Fillable Printable Living Trust Template

Fillable Printable Living Trust Template

Living Trust Template

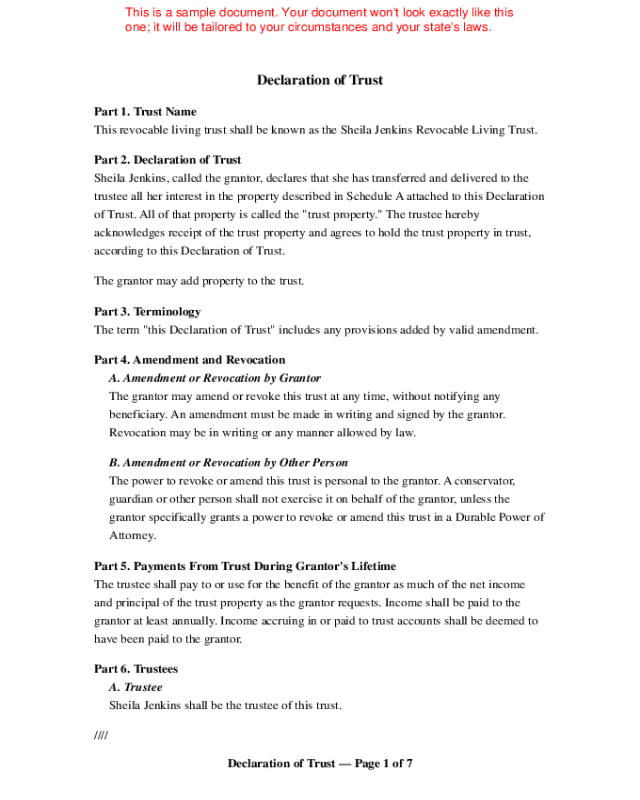

Declaration of Trust

Part 1. Trust Name

This revocable living trust shall be known as the Sheila Jenkins Revocable Living Trust.

Part 2. Declaration of Trust

Sheila Jenkins, called the grantor, declares that she has transferred and delivered to the

trustee all her interest in the property described in Schedule A attached to this Declaration

of Trust. All of that property is called the "trust property." The trustee hereby

acknowledges receipt of the trust property and agrees to hold the trust property in trust,

according to this Declaration of Trust.

The grantor may add property to the trust.

Part 3. Terminology

The term "this Declaration of Trust" includes any provisions added by valid amendment.

Part 4. Amendment and Revocation

A. Amendment or Revocation by Grantor

The grantor may amend or revoke this trust at any time, without notifying any

beneficiary. An amendment must be made in writing and signed by the grantor.

Revocation may be in writing or any manner allowed by law.

B. Amendment or Revocation by Other Person

The power to revoke or amend this trust is personal to the grantor. A conservator,

guardian or other person shall not exercise it on behalf of the grantor, unless the

grantor specifically grants a power to revoke or amend this trust in a Durable Power of

Attorney.

Part 5. Payments From Trust During Grantor's Lifetime

The trustee shall pay to or use for the benefit of the grantor as much of the net income

and principal of the trust property as the grantor requests. Income shall be paid to the

grantor at least annually. Income accruing in or paid to trust accounts shall be deemed to

have been paid to the grantor.

Part 6. Trustees

A. Trustee

Sheila Jenkins shall be the trustee of this trust.

////

Declaration of Trust — Page 1 of 7

B. Trustee's Responsibilities

The trustee in office shall serve as trustee of all trusts created under this Declaration of

Trust, including children's subtrusts.

C. Terminology

In this Declaration of Trust, the term "trustee" includes successor trustees or alternate

successor trustees serving as trustee of this trust. The singular "trustee" also includes

the plural.

D. Successor Trustee

Upon the death or incapacity of Sheila Jenkins, the trustee of this trust and of any

children's subtrusts created by it shall be Richard Jenkins. If Richard Jenkins is unable

or unwilling to serve as successor trustee, Ann Heron shall serve as trustee.

E. Resignation of Trustee

Any trustee in office may resign at any time by signing a notice of resignation. The

resignation shall be delivered to the person or institution who is either named in this

Declaration of Trust, or appointed by the trustee under Section F of this Part, to next

serve as the trustee.

F. Power to Appoint Successor Trustee

If no one named in this Declaration of Trust as a successor trustee or alternate

successor trustee is willing or able to serve as trustee, the last acting trustee may

appoint a successor trustee and may require the posting of a reasonable bond, to be

paid for from the trust property. The appointment must be made in writing, signed by

the trustee and notarized.

G. Bond

No bond shall be required for any trustee named in this Declaration of Trust.

H. Compensation

No trustee shall receive any compensation for serving as trustee, unless the trustee

serves as a trustee of a child's subtrust created by this Declaration of Trust.

I. Liability of Trustee

With respect to the exercise or non-exercise of discretionary powers granted by this

Declaration of Trust, the trustee shall not be liable for actions taken in good faith.

Such actions shall be binding on all persons interested in the trust property.

////

Declaration of Trust — Page 2 of 7

Part 7. Trustee's Management Powers and Duties

A. Powers Under State Law

The trustee shall have all authority and powers allowed or conferred on a trustee under

Arizona law, subject to the trustee's fiduciary duty to the grantors and the

beneficiaries.

B. Specified Powers

The trustee's powers include, but are not limited to:

1. The power to sell trust property, and to borrow money and to encumber trust

property, including trust real estate, by mortgage, deed of trust or other method.

2. The power to manage trust real estate as if the trustee were the absolute owner of

it, including the power to lease (even if the lease term may extend beyond the

period of any trust) or grant options to lease the property, to make repairs or

alterations and to insure against loss.

3. The power to sell or grant options for the sale or exchange of any trust property,

including stocks, bonds, debentures and any other form of security or security

account, at public or private sale for cash or on credit.

4. The power to invest trust property in every kind of property and every kind of

investment, including but not limited to bonds, debentures, notes, mortgages, stock

options, futures and stocks, and including buying on margin.

5. The power to receive additional property from any source and add it to any trust

created by this Declaration of Trust.

6. The power to employ and pay reasonable fees to accountants, lawyers or

investment experts for information or advice relating to the trust.

7. The power to deposit and hold trust funds in both interest-bearing and non-

interest bearing accounts.

8. The power to deposit funds in bank or other accounts, whether or not they are

insured by the FDIC.

9. The power to enter into electronic fund transfers or safe deposit arrangements

with financial institutions.

10. The power to continue any business of the grantor.

Declaration of Trust — Page 3 of 7

11. The power to institute or defend legal actions concerning this trust or the

grantor's affairs.

12. The power to execute any documents necessary to administer any trust created

by this Declaration of Trust.

13. The power to diversify investments, including authority to decide that some or

all of the trust property need not produce income.

Part 8. Incapacity of Grantor

If the grantor becomes physically or mentally incapacitated, whether or not a court has

declared the grantor incompetent or in need of a conservator or guardian, the successor

trustee named in Part 6 shall be trustee.

The determination of the grantor's capacity to manage this trust shall be made by Patricia

Jenkins. The successor trustee shall, if necessary, ask Patricia Jenkins to state, in writing,

an opinion as to whether or not the grantor is able to continue serving as trustee. The

successor trustee may rely on that written opinion when determining whether or not to

begin serving as trustee.

If the successor trustee is unable, after making reasonable efforts, to obtain a written

opinion from Patricia Jenkins, the successor trustee may request an opinion from Eric

Workman and may rely on that opinion.

If the successor trustee is also unable, after making reasonable efforts, to obtain a written

opinion from Eric Workman, the successor trustee may request an opinion from Delia

Holt and may rely on that opinion.

If the successor trustee is unable, after making reasonable efforts, to obtain a written

opinion from Patricia Jenkins, Eric Workman or Delia Holt, the successor trustee may

request an opinion from a physician who examines the grantor, and may rely on that

opinion.

The trustee shall use any amount of trust income or trust property necessary for the

grantor's proper health care, support, maintenance, comfort and welfare, in accordance

with the grantor's accustomed manner of living. Any income not spent for the benefit of

the grantor shall be accumulated and added to the trust property. Income shall be paid to

the grantor at least annually. Income accruing in or paid to trust accounts shall be deemed

to have been paid to the grantor.

The successor trustee shall manage the trust until the grantor is again able to manage her

Declaration of Trust — Page 4 of 7

affairs. The determination of the grantor's capacity to again manage this trust shall be

made in the manner specified just above.

Part 9. Death of a Grantor

When the grantor dies, this trust shall become irrevocable. It may not be amended or

altered except as provided for by this Declaration of Trust. It may be terminated only by

the distributions authorized by this Declaration of Trust.

The trustee may pay out of trust property such amounts as necessary for payment of the

grantor's debts, estate taxes and expenses of the grantor's last illness and funeral.

Part 10. Beneficiaries

At the death of the grantor, the trustee shall distribute the trust property as follows:

Richard Jenkins shall be given Sheila Jenkins's interest in 100 shares of Applied

Dynamics stock. If Richard Jenkins does not survive Sheila Jenkins, that property

shall be given to Patricia Jenkins.

David Jenkins shall be given Sheila Jenkins's interest in the trust property not

otherwise specifically and validly disposed of by this Part. If David Jenkins does not

survive Sheila Jenkins, that property shall be given to Richard Jenkins.

Part 11. Terms of Property Distribution

All distributions are subject to any provision in this Declaration of Trust that creates a

child's subtrust or a custodianship under the Uniform Transfers to Minors Act.

A beneficiary must survive the grantor for 120 hours to receive property under this

Declaration of Trust. As used in this Declaration of Trust, to survive means to be alive or

in existence as an organization.

All personal and real property left through this trust shall pass subject to any

encumbrances or liens placed on the property as security for the repayment of a loan or

debt.

If property is left to two or more beneficiaries to share, they shall share it equally unless

this Declaration of Trust provides otherwise. If any of them does not survive the grantor,

the others shall take that beneficiary's share, to share equally, unless this Declaration of

Trust provides otherwise.

////

////

Declaration of Trust — Page 5 of 7

Part 12. Custodianships Under the Uniform Transfers to Minors Act

Any property to which David Jenkins becomes entitled under Part 10 of this Declaration

of Trust shall be given to Richard Jenkins, as custodian for David Jenkins under the

Arizona Uniform Transfers to Minors Act, until David Jenkins reaches the age of 21. If

Richard Jenkins is unable or ceases to serve as custodian, Ann Heron shall serve as

custodian.

Part 13. Homestead Rights

If the grantor's principal residence is held in trust, the grantor has the right to possess and

occupy it for life, rent-free and without charge except for taxes, insurance, maintenance

and related costs and expenses. This right is intended to give the grantor a beneficial

interest in the property and to ensure that the grantor does not lose eligibility for a state

homestead tax exemption for which she otherwise qualifies.

Part 14. Severability of Clauses

If any provision of this Declaration of Trust is ruled unenforceable, the remaining

provisions shall stay in effect.

Certification of Grantor

I certify that I have read this Declaration of Trust and that it correctly states the terms and

conditions under which the trust property is to be held, managed and disposed of by the

trustee, and I approve the Declaration of Trust.

_____________________________________Dated: ______________

Sheila Jenkins, Grantor and Trustee

////

////

////

////

////

////

////

////

////

////

////

////

Declaration of Trust — Page 6 of 7

CERTIFICATE OF ACKNOWLEDGMENT OF NOTARY PUBLIC

State of ______________________)

) ss.

County of ____________________)

On ____________________, __________ before me, _____________________, a notary

public in and for said state, personally appeared

_________________________________, personally known to me (or proved on the

basis of satisfactory evidence) to be the person whose name is subscribed to the within

instrument, and acknowledged to me that she/he executed the same in her/his authorized

capacity, and that by her/his signature on the instrument the person, or the entity upon

behalf of which the person acted, executed the instrument.

WITNESS my hand and official seal.

Notary Public

[NOTARIAL SEAL]My commission expires:

Declaration of Trust — Page 7 of 7

SCHEDULE A

Property Placed in Trust

1. 100 shares of Applied Dynamics stock.

2. House at 2100 Fortuna Street, Phoenix, Arizona.

3. Condominium at 57-A Alpine Way, Tahoe City, California.

Schedule A — Page 1 of 1