Fillable Printable Maine Child Support Worksheet - Divorce Source

Fillable Printable Maine Child Support Worksheet - Divorce Source

Maine Child Support Worksheet - Divorce Source

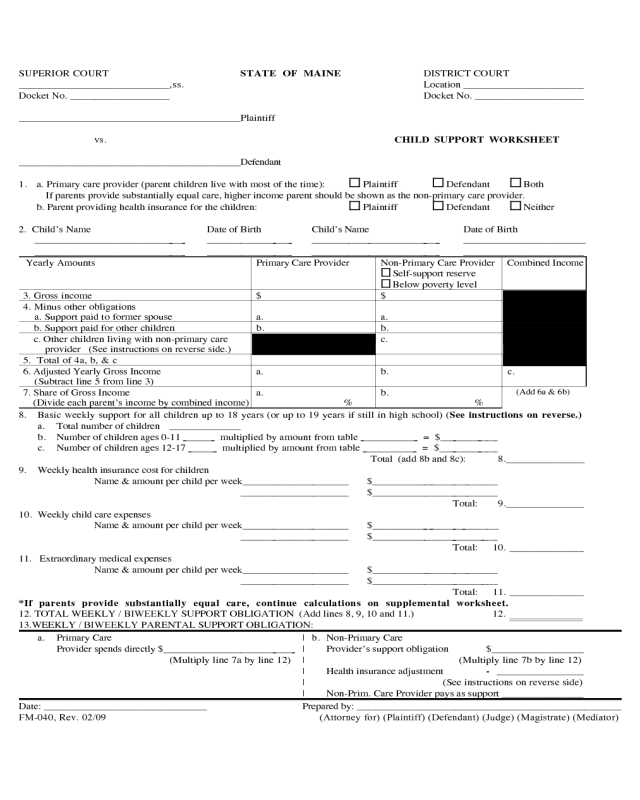

SUPERIOR COURT STATE OF MAINE DISTRICT COURT

,ss. Location

Docket No. Docket No.

Plaintiff

vs. CHILD SUPPORT WORKSHEET

Defendant

1. a. Primary care provider (parent children live with most of the time): Plaintiff Defendant Both

If parents provide substantially equal care, higher income parent should be shown as the non-primary care provider.

b. Parent providing health insurance for the children: Plaintiff Defendant Neither

2. Child’s Name Date of Birth Child’s Name Date of Birth

Yearly Amounts Primary Care Provider Non-Primary Care Provider

Self-support reserve

Below poverty level

Combined Income

3. Gross income $ $

4. Minus other obligations

a. Support paid to former spouse a. a.

b. Support paid for other children b. b.

c. Other children living with non-primary care

provider (See instructions on reverse side.)

c.

5. Total of 4a, b, & c

6. Adjusted Yearly Gross Income

(Subtract line 5 from line 3)

a. b. c.

7. Share of Gross Income

(Divide each parent’s income by combined income)

a.

%

b.

%

(Add 6a & 6b)

8. Basic weekly support for all children up to 18 years (or up to 19 years if still in high school) (See instructions on reverse.)

a. Total number of children

b. Number of children ages 0-11 multiplied by amount from table = $

c. Number of children ages 12-17 multiplied by amount from table = $

Total (add 8b and 8c): 8.

9. Weekly health insurance cost for children

Name & amount per child per week $

$

Total: 9.

10. Weekly child care expenses

Name & amount per child per week $

$

Total: 10.

11. Extraordinary medical expenses

Name & amount per child per week $

$

Total: 11.

*If parents provide substantially equal care, continue calculations on supplemental worksheet.

12. TOTAL WEEKLY / BIWEEKLY SUPPORT OBLIGATION (Add lines 8, 9, 10 and 11.) 12.

13.WEEKLY / BIWEEKLY PARENTAL SUPPORT OBLIGATION:

a. Primary Care | b. Non-Primary Care

Provider spends directly $ | Provider’s support obligation $

(Multiply line 7a by line 12) | (Multiply line 7b by line 12)

| Health insurance adjustment -

| (See instructions on reverse side)

| Non-Prim. Care Provider pays as support

Date: Prepared by:

FM-040, Rev. 02/09 (Attorney for) (Plaintiff) (Defendant) (Judge) (Magistrate) (Mediator) (Attorney for) (Plaintiff) (Defendant) (Judge) (Magistrate) (Mediator)

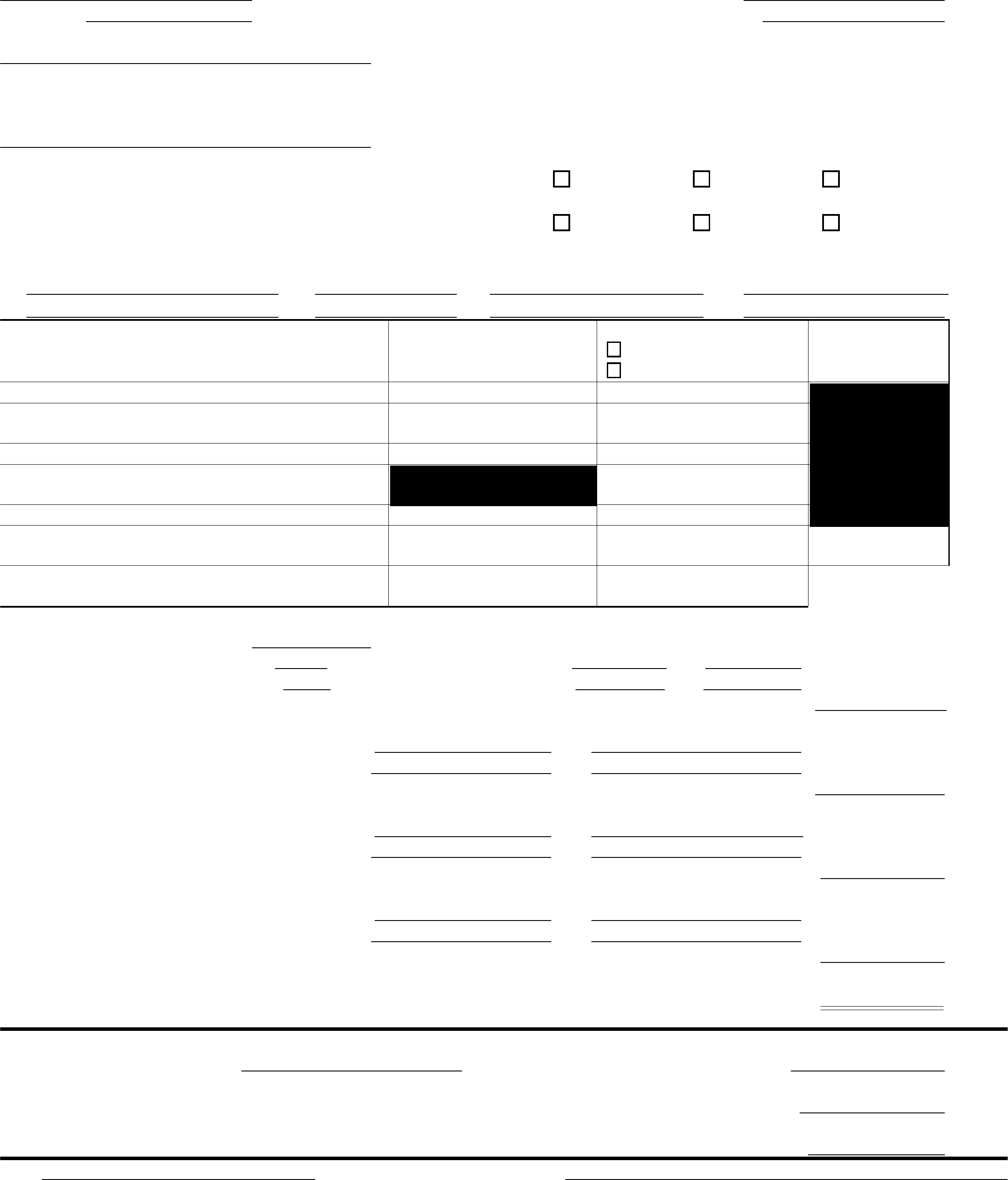

SUPERIOR COURT STATE OF MAINE DISTRICT COURT

, ss. Location

Docket No. Docket No.

Plaintiff

vs. SUPPLEMENTAL WORKSHEET

Defendant

Supplemental Child Support Worksheet

(For use when parents provide substantially equal care. CV-040 must be prepared first.)

14. Higher income parent’s share of basic weekly support

(line 7b) x (line 8) = 14.

15. Enhanced weekly support entitlement

(line 8) x 1.5 = 15.

16. Lower income parent’s share of enhanced weekly support entitlement

(line 7a) x (line 15) = 16.

17. Higher income parent’s share of enhanced weekly support entitlement

(line 7b) x (line 15) = 17.

18. Enhanced Support Obligation

(line 17) - (line 16) = 18.

19. Presumptive Parental Support Obligation

Enter the amount from line 14 or line 18, whichever is less = 19.

20. Additional expenses to be shared by parents in proportion to their incomes:

Expense

Weekly Amount

Parent Paying

HIP Share*

LIP Share*

Health Insurance

(enter amount from line 9)

$

$

Child Care

(enter amount from line 10)

$

$

Extraordinary Medical Expenses

(enter amount from line 11)

$

$

*HIP = higher income parent

*LIP – lower income parent

TOTAL:

$

$

Adjustment for additional expenses = 20. _

(If HIP pays the expense(s), subtract LIP share.

If LIP pays the expense(s), add HIP share.

Do not include on line 20 amount(s) HIP pays directly to a provider because

this is taken into account elsewhere in the calculations.)

21. Total weekly support obligation of HIP to be paid to LIP = 21.________

FM-040A, 1/10

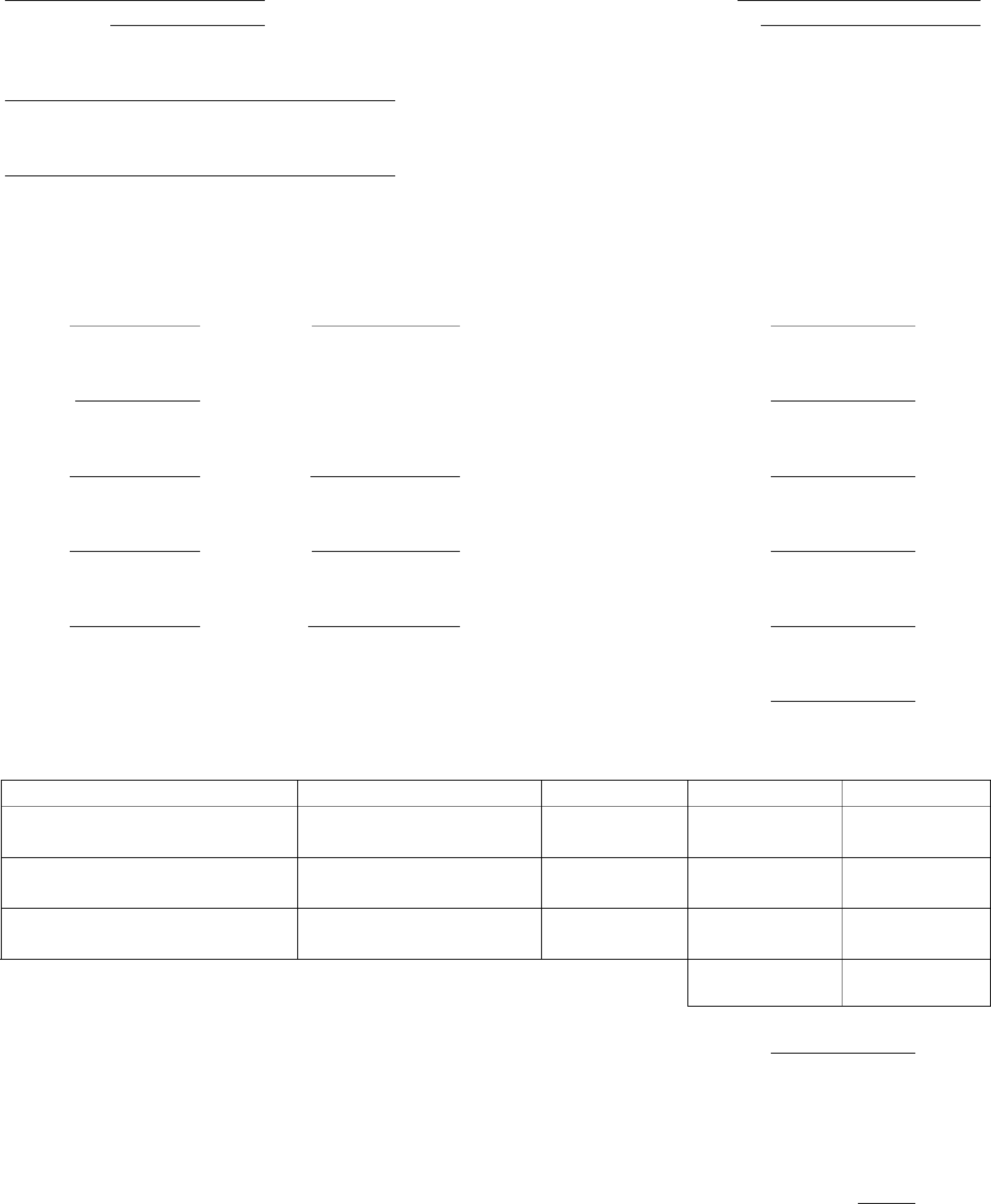

CALCULATING “AMOUNT FROM TABLE” FOR LINES 8a, 8b,

AND 8c OF THE WORKSHEET

1. Look at the Child Support Table. It is divided into two age categories. The one on the left is for children under 12.

The one on the right is for children 12 and over.

2. Circle the amount in the Table under “Parents’ Combined Annual Income” that is closest to the “Combined

Income” on Line 6c of the Worksheet. From that number draw a line across both age categories of the Table.

3. In the “Number of Children” column in each age category, circle the TOTAL number of children in this case.

The number you circle should be the same as the number you wrote on Line 8a of the Worksheet.

If you have children under 12, draw a line from the circled number of children down the column until it meets the

line you drew for parents’ yearly combined income. Circle the number where the lines meet and write the number

you circled in the space after “amount from table” on Line 8b of the Worksheet.

If you have children 12 or over, draw a line from the circled number of children down the column until it meets the

line you drew for parents’ yearly combined income. Circle the number where the lines meet and write the number

you circled in the space after “amount from table” on Line 8c of the Worksheet.

4. For example, if you have two children under 12 and two children over 12 and a combined annual gross income of

$18,000, use the column for 4 children in both age categories. The “Parents’ Combined Annual Income” and the

“Number of Children” lines should meet at $30 in the under 12 category. The lines should meet at $38 in the over

12 category.

Using this example, you would write the following on the Worksheet:

8a. Total number of children 4

8b. Number of children ages 0-11 2 multiplied by amount from table $

30 = $ 60

8c. Number of children ages 12-17 2 multiplied by amount from table $ 38 = $ 76

NON-PRIMARY CARE PROVIDERS WITH VERY LOW INCOMES

When the non-primary care provider’s income is very low, different rules for calculating child support apply. These

rules are explained in the Child Support Guidelines, 19-A M.R.S.A. § 2006(5)(C). If the non-primary care provider’s

income falls in the self-support reserve (the shaded area of the Child Support Table), check the box in the non-primary

care provider column next to “self-support reserve” on the child support worksheet. If the non-primary care

provider’s income is lower than all income amounts listed in the Child Support Table, check the box next to “below

poverty level” on the child support worksheet.

CALCULATING AMOUNT FOR LINE 4c OF THE WORKSHEET

(OTHER CHILDREN LIVING WITH NON-PRIMARY CARE PROVIDER)

If the non-primary care provider has a legal obligation to support other children living in his/her home, the non-primary

care provider is entitled to a credit. The amount of the credit is written on line 4c. To determine the credit to be entered

on Line 4c, follow the steps in paragraphs 1, 2, 3, and 4, with some changes. In step 2, circle the amount in the Table

under “Parents’ Combined Annual Income” that is closest to the non-primary care provider’s total gross income after

any deductions on Line 4b. Do not circle the combined yearly gross income of both parties in this case. In step 3, in

the “Number of Children” column in each age category, circle the total number of other children living with the non-

primary care provider that the non-primary care provider has a legal obligation to support. Do not circle the total

number of children in this case.

Warning: If there is an existing child support order for the children in this case, the credit may not apply.

CALCULATING THE HEALTH INSURANCE ADJUSTMENT

FOR SECTION 13b OF THE WORKSHEET

If the non-primary care provider pays the cost of the children’s health insurance, that parent’s weekly support

obligation must be adjusted. The amount of the adjustment is the cost of the health insurance for the children (line 9).

Put the amount from line 9 on the line next to “Health insurance adjustment.” Subtract this number from the non-

primary care provider’s support obligation to determine the amount that must be paid as support.

If the primary care provider pays the cost of the children’s health insurance or if neither parent pays for health

insurance, enter 0 on the line next to “health insurance adjustment.”