Fillable Printable Payroll Remittance Form - Ottawa

Fillable Printable Payroll Remittance Form - Ottawa

Payroll Remittance Form - Ottawa

•^H

Canada

Customs

Agence

des

douanes

•^B

and

Revenue

Agency

et

du

revenu

du

Canada

ACCOUNTING

ENTRIES

-

EXPLANATIONS

AMOUNT

PAID

payments

of

Canada

Pension

Plan

contributions,

Employment

Insurance

premiums

and

income

tax

(net

of

adjustments)

for

the

year

indicated

GROSS

PAYROLL

IN

REMITTING

PERIOD

(dollars

only)

all

remuneration

before

any

deductions

It

includes

regular

wages,

commissions,

overtime

pay,

paid

leave,

taxable

benefits

and

allowances,

piecework

payments,

and

special

payments

It

is

equivalent

to

the

monthly

total

of

all

amounts

that

would

appear

in

Box

14,

"Employment

income"

on

the

T4

slip

For

quarterly

remitters,

it

is

the

total

of

these

amounts

for

the

last

month

of

the

quarter

NUMBER

OF

EMPLOYEES

IN

LAST

PAY

PERIOD

the

number

of

people

who

drew

pay

during

the

last

pay

period

in

the

month

or

quarter

Include

anyone

for

whom

you

will

complete

a

T4

slip,

such

as

part-time

and

temporary

employees,

employees

absent

with

pay,

etc

Do

not

include

persons

for

whom

you

will

not

complete

a

T4

slip,

such

as

occasional

employees

not

part

of

your

payroll,

and

persons

who

did

not

draw

pay

in

the

last

pay

period

in

the

month

or

quarter

such

as

those

on

unpaid

leave

REMITTING

PROCEDURES

We

must

receive

deductions

made

during

the

month

or

quarter

by

the

due

date

For

more

information

see

the

Employer's

Guide

The

date

of

receipt

is

the

date

the

payment

is

delivered

to

the

Receiver

General

(i

e

,

tax

services

office,

tax

centre,

or

a

financial

institution)

and

not

the

date

you

mailed

the

payment

Please

include

your

share

of

Canada

Pension

Plan

contributions

and

Employment

Insurance

premiums

when

you

remit

your

employees'

deductions

We

will

apply

penalties

for

late

or

deficient

remittances

on

amounts

over

$500

unless

the

failure

is

made

knowingly

or

under

circumstances

amounting

to

gross

negligence,

in

which

case

the

minimum

$500

will

not

apply

If

you

make

your

payment

at

an

Automated

Teller

Machine,

check

with

your

financial

institution

to

make

sure

your

payment

will

be

processed

and

credited

to

the

Receiver

General

account

by

the

due

date

ENQUIRIES

If

you

need

more

information,

or

help

in

completing

the

form

or

using

the

Payroll

Deductions

Tables,

contact

your

tax

services

office

Please

quote

your

account

number

on

all

correspondence

Form

authorized

by

the

Minister

of

National

Revenue

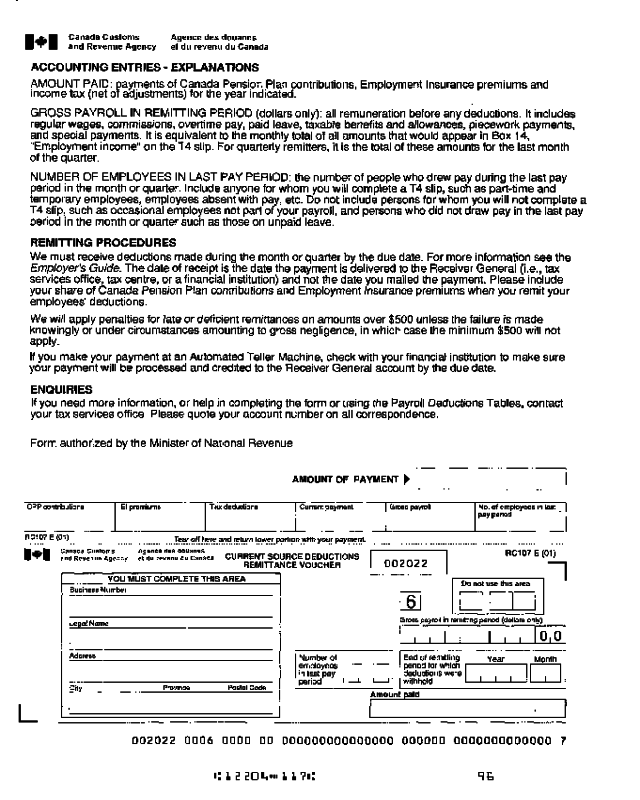

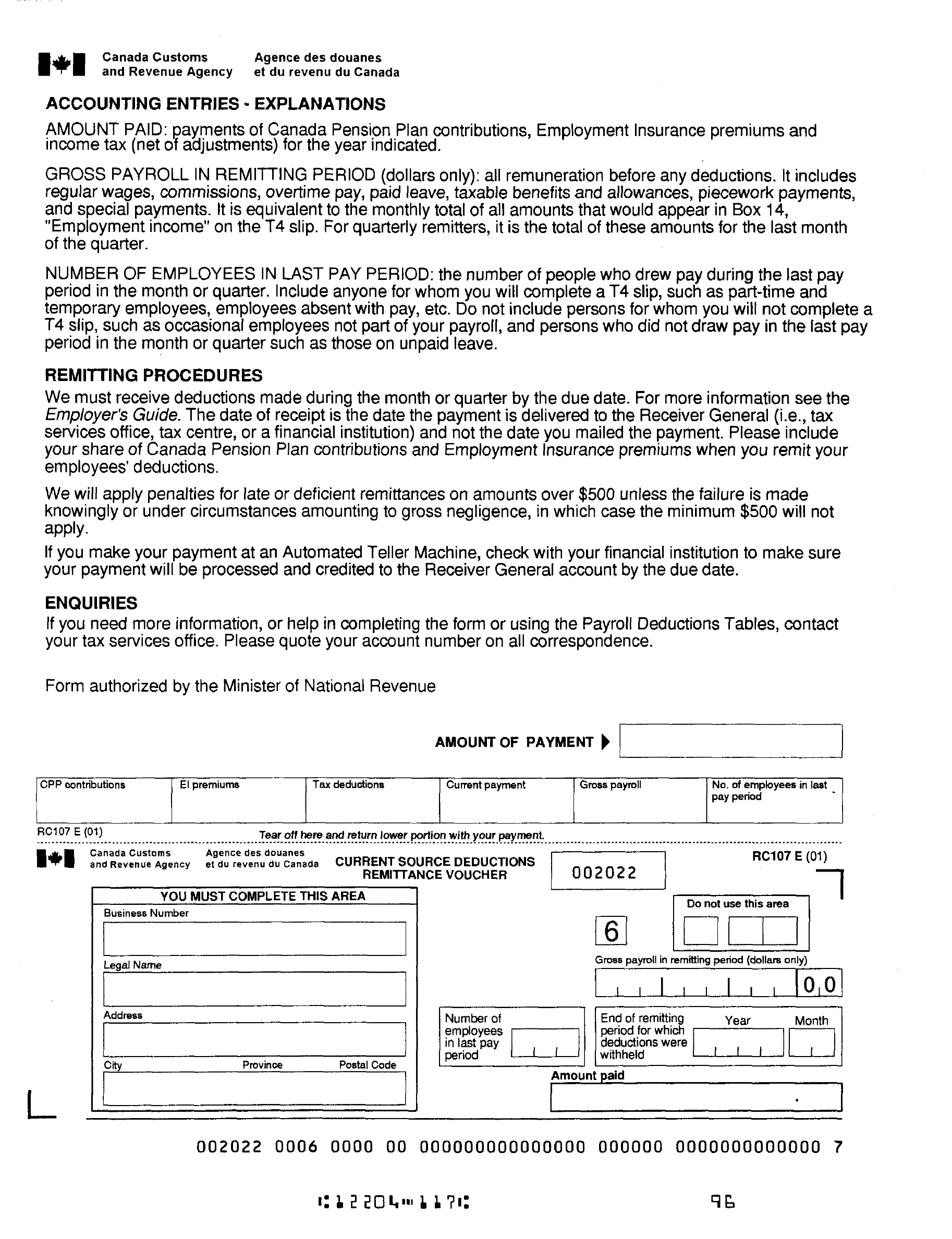

AMOUNT

OF

PAYMENT

^

CPP

contributions

El

premiums

Tax

deductions

Current

payment

Gross

payroll

No

of

employees

in

last

pay

penod

RC107E(01)

Tear

off

here

and

return

lower

portion

with

your

payment

l_

and

Revenue

Agency

et

du

revenu

du

Canada

CURRENT

SO

REMITTA

YOU

MUST

COMPLETE

THIS

AREA

Business

Number

Legal

Name

Address

City

Province

Postal

Code

URC

NCE

;E

DEDUCTK

:VOUCHER

Number

of

employees

in

last

pay

period

ONS

002022

Amount

paid

6

Gross

,

End

peno

dedu

wrthh

payroll

in

I

|

of

remil

dforw

ctions

v

eld

RC107E(

Do

not

use

this

area

remitting

penod

(dollars

only)

1

1

1

ti"9

Year

Month

hich

|————————]

-

nere

.

0|0

01)

~l

002022

0006

0000

00

000000000000000

000000

0000000000000

7

l330U"'l

l?i:

To

make

your

payment

directly

to

Canada

Customs

and

Revenue

Agency,

return

the

bottom

portion

with

your

cheque

or

money

order

made

payable

to

the

Receiver

General

to

the

address

shown

below.

To

help

us

credit

your

payment,

write

your

business

number

on

the

back

of

your

cheque

or

money

order.

If

you

prefer

to

make

your

payment

at

your

financial

institution

in

Canada,

present

this

form

to

the

teller

with

your

payment.

The

teller

will

return

the

top

portion

as

your

receipt.

Teller's

Stamp

We

will

charge

a

fee

for

any

dishonoured

payment.

DO

NOT

staple,

paper

clip,

tape

or

fold

voucher

or

your

cheque.

DO

NOT

mail

cash.

Please

ensure

the

address

below

appears

in

the

window

of

the

envelope

provided.

CANADA

CUSTOMS

AND

REVENUE

AGENCY

TECHNOLOGY

CENTRE

875

HERON

RD

OTTAWA

ON

K1A

1B1

Teller's

Stamp