Fillable Printable Certified Payroll Form - Minnesota Department of Labor and Industry

Fillable Printable Certified Payroll Form - Minnesota Department of Labor and Industry

Certified Payroll Form - Minnesota Department of Labor and Industry

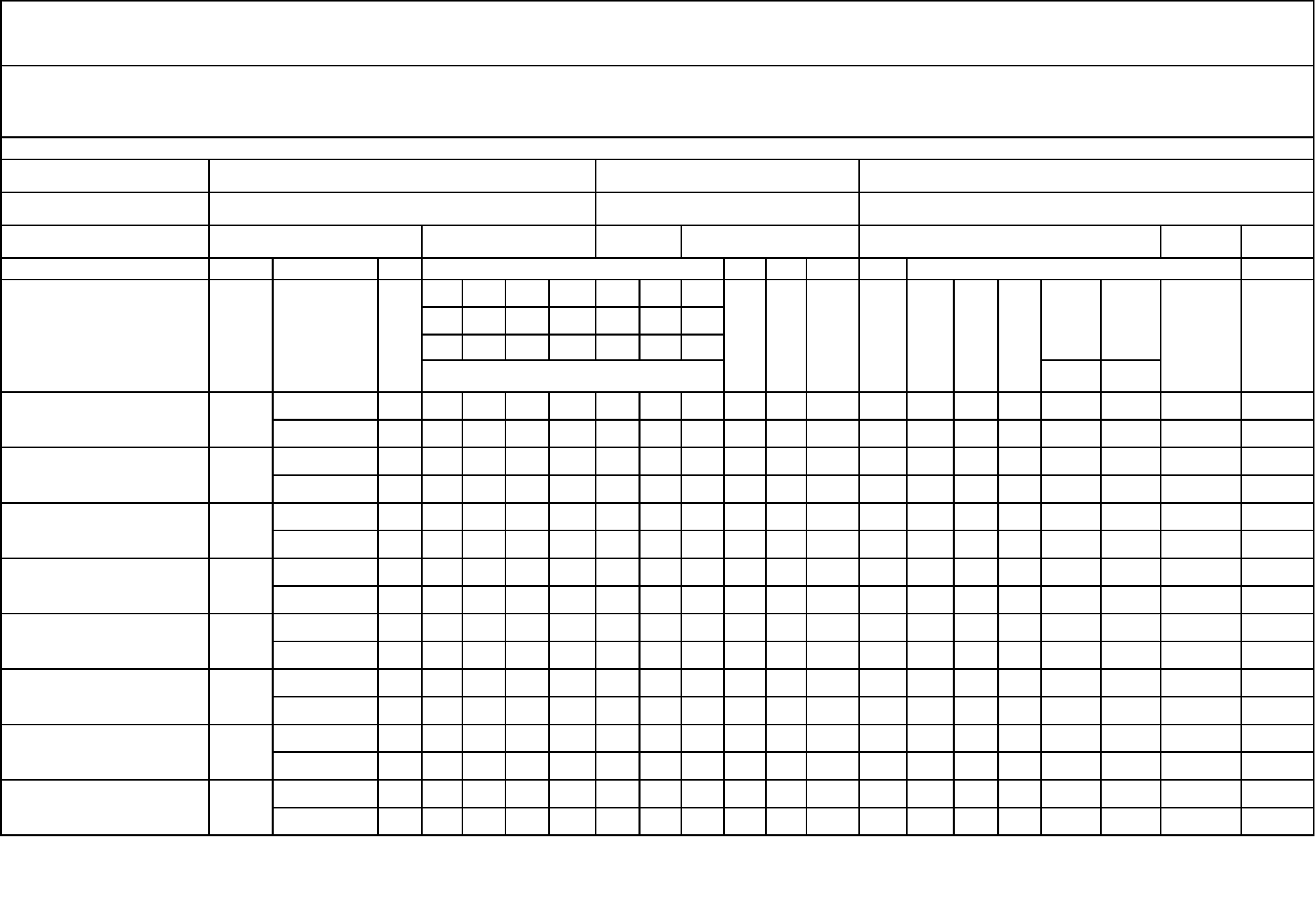

Name of Contractor or

Subcontractor

Address & Telephone Number

Contract Purchase Order Number Pa yroll #

1

2

3 4 6 7 8 9 11

Su M T Th F S

OT

ST

OT

ST

OT

ST

OT

ST

OT

ST

OT

ST

OT

ST

OT

ST

*Pursuant to the Minnesota Government Data Practices Act, all of the data provided hereunder is public data, which is available to anyone upon request. DO NOT provide any confidential data such as

social security numbers, in part or whole, on this form. This data is collected pursuant to Minnesota Stat. §177.30 Sub. 4 and 177.43 Sub. 3. If you have questions regarding the Prevailing Wage Laws,

contact the Minnesota Department of Labor & Industry, 443 Lafayette Road Nl, St. Paul, MN 55155, P hone (651) 284-5091 or 1-800-DIAL-DLI (1-800-342-53584), TTY (651) 297-4198. The willful

falsification of any of the above statements may subject the contractor or subcontractor to civil or criminal prosecution under state and/or federal law.

Employee Name , Addre ss , &

Identifying Number

(DO NOT provi de S ocia l Security

No.)

# of

Exemp-

tions

Labor Code and

-----------------

-

Classification

Title

OT

&

ST

Minne s ot a De pa rtme nt of La bor and I ndus t ry Cert ifi e d P a yr oll Form

W

Total

Deductions

Total Net

Wages Paid

Hours Worked Each Day

5 Day of Week & Date (xx/xx)

10

Fed

Tax

State

Tax

Other

(Specify)

Other

(Specify)

Address & Telephone Number

Proj ect Name and Locat ion

Total

Hrs

This

Job

Gross

Amt.

Earned

This

Job

Gross

Amt

Earned

This

Pay

Period

FICA

Pay Period End Date

Hrly

Rates

of

Pay

This is a two part form consisting of Par t 1 - Prevailing Wage Payroll Information listed below and the accompany Par t 2 - Statement of Compliance. The contractor and

subcontractor(s) shall furnish these completed forms every two weeks to the contracting authority. Copies of the Prevailing Wage Payroll Information form and the Statement of

Comp liance form are available at DLI.MN.GOV/LS/PrevWage.asp

All pay rol ls must be certified by attaching t o each report a completed and executed S t atement of Compliance.

Prime C ontra ctor Name

MINNESOTA

DEPARTMENT OF LABOR & INDUSTRY

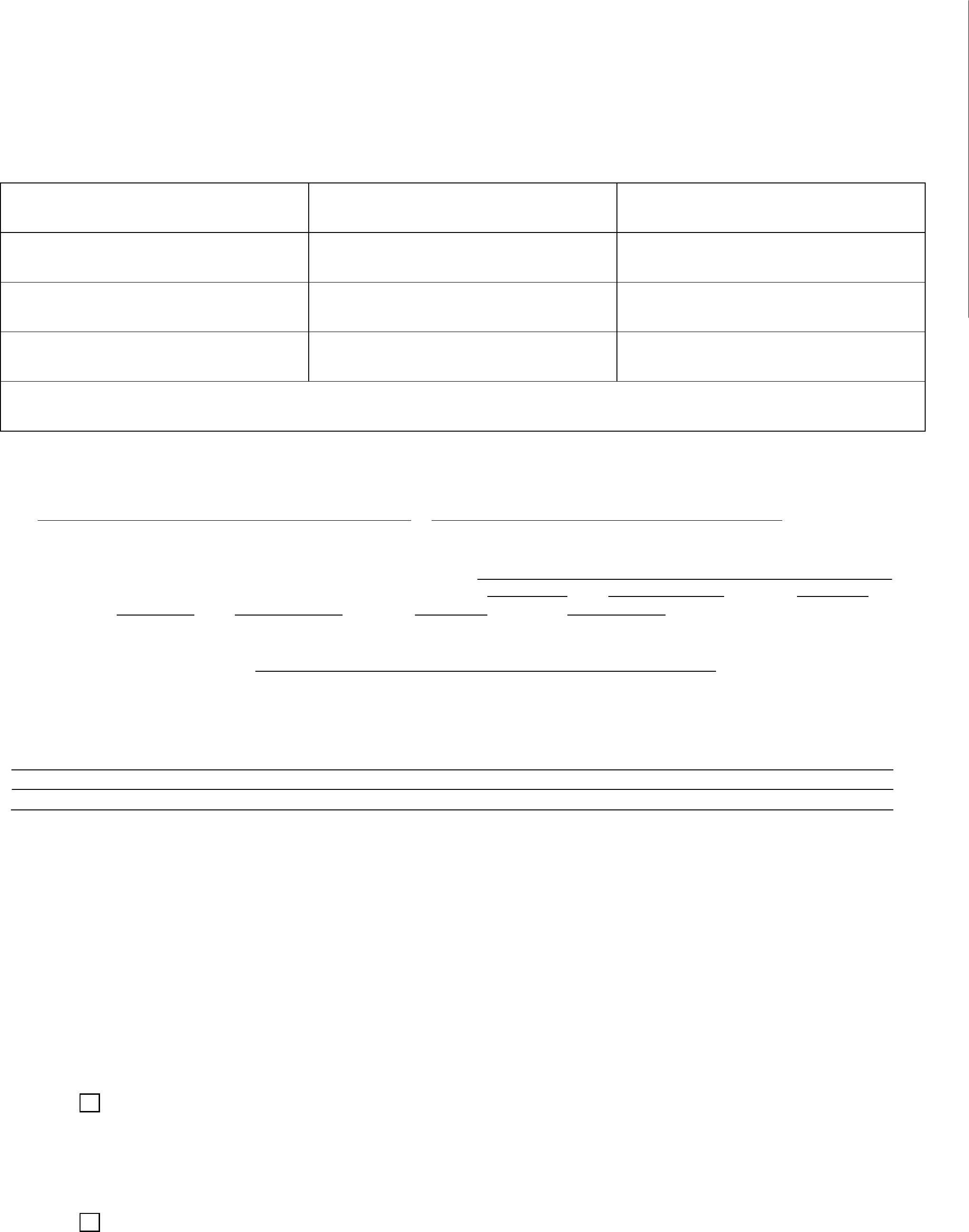

Part 2 Statement of

Compliance

RE PORT NUMBER STATE PR OJECT NAME AND LOCAT ION DATE

CONT ACTING AU THOR ITY PROJECT GENERAL CONTRACTOR

CONTRACTOR/SUBCONTRACTOR PHONE NUM BER CONTRACT PURCHASE OR DER NUMB ER

ADDRESS CITY/STATE ZIP

TYPE OF WORK

(Complete as described on solicitation documents.)

STATEMENT WITH RESPECT TO COMPLIANCE AND WAGES PAID

I, do hereby state:

(Name of signat ory party)

(Title-

Owner or

Officer)

(1) That I pay or

supervise

the payment of the persons employed by

on said Contract; that during the payroll period commencing on the day of of the year , and

ending the day of of the year , there were employees performing work on said

Contract. That all persons performing work under said Contract are listed on the payroll and have been paid the full prevailing

wages for all hours worked under said Contract, that no rebates and or deductions have or will be made either directly or

indirectly to or on behalf of said

(Contractor

or

Subcontractor)

from the full wages earned by any person, other than permissible deductions as defined in Minnesota Statutes 177.24, Subdivision

4, 181.06, and 181.79, issued by the Minnesota Commissioner of Labor and Industry and described below:

DESCRIBE LEGAL DEDUCTIONS

(2) That the payroll submitted under said Contract is complete and accurate; that the wage rate(s) of the laborer(s), mechan ic(s), and

worker(s) performing work under said Contract is (are) paid according to the wage determination(s) and labor provisions

incorporated in said Contract and according to applicable laws; that wages paid to laborer(s) mechanic(s), and worker(s) performing

work under said Contract is at least the prevailing wage rate for the most similar classification of labor performed as d ef ined under

applicable law; and that the laborer(s), mechanic(s), and worker(s) performing work under said Contract is (are) paid for all hours

in excess of the prevailing hours at a rate of at least one and one-halftimes the applicable base rate of pay.

(3) That any apprentices employed during said payroll period are duly registered in a bona fide apprenticeship program registered with

the Minnesota Department of Labor and Industry, or are registered with the Bureau of Apprenticeship and Training; United States

Department of Labor.

(4) That:

(a) WHERE FRINGE

BENEFITS

ARE PAID TO ANY AP P ROVED P L ANS, FUNDS, OR

PROGRAMS

In addition to the basic hourly wage rates paid to each laborer, worker or mechanic listed on said payroll,

payments

to current, bona fide

fringe

benefit programs as set forth in paragraph 4(d), have been or will be made to the

program's administrators as set forth in paragraph 4(e) for the benefit of said employees, except as noted in Section

4(c).

(b) WHERE FRINGE

BENEFITS

ARE PAID IN CASH TO ALL

EMPLOYEES

Each laborer, worker, or mechanic listed on said payroll has been paid, as indicated on the payroll, an amount not

less than the sum of the applicable basic rate plus the fringe rate as listed in the appropriate wage determination

incorporated into said Contract.

NOTE-

FRINGE

BENEFIT SECTIONS

C, D, E AND SIGNATURE BLOCK ARE ON NEXT

PAGE

(c)

EXCEPTIONS

EMPLOYEE NAME

CLASSIFICATION/OCCUPATION

EXPLANATION

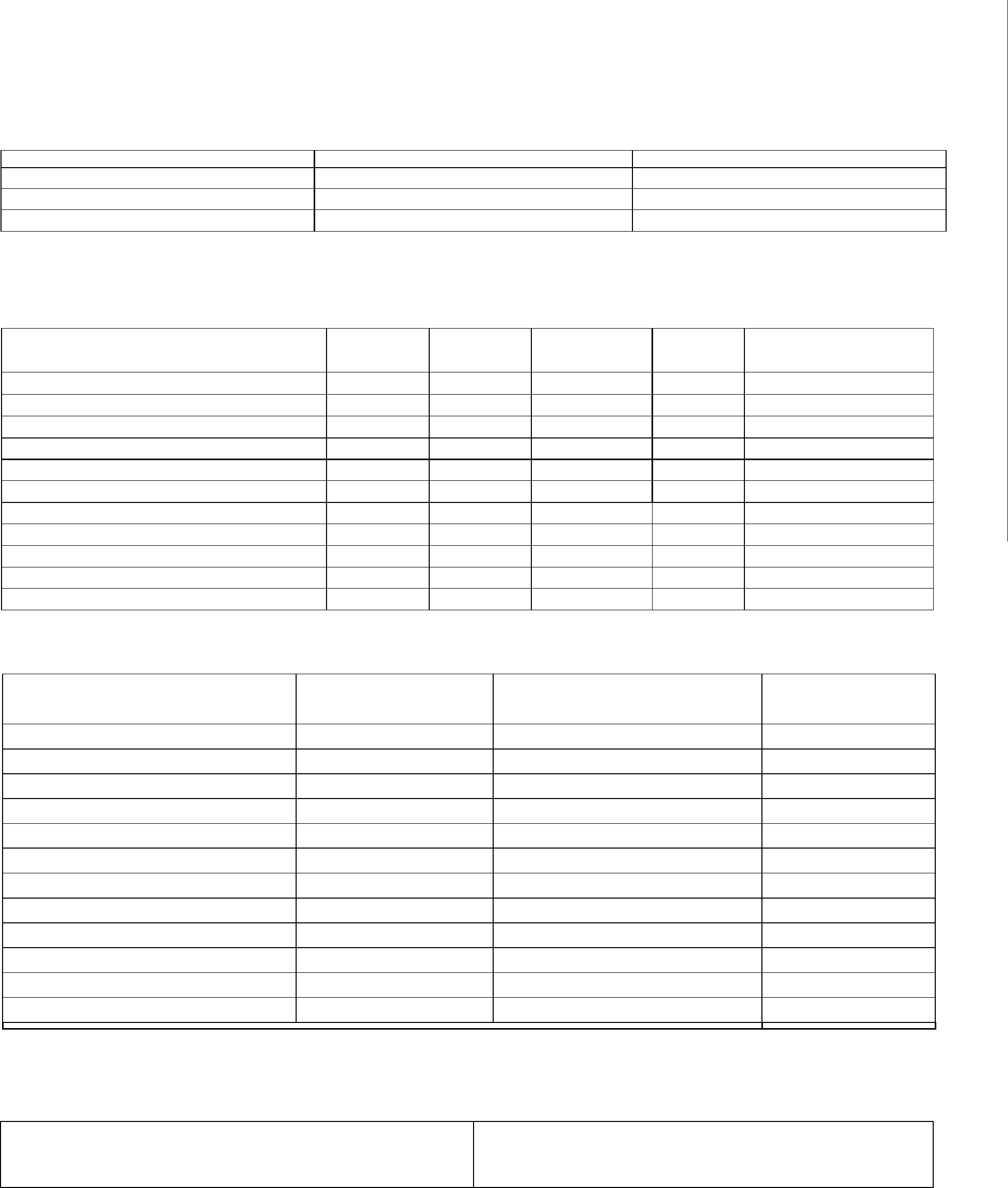

(d) BENEFIT

PROGRAM INFORMATION

in DOLLARS CONTRIBUTED PER

HOUR

(Must be completed if 4(a) is

checked.)

PROGRAM TITLE, CLASSIFICATION TITLE, OR

INDIVIDUAL EMPLOYEES

HEALTH/

WELFARE

VACATION/

HOLIDAY

APPRENTI-

CESHIP

TRAINING

PENSION

OTHER

INCLUDE TITLE

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

(e) BENEFIT

PROGRAM INFORMATION

(Must be completed if 4(a) is

checked.)

NAME & ADDRESS OF FRINGE BENEFIT

FUND, PLAN, OR PROGRAM

ADMINISTRATOR

BENEFIT ACCOUNT

NUMBER

THIRD PARTY TRUSTEE

AND/OR CONTACT PERSON

TELEPHONE NUMBER

The willful falsification of any of the above statements may subject the

contractor

or

subcontractor to

civil or criminal prosecution under federal and/or state law.

NAME AND TITLE O F OWNER OR OFFICER

SIGNATURE

As a representative of the contractor submitting the payroll identified above, I hereby certify that the payroll is true and correct

to

the best of my

knowledge.

NOTE: For information regarding this form, submission of payroll records, or copies of the laws stated above,

contact the Minnesota Department of Labor and Industry, 443 Lafayette Road N., St. Paul, MN

55155,

Phone: (651) 284-5091 or 1-800-DIAL-DLI (1-800-342-5354), TTY: (651)

297-4198.