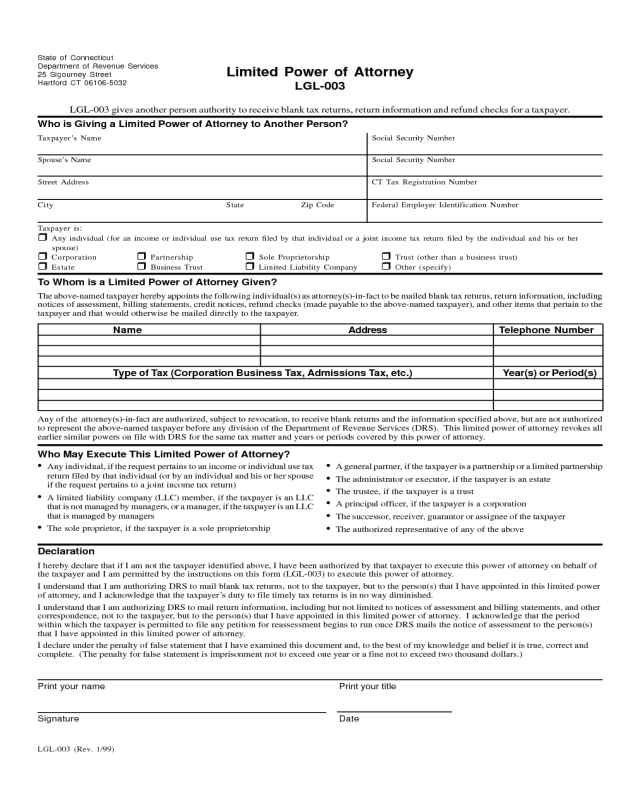

Fillable Printable Limited Power of Attorney - Connecticut

Fillable Printable Limited Power of Attorney - Connecticut

Limited Power of Attorney - Connecticut

State of Connecticut

Department of Revenue Services

25 Sigourney Street

Hartford CT 06106-5032

Limited Power of Attorney

LGL-003

LGL-003 gives another person authority to receive blank tax returns, return information and refund checks for a taxpayer .

Who is Giving a Limited Power of Attorney to Another Person?

Taxpayer’s Name Social Security Number

Spouse’s Name Social Security Number

Street Address CT Tax Registration Number

City State Zip Code Federal Employer Identification Number

Taxpayer is:

r Any individual (for an income or individual use tax return filed by that individual or a joint income tax return filed by the individual and his or her

spouse)

r Corporation r Partnership r Sole Proprietorship r Trust (other than a business trust)

r Estate r Business Trust r Limited Liability Company r Other (specify)

To Whom is a Limited Power of Attorney Given?

The above-named taxpayer hereby appoints the following individual(s) as attorney(s)-in-fact to be mailed blank tax returns, return information, including

notices of assessment, billing statements, credit notices, refund checks (made payable to the above-named taxpayer), and other items that pertain to the

taxpayer and that would otherwise be mailed directly to the taxpayer.

Name Address T elephone Number

Type of Tax (Corporation Business Tax, Admissions Tax, etc.) Year(s) or Period(s)

Any of the attorney(s)-in-fact are authorized, subject to revocation, to receive blank returns and the information specified above, but are not authorized

to represent the above-named taxpayer before any division of the Department of Revenue Services (DRS). This limited power of attorney revokes all

earlier similar powers on file with DRS for the same tax matter and years or periods covered by this power of attorney.

Who May Execute This Limited Power of Attorney?

LGL-003 (Rev. 1/99)

• Any individual, if the request pertains to an income or individual use tax

return filed by that individual (or by an individual and his or her spouse

if the request pertains to a joint income tax return)

• A limited liability company (LLC) member, if the taxpayer is an LLC

that is not managed by managers, or a manager, if the taxpayer is an LLC

that is managed by managers

• The sole proprietor, if the taxpayer is a sole proprietorship

• A general partner, if the taxpayer is a partnership or a limited partnership

• The administrator or executor, if the taxpayer is an estate

• The trustee, if the taxpayer is a trust

• A principal officer, if the taxpayer is a corporation

• The successor, receiver, guarantor or assignee of the taxpayer

• The authorized representative of any of the above

Declaration

I hereby declare that if I am not the taxpayer identified above, I have been authorized by that taxpayer to execute this power of attorney on behalf of

the taxpayer and I am permitted by the instructions on this form (LGL-003) to execute this power of attorney.

I understand that I am authorizing DRS to mail blank tax returns, not to the taxpayer, but to the person(s) that I have appointed in this limited power

of attorney, and I acknowledge that the taxpayer’s duty to file timely tax returns is in no way diminished.

I understand that I am authorizing DRS to mail return information, including but not limited to notices of assessment and billi ng statements, and other

correspondence, not to the taxpayer, but to the person(s) that I have appointed in this limited power of attorney. I acknowled ge that the period

within which the taxpayer is permitted to file any petition for reassessment begins to run once DRS mails the notice of assessment to the person(s)

that I have appointed in this limited power of attorney.

I declare under the penalty of false statement that I have examined this document and, to the best of my knowledge and belief it is true, correct and

complete. (The penalty for false statement is imprisonment not to exceed one year or a fine not to exceed two thousand dollars.)

Print your name Print your title

Signature Date