Fillable Printable Single Member Llc Operating Agreement Template Free

Fillable Printable Single Member Llc Operating Agreement Template Free

Single Member Llc Operating Agreement Template Free

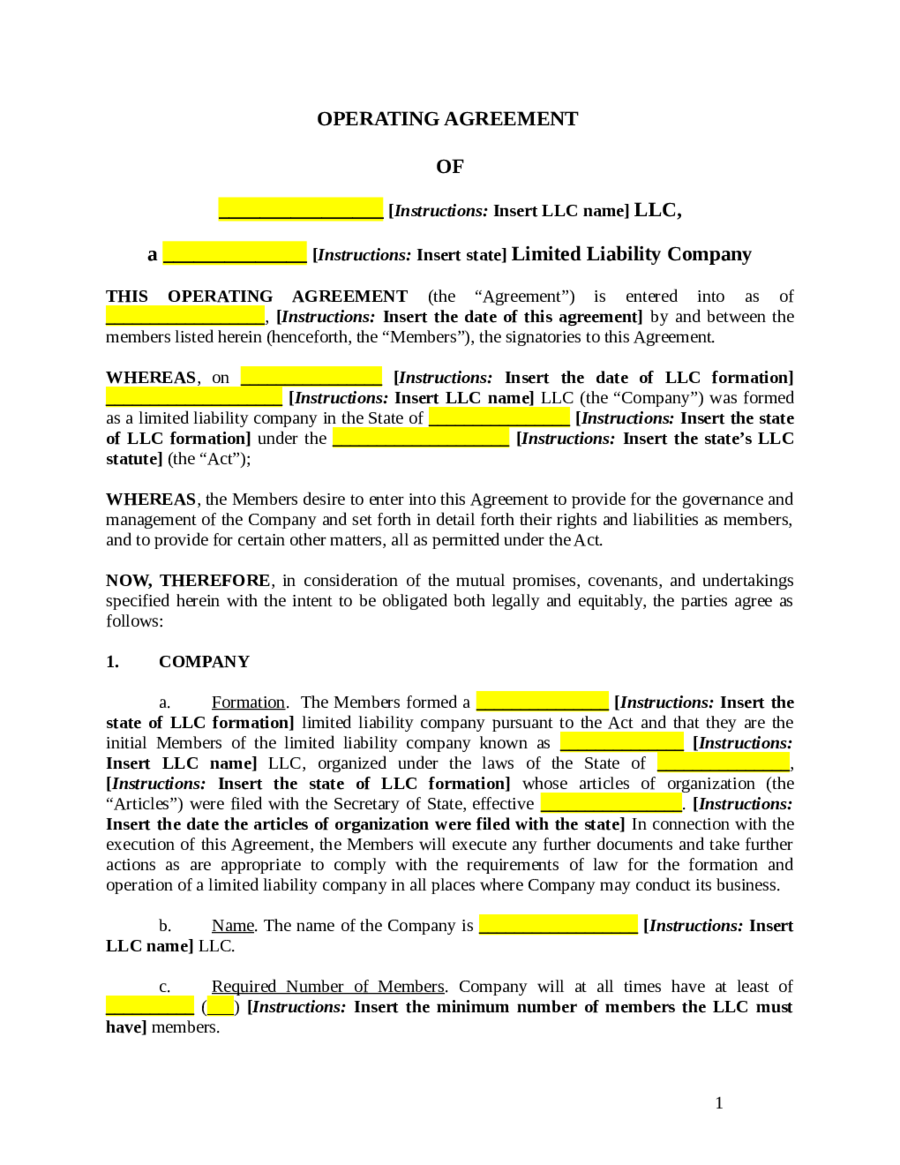

OPERATING AGREEMENT

OF

________________ [Instructions: Insert LLC name] LLC,

a ______________ [Instructions: Insert state] Limited Liability Company

THIS OPERATING AGREEMENT (the “Agreement”) is entered into as of

__________________, [Instructions: Insert the date of this agreement] by and between the

members listed herein (henceforth, the “Members”), the signatories to this Agreement.

WHEREAS, on ________________ [Instructions: Insert the date of LLC formation]

____________________ [Instructions: Insert LLC name] LLC (the “Company”) was formed

as a limited liability company in the State of ________________ [Instructions: Insert the state

of LLC formation] under the ____________________ [Instructions: Insert the state’s LLC

statute] (the “Act”);

WHEREAS, the Members desire to enter into this Agreement to provide for the governance and

management of the Company and set forth in detail forth their rights and liabilities as members,

and to provide for certain other matters, all as permitted under the Act.

NOW, THEREFORE, in consideration of the mutual promises, covenants, and undertakings

specified herein with the intent to be obligated both legally and equitably, the parties agree as

follows:

1. COMPANY

a. Formation. The Members formed a _______________ [Instructions: Insert the

state of LLC formation] limited liability company pursuant to the Act and that they are the

initial Members of the limited liability company known as ______________ [Instructions:

Insert LLC name] LLC, organized under the laws of the State of _______________,

[Instructions: Insert the state of LLC formation] whose articles of organization (the

“Articles”) were filed with the Secretary of State, effective ________________. [Instructions:

Insert the date the articles of organization were filed with the state] In connection with the

execution of this Agreement, the Members will execute any further documents and take further

actions as are appropriate to comply with the requirements of law for the formation and

operation of a limited liability company in all places where Company may conduct its business.

b. Name. The name of the Company is __________________ [Instructions: Insert

LLC name] LLC.

c. Required Number of Members. Company will at all times have at least of

__________ (___) [Instructions: Insert the minimum number of members the LLC must

have] members.

1

d. Term. The Company’s existence commenced on _______________

[Instructions: Insert the date of LLC formation] and shall continue for the term stated in the

Articles unless sooner terminated pursuant hereto or as set forth in the Act.

e. Purpose. The general purpose of the Company will be to transact any and all

businesses for which limited liability companies may be formed under ________________

[Instructions: Insert the state of LLC formation] law, to engage in all activities reasonably

necessary or incidental thereto, and to engage in any or all businesses and related activities

approved by the Members as set forth herein.

f. Registered Office; Agent. The Company shall maintain an office in

_________________ [Instructions: Insert the state where the LLC’s office will be located] as

required by the Act at which it shall maintain the records required to be maintained there by the

Act. The Company may have such other offices as the Members may determine, within or

without the State of _________________ [Instructions: Insert the state where the LLC’s

office will be located] and any such office may be the Company’s principal place of business, as

determined by the Members. The Company’s initial agent for service of process required by the

Act is as set forth in the Articles and may be changed if and as determined by the Members.

g. Management of Business. As more fully set forth herein, the business of the

Company will be conducted by the Members as a member-managed limited liability company.

h. Tax Classification. The Members intend the Company to be classified as a

partnership for federal and, to the maximum extent possible, state income taxes. This

classification for tax purposes does not create or imply a general partnership, limited partnership,

or joint venture between the Members for state law or any other purpose. Instead, the Members

acknowledge the Company’s status as a limited liability company formed under the Act.

2. MEMBERS

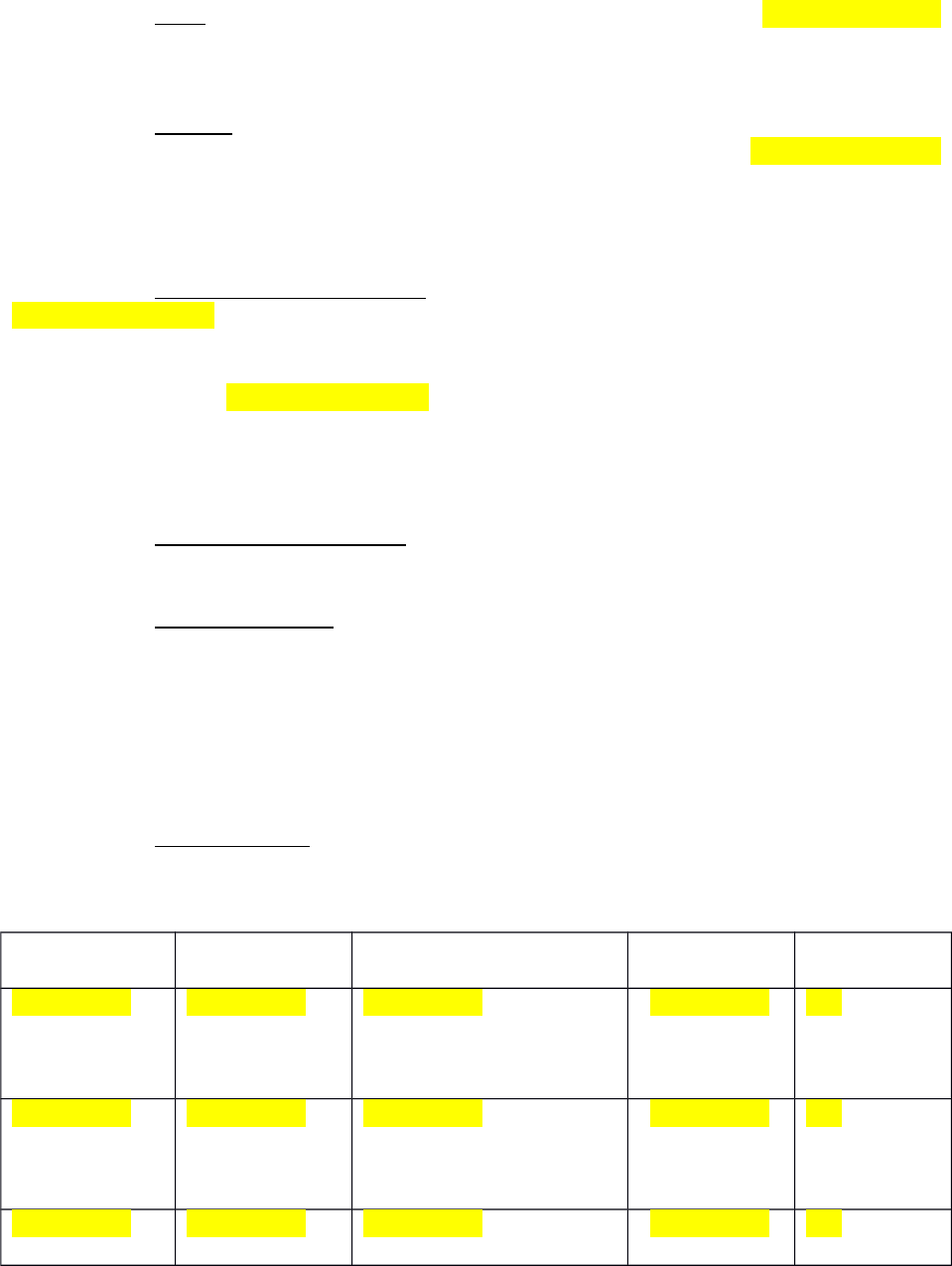

a. Initial Members. The name, social security number, business or residence street

address, initial capital contribution, and percentage interest in the Company (the “Sharing

Ratio”) of each Member are as follows:

Name Social Security

Number

Address Initial Capital

Contribution

Sharing

Ratio

__________

[Instructions:

Insert name]

__________

[Instructions:

Insert SSN]

__________

[Instructions: Insert

address]

$__________

[Instructions:

Insert

amount]

___%

[Instructions

: Insert

percent]

__________

[Instructions:

Insert name]

__________

[Instructions:

Insert SSN]

__________

[Instructions: Insert

address]

$__________

[Instructions:

Insert

amount]

___%

[Instructions

: Insert

percent]

__________

[Instructions:

__________

[Instructions:

__________

[Instructions: Insert

$__________

[Instructions:

___%

[Instructions

2

Insert name] Insert SSN] Address] Insert

Amount]

: Insert

Percent]

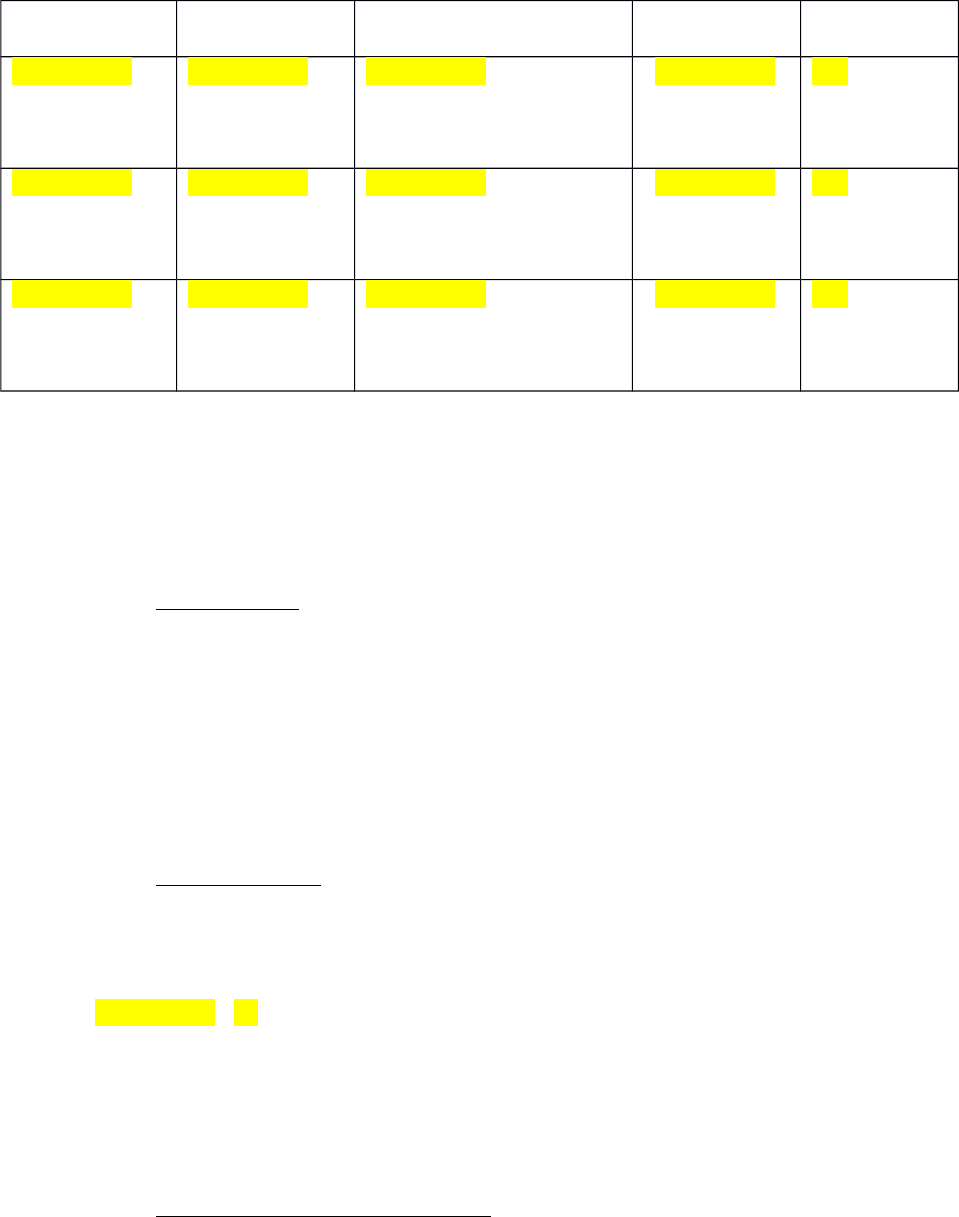

__________

[Instructions:

Insert name]

__________

[Instructions:

Insert SSN]

__________

[Instructions: Insert

address]

$__________

[Instructions:

Insert

amount]

___%

[Instructions

: Insert

percent]

__________

[Instructions:

Insert name]

__________

[Instructions:

Insert SSN]

__________

[Instructions: Insert

address]

$__________

[Instructions:

Insert

amount]

___%

[Instructions

: Insert

percent]

__________

[Instructions:

Insert name]

__________

[Instructions:

Insert SSN]

__________

[Instructions: Insert

address]

$__________

[Instructions:

Insert

amount]

___%

[Instructions

: Insert

percent]

Each such Member shall make the Initial Capital Contribution and have the Sharing Ratio set

forth above. The Initial Capital Contribution shall be in the form of cash, unless otherwise set

forth in Exhibit “A,” attached hereto and incorporated herein. The cash equivalent of any Initial

Capital Contribution that is in the form of assets other than cash will be as set forth in Exhibit

“A.”

b. New Members. If any person subsequently becomes a Member of the Company,

that person shall become a party to this Agreement by executing and delivering to the Members a

membership supplement (the “Membership Supplement”) to this Agreement in such form as the

Members prescribe. The Membership Supplement shall include: (i) the full name, business or

residence street address and social security number of the new Member; (ii) the initial capital

contribution, if any, to be made by the new Member; (iii) the Sharing Ratio of the new Member;

and (iv) any adjustments in the Sharing Ratios of other Members resulting from the admission of

the new Member. By executing and delivering the Membership Supplement, the new Member

shall become a party to this Agreement without further action.

c. Spousal Consent. In the event that any Member is married as of the date on

which such Member becomes a party to this Agreement, such Member’s spouse shall execute

and deliver to the Company the Spousal Consent attached hereto as Exhibit “B” and incorporated

herein (“Spousal Consent”), effective as of such date. If any Member should marry or remarry

after the date on which such Member becomes a party to this Agreement, such Member shall,

within __________ (__) [Instructions: Insert the number of days after marriage that a

member’s spouse must submit the “Spousal Consent”] days thereafter, obtain his/her new

spouse’s acknowledgement of and consent to the existence and binding effect of all restrictions

contained in this Agreement by causing such spouse to execute and deliver a Consent of Spouse

acknowledging the restrictions and obligations contained in this Agreement and agreeing and

consenting to the same.

d. Additional Capital Contributions. Any Members may make a subsequent

additional capital contribution in the form of money (including promissory notes), property, and

services rendered or to be rendered, provided that such contribution is previously approved in

3

writing by Members whose Sharing Ratios equal more than __________ percent (___%)

[Instructions: Insert the percentage of Sharing Ratios that must approve additional capital

contributions] of the Sharing Ratios of all Members. No Member will be obligated to make any

additional capital contribution to the Company. However, if Company's revenues are insufficient

to pay Company’s expenses, the Members have the opportunity, but not the obligation, to

contribute additional capital in cash to Company on a pro-rata basis in accordance with their

respective Sharing Ratio. Each Member will receive a credit to that Member’s Capital Account

(as defined below) in the amount of any additional capital that the Member contributes to

Company. Immediately following such capital contributions, the Sharing Ratio’s will be adjusted

to reflect the new relative proportions of the Members' Capital Accounts.

e. Member Loans to Company. No Member will be required to loan any funds to

Company. Notwithstanding the foregoing, any Member may loan funds to the Company,

provided that such loan is previously approved in writing by Members whose Sharing Ratios

equal more than __________ percent (___%) [Instructions: Insert the percentage of Sharing

Ratios that must approve member loans] of the Sharing Ratios of all Members. All loans must

be evidenced by a promissory note (each a “Note”) payable by Company to the lending Member.

f. Liability for Company Obligations. Except as otherwise provided in this

Agreement, or required by law, no Member shall be personally liable for any debt, obligation, or

liability of the Company, whether that debt, obligation, or liability arises in contract, tort, or

otherwise.

3. PROFITS, LOSSES AND DISTRIBUTIONS

a. Capital Accounts. A Capital Account shall be maintained for each Member. The

Capital Account of each Member will be credited initially with the amount of the Initial Capital

Contribution by that Member. Thereafter, each Member’s Capital Account will be credited with

that Member’s Sharing Ratio of Profits and the amount of any additional capital contributed to

the Company by that Member, and will be debited with that Member’s Sharing Ratio of Losses

and the amount of any capital distributed to that Member. Each Capital Account shall be

maintained in accordance with the requirements of Internal Revenue Code of 1986 (“IRC”) §

704(b) and all other applicable local, state and/or federal regulations. In the event that the

Members determine that it is necessary to modify the manner in which the Capital Accounts are

computed to comply with local, state and/or federal regulations in order to reflect the agreed

allocations, the Members may make a modification, provided that such allocation is not likely to

have a material effect on the amounts distributable to any member upon the dissolution of

Company. No interest will be paid to the Members on capital contributions or on Capital

Account balances.

b. Profits and Losses. The Profits and Losses of the Company shall be allocated

among the Members in accordance with their Sharing Ratios.

c. Distributions. Annually or at more frequent intervals, the Members shall

distribute available funds to the Members, in proportion to their Sharing Ratios. As used herein,

“Available funds” shall mean the Company’s gross cash receipts (other than cash funds obtained

4

as contributions to the Company by its Members and cash funds, if any, obtained from loans to

the Company), less the Company’s operating expenses including provisions for payment of

outstanding and unpaid current obligations of the Company as of such time, and less the amount

that, in the Members’ reasonable judgment, the Company should retain in order to maintain a

reasonable reserve and to satisfy Company’s current obligations (including the current portion of

long term debt) and fulfill Company’s business purposes.

4. MANAGEMENT

a. Management by Members. The Members, as managers, will manage the

Company. Except as otherwise provided in this Agreement, the Members shall have equal rights

in and the exclusive authority to manage the operations and affairs of the Company and to make

all decisions regarding the Company and its business. The Members will take all actions that

may be necessary or appropriate for the continuation of the Company’s valid existence as a

limited liability company under the Act, and for the acquisition, development, maintenance,

preservation, and operation of Company property in accordance with the provisions of this

Agreement and applicable laws and regulations. Except as otherwise provided herein, any action

approved by Members whose Sharing Ratios equal more than __________ percent (___%)

[Instructions: Insert the percentage of Sharing Ratios that must approve a Company

action] of the Sharing Ratios of all Members will constitute the act of and serve to bind the

Company. The signature of any Member authorized to do so by such approval is sufficient to

bind the Company with respect to the matter or matters so approved. No member acting alone

without such approval may bind the Company to any agreement with or obligation to any third

party or represent or claim to have the ability to do so and all statements of the Company filed or

recorded by the Members or by the Company, if possible, must so state. The Members will not

be required to hold meetings to make management decisions but may do so if and as desired and

appropriate, as provided herein.

b. Major Decisions. Except as otherwise provided in this paragraph, decisions shall

be made by the prior written consent of Members whose Sharing Ratios equal more than

__________ percent (___%) [Instructions: Insert the percentage of Sharing Ratios that must

approve a Company action] of the Sharing Ratios of all Members. Notwithstanding the

foregoing, however, to the fullest extent permitted by law, the following major decisions require

the prior written consent of Members whose Sharing Ratios equal more than __________

percent (___%) [Instructions: Insert the percentage of Sharing Ratios that must approve a

“major decision”] of the Sharing Ratios of all Members:

i. A change in the purposes or the nature of the business of the Company;

ii. The merger of Company with any other limited liability company, limited

partnership, or corporation;

iii. The transfer, exchange, or other disposition of all Company’s assets, any

significant portion thereof, or any significant interest in Company assets occurring as part of a

single transaction or plan;

5

iv. The admission or withdrawal of Members or a change in their Sharing

Ratios in any manner other than in accordance with this Agreement;

v. The dissolution of the Company other than in accordance with this

Agreement;

vi. Any amendment to this Agreement;

vii. The incurrence or prepayment of any debt for borrowed money by the

Company in excess of __________ Dollars ($________); [Instructions: Insert the minimum

debt prepayment amount that will trigger this section]

viii. The incurrence of obligations having a maturity beyond __________ (__)

[Instructions: Insert the minimum number of months maturity an obligation must have to

trigger this section] months or in excess of __________ Dollars ($________); [Instructions:

Insert the minimum obligation amount that will trigger this section]

ix. Any purchase of capital assets or other properties for the Company in

excess of __________ Dollars ($________); [Instructions: Insert the minimum purchase

price of capital assets or other properties that will trigger this section]

x. Making, executing, or delivering on behalf of Company any assignment

for the benefit of creditors or any guarantee, indemnity bond, or surety bond, or any equivalent

thereof;

xi. Lending funds belonging to Company to any third party or extending to

any person, firm, or corporation, credit on behalf of Company, except in the ordinary course of

business or as set forth in this Agreement;

xii. Investing any funds of Company temporarily, including without limitation,

in time deposits, short-term governmental obligations, commercial paper, or other investments;

or

xiii. Changes in tax elections and accounting policies of the Company.

c. Other Activities; Affiliates.

i. Members will not be required to manage the Company as their sole and

exclusive function and each of them may have other business interests and may engage in other

activities in addition to those relating to the Company, including the making or management of

other investments. Each Member recognizes that each other Member has or may have an interest

in investing in, operating, transferring, leasing, and otherwise using property of various kinds

and interests therein for profit, and engaging in any and all activities related or incidental thereto

and that each will make other investments consistent with such interests. Neither the Company

nor any Member by virtue of this Agreement or any relationship created hereby will have any

right in or to any other ventures or activities in which any other Member is involved or to the

6

income or proceeds derived therefrom, and the pursuit of other ventures and activities by each

Member, is hereby consented to by each Member and will not be deemed wrongful or improper.

Notwithstanding the foregoing, no Member may engage in any activity that is in direct

competition with Company’s business. Except as otherwise provided in this Agreement, neither

any Member nor any Affiliate of a Member will be obligated to present any particular investment

opportunity to the Company, and each Member and each Affiliate of a Member will have the

right to take for its own account, or to recommend to others, any such particular investment

opportunity.

ii. As used herein, “Affiliate(s) of a Member” means (1) any partners in that

Member; (2) any person that directly or indirectly (including through any related entity) or in a

fiduciary capacity controls, is controlled by, or is under common control with that Member or

any general partner in that Member; or (3) any other person of which five percent (5%) or more

of the equity interest is held beneficially or of record by that Member or any general partner in

that Member. “Affiliate” also includes any officer or director of that Member, a spouse, ancestor,

or lineal descendant of such officer or director or a trust for the benefit of any of the foregoing.

For purposes of this definition, the term “control” means the possession, directly or indirectly, of

the power to cause the direction of the management and policies of a person, whether through the

ownership of voting securities, by contract, family relationships, or otherwise.

d. Liability; Indemnification. To the maximum extent permitted by the Act and the

other laws and public policies of the State of _______________, [Instructions: Insert the state

of LLC formation] the Members shall not be liable to the Company or to any other person for

any loss, damage or claim incurred by reason of any act or omission performed or omitted to be

performed by the Members in good faith on behalf of the Company in the conduct of the

business and/or affairs of the Company. Further, to the maximum extent permitted by the Act

and the other laws and public policies of the State of ______________, [Instructions: Insert the

state of LLC formation] the Company shall defend, indemnify and hold harmless the Members

and any of the Affiliates of a Member, and any of his or their respective shareholders, members,

directors, officers, employees, agents, attorneys or Affiliates, from and against any and all

liabilities, losses, claims judgments, fines, settlements and damages incurred by the Members, or

by any such person, arising out of any claim based upon any acts performed or omitted to be

performed by the Members, or by any such other person, on behalf of the Members, in

connection with the organization, management, business or property of the Company, including

costs, expenses and attorneys’ fees (which may be paid as incurred) expended in the settlement

or defense of any such claim.

e. Deadlock. In the event that the Members are divided and are unable to reach

agreement with respect to any proposed course of action, within __________ (__) [Instructions:

Insert the number of days a deadlock must last to trigger this section] days after such request

for action by any Member, a deadlock (the “Deadlock”) shall be deemed to exist. In the event of

a Deadlock the Members shall unanimously agree upon an independent third-party (the “Tie-

Breaker”), who will, after good faith discussions with the Members, resolve the Deadlock

(including, if necessary, by voting in favor of or against a proposed resolution). In the event that

a Tie-Breaker cannot be unanimously agreed, each member shall appoint a Tie-Breaker, and the

Tie-Breakers shall mutually agree upon and appoint a Tie-Breaker, provided that such Tie-

7

Breaker is an independent third-party of good reputation and possesses significant experience in

the subject matter of the Deadlock. As soon as practicable after the appointment of the Tie-

Breaker, the Tie-Breaker shall, after good faith discussions with the Members, resolve the

Deadlock (including, if necessary, by voting in favor of or against a proposed resolution). The

determination of the Tie-Breaker shall be final and binding upon all of the Members and the

Company. Any fee charged by the Tie-Breaker shall be paid by Company.

f. Meetings and Consents of Members. Actions of Members may be taken at

meetings, by written consent of all Members, or otherwise as agreed among the Members. If

action is taken at a meeting, an appropriate record of the action taken shall be made and retained

in the Company’s records. If the action is by written consent, executed copies shall be

maintained in the Company’s records. Meetings of Members may be called by any Member.

Reasonable notice shall be given to each Member of any meeting of Members. Notice is

reasonable if it specifies briefly the nature of the matters to be presented at the meeting, and is

sent or delivered in a manner that in the ordinary course of business would be received by each

Member not less than __________ (__) [Instructions: Insert the number of days notice

required for a meeting of members] days prior to the day of the meeting.

g. Information Relating to Company. Any Member is entitled to receive any

information regarding the Company or its activities. Each Member or authorized representative

shall have access to and may inspect and copy all books, records, and materials regarding the

Company or its activities. The exercise of the rights contained in this paragraph shall be at the

requesting Member’s expense.

h. Member Compensation. Unless otherwise specifically agreed among the

Members, no Member shall receive any payment or compensation for performance of obligations

under this Agreement or for management services to the Company. Notwithstanding the

foregoing, subject to local, state and/or federal regulations, the Company shall reimburse any

Member for all, previously approved, reasonable, direct out-of-pocket expenses incurred by such

Member in the course of managing the Company.

5. BOOKS AND RECORDS

a. Maintenance of Books and Records. Complete and accurate books of account of

the Company’s affairs shall be maintained at the Company’s principal place of business or at

such other place designated by Company and shall remain open to inspection by any of the

Members or their authorized representatives at any reasonable time during business hours. The

accounting records will be maintained in accordance with generally accepted bookkeeping

practices for Company’s type of business and those methods followed for federal and state

income tax purposes.

b. Reports. The books of account shall be closed promptly after the close of the

fiscal year. Each Member shall promptly be sent a statement of the Member’s distributive share

of income and expense for federal income tax reporting purposes.

8

c. Tax Matters Partner. ______________ [Instructions: Insert the member’s

name that will be responsible for tax matters] shall be designated as the Tax Matters Partner

for purposes of IRC to represent Company, at Company’s expense, in connection with all

examinations of Company affairs by tax authorities and to expend Company funds for

professional services and associated costs.

d. Fiscal Year. The fiscal year end of Company for financial reporting and for

federal income tax purposes will be ______________. [Instructions: Insert the fiscal year end

date]

e. Tax Returns. The Members will cause to be prepared at least annually, at

Company's expense, information necessary for the preparation of the Members’ federal and state

income tax returns. The Company will send or cause to be sent to each Member within

__________ (__) [Instructions: Insert the number of days after the end of a tax year that

members will receive tax returns] days after the end of each taxable year: (i) the information

necessary to complete federal and state income tax or information returns; and (ii) a copy of the

Company's federal, state, and local income tax or information returns for that year.

6. TRANSFERS; NEW MEMBERS

a. Assignment. Notwithstanding anything to the contrary in this Agreement, a

Member’s interest in the Company may be assigned only with the written consent of

__________ percent (___%) [Instructions: Insert the percentage of shares that must approve

an assignment of a member’s shares] of the Sharing Ratios of all Members.

b. Substitution of Transferee as Member. Notwithstanding anything to the contrary

in this Agreement, no transferee, assignee, purchaser, designee, or legal representative of a

Member may become a Member without the written consent of __________ percent (___%)

[Instructions: Insert the percentage of shares that must approve a transferee as a new

member] of the Sharing Ratios of all Members. If consent is not granted, the transferee,

assignee, purchaser, designee, or legal representative of a Member, except as otherwise required

by law, shall have no right to participate in the management of the business and affairs of the

Company including any right to vote, and shall be entitled only to receive the economic right to

receive distributions made by the Company and the transferring Member’s allocable share of

taxable income, gain, loss, deduction, and credit (the “Economic Rights”) to which that Member

would otherwise be entitled and which was assigned. As further conditions to admission as a

Member, any transferee, assignee, purchaser, designee, or legal representative of a Member shall

(i) execute and deliver such instruments, in the form and substance satisfactory to the Members,

as the Members deem necessary or desirable to cause the transferee to become a Member

including the Membership Supplement and (ii) pay all reasonable expenses in connection with

admission as a Member, including but not limited to the cost of preparation and filing of the

Membership and any other amendment of this Agreement or the Articles or of taking any other

action necessary or desirable in connection therewith.

c. Admission of New Members. Notwithstanding anything to the contrary in this

Agreement, additional persons may be admitted as Members of the Company upon the

9

affirmative vote of __________ percent (___%) [Instructions: Insert the percentage of shares

that must approve a new member’s admission] of the Sharing Ratios of all Members.

Concurrently with admission of a person as a Member, that new Member shall execute and

deliver the Membership Supplement.

d. Death, Incompetency, or Bankruptcy of Member.

i. Upon the death, adjudicated incompetence, or bankruptcy (the

“Incapacitating Event”) of a Member, the successor in interest, whether an estate, bankruptcy

trustee, or otherwise (the “Successor”) to any Member that has suffered an Incapacitating Event

(the “Incapacitated Member”), will receive only the Economic Rights of the Incapacitated

Member. For the purposes of Member votes, consents, and participation in management, the

Sharing Ratio of the Incapacitated Member shall be eliminated and the Sharing Ratio of the

remaining Members shall be increased proportionately. Should the remaining Members desire to

substitute the Successor as a Member of the Company, they must do so in accordance with the

provisions of this Agreement.

ii. Notwithstanding the foregoing, the Members covenant and agree that upon

the occurrence of an Incapacitating Event of a Member, the Company, at its option, may

purchase, acquire, and redeem the Sharing Ratio of the Incapacitated Member in the Company

for fair market value by providing written notice to the Successor of the Incapacitated Member

within __________ (__) [Instructions: Insert the number of days notice required to purchase

the shares of an incapacitated member] days of the occurrence of the Incapacitating Event.

The fair market value of the Incapacitated Member’s Sharing Ratio of the Company shall be

determined by mutual agreement of the remaining Members and the Successor. If the parties

cannot reach an agreement on the value within __________ (__) [Instructions: Insert the

number of days the remaining members have to agree on the fair market value of the

shares] days following Company’s notice, then the surviving Members and the Successor each

must select a qualified appraiser within the next __________ (__) [Instructions: Insert the

number of days that appraisers must be selected] days. The selected appraisers must attempt

to determine the value of the Sharing Ratio owned by the Incapacitated Member at the time of

the Incapacitating Event, based solely on their appraisal of the total value of the Company’s

assets and the amount the decedent would have received had the assets of the Company been

sold at that time for an amount equal to their fair market value and the proceeds (after payment

of all Company obligations) were distributed as they would be upon dissolution of the Company.

In the event the two selected appraisers cannot agree on the value within __________ (__)

[Instructions: Insert the number of days the appraisers have to determine the value of the

shares] days after being selected, the appraisers must, within __________ (__) [Instructions:

Insert the number of days the appraisers have to select a third appraiser] days, select a third

appraiser. The value of the Sharing Ratio owned by the Incapacitated Member at the time of the

Incapacitating Event (and Company’s purchase price thereof) will be the average of the two

appraisals nearest in amount to one another. That amount will be final and binding on all parties

and their respective successors, assigns, and representatives. The costs and expenses of the third

appraiser and any costs and expenses of the appraiser retained but not paid for by Successor will

be offset against the purchase price paid for the Incapacitated Member’s Interest in the Company.

10

On completion of the purchase of the Incapacitated Member’s Sharing Ratio in the Company, the

Sharing Ratio of the remaining Members will increase proportionately.

iii. Should Company fail to exercise its right to purchase the Sharing Ratio of

the Incapacitated Member within __________ (__) [Instructions: Insert the number of days

the Company has to purchase the shares of an incapacitated member] days of the occurrence

of the Incapacitating Event, the Successor may attempt to transfer the Incapacitated Member’s

Sharing Ratio to a third party. In the event that the substitution complies with the terms of this

Agreement, the third party shall become a Member; otherwise, the transfer shall only be of the

Incapacitated Member’s Economic Rights.

e. Buyout upon Deadlock. Notwithstanding anything to the contrary contained

herein, in the event that a Deadlock occurs and the parties agree that a buyout is the best course

of action, the Members covenant and agree that the Member(s) that are purchasing, acquiring,

and redeeming (the “Purchasing Member(s)”) the Sharing Ratio of the other Member(s) (the

“Selling Member(s)”) must pay fair market value. To determine the fair market value of the

Selling Member(s)’ Sharing Ratio of the Company, the Purchasing Member(s) and the Selling

Member(s) shall each select a qualified appraiser. The selected appraisers must attempt to

determine the value of the Sharing Ratio owned by the Selling Member(s) at the time of

appraisal, based solely on their appraisal of the total value of the Company’s assets and the

amount the Selling Member(s) would have received had the assets of the Company been sold at

that time for an amount equal to their fair market value and the proceeds (after payment of all

Company obligations) were distributed as they would be upon dissolution of the Company. In

the event the two selected appraisers cannot agree on the value within __________ (__)

[Instructions: Insert the number of days the two appraisers have to agree on the value of

shares] days after being selected, the appraisers must, within __________ (__) [Instructions:

Insert the number of days the two appraisers have to select a third appraiser] days, select a

third appraiser. The value of the Sharing Ratio owned by the Selling Member(s) will be the

average of the two appraisals nearest in amount to one another. That amount will be final and

binding on all parties and their respective successors, assigns, and representatives. The costs and

expenses of the appraisers will be offset against the purchase price paid for the Selling

Member(s)’ interest in the Company.

7. DISSOLUTION AND WINDING UP

a. The Company will be dissolved, its assets disposed of, and its affairs wound up on

the first of the following “Dissolution Events” to occur:

i. The happening of an event stated in this Agreement or the Articles;

ii. A determination that the Company be dissolved and wound up by

Members whose Sharing Ratios equal more than __________ percent (___%) [Instructions:

Insert the percentage of shares that must approve dissolution] of the Sharing Ratios of all

Members;

11