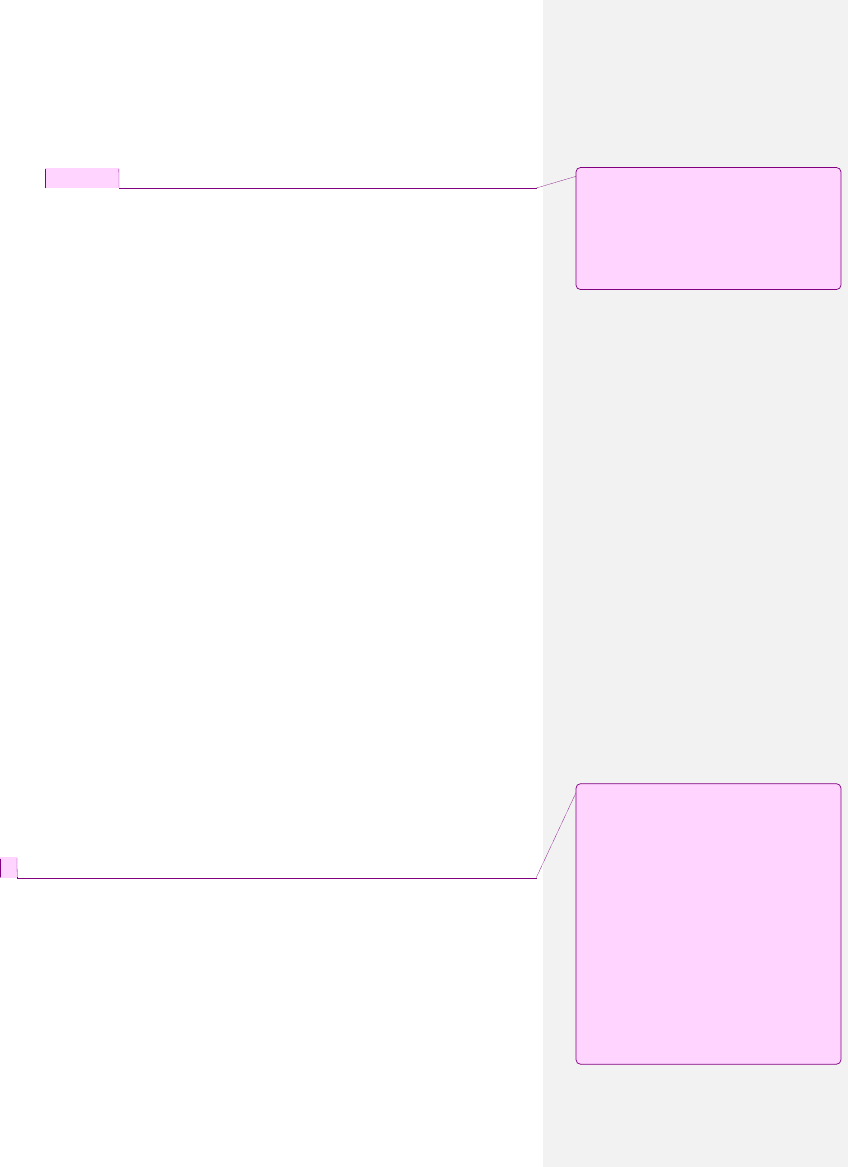

ALTERNATE SPECIFIC BEQUESTS

If my spouse does not survive me, I give, devise, and bequeath to the persons named below, if he or

she, whichever the case may be, survives me, the following items of property:

1. To my daughter, Megan A. Smith,

I give: My Tag Hueur watch.

If said beneficiary does not survive me, this specific bequest will lapse, be added to the residue of my

estate, and be distributed to my remainder beneficiaries as set forth below.

2. To my daughter, Christen L. Smith,

I give: My jewelry.

If said beneficiary does not survive me, this specific bequest will lapse, be added to the residue of my

estate, and be distributed to my remainder beneficiaries as set forth below.

ALTERNATE REMAINDER BENEFICIARIES

If my spouse does not survive me, I give, devise, and bequeath all of the rest, residue, and remainder

of my property to the persons named below, in the percentages set forth below. Unless otherwise indicated in

this Will, these shares will be distributed outright and free of trust.

1. Name: Stephen A. Smith Relation: Son

Percentage: 10%

2. Name: Megan A. Smith Relation: Daughter

Percentage: 45%

3. Name: Christen A. Smith Relation: Daughter

Percentage: 45%

DISTRIBUTION IF NO LIVING BENEFICIARIES

Comment [TB4]: This provision (where a

beneficiary's share is reduced by any amount the

beneficiary owes the testator) appears to be

automatically generated, and could result in

unintended consequences. For example, the user

may factor in an outstanding debt and reduce a

bequest accordingly, and then it would be further

reduced by this paragraph.

Comment [TB5]: This appears to be a major

issue. There is no provision for what happens to

each recipient's share if he/she predeceases the

testator. There is a spot in the LegalZoom

questionnaire for a "Second Alternate Heir," but if it

is not filled in, then it is not clear where the

deceased child's share passes. There is no provision

stating that a deceased child's share passes to his or

her children, or even to the other children

proportionately. If the default takers provision in

the next section applies, that may result in

unintended consequences. For example, if Christen

marries and has children, Mary would probably

want Christen's 45% to pass to those children if

Christen is not alive. The default takers clause

would instead divide Christen's share equally

between Stephen and Megan. State law may

provide an answer, but the Will is subject to

different constructions on this point.

Page 3 of my Last Will and Testament ___________________

(Signature)

If at any time before full distribution of my estate all of my beneficiaries are deceased and this

instrument directs no other disposition of the property, the remaining portion of my estate will then be

distributed to my heirs determined according to the laws of intestate succession, unless specifically

disinherited elsewhere in this Will.

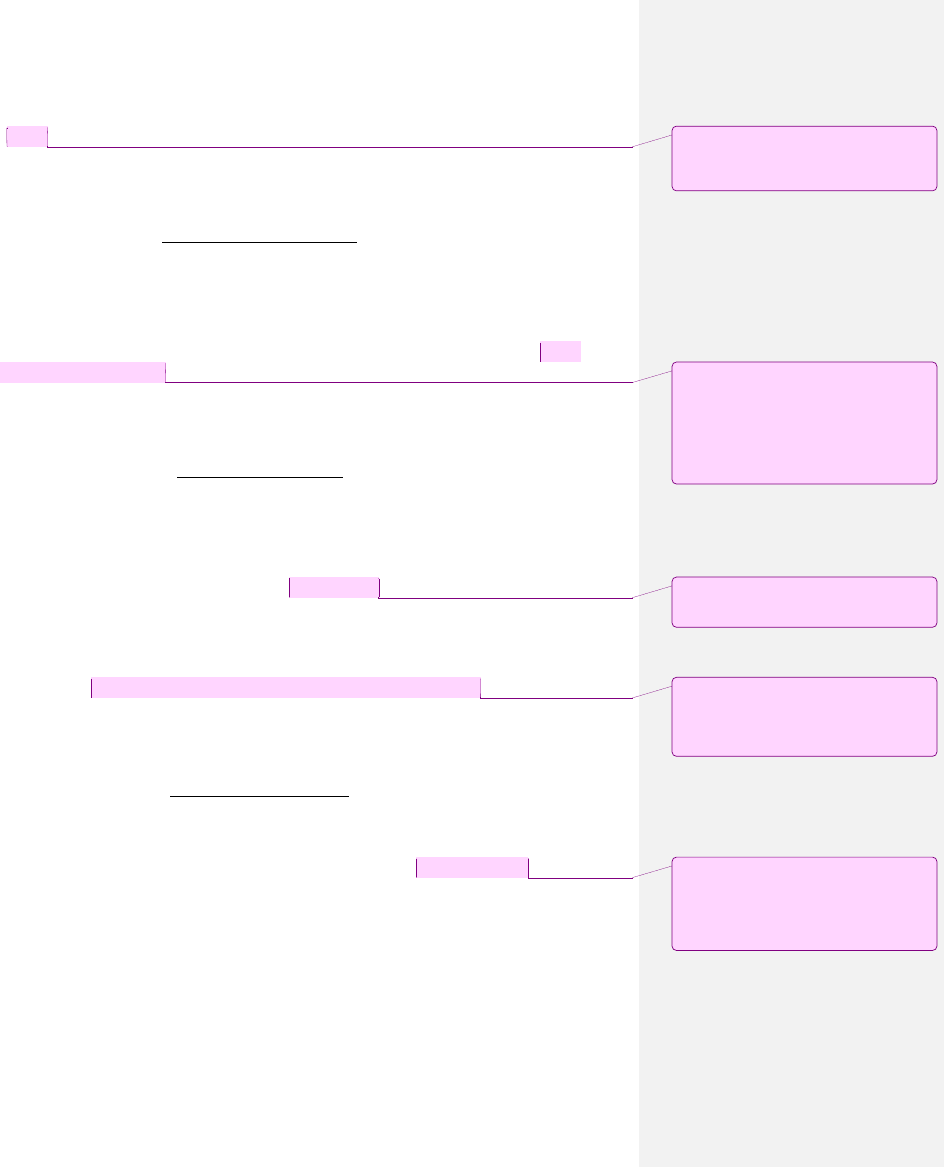

TESTAMENTARY TRUST

Allocation of Trust Estate

Notwithstanding any other provision of this Will to the contrary, I direct that the share(s) of my

estate allocated to the beneficiary(ies) designated below be held in trust and administered and distributed in

accordance with the terms of this “Testamentary Trust” clause as set forth below.

1. That share of my estate given to Megan A. Smith will be held in trust as follows: At the

discretion of the Trustee.

2. That share of my estate given to Christen L. Smith will be held in trust until: She reaches 35

years of age.

Nomination of Trustee

I nominate Richard L. Smith as trustee of all trusts created under this “Testamentary Trust” clause, to

hold, administer, and distribute said trusts in accordance with the terms of the trusts as set forth herein.

If the above-named trustee is unable or unwilling to serve or continue to serve as trustee of the trusts

created under this “Testamentary Trust” clause, I nominate Megan Smith as trustee, to hold, administer, and

distribute the trusts in accordance with the terms of the trusts as set forth herein.

If all trustees nominated in this clause are unable or unwilling to serve or to continue to serve as

trustee, the majority of beneficiaries of the trusts created under the “Testamentary Trust” clause shall

nominate a successor trustee, subject to the approval of a court of competent jurisdiction. If these

beneficiaries are unable to nominate a successor trustee, a court of competent jurisdiction shall appoint a

successor trustee pursuant to a petition filed by the resigning trustee or any beneficiary of a trust created

under this “Testamentary Trust” clause.

Distribution Provisions

The trustee shall distribute, in convenient installments to or for the benefit of a trust beneficiary, so

much of the net income and principal of the beneficiary’s trust share as the trustee deems necessary, in the

trustee’s discretion, for the health, education, maintenance, and support of said trust beneficiary. Education

includes, but is not limited to, college, graduate school, vocational studies, and reasonably related living and

travel expenses.

In exercising any power concerning discretionary payments of income or principal to or for the

benefit of the beneficiary of any trust under this Will, the trustee shall consider other income or resources of

the beneficiary known to the trustee and the trustee may rely on the written statement of the beneficiary

about such other income or resources.

Comment [TB6]: It appears that "heirs" is the

only option for default takers. There is no ability to

exclude certain heirs or to benefit specific people or

charities

Comment [TB7]: The choice typed in was "in

perpetuity" – perhaps this was modified during the

review by LegalZoom staff? This appears to give

the trustee the ability to terminate the trust at his

discretion, rather than retaining the property in

trust for Megan's entire lifetime. Further, there

appears to be no guidance for the trustee on what

factors to consider in terminating the trust.

Comment [TB8]: Is this the same person as

"Megan A. Smith?" There appears to be no check

on name spelling, which could create confusion.

Comment [TB9]: In order to fill a trustee

vacancy, court involvement appears to be

mandatory. It would be preferable if there was a

way to appoint a replacement trustee without court

action.

Comment [TB10]: The trust distribution

provisions are not flexible. There is no way to add

others (such as grandchildren) as permissible

beneficiaries. Further, there is no option for

distributions other than a HEMS standard, and no

ability to distribute principal in shares over time.

Page 4 of my Last Will and Testament ___________________

(Signature)

Any net income not distributed to the trust beneficiaries will be added to the principal of the

applicable trust share and reinvested for future distribution.

When a trust beneficiary is entitled to distribution of the balance of the beneficiary’s trust share in

accordance with the trust provisions set forth above, the trustee shall distribute to such trust beneficiary the

remaining principal and accumulated net income of his trust share, less the beneficiary’s pro rata share of

unpaid trust administration expenses.

If a trust beneficiary survives me but predeceases the complete distribution of his or her trust, such

trust will be terminated forthwith and the remaining principal balance and any accumulated but undistributed

net income will be distributed to the deceased beneficiary’s surviving heirs at law.

If a trustee determines, in the trustee’s discretion, that the corpus of a trust share is of insufficient

value to economically administer, the trustee may terminate the trust in accordance with applicable state law

and distribute the accrued and undistributed net income and remaining principal balance of the trust share to

the trust beneficiary, outright and free of trust.

CREDIT SHELTER TRUST

My spouse has the right to disclaim all or a portion of any property or other interests left to him or

her under this Will, provided that my spouse do so within the qualifying time limit for the disclaimer

pursuant to Section 2518 of the Internal Revenue Code of 1986, as amended from time to time (the “Code”),

or a corresponding provision in any successor statute. Anything in the “Alternate Remainder Beneficiaries”

clause to the contrary notwithstanding, if my spouse makes any such disclaimer, all such disclaimed property

or interests will be distributed in trust to Richard L. Smith, as trustee of The Mary G. Smith Credit Shelter

Trust.

During my spouse’s lifetime, the trustee shall distribute net income and principal of the Credit

Shelter Trust in accordance with the following provisions:

a. The trustee shall pay to my spouse or apply for his or her benefit all of the net income of the

trust, with such payments to be made at regular intervals as determined in the trustee’s sole

discretion, except that the trustee shall make payments at least annually.

b. The trustee may also pay to or apply for the benefit of my spouse from time to time so much

of the principal as the trustee determines is necessary for my spouse’s health, education,

maintenance, and support.

c. In making any such discretionary distributions, the trustee may take into consideration all

relevant circumstances, including but not limited to my spouse’s accustomed standard of

living and other assets and sources of income or support available to my spouse and known

to the trustee.

d. On the death of my spouse, the remaining Credit Shelter Trust assets will be distributed in

accordance with the provisions of this Will, as if I had died on the date of my spouse’s death

and my spouse had not survived me.

GENERAL TRUST PROVISIONS

Comment [TB11]: Another issue that could be

important (and a provision inserted by default with

no option to modify): If a child dies before receiving

all of the property in her trust, the remainder passes

to her "heirs." Usually, people would like to keep

things "in the family" and would provide for

property passing to descendants. Using "heirs" here

means that the trust would pass to the child's

surviving spouse first, which may not be what the

testator wants (to benefit her sons-in-law?) .

Comment [TB12]: The testator might want to

have the children as beneficiaries of the credit

shelter trust, but that is not an option (the

provisions of this trust are fixed).

Comment [TB13]: Distributing all income from a

credit shelter trust is not generally the best choice,

but there is no option here for any other

distribution standard.

Comment [TB14]: If a child is not living upon

the surviving spouse's death, the problem noted

above of there being no alternate disposition

appears again, and could require court clarification.

Page 5 of my Last Will and Testament ___________________

(Signature)

Trustee Powers

(a) General Powers and Duties. Each trustee of a trust created under this Will will have all of the

powers deemed necessary and appropriate to administer that trust, including all powers granted

under Florida law, subject to the trustee’s fiduciary duties to the beneficiaries and any

restrictions or limits set forth under Florida law.

(b) Specific Powers. In furtherance of subsection (a) above, the powers of the trustee include, but are

not limited to, the powers to:

1. Collect, hold, maintain, manage, and administer the assets of the trust as if the trustee were

the absolute owner of it;

2. Sell, trade, deal, encumber, mortgage, pledge, option, lease, lend, or improve the assets of the

trust;

3. Invest, reinvest, and make purchases with the profits and principal of the trust in every kind

of property, asset, and investment;

4. Borrow money from the trust for trust purposes;

5. Employ and pay reasonable fees to counsel, accountants, financial advisors, and any other

professionals deemed necessary or advisable for the proper administration of the trust;

6. Enter into contracts and otherwise execute any instruments on behalf of the trust;

7. Establish bank, brokerage, and other financial and nonfinancial accounts for and on behalf of

the trust, and execute any and all documents on the trust’s behalf in relation thereto,

including any resolutions, certifications, or certificates required for such accounts;

8. Distribute or divide the assets of the trust in accordance with this Will (subject to any

restrictions or limits set forth under Florida law), and execute any documents necessary to

administer any trust or subtrust created by this Will;

9. Continue, operate, expand, manage, and sell any business that is a trust asset;

10. Commence, defend, arbitrate, and settle legal claims or actions concerning the trust or the

assets and property in the trust;

11. Exercise voting rights, give proxies, and enter into voting agreements with respect to stock

and other business ownership interests held by the trust;

12. Prepare tax returns and take any necessary or desirable actions with governmental agencies;

and

13. Purchase and modify insurance.

Physical Segregation of Trust Shares Not Required.

Page 6 of my Last Will and Testament ___________________

(Signature)

If more than one trust is created under this Will, the trustee is not required to physically segregate or

divide the assets of the various trusts, except if physical segregation or division is required on the termination

of any of the trusts. Notwithstanding the forgoing, the trustee shall maintain separate books and records for

each separate trust.

Bond Not Required

No trustee of any trust created under this instrument is required to post a bond.

Distribution Authority

If the trustee is required by this Will to divide any trust property into parts or shares for or otherwise,

the trustee is authorized, in the trustee’s sole discretion, to make that division and distribution in identical

interests, in kind, or partly in kind or partly in money, pro rata or non pro rata. For this purpose, the trustee

may sell such trust property not specifically devised as the trustee deems necessary.

Trustee Compensation

The trustee is entitled to annual reasonable compensation for services rendered in that capacity.

Trustee fees will be prorated for any partial years of service in amounts proportionate with the period of

service during that year.

Spendthrift Provision

No interest in the principal or income of any trust created under this instrument may be anticipated,

assigned, encumbered, or subjected to a creditor’s claims or legal process until it is actually received by the

beneficiary. This spendthrift provision constitutes one of the material purposes of the trusts created

hereunder.

Payments to Minor Beneficiaries

The trustee may make distributions from a minor’s trust share, up to the whole thereof, to the

guardian of the minor’s person, a custodian for the minor under the applicable Transfers to Minors Act, or

Gifts to Minors Act, or the trustee may apply distributions directly for the minor’s benefit.

Qualified Subchapter S Trust Provision

It is my intent that any trust created herein holding stock in a qualified subchapter S corporation, if

any, for any beneficiary qualify as a qualified subchapter S trust (“QSST”). A QSST will have at least one

beneficiary and the income of that trust will be distributed at least annually. If a trust is comprised of shares

in a “small business corporation,” as defined in Section 1361 of the Code or any successor thereto, the trustee

may segregate said trust property into a separate trust and, as trustee, may modify the terms of said trust (if

necessary) so that said trust will be a QSST as defined in the Code or any successor thereto. The trustee shall

make any such modification by a written document signed by the trustee and delivered to the beneficiary of

said trust or to the guardian of any minor beneficiary or conservator any incompetent beneficiary. The terms

of the so-called QSST will continue for so long as necessary as long as an election under Section 1362 of the

Code or any successor thereto, is in effect. When the trust property is no longer comprised of small business

corporation stock or a Section 1362 election has not been made, the special QSST will terminate and the trust

property will be held in accordance with the terms of the original trust.

Comment [TB15]: Why not allow payment also

to the guardian of the minor's estate, as can be

done by the executor, below?

Comment [TB16]: The QSST language appears

standard, but there is no alternative for using an

ESBT instead.

Page 7 of my Last Will and Testament ___________________

(Signature)

EXECUTOR NOMINATION

I nominate my husband, Richard L. Smith, to be the executor of my Will.

If, for any reason, my first nominee executor is unable or unwilling to serve or to continue to serve as

executor of my Will, I nominate my son, Stephen A. Smith, to be the executor of my Will.

If, for any reason, all of the nominees designated above are unable or unwilling to serve or to

continue to serve as executor of my Will, I nominate my daughter, Megan A. Smith, to be the executor of my

Will.

If none of the nominated executors are able or willing to serve or continue to serve, and a vacancy is

not filled as set forth above, the majority of estate beneficiaries shall nominate a successor executor. If the

majority of estate beneficiaries are unable to nominate a successor executor, a court of competent jurisdiction

shall appoint a successor executor pursuant to a petition filed by the resigning executor or any estate

beneficiary.

MISCELLANEOUS EXECUTOR PROVISIONS

The term “executor” includes any executrix, personal representative, or administrator, if those terms

are used in the statutes of any state that has jurisdiction over all or any portion of my estate.

My executor will have broad and reasonable discretion in the administration of my estate to exercise

all of the powers permitted to be exercised by an executor under state law, including the power to sell estate

assets with or without notice, at either public or private sale, and to do everything he or she deems advisable

and in the best interest of my estate and the beneficiaries thereof, all without the necessity of court approval

or supervision. I direct that my executor perform all acts and exercise all such rights and privileges, although

not specifically mentioned in this Will, with relation to any such property, as if the absolute owner thereof

and, in connection therewith, to make, execute, and deliver any instruments, and to enter into any covenants

or agreements binding my estate or any portion thereof.

Subject to specific provisions to the contrary, I authorize my executor to distribute a share of my

estate given to a minor beneficiary, up to the whole thereof, to a custodian under the applicable Transfers to

Minors Act or Gifts to Minors Act, if in the executor’s discretion, it is in the best interests of the beneficiary.

The executor may also make distributions to a minor by making distributions to the trustee of a trust created

under my Will for a minor beneficiary, the guardian of the minor’s person, or the guardian of the minor’s

estate.

No executor is required to post any bond.

I authorize my executor to make the following choices or elections in my executor’s absolute

discretion, regardless of the resulting effect on any other provisions of this Will or on any person interested

in my estate or in the amount of any of the taxes referred to: (a) choose a valuation date for estate or

inheritance tax purposes or choose the methods to pay estate or inheritance taxes; (b) elect to treat or use an

item, for either federal or state tax purposes, as either an income tax deduction or as a deduction for state or

inheritance tax purposes; (c) determine when a particular item is to be treated as taken into income or used as

a tax deduction, to the extent the law provides that choice; and (d) disclaim all or any portion of any interest

in property passing to my estate at or after my death, even though any of these actions may subject my estate

Page 8 of my Last Will and Testament ___________________

(Signature)

to additional tax liabilities. No person adversely affected by my executor’s exercise of discretion under this

clause is entitled to any reimbursement or adjustment, and my executor is not required to make any

adjustment between income and principal or in the amount of any property passing under this Will as a result

of any election under this provision.

I authorize my executor, without obtaining court approval, to employ professional investment

counsel on such terms as my executor considers proper, and to pay the fees of investment counsel as an

expense of administration of my estate. However, my executor is under no obligation to employ any

investment counsel.

I authorize my executor either to continue the operation of any business belonging to my estate for

such time and in such manner as my executor may consider advisable and in the best interest of my estate, or

to sell or liquidate the business at such time and on such terms as my executor may consider advisable and in

the best interest of my estate. Any such good faith operation, sale, or liquidation by my executor, will be at

the risk of my estate and without liability on the part of my executor for any losses that may result.

SIMULTANEOUS DEATH

If it cannot be established if a beneficiary of my estate survived me, the provisions of the applicable

Uniform Simultaneous Death Act, as amended, or any substantially similar successor act effective on the

date of my death, will apply.

NONLIABILITY OF FIDUCIARIES

Any fiduciary, including my executor and any trustee, who in good faith endeavors to carry out the

provisions of this Will, will not be liable to me, my estate, my heirs, or my beneficiaries for any damages or

claims arising because of their actions or inaction, or the actions of any predecessor fiduciary acting pursuant

to this Will. My estate will indemnify and hold them harmless.

SAVINGS CLAUSE

If a court of competent jurisdiction at any time invalidates or finds unenforceable any provision of

this Will, such invalidation will not invalidate the whole of this Will. All of the remaining provisions will be

undisturbed as to their legal force and effect. If a court finds that an invalidated or unenforceable provision

would become valid if it were limited, then such provision will be deemed to be written, deemed, construed,

and enforced as so limited.

IN WITNESS WHEREOF, I, the undersigned testator, declare that I sign and execute this instrument

on the date written below as my last will and testament and further declare that I sign it willingly, that I

execute it as my free and voluntary act for the purposes expressed in this document, and that I am eighteen

years of age or older, of sound mind and memory, and under no constraint or undue influence.

(Signature of Mary G. Smith)

Date: ________________________

Page 9 of my Last Will and Testament(Signature)

ATTESTATION

This last will and testament, which has been separately signed by Mary G. Smith, the

testator, was signed, executed and declared by the above named testator as his or her last will

and testament in the presence of each of us. We, in the presence of the testator and each other,

under penalty of perjury, hereby subscribe our names as witnesses to the declaration and

execution of the last will and testament by the testator, and we declare that, to the best of our

knowledge, said testator is eighteen years of age or older, of sound mind and under no constraint

or undue influence.

1. ________________________________ ________________________________________

(Signature of witness) (Print Name)

Date: __________________ ________________________________________

(Address)

________________________________________

(City, State, ZIP)

2. ________________________________ ________________________________________

(Signature of witness) (Print Name)

Date: __________________ ________________________________________

(Address)

________________________________________

(City, State, ZIP)

SELF-PROVING AFFIDAVIT

State of Florida

County of Brevard

I, Mary G. Smith, the undersigned testator, being first duly sworn, do declare to the

undersigned authority that I signed and executed the attached or annexed instrument as my last

will and testament and that I signed it willingly, that I executed it as my free and voluntary act

for the purposes expressed in that document, and that at the time I signed the document I was

eighteen years of age or older, of sound mind and memory, and under no constraint or undue

influence.

Date: ___________________ ________________________________________

(Signature of Mary G. Smith)

We, the undersigned witnesses, being first duly sworn, do each declare to the

undersigned authority the following: (1) the testator declared to each of us that the attached or

annexed instrument is his or her last will and testament; (2) the testator executed the last will

and testament in our presence; (3) each of us, in the presence of the testator and in the presence

of each other, signed the last will and testament as witness; and (4) to the best of our knowledge

the testator is eighteen years of age or older, of sound mind and memory, and under no

constraint of undue influence.

1. ________________________________ _________________________________

(Signature of witness) (Print Name)

2. ________________________________ _________________________________

(Signature of witness) (Print Name)

Acknowledgement of Notary Public:

Subscribed, sworn and acknowledged to me on this _____ day of __________, 20__, by Mary

G. Smith, as testator, and ____________________________ and _______________________

as witnesses.

Witness my hand and seal.

Signature of Notary Public: ____________________________

STATEMENT OF INTERMENT, CREMATION, and WISHES

I, Mary G. Smith, the undersigned, having previously executed a last will and testament

on the date hereof, hereby state that, in addition to the directives and bequests set forth in said

last will and testament, it is my desire that my remains be interred in a burial plot.

My further wishes and directives are as follows: I would like an opera singer to sing at

my funeral. I would like to be buried at Holy Church Cemetery.

Dated: _______________ __________________________________

Signature of Mary G. Smith

WITNESS ATTESTATION CLAUSE

This Statement of Interment, Cremation, and Wishes, which has been separately signed

by Mary G. Smith was signed, executed and declared in the presence of each of us. We, in the

presence of Mary G. Smith and each other, under penalty of perjury, hereby subscribe our names

as witnesses to the declaration and execution of the Statement of Interment, Cremation, and

Wishes by Mary G. Smith and we declare that, to the best of our knowledge, Mary G. Smith is

eighteen years of age or older, of sound mind and memory, and under no constraint or undue

influence.

1. ________________________________ ________________________________________

(Signature of witness) (Print Name)

Date: __________________ ________________________________________

(Address)

________________________________________

(City, State, ZIP)

2. ________________________________ ________________________________________

(Signature of witness) (Print Name)

Date: __________________ ________________________________________

(Address)

________________________________________

(City, State, ZIP)