Fillable Printable Statement of Compliance - California

Fillable Printable Statement of Compliance - California

Statement of Compliance - California

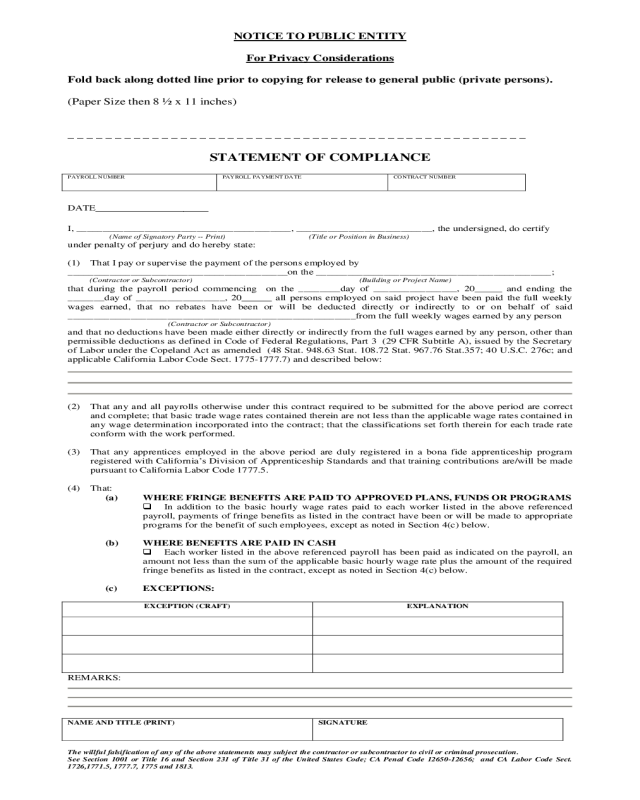

NOTICE TO PUBLIC ENTITY

For Privacy Considerations

Fold back along dotted line prior to copying for release to general public (private persons).

(Paper Size then 8 ½ x 11 inches)

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

STATEMENT OF COM PLI ANCE

PAYROLL NUMBER

PAYROLL PAYMENT DATE CONTRACT NUMBER

DATE__________________

I, _________________________________________, __________________________, the undersigned, do certify

(Name of Signatory Party -- Print) (Title or Position in Business)

under penalty of perjury and do hereby state:

(1) That I pay or supervise the payment of the persons employed by

__________________________________________on the _____________________________________________;

(Contractor or Subcontractor) (Building or Project Name)

that during the payroll period commencing on the ________day of ________________, 20 and ending the

_______day of _________________, 20

all persons employed on said project have been paid the full weekly

wages earned, that no rebates have been or will be deducted directly or indirectly to or on behalf of said

_______________________________________________________from the full weekly wages earned by any person

(Contractor or Subcontractor)

and that no deductions have been made either directly or indirectly from the full wages earned by any person, other than

permissible deductions as defined in Code of Federal Regulations, Part 3 (29 CFR Subtitle A), issued by the Secretary

of Labor under the Copeland Act as amended (48 Stat. 948.63 Stat. 108.72 Stat. 967.76 Stat.357; 40 U.S.C. 276c; and

applicable California Labor Cod e Sect. 1775-1777.7) and described below:

(2) That any and all payrolls otherwise under this contract required to be submitted for the above period are correct

and complete; that basic trade wage rates contained therein are not less than the app licable wage rates con tained in

any wage determination incorporated into the contract; that the classifications set forth therein for each trade rate

conform with the work performed.

(3) That any apprentices employed in the above period are duly registered in a bona fide apprenticeship program

registered with California’s Division of Apprenticeship Standards and that training contributions are/will be made

pursuant to California Labor Code 1777.5.

(4) That:

(a) WHERE FRINGE BENEFITS ARE PAID TO APPROVED PLANS, FUNDS OR PROGRAMS

In addition to the basic hourly wage rates paid to each worker listed in the above referenced

payroll, payments of fringe benefits as listed in the contract have been or will be made to appropriate

programs for the benefit of such employees, except as noted in Section 4(c) below.

(b) WHERE BENEFITS ARE PAID IN CASH

Each worker listed in the above referenced payroll has been paid as indicated on the payroll, an

amount not less than the sum of the applicable basic hourly wage rate plus the amount of the required

fringe benefits as listed in the contract, except as noted in Section 4(c) below.

(c) EXCEPTIONS:

EXCEPTION (CRAFT)

EXPLANATION

REMARKS:

NAME AND TITLE (PRINT)

SIGNATURE

The willful falsification of any of the above statements may subject the contractor or subcontractor to civil or criminal prosecution.

See Section 1001 or Title 16 and Section 231 of Title 31 of the United States Code; CA Penal Code 12650-12656; and CA Labor Code Sect.

1726,1771.5, 17 77.7, 1775 and 1813.