Fillable Printable Loan Agreement Sample Form

Fillable Printable Loan Agreement Sample Form

Loan Agreement Sample Form

Place: Date:

LoanAgreement

1.PartiesoftheAgreement

1.1. "Thelender"‐JSCMicrofinanceOrganizationCrystal;registrationnumber:212896570;legaladdress:72Tamar

MepeStr.,Kutaisi,4600Georgia

1.2. "TheBorrower"‐

"Thelender"and"TheBorrower"actingundertheCountrylegislationandtherightsunderthecharterofthelender,

haveagreedonthefollowing:

2.SubjectoftheAgreement

2.1. OnthebasisofthetermsspecifiedinthisAgreement,theLenderisprovidingtheBorrowerwiththeloan

2.2. LenderandBorrowertakeresponsibilitytofulfillcommitmentstowardseachotherfullyandinaduetime

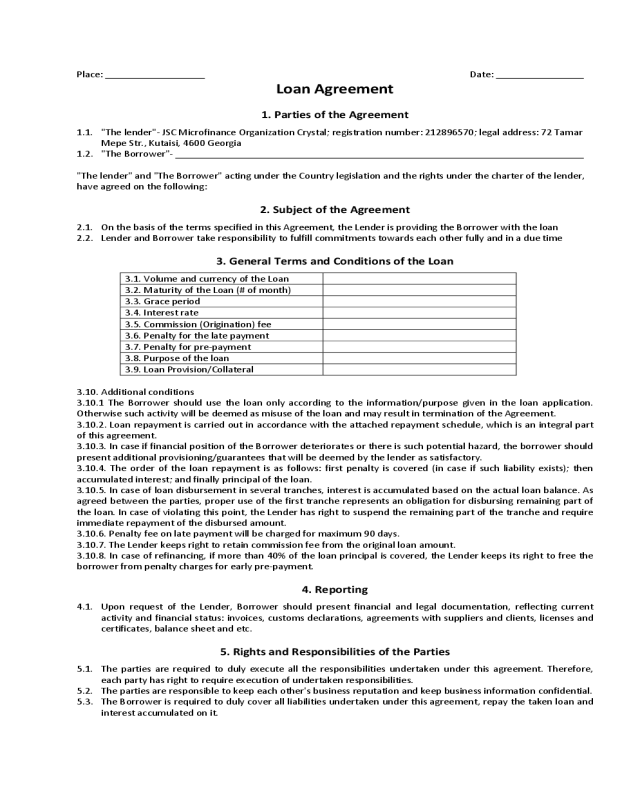

3.GeneralTermsandConditionsoftheLoan

3.1.VolumeandcurrencyoftheLoan

3.2.MaturityoftheLoan(#ofmonth)

3.3.Graceperiod

3.4.Interestrate

3.5.Commission(Origination)fee

3.6.Penaltyforthelatepayment

3.7.Penaltyforpre‐payment

3.8.Purposeoftheloan

3.9.LoanProvision/Collateral

3.10.Additionalconditions

3.10.1 The Borrower should use the loan only according to the information/purpose given in the loan application.

OtherwisesuchactivitywillbedeemedasmisuseoftheloanandmayresultinterminationoftheAgreement.

3.10.2.Loanrepaymentiscarriedoutinaccordancewiththeattachedrepaymentschedule,whichisanintegralpart

ofthisagreement.

3.10.3.IncaseiffinancialpositionoftheBorrowerdeterioratesorthereissuchpotentialhazard,theborrowershould

presentadditionalprovisioning/guaranteesthatwillbedeemedbythelenderassatisfactory.

3.10.4. The order of the loan repayment is as follows: first penalty is covered (in case if such liability exists); then

accumulatedinterest;andfinallyprincipaloftheloan.

3.10.5.Incaseofloandisbursementinseveraltranches,interestisaccumulatedbasedontheactualloanbalance.As

agreedbetweentheparties,properuseofthefirsttrancherepresentsanobligationfordisbursingremainingpartof

theloan.Incaseofviolatingthispoint,theLenderhasrighttosuspendtheremainingpartofthetrancheandrequire

immediaterepaymentofthedisbursedamount.

3.10.6.Penaltyfeeonlatepaymentwillbechargedformaximum90days.

3.10.7.TheLenderkeepsrighttoretaincommissionfeefromtheoriginalloanamount.

3.10.8.Incaseofrefinancing,ifmorethan40%oftheloanprincipaliscovered,theLenderkeepsitsrighttofreethe

borrowerfrompenaltychargesforearlypre‐payment.

4.Reporting

4.1. Upon request of the Lender, Borrower should present financial and legal documentation, reflecting current

activityandfinancialstatus:invoices,customsdeclarations,agreementswithsuppliersandclients,licensesand

certificates,balancesheetandetc.

5.RightsandResponsibilitiesoftheParties

5.1. The parties are required to duly execute all the responsibilities undertaken under this agreement. Therefore,

eachpartyhasrighttorequireexecutionofundertakenresponsibilities.

5.2. Thepartiesareresponsibletokeepeachother'sbusinessreputationandkeepbusinessinformationconfidential.

5.3. TheBorrowerisrequiredtodulycoverallliabilitiesundertakenunderthisagreement,repaythetakenloanand

interestaccumulatedonit.

5.4. After the Lender makes a written requirement, the Borrower should present within 5 business days all

information and documents required by the lender concerning his business activity. Borrower should also

provideadequateconditionsforthelendertogetanyinformationrequiredforimplementingthisagreement.

5.5. TheBorrowershouldnotifythelenderabout:

‐Potentialchangesinfinancialorpropertyconditionsorthosefactorsthatmayleadtosuchchanges

‐Changeoflivingplaceorbusinesslocationandthedateofsuchchange.

5.6. TheLenderclaimsandensuresthat:

‐Incaseifdisputearisesbetweentheparties,unpaidaccumulatedinterestwillbedeemedasliability;

‐Putting and implementation of the given agreement does not violate terms of the Lender’s charter

documentationoranyothertransactiontowhichtheborrowerisaparty;

‐the Borrower will not refrain from implementing all undertaken obligations or will not transfer his

responsibilitiestoathirdpartywithoutgettingpreliminarywrittenconsentfromtheLender;

‐TheBorrowerisnotengagedinanycourtproceedingthatmayendangeritspropertyand/orassets.

5.7. Whilethisagreementremainsinforce,theBorrowerhasnorighttoundertakeanyothercreditliabilitiesfrom

thirdparties(physicalorlegal)withoutfirstinformingtheLenderinadvance.

5.8. TheLenderhasrighttoconductperiodicmonitoringoftheborrower’sbusinessactivity,controlfinancialstatus

oftheborrowerandcheckforchangesinloanprovisioning.Thefrequencyofmonitoringandnumberofvisitsis

determinedbythelenderwithoutgivingpriornotificationtotheborrower.

5.9. Duringcreditrelationship,theborrowertakesresponsibilitytoprovideadequateconditionsandopportunityto

lenderrepresentativesforconductingfinancialmonitoringoftheloan.

5.10.TheLendertakesresponsibilitytoprovideBorrowerwithfullandclearinformationontheloan,informaboutall

potentialfeesandcharges,andclarifytheLender’ssocialresponsibilityaswellasborrower’srights

6.Groundsforcontracttermination

6.1. The Lender has right to terminate the agreement and all relevant contracts and require from the borrower

immediaterepaymentoftheliabilitiesincaseif:

6.1.1.TheBorroweroranythirdpartiesinvolvedinloanprovisioningagreementsortheirlegalrepresentativesviolate

responsibilitiestakentowardsthelender;

6.1.2.Financialposition oftheBorrower(or guarantor) deterioratesandwillendangerdue andproperexecution of

theresponsibilities;

6.1.3.TheBorrowerprovideswrongandfalseinformationtothelender;

6.1.4.Itemspresentedasloanprovisiongetdestroyed,damagedordecreaseinvalue.

6.1.5.TheloanisnotusedforduepurposebytheBorrower;

6.1.6.EquityoftheBorrowersharplygoesdown;

6.1.7.Thecaseindicatedinpoint5.7occurs;

7.Otherconditions

7.1.TheBorroweragrees to provide his credit information to the NationalCredit Bureau: JSC "CreditInfo Georgia",

whichmaygiveaccesstothisinformationtoallauthorizedparties;

7.2.Thegivenagreementbecomesvalidfromthemomentbothpartiesputtheirsignaturesandremainsinforcetill

allobligationsundertakenbythepartiesarefullymet.

7.3Anychangesandadditiontothepresentagreementaretobedoneinthewrittenformand areconsideredasthe

integralpartoftheagreement.

7.4.ThepresentagreementisregulatedbytheGeorgianlegislation.

7.5 Any disputes that rise between parties should be discussed by mutual understanding. In case parties failed do

cometoagreement,thedisputewillbediscussedinthecourt.

7.6.ThepartiesagreedtheplaceoftheagreementimplementationistobethelegaladdressoftheLender

7.7.StoppageofanyparagraphsoftheAgreementdoesnotgiverisetostopthefullagreementorotherparagraphs.

7.8.Nonusageofitsrights‐responsibilitiesbyanypartydoesnotmeanitsrejection.

7.9.Thepresentagreementispreparedinthreeequalinrightscopies.OnecopyispassedtotheBorrower

8.Signatures

"TheLender" "TheBorrower"

Place: Date:

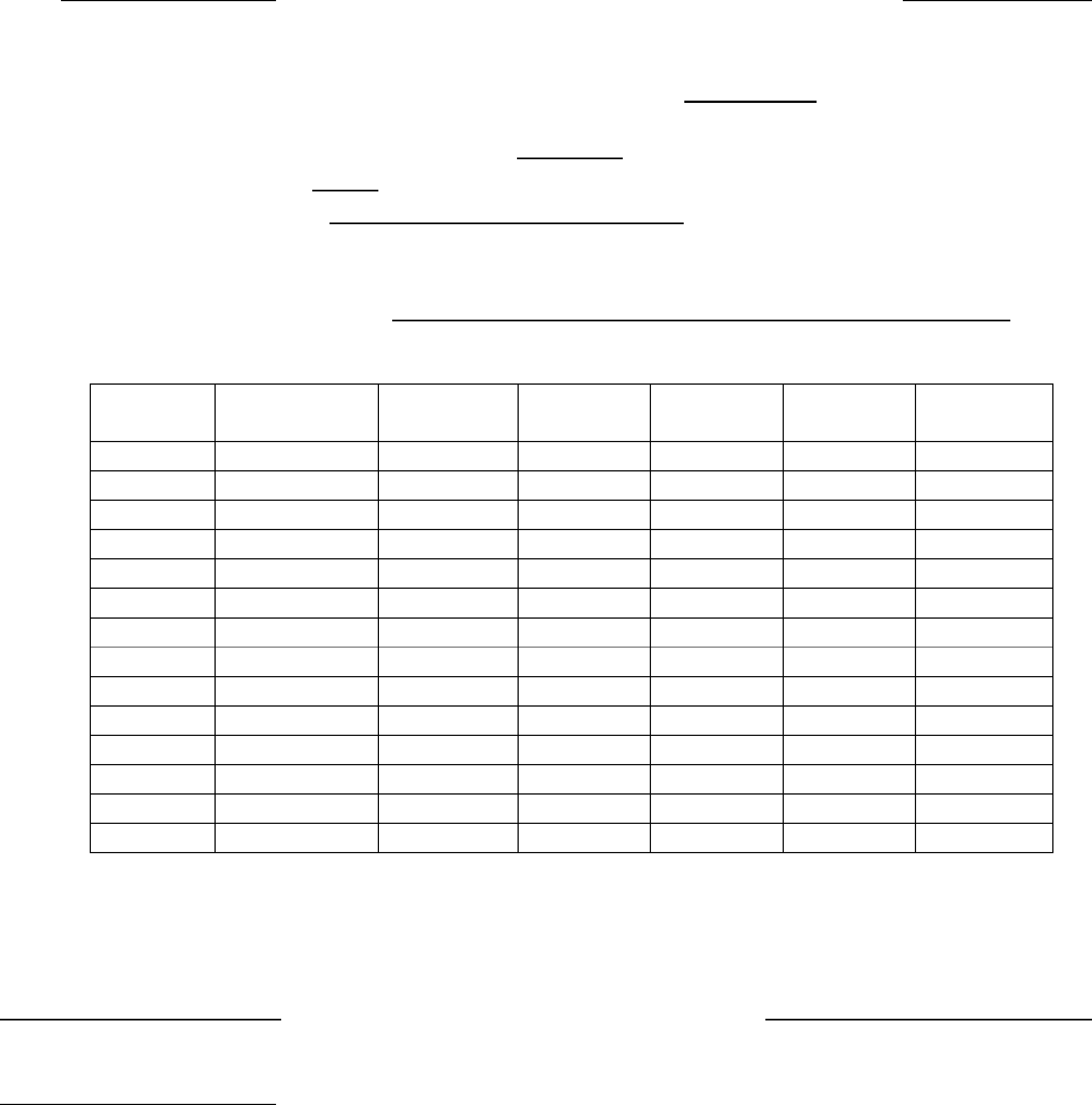

LoanRepaymentSchedule

Appendix1totheLoanAgreement#

1. Theloanrepaymentscheduleismadein:/USDorGEL

/Currency

2. Annualinterestrate:

%

3. NameofloanProduct:

4. Theamountsaretoberepaidtill17.00ontheindicateddates

5. TherepaymentcanbemadeinanyofficeofJSCMicrofinanceOrganizationCrystaloratthefollowing

bankaccountsoftheLender:

6. Loanprincipalandallchargedaretoberepaidaccordingtothetablegivenbelow:

Date Loan

Disbursement

Commission

Fee

Principle

Repayment

Interest

Repayment

Total

Repayment

Total

Balance

Total:‐ ‐ ‐‐‐‐

Signatures

"TheLender" "TheBorrower"

/CreditOfficer/

/CreditManager/

ContactInformation:

(Legalandcurrentaddressesoftheparties;contactpersons;phonenumbers)