Fillable Printable Pay Stub Template for Full-Time Salaried Employees

Fillable Printable Pay Stub Template for Full-Time Salaried Employees

Pay Stub Template for Full-Time Salaried Employees

Human Resources

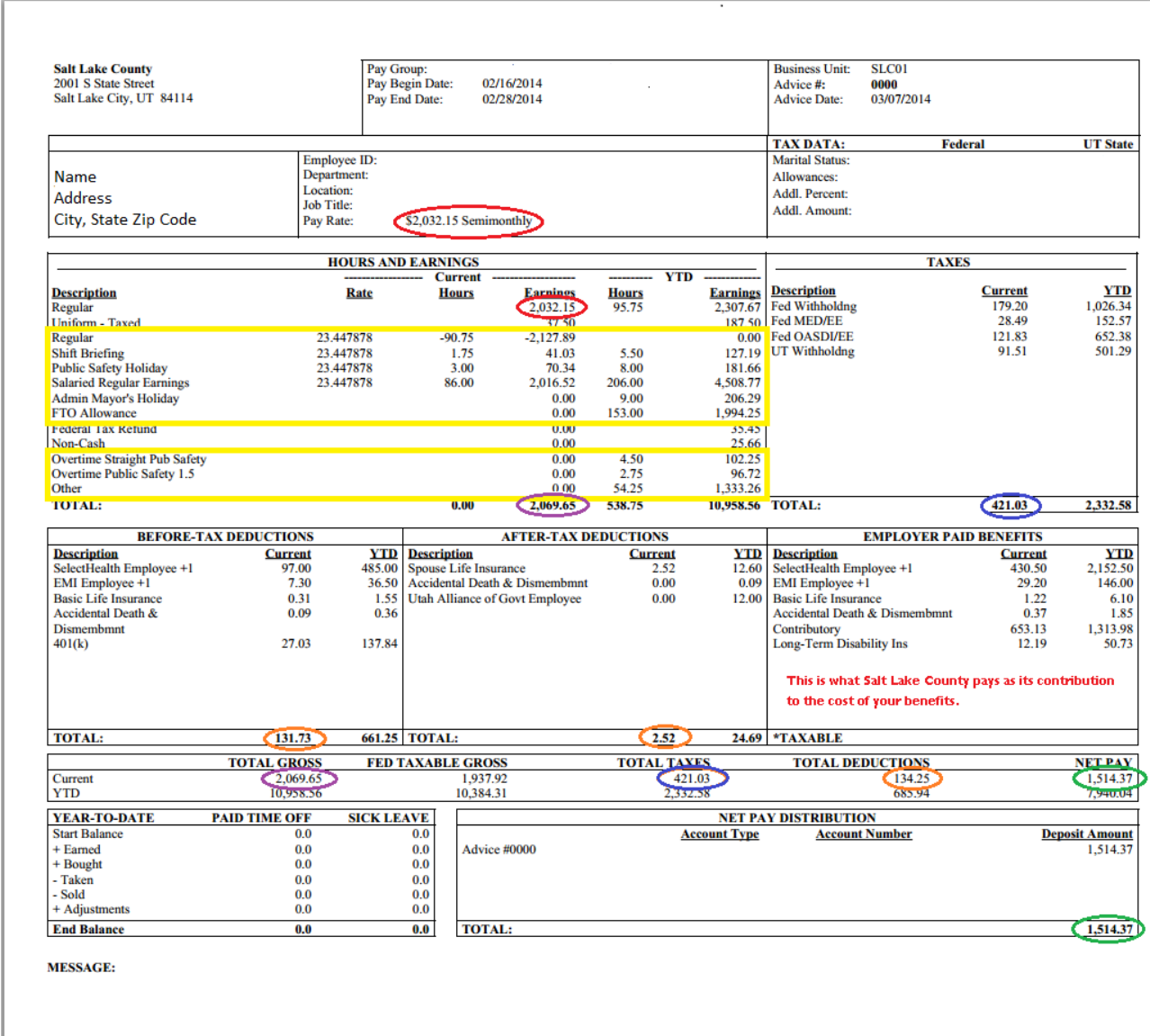

This sample pay stub is for a full-time salaried employee.

The actual semi-monthly salary is shown in the Pay Rate line near the top of the pay stub. The semi-monthly salary is also shown in the Hours and

Earnings box.

The semi-monthly salary amounts are circled in red.

Total Gross Earnings is calculated by adding the semi-monthly salary plus any additional earnings (e.g., uniform allowance, overtime pay). Total

Earnings are shown at the bottom of the Hours and Earnings box and in the box near the bottom of the pay stub where Net Pay is calculated. Total

Gross Earnings amounts are circled in purple.

Taxes withheld from gross salary are detailed in the Taxes box to the right of the Hours and Earnings box. Total taxes are summarized in the box

where Net Pay is calculated. The Total Taxes amounts are circled in blue.

Deductions from gross salary are detailed in two boxes: Before-Tax Deductions and After-Tax Deductions. The premium for each insurance plan in

which an employee participates as well as the amount of other optional payroll deductions are detailed in these boxes. Total Deductions are

summarized in the box where

Net Pay is calculated. The Total Deductions amounts are circled in orange. NOTE: Accidental Death & Dismemberment premiums are considered a

Before-Tax Deduction. For the first paycheck of 2014, they were inadvertently categorized as After-Tax Deductions. This will not be corrected as it will

have a minimal impact on individual taxes.

Net Pay is calculated in the box near the bottom of the pay stub: Total Gross – Total Taxes – Total Deductions = Net Pay. (Federal Taxable Gross

equals Total Gross less Before-Tax Deductions.) The amount of all direct deposits and/or paper checks is the Net Pay Distribution. The Net Pay

amounts are circled in green.

Understanding the Hours and Earnings Information

Information in the Hours and Earnings box comes from two areas of PeopleSoft. The information outside the yellow boxes comes from the PeopleSoft

Job Record, the file that describes earnings for a position, or from additional earnings: semi-monthly salary as well as additional earnings items, e.g.

Uniform Allowance. The information inside the yellow box comes from the timesheet. This area details earnings for each Time Reporting Code (TRC)

reported on the timesheet. The earnings are based on the employee’s hourly Rate which is the annual salary divided by 2080 hours. Hours for each

TRC (Salary, Vacation, Funeral Leave, etc.) come directly from the timesheet. Because County employees are paid on a semi-monthly schedule, the

number of Regular Work Hours in a pay period will vary from pay period to pay period. Earnings are calculated by multiplying the hourly rate by the

number of hours reported in each TRC. Earnings based on the actual number of regular work hours in a pay period will never equal the semi-monthly

salary. The earnings amounts in the yellow box are for your information only; the amounts will always balance to $0.00 (earnings for the regular work

hours less earnings for each TRC on the timesheet).

1 Version: 12/10/2015