Fillable Printable Payroll - Indiana

Fillable Printable Payroll - Indiana

Payroll - Indiana

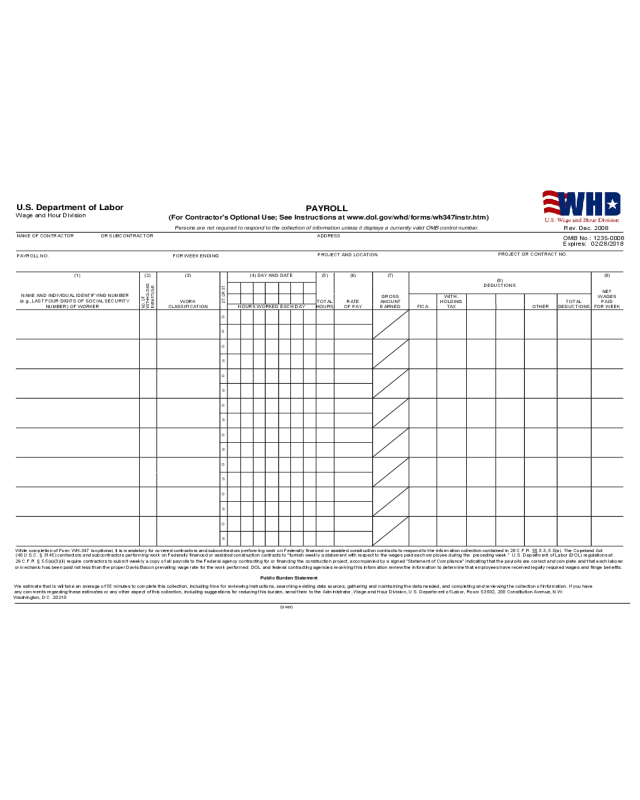

U.S. Department of Labor

PAYROLL

(For Contractor's Optional Use; See Instructions at www.dol.gov/whd/forms/wh347instr.htm)

Wage and Hour Division

Persons are not required to respond to the collection of information unless it displays a currently valid OMB control number.

NAME OF CONTRACTOR OR SUBCONTRACTOR

ADDRESS

OMB No.: 1235-0008

Expires: 02/28/2018

PAYROLL NO. FOR WEEK ENDING

PROJECT AND LOCATION

PROJECT OR CONTRACT NO.

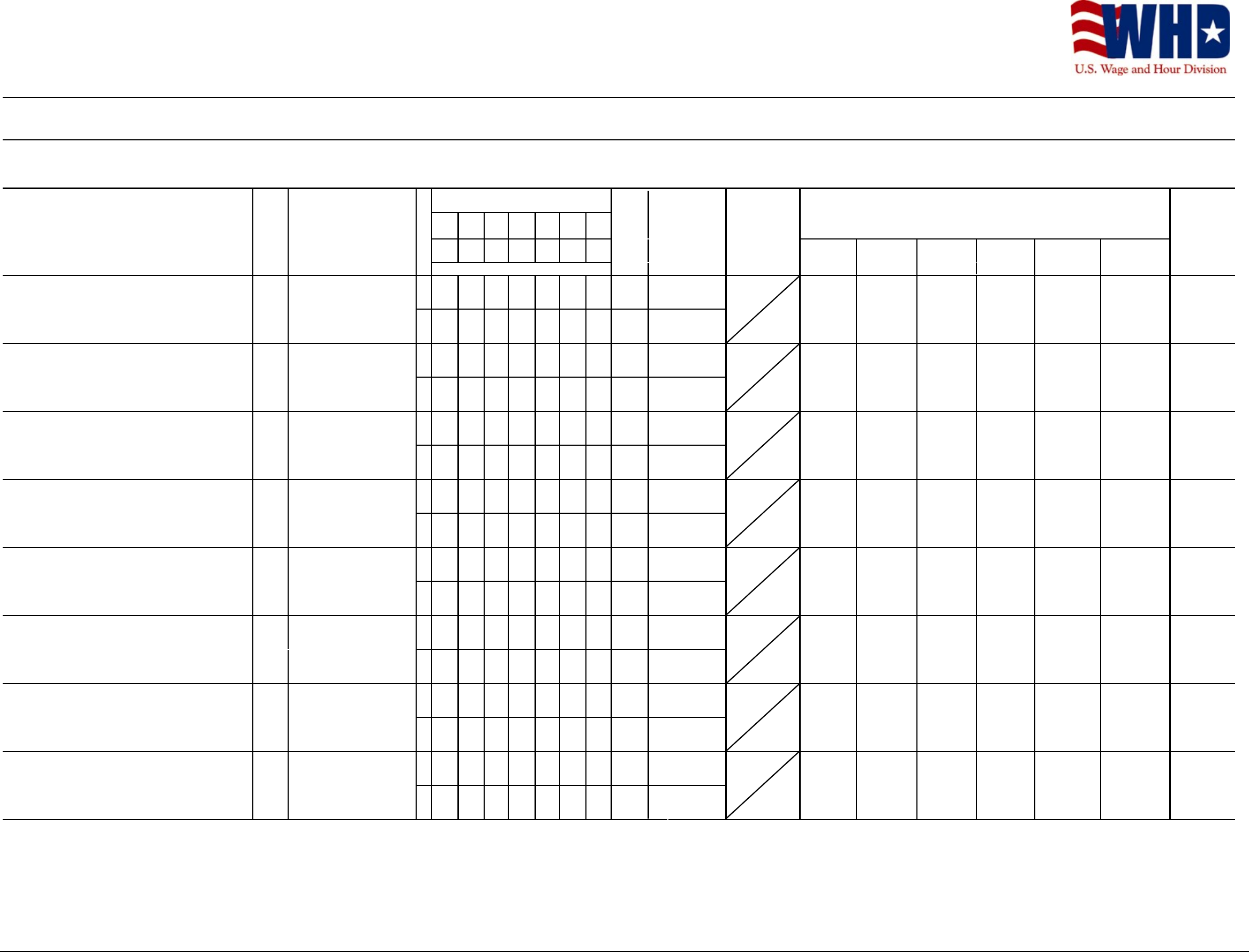

(1) (2) (3) (4) DAY AND DATE (5) (6) (7) (9)

(8)

DEDUCTIONS

O

O

O

O

O

O

O

O

NAME AND INDIVIDUAL IDENTIFYING NUMBER

(e.g., LAST FOUR DIGITS OF SOCIAL SECURITY

NUMBER) OF WORKER

NO. OF

W ITHHOLDiNG

EXEMPTIONS

WORK

CLASSIFICATION

OT. OR ST.

HOURS WORKED EACH DAY

TOTAL

HOURS

RATE

OF PAY

GROSS

AMOUNT

EARNED FICA

WITH-

HOLD

ING

TAX OTHER

TOTAL

DEDUCTIONS

NET

WAGES

PAID

FOR WEEK

S

S

S

S

S

S

S

S

Rev. Dec. 2008

Rev. Dec. 2008

While completion of Form WH-347 is optional, it is mandatory for covered contractors and subcontractors performing work on Federally financed or assisted construction contracts to respond to the information collection contained in 29 C.F.R. §§ 3.3, 5.5(a). The Copeland Act

(40 U.S.C. § 3145) contractors and subcontractors performing work on Federally financed or assisted construction contracts to "furnish weekly a statement with respect to the wages paid each employee during the preceding week." U.S. Department of Labor (DOL) regulations at

29 C.F.R. § 5.5(a)(3)(ii) require contractors to submit weekly a copy of all payrolls to the Federal agency contracting for or financing the construction project, accompanied by a signed "Statement of Compliance" indicating that the payrolls are correct and complete and that each laborer

or mechanic has been paid not less than the proper Davis-Bacon prevailing wage rate for the work performed. DOL and federal contracting agencies receiving this information review the information to determine that employees have received legally required wages and fringe benefits.

Public Burden Statement

We estimate that is will take an average of 55 minutes to complete this collection, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. If you have

any comments regarding these estimates or any other aspect of this collection, including suggestions for reducing this burden, send them to the Administrator, Wage and Hour Division, U.S. Department of Labor, Room S3502, 200 Constitution Avenue, N.W.

Washington, D.C. 20210

(over)

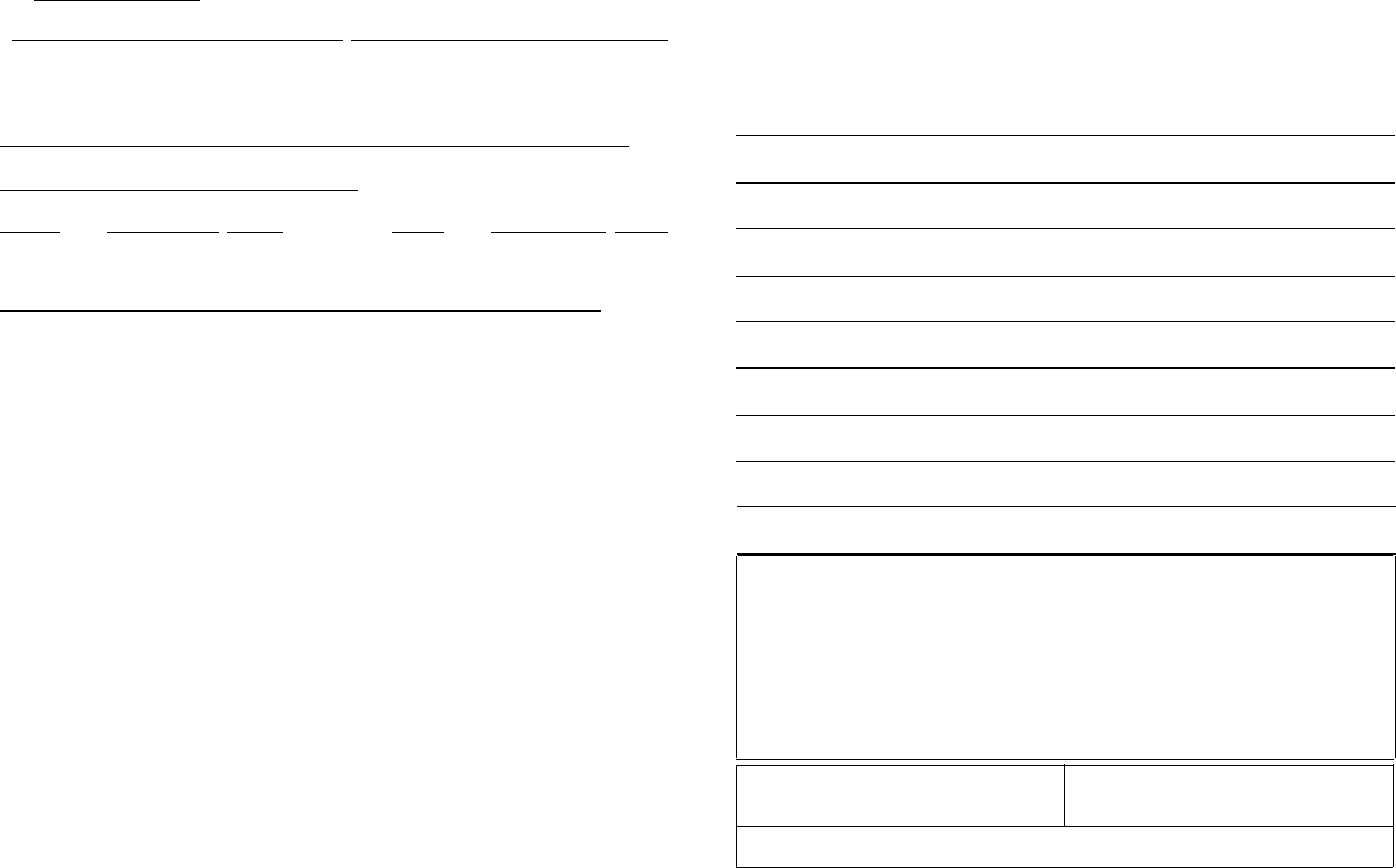

Date

I,

(Name of Signatory Party) (Title)

do hereby state:

(1) That I pay or supervise the payment of the persons employed by

o

n

t

h

e

(Contractor or Subcontractor)

; that during the payroll period commencing on the

(Building or Work)

day of , , and ending the day of , ,

all persons employed on said project have been paid t

he full weekly wages earned, that no rebates have

been or will be made either directly or indirectly to or on behalf of s

aid

from the full

(Contractor or Subcontractor)

weekly wages earned by any person and that no deductions have been made either directly or indirectly

from the full wages earned by any person, other than permissible deductions as defined in Regulations, Part

3 (29 C.F.R. Subtitle A), issued by the Secretary of Labor under the Copeland Act, as amended (48 Stat. 948,

63 Stat. 108, 72 Stat. 967; 76 St

at. 357; 40 U.S.C. § 3145), and described below:

(2) That

any payrolls ot

herwise under this contract required to be subm

itted for t he above period are

correct and complete; that the wage rates for laborers or mechanics contained therein are not less than the

applicable wage rates contained in any

wage determination incorporated into the contract; that the classifications

set forth therein for each laborer or mechanic conform with the work he performed.

(3) That any apprentices employed in the above period are duly registered in a bona fide apprenticeship

program regis

tered with a State apprenticeship agency recognized by the Bureau of Apprenticeship and

Training, United States Department of Labor, or if no such recognized agency exists in a State, are registered

with the Bureau of Apprenticeship and Training, United States Department of Labor.

(4) That:

(a) WHERE FRINGE BENEFITS ARE PAI

D TO APPROVED PLANS, FUNDS, OR PROGRAMS

−

in addition to the basic hourly wage rates paid to each laborer or mechanic listed in

the above referenced payroll, payments of fringe benefits as list

ed in the contract

have b

een or will be made to appropriate programs for the benefit of such employees,

e

xcept as noted in section 4(c)

below.

(b) WHERE FRINGE BENEFITS AR

E PAID IN CASH

−

Each laborer or mechanic listed in the above referenced payroll has been paid,

as indicated on the payroll, an amount not less than the sum of the applicable

basic hourly wage rate plus the amount of the required fringe benefits as listed

in the contract, except as noted in section 4(c) below.

(c) E

XCEPTIONS

REMARKS:

EXCEPTION (CRAFT)

EXPLANATION

NAME AND TITLE SIGNATURE

THE WILLFUL FALSIFICATION OF ANY

OF THE ABOVE STATEMENTS MAY SUBJECT THE CONTRACTOR OR

SUBCONTRACTOR TO CIVIL OR CRIMINAL PROSECUTION. SEE SECTION 1001 OF TITLE 18 AND SECTION 231 OF TITLE

31 OF THE UNITED STATES CODE.