Fillable Printable Payment Schedule Format

Fillable Printable Payment Schedule Format

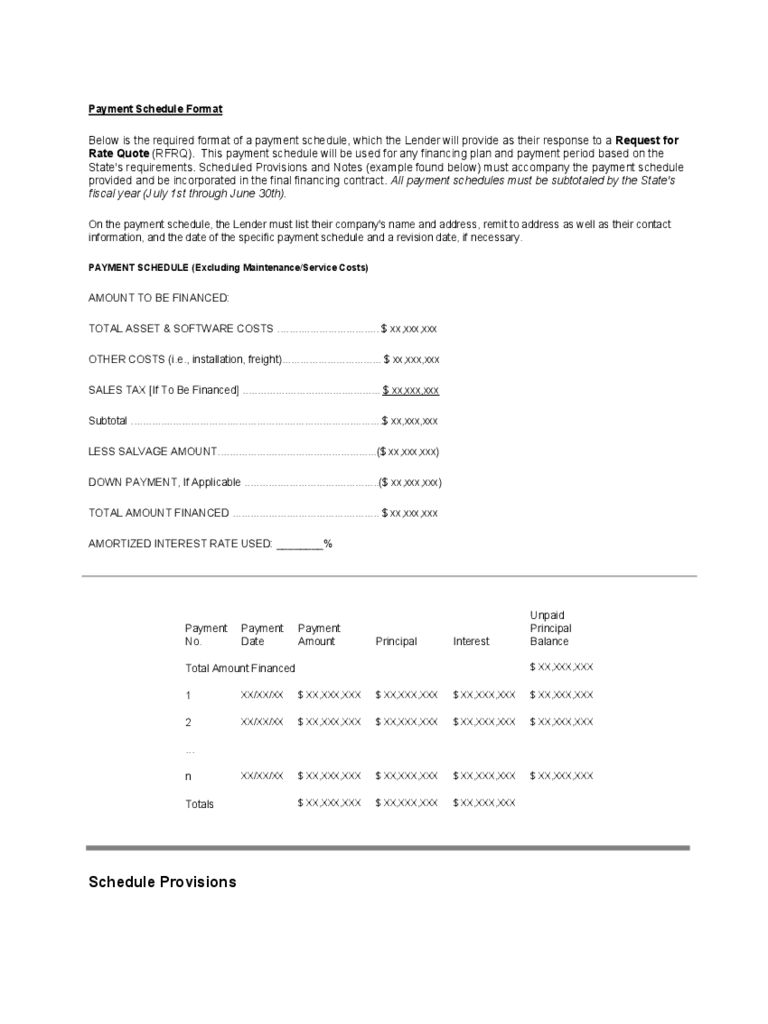

Payment Schedule Format

Payment Schedule Format

Below is the required format of a payment schedule, which the Lender will provide as their response to a Request for

Rate Quote (RFRQ). This payment schedule will be used for any financing plan and payment period based on the

State's requirements. Scheduled Provisions and Notes (example found below) must accompany the payment schedule

provided and be incorporated in the final financing contract. All payment schedules must be subtotaled by the State's

fiscal year (July 1st through June 30th).

On the payment schedule, the Lender must list their company's name and address, remit to address as well as their contact

information, and the date of the specific payment schedule and a revision date, if necessary.

PAYMENT SCHEDULE (Excluding Maintenance/Service Costs)

AMOUNT TO BE FINANCED:

TOTAL ASSET & SOFTWARE COSTS .................................. $ xx,xxx,xxx

OTHER COSTS (i.e., installation, freight)................................. $ xx,xxx,xxx

SALES TAX [If To Be Financed] .............................................. $ xx,xxx,xxx

Subtotal ....................................................................................$ xx,xxx,xxx

LESS SALVAGE AMOUNT.....................................................($ xx,xxx,xxx)

DOWN PAYMENT, If Applicable .............................................($ xx,xxx,xxx)

TOTAL AMOUNT FINANCED ................................................. $ xx,xxx,xxx

AMORTIZED INTEREST RATE USED: ________%

Payment

No.

Payment

Date

Payment

Amount Principal Interest

Unpaid

Principal

Balance

Total Amount Financed

$ XX,XXX,XXX

1

XX/XX/XX $ XX,XXX,XXX $ XX,XXX,XXX $ XX,XXX,XXX $ XX,XXX,XXX

2

XX/XX/XX $ XX,XXX,XXX $ XX,XXX,XXX $ XX,XXX,XXX $ XX,XXX,XXX

...

n

XX/XX/XX $ XX,XXX,XXX $ XX,XXX,XXX $ XX,XXX,XXX $ XX,XXX,XXX

Totals

$ XX,XXX,XXX $ XX,XXX,XXX $ XX,XXX,XXX

Schedule Provisions

•

Per the California Prompt Payment Act (California Government Code Section 927 et seq.), correct invoices must be

submitted at least forty-five (45) days prior to the payment schedule dates. Delayed invoices may delay payments.

•

If the contract requires an acceptance testing period, interest shall be owed on the accepted assets from the first day

of the successful acceptance test period. If the contract does not contain an acceptance test, interest shall be owed

from a date no later than the acceptance date of the asset purchased pursuant to the contract

•

Should acceptance not occur by the agreed upon anticipated acceptance date, the payment schedule will be adjusted

pro rata based on the change greater than 10 basis points to the US Treasury (or specify other securities rate for the

payment term from the time of rate quote to the date of acceptance. Lender has provided rates to the State agency

with any limitations clearly identified including the possibility of a payment schedule revision. The US Treasury

securities rate as of the rate quote date is _________% for __________ term.

•

In the event actual funding rates differ from originally quoted funding rates, a revised schedule will be necessary

reflecting the actual rates at which the loan is entered into. Subsequent revised payment schedules for proposed

refunding of the original issue will not be allowed unless it is in the best interest of the State.

•

Unless otherwise specified, the interest portion for any payment will be calculated by using the following formula:

Interest = (Annual Net Interest Rate/100) x (Number of Days from Last Payment/360) x (Previous Unpaid Principal

Balance)

Notes

•

The date of the first payment will be identified by the State agency when requesting a rate quote along with other

payment information such as down payment amount, term desired, financed amount, financing plan, and other

purchase contract characteristics (e.g. whether there is an acceptance testing period and how long if there is one, the

Supplier's name, the contract number, and anticipated award and acceptance dates).

•

The first payment should include interest on the accepted assets for one period length or less. Any other prior interest,

if any, will be shown as capitalized interest in the payment schedule.

•

All payment schedules for a plan will be based on the plan's terms, conditions, and closing documents as described

for that plan and are guaranteed for at least 30 days when provided via electronic (fax or e-mail) or written document

from the Lender. Once the contract is executed with the payment schedule provided by the Lender, a commitment is

made to that Lender for that installment purchase.

•

For more information or additional financing plans and rates, contact the $Mart Managers.

•

Payments will be fixed, approximately equal installment amounts as shown in the payment schedule (unless specified

otherwise).

•

The annual amortization interest rate for the payment schedule is based on a 360-day year.

•

A down payment, if any, does not accrue interest and should be subtracted from the asset purchase costs to arrive at

the financed amount. The down payment will be considered a passthrough from the State to the Supplier.

•

The State has no financial obligation to pay for the purchased goods until they are accepted by the State. However, in

order to offer rates, Lenders rely on the State to provide an accurate acceptance date. Should acceptance not occur

as pledged to the Lender, financing costs may increase, which would require a contract revision.

•

The State will only pay interest on assets that have been accepted by the State, unless escrow funding is

implemented. Interest charges will commence on the date of acceptance and on the amount of the assets accepted.