Fillable Printable Loan Agreement Form Micro Finance Scheme

Fillable Printable Loan Agreement Form Micro Finance Scheme

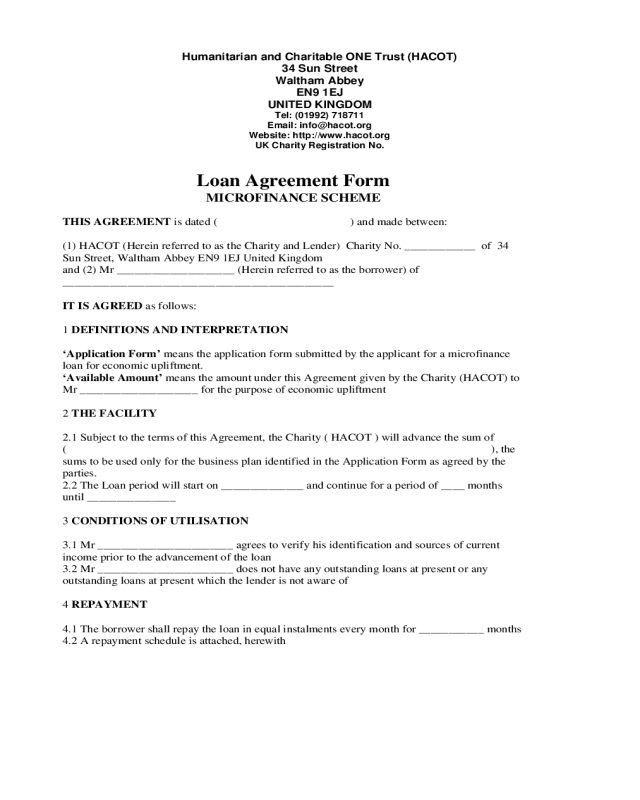

Loan Agreement Form Micro Finance Scheme

Humanitarian and Charitable ONE Trust (HACOT)

34 Sun Street

Waltham Abbey

EN9 1EJ

UNITED KINGDOM

Tel: (01992) 718711

Email: info@hacot.org

Website: http://www.hacot.org

UK Charity Registration No.

Loan Agreement Form

MICROFINANCE SCHEME

THIS AGREEMENT is dated ( ) and made between:

(1) HACOT (Herein referred to as the Charity and Lender) Charity No. ____________ of 34

Sun Street, Waltham Abbey EN9 1EJ United Kingdom

and (2) Mr ____________________ (Herein referred to as the borrower) of

______________________________________________

IT IS AGREED as follows:

1

DEFINITIONS AND INTERPRETATION

‘Application Form’

means the application form submitted by the applicant for a microfinance

loan for economic upliftment.

‘Available Amount’ means the amount under this Agreement given by the Charity (HACOT) to

Mr ____________________ for the purpose of economic upliftment

2

THE FACILITY

2.1 Subject to the terms of this Agreement, the Charity ( HACOT ) will advance the sum of

( ), the

sums to be used only for the business plan identified in the Application Form as agreed by the

parties.

2.2 The Loan period will start on ______________ and continue for a period of ____ months

until _______________

3

CONDITIONS OF UTILISATION

3.1 Mr _______________________ agrees to verify his identification and sources of current

income prior to the advancement of the loan

3.2 Mr _______________________ does not have any outstanding loans at present or any

outstanding loans at present which the lender is not aware of

4

REPAYMENT

4.1 The borrower shall repay the loan in equal instalments every month for ___________ months

4.2 A repayment schedule is attached, herewith

5 REPRESENTATIONS AND UNDERTAKINGS

5.1 The borrower represents that the entire sum borrowed under this Agreement shall be for the

purposes of purchasing capital items and stock as identified in the Application Form and shall not

be used for any other purposes.

5.2 The borrower undertakes not to sell any of the machinery, vehicle or stock or items purchased

by way of this loan Agreement without the prior written consent of the Charity.

5.3 The borrower undertakes to provide the Charity financial statements and figures as agreed

between the Parties every _________ months

5.4 The borrower represents that no Event of Default is continuing or might reasonably be

expected

5.5 Any factual information provided by the borrower is true and accurate in all material aspects

as at the date it was provided

6

EVENTS OF DEFAULT

Each of the events or circumstances set out below in Clause 6 is an Event of Default

6.1 Non-Payment. The borrower does not pay on the due date any amount payable unless the

failure to pay is caused by administrative or technical error, or payment is made within 5 days of

the due date

6.2 Any requirement under Clause 5 is not met

6.3 Misrepresentation. Any representation or statement made by the borrower is incorrect or

misleading in any material aspect when made or deemed to be made

6.4 Insolvency. The borrower is unable or admits to inability to pay his/her debts as they fall due,

suspends making payments on any of its debts or, by reason of actual or anticipated financial

difficulties, commences negotiations with one or more of its creditors with a view to

rescheduling any of its indebtedness

6.5 Unlawfulness. It is or becomes unlawful for a borrower or lender to perform any of its

obligations under the Agreement

Acceleration. On and at any time after the occurrence of an Event of Default the lender may:

(a) Declare some or all of the loan immediately due

(b) Declare the amounts outstanding payable on demand

7

GOVERNING LAW AND ENFORCEMENT

7.1 This Agreement is governed by ______________ Law

7.2 The Courts of ______________ have exclusive jurisdiction to settle any dispute arising out of

or in connection with this Agreement

Name of Lender: ___________________________________________

Signature (1) ____________________________ PRINT NAME _________________________

Signature (2) ____________________________ PRINT NAME _________________________

Name of Borrower: _____________________________

Signature: _____________________________________

Name of Witness: __________________________________________

Signature: ___________________________________________