LLC Operating Agreement Template

- DOCUMENTS

- GUIDANCE

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Are you involved in corporate business affairs? Then you must be in need of an LLC operating agreement. It is evident that once you are done with your Limited Liability Company (LLC), you are free to use LLC operating agreement in order to delineate the operating terms of your corporation. In addition, it also helps to safeguard legal rights and responsibilities.With the help of written record expressing the management policies and procedures of your organization you can easily get down to business. However, sometimes it gets difficult to frame the perfect LLC sample operating agreement. You need not worry as you can get exclusive LLC operating agreement template from professional websites. These templates perfectly designed and formatted, all you need is to download them and serve your purpose. So, what are you waiting for?

What is an LLC?

Just like another corporation, Limited Liability Company (LLC) is also a distinct and separate legal entity. This implies that an LLC can open a bank account to carry their business under a name and can also get a tax identification number. Limited liability companies are mainly hybrid entities which amalgamate features of an organization and a partnership.It is actually a specific form of private limited company from the US. It is worth to mention that LLC is not a legal form of a company which offers limited liability to its owners in a number of dominions. LLC owners report their business profits or their losses on their individual tax income returns and one must remember that LLC is not a distinct taxable entity.How to form an LLC (Limited Liability Company)?

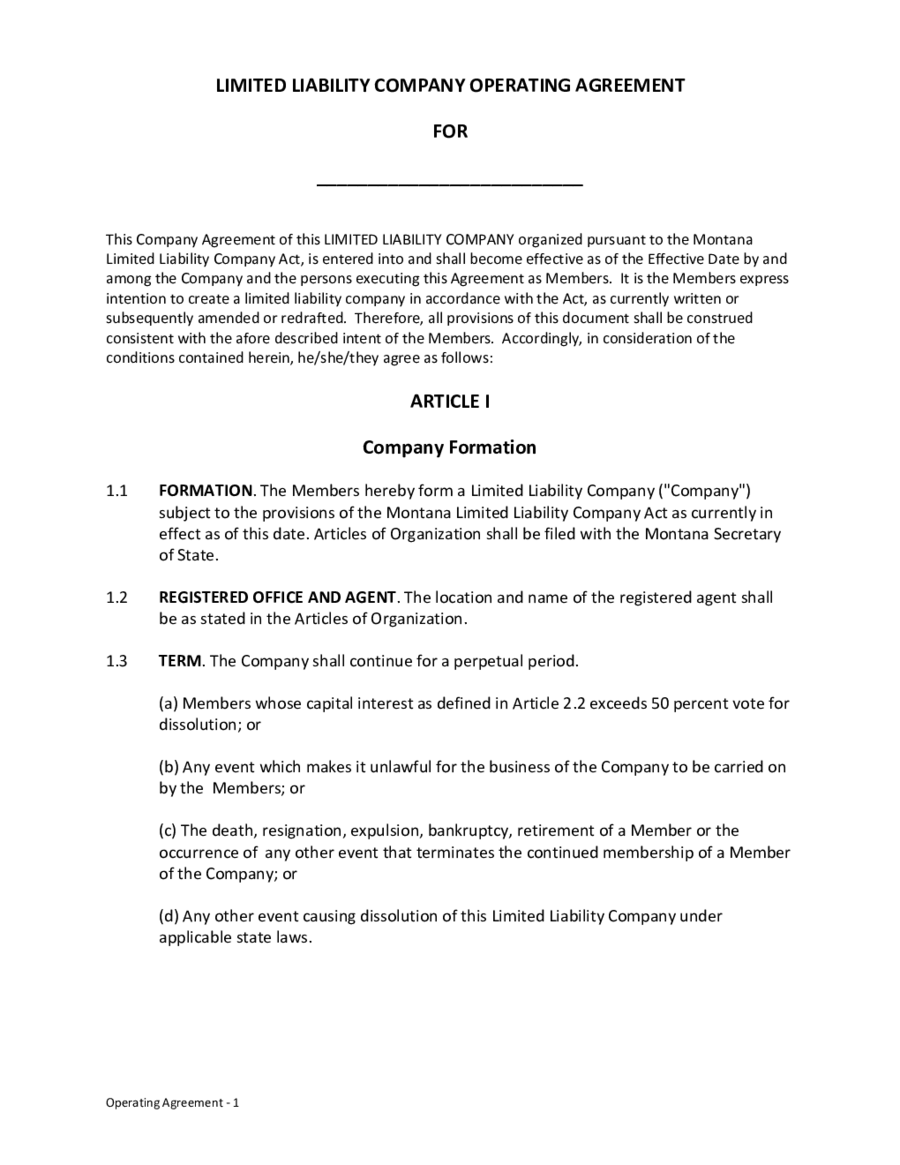

There are certain steps to be followed to form an LLC and they are explained below:- First of all, it is important to choose a legal name and reserve it.

- Then draft and file the articles of incorporation along with the Secretary of the state.

- Then it is important to decide that who will run the business and how many owners will be there in the business.

- Now it is crucial to apply for a business license along with other important certificates and documents which particular to the industry applied for.

- Then the applicant can apply online at Internal Revenue Service website or can also file form SS-4 in order to attain an Employer Identification Number (EIN).

- Finally, apply for any other ID numbers which are essential for local and state management authorities.

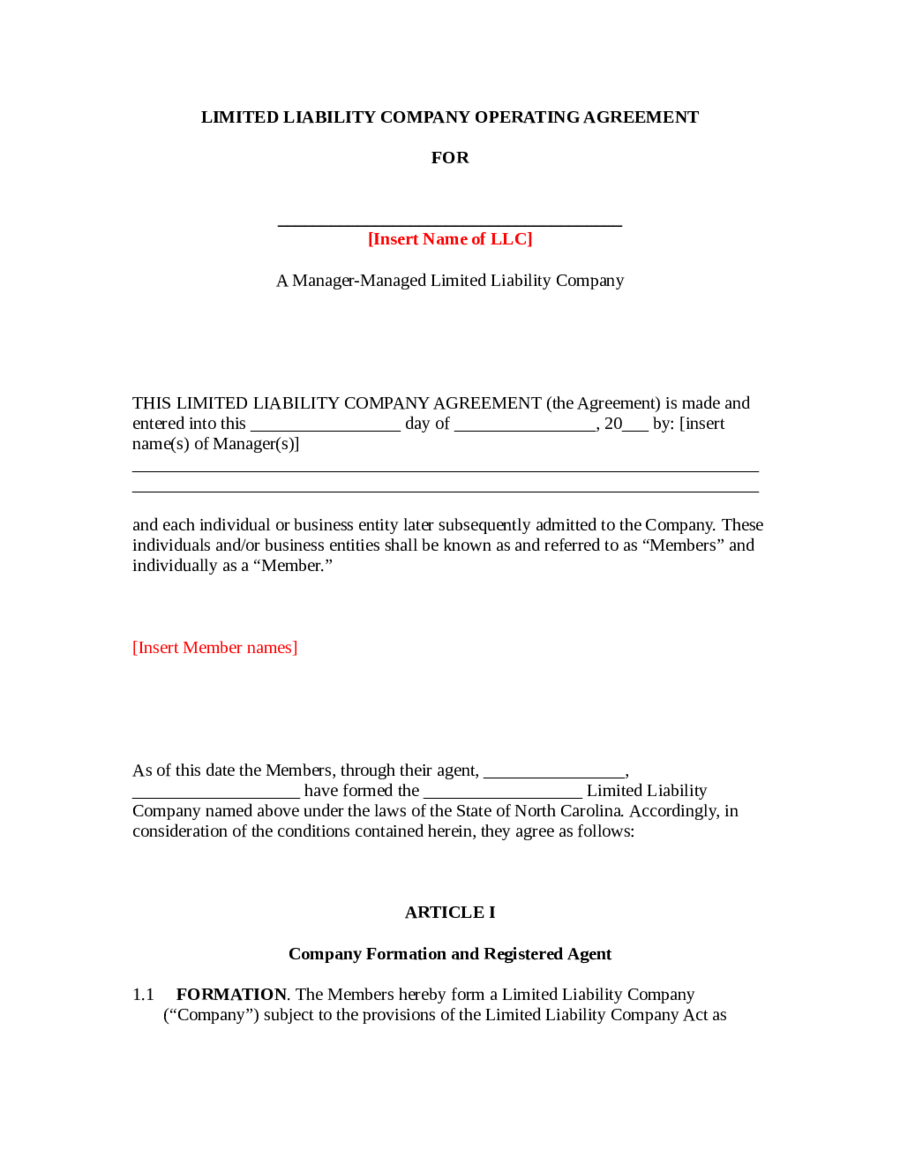

What is an operating agreement?

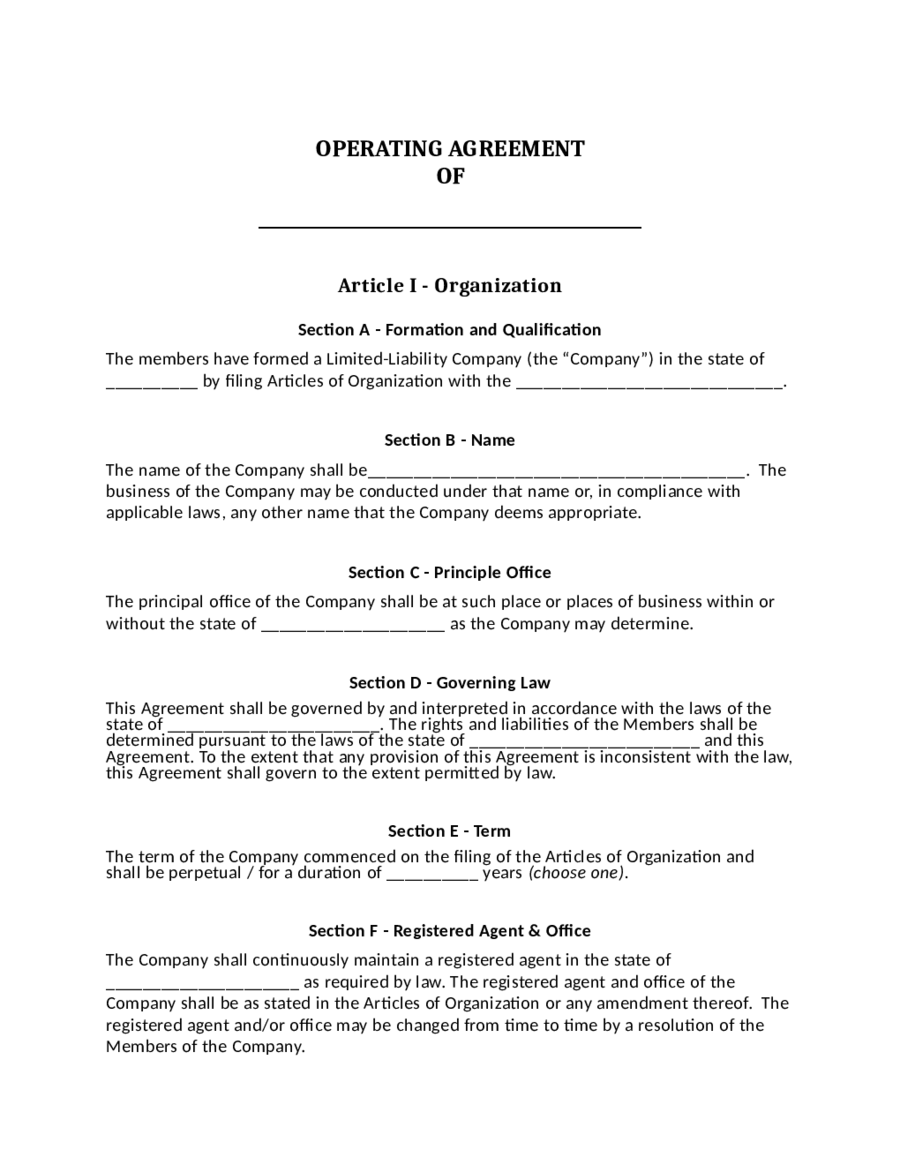

An operating agreement is a valid document which modifies the terms and conditions of an LLC (Limited Liability Company), as per certain needs of the proprietors. In addition to that, it also summarizes the economic and functional decision-making in a structured manner. To be precise, operating agreement is a contract document of 10-20 which states all the guidelines and terms for an LLC.Operating agreement in context to LLC can also be explained as a lawful document which institutes right and responsibilities for each of LLC member, along with that it also offer details about inner management of LLC which include when the meeting was held, how the decision was taken, how new members were admitted and much more.Operating agreement is identical in its function to corporate by-laws. For single member LLCs, an operating agreement is a declaration of structure that the member itself has chosen for its organization and is sometimes used to substantiate in court that the LLC structure is dispersed from that of the individual owner.So, if you are also in need of an operating agreement then you must not waste your time and opt for an LLC operating agreement template available online. The templates are already pre-formatted and they can be edited as well as per your requirements.When to use LLC operating agreement?

LLC operating agreement can be used when-- The applicant is prepared to form an LLC and the same seek to explain terms and condition of business, and

- The applicant has already applied formed an LLC, but still yet to have an operating agreement.

Pros and cons of LLC

There are a number of advantages to starting an LLC, but the points mentioned below are few that stand out.- Sharing of Profits: There are very fewer limitations on profit sharing within an LLC, as most of the members distribute profits as they see it. It is also evident that the members may donate dissimilar shares of equity and capital.

- Less Recordkeeping: This is one of the most important operational advantages of LLC. Compared to any other organization there are fewer startup costs and less paperwork registration.

- Free from taxes: In LLC there is no need to submit a corporate tax return. Proprietors report their profit share and loss through their individual tax returns.

- Enhanced credibility: It is evident that most of the lenders, partners, suppliers, etc., may look more favorably on the business when an applicant is forming an LLC.

- LLC’s offers limited liability shield to its owners/members.

- One of the biggest disadvantages of LLC is that the managerial structure of LLC is not clearly stated. Dissimilar to other organizations, LLC's are not required to have an officer or a board of directors.

- LLC’s lacks in uniformity as they are treated differently in different states.

- Also, there is less scope or chances of potential growth as the applicants cannot issue shares of stock in order to entice stakeholders.

How to draft an LLC operating agreement?

LCC operating agreement is the prevailing article of an LLC (Limited Liability Company). It actually sets forth the way that the business of the LCC's will be carried out. Well in order to answer the question on how to draft an LCC operating agreement, there is no definite answer as each and every business has its own distinct requirements to be addressed in the operating agreement. It is also possible that the requirement of the business might get changes so it is good to make proper amendments.Let us consider some topics that one can consider including while framing the operating agreement.- The first and the foremost thing is to define the purpose of the business.The purpose should be explained in clear statements regarding what sort of business will be operated. The applicant can be general or specific and it entirely depends on the desire of the person.

- After defining the purpose it is crucial to determine the members of the LLC.This step is associated with the points 4 and 5, as the number of members will help to decide that how much money each of those members will contribute in the business.

- Then comes the most important thing and it is to explain that what the business will do with the distributions, gains, and losses.It is very crucial to decide that whether to put back all the profits into the company or to be given to the members as disseminations. It is also good to discuss thoroughly the point along with all the members in order to agree on how the financial aspect of the LCC will work. Stating this fact will also help to avoid disagreements between members.

- If there is any member then it is important to decide that how much money each of the members will put into the organization. It is the proven fact that organizations need money to make money. It is important to write out clearly that which member will contribute money as a contribution to the LLC. It is also good to check that whether the money given will be considered as contribution or loan which should be given back by the company at a given time.5. Then it is to adopt that who will administer the business.It is evident that entrusting duties early will evade administration conflicts once the firm is established and running up. It is also necessary to forestall all the activities that the organization will need to perform and allocate them. Always agree on the fact that who will manage the LLC.6. Last but not the least it is important to analyze that is there anyone who will get compensation in the business.In this step, it is important to check that whether the manager is going to get a salary or a larger distribution share? In addition to that, it is also good to check that whether the manager is going to put in as much capital as all the other available members?Well, these are some of the crucial topics to be mentioned while LCC framing operating agreement and it is hoped that now it is clear that how to draft an LCC operating agreement. But users can get free from these topics and technicalities if they want, as they can download the professional and ready-made LLC operating agreement template to serve their purpose. The best thing is that they are pre-structured and incorporated with all the required points. If not then you can give it a try once. What say?

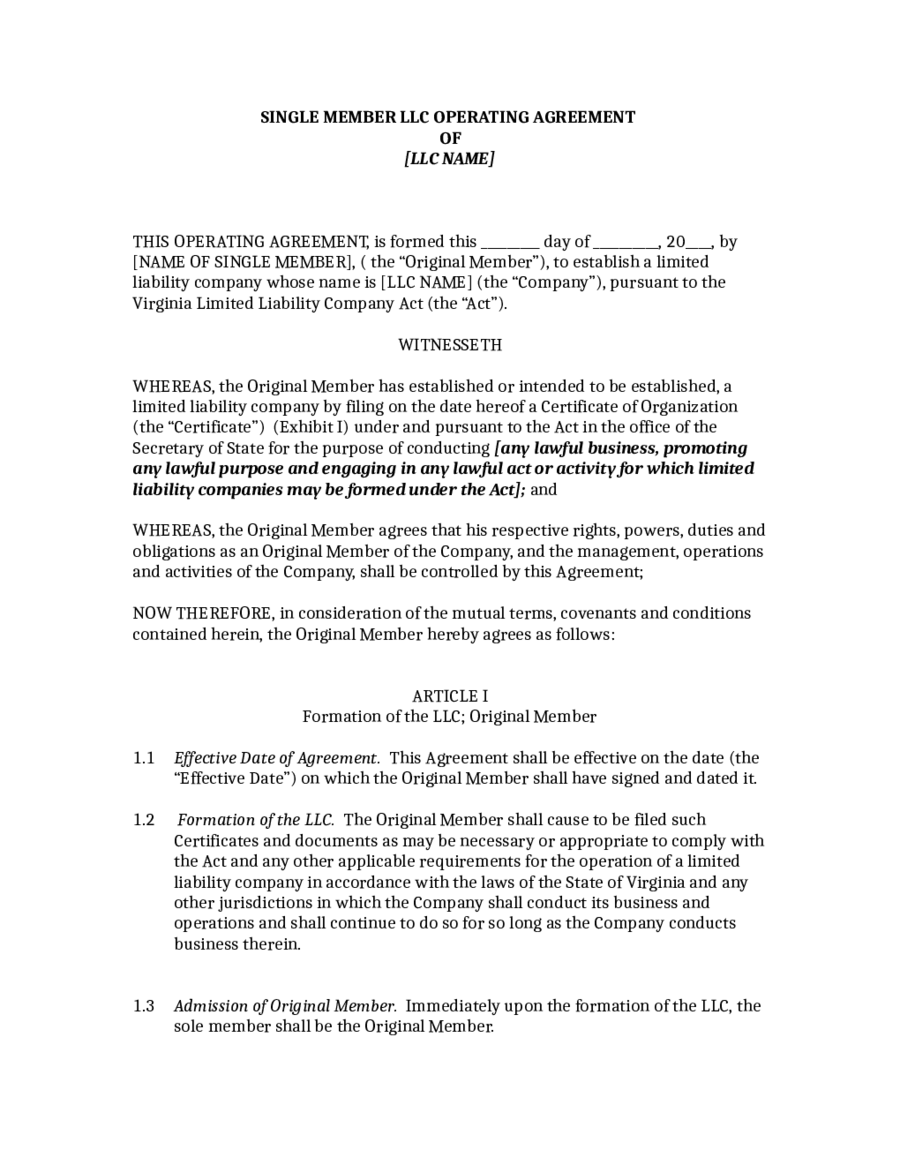

Introduction of single member LLC operating agreement

The motive behind the creation of Single member LLC operating agreement was to able the single owner to get personal asset protection from the actions of the LLC that too without commercial regulations. An effective operating agreement is personalized to fit certain requirements of Single member LCC operating agreement. This is the reason for which the contents, length or operating agreements vary extensively. Operating agreements include the following information:- Membership

- Administration

- Corporation

- Economic contributions and distributions

- Dissolution

- Tax and economic matters

- miscellaneous provisions

- Signatures

What are the benefits offered by single member LCC operating agreement?

- It serves as an added document in order to show the potential lenders in terms of organization.

- It offers an extra confirmation of separation of the business from the applicant personally.

- It offers rules that can surpass default provisions of state's LLC act.

- It also provides a point of reference for how the applicant is actually envisioned to operate the business.

Why is the need of an operating agreement for a single member LLC?

It is good to recapitulate the operating agreement is actually a contract which allows that how an LLC works along with the fact that how members interact with LLC. Let us discuss that why a single member LLC needs an operating agreement.- The applicant should separate the business from the individual

- It can help to regulate everyday operations

Related Categories

Apprenticeship Agreement FormCar Payment Agreement FormCommercial Rental Agreement FormConsignment Agreement FormConsulting Agreement FormContingency Fee Agreement FormContractor Agreement FormDebt Settlement Agreement FormDriveway Easement Agreement FormEmployment Agreement FormEscrow Agreement FormPartnership Agreement FormGuarantor Agreement FormInstallment Agreement FormJoint Custody Agreement FormLoan Agreement FormLottery Syndicate Agreement FormMortgage Agreement FormNon-Compete Agreement FormNon-Disclosure Agreement FormParking Agreement FormParty Wall Agreement FormPet Agreement FormPostnuptial Agreement FormPrenuptial Agreement FormRoad Maintenance Agreement FormRoommate Agreement FormSecurity Agreement FormSeparation Agreement FormStock Purchase Agreement FormTenancy Agreement FormTraining Agreement FormCohabitation Agreement TemplateConfidentiality Agreement TemplateConsultant Agreement TemplateExclusivity Agreement TemplateNon Compete Agreement TemplateNovation Agreement TemplateJoint Venture Agreement TemplateTrailer Rental AgreementVacation Rental AgreementPasture Lease AgreementHorse Lease AgreementCondo Lease AgreementBooth Rental AgreementPower Purchase AgreementMemorandum of Lease AgreementShareholder AgreementHold Harmless Agreement