Fillable Printable Sample Operating Agreement - California

Fillable Printable Sample Operating Agreement - California

Sample Operating Agreement - California

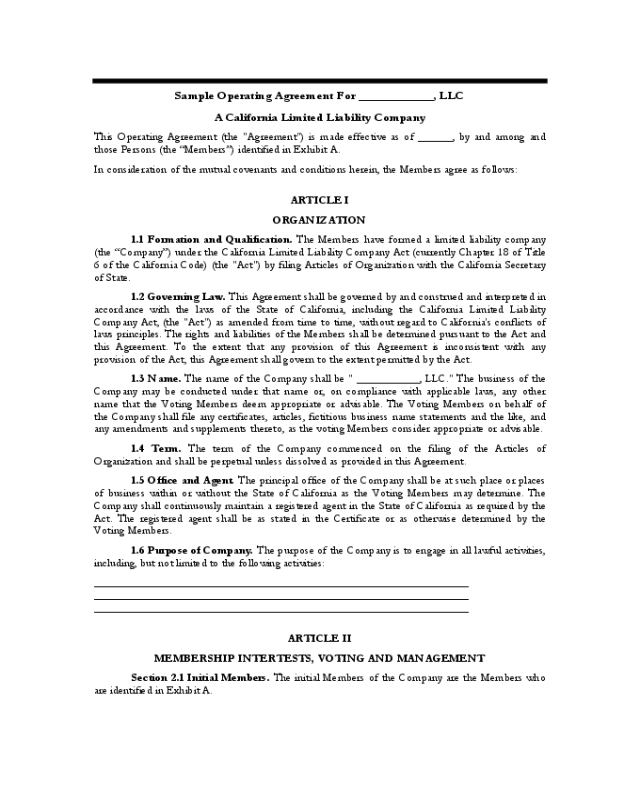

Sample Operating Agreement For ____________, LLC

A California Limited Liability Company

This Operating Agreement (the "Agreement") is made effective as of ______, by and among and

those Persons (the “Members”) identified in Exhibit A.

In consideration of the mutual covenants and conditions herein, the Members agree as follows:

ARTICLE I

ORGANIZATION

1.1 Formation and Qualification. The Members have formed a limited liability company

(the “Company”) under the California Limited Liability Company Act (currently Chapter 18 of Title

6 of the California Code) (the "Act") by filing Articles of Organization with the California Secretary

of State.

1.2 Governing Law. This Agreement shall be governed by and construed and interpreted in

accordance with the laws of the State of California, including the California Limited Liability

Company Act, (the "Act") as amended from time to time, without regard to California's conflicts of

laws principles. The rights and liabilities of the Members shall be determined pursuant to the Act and

this Agreement. To the extent that any provision of this Agreement is inconsistent with any

provision of the Act, this Agreement shall govern to the extent permitted by the Act.

1.3 Name. The name of the Company shall be " ___________, LLC." The business of the

Company may be conducted under that name or, on compliance with applicable laws, any other

name that the Voting Members deem appropriate or advisable. The Voting Members on behalf of

the Company shall file any certificates, articles, fictitious business name statements and the like, and

any amendments and supplements thereto, as the voting Members consider appropriate or advisable.

1.4 Term. The term of the Company commenced on the filing of the Articles of

Organization and shall be perpetual unless dissolved as provided in this Agreement.

1.5 Office and Agent. The principal office of the Company shall be at such place or places

of business within or without the State of California as the Voting Members may determine. The

Company shall continuously maintain a registered agent in the State of California as required by the

Act. The registered agent shall be as stated in the Certificate or as otherwise determined by the

Voting Members.

1.6 Purpose of Company. The purpose of the Company is to engage in all lawful activities,

including, but not limited to the following activities:

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

ARTICLE II

MEMBERSHIP INTERTESTS, VOTING AND MANAGEMENT

Section 2.1 Initial Members. The initial Members of the Company are the Members who

are identified in Exhibit A.

Section 2.2 Classification of Membership Interests. The Company shall issue Class A

Voting Capital (“Voting Capital”), to the Voting Members (the “Voting Members”). The Voting

Members shall have the right to vote upon all matters upon which Members have the right to vote

under the Act or under this Agreement, in proportion to their respective Percentage Voting Interest

("Percentage Voting Interest") in the Company. The Percentage Voting Interest of a Voting Member

shall be the percentage that is derived when the Member’s Voting Capital account is divided by the

total of all of the Voting Capital accounts.

The Company may issue Class B, Nonvoting Capital (“Nonvoting Capital”). Members may own

interests in both Voting Capital and Nonvoting Capital. Members who own interests only in

Nonvoting Capital (“Nonvoting Members”) shall have no right to vote upon any matters.

Notwithstanding, to the extent otherwise permitted by this agreement, a Nonvoting Member shall

have the right to file or participate in a mediation or an arbitration action, and shall be bound by an

amendment to this agreement only if he signs such amendment.

Section 2.3 Percentage Ownership and Voting Interests. A Member’s Ownership

Interest (“Ownership Interest”) is the total of his interests in Voting Capital and Nonvoting Capital,

together with all of the rights, as a Member or Manager of the Company, that arise from such

interests. The Percentage Ownership Interest ("Percentage Ownership Interest") of a Member shall

be calculated by adding together that Member’s Voting Capital Account and Nonvoting Capital

Account, and then dividing this sum by the total of all of the Member’s Voting Capital and

Nonvoting Capital Accounts.

The Members shall have the initial Ownership, Percentage Ownership and Percentage Voting

Interests in the Company that are identified in Exhibit A, immediately following the making of the

capital contributions set forth therein.

Section 2.4 Management by Voting Members. The Voting Members shall manage the

Company and shall have the right to vote, in their capacity as Managers, upon all matters upon which

Managers have the right to vote under the Act or under this Agreement, in proportion to their

respective Percentage Voting Interests in the Company. Voting Members need not identify whether

they are acting in their capacity as Members or Managers when they act.

The Nonvoting Members shall have no right to vote or otherwise participate in the management of

the Company. No Nonvoting Member shall, without the prior written consent of all of the Voting

Members, take any action on behalf of, or in the name of, the Company, or enter into any contract,

agreement, commitment or obligation binding upon the Company, or perform any act in any way

relating to the Company or the Company's assets.

Section 2.5 Voting. Except as otherwise provided or permitted by this Agreement, Voting

Members shall in all cases, in their capacity as Members or Managers of the Company, act

collectively, and, unless otherwise specified or permitted by this Agreement, unanimously. Except as

otherwise provided or permitted by this Agreement, no Voting Member acting individually, in his

capacity as a Member or Manager of the Company, shall have any power or authority to sign for,

bind or act on behalf of the Company in any way, to pledge the Company's credit, or to render the

Company liable for any purpose.

Unless the context requires otherwise, in this Agreement, the terms “Member” or “Members,”

without the qualifiers “Voting” or “Nonvoting,” refer to the Voting and Nonvoting Members

collectively; and the terms “Manager” or “Managers” refers to the Voting Members.

Section 2.6 Liability of Members. All debts, obligations and liabilities of the Company,

whether arising in contract, tort or otherwise, shall be solely the debts, obligations and liabilities of

the Company, and no Member shall be obligated personally for any such debt, obligation or liability

of the Company solely by reason of being a Member.

Section 2.7 New Members. The Voting Members may issue additional Voting Capital or

Nonvoting Capital and thereby admit a new Member or Members, as the case may be, to the

Company, only if such new Member (i) is approved unanimously by the Voting Members; (ii) delivers

to the Company his required capital contribution; (iii) agrees in writing to be bound by the terms of

this Agreement by becoming a party hereto; and (iv) delivers such additional documentation as the

Voting Members shall reasonably require to so admit such new Member to the Company.

Upon the admission of a new Member or Members, as the case may be, to the Company, the capital

accounts of Members, and the calculations that are based on the capital accounts, shall be adjusted

appropriately.

ARTICLE III

CAPITAL ACCOUNTS

3.1 Initial Capital Contributions. Each original Member to this Agreement shall make an

initial Capital Contribution to the Company in accordance with Exhibit A, at the time of each

Member's execution of this Agreement.

3.2 Capital Accounts. A separate capital account shall be maintained for each Member’s

ownership interest in Class A Voting Capital (the "Voting Capital Account") and Class B Nonvoting

Capital (the "Nonvoting Capital Account").

The capital account of each Member shall be increased by (i) the amount of any cash and the fair

market value of any property contributed to the Company by such Member (net of any liability

secured by such contributed property that the Company is considered to assume or take subject to),

(ii) the amount of income or profits allocated to such Member.

The capital account or accounts of each Member shall be reduced by (i) the amount of any cash and the

fair market value of any property distributed to the Member by the Company (net of liabilities secured by

such distributed property that the Member is considered to assume or take subject to on account of his

ownership interest), (ii) the amount of expenses or loss allocated to the Member. If any property other

than cash is distributed to a Member, the Capital Accounts of the Members shall be adjusted as if the

property had instead been sold by the Company for a price equal to its fair market value and the proceeds

distributed.

Guaranteed Payments (“Guaranteed Payments”) for salary, wages, fees, payments on loans, rents,

etc., may be made to the Members. Guaranteed Payments shall not be deemed to be distributions to

the Members on account of their Ownership Interests, and shall not be charged to the Members’

capital accounts.

No Member shall be obligated to restore any negative balance in his Capital Account. No Member

shall be compensated for any positive balance in his Capital Account except as otherwise expressly

provided herein. The foregoing provisions and the other provisions of this Agreement relating to the

maintenance of Capital Accounts are intended to comply with the provisions of Regulations Section

1.704-1(b)(2) and shall be interpreted and applied in a manner consistent with such Regulations. The

Members agree that the initial Capital Accounts of the Members on the date hereof are as set forth in

Exhibit A.

3.3 Additional Contributions. If, at any time or times hereafter, the Voting Members

shall determine that additional capital is required by the Company, the Voting Members shall

determine the amount of such additional capital and the anticipated time such additional capital

will be required; whether such additional capital shall be provided by the Members by way of

additional Capital Contributions or by way of loans from Members; whether additional Capital

Contributions, if any, shall be of in the form of Class A Voting Capital or Class B Nonvoting

Capital. No Member shall be obligated, at any time, to guarantee or otherwise assume or become

liable for any obligations of the Company or to make any additional Capital Contributions

advances or loans to the Company, unless such obligations are specifically accepted and agreed to

by such Member.

In the event that additional Class A Voting Capital is to be issued, the Voting Members who exist

immediately prior to such issuance shall be provided written notice of this intent, and shall be offered

in such notice the opportunity to make additional capital contributions in Class A Voting Capital in

proportion to their respective Percentage Voting Interests; provided that this right, if not exercised

within ninety (90) days after such notice is received, shall expire automatically, unless this period is

extended by the Voting Members. Any loans or additional capital contributions shall be voluntary.

The capital accounts of the Members, and the calculations that are based on the capital accounts,

shall be adjusted appropriately to reflect any transfer of an interest in the Company, distributions, or

additional capital contributions.

ARTICLE IV

MANNER OF ACTING

4.1 Officers and Agents of the Company. The Voting Members may authorize any

Member or Members of the Company, or other individuals or entities, whether or not a Member, to

take action on behalf of the Company, as the Voting Members deem appropriate. Any Member may

lend money to and receive loans from the Company, act as an employee, independent contractor,

lessee, lessor, or surety of the company, and transact any business with the Company that could be

carried out by someone who is not a Member; and the Company may receive from or pay to any

Member remuneration, in the form of wages, salary, fees, rent, interest, or any form that the Voting

Members deem appropriate.

The Voting Members may appoint officers of the Company who, to the extent provided by the

Voting Members, may have and may exercise all the powers and authority of the Members or

Managers in the conduct of the business and affairs of the Company. The officers of the Company

may consist of a President, a Treasurer, a Secretary, or other officers or agents as may be elected or

appointed by the Voting Members. The Voting Members may provide rules for the appointment,

removal, supervision and compensation of such officers, the scope of their authority, and any other

matters relevant to the positions. The officers shall act in the name of the Company and shall

supervise its operation, within the scope of their authority, under the direction and management of

the Voting Members.

Any action taken by a duly authorized officer, pursuant to authority granted by the Voting Members

in accordance with this Agreement, shall constitute the act of and serve to bind the Company, and

each Member hereby agrees neither to dispute such action nor the obligation of the Company created

thereby.

4.2 Meetings of Voting Members. No regular, annual, special or other meetings of Voting

Members are required to be held. Any action that may be taken at a meeting of Voting Members may

be taken without a meeting by written consent in accordance with the Act. Meetings of the Voting

Members, for any purpose or purposes, may be called at any time by a majority of the Voting

Members, or by the President of the Company, if any. The Voting Members may designate any place

as the place of meeting for any meeting of the Voting Members. If no designation is made, the place

of meeting shall be the principal place of business of the Company.

4.3 Notice of Meetings. In the event that a meeting of the Voting Members is called,

written notice stating the place, day and hour of the meeting and the purpose or purposes for which

the meeting is called shall be delivered not less than five nor more than sixty business days before the

date of the meeting unless otherwise provided, either personally or by mail, by or at the direction of

the Members calling the meeting, to each Voting Member. Notice of a meeting need not be given to

any Voting Member who signs a waiver of notice or a consent to holding the meeting or an approval

of the minutes thereof, whether before or after the meeting, or who attends the meeting without

protesting, prior thereto or at its commencement, the lack of notice to such Voting Member.

4.4 Record Date. For the purpose of determining Voting Members entitled to notice of or

to vote at any meeting of Voting Members or any adjournment thereof, the date on which notice of

the meeting is provided shall be the record date for such determination of the Voting Members.

When a determination of Voting Members has been made as provided in this Section, such

determination shall apply to any adjournment thereof.

4.5 Quorum. Members holding at least 67% of the Voting Capital in the Company

represented in person, by telephonic participation, or by proxy, shall constitute a quorum at any

meeting of Voting Members. In the absence of a quorum at any such meeting, a majority of the

Voting Members so represented may adjourn the meeting from time to time for a period not to

exceed sixty days without further notice. However, if the adjournment is for more than sixty days, or

if after the adjournment a new record date is fixed for another meeting, a notice of the adjourned

meeting shall be given to each Voting Member. The Voting Members present at a duly organized

meeting may continue to transact business only as previously provided on the agenda until

adjournment, notwithstanding the withdrawal during such meeting of that number of Voting

Members whose absence would cause less than a quorum.

4.6 Voting. If a quorum is present, a unanimous vote of the Voting Members so

represented shall be the act of the Members or Managers, unless the vote of a lesser proportion or

number is otherwise required by the Act, by the Certificate or by this Agreement.

ARTICLE V

ALLOCATIONS AND DISTRIBUTIONS

5.1 Allocations of Profits and Losses. Profits and Losses, after deducting Guaranteed

Payments, shall be allocated among the Members in proportion to their Percentage Ownership

Interests. Any special allocations necessary to comply with the requirements set forth in Internal

Revenue Code Section 704 and the corresponding Regulations, including, without limitation, the

qualified income offset and minimum gain chargeback provisions contained therein, shall be made if

the Voting Members deem these actions to be appropriate.

5.2 Distributions. Subject to applicable law and any limitations elsewhere in this

Agreement, the Voting Members shall determine the amount and timing of all distributions of cash,

or other assets, by the Company. Except as otherwise provided in this Agreement, all distributions

shall be made to all of the Members, in proportion to their Percentage Ownership Interests. Except

as otherwise provided in this Agreement, the decision as to whether to make distributions shall be

within the sole discretion of the Voting Members.

All such distributions shall be made only to the Members who, according to the books and records

of the Company, are the holders of record on the actual date of distribution. The Voting Members

may base a determination that a distribution of cash may be made on a balance sheet, profit and loss

statement, cash flow statement of the Company or other relevant information. Neither the Company

nor the Members shall incur any liability for making distributions.

5.3 Form of Distribution. No Member has the right to demand and receive any

distribution from the Company in any form other than money. No Member may be compelled to

accept from the Company a distribution of any asset in kind in lieu of a proportionate distribution of

money being made to other Members except on the dissolution and winding up of the Company.

ARTICLE VI

TRANSFER AND ASSIGNMENT OF INTERESTS

6.1 Resignation of Membership and Return of Capital. For a period of one (1) year after

the Articles of Organization for the Company are filed (“the filing”), no Member may voluntarily

resign his membership in the Company, and no Member shall be entitled to any return of capital

from the company, except upon the written consent of all of the other Voting Members. During the

second year after the filing, a Member may voluntarily resign his membership, but such Member shall

be entitled to receive from the Company only the book value of his Ownership Interest, adjusted for

profits and losses to the date of resignation, unless otherwise agreed by written consent of all of the

other Voting Members. Subsequent to the second year after filing, a Member may voluntarily resign

his membership and shall be entitled to receive from the Company the fair market value of his

Ownership Interest, adjusted for profits and losses to the date of resignation. Fair market value may

be determined informally by unanimous agreement of all of the Voting Members, including the

resigning Member. In the absence of an informal agreement as to fair market value, the Voting

Members shall hire an appraiser to determine fair market value. The cost of any appraisal shall be

deducted from the fair market value to which the resigning Member is entitled. The other Voting

Members may elect, by written notice that is provided to the resigning Member within thirty (30)

days after the resignation date, for the Company to purchase the resigning Member’s Interest

(whether the interest is being purchased at book value or fair market value) in four (4) equal annual

installments, with the first installment being due sixty (60) days after the Member’s resignation.

6.2 Death of a Member. Upon the death of a Member, the Member’s estate or

beneficiary or beneficiaries, as the case may be, shall be entitled to receive from the Company, in

exchange for all of the deceased Member’s Ownership Interest, the fair market value of the

deceased Member’s Ownership Interest, adjusted for profits and losses to the date of death. Fair

market value may be determined informally by a unanimous good-faith agreement of all of the

Voting Members. In the absence of an informal agreement as to fair market value, the Voting

Members shall hire an appraiser to determine fair market value. The cost of any appraisal shall be

deducted from the fair market value to which the deceased Member’s estate or beneficiary or

beneficiaries is or are entitled. The Voting Members may elect, by written notice that is provided to

the deceased Member’s estate or beneficiary or beneficiaries, within thirty (30) days after the

Member’s death, to purchase the deceased Member’s Ownership Interest over a one-year (1 year)

period, in four (4) equal installments, with the first installment being due sixty (60) days after the

Member’s date of death. Unless otherwise agreed unanimously by the Voting Members, prior to

the completion of such purchase, the Member’s estate or beneficiary or beneficiaries, shall have no

right to become a Member or to participate in the management of the business and affairs of the

Company as a Member or Manager, and shall only have the rights of an Assignee and be entitled

only to receive the share of profits and the return of capital to which the deceased Member would

otherwise have been entitled. The Company, or the other Voting Members, in its or their

discretion, may purchase insurance on the lives of any of the Members, with the company or the

purchasing Member named as the beneficiary, as the purchaser may decide, and use all or any of

the proceeds from such insurance as a source of proceeds from which the deceased Member’s

Membership Ownership Interest may be purchased by the Company.

6.3 Restrictions on Transfer. Except (i) as otherwise provided in this Article or (ii) upon

the unanimous consent of all of the other Voting Members, no Member shall sell, hypothecate,

pledge, assign or otherwise transfer, with or without consideration, any part or all of his Ownership

Interest in the Company to any other person or entity (a “Transferee”), without first offering (the

“Offer”) that portion of his or her Ownership Interest in the Company subject to the contemplated

transfer (the “Offered Interest”) first to the Company, and secondly, to the other Voting Members,

at the purchase price (hereinafter referred to as the “Transfer Purchase Price”) and in the manner as

prescribed in the Offer.

The Offering Member shall make the Offer first to the Company by written notice (hereinafter

referred to as the “Offering Notice”). Within twenty (20) days (the “Company Offer Period”) after

receipt by the Company of the Offering Notice, the Company shall notify the Offering Member in

writing (the “Company Notice”), whether or not the Company shall accept the Offer and shall

purchase all but not less than all of the Offered Interest. If the Company accepts the Offer to

purchase the Offered Interest, the Company Notice shall fix a closing date not more than twenty-five

(25) days (the “Company Closing Date”) after the expiration of the Company Offer Period.

In the event the Company decides not to accept the Offer, the Offering Member or the Company, at

his or her or its election, shall, by written notice (the “Remaining Member Notice”) given within that

period (the “Member Offer Period”) terminating ten (10) days after the expiration of the Company

Offer Period, make the Offer of the Offered Interest to the other Voting Members, each of whom

shall then have a period of twenty-five (25) days (the “Member Acceptance Period”) after the

expiration of the Member Offer Period within which to notify in writing the Offering Member

whether or not he or she intends to purchase all but not less than all of the Offered Interest. If two (2)

or more Voting Members of the Company desire to accept the Offer to purchase the Offered Interest,

then, in the absence of an agreement between them, such Voting Members shall have the right to

purchase the Offered Interest in proportion to their respective Percentage Voting Interests. If the

other Voting Members intend to accept the Offer and to purchase the Offered Interest, the written

notice required to be given by them shall fix a closing date not more than sixty (60) days after the

expiration of the Member Acceptance Period (hereinafter referred to as the “Member Closing Date”).

The aggregate dollar amount of the Transfer Purchase Price shall be payable in cash on the Company

Closing Date or on the Member Closing Date, as the case may be, unless the Company or the

purchasing Voting Members shall elect by written notice that is delivered to the Offering Member,

prior to or on the Company Closing Date or the Member Closing Date, as the case may be, to

purchase such Offered Interest in four (4) equal annual installments, with the first installment being

due on the Closing Date.

If the Company or the other Voting Members fail to accept the Offer or, if the Offer is accepted by

the Company or the other Voting Members and the Company or the other Voting Members fail to

purchase all of the Offered Interest at the Transfer Purchase Price within the time and in the manner

specified, then the Offering Member shall be free, for a period (hereinafter referred to as the “Free

Transfer Period”) of sixty (60) days from the occurrence of such failure, to transfer the Offered

Interest to a Transferee; provided, however, that if all of the other Voting Members other than the

Offering Member do not approve of the proposed transfer by unanimous written consent, the

Transferee of the Offered Interest shall have no right to become a Member or to participate in the

management of the business and affairs of the Company as a Member or Manager, and shall only

have the rights of an Assignee and be entitled to receive the share of profits and the return of capital

to which the Offering Member would otherwise have been entitled. A Transferee shall be admitted

as a Member of the Company, and as a result of which he or she shall become a substituted Member,

with the rights that are consistent with the Membership Interest that was transferred, only if such

new Member (i) is approved unanimously by the Voting Members; (ii) delivers to the Company his

required capital contribution; (iii) agrees in writing to be bound by the terms of this Agreement by

becoming a party hereto.

If the Offering Member shall not transfer the Offered Interest within the Free Transfer Period, his or

her right to transfer the Offered Interest free of the foregoing restrictions shall thereupon cease and

terminate.

6.4 Involuntary Transfer of a Membership Interest. A creditor’s charging order or lien on a

Member’s Membership Interest, bankruptcy of a Member, or other involuntary transfer of Member’s

Membership Interest, shall constitute a material breach of this Agreement by such Member. The

creditor, transferee or other claimant, shall only have the rights of an Assignee, and shall have no right

to become a Member, or to participate in the management of the business and affairs of the Company

as a Member or Manager under any circumstances, and shall be entitled only to receive the share of

profits and losses, and the return of capital, to which the Member would otherwise have been entitled.

The Voting Members, including a Voting Member whose interest is the subject of the charging order,

lien, bankruptcy, or involuntary transfer, may unanimously elect, by written notice that is provided to

the creditor, transferee or other claimant, at any time, to purchase all or any part of Membership

Interest that was the subject of the creditor’s charging order, lien, bankruptcy, or other involuntary

transfer, at a price that is equal to one-half (1/2) of the book value of such interest, adjusted for profits

and losses to the date of purchase. The Members agree that such valuation is a good-faith attempt at

fixing the value of the interest, after taking into account that the interest does not include all of the

rights of a Member or Manager, and after deducting damages that are due to the material breach of this

Agreement.

ARTICLE VII

ACCOUNTING, RECORDS AND REPORTING

7.1 Books and Records. The Company shall maintain complete and accurate accounts in

proper books of all transactions of or on behalf of the Company and shall enter or cause to be

entered therein a full and accurate account of all transactions on behalf of the Company. The

Company's books and accounting records shall be kept in accordance with such accounting

principles (which shall be consistently applied throughout each accounting period) as the Voting

Members may determine to be convenient and advisable. The Company shall maintain at its principal

office all of the following:

A current list of the full name and last known business or residence address of each Member in the

Company set forth in alphabetical order, together with, for each Member, the Class A Voting Capital

account and Class B Nonvoting Capital account, including entries to these accounts for contributions

and distributions; the Ownership Interest, Percentage Ownership and Voting Interests; a copy of the

Certificate and any and all amendments thereto together with executed copies of any powers of

attorney pursuant to which the Certificate or any amendments thereto have been executed; copies of

the Company's federal, state and local income tax or information returns and reports, if any, for the

six most recent taxable years; a copy of this Agreement and any and all amendments hereto together

with executed copies of any powers of attorney pursuant to which this Agreement or any

amendments thereto have been executed; copies of the financial statements of the Company, if any,

for the six most recent Fiscal Years; the Company's books and records as they relate to the internal

affairs of the Company for at least the current and past four Fiscal Years; true and full information

regarding the status of the business and financial condition of the Company; and true and full

information regarding the amount of cash and a description and statement of the agreed value of

any other property or services contributed by each Member and which each Member has agreed to

contribute in the future, and the date on which each became a Member.

7.2 Inspection of Books and Records. Each Member has the right, on reasonable request

for purposes reasonably related to the interest of the person as a Member or a Manager, to: (a)

inspect and copy during normal business hours any of the Company's records described in Section

7.1; and (b) obtain from the Company promptly after their becoming available a copy of the

Company's federal, state and local income tax or information returns for each Fiscal Year.

7.3 Accountings. As soon as is reasonably practicable after the close of each Fiscal Year,

the Voting Members shall make or cause to be made a full and accurate accounting of the affairs of

the Company as of the close of that Fiscal Year and shall prepare or cause to be prepared a balance

sheet as of the end of such Fiscal Year, a profit and loss statement for that Fiscal Year and a

statement of Members' equity showing the respective Capital Accounts of the Members as of the

close of such Fiscal Year and the distributions, if any, to Members during such Fiscal Year, and any

other statements and information necessary for a complete and fair presentation of the financial

condition of the Company, all of which the Manager shall furnish to each Member. In addition, the

Company shall furnish to each Member information regarding the Company necessary for such

Member to complete such Member's federal and state income tax returns. The Company shall also

furnish a copy of the Company's tax returns to any Member requesting the same. On such

accounting being made, profits and losses during such Fiscal Year shall be ascertained and credited or

debited, as the case may be, in the books of account of the Company to the respective Members as

herein provided.

7.4 Filings. The Voting Members, at Company expense, shall cause the income tax returns

for the Company to be prepared and timely filed with the appropriate authorities. The Voting

Members, at Company expense, shall also cause to be prepared and timely filed with appropriate

federal and state regulatory and administrative bodies amendments to, or restatements of, the

Certificate and all reports required to be filed by the Company with those entities under the Act or

other then current applicable laws, rules, and regulations. If the Company is required by the Act to

execute or file any document and fails, after demand, to do so within a reasonable period of time or

refuses to do so, any Member may prepare, execute and file that document with the California

Secretary of State.

7.5 Bank Accounts. The Company shall maintain its funds in one or more separate bank

accounts in the name of the Company, and shall not permit the funds of the Company to be co-

mingled in any fashion with the funds of any other Person.

7.6 Tax Matters Partner. The Voting Members may, in their exclusive discretion, appoint,

remove and replace a Tax Matters Partner at any time or times. The Voting Members shall from time

to time cause the Company to make such tax elections as they deem to be in the interests of the

Company and the Members generally. The Tax Matters Partner, as defined in Internal Revenue Code

Section 6231, shall represent the Company (at the Company's expense) in connection with all

examinations of the Company's affairs by tax authorities, including resulting judicial and

administrative proceedings, and shall expend the Company funds for professional services and costs

associated therewith.

ARTICLE VIII

DISSOLUTION AND WINDING UP

8.1 Dissolution. The Company shall be dissolved, its assets shall be disposed of, and its

affairs wound up on the first to occur of: the entry of a decree of judicial dissolution pursuant to the

Act; or the unanimous approval of the Voting Members.

8.2 Winding Up. On the occurrence of an event specified in Section 8.1, the Company shall

continue solely for the purpose of winding up its affairs in an orderly manner, liquidating its assets

and satisfying the claims of its creditors. The Voting Members shall be responsible for overseeing the

winding up and liquidation of Company, shall take full account of the assets and liabilities of

Company, shall cause such assets to be sold or distributed, and shall cause the proceeds therefrom, to

the extent sufficient therefor, to be applied and distributed as provided in Section 9.4. The Voting

Members shall give written notice of the commencement of winding up by mail to all known

creditors and claimants whose addresses appear on the records of the Company. The Members shall

be entitled to reasonable compensation for such services.

8.3 Distributions in Kind. Any noncash assets distributed to the Members shall first be

valued at their fair market value to determine the profit or loss that would have resulted if such assets

were sold for such value. Such profit or loss shall then be allocated pursuant to this Agreement, and

the Members' Capital Accounts shall be adjusted to reflect such allocations. The amount distributed

and charged against the Capital Account of each Member receiving an interest in a distributed asset

shall be the fair market value of such interest (net of any liability secured by such asset that such

Member assumes or takes subject to). The fair market value of such asset shall be determined by the

Voting Members, or if any Voting Member objects, by an independent appraiser (and any such

appraiser must be recognized as an expert in valuing the type of asset involved) selected by a Majority

of the Voting Members.

8.4 Order of Payment of Liabilities on Dissolution. After a determination that all known

debts and liabilities of the Company in the process of winding up, including, without limitation, debts

and liabilities to Members who are creditors of the Company, have been paid or adequately provided

for, the remaining assets shall be distributed to the Members in proportion to their positive Capital

Account balances, after taking into account profit and loss allocations for the Company's taxable year

during which liquidation occurs.

8.5 Adequacy of Payment. The payment of a debt or liability, whether the whereabouts of

the creditor is known or unknown, shall have been adequately provided for if payment thereof shall

have been assumed or guaranteed in good faith by one or more financially responsible Persons or by

the United States government or any agency thereof, and the provision, including the financial

responsibility of the Person, was determined in good faith and with reasonable care by the Members

to be adequate at the time of any distribution of the assets pursuant to this Section. This Section shall

not prescribe the exclusive means of making adequate provision for debts and liabilities.

8.6 Compliance with Regulations. All payments to the Members on the winding up and

dissolution of Company shall be strictly in accordance with the positive capital account balance

limitation and other requirements of Regulations Section 1.704-1(b)(2)(ii)(d), as the voting Members

deem appropriate.

8.7 Limitations on Payments Made in Dissolution. Except as otherwise specifically

provided in this Agreement, each Member shall only be entitled to look solely to the assets of the

Company for the return of such Member's positive Capital Account balance and shall have no

recourse for such Member's Capital Contribution or share of profits (on dissolution or otherwise)

against any other Member.

8.8 Certificate of Cancellation. The Voting Members conducting the winding up of the

affairs of the Company shall cause to be filed in the office of, and on a form prescribed by the

California Secretary of State, a certificate of cancellation of the Certificate on the completion of the

winding up of the affairs of the Company.

ARTICLE IX

EXCULPATION AND INDEMNIFICATION

9.1 Exculpation of Members. No Member shall be liable to the Company or to the other

Members for damages or otherwise with respect to any actions taken or not taken in good faith and

reasonably believed by such Member to be in or not opposed to the best interests of the Company,

except to the extent any related loss results from fraud, gross negligence or willful or wanton

misconduct on the part of such Member or the material breach of any obligation under this

Agreement or of the fiduciary duties owed to the Company or the other Members by such Member.

9.2 Indemnification by Company. The Company shall indemnify, hold harmless and

defend the Members, in their capacity as Members, Managers, or Officers, from and against any loss,

expense, damage or injury suffered or sustained by them by reason of any acts or omissions arising

out of their activities on behalf of the Company or in furtherance of the interests of the Company,

including but not limited to any judgment, award, settlement, reasonable attorneys' fees and other

costs or expenses incurred in connection with the defense of any actual or threatened action,

proceeding or claim, if the acts or omissions were not performed or omitted fraudulently or as a

result of gross negligence or willful misconduct by the indemnified party. Reasonable expenses

incurred by the indemnified party in connection with any such proceeding relating to the foregoing

matters may be paid or reimbursed by the Company in advance of the final disposition of such

proceeding upon receipt by the Company of (i) written affirmation by the Person requesting

indemnification of its good-faith belief that it has met the standard of conduct necessary for

indemnification by the Company and (ii) a written undertaking by or on behalf of such Person to

repay such amount if it shall ultimately be determined by a court of competent jurisdiction that such

Person has not met such standard of conduct, which undertaking shall be an unlimited general

obligation of the indemnified party but need not be secured.

9.3 Insurance. The Company shall have the power to purchase and maintain insurance on

behalf of any Person who is or was a Member or an agent of the Company against any liability

asserted against such Person and incurred by such Person in any such capacity, or arising out of such

Person's status as a Member or an agent of the Company, whether or not the Company would have

the power to indemnify such Person against such liability under Section 10.1 or under applicable law.

ARTICLE X

MISCELLANEOUS

10.1 Authority. This Agreement constitutes a legal, valid and binding agreement of the

Member, enforceable against the Member in accordance with its terms. The Member is empowered

and duly authorized to enter into this Agreement (including the power of attorney herein) under

every applicable governing document, partnership agreement, trust instrument, pension plan, charter,

certificate of incorporation, bylaw provision or the like. The Person, if any, signing this Agreement

on behalf of the Member is empowered and duly authorized to do so by the governing document or

trust instrument, pension plan, charter, certificate of incorporation, bylaw provision, board of

directors or stockholder resolution or the like.

10.2 Indemnification by the Members. Each Member hereby agrees to indemnify and

defend the Company, the other Members and each of their respective employees, agents, partners,

members, shareholders, officers and directors and hold them harmless from and against any and all

claims, liabilities, damages, costs and expenses (including, without limitation, court costs and attorneys'

fees and expenses) suffered or incurred on account of or arising out of any breach of this Agreement

by that Member.

ARTICLE XI

DISPUTE RESOLUTION

11.1 Disputes Among Members. The Members agree that in the event of any dispute or

disagreement solely between or among any of them arising out of, relating to or in connection with

this Agreement or the Company or its organization, formation, business or management ("Member

Dispute"), the Members shall use their best efforts to resolve any dispute arising out of or in

connection with this Agreement by good-faith negotiation and mutual agreement. The Members shall

meet at a mutually convenient time and place to attempt to resolve any such dispute.

However, in the event that the Members are unable to resolve any Member Dispute, such parties

shall first attempt to settle such dispute through a non-binding mediation proceeding. In the event

any party to such mediation proceeding is not satisfied with the results thereof, then any unresolved

disputes shall be finally settled in accordance with an arbitration proceeding. In no event shall the

results of any mediation proceeding be admissible in any arbitration or judicial proceeding.

11.2 Mediation. Mediation proceedings shall be conducted in accordance with the

Commercial Mediation Rules of the American Arbitration Association (the "AAA") in effect on the

date the notice of mediation was served, other than as specifically modified herein, and shall be non-

binding on the parties thereto.