Fillable Printable Live-in Caregiver Employer/Employee Contract - Canada

Fillable Printable Live-in Caregiver Employer/Employee Contract - Canada

Live-in Caregiver Employer/Employee Contract - Canada

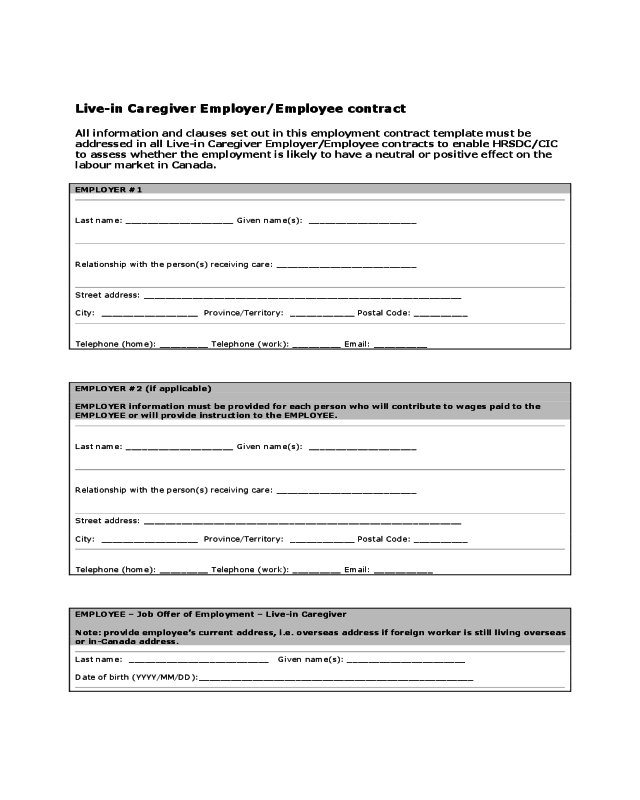

Live-in Caregiver Employer/Employee contract

All information and clauses set out in this employment contract template must be

addressed in all Live-in Caregiver Employer/Employee contracts to enable HRSDC/CIC

to assess whether the employment is likely to have a neutral or positive effect on the

labour market in Canada.

EMPLOYER #1

Last name: ____________________ Given name(s): ____________________

Relationship with the person(s) receiving care: __________________________

Street address: ___________________________________________________________

City: __________________ Province/Territory: ____________ Postal Code: __________

Telephone (home): _________ Telephone (work): _________ Email: __________

EMPLOYER #2 (if applicable)

EMPLOYER information must be provided for each person who will contribute to wages paid to the

EMPLOYEE or will provide instruction to the EMPLOYEE.

Last name: ____________________ Given name(s): ____________________

Relationship with the person(s) receiving care: __________________________

Street address: ___________________________________________________________

City: __________________ Province/Territory: ____________ Postal Code: __________

Telephone (home): _________ Telephone (work): _________ Email: ___________

EMPLOYEE – Job Offer of Employment – Live-in Caregiver

Note: provide employee’s current address, i.e. overseas address if foreign worker is still living overseas

or in-Canada address.

Last name: __________________________ Given name(s): ______________________

Date of birth (YYYY/MM/DD):___________________________________________________

Street address: ___________________________________________________________

City: __________________ Province/Territory: _______________ Country: __________

Postal Code: _____________

Telephone (home): __________ Telephone (work): ___________ Email: _____________

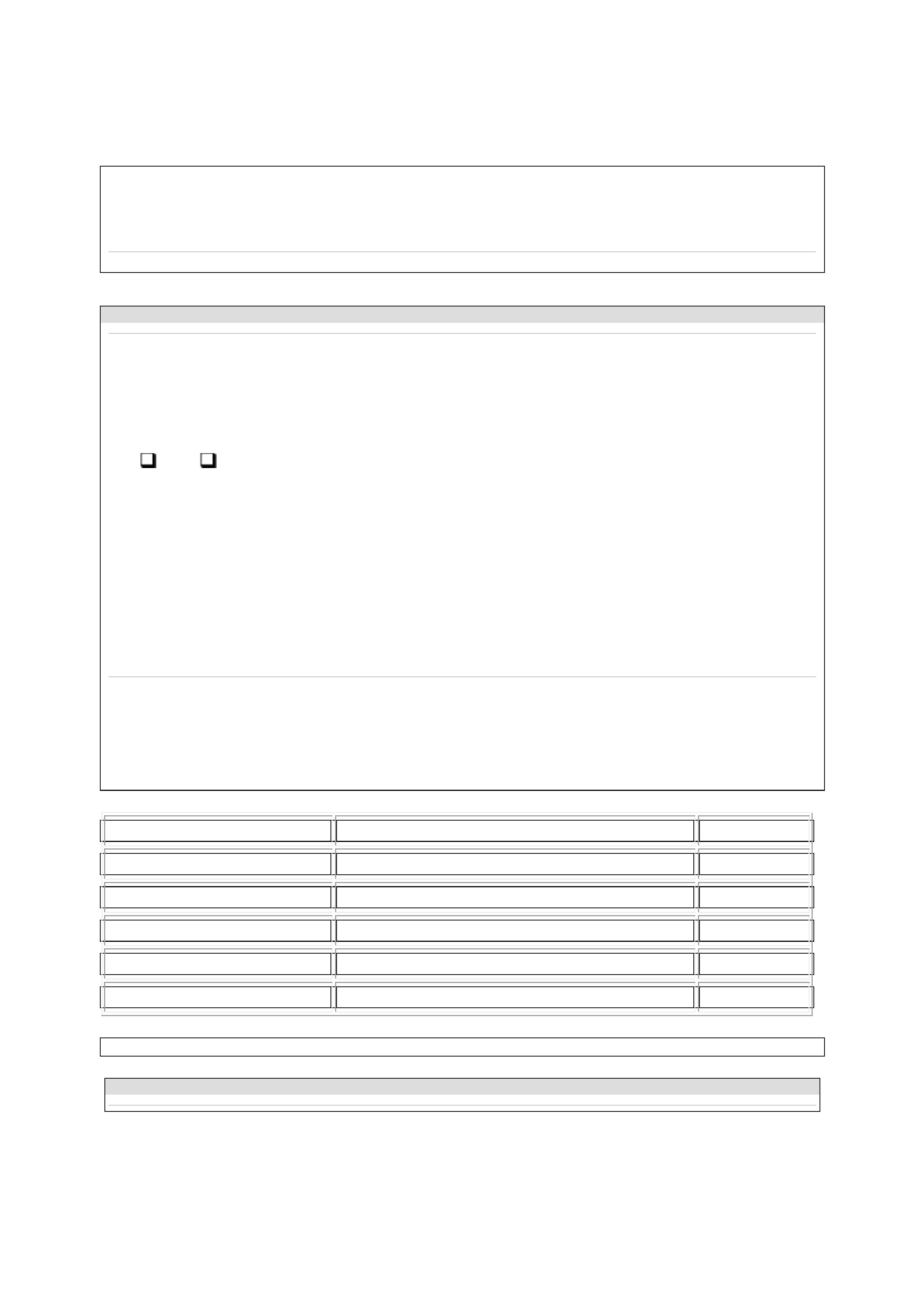

EMPLOYEE’S PLACE OF WORK

NOTE: Under the Live-in Caregiver Program, only work that has been completed in Canada under a valid work

permit is considered toward the live-in caregiver’s work requirement for permanent residence. Any work completed

outside Canada will not be counted.

Will the EMPLOYEE work at EMPLOYER’s residence in Canada as indicated above?

Yes No

If no, provide the details of where the EMPLOYEE will work and reside (must be in the residence in Canada of the

person receiving care):

Street address: ___________________________________________________________

City: __________________ Province/Territory: _______________ Postal Code: _______

Telephone (home): _________________ Telephone (work): _________________

Email: ___________________

Description of the house and the household

Total number of rooms: _________ Total number of bedrooms: ______

Details of all household members (ALL adults and minors residing in the house):

Surname Given name(s) Age

1.

2.

3.

4.

5.

If more space is required, add an annex to this contract and cross-reference.

The PARTIES agree as follows:

Duration of contract

This contract shall have a duration of ________________months from the date the EMPLOYEE assumes his/her

functions. Anticipated start date ____________

Work permit

Both parties agree that this contract is conditional upon the EMPLOYEE obtaining a valid work permit pursuant to

the Immigration and Refugee Protection Act and its Regulations, and his/her entry into Canada under the Live-in

Caregiver Program.

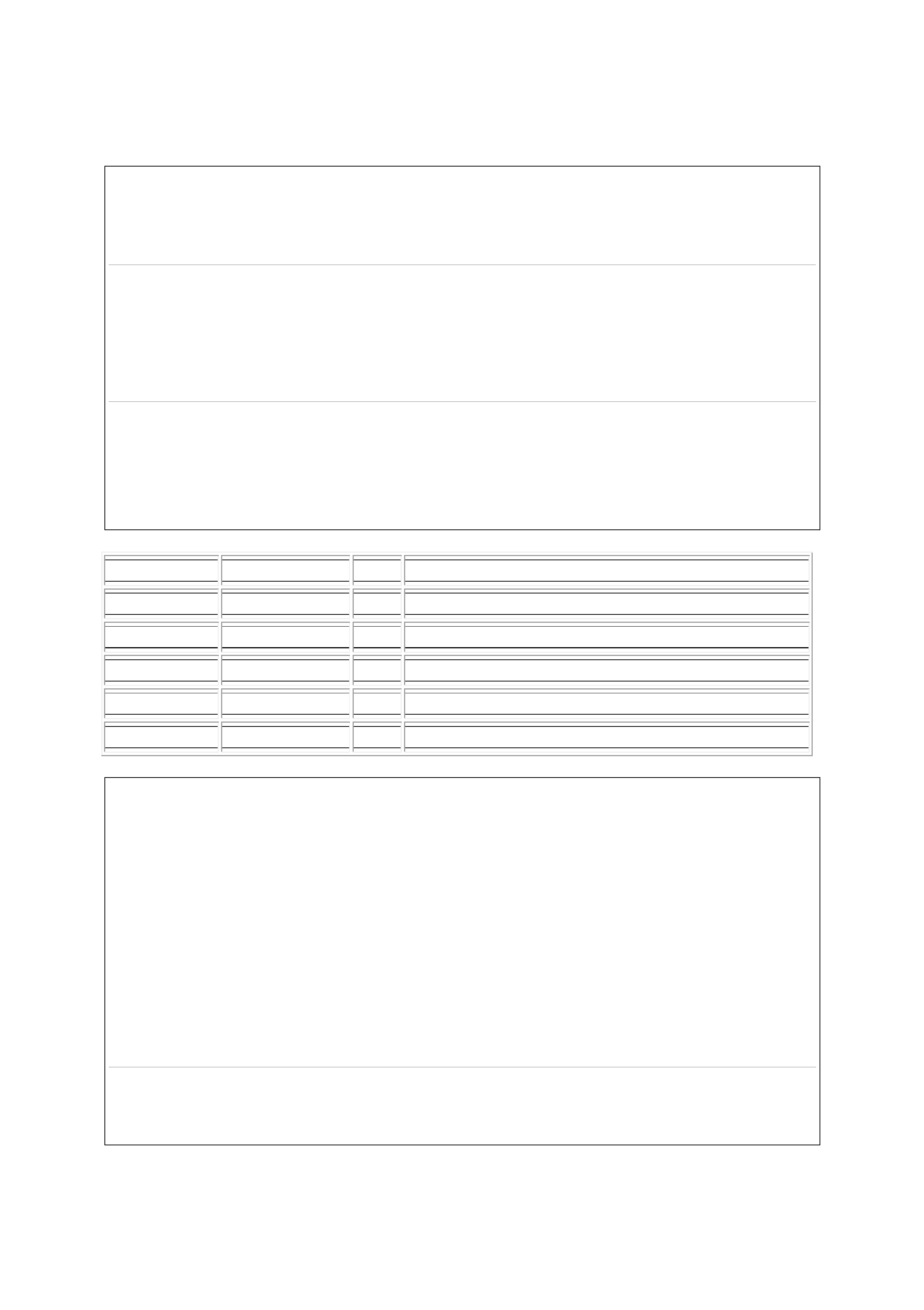

Job description

The EMPLOYEE agrees to provide services as a live-in caregiver and carry out the following tasks in the home of the

person requiring care.

Details of person(s) requiring care:

Last name Given name Age Type of care (child, elderly or disabled)

1.

2.

3.

4.

5.

If more space is required, add an annex to this contract and cross-reference.

Describe care responsibilities/duties (specify if there will be meal preparation, shopping, driving, housekeeping, pet

care, etc.):

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

Work schedule and wages

The parties agree to abide by provincial/territorial labour/employment standards regarding wages and leave.

1. The EMPLOYEE shall work ______ hours per week.

2.

The EMPLOYEE’s workday shall begin at ______ and end at ______, or if the schedule varies by day,

specify work hours:

_____________________________________________________________________

_____________________________________________________________________

3. The EMPLOYEE shall be entitled to ______ minutes for each paid___ or unpaid ___meal break.

4. The EMPLOYEE shall be entitled to ___ number of paid___ or unpaid___ health breaks of ____minutes.

5. The EMPLOYEE shall be entitled to ______ day(s) off per week, on _____________.

6. The EMPLOYEE shall be entitled to ______ days of paid vacation per year. The schedule shall be confirmed

by the EMPLOYER and the EMPLOYEE at least ___ weeks in advance of the proposed date.

7. The EMPLOYEE shall be entitled to ______ days of paid___ or unpaid___sick leave per year.

8. The EMPLOYEE shall be entitled to all applicable provincial, territorial and national statutory and public

holidays with pay.

9. The EMPLOYER agrees to pay the EMPLOYEE for his/her work by cheque or alternate means if mutually

agreed and with documentation and receipts, the gross wages before deductions in the amount of:

$ _________ per hour worked. Equivalent to $________ per week.

10. The EMPLOYER agrees to pay the wages on the following basis:

____weekly ____bi-weekly ____monthly.

11. The EMPLOYER agrees to pay the EMPLOYEE for his/her overtime hours for all hours worked over the

required hours confirmed in item 1 in accordance with provincial/territorial labour/employment standards.

12. The EMPLOYER agrees to regularly review and adjust the EMPLOYEE’s wages to ensure they meet or

exceed the prevailing wage rate requirements for live-in caregivers in the region where the EMPLOYEE is

being employed as indicated on HRSDC’s website.

The EMPLOYER and EMPLOYEE will indicate wage increases by amending no.9 of this section of the

contract in writing, and with all EMPLOYER and EMPLOYEE signatures and the date of the amendment.

13. The EMPLOYER agrees to regularly review and adjust the EMPLOYEE’s room and board charges to ensure

they do not exceed the prevailing room and board rates for live-in caregivers in the region where the

EMPLOYEE is being employed as indicated on HRSDC’s’s website.

The EMPLOYER and EMPLOYEE will indicate room and board increases by amending no. 2 and/or no. 3 of

the “Accommodation” section of the contract in writing, and with all EMPLOYER and EMPLOYEE signatures

and the date of the amendment.

14. The EMPLOYER agrees to pay taxes and submit all deductions payable as prescribed by law (including, but

not limited to, employment insurance, income tax, Canada Pension Plan or Quebec Pension Plan).

NOTE: Employers are reminded that overtime hourly rates may vary, for example, depending on the day of the

week or for national statutory or public holidays.

NOTE: HRSDC regularly reviews and updates the prevailing wage rate table. EMPLOYERS must, at the minimum,

increase the EMPLOYEE’s wages as they are increased as per HRSDC’s website.

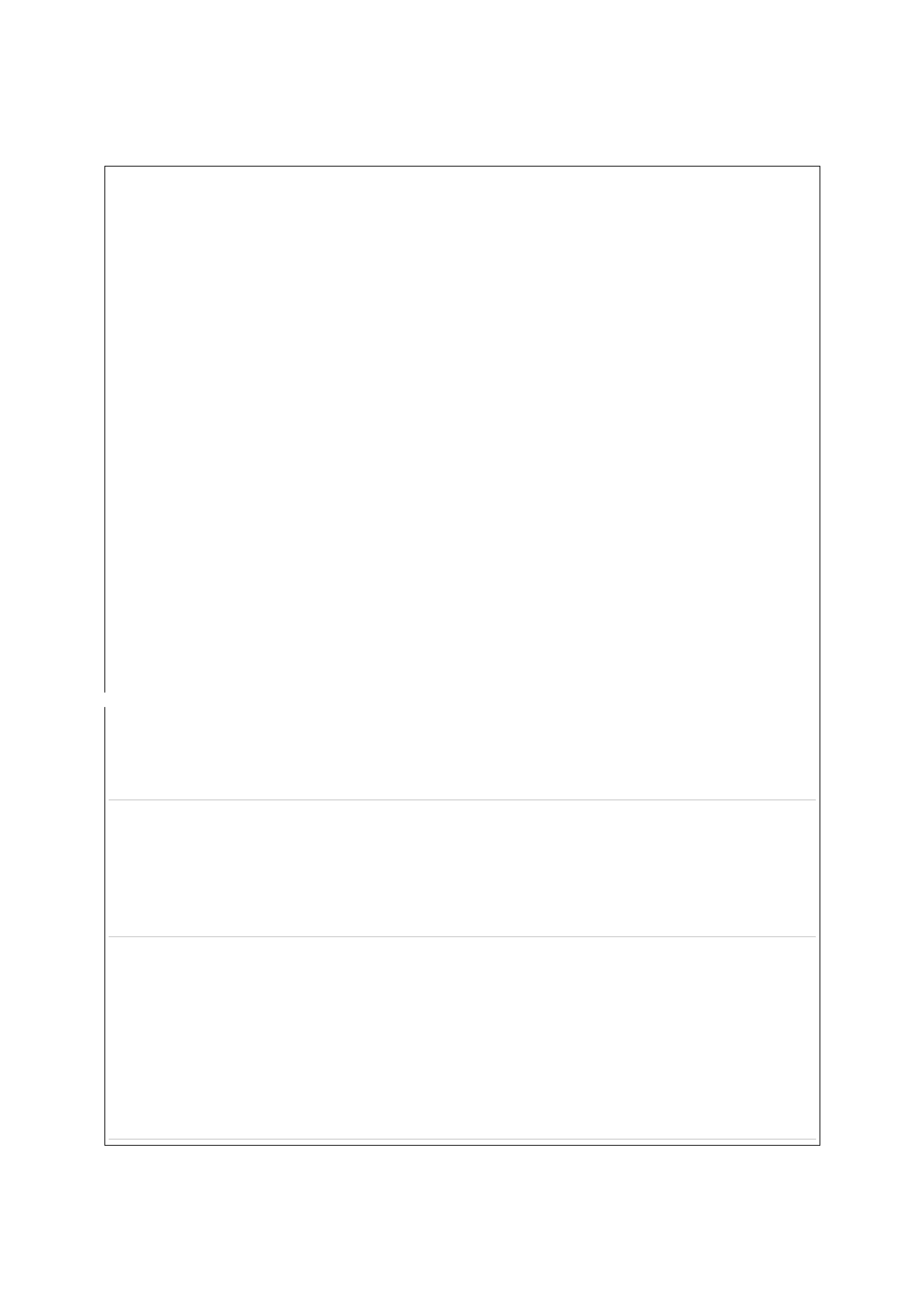

Recruitment Fees

The EMPLOYER shall not recoup from the EMPLOYEE, through payroll deductions or any other means, the fees they

have paid to a third party recruiter or recruitment agency, or their authorized representative(s) for services related

to hiring and retaining the EMPLOYEE.

NOTE: Should the EMPLOYER’S third party recruiter or recruitment agency, or their authorized representative(s)

charge the EMPLOYEE for any recruitment fees, the EMPLOYER must reimburse the EMPLOYEE in full for any such

costs disclosed with proof by the EMPLOYEE.

Accommodation

1. The EMPLOYER agrees to ensure that reasonable and proper accommodation is available for the

EMPLOYEE, and shall provide the EMPLOYEE with suitable furnished accommodation. Suitable

accommodation is housing that meets municipal building requirements and health standards set by the

province. This includes a private unit or a room with a lock and which therein provides living and sleeping

facilities intended for human habitation with no visible or structural repairs required.

2. The EMPLOYER will recoup the costs of the room at an amount of $_____ per_____ (weekly / bi-weekly /

monthly) through payroll deductions. The amount must not exceed provincial/territorial

labour/employment standards where applicable.

3. The EMPLOYER will recoup the costs of meals at an amount of $______ per______ (weekly / bi-weekly /

monthly) through payroll deductions. The amount must not exceed provincial/territorial

labour/employment standards where applicable.

4. The EMPLOYER agrees to provide the EMPLOYEE with meals, where applicable, and an adequate, properly

heated and ventilated room. The door of the room shall be equipped with a lock and a safety bolt from

within the room and the EMPLOYEE will be provided with the corresponding key.

5. The EMPLOYER shall provide the EMPLOYEE with independent access to the residence (for example, house

keys, security code) where the EMPLOYEE resides.

6. The EMPLOYER agrees to provide the employee with (check if applicable):

Private bathroom

Telephone (charge of $_____ per month or no charge___ except for long-distance calls)

Radio (in his/her room)

Television (in his/her room)

Internet access (____charge of $____ per month or ____no charge)

Other, specify:____________________________________________________

Description of EMPLOYEE’s room and furnishings:

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

Transportation costs

Use the appropriate clause according to the situation. Strike out the clause which does not apply.

1. In the situation where the live-in caregiver resides abroad:

The EMPLOYER agrees to pay the EMPLOYEE’s transportation costs for the one-way trip travel from his/her

country of permanent residence or of current residence to the place of work in Canada, namely from

__(country of permanent residence or of current residence)__ to __(place of work in Canada)__.

It is the EMPLOYER’s obligation and responsibility to pay for the transportation costs and they cannot be

passed on to the foreign worker (for example, the EMPLOYEE must not pay the transportation on behalf of

the employer to be reimbursed at a later date). Under no circumstances are transportation costs

recoverable from the EMPLOYEE.

OR

2. In the situation where the live-in caregiver resides in Canada:

If the EMPLOYEE is currently in Canada, the EMPLOYER agrees to pay the costs of transporting the

EMPLOYEE from his/her current Canadian address to the new place of work in Canada, namely __(current

Canadian address)__ and __(new place of work in Canada)__. It is the EMPLOYER’s obligation and

responsibility to pay for the transportation cost and it cannot be passed on to the foreign worker (for

example, the EMPLOYEE must not pay the transportation on behalf of the employer to be reimbursed at a

later date). Under no circumstances are transportation costs recoverable from the EMPLOYEE.

NOTE: Transportation costs include the purchase of tickets for a live-in caregiver to travel by plane, train,

boat or bus from his/her country of permanent residence or of current residence to the location of work in

Canada. If the live-in caregiver is already in Canada, transportation costs include the worker’s travel to the

new location of work. The mode of transportation must have the least negative impact on the live-in

caregiver in terms of travel time, expenses and inconvenience. Travel costs do not include for example,

hotels, meals and miscellaneous expenses during the worker’s travel to Canada or the new place of work

in Canada.

Health care insurance

1. The EMPLOYER agrees to provide health care insurance of equal coverage to that of the public

provincial/territorial health insurance plan at no cost to the EMPLOYEE until such time as the EMPLOYEE is

eligible for applicable provincial/territorial health insurance.

2. The EMPLOYER agrees not to deduct money from the EMPLOYEE’s wages for this purpose.

Workplace safety insurance (called Worker’s Compensation)

1. The EMPLOYER agrees to register the EMPLOYEE under the relevant provincial/territorial government

insurance plan or its equivalent (for free, on-the-job injury or illness insurance).

2. The EMPLOYER agrees not to deduct money from the EMPLOYEE’s wages for this purpose.

Notice of resignation

Should he/she wish to terminate the present contract, the EMPLOYEE agrees to give the EMPLOYER written notice

thereof at least _______ weeks in advance. The parties agree to abide by provincial/territorial labour/employment

standards regarding written notice of resignation.

It is recommended that a copy of the relevant portions of provincial/territorial labour standards be attached as an

appendix.

Notice of termination of employment

The EMPLOYER must give written notice before terminating the contract of the EMPLOYEE. This notice shall be

given at least ______ weeks in advance. The parties agree to abide by provincial/territorial labour/employment

standards regarding written notice of termination of employment.

It is recommended that a copy of the relevant portions of provincial/territorial labour standards be attached as an

appendix.

CONTRACT SUBJECT TO PROVINCIAL/TERRITORIAL LABOUR AND EMPLOYMENT LEGISLATION

The EMPLOYER is obligated to abide by the standards set out in the relevant provincial/territorial

labour/employment standards act. In particular, the EMPLOYER must abide by the standards with respect to how

wages are paid, how overtime is calculated, meal periods, statutory/public holidays, vacation leave, family leave,

benefits and recourse under the provisions of the applicable Provincial/Territorial Employment Standards Act. Any

terms of this contract of employment less favourable to the EMPLOYEE than the standards stipulated in the

relevant labour/employment standards act is null and void.

SIGNATURE OF ALL EMPLOYERS

I have read and understand this contract as well as the notice regarding personal information.

I declare that the information I have given in this employment contract is truthful, complete and correct and that I

will abide by the terms and conditions outlined therein.

I will abide by the employment and labour standards in the province/territory where the EMPLOYEE resides.

I will provide a Record of Employment on termination of employment.

I agree to maintain complete records of employment, including any additional or overtime hours worked and to

provide the employee with accurate records reflecting their employment, salary and allowable deductions on their

behalf.

EMPLOYER #1:

Given name (print): _____________________________

Surname (print): _______________________________

EMPLOYER’S Signature: __________________________

Date (YYYY/MM/DD): ____________________________

EMPLOYER #2 (if applicable):

Given name (print): _____________________________

Surname (print): _______________________________

EMPLOYER #2 Signature: _________________________

Date (YYYY/MM/DD): _____________________________

Add above information and signature of all EMPLOYERS listed on this employment contract.

SIGNATURE OF EMPLOYEE

I have read and understand this contract as well as the notice regarding personal information.

I declare that the information I have given in this employment contract is truthful, complete and correct and I will

abide by the terms and conditions outlined therein.

I will abide by the terms and conditions of this employment contract and the employment and labour standards in

my province/territory of residence.

Given name (print): ______________________________

Surname (print): ________________________________

EMPLOYEE’S Signature: ___________________________

Date (YYYY/MM/DD): _____________________________