Fillable Printable Life Insurance Application Form - California

Fillable Printable Life Insurance Application Form - California

Life Insurance Application Form - California

Life Insurance Application and Forms Package

IDENTITY VERIFICATION:

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial

institutions to obtain, verify, and record information that identifies each person who applies for life insurance.

WHAT THIS MEANS FOR YOU:

When you apply for a policy, we will ask for your name, address, date of birth, and other information that will allow us to

identify you. We may also ask to see your driver's license or other identifying documents.

What Customers Should Know

Table of Contents and Instructions

APP-PACK-IDG-CA (08/08)

PEANUTS © United Feature Syndicate, Inc.

eF

Form Name Form Number Instructions/Notes

Application for Life Insurance

ENB-7-07-CA Application for Individual Life Insurance for all MetLife

affiliated companies.

Signatures Required

Authorization EAUTH-07 Proposed Insured’s authorization for release of

information to comply with the requirements of the

Health Insurance Portability and Accountability Act

(HIPAA).

Signatures Required

Notice and Consent for HIV-Related Testing EHIV-04 Notice and Consent Authorization form for HIV related

testing. Note: Use the applicable form for each

Proposed Insured's state of residence.

Signatures Required

Producer Identification & Certification

EPID-54-07 This is to be completed by the Producer attesting to

completion of the application and certification of

Owner identity.

Signatures Required - Producer and

Agency Management

Personal Financial Information

EFIN-05 To be completed when the amount of coverage is

$1,000,000 or over. Used to obtain information about

income and assets/liabilities of the Proposed Insured(s).

Medical Supplement EMED-48-07-CA This form is to be completed by the Proposed Insured

regarding his/her health for underwriting purposes.

Note: Completion is optional if a full Paramedical/

Medical Exam is required. Best practice is to answer all

medical questions to enable the underwriter to

promptly begin the underwriting process.

For use in the State of:

California

What Producers Should Know

Incomplete Applications may delay processing.

Complete all required sections and obtain all signatures and titles (where required).

Do not use pencil to complete this application or use “white out” to make changes. If a change is made to

an answer, the respondent must initial the change.

When a replacement is involved or if the policy state has adopted a replacement regulation, the appropriate state required

replacement form(s) must be signed and dated on, or prior to, the Application date.

The NAIC Replacement Notice (EREPLDIS-NAIC) must be completed and signed in certain states if either the Proposed

Insured or the Owner has any existing life insurance policies or annuity contracts even if they are not replacing

this coverage.

While completion of the Medical Supplement (EMED-48-07-CA) is not required if the Proposed Insured is being examined,

answering all medical questions (including the full name, address and phone number for each physician consulted) is

good field underwriting practice and will enable the underwriter to promptly begin the underwriting process.

Complete and sign the Producer Identification & Certification form.

Social Security number of the Beneficiary is an optional field. However, this information is valuable in helping us locate

Beneficiaries at time of claim.

Complete all Supplements and Questionnaires indicated by the applicant's selection in this Application, and submit them

WITH this Application.

We do not accept cash, traveler's checks, credit cards or money orders as a form of payment for variable life products.

Use 'Other' as source of funds if the contract is to be funded in full or in part with monies from a reverse mortgage or

home equity loan. If this is one of several "other" fund sources, please provide details in the Section IX - Additional

Information.

When selecting List Bill as the method of payment, you must also indicate the bill frequency by checking the appropriate

box (annual, semiannual, quarterly). In the event the frequency is monthly, please indicate that in Section IX in

this application.

For details regarding products and riders, as well as a forms inventory for the new business application process, please

review the producer tools and the product section of the Producer Portal.

Additional Insureds must complete the Additional Insureds Supplement for each life proposed for coverage.

Legend for Symbols

- For Your Information

- Refer to Supplement

- Attention

APP-PACK-IDG-CA (08/08) eF

Policy Number

Application for Life Insurance

Company (Check the appropriate ONE.)

Metropolitan Life Insurance Company General American Life Insurance Company

New England Life Insurance Company MetLife Investors USA Insurance Company

MetLife Investors Insurance Company

The Company indicated in this section is

referred to as "the Company".

For Additional Insureds please complete the Additional Insureds Supplement form.

First Name Middle Name Last Name

Permanent Address

City

State

Zip

Country of Legal Residence Date of Birth

E-Mail Address

Primary Phone Number Alternate Phone Number

Preferred

Time to Call

From

To

Sex

Place of Birth

Social Security or Tax ID Number

Earned Annual Income Net Worth

U.S. Driver's License

If not licensed, please indicate other form of ID:

Passport Government Issued Photo ID

Issuer of ID

ID Number

Issue Date (if any)

Expiration Date (if any)

Name of Employer

Employer City

State

Zip

Position/Duties

NON U.S. CITIZENS ONLY - Country of Citizenship

Green Card/Visa Type

Expiration Date

Country of Permanent Residence

ID Number Years in the U.S.

Complete ONLY if the Owner is NOT the Proposed Insured.

OWNER - TRUST / BUSINESS ENTITY - Name of Entity

Tax ID Number

Trustee / Owner State

Trust Business Entity

Charity

Qualified Pension Plan

Complete the appropriate required form(s).

OWNER - OTHER INDIVIDUAL

First Name

Middle Name

Last Name

Permanent Address

City

State

Zip

Country of Legal Residence

Citizenship

Social Security or Tax ID Number

Date of Birth

Phone Number

E-Mail Address Earned Annual Income

Net Worth

Relationship to Proposed Insured

Please indicate form of ID:

U.S. Driver's License

Passport

Government Issued Photo ID

Issuer of ID

ID Number

Issue Date (if any) Expiration Date (if any)

Check if ownership should revert to Insured upon Owner and Contingent Owner’s deaths.

ENB-7-07-CA

SECTION II - About the Owner

SECTION I - About the Proposed Insured

AM

PM

PM

AM

Female

Male

1 of 11

(07/07) eF

For additional Beneficiaries, use Section IX - Additional Information.

Check here if the Owner is the Primary Beneficiary.

For Primary or Contingent Beneficiaries who are NOT the Owner, complete the table below.

Beneficiary

Type

Name (First, Middle, Last)

Date of

Birth

Relationship to

Proposed Insured

Social Security

Number

(Optional)

Percentage

of Proceeds

(if not equal)

Primary

Primary

Contingent

Primary

Contingent

Check here to include all living and future natural or adopted children of the Proposed Insured as Contingent Beneficiaries. (Name all

living children above.)

If a Custodian is acting on behalf of a minor Beneficiary listed above, please use Co-Owner/Contingent Owner and UTMA

Designations Supplement form.

Federal law states that if someone with special needs has assets over $2,000, they may lose eligibility for government benefits.

Check the desired coverage(s).

Universal Life

Variable Life

Product Name

Face Amount

*

Riders and Details

Coverage Continuation (UL only)

Disability Waiver:

Specified Premium

Monthly Deduction (VUL only)

Death Benefit Option

Definition of Life Insurance:

Guideline Premium Test

Cash Value Accumulation Test

Planned Premium

Year 1

Years 2 to

Years

to

(UL only)

Whole Life

Product Name

Face Amount

*

Riders and Details

Disability Waiver

Dividend Options:

Paid-Up Additions

Other, please specify:

Automatic Premium Loan Requested

Term Life

Product Name

Face Amount

*

Riders and Details

Disability Waiver:

Convertible

Non-Convertible

For a full list of riders and options, please consult with your Producer.

Note: Some riders may require supplement forms to be completed.

For Variable Life products, please complete the Variable Life Supplement form.

* If Face Amount is equal to or exceeds $1,000,000, please complete the Personal

Financial Information form.

ADDITIONAL OPTIONS

One Time (Single) Payment Amount

1035 Exchange Amount

Requested Policy Date

Save Age

POLICY OPTIONS

Alternate Policy: Product, Face Amount and Details

Additional Policy: Product, Face Amount and Details

Group Conversion Only

Group Conversion Alternative

}

Please complete the Group Conversion Supplement form for either choice.

ENB-7-07-CA

SECTION IV - About Proposed Coverage

SECTION III - About the Beneficiary / Beneficiaries

2 of 11

(07/07) eF

Does the Proposed Insured or Owner have any existing or applied for life insurance or

annuities with this or any other company?

Proposed Insured

Yes No

Owner

Yes No

If YES, please provide details of any existing or applied for Life Insurance on the Proposed Insured only.

Company

Amount of

Insurance

Year of Issue Status

Existing Applied For

Applied ForExisting

Existing Applied For

Existing Applied For

In connection with this application, has there been, or will there be with this or any other company any: surrender

transaction; loan; withdrawal; lapse; reduction or redirection of premium/consideration; or change transaction

(except conversions) involving an annuity or other life insurance?

If YES, complete Replacement Questionnaire AND any other state required replacement forms or 1035 exchange forms.

Yes No

If Proposed Insured is financially dependent on another individual, indicate individual providing support:

Spouse

Child Parent Other

Amount of insurance on individual providing support.

Existing Insurance

Insurance Applied For

If Proposed Insured is a minor, are all siblings equally insured?

Yes No

If NO, please provide details:

PREMIUM PAYOR

Proposed Insured

Owner (If NOT the Proposed Insured.)

Other (Complete the box below.)

Other Premium Payor Name

Social Security or Tax ID Number

Relationship to Proposed Insured or Owner

Reason this Person is the Payor

Permanent Address

City

State

Zip

PAYMENT MODE

(Check the appropriate ONE.)

Billing Mode:

Annual Semi-Annual Quarterly

Monthly Draft per Debit Authorization (See next page.)

Monthly

Draft per Existing Electronic Payment Number

Special Account:

Government Allotment Salary Deduction List Bill

If Special Account, provide Employer Group Number (EGN) or List Bill Number

INITIAL PAYMENT

Method of Collection:

Amount Collected with Application

Initial Premium by Electronic Funds Transfer (Must be at least a monthly amount.)

Check (Must be at least 1/12 of an annual premium.)

SOURCE OF CURRENT AND FUTURE PAYMENTS (Check ALL that apply.)

Earned Income Savings Loans

Use of Values in another Life Insurance/Annuity Contract

Other

ENB-7-07-CA

Mutual Fund/Brokerage Account Money Market Fund

Certificate of Deposit

SECTION V - About Existing or Applied for Insurance

SECTION VI - About Payment Information

3 of 11

(07/07) eF

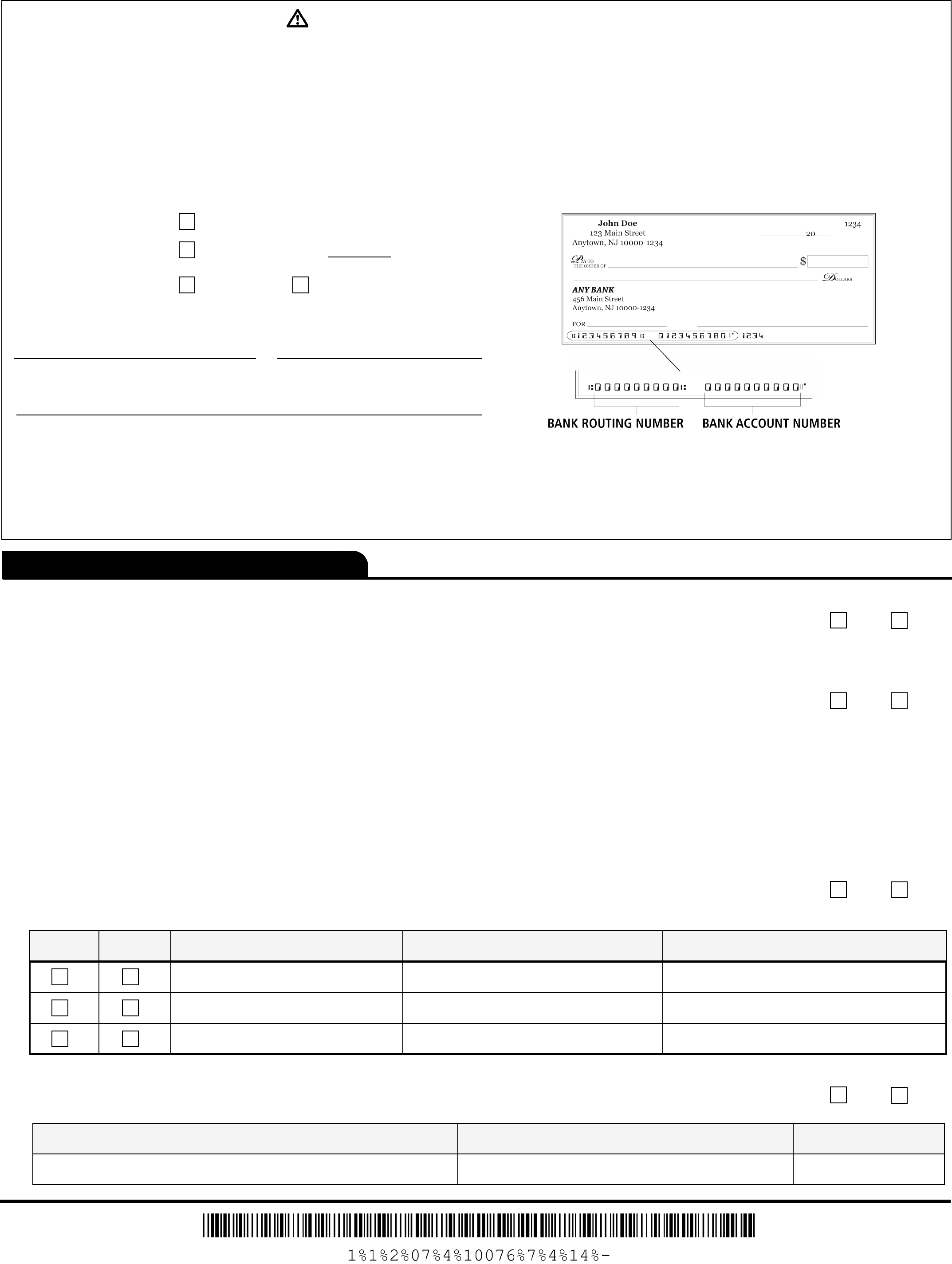

DEBIT AUTHORIZATION

Available only if the bank account holder is the Owner and/or Proposed Insured.

All others please complete the Electronic Payment (EP) Account Agreement form.

The undersigned (“I”) hereby authorize the Company with whom I am completing this application to initiate debit entries through

Metropolitan Life Insurance Company to the deposit account designated below, at the Financial Institution named below, using the

Automated Clearing House. I authorize:

1. Monthly recurring debits; AND

2. Debits made from time to time, as I authorize.

This authorization is to remain in full force and effect until the Company has received written notification from me of its termination

at such time and in such manner as to afford the Company and the Financial Institution a reasonable opportunity to act on it.

Monthly Debit Date:

Issue Date of the Policy

Debit Date on the

of each month

Bank Account Type:

Checking Savings

Bank Routing Number

Bank Account Number

Name of Financial Institution

Note: Please attach a voided check or deposit slip to Section IX - Additional Information.

We cannot establish banking services from starter checks, cash management, brokerage, or mutual fund checks. We cannot establish

banking services from foreign banks UNLESS the check is being paid in U.S. Dollars through a U.S. correspondent bank (the U.S.

correspondent bank name must be on the check).

Use Section IX - Additional Information if necessary.

1. Within the past three years has the Proposed Insured flown in a plane other than as a passenger on a commercial

airline or does he or she have plans for such activity within the next year?

Yes

No

If YES, please complete a separate Aviation Risk Supplement form for the Proposed Insured.

2. Within the past three years has the Proposed Insured participated in or does he or she plan to participate in any

of the following?

Yes

No

Underwater sports - SCUBA diving, skin diving, or similar activities

Racing sports - motorcycle, auto, motor boat or similar activities

Sky sports - skydiving, hang gliding, parachuting, ballooning or similar activities

Rock or mountain climbing or similar activities

Bungee jumping or similar activities

If YES, please complete a separate Avocation Risk Supplement form for the Proposed Insured.

3. Has the Proposed Insured traveled or resided outside the U.S. or Canada within the past two years; or does he

or she plan to travel or reside outside the U.S or Canada within the next two years?

If YES, please provide details.

Yes

No

Past Future

Duration (weeks)

Cities and Countries Purpose

4. Has the Proposed Insured EVER used tobacco or nicotine products in any form (e.g., cigars, cigarettes, cigarillos,

pipes, chewing tobacco, nicotine patches, or nicotine gum)? If YES, please provide details.

Yes

No

Product(s)

Frequency / Amount Date Last Used

ENB-7-07-CA

SECTION VII - General Risk Questions

4 of 11

(07/07) eF

5. In the past 10 years, has the Proposed Insured had a driver's license suspended or revoked, been convicted

of DUI or DWI, or in the last five years had any moving violations? If YES, please provide date(s) and violation(s).

Yes

No

6. In the past 10 years, has the Proposed Insured been convicted of or pled Guilty or No Contest to a felony?

If YES, list type of felony, state, and date of occurrence.

Yes No

7. Is the Proposed Insured actively at work performing the usual duties of his or her occupation?

If NO, please provide details.

Yes No

Check here if Proposed Insured does not have a personal physician.

Physician Name

Name of Practice or Clinic

Street Address

City

State

Zip

Phone Number

Date Last Consulted

Reason

Findings/Treatment Given/Medication Prescribed

ENB-7-07-CA

If more space is needed, attach additional sheet(s).

SECTION VIII - Personal Physician

SECTION IX - Additional Information

5 of 11

(07/07) eF

Certification / Agreement / Disclosure

Was a sales illustration provided for the life insurance policy as applied for?

Yes

No

A. If Yes, please choose one of the following:

An illustration was signed and matches the policy applied for. It is included with this application.

An illustration was shown or provided but is different from the policy applied for. An illustration

conforming to the policy as issued will be provided no later than at the time of policy delivery.

The sale was made using an illustration with Accelerated Payment.

If illustration was only shown on a computer screen, check and complete the details in the box below.

An illustration was displayed on a computer screen. The displayed illustration matches the policy applied for but no printed copy

of the illustration was provided. An illustration conforming to the policy as issued will be provided no later than at the time of policy

delivery. The illustration on the screen included the following personal and policy information:

1. Gender (as illustrated)

Male

Female

Unisex

2. Age

3. Rating Class (e.g. Standard Non-smoker)

Non-smoker

Smoker

4. Product Name (e.g. GAUL)

5. Face Amount

6. Dividend Option (Whole Life only)

B. If No, please choose one of the following:

Producer certifies that a signed illustration is not required by law or the policy applied for is not illustrated in this state.

No illustration conforming to the policy as applied for was shown or provided prior to or at the time of this

application. An illustration conforming to the policy as issued will be provided no later than at the time of policy delivery.

ENB-7-07-CA

I have read this application for life insurance including any amendments and supplements and to the best of my knowledge and belief, all

statements are true and complete. I also agree that:

My statements in this application and any amendment(s), paramedical/medical exam and supplement(s) are the basis of any policy issued.

This application and any amendment(s), paramedical/medical exam, and supplement(s) to this application will be attached to and become

part of the new policy.

No information will be deemed to have been given to the Company unless it is stated in this application, paramedical/medical exam,

amendment(s), or any supplement(s).

Only the Company’s President, Vice-President or Secretary may: (a) make or change any contract of insurance; (b) make a binding promise

about insurance; or (c) change or waive any term of an application, receipt, or policy.

Except as stated in the Temporary Insurance Agreement and Receipt, no insurance will take effect until a policy is delivered to the Owner

and the full first premium due is paid. It will only take effect at the time it is delivered if: (a) the condition of health of each person to be

insured is the same as stated in the application; and (b) no person to be insured has received any medical advice or treatment from a

medical practitioner since the date of the application.

If I have requested a rider that provides an acceleration of death benefit, I have received the appropriate disclosure form.

I understand that paying my insurance premiums more frequently than annually may result in a higher yearly out-of-pocket cost or different

cash values.

If I intend to replace existing insurance or annuities, I have so indicated in the appropriate section of the application.

I have received the Company’s Privacy Notice and the Life Insurance Buyer’s Guide.

If I was required to sign a Notice and Consent for HIV Testing, I have received a copy of that Notice.

Agreement / Disclosure

6 of 11

(07/07) eF

Under penalties of perjury, I, the Owner, certify that:

The number shown in this application is my correct taxpayer identification number, and I am not subject to backup withholding because:

(a) I have not been notified by the IRS that I am subject to backup withholding as a result of a failure to report all interest or

dividends; or

(b) the IRS has notified me that I am not subject to backup withholding.

(If you have been notified by the IRS that you are currently subject to backup withholding because of under reporting

interest or dividends on your tax return, you must cross out and initial this item.)

I am a U.S. citizen or a U.S. resident alien for tax purposes.

(If you are not a U.S. citizen or a U.S. resident alien for tax purposes, please cross out this certification and complete

form W-8BEN).

Please note: The Internal Revenue Service does not require your consent to any provision of this document other than the

certifications required to avoid backup withholding.

If not witnessing all signatures, witness should initial next to signature being witnessed and sign below.

Signature(s) of all Proposed Insured(s)

Date

Signed at City, State

(age 18 or over)

Please complete the Additional Insureds Supplement or Child Rider Supplement form(s) if applicable.

Signature(s) of all Owner(s) (If NOT the Proposed Insured.)

Date

Signed at City, State

(age 18 or over)

If the Owner is a firm or corporation, include Officer's title with signature.

If Co-Owner or Custodian, please complete the Co-Owner/Contingent Owner and UTMA Designations Supplement form.

Signature of Parent or Guardian

Date

Signed at City, State

(If Owner or Proposed Insured is under 18, sign here. If not sign above.)

ENB-7-07-CA

Taxpayer Identification Number Certification

Signatures

Witness to Signatures

Print Name of Producer

Licensed Producer

7 of 11

(07/07) eF

Authorization

Company (Check the appropriate ONE.)

The Company indicated in this section is

referred to as "the Company".

Metropolitan Life Insurance Company

General American Life Insurance Company

New England Life Insurance Company

MetLife Investors USA Insurance Company

MetLife Investors Insurance Company

Metropolitan Tower Life Insurance Company

This form was designed to comply with the requirements of the Health Insurance Portability and Accountability

Act (HIPAA).

For underwriting and claim settlement purposes regarding

me or any child(ren) under the age of 18 named below,

I authorize:

Any medical practitioner; any medical facility; any other medical

entity; any pharmacy or pharmacy-related service organization; any

insurer; any consumer reporting agency; and the MIB Group, Inc.

(MIB) to give the Company information about me or such child(ren),

including:

- personal information and data;

- entire medical file for the last ten (10) years, including medical

information, records and data (such as: office visits; patient

treatment; hospitalization; drugs prescribed; medical test results;

information about sexually transmitted diseases and other

similar information);

- information related to alcohol and drug abuse and treatment;

- information, records and data relating to Acquired Immune

Deficiency Syndrome (AIDS) or AIDS related conditions, including

Human Immunodeficiency Virus (HIV) test results; and

- information, records and data relating to mental illness.

The Company to redisclose information received pursuant to this

Authorization as authorized by me in writing or as otherwise

permitted by applicable law.

The Company to request and obtain: consumer; investigative

consumer; or motor vehicle reports.

Any employer, business associate, financial institution, or

government agency to give the Company any information or data

that it may have about: occupations; avocations; driving record;

finances; character; reputation; and aviation activities.

I understand that:

Information, records and data that the Company receives pursuant

to this Authorization will be used and maintained by the Company

as described in the Company’s Privacy Notice, a copy of which was

given to me.

All or part of the information, records and data that the Company

receives pursuant to this Authorization may be disclosed to MIB.

Such information may also be disclosed to and used by: any reinsurer;

any Company employee; or any affiliate or independent contractor

who performs a business service for the Company on the insurance

applied for or on existing insurance with the Company. Information

may also be disclosed as otherwise required or permitted by

applicable laws.

Information related to alcohol and drug abuse that has been

disclosed to the Company may be protected by Federal

Regulations 42 CFR Part 2. This information may be redisclosed

as provided in this Authorization.

Medical information, records and data disclosed may have been

subject to federal and state laws or regulations, including federal

rules issued by Health and Human Services, 45 CFR Parts

160-164. These rules set forth standards for the use, maintenance

and disclosure of such information by health care providers and

health plans. Once disclosed to the Company, this information

may no longer be subject to those laws or regulations.

Information obtained pursuant to this Authorization about me or

such child(ren) may be used, to the extent permitted by law, to

determine the insurability of other family members.

Information relating to HIV test results will only be disclosed as

permitted by applicable law.

If underwriting determines that an investigative consumer report

is needed, I will be contacted by the consumer reporting agency

and interviewed in connection with its preparation.

I am not required by law to sign this Authorization, but if I do

not, the Company will not be able to underwrite my application

for life insurance. Health care provider(s) or health care plan(s)

asked to release information pursuant to this Authorization cannot

condition treatment or payment for treatment or other benefits on

my signing it.

This Authorization will end 24 months from the date on

this form or sooner if prescribed by law. I may revoke it

at any time by writing to the Company, Privacy Office,

PO BOX 489, Warwick, RI 02887-9954 and advising it that

I have revoked this Authorization. Any action taken

before the Company has received my revocation will

be valid.

I have a right to receive a copy of this form.

A photocopy of this form is as valid as the original form.

Print Name of Proposed Insured

First Middle Last

If Proposed Insured is under 18, the

Parent or

Guardian

is to sign on line for such child.

Signature of Proposed Insured

Date

Signed at City, State

As witness, I attest to having observed all parties sign in my presence.

Witness to Signature

Signatures

8 of 11

(07/07) eF

EAUTH-07

Date of Birth

Proposed Insured:

Notice and Consent For HIV-Related Testing

Company Copy

Company (Check the appropriate ONE.)

The Company indicated in this section is

referred to as "the Insurer".

Metropolitan Life Insurance Company General American Life Insurance Company

200 Park Avenue, New York, NY 10166 13045 Tesson Ferry Road, St. Louis, MO 63128

New England Life Insurance Company

MetLife Investors USA Insurance Company

501 Boylston Street, Boston, MA 02116-3700 222 Delaware Ave., Suite 900, P.O. Box 25130, Wilmington, DE 19899

MetLife Investors Insurance Company

Metropolitan Tower Life Insurance Company

13045 Tesson Ferry Road, St. Louis, MO 63128 200 Park Avenue, New York, NY 10166

9 of 11

EHIV-04 (05/05)

eF

First Name Middle Name Last Name

b. False negatives: the test may give a negative result, even though

you are infected with HIV. This happens most commonly in

recently infected persons; it takes at least four to 12 weeks for a

positive test result to develop after a person is infected.

MEANING OF POSITIVE HIV TEST RESULT

A positive HIV test result does not mean that you have AIDS but that

you are at a significantly increased risk of developing problems with

your immune system including AIDS or AIDS-related conditions.

Federal authorities consider persons who are HIV antibody/antigen-

positive to be infected with the AIDS virus and capable of infecting

others. If you test positive, you should seek a follow-up visit with

your personal physician and/or a public health clinic or an AIDS

information organization. You may want to consider further

independent testing.

SIDE EFFECTS

A positive HIV test result may cause you significant anxiety, and may

also result in uninsurability for life, health, or disability insurance

policies you may apply for now or in the future. Although prohibited

by law, discrimination in housing, employment or public

accommodations may result if your test results were to become

known to others. A negative result may create a false sense of

security.

CONFIDENTIALITY

All test results will be treated confidentially. They will be reported by

the laboratory to the Insurer. The test results may be disclosed: to

the proposed insured (unless state law requires disclosure only to a

physician; see Notification section); to the person legally authorized

to consent to the test; to a licensed physician, medical practitioner,

or other person designated by the proposed insured; if your HIV test

is other than normal, to the Medical Information Bureau (MIB), a

national insurance data bank, using a non-specific code, indicating

only an abnormal test, to assure confidentiality; for statistical

reports that do not disclose the identity of any particular proposed

insured; to employees, reinsurers, or contractors of the Insurer who

have the responsibility to make underwriting decisions on behalf of

the Insurer; and to Insurer’s legal counsel who needs such

information to represent the Insurer effectively in matters concerning

the proposed insured. Results will not otherwise be disclosed except

as allowed by law or as authorized by you. Results will not be

disclosed to your agent or broker. You may request by notice to the

Insurer the names of the specific individuals or organizations that:

will have access to your file; will receive a copy of your results; or

will keep the test information in a data bank or other file.

THE HIV VIRUS AND AIDS

To evaluate your insurability, it is requested that you provide a blood

or other bodily fluid sample for testing for the presence of HIV

antibodies or antigens, as well as for other tests

such as cholesterol,

diabetes and immune disorders. The antibody test will determine the

presence of antibodies to the human immunodeficiency virus (HIV),

the virus associated with Acquired Immunodeficiency Syndrome

(AIDS), a life-threatening disorder of the immune system. The HIV

antigen test directly identifies AIDS viral particles. These tests are not

tests for AIDS; AIDS can only be diagnosed by medical evaluation. By

signing and dating this form, you agree that testing may be

performed and that underwriting decisions will be based on the test

results. You may refuse to be tested; however, such refusal may be

used by the insurer as a reason to deny coverage.

COUNSELING/ANONYMOUS TESTING

Many public health organizations have recommended that

before submitting to an HIV test, a person seek counseling

to better understand the implications of the test. You may

wish to consider counseling, at your expense, prior to

being tested or to consult with your physician or local

health department. You may also wish to be anonymously

tested.

See reverse side for counseling information. For your information,

HIV is transmitted: by sexual contact with an infected person; from

an infected mother to her newborn infant; or by exposure to infected

blood (as in needle sharing during intravenous drug use). HIV is not

spread through casual contact, such as eating with, touching or

kissing a person infected with the virus. Persons at high risk of

contracting AIDS include: males who have had sexual contact with

another male; intravenous drug users; hemophiliacs; and sexual

contacts of any of these persons. A person may remain free of

symptoms for years after becoming infected. It is thought that

persons have a 25-50% chance of developing AIDS within 10 years

of becoming infected.

THE TEST: PURPOSE AND ACCURACY

The HIV antibody test is a medically accepted three-test series which

is extremely accurate and reliable and is performed by a licensed

laboratory. It is not error free. Possible errors include:

a. False positives: the test may give a positive result, even though

you are not infected. This happens only rarely and is more

common in persons who have not engaged in high-risk behavior.

Retesting should be done to help confirm the validity of a

positive test.