Fillable Printable Motor Vehicle Certificate of Payment of Sales or Use Tax

Fillable Printable Motor Vehicle Certificate of Payment of Sales or Use Tax

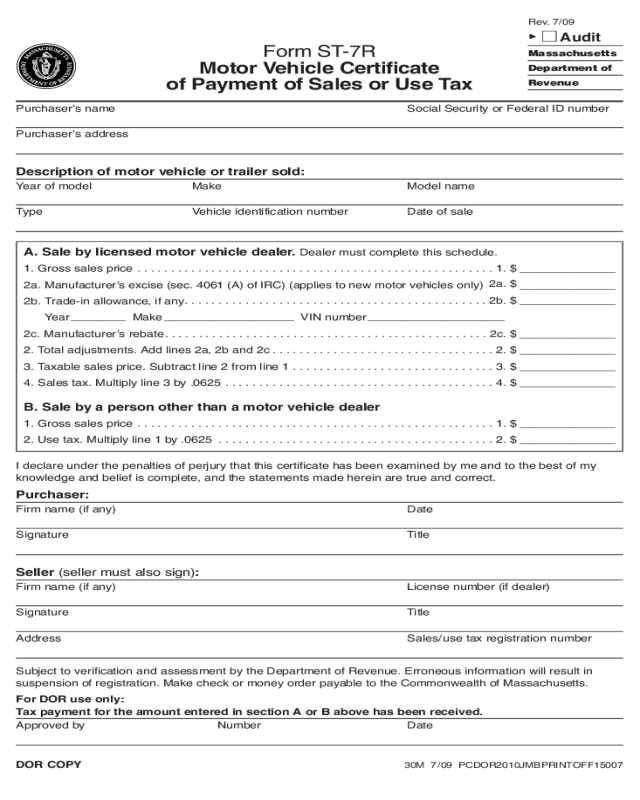

Motor Vehicle Certificate of Payment of Sales or Use Tax

A. Sale by licensed motor vehicle dealer. Dealer must complete this schedule.

1. Gross sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $ ______________

2a. Manufacturer’s excise (sec. 4061 (A) of IRC) (applies to new motor vehicles only)

2a. $

______________

2b. Trade-in allowance, if any

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b. $ ______________

2b. Year

________

Make

___________________

VIN number

____________________

2c. Manufacturer’s rebate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c. $ ______________

2. Total adjustments. Add lines 2a, 2b and 2c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $ ______________

3. Taxable sales price. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. $ ______________

4. Sales tax. Multiply line 3 by .0625 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. $ ______________

B. Sale by a person other than a motor vehicle dealer

1. Gross sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $ ______________

2. Use tax. Multiply line 1 by .0625 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $ ______________

I declare under the penalties of perjury that this certificate has been examined by me and to the best of my

knowledge and belief is complete, and the statements made herein are true and correct.

Purchaser:

Firm name (if any) Date

Signature Title

Seller (seller must also sign):

Firm name (if any) License number (if dealer)

Signature Title

Address Sales/use tax registration number

Subject to verification and assessment by the Department of Revenue. Erroneous information will result in

suspension of registration. Make check or money order payable to the Commonwealth of Massachusetts.

For DOR use only:

Tax payment for the amount entered in section A or B above has been received.

Approved by Number Date

Form ST-7R

Motor Vehicle Certificate

of Payment of Sales or Use Tax

Purchaser’s name Social Security or Federal ID number

Purchaser’s address

Description of motor vehicle or trailer sold:

Year of model Make Model name

Type Vehicle identification number Date of sale

DOR COPY 30M 7/09 PCDOR2010JMBPRINTOFF15007

Rev. 7/09

3

Audit

Massachusetts

Department of

Revenue

A. Sale by licensed motor vehicle dealer. Dealer must complete this schedule.

1. Gross sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $ ______________

2a. Manufacturer’s excise (sec. 4061 (A) of IRC)

(applies to new motor vehicles only)

. . . . 2a. $

______________

2b. Trade-in allowance, if any

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b. $ ______________

2b. Year

________

Make

___________________

VIN number

____________________

2c. Manufacturer’s rebate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c. $ ______________

2. Total adjustments. Add lines 2a, 2b and 2c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $ ______________

3. Taxable sales price. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. $ ______________

4. Sales tax. Multiply line 3 by .0625 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. $ ______________

B. Sale by a person other than a motor vehicle dealer

1. Gross sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $ ______________

2. Use tax. Multiply line 1 by .0625 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $ ______________

I declare under the penalties of perjury that this certificate has been examined by me and to the best of my

knowledge and belief is complete, and the statements made herein are true and correct.

Purchaser:

Firm name (if any) Date

Signature Title

Seller (seller must also sign):

Firm name (if any) License number (if dealer)

Signature Title

Address Sales/use tax registration number

Subject to verification and assessment by the Department of Revenue. Erroneous information will result in

suspension of registration. Make check or money order payable to the Commonwealth of Massachusetts.

Tax payment received in the amount entered in A or B above:

NUMBER _____________________________ DATE _____________________________

REGISTRAR OF MOTOR VEHICLES

Form ST-7R

Motor Vehicle Certificate

of Payment of Sales or Use Tax

Purchaser’s name Social Security/Federal ID number

Purchaser’s Address

Description of motor vehicle or trailer sold:

Year of model Make Model name

Type Vehicle identification number Date of sale

COPY FOR REGISTRY OF MOTOR VEHICLES 30M 7/09 PCDOR2010JMBPRINTOFF15007

Rev. 7/09

3

Audit

Massachusetts

Department of

Revenue

A. Sale by licensed motor vehicle dealer. Dealer must complete this schedule.

1. Gross sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $ ______________

2a. Manufacturer’s excise (sec. 4061 (A) of IRC)

(applies to new motor vehicles only)

. . . . 2a. $

______________

2b. Trade-in allowance, if any

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b. $ ______________

2b. Year

________

Make

___________________

VIN number

____________________

2c. Manufacturer’s rebate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c. $ ______________

2. Total adjustments. Add lines 2a, 2b and 2c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $ ______________

3. Taxable sales price. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. $ ______________

4. Sales tax. Multiply line 3 by .0625 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. $ ______________

B. Sale by a person other than a motor vehicle dealer

1. Gross sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $ ______________

2. Use tax. Multiply line 1 by .0625 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $ ______________

I declare under the penalties of perjury that this certificate has been examined by me and to the best of my

knowledge and belief is complete, and the statements made herein are true and correct.

Purchaser:

Firm name (if any) Date

Signature Title

Seller (seller must also sign):

Firm name (if any) License number (if dealer)

Signature Title

Address Sales/use tax registration number

Subject to verification and assessment by the Department of Revenue. Erroneous information will result in

suspension of registration. Make check or money order payable to the Commonwealth of Massachusetts.

Tax payment received in the amount entered in A or B above:

NUMBER _____________________________ DATE _____________________________

REGISTRAR OF MOTOR VEHICLES

Form ST-7R

Motor Vehicle Certificate

of Payment of Sales or Use Tax

Purchaser’s name Social Security/Federal ID number

Purchaser’s Address

Description of motor vehicle or trailer sold:

Year of model Make Model name

Type Vehicle identification number Date of sale

Rev. 7/09

3

Audit

Massachusetts

Department of

Revenue

COPY FOR REGISTERED DEALER OR OTHER SELLER’S RECORDS

30M 7/09 PCDOR2010JMBPRINTOFF15007

A. Sale by licensed motor vehicle dealer. Dealer must complete this schedule.

1. Gross sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $ ______________

2a. Manufacturer’s excise (sec. 4061 (A) of IRC)

(applies to new motor vehicles only)

. . . . 2a. $

______________

2b. Trade-in allowance, if any

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b. $ ______________

2b. Year

________

Make

___________________

VIN number

____________________

2c. Manufacturer’s rebate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c. $ ______________

2. Total adjustments. Add lines 2a, 2b and 2c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $ ______________

3. Taxable sales price. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. $ ______________

4. Sales tax. Multiply line 3 by .0625 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. $ ______________

B. Sale by a person other than a motor vehicle dealer

1. Gross sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $ ______________

2. Use tax. Multiply line 1 by .0625 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $ ______________

I declare under the penalties of perjury that this certificate has been examined by me and to the best of my

knowledge and belief is complete, and the statements made herein are true and correct.

Purchaser:

Firm name (if any) Date

Signature Title

Seller (seller must also sign):

Firm name (if any) License number (if dealer)

Signature Title

Address Sales/use tax registration number

Subject to verification and assessment by the Department of Revenue. Erroneous information will result in

suspension of registration. Make check or money order payable to the Commonwealth of Massachusetts.

Tax payment received in the amount entered in A or B above:

NUMBER _____________________________ DATE _____________________________

REGISTRAR OF MOTOR VEHICLES

Form ST-7R

Motor Vehicle Certificate

of Payment of Sales or Use Tax

Purchaser’s name Social Security/Federal ID number

Purchaser’s Address

Description of motor vehicle or trailer sold:

Year of model Make Model name

Type Vehicle identification number Date of sale

COPY FOR TAXPAYER 30M 7/09 PCDOR2010JMBPRINTOFF15007

Rev. 7/09

3

Audit

Massachusetts

Department of

Revenue